Sponsored – Est. 8min Read

High-Upside Alert:

Unprecedented Demand for Electric Vehicles Triggers Red-Hot Bull Market Opportunities in Lithium and Other Battery Metals

Now one little-known Quebec-based company – Q Battery Metals (CSE: QMET); (OTC: BTKRF) – offers investors smart exposure to this unstoppable megatrend

The global shift toward electric vehicles is one of the most significant megatrends of our lifetime.

2022 saw a historic surge in demand for electric vehicles, with 7.8 million EVs sold worldwide – an increase of 68% from 2021 – according to the Wall Street Journal.[i] [ii]

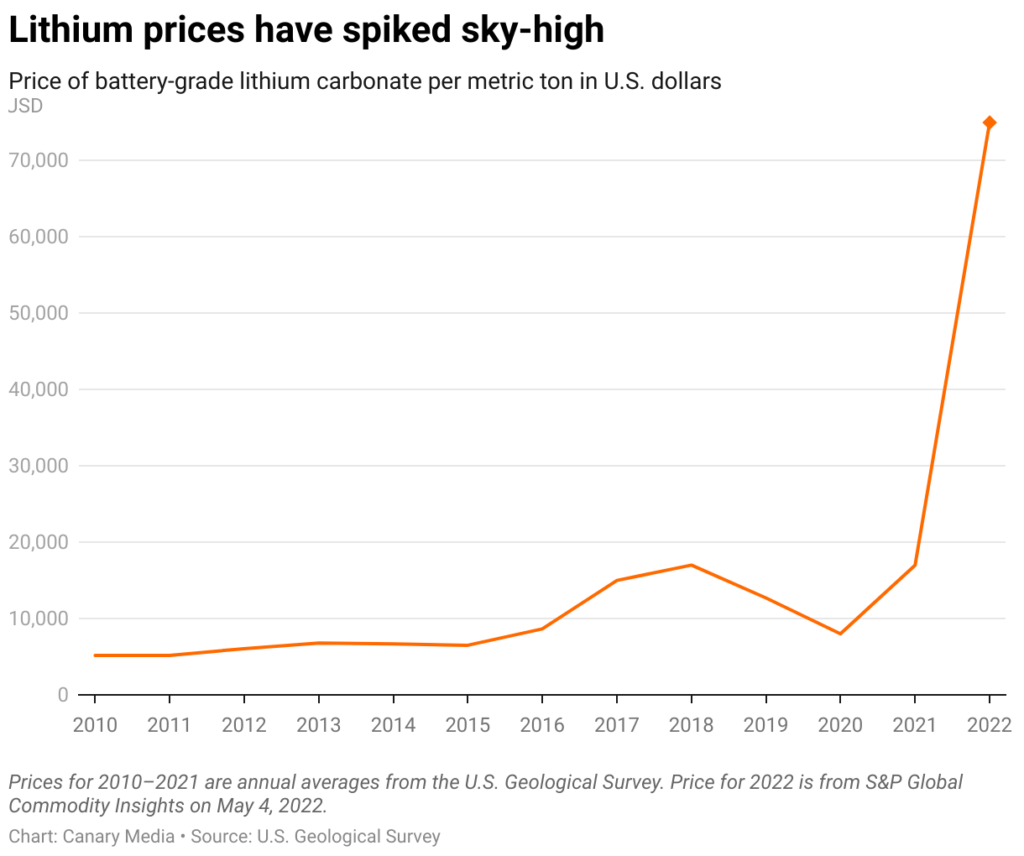

This explosion in demand for electric vehicles – and the resources needed to power them – has caused lithium prices to soar to record heights.

* Note: management cautions that potential lithium resources that exist on properties outside of the PegaLith claims are not direct indicators of lithium mineralization on the PegaLith property.

Of course, all of these new electric vehicles need batteries – and that means more and more lithium is needed for manufacturing.

This exceptionally potent combination – of rising lithium prices and continued high demand for the lithium to power new EVs – means that exploration companies with significant potential in the lithium space could deliver potential windfall profits.

One under-the-radar company in this space worth considering is Q Battery Metals (CSE: QMET); (OTC: BTKRF).

Q Battery Metals is a company with an impressive portfolio of battery metals projects – including a recently-acquired flagship lithium property – in one of the world’s most advantageous and mining-friendly jurisdictions: Quebec.

The company’s presence in Quebec – and the extraordinary potential for its recently-acquired property – are just two of the six critical reasons why investors should pay close attention to Q Battery Metals (CSE: QMET); (OTC: BTKRF) in the coming weeks.

Investment Summary:

Q Battery Metals (CSE: QMET); (OTC: BTKRF) offers investors smart exposure to the unstoppable electric vehicle megatrend. This under-the-radar exploration company has an impressive portfolio of battery metals projects – including high-upside lithium properties – located in one of the world’s most attractive regions for exploration: Quebec. Investors should consider the opportunity with Q Battery Metals as potentially one of the best ways to play the EV megatrend as demand for lithium and other battery metals continues to soar.

6 Critical Reasons Why Q Battery Metals (CSE: QMET); (OTC: BTKRF) Offers High-Upside Exposure to the Massive Electric Vehicle Megatrend

Critical Reason #1: The red-hot lithium bull market has created a significant profit opportunity for investors.

No question about it – a new, long-term bull market in lithium is well underway.

Thanks to the historic surge in demand for electric vehicles, lithium prices have more than tripled over the past year.

But this story is just getting started.

“Researchers predict the EV industry’s market share will double or even quadruple by 2030.”

At the end of 2021, there were just 16.5 million EV cars and trucks on the road…but the IEA projects that number will climb to 145 million by 2030.

And the batteries for all these EV’s will require millions of tons of lithium.

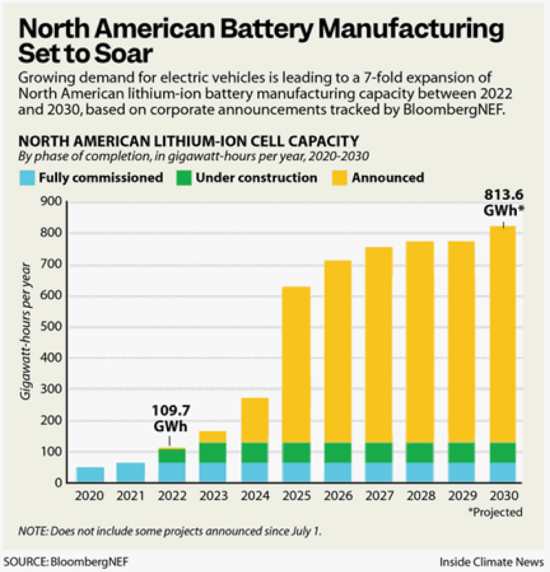

Soaring EV demand has also triggered a massive investment in new lithium battery production plants in North America with more than $40 billion – and counting – invested in new battery gigafactories.[i]

The unprecedented level of investment in new lithium-ion battery gigafactories is projected to lead to a seven-fold expansion of manufacturing capacity by 2030 according to BloombergNEF.[i]

Identifying – and bringing online – new sources of battery metals production could mean massive upside potential for exploration companies as this demand continues to push prices higher.

For investors in exploration companies like Q Metals (CSE: QMET); (OTC: BTKRF), there could be tremendous upside as positive news about potential supplies could quickly generate intense interest from Wall Street and major producing companies.

Critical Reason #2: Q Metals’ flagship PegaLith property appears to offer strong lithium potential.

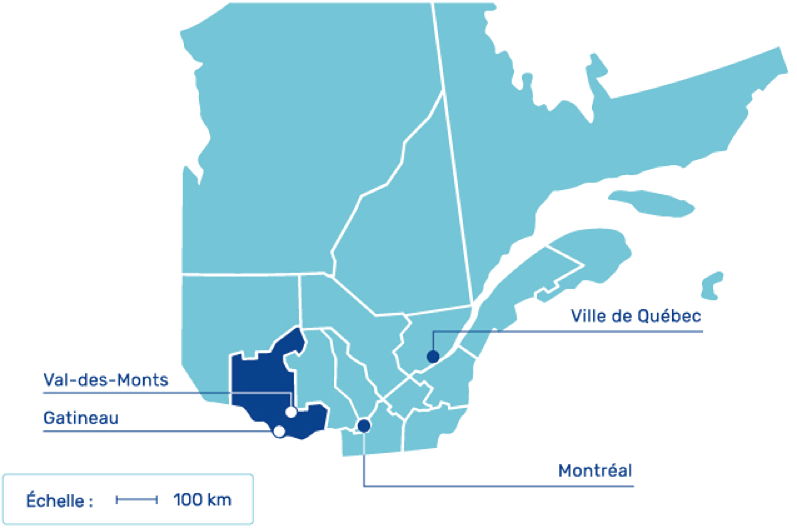

Recently, on February 6, Q Battery Metals announced that it had acquired the PegaLith project in Gaineau, Quebec.

The PegaLith project consists of claims that cover strong geological and mineralogical indicators for lithium potential.

The claims cover 1,571 acres of strong geological and mineralogical indicators for lithium potential in 11 contiguous claims located within 25 kilometers north of Gatineau, Quebec.

The geologic summary for these historic mines indicate the presence of mica in the pegmatite, one possible source for lithium.

In addition, the historic Mine Leduc, located approximately six kilometers southwest of the PegaLith property contains a small lithium-bearing body, approximately 230 tons of 5.39% Lithium Oxide from pegmatitic materials, as reported in a non NI 43-101 compliant report.*

The company’s geologic team is currently compiling all available data for the PegaLith project in preparation for a 2023 Phase I exploration program.

The claims are easily accessible for exploration, including initial sampling of pegmatitic outcrops for lithium.

Critical Reason #3: Q Battery Metals operates in one of the world’s best jurisdictions for exploration: Quebec.

Quebec is one of the most attractive places for exploration companies not only for the quality of its resources, but also its extensive government support.

The Quebec government’s energy and natural resources department is committed to the province’s mineral development, providing valuable resources to mining companies to support exploration and development.

“We have lithium in Quebec, and it’s important to take advantage of it”

These resources include specialized research and development centers, an in-depth database with over 150 years’ worth of geological data, and several geoscientific data banks.

The Quebec government also provides financial support in the form of equity and debt packages to act as a cornerstone for mining companies.

In addition, the Quebec government’s Sidex exploration fund invests in the shares of publicly-listed mineral exploration companies to help stimulate investments for exploration in existing districts and to open new territories for potential exploration.

Critical Reason #4: Q Battery Metals has a portfolio of impressive projects with tremendous upside.

Q Battery Metals’ PegaLith property is not the only promising project in the company’s portfolio.

The company’s Lorrain Nickel Project covers 2,208 hectares in 38 contiguous claims located in western Quebec, overlying favorable geologic and geophysical features for hosting nickel.

The property is located along Highway 391 approximately one kilometer south of Lorrainville in the Quebec Abitibi- Greenstone Belt.

This region of Quebec contains PGE and Nickel properties located within 15 km of Q Battery Metals’ Lorrain project, including the Lac Croche and Delhi deposits to the north and the Pyke, Lac Kelly, and Mine Lorrain to the east.

Q Battery Metals is currently compiling all of the geologic and exploration records that are available for the Lorrain property, concentrating on the nickel potential.

Q Battery Metals’ PG Highway Property is a copper and zinc exploration project located along Highway 397, 22 kilometers north of Val d’Or Quebec.

On this property, the Geophysique TMC report concludes that the newly acquired surface TDEM data identified a group of strong conductive anomalies in places coincident with areas of rock exposures that contained significant percentages of pyrite and pyrrhotite.

The geology along the trend is interpreted to have potential for volcanogenic massive sulphide (VMS) mineralization. The zone of interest also displays magnetic features derived from Black Tusk 2021 surveys. The geophysical survey results combined with the geology and rock sampling provide compelling targets for further exploration.

Q Battery Metals’ LaCorne South Lithium Project Could Offer Sayona Mining-Like Potential

Q Battery Metals’ LaCorne South Lithium property is comprised of 21 claims totaling 1203.09 hecatres. The claims are located west of Highway 397, 22 kilometers north of Val d’Or Quebec and adjoin the company’s PG Highway claims.

This property, which was originally explored for gold but has now been re-focused to explore lithium opportunities, could have extraordinary potential.

But here’s where the story gets even more interesting: The MoGold property is located in close proximity to Sayona Mining Limited (OTC: SYAXF). That’s a $2 billion lithium company that is currently in production with good reserves.

And Q Battery Metals is now exploring a promising lithium opportunity right next door.

Here’s what that could mean in terms of potential: Just five years ago, Sayona Mining (OTC: SYAXF) was just a lowly penny stock…and now it’s a company with a market cap of US $1.47 billion.

Critical Reason #5: Q Battery Metals is structured to perform for shareholders.

Another one of the more attractive components of the Q Battery Metals story is the way the company is structured.

Q Battery Metals (CSE: QMET); (OTC: BTKRF) is a fresh company, structured to perform – with only 46 million shares outstanding.

This tight share structure means that each share purchased has the potential to increase in value more quickly than shares with companies who have floated more stock, thus diluting shareholder value.

In the case of Q Battery Metals, investors will be considering a company that is structured to perform – with potential increased liquidity and ease of trading.

The company’s management team are also significant shareholders, indicating their strong belief in the company’s promising future.

Critical Reason #6: Q Battery Metals’ leadership team has decades of geological experience and a proven track record of success.

When it comes to evaluating the potential of any exploration investment, the strength of the management team is always one of the most critical factors.

In the case of Q Battery Metals (CSE: QMET); (OTC: BTKRF), a world class team of mining and finance expertise is in place to help guide the company to success.

This team includes…

Richard Penn

Chief Executive Officer, Chairman of the Board and Director

Mr. Penn first started off in the capital markets industry in 2009 as a stockbroker. Richard worked at Mackie Research Capital after attending the Canadian Securities Institute, completing the (Securities Course & Wealth Management designations). Before leaving the brokerage industry in 2014, Mr. Penn helped take Five Star Diamonds (TSX-V: STAR) public on the TSX Venture Exchange, then advancing into the public company sector. In late 2014 Mr. Penn IPO’ed a new company, Maccabi Ventures which then went on to become Curaleaf Holdings (CSE: CURA). Mr. Penn is currently a Director of Rain City Resources (CSE: RAIN), a mineral exploration company trading on the CSE Exchange. Richard is also a director of Abitibi Metals Corp. Mr. Penn is one of the founding Directors of Q Battery Metals and is the company’s President & CEO.

Krystal Pineo

Chief Financial Officer

Krystal Pineo is the founder of KP Capital Inc, a family office and corporate advisory firm. Krystal was a co-founder and former director of Yield Growth Corp a CSE listed company offering a collection of high efficacy, plant based products for optimum health and wellness. Krystal was a board member of CSE listed Ultra Brands Ltd an agri-food holdings company focused on innovative products and technologies in the food services industry. Krystal is the also the acting COO at AbsolemHealth Corp. a company focused on creating natural solutions for human health optimization through functional and medicinal products. In 2022 Krystal formed Quartier Minerals Inc a privately held battery metals focused project generator.

Gary MacDonald

Advisor – BComm; MBA

Mr. MacDonald has over 25 years of natural resource experience, specializing in mining operations on a global basis. Mr. MacDonald holds a bachelor of commerce from UBC and a master of business administration from Erasmus University in Rotterdam. Mr. MacDonald’s roles have been all-encompassing from field to boardroom. Mr. MacDonald has been the president and chief executive officer of American Mining Corp. since 2006 and currently holds numerous board positions in the resource sector.

Earnest Brooks

Advisor – BSc; PGeo; CIM

Mr. Brooks brings a wealth of experience and mining knowledge to Black Tusk Resources. He has worked on the TPW property for Explor Resources Inc., primarily compiling data, Timmins, Ont., mining camp for the past several years.

He was a mining geologist for Patino Mines (Quebec) Ltd.’s underground mining operations, as well as mining and exploration geologist for Brunswick Mining Ltd., Bathurst, N.B., a large open-pit and underground trackless mining operation. He has been president of the NBPDA several times since 1992, and was elected Prospector of the Year for work in the Plaster Rock area of New Brunswick in 1997 to 1998.

Dr. Mathieu Piche

Director – Geologist

Dr. Piche has over 35 years of experience exploring for mineral deposits in the Abitibi greenstone belt. He was a past recipient of the Quebec Mineral Exploration Association’s John-Descarreaux Award, bestowed to highlight the contribution of an individual to enhanced geoscientific knowledge linked to mining exploration, as well as The Quebec Geologists Order Merite Geoscientifique Award.

Perry B. Grunenberg, P. Geo

Chief Exploration Geologist

Mr. Grunenberg has a B.A., Sc; degree in geological sciences. He is a Professional Geoscientist, registered with the Engineers and Geoscientists of British Columbia since 1992. Mr. Grunenberg has worked for more than 30 years on many projects in various parts of the world, including famous gold camps of Dawson City Yukon, Pogo district in Alaska, and Barkerville, Bralorne, Tulameen, and various other gold districts in British Columbia. Mr. Grunenberg also has experience with lead-zine, molybdenum, copper, tungsten, diamonds and other deposit types. Mr. Grunenberg has worked as a consultant to both major and junior mining companies and has completed contracts for government agencies.

Investment Summary:

Q Battery Metals (CSE: QMET); (OTC: BTKRF) offers investors smart exposure to the unstoppable electric vehicle megatrend. This under-the-radar exploration company has an impressive portfolio of battery metals projects – including high-upside lithium properties – located in one of the world’s most attractive regions for exploration: Quebec. Investors should consider the opportunity with Q Battery Metals as potentially one of the best ways to play the EV megatrend as demand for lithium and other battery metals continues to soar.

* Note: management cautions that potential lithium resources that exist on properties outside of the PegaLith claims are not direct indicators of lithium mineralization on the PegaLith property.

[i] https://www.businessinsider.com/electric-vehicles-accounted-global-

auto-sales-could-quadruple-2030-report-2023-1

[ii] https://www.wsj.com/articles/evs-made-up-10-of-all-new-cars-sold-

last-year-11673818385?mod=hp_lead_pos2

[iii] https://www.businessinsider.com/electric-vehicles-accounted-

global-auto-sales-could-quadruple-2030-report-2023-1

[iv] https://www.dallasfed.org/research/economics/2022/1011?

utm_source=newsletter&utm_medium=email&utm_campaign=

newsletter_axiosgenerate&stream=top

[v] https://insideclimatenews.org/news/27102022/the-ev-battery-

boom-is-here-with-manufacturers-investing-billions-in-midwest-factories/

[vi] https://www.theglobeandmail.com/business/article-ottawa-

approves-new-quebec-lithium-mine-as-canada-doubles-down-

on/#:~:text=Quebec%20is%20blessed%20not%20only,attractive

%20jurisdiction%20for%20mining%20companies.

[vii] https://www.cbc.ca/news/canada/montreal/lithium-mine-val-dor-1.6648344

Disclaimer: This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. WallStreetNation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.

Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of Battery Metals Corp. and its securities. Neither WallStreetNation.com, Winning Media LLC or Jade Cabbage Media LLC currently hold the securities of Battery Metals Corp. and do not currently intend to purchase such securities.

The issuer, Battery Metals Corp. has compensated Winning Media LLC the sum total of seventy five thousand dollars USD total production budget to manage a digital media campaign for thirty days.

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.