Sponsored – Est. 8 Min Read

Undervalued Gold Mining Company Offers Significant Upside Potential Throughout 2023 as it Reaches its Production Goals

Luca Mining Corp. (TSXV: LUCA); (OTCQX: LUCMF) is a classic turnaround story…

News Update: news content

Breaking News: Luca Mining Corp.: Invitation to 121 Mining Investment New York

Breaking News:

Luca Mining Corp.: Invitation to 121 Mining Investment New York

Vancouver, British Columbia–(Newsfile Corp. – May 30, 2023) – Luca Mining Corp. (TSXV: LUCA) is pleased to announce the company is participating in the upcoming 121 Mining Investment Conference in New York City.

For more information, click here.

7 Reasons Why You Should Consider Investing in Luca Mining Corp. (TSXV: LUCA); (OTCQX: LUCMF) Today

1

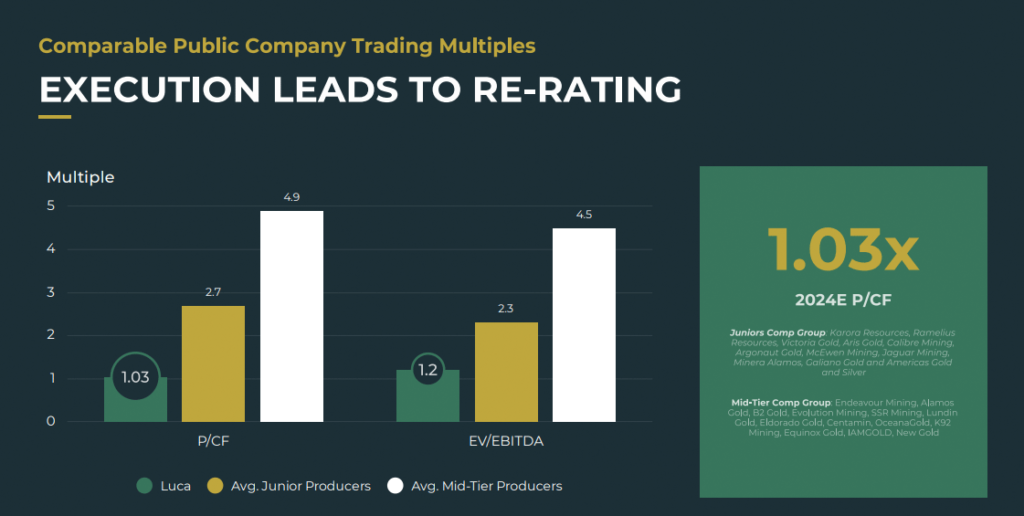

Luca Mining Corp. Appears to Be Significantly Undervalued: Luca Mining Corp. is an operating mining company with a surprisingly low market cap around CAD$37 million. A 2022 Prefeasibility study on its Tahuehueto Project indicated a NPV (net present value) of US$161 million on that project alone. An independent Preliminary Economic Assessment on its Campo Morado mine indicated an after-tax NPV of CAD$83.65 million. In other words, the company has two properties…each of which is currently poised to be greater than its current market cap.

2

Luca Mining Corp. Represents an Attractive Turnaround Opportunity: The company’s two properties have such significant potential that as recently as June 2021 its shares were trading for over $6, equivalent to a market cap of C$208m at the time. But an unforeseen liquidation by the bank financing its flagship gold project at Tahuehueto would stall the project and force the bank to gradually sell its shares. This one-off event proved to be a storm the company could weather, however, with new management – and only recently free of the negative impact on share price caused by bank liquidation – the company is poised to hit its gold targets and potentially climb back to its previous highs.

3

The Company Has Both Quantity and Quality with its Resources: Luca Mining Corp. has two advanced projects with a combined 2.2 million Gold Equivalent ounces with one operating mine and one in pre-production targeted for full commercial production by late 2023. Each of these two mines has a projected lifespan of greater than 10 years.

4

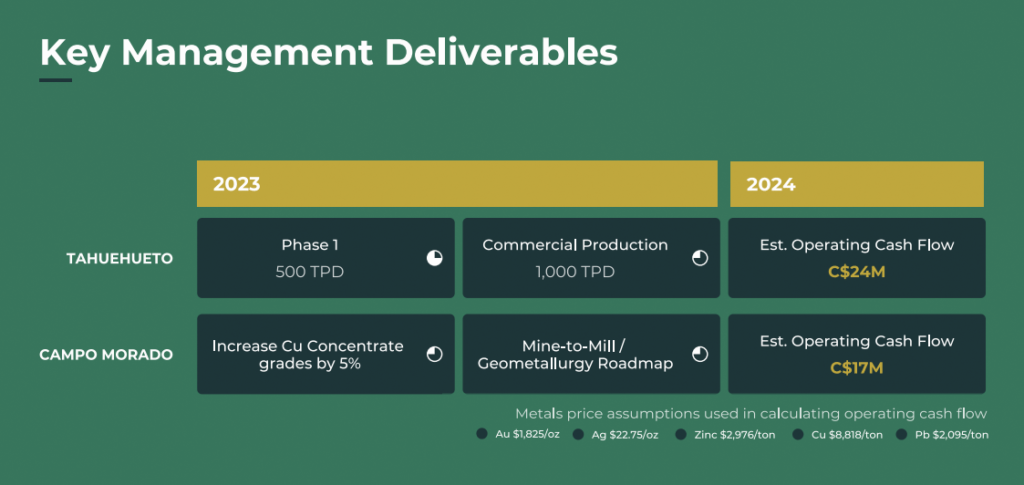

Luca Mining Corp.’s Tahuehueto Gold Mine Could Generate 40,000 Ounces of Gold per Year: The company’s flagship project, Tahuehueto is located within the prolific Sierra Madre Belt and is already producing The Company’s Stage I goal is to reach 500 tons per day of production by the end of Q2 2023 and ultimately 1,000 tons per day of production by the end of Q4 2023.

5

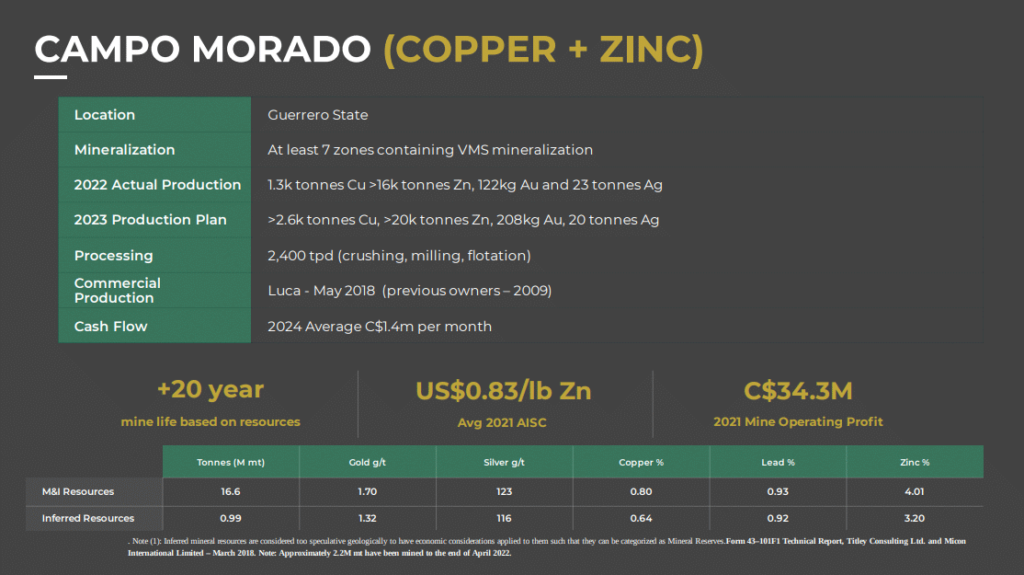

The Company’s Campo Morado Mine Is Fully Operating and Cash Flow Positive: This property is currently producing 2,400 tons per day of zinc and copper concentrates with average operating cash flows of $1.4 million per month expected in 2024. The property has significant potential upside through expanding resources and reserves, increasing throughput, and increasing recoveries of all metals, but particularly precious metals.

6

Mexico is a Top Tier Mining Jurisdiction: With an extensive mining history extending nearly 500 years, Mexico provides an attractive environment for exploration opportunities. The country is the largest producer of silver in the world and a top global producer of gold, copper, zinc, amongst other minerals. The country’s terrain is one of the most tectonically active and complex in the world and its potential has attracted more than 250 private exploration companies to Mexico.

7

Experienced, Proven Management Team: Luca’s Management Team and Board of Directors boasts many years of combined experience in the mining industry, covering mineral exploration, mine design and planning, construction and operation of mines, management of public companies and capital markets. This professional management team is focused on operational execution and has the ability and experience to unlock the hidden intrinsic value within the company’s projects and is proving that by delivering on its business plan of action.

Investor Alert:

Luca Mining Corp. Appears to Be a Fast-Mover On a Path to Significant Re-Rating Potential

Luca Mining Corp. (TSXV: LUCA); (OTCQX: LUCMF) is a junior resource company with a unique opportunity for rapid growth by advancing two Mexican gold, silver and base metal mining projects.

These two projects are estimated to produce approximately 65,000 Gold Equivalent Ounces per year by 2024…and each mine is projected to have a lifespan of greater than 10 years.

Investors will find a company with two high quality projects…decades worth of resources in the ground…and a new, focused management team with a proven track record of delivering success.

In the coming months, the company is projected to reach specific targets at its flagship Tahuehueto Gold Mine. Achieving these goals could help move the company from one that now appears to be significantly undervalued…to one that more closely resembles other comparable companies in the company’s peer group.

Luca’s Tahuehueto Mine is Projected to Deliver 1,000 Tons of Gold Per Day By the End of Q4 2023

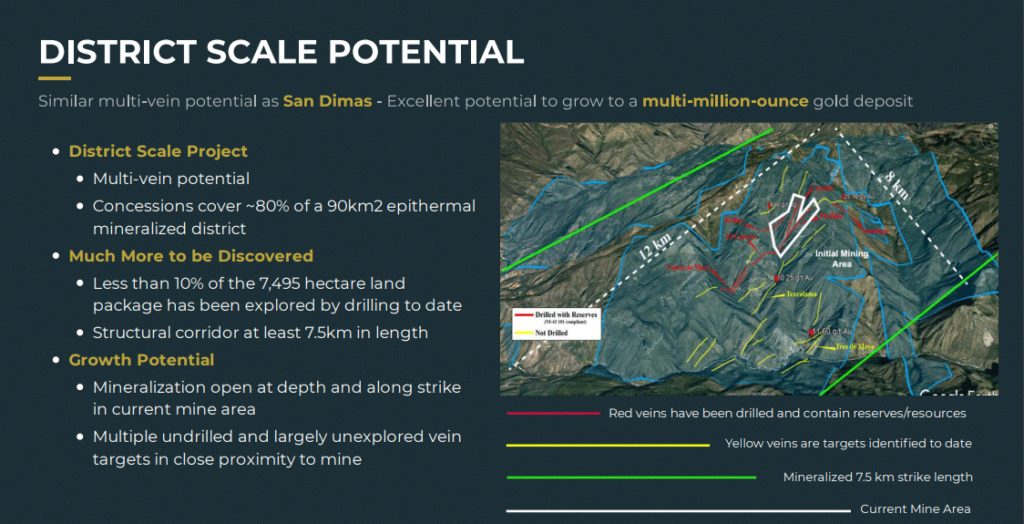

The company’s Tahuehueto mine is located in Durango, Mexico and has seen an investment to date of over $30 million between exploration, prefeasibility study and mine development.

The property consists of 28 mining concessions totaling 7,492 hectares in the Durango State, located within the prolific Sierra Madre Belt. The property covers at least 12 mineralized zones hosted within a structurally controlled epithermal system that has been traced for more than six kilometers.

In 2022, this project commenced pre-production at approximately 320 tons per day, generating zinc and lead concentrates with significant gold and silver grades. Over 60% of the mine revenues are from gold. A Stage I target of 500 tons per day has been established for end of Q2 2023 with an estimated commercial production target by the end of 2023 of 1,000 tons per day.

At that level – production of 1,000 tons per day – the project should be generating over $2 million per month EBITDA. Keep in mind – that is only one of the company’s two producing properties – and its market cap remains just around CAD $37 million.

For 2024, the company’s focus at Tahuehueto will be on expanding its exploration potential with a goal of increasing the mine life 2x to 3x while allowing for throughput expansions.

The large resource base on the property allows for organic growth by potentially doubling production to ~100,000 Gold Equivalent ounces per year.

Luca’s Campo Morado is Producing 2,400 Tons per Day of Zinc and Copper Concentrates

The company’s Campo Morado is a fully operating asset that brings a consistent cash flow to the company and provides exposure to base metal markets.

Campo Morado is an underground multi-metal mine currently producing at 2,400 tons of ore per day. Currently the property is producing zinc, copper and bulk copper-lead concentrates (with significant silver contents) and generates revenues of $1.3 million per week.

There are over 700 exploration diamond drill holes in place which have outlined six mineralized bodies containing approximately 16.6 million tons of measured and indicated resources grading 4.01% zinc, 0.80% copper, 0.93% lead, 123 g/t Ag and 1.70 g/t Au plus, an additional 1 million tons of inferred mineral resources as calculated and released by Titley Consulting Ltd. in November 2017.

Luca Mining’s Management Team Has More than 250 Years of Combined Experience…and a Proven Track Record of Success

The Luca Mining Corp. (TSXV: LUCA); (OTCQX: LUCMF) team has more than 250 years of combined mining and capital markets experience.

The company is managed by a team experienced in mining engineering, metallurgy and geology plus other mining professionals employed and committed to adding value to Tahuehueto and increasing shareholder returns through cost-effective programs conducted in a socially and environmentally progressive manner.

Luca Mining Corp.’s new management team is led by…

Mike Struthers – CEO and Director

Mr. Struthers is a seasoned professional and Chartered Engineer with over 40 years of international mining experience which includes:

A 40+ year mining career starting in operations in Africa and Australia, then a technical consulting career in Australia and internationally, with extensive experience in feasibility studies, capital projects, and for the last 5 years in executive roles with public companies.

Mike’s experience includes project management infeasibility and engineering studies, project development, technical reviews, financial evaluations, strategic planning, mine expansions, construction management, and project due diligence over a wide range of commodities and jurisdictions including base-metals, gold, and diamonds, in jurisdictions including Africa, Australia, North America, South America, Europe and Russia. Prior to his consulting career he held operational and management positions in mining operations in Africa and Australia.

Ramon Perez – President

Mr. Perez is a mining executive with over 15 years of international mining experience. This includes 10 years as vice president of the Carrelton Horizon Natural Resource Fund covering the metals and mining sector with a focus on publicly listed junior mining companies in Latin America.

Previously, Mr. Perez was a consultant to Core Gold Inc. in Ecuador during its M&A transaction with Titan Minerals (ASE: TTM) and was a founding member of Sociedad Minera Reliquias S.A., now listed on the TSXC (AGMR) as Silver Mountain Resources, Inc.

7 Reasons Why You Should Consider Investing in Luca Mining Corp. (TSXV: LUCA); (OTCQX: LUCMF) Today

1

Luca Mining Corp. Appears to Be Significantly Undervalued: Luca Mining Corp. is an operating mining company with a surprisingly low market cap around CAD$37 million. A 2022 Prefeasibility study on its Tahuehueto Project indicated a NPV (net present value) of US$161 million on that project alone. An independent Preliminary Economic Assessment on its Campo Morado mine indicated an after-tax NPV of CAD$83.65 million. In other words, the company has two properties…each of which is currently poised to be greater than its current market cap.

2

Luca Mining Corp. Represents an Attractive Turnaround Opportunity: The company’s two properties have such significant potential that as recently as June 2021 its shares were trading for over $6, equivalent to a market cap of C$208m at the time. But an unforeseen liquidation by the bank financing its flagship gold project at Tahuehueto would stall the project and force the bank to gradually sell its shares. This one-off event proved to be a storm the company could weather, however, with new management – and only recently free of the negative impact on share price caused by bank liquidation – the company is poised to hit its gold targets and potentially climb back to its previous highs.

3

The Company Has Both Quantity and Quality with its Resources: Luca Mining Corp. has two advanced projects with a combined 2.2 million Gold Equivalent ounces with one operating mine and one in pre-production targeted for full commercial production by late 2023. Each of these two mines has a projected lifespan of greater than 10 years.

4

Luca Mining Corp.’s Tahuehueto Gold Mine Could Generate 40,000 Ounces of Gold per Year: The company’s flagship project, Tahuehueto is located within the prolific Sierra Madre Belt and is already producing The Company’s Stage I goal is to reach 500 tons per day of production by the end of Q2 2023 and ultimately 1,000 tons per day of production by the end of Q4 2023.

5

The Company’s Campo Morado Mine Is Fully Operating and Cash Flow Positive: This property is currently producing 2,400 tons per day of zinc and copper concentrates with average operating cash flows of $1.4 million per month expected in 2024. The property has significant potential upside through expanding resources and reserves, increasing throughput, and increasing recoveries of all metals, but particularly precious metals.

6

Mexico is a Top Tier Mining Jurisdiction: With an extensive mining history extending nearly 500 years, Mexico provides an attractive environment for exploration opportunities. The country is the largest producer of silver in the world and a top global producer of gold, copper, zinc, amongst other minerals. The country’s terrain is one of the most tectonically active and complex in the world and its potential has attracted more than 250 private exploration companies to Mexico.

7

Experienced, Proven Management Team: Luca’s Management Team and Board of Directors boasts many years of combined experience in the mining industry, covering mineral exploration, mine design and planning, construction and operation of mines, management of public companies and capital markets. This professional management team is focused on operational execution and has the ability and experience to unlock the hidden intrinsic value within the company’s projects and is proving that by delivering on its business plan of action.

Disclaimer: This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. WallStreetNation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.

Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of Luca Mining Corp. and its securities. Neither WallStreetNation.com, Winning Media LLC or Jade Cabbage Media LLC currently hold the securities of Luca Mining Corp. and its securities and do not currently intend to purchase such securities.

The issuer, Luca Mining Corp. has compensated Winning Media LLC the sum total of one hundred twenty five thousand dollars USD total production budget to manage a digital media campaign for ninety days.

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.