Sponsored / Est. 8 Min

With Bitcoin Soaring 150% Higher in 2023, Crypto Miners Have Seen a Rise in Valuation…

Here’s why Bitdeer Technologies Group (Nasdaq: BTDR) appears to offer investors the best way to play the rising crypto market in 2024

Breaking News:

In November 2023, Bitdeer Technologies Group (Nasdaq: BTDR) announced that it has become a Preferred cloud service provider (CSP) in the NVIDIA Partner Network and plans to launch Bitdeer AI Cloud, among the first cloud services powered by NVIDIA DGX SuperPOD with DGX H100 systems in the Asia region. The service will provide Bitdeer’s customers with access to NVIDIA AI supercomputing to help them accelerate their development of generative AI, large language models (LLMs), and other AI workloads.

Bitcoin’s strong performance in 2023 – a year that saw it soar by 150% — has triggered a wave of profit opportunities in the crypto space.

“Crypto stocks surge as bitcoin hits fresh 2023 high”

One of the most attractive opportunities is setting up now, with a pioneer of the cryptocurrency mining industry – one of the world’s largest publicly-traded crypto miners – that now appears to be undervalued.

Here’s what appears to be unfolding with this industry pioneer… Bitdeer Technologies Group (Nasdaq: BTDR).

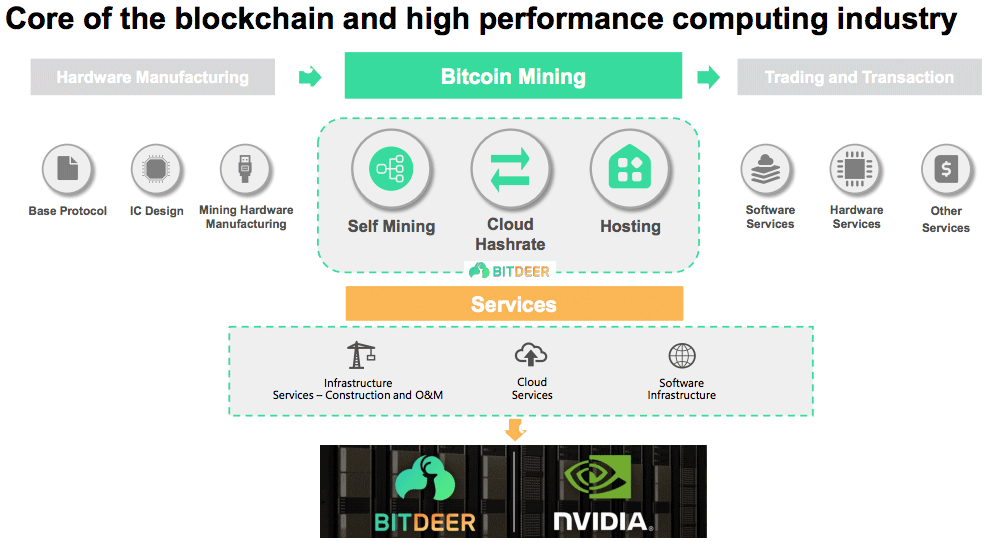

Bitdeer Technologies Group (Nasdaq: BTDR) is a world-leading technology company for blockchain and high-performance computing.

The company handles complex processes involved in computing such as equipment procurement, transport logistics, datacenter design and construction, equipment management, and daily operations.

Bitdeer also offers advanced cloud capabilities to customers with high demand for artificial intelligence.

Investors looking for the highest-upside opportunities to profit as Bitcoin continues to surge should strongly consider the potential for Bitdeer Technologies Group (Nasdaq: BTDR).

Now here are 6 key reasons why Bitdeer Technologies Group (Nasdaq: BTDR) appears poised to delivery high-upside profit potential in the months ahead:

5 Key Reasons

Why Bitdeer Technologies Group (Nasdaq: BTDR) Appears Poised to Soar

Key Reason #1

Shares for crypto mining companies have been climbing higher recently.

Bitcoin’s 150% growth in 2023 has been good news not just for investors in the crypto itself, but also for investors in related companies…including crypto mining.

In just six weeks – from the beginning of November through the middle of December – crypto mining stocks have made an impressive rally.

- Riot Platforms (Nasdaq: RIOT) gained 57.5% over that stretch…[i]

- Marathon Digital Holdings (Nasdaq: MARA) nearly doubled – climbing 98% in just six weeks…[ii]

- And CleanSpark, Inc. (Nasdaq: CLSK) soared a whopping 160% in just over a month-and-a-half.[iii]

RIOT + 57.5%

MARA + 98%

CLSK + 160%

This strong performance is expected to continue should Bitcoin continue climbing higher in the months ahead.

And as one of the industry leaders in the crypto mining space, Bitdeer Technologies Group (Nasdaq: BTDR) could deliver gains similar to its competitors – if not higher – on the back of a crypto rally.

Key Reason #2

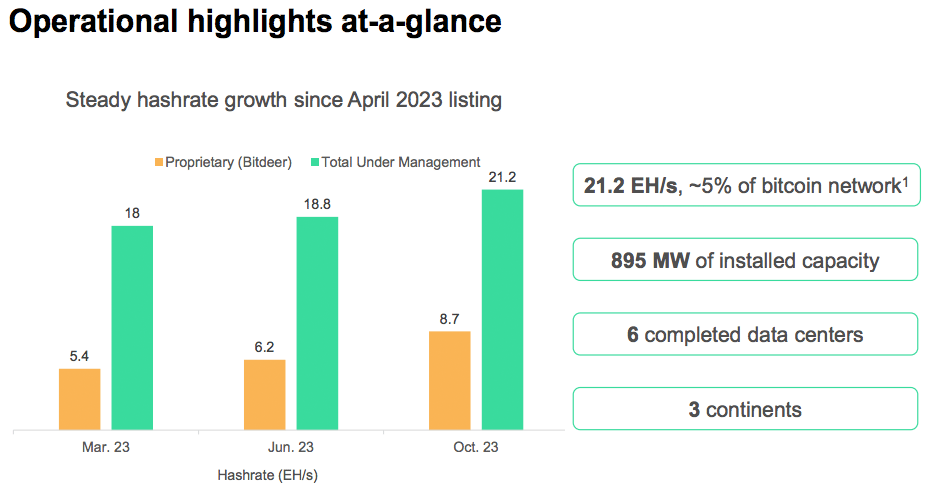

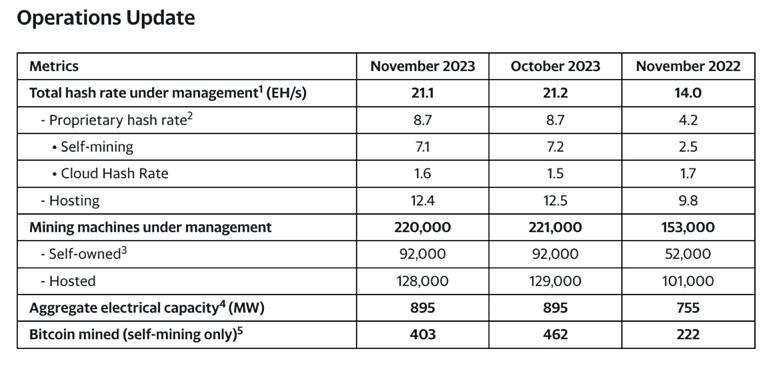

Bitdeer has dramatically increased its production in recent months.

2023 was an impressive year for Bitdeer Technologies Group thanks in large part to its strong production figures.

In early December 2023, the company reported its third quarter results with its Bitcoin production up 121% year-over-year while its adjusted EBITDA surged by 222%.

Linghui Kong, Chief Executive Officer of Bitdeer, commented, “During November (2023), our core business performed steadily and new growth opportunities emerged… We mined 403 Bitcoins in total in November, representing a year-over-year increase of 81.5%.”

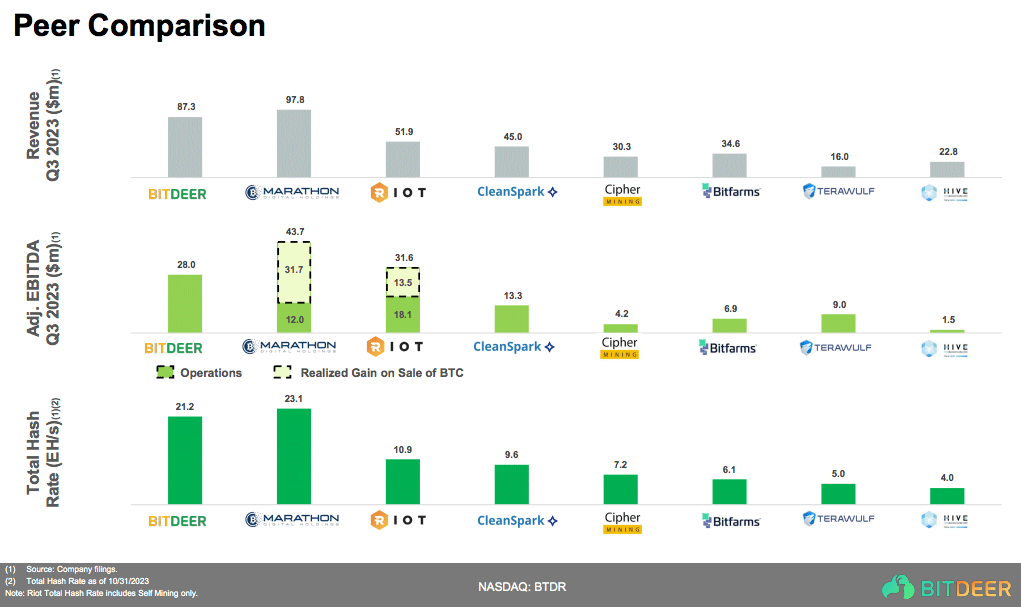

Bitdeer’s hash rate of 21.2 EH/s is one of the industry’s best, topped just slightly by Marathon’s rate of 23.1 EH/s.

But according to J.P. Morgan, Marathon Digital Holdings is “the largest operator but has the highest energy costs and lowest margins.”[v] Bitdeer appears to offer significantly lower risk in this regard, as it owns its operational infrastructure and can more easily control it costs.

Key Reason #3

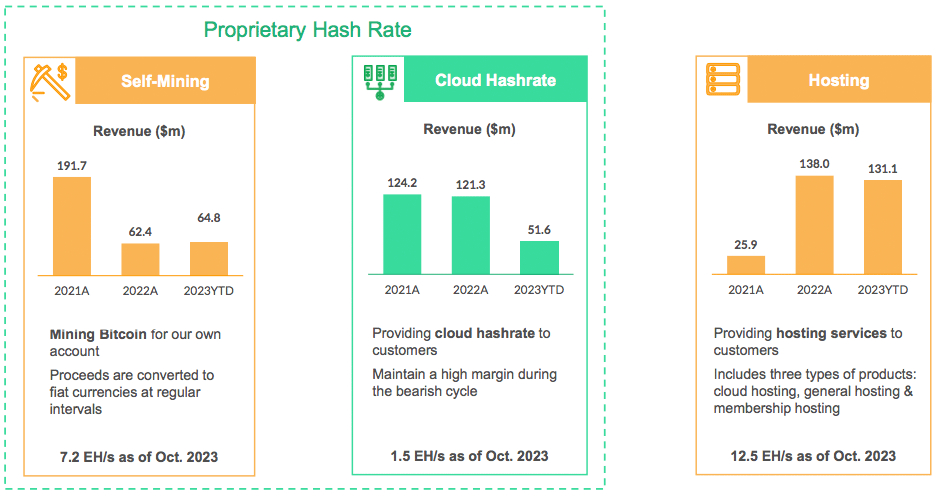

Bitdeer Technologies Group has a number of diverse revenue streams to accelerate growth.

The company’s unique business strategy sets it apart from others in the Bitcoin mining space as it is designed to both mitigate volatility and foster accelerated growth.

These three diverse revenue streams include:

- Self-Mining, which refers to cryptocurrency mining for Bitdeer’s own account, which allows it to directly capture the high appreciation potential of cryptocurrency.

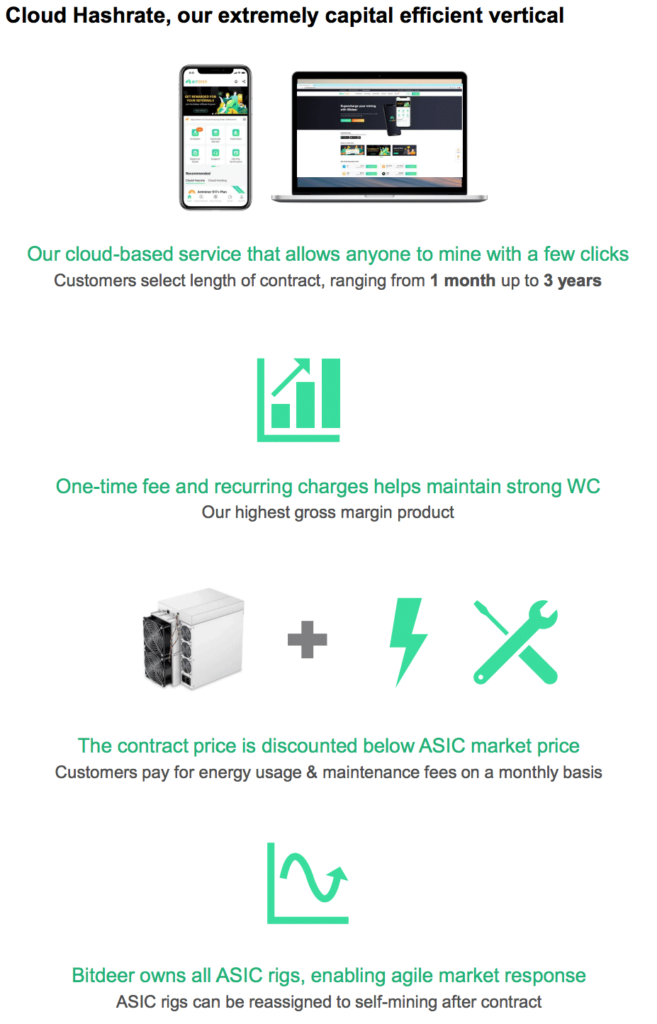

- Hash Rate Sharing currently primarily includes Cloud Hashrate, in which Bitdeer offers hash rate subscription plans and shares mining income with customers under certain arrangements.

Cloud Hashrate is the company’s patent-pending, in-house technology that allows Bitdeer to not only collect revenue upfront – covering the capex for the computing hardware – but also generate revenue from these contracts months into the future.

- Hosting, which encompasses a one-stop mining machine hosting solution including deployment, maintenance, and management services for efficient cryptocurrency mining.

In addition to its unique business model, Bitdeer Technologies Group’s commitment to research and development is a key differentiator.

The company allocates an impressive 25% of its workforce to R&D, emphasizing its innovation-first strategy.

Key Reason #4

Bitdeer Technologies Group’s newly-announced partnership with NVIDIA could be a game-changer.

In the fall of 2023, Bitdeer Technologies Group announced a new strategic partnership with NVIDIA Corporation.

Bitdeer is well-known for its global datacenter deployment capabilities, proficiency in high-performance machine operations, and extensive cloud service expertise, is in the process of methodically building its GPU cloud business.

The company’s designation as an NVIDIA Preferred partner will serve as a catalyst for Bitdeer to develop its GPU cloud capabilities.

This collaboration heralds the launch of Bitdeer AI Cloud, setting the stage for a new era in cloud computing and AI capabilities from Bitdeer.

The Bitdeer AI Cloud, leveraging NVIDIA DGX SuperPOD with DGX H100 systems, is positioned to address the increasing demand for AI supercomputing.

Matt Linghui Kong, Chief Executive Officer of Bitdeer, commented, “We are excited to work with NVIDIA to lay the groundwork for the next era of AI and large language model advancements in Asia. Becoming a Preferred member of the NVIDIA Partner Network validates our technological competence and market reach. We look forward to collaborating with NVIDIA to empower businesses in Asia to innovate, grow, and prosper.”

“Generative AI empowers businesses to unlock unprecedented scalability, reliability, and innovation,” said Tony Paikeday, senior director of the DGX platform at NVIDIA, “With its NVIDIA DGX infrastructure, Bitdeer can provide the AI supercomputing and software needed to build and deploy generative AI models and services.”

Key Reason #5

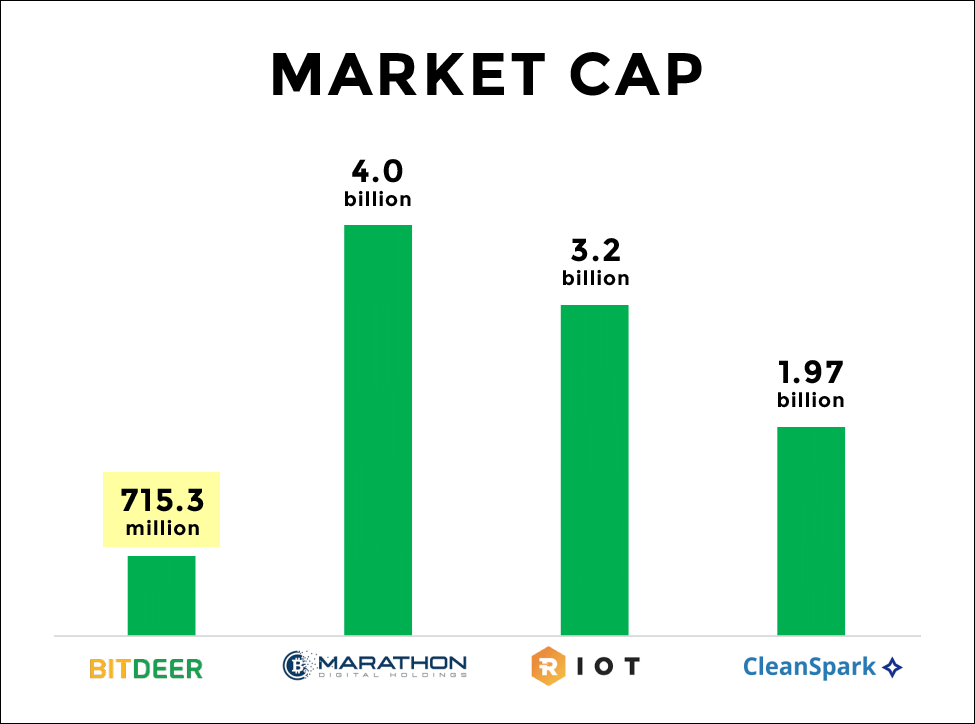

Bitdeer Technologies Group (Nasdaq: BTDR) appears to be significantly undervalued.

As mentioned earlier, share prices for cryptocurrency mining companies have performed extremely well in recent months as Bitcoin has moved higher.

In spite of the fact that Bitdeer Technologies Group (Nasdaq: BTDR) is one of the pioneers in the space – and among the world’s largest publicly traded commercial miners…the company’s shares have not seen the same type of growth.

At least…not yet.

Companies like Riot, Marathon and CleanSpark saw six-week gains of 57.5%, 98% and 160% while Bitdeer Technologies Group did not.

That means there could still be significant room to run for Bitdeer shares in the weeks and months ahead.

In terms of revenue for the most recent quarter, Bitdeer is just slightly behind Marathon, while significantly higher than Riot, CleanSpark, Cipher and others.

The same goes for the company’s total Hash Rate and its adjusted EBITDA.

Yet in terms of market cap, the valuations for those other companies are significantly higher:

It appears clear that there is plenty of room for growth in valuation for Bitdeer Technologies Group (Nasdaq: BTDR) as it now appears to be undervalued compared to its peers.

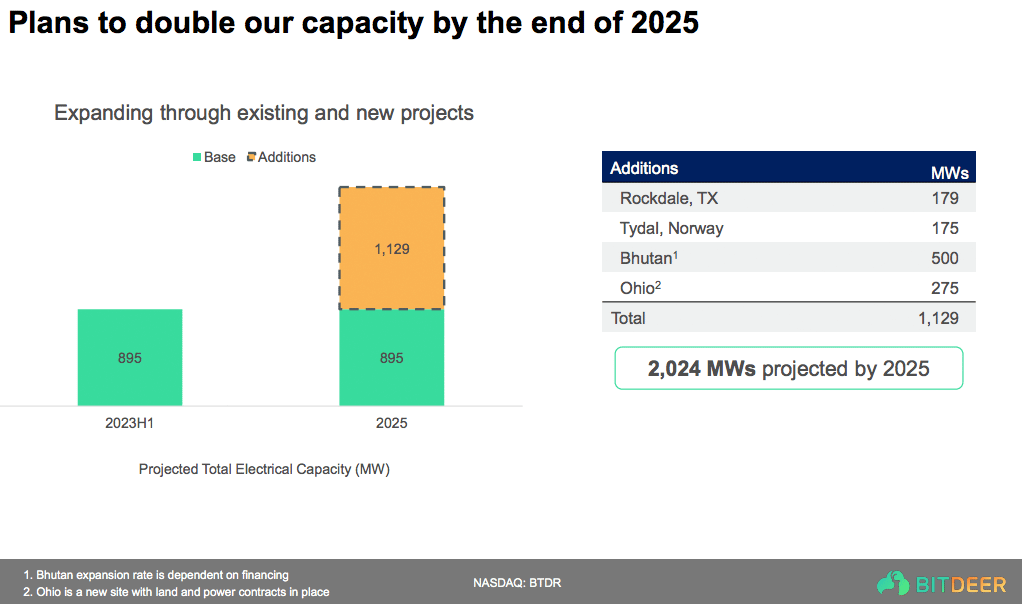

This potential growth is even more clear when you consider the company’s recent performance…its strategic partnership with NVIDIA Corp…and its plans for growth over the next two years as the company plans to double its capacity.

Key Reason #6

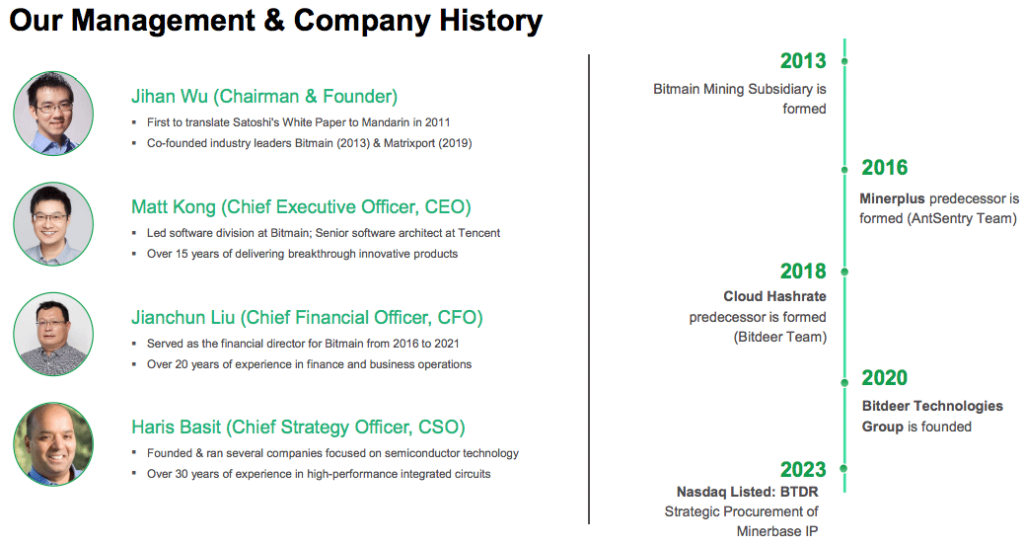

Bitdeer’s leadership team includes some of the pioneers of the cryptocurrency mining industry.

Bitdeer Technologies Group (Nasdaq: BTDR) was founded by Jihan Wu, who was an early advocate and pioneer in cryptocurrency.

It was Jihan Wu’s effort in translating Satoshi Nakamoto’s white paper into Mandarin that marked a significant step in the industrial development of Bitcoin mining.

Investor’s Summary

Bitdeer Technologies Group (Nasdaq: BTDR) is one of the pioneers in the cryptocurrency mining space with a diverse array of revenue streams.

Right now, the company appears to be significantly undervalued as compared to industry peers, making its shares especially attractive for potential investors.

In recent months, Bitdeer has effectively capitalized on the rising price of Bitcoin while expanding its overall operation.

Moving forward, the company’s recently-announced strategic partnership with NVIDIA Corporation. is designed to set the stage for a new era in cloud computing and AI capabilities for Bitdeer Technologies Group, triggering even further potential growth in 2024 and beyond.

[i] https://www.reuters.com/markets/us/crypto-stocks-surge-bitcoin-

hits-fresh-2023-high-2023-12-04/#:~:text=However%2C%20the%20recent

%20rally%20has,best%20annual%20performance%20since%202020.

[ii] RIOT opened at $10.00 on 11/1/23 and closed at $15.75 on 12/14/23

[iii] MARA opened at $9.00 on 11/1/23 and closed at $17.82 on 12/14/23

[iv] CLSK opened at $4.20 on 11/1/23 and closed at $10.92 on 12/14/23

[v] https://finbold.com/this-is-jpmorgans-top-pick-for-bitcoin-mining-companies/

Disclaimer: