Sponsored – Est. Read 9 Min

Junior Uranium Miner Planning Multiple Drill Campaigns this Year…

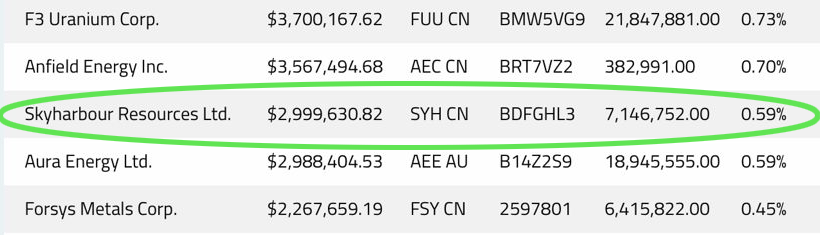

Maybe that’s why institutions are quietly accumulating millions of shares in Skyharbour Resources (OTCQX: SYHBF) (TSXV: SYH)(24)(25)

“This is a transformative transaction for Skyharbour and our shareholders as it represents a major stamp of approval for Russell with up to $61.5 million in combined project consideration coming in. We are very pleased to expand upon our long-standing relationship with Denison and to partner with their team to advance one of the more prospective exploration projects in the Athabasca Basin proximal to existing and developing mines. Denison’s success in exploring, permitting, and developing the neighboring world-class Wheeler River Project will provide considerable insight and experience as we jointly pursue success at Russell.”

Jordan Trimble, President, and CEO of Skyharbour Resources1A

6 Key Reasons

Why Skyharbour Resources

(OTCQX: SYHBF) (TSXV: SYH) Offers Strong Upside Potential Right Now.

Noteworthy Strategic Partners: Skyharbour is backed by major industry players, including mining giant Rio Tinto and uranium developer Denison Mines, both of whom are significant shareholders. In 2025, Skyharbour consolidated a 100% interest in its flagship Russell Lake Project from Rio Tinto and subsequently formed four strategic joint ventures with Denison Mines across various claim blocks at Russell. Denison, listed on the NYSE, is also a major strategic shareholder, and its President & CEO serves on Skyharbour’s Board of Directors. In addition, Orano, France’s leading uranium mining and nuclear fuel company, is a joint venture partner with Skyharbour at the Preston Project.(23)(18)

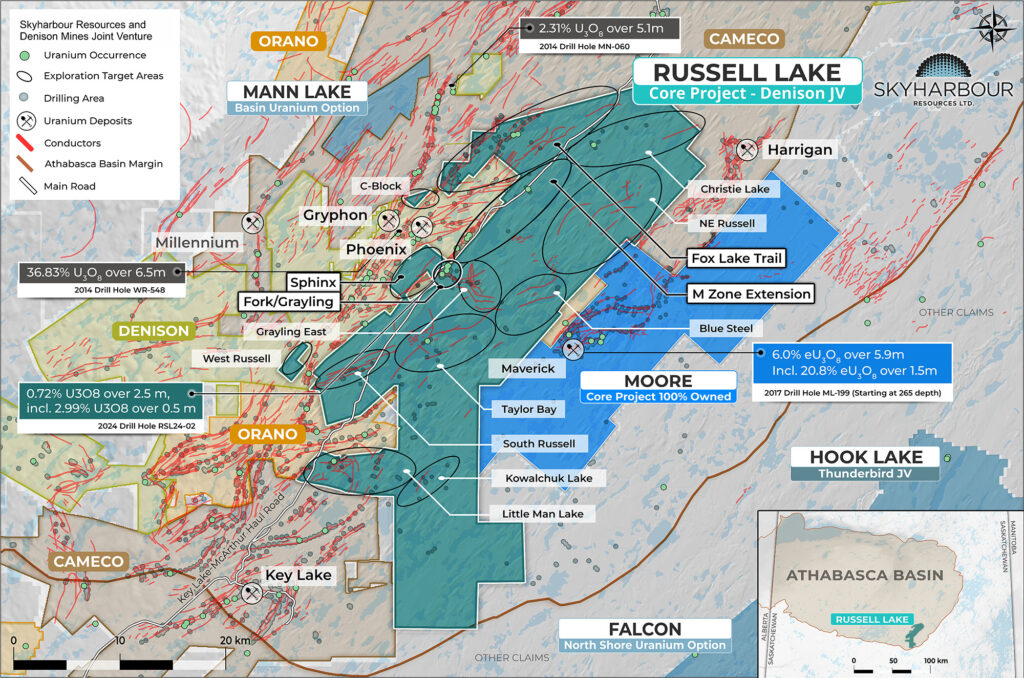

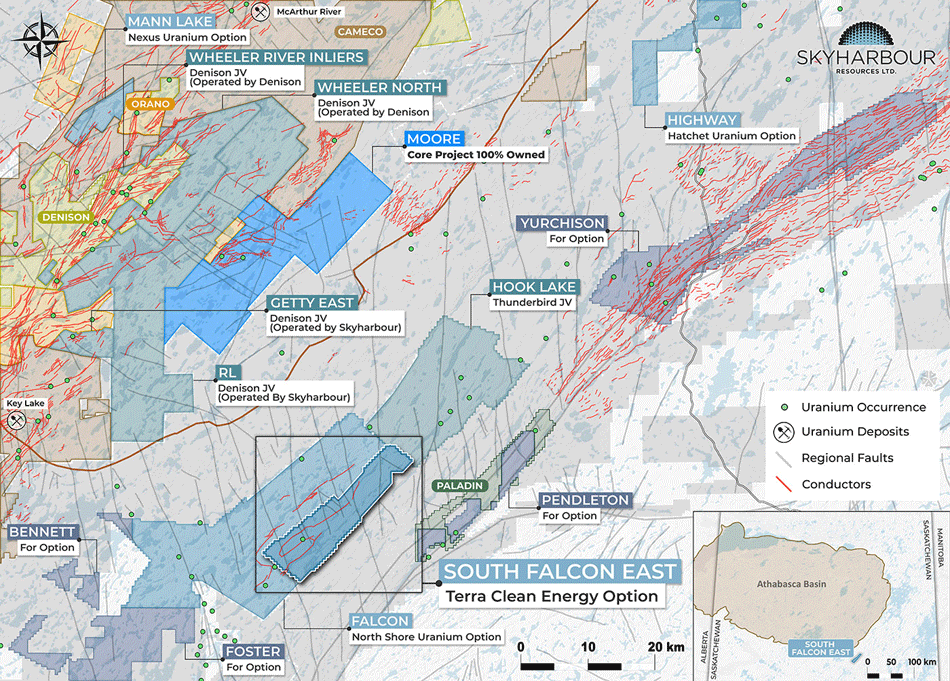

Projects Located in the Highest-Grade Depository of Uranium in the World: Skyharbour’s flagship projects are located in the Athabasca Basin in Saskatchewan, Canada. This is an ancient sedimentary basin hosting the world’s richest uranium deposits and mines. Historically the basin has produced approximately 20% of the world’s primary uranium supply and is a safe and favorable mining jurisdiction.(6) The Russell Lake uranium project comes with a fully permitted and functioning camp and is located adjacent to Denison’s “Wheeler River Project” which hosts the highest-grade undeveloped uranium deposit in the eastern portion of the Athabasca Basin. In addition to its co-flagship Russell Lake and Moore Projects, Skyharbour holds an extensive portfolio of uranium exploration projects in the Athabasca Basin and is well-positioned to benefit from improving uranium market fundamentals with forty-three projects covering over 1.6 million acres of mineral claims.

Catalyst-Rich Company and Institutional Accumulation: Skyharbour is fully funded for the upcoming drill programs at its co-flagship Russell Lake and Moore Uranium Projects in 2026 totaling approx. 30,000 meters of combined drilling, representing one of the largest annual drill campaign ever carried out by the Company. Other partner companies are planning additional exploration and drilling programs across several of Skyharbour’s secondary projects as part of its growing prospect generator strategy. Under this model, partners fund exploration activities while providing Skyharbour with annual cash and share payments, allowing the Company to advance its broader portfolio in a non-dilutive manner. Institutions are piling in and have been accumulating millions of shares of Skyharbour. The Sprott URNJ ETF owns around 7,146,752 shares and Global X ETF is sitting on about 12,132,755 shares as of 01/28/2026.(24)(25)

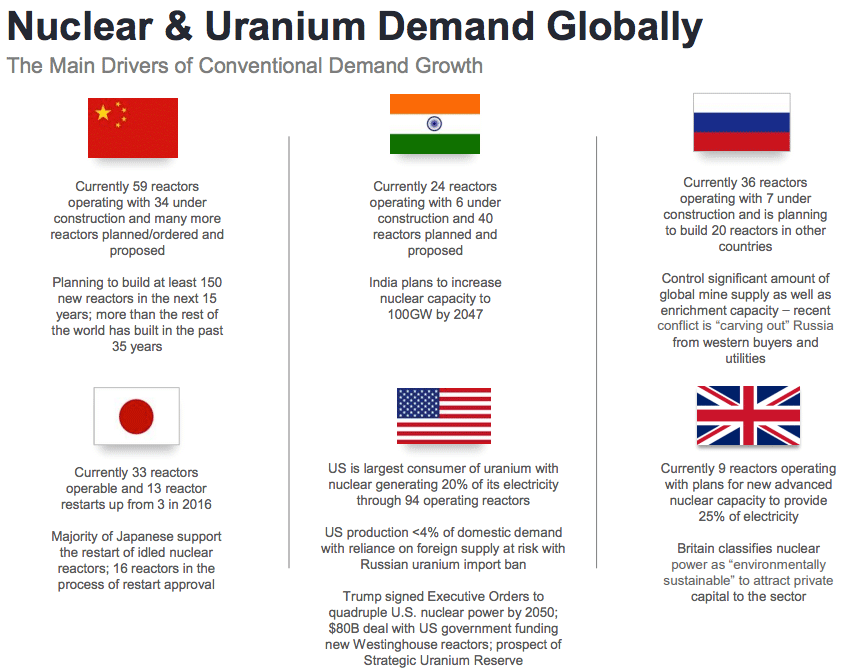

Uranium’s Value is Rising: In the last 60 years uranium has become one of the world’s most important energy minerals. The price of uranium has risen steadily since 2020 as demand grows for nuclear energy generation around the globe. In fact, uranium prices have more than tripled since 2020, driven by shrinking secondary supplies, geopolitical risks like the war in Ukraine and the coup in Niger, and growing demand from Big Tech. Recent executive orders from Trump to boost U.S. nuclear energy and secure domestic uranium supply chains have added further momentum to the sector and continue to put upward pressure on the price. (23)(18)

Uranium Miners are Critical to Clean Energy Transition: Worldwide, ESG investors are warming up to nuclear power after the carbon-free technology won EU recognition as sustainable.(4) US$565 billion of investment in nuclear power will be needed by 2050 if the EU is to hit its carbon neutrality targets.(26) And the recent COP30 conference saw 33 countries commit to a monumental declaration to triple nuclear power generation by 2050.

Skyharbour is a preeminent uranium exploration and prospect generator company with projects scattered throughout the prolific Athabasca Basin of Saskatchewan in Canada – home to the world’s largest and highest grade uranium mining and milling operations.(33)

At the moment, it has 43 uranium projects with well over 1.6 million acres strategically located throughout the Basin.(38)

Institutions have been accumulating millions of shares of Skyharbour Resources (OTCQX: SYHBF) (TSXV: SYH)

Across the globe, investors are now realizing that a long-term uranium bull market is still in its early stages.

Sprott Asset Management is a leading independent asset manager focused on delivering value to investors through alternative asset management strategies. Headquartered in Toronto, Canada, the mining finance center of the world, Sprott manages several billion dollars in precious metals investments, including the Sprott Physical Bullion Trusts which trade on the NYSE Arca.(28)

A

Global X ETFs is a member of Mirae Asset Financial Group, a global enterprise that offers asset management expertise worldwide with over $700B under management.(35)

The Global X Uranium ETF is currently sitting on 12,132,755 shares as of 01/28/2026 and the Sprott URNJ ETF currently owns around 7,146,752 shares.(25)

19,279,507 shares of Skyharbour Resources have been accumulated just between those two institutions as of 01/28/2026 (24)(25)

Skyharbour Resources Quickly Grabs Analyst Attention

In a recent analyst report by Red Cloud Securities, David A. Talbot, issued a “Buy” rating on the company with a C$0.65 target price. This price target would indicate a potential move of as much as 12% as suggested by the Red Cloud Securities report from 01/15/2026.

Additionally, analysts at Fundamental Research Corp. in December 2025 issued a “Buy” rating for Skyharbour Resources, with a price target of C$1.12.

Investor’s Summary:

Why You Should Consider Skyharbour Resources

(OTCQX: SYHBF) (TSXV: SYH) Today

- Skyharbour is well positioned with one of the largest uranium project portfolios in the Athabasca Basin (over 1.6M acres of mineral tenure)

- The Company is well funded and is about to embark on its largest combined drill campaign across several projects

- Offers investors to upside high-grade uranium discovery potential at the co-flagship Russell and Moore uranium projects while partners advance some of the secondary projects

- Two larger strategic partners in Denison Mines and Orano

- Institutions are piling in and have been accumulating millions of shares of Skyharbour Resources (OTCQX: SYHBF) (TSXV: SYH)(24)(25)

- Prospect Generator Business – 10 partner companies potentially

spending over CAD $118M in combined project consideration at numerous other Skyharbour projects

Skyharbour Holds an Extensive Portfolio of Drill Ready Uranium Exploration Projects in “Friendly” Saskatchewan.

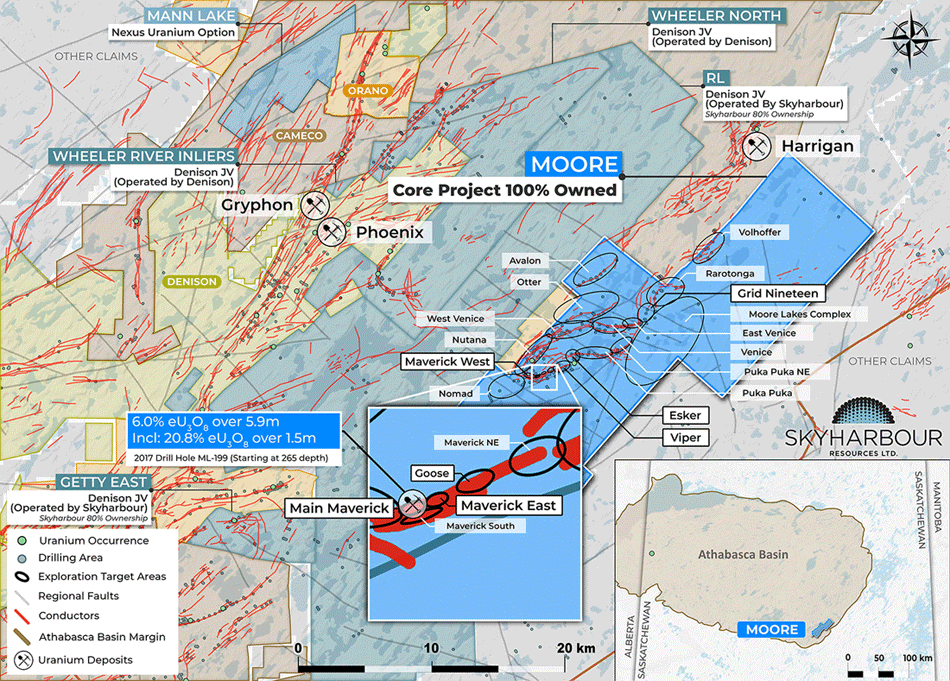

Skyharbour Advances Moore Lake and Establishes $61.5M Strategic JV Partnership with Denison at Russell Lake. Skyharbour has acquired from Denison Mines, a large strategic shareholder of the Company, a 100% interest in the Moore Uranium Project which is located 15 kilometers east of Denison’s Wheeler River project and 39 kilometers south of Cameco’s McArthur River uranium mine.(38)

Moore is an advanced stage uranium exploration property with high-grade uranium mineralization at the Maverick Zone that returned drill results of up to 6.0% U3O8 over 5.9 meters including 20.8% U3O8 over 1.5 meters at a vertical depth of 265 meters.(38)

Adjacent to the Moore Uranium Project is Skyharbour’s Russell Lake Uranium Project, which hosts historical high-grade drill intercepts over a large property area with robust exploration upside potential.(38)

Skyharbour consolidated 100% ownership of the 73,314-hectare Russell Lake Project after acquiring Rio Tinto’s remaining interest. Following this consolidation, the Company entered into a major strategic agreement with Denison Mines, establishing four new joint ventures across the various claim blocks that make up Russell Lake, Skyharbour remains operator on key areas of the project programs. The Company is actively advancing these two co-flagship projects through exploration and drill programs.(38) The Company is planning a total of approximately 30,000 metres of drilling across its Russell and Moore projects, with approximately 8,000 to 10,000 metres allocated to Moore and over 15,000 metres across newly reorganized properties at the Russell Lake Joint Ventures.

Furthermore, Skyharbour has an ownership interest in the South Falcon East Project located in the eastern perimeter of the Basin, which contains a NI 43-101 inferred resource totaling 7.0 million pounds of U308 at 0.03% and 5.3 million pounds of Th02 at 0.023% (the project is currently under option to Terra Clean Energy).

Russell Lake Uranium Project, which comprises 27 claims covering 73,314 hectares of prospective exploration ground strategically situated between the Company’s Moore Uranium project (to the east) and Denison Mines’ Wheeler River project (to the west) in the eastern portion of the Athabasca.(17)

The Project is a premier, advanced-stage exploration property given its large size, proximity to critical regional infrastructure, and the significant amount of historical exploration carried out on the property, which has identified numerous prospective target areas and several high-grade uranium showings as well as drill hole intercepts. The Property is centrally located between Cameco Corp.’s Key Lake mill to the south and the McArthur River mine to the north.(17)

Access to the Property is via Highway 914, which services the McArthur River Mine and runs through the western extent of the Property along with a high-voltage powerline that energizes the existing mining operations in the eastern portion of the Athabasca Basin.(17)

Highlights:

In 2025, Skyharbour entered into a major strategic partnership with Denison Mines, whereby Denison joined Skyharbour as an active funding and operating partner at Russell Lake. The transaction, valued at up to C$61.5 million in combined consideration, establishes Denison as a key strategic shareholder and joint venture partner, with earn-in rights of 20% to 70% across the newly restructured Russell Lake property package. Skyharbour remains the operator across the majority of the project area, including the Russell Lake (RL) and Getty East claims, while Denison will lead exploration at Wheeler North and the Wheeler Inlier claims. The partnership brings significant technical and financial strength to accelerate discovery efforts at Russell Lake, leveraging Denison’s expertise and proximity at Wheeler River. It also provides Skyharbour with substantial near-term funding and long-term exposure to one of the most prospective uranium corridors in the Athabasca Basin.

Both Highway 914 servicing McArthur River and a high-voltage power line connected to the provincial power grid run through the Property’s western claims.(17)

The Property has been the subject of significant historical exploration efforts including over 95,000 meters of drilling in over 220 drill holes. This provides the Company with an excellent dataset to direct subsequent exploration of high-priority areas with the potential for near-term discovery of high-grade uranium mineralization.(17)

Previous exploration work has identified numerous highly prospective target areas, some of which host high-grade uranium mineralization in historical drill holes. Furthermore, there are over 35 kilometers of untested conductors on the Property in magnetic lows, which are indicative of pelitic basement rocks conducive to uranium deposition in the Athabasca Basin.(17)

The Property has a permitted and functional exploration camp suitable for over forty people and is conveniently located near Highway 914 and within 5 km kilometers of Denison’s Phoenix deposit. The Property’s claims are in good standing for 2-22 years from banked assessment credits.(17)

Skyharbour completed an inaugural drilling campaign in 2023 which consisted of 9,595m in nineteen holes over three phases at the Project in which significant uranium mineralization was found in numerous holes.

The Company completed several phases of drilling in 2024, following up on high-priority target areas at the project, successfully intersecting high-grade uranium mineralization that warranted follow up drilling.

High-grade, sandstone-hosted mineralization up to 2.99% U3O8 was intersected over 0.5 meters in hole RSL24-02 at the new Fork Zone, within an interval of 0.721% U3O8 over 2.5 meters from 338.1 to 340.6 meters downhole just above the unconformity.

Skyharbour completed an Ambient Noise Tomography (ANT) survey to collect data over the highly prospective Grayling and Fork target areas, where previous drilling has intersected high-grade uranium mineralization. In 2025, Skyharbour completed a successful exploration program at the Russell Lake Project, drilling 19 holes totaling 9,844 metres. This work was complemented by Moving Loop and Fixed Loop Transient Electromagnetic (TEM) surveys across multiple priority target areas within the broader project footprint. Exploration focused on advancing several high-priority targets, including the Fork Zone, M-Zone Extension, Fox Lake Trail, and the newly identified Sphinx target area. Denison and Skyharbour plan to build on these results with follow-up exploration and drilling programs in 2026.

In 2026, Denison and Skyharbour are planning an aggressive, multi-phase exploration and drilling program across the newly reorganized Russell Lake Joint Venture properties, totaling over 15,000 metres of diamond drilling. This includes an initial 2,500-metre winter drill program at the Fox Lake Trail target on the Denison-operated Wheeler North property, followed by an additional 5,000 metres later in the year at the Fork and Sphinx target areas. Skyharbour will also advance exploration at the Russell Lake (RL) property through ground EM surveys and 4,000–5,000 metres of targeted drilling, while approximately 3,600 metres of drilling is planned at Getty East to test the Little Mann Lake prospect and extensions of the mineralized Middle Lake Trend. Additional Skyharbour Projects info can be found here.

The Changing of Attitudes Across the Globe Could Bring Billions of Dollars into the Uranium Market.(32)

Europe’s ethical investors may soften their attitude toward nuclear power after the carbon-free technology won EU recognition as a sustainable activity.(32)

Nuclear has joined the EU’s green taxonomy easing investor concerns about whether it should be considered environmentally friendly. This move could in turn open new funding sources for European nuclear operators, as the industry faces up to €550 billion (USD $580 billion) of investment needs through 2050, based on EU forecasts.(32)

The new green status adds to growing momentum for the power source in Europe as technology developments and greater appreciation for nuclear’s ability to consistently supply carbon-free power increasingly outweigh traditional worries about radioactive waste and safety levels.

Rwanda and Senegal joined the global commitment to triple nuclear energy capacity by 2050 at COP30 in Belém, Brazil. They have united with 31 other countries in endorsing the , which was launched two years ago at COP28.

“33 Countries Pledge to Triple Nuclear Capacity…Calling Nuclear the Most Effective Alternative to Fossil Fuels”iv

Global Demand For Uranium Is Growing, Shortages Possible(37)

The lion’s share of uranium is traded under long-term contracts between uranium producers and utility companies. The rest is traded in the spot market. The primary driver of the demand for uranium is the capacity of nuclear reactors used to generate electricity.(37)

Industry experts project that, given the number of new reactors planned and the worldwide growing demand for electricity, the demand for uranium will grow significantly over the next decade.(37)

Only freshly-mined uranium may satisfy the growing demand.(37)

The current annual global consumption is 200 million pounds, while annual global mine production is 175 million pounds, resulting in a 25-million pound deficit.(37)

Inventory drawdowns and other sources of secondary supply currently make up the difference. Industry experts, however, project that the supply of these secondary sources will decrease by 50% over the next decade, while global demand for uranium will increase, widening the supply-demand gap.(37)

Only primary sources of uranium—i.e., the supply produced from mines—can make up the coming shortfall, because the stockpiles will be gone.(37)

There are 439 operating nuclear power plants in the world, and 68 new reactors are currently under construction.(37)

In the next two decades, China, India, Russia, Europe, the Middle East, and Southeast Asia will dramatically expand their use of nuclear energy, causing fierce competition for mined uranium.(37)

According to the World Nuclear Association, there are over 100 new nuclear reactors in the planning stage and more than 350 reactors proposed worldwide, highlighting a substantial pipeline of future nuclear capacity expansion.(37)

China has one of the most active nuclear build programs in the world with dozens of reactors currently under construction and many more planned to support a significant expansion of its nuclear capacity through the 2030s, and India is steadily advancing its nuclear program with multiple new units and small modular reactors planned as part of its long-term energy strategy. 37)

China alone will consume the equivalent of one-third of today’s global uranium market.(37)

China and Russia have already begun aggressively buying up huge stakes in uranium mining operations around the world in order to stockpile uranium to meet their rising domestic demand.(37)

Investor’s Summary:

Why You Should Consider Skyharbour Resources

(OTCQX: SYHBF) (TSXV: SYH) Today

- Skyharbour is well positioned with one of the largest uranium project portfolios in the Athabasca Basin (over 1.6M acres of mineral tenure)

- The Company is well funded and is about to embark on its largest combined drill campaign across several projects

- Offers investors to upside high-grade uranium discovery potential at the co-flagship Russell and Moore uranium projects while partners advance some of the secondary projects

- Two larger strategic partners in Denison Mines and Orano

- Institutions are piling in and have been accumulating millions of shares of Skyharbour Resources (OTCQX: SYHBF) (TSXV: SYH)(24)(25)

- Prospect Generator Business – 10 partner companies potentially

spending over CAD $118M in combined project consideration at numerous other Skyharbour projects

A Closer Look at Skyharbour’s High-Upside Uranium Projects

Moore Uranium Project

Skyharbour owns 100% of the 35,705 hectares Moore Uranium Project located 42 kilometers northeast of the Key Lake mill, approx. 15 kilometers east of Denison’s Wheeler River project, and 39 kilometers south of Cameco’s McArthur River mine.(42)

Unconformity-hosted uranium mineralization was discovered on the property at the Maverick Zone in the early 2000s at relatively shallow depths. Skyharbour has carried out several drill programs with multiple holes intersecting high-grade uranium mineralization over the 4km long Maverick corridor.(42)

Drill results include 20.8% U3O8 over 1.5m at 264m depth in hole ML-199, 9.12% U3O8 over 1.4m at 278m in hole ML-202, and 5.29% over 2.5m U3O8 at 279m depth in hole ML-200. Hole ML-202 represents a new high-grade discovery and illustrates the strong discovery potential of additional high-grade lenses along strike.(42)

Skyharbour has continued to advance the high-grade Moore Lake Project through multiple successful drill campaigns. In the winter of 2024, the Company completed 2,864 metres of drilling focused on the Main Maverick Zone and Grid 19 target conductors, intersecting significant uranium mineralization at the unconformity at relatively shallow depths.

This was followed by a summer 2024 program totaling 2,759 metres in nine holes, designed to extend and expand both the Main Maverick and Maverick East Zones. All but one hole intersected uranium mineralization, including drill hole ML24-15, which returned 6.4 metres of 1.50% U₃O₈ and extended the Maverick East Zone more than 40 metres along strike to the northeast. Building on this momentum, Skyharbour completed a 7,884-metre diamond drill program in 2025 that confirmed high-grade mineralization at the Main Maverick Zone, highlighted by hole ML25-15, which returned 4.84% U₃O₈ over 4.4 metres, including 11.77% U₃O₈ over 1.6 metres.

The 2025 program also led to the identification of a new regional discovery opportunity at the Nomad Zone, located 1.7 kilometres southwest of Maverick, where initial drilling intersected strong faulting and intense hydrothermal alteration, reinforcing the potential for further uranium discoveries across the broader Moore Lake property.

In 2026, Skyharbour plans a multi-phased drill program at the Moore Lake Project totaling approximately 8,000 to 10,000 metres, beginning with a winter phase of 5,000 to 6,000 metres. Additional geophysical surveys and fieldwork are currently underway to refine targets ahead of drilling.

Highlights:

- 12 contiguous claims totalling 35,705 hectares(42)

- Strategically located just east of the midpoint between the Key Lake mine and mill complex and the producing McArthur River mine (42)

- The property has been the subject of extensive historic exploration with over $40 million in expenditures, and over 140,000 meters of diamond drilling completed in +380 drill holes (42)

High grade and relatively shallow “Maverick Zone”:(42)

- Drill hole ML-61 returned 4.03% eU3O8 over 10 meters, including 20% eU3O8 over 1.4 meters, starting at a depth of 264.68 meters(42)

- Drill holes ML-55 and ML-47 also encountered high-grade mineralization, returning 5.14% U3O8 over 6.2 meters, and 4.01% U3O8 over 4.7 meters, respectively(42)

- From the latest drilling, drill hole ML24-08 returned 4.61% U3O8 over 5.0 meters, including 7.30% U3O8 over 3.0 meters

- 2024 first phase of winter drilling totaled 2,864 metres in nine holes; 2024 second phase of drilling totalled 2,759 metres in nine holes

- 2024 assays expanded the Main Maverick and Maverick East Zones, highlighted by ML24-15 returning 6.4m of 1.50% U₃O₈ and extending Maverick East 40m to the northeast.

- In 2025, Skyharbour drilled 7,884 metres, confirming high-grade uranium at Main Maverick (ML25-15: 4.84% U₃O₈ over 4.4m, including 11.77% over 1.6m) and identifying the new Nomad Zone target.

Skyharbour also has several active Earn-in Option and Joint Venture partners:

In addition to offering high-grade uranium discovery potential at its two co-flagships of Russell and Moore Lake, Skyharbour also boasts ten partner companies advancing fourteen other projects. The option agreements and JV’s with these companies combine for over CAD $76 million in exploration expenditures, CAD $16 million in cash payments, and over $26 million in share issuances from these partner companies assuming they complete their respective earn-ins.

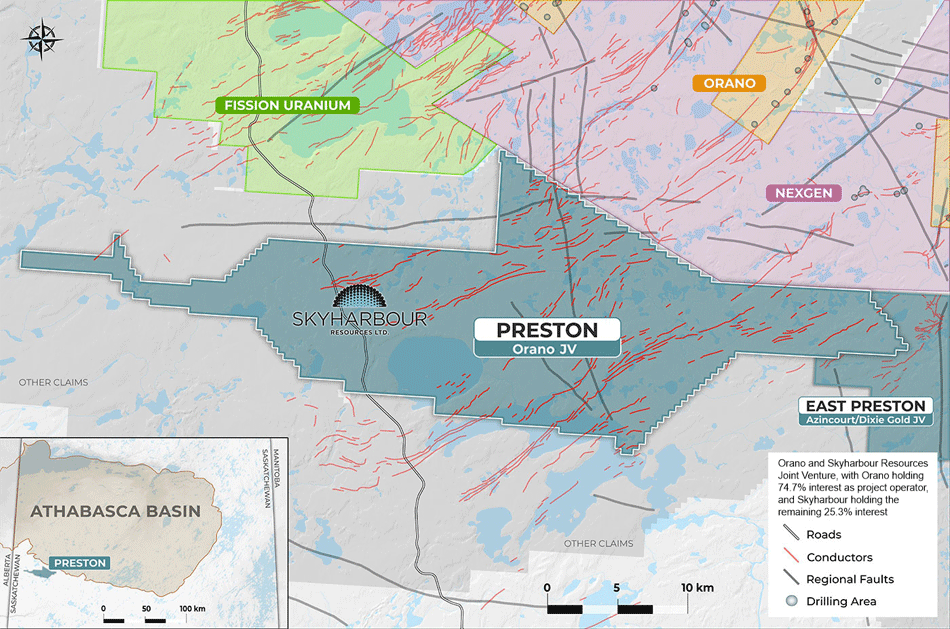

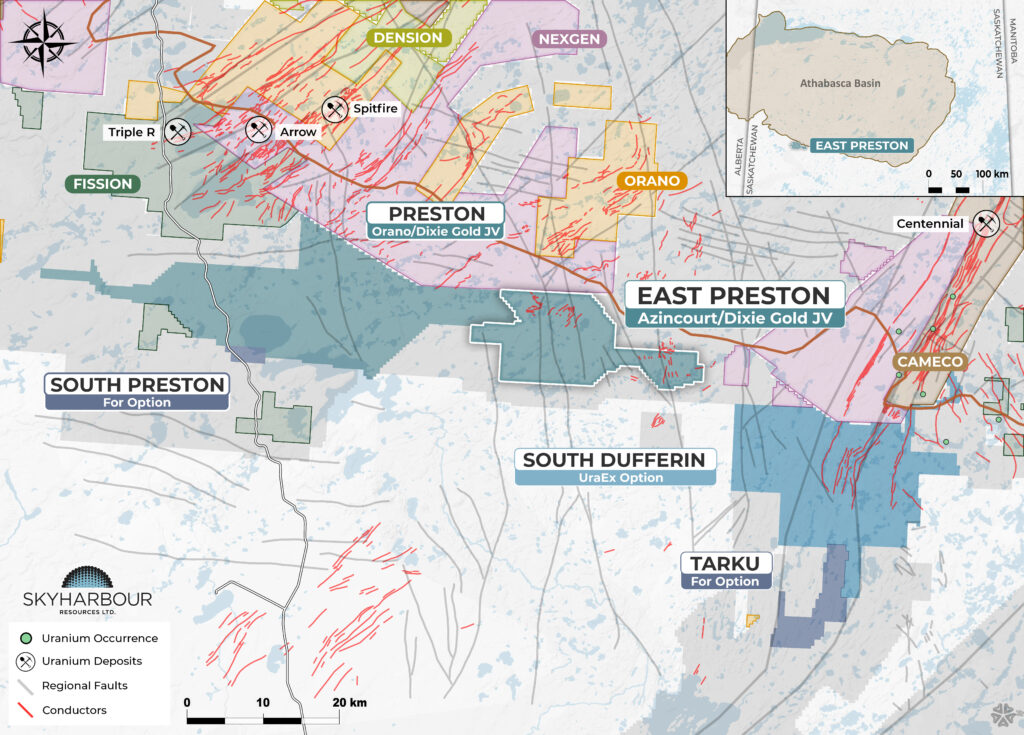

Skyharbour has a joint venture with industry leader Orano (France’s largest uranium mining and nuclear fuel cycle company) at the Preston Project whereby Orano has earned a 74.7% interest in the project through exploration expenditures and cash payments. Skyharbour now owns a 25.3% interest in the Project.(42)

Skyharbour has entered into a series of strategic joint venture agreements with NYSE listed Denison Mines at the Russell Lake Project, formed after consolidating 100% ownership of the property. The transaction represents up to CAD $61.5 million in combined consideration—including cash, shares, and exploration expenditures—through which Denison can earn between 20% and 70% ownership interests across various claim blocks over a seven-year period. Skyharbour remains a significant stakeholder and operator on key portions of the project.

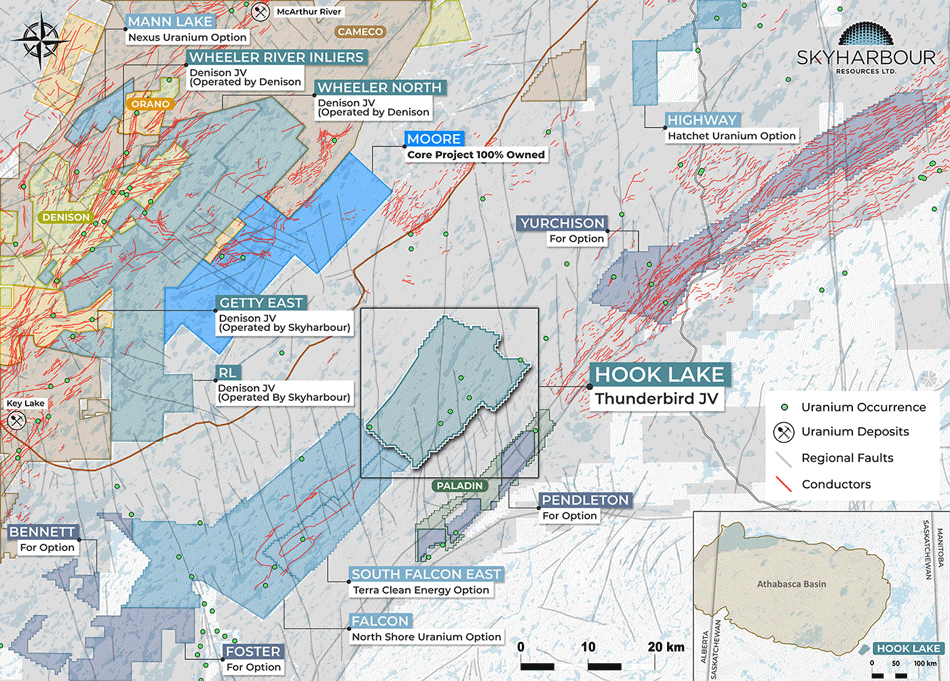

Skyharbour has a joint venture with ASX listed Thunderbird Resources on the Hook Lake Uranium Project. Thunderbird completed an earn-in of 80% interest through exploration expenditures as well as cash and share payments to Skyharbour whereby Skyharbour now retains a 20% interest in the Project.

Skyharbour also has a joint venture with Azincourt Energy at the East Preston Project whereby Azincourt has earned a majority interest in the project through exploration expenditures, cash payments, and share issuance. Skyharbour now owns a 9.5% interest in the Project. Preston and East Preston are large, geologically prospective properties proximal to Fission Uranium’s Triple R deposit as well as NexGen Energy’s Arrow deposit.(42)

In addition, Skyharbour also has several active earn-in option partners including:

- Nexus Uranium Corp. (CSE) – Option to earn up to a 75% interest in the Mann Lake Project through $4,000,000 in exploration spending, $850,000 in cash, and share issuances over three years.

- Terra Clean Energy (TSX-V) – Option to earn up to a 75% interest in the South Falcon East Project via 1,111,111 shares upfront, $10.5 million in exploration expenditures, and $11.1 million in cash payments, of which $6.5 million may be settled in shares, over a five-year earn-in.

- North Shore Uranium (TSX-V) – Option to earn an initial 80% interest in the Falcon Project through $5.3 million in combined cash, shares, and exploration spending over three years, with an option to acquire the remaining 20% for an additional $10 million in cash and shares.

- UraEx Resources Inc. (Private Co.) – Option to acquire up to 100% of the South Dufferin and Bolt Projects. UraEx may earn an initial 51% through $4.6 million in total consideration, and up to 100% through $9.8 million in combined cash, shares, and exploration expenditures over five years.

- Hatchet Uranium Corp. (Private Co.) – Option to earn 80% of the Highway Project via $1,050,000 in shares, $245,000 in cash, and $2,050,000 in exploration spending over three years. Hatchet has also agreed to purchase 100% of Skyharbour’s Genie, Usam, and CBX/Shoe Projects.

- Mustang Energy Corp. (CSE) – Option to earn a 75% interest through $480,000 in shares, $275,000 in cash, and $800,000 in exploration expenditures over three years.

Falcon and South Falcon East Uranium Projects(46)

Image Source (46)

The South Falcon East Project is an advanced-stage uranium exploration project in the southeast Athabasca Basin in which Skyharbour has an ownership interest.

The Falcon Point Project spans 12,234 hectares, located 18 km outside the Athabasca Basin and 55 km east of the Key Lake Mine. It hosts a shallow NI 43-101 inferred resource of 7.0 M lbs U O and 5.3 M lbs ThO , supported by over 22,000 metres of drilling in 110+ holes. Skyharbour has optioned the project to Terra Clean Energy, which can earn up to a 75% interest; Terra’s 2024 drilling at the Fraser Lakes B Deposit confirmed uranium-bearing pegmatites and graphitic paragneiss, completing 1,927 metres in seven holes.

Terra completed a successful 1,927-metre winter 2025 drill program at Fraser Lakes B, expanding the known mineralized footprint and confirming uranium in six of seven holes across both the eastern and western parts of the property. Several holes returned wide zones of uranium that remain open to the north and east, highlighting strong potential for continued growth.

Skyharbour also holds 100% of the adjacent 42,908-hectare Falcon Uranium Project, where shallow uranium mineralization occurs in multiple geological settings, including Athabasca-style basement targets along EM conductors. Extensive historical exploration—including airborne and ground geophysics, drilling, sampling, and prospecting—has established a strong geological database, with the property accessible via nearby northern highways and grid power.

Skyharbour entered into an option agreement with North Shore Uranium on the Falcon Uranium Project whereby North Shore can earn an initial 80% interest in the claims over a three year period by fulfilling combined cash, share issuance and exploration expenditure commitments. North Shore is planning exploration and drilling to commence in 2026.

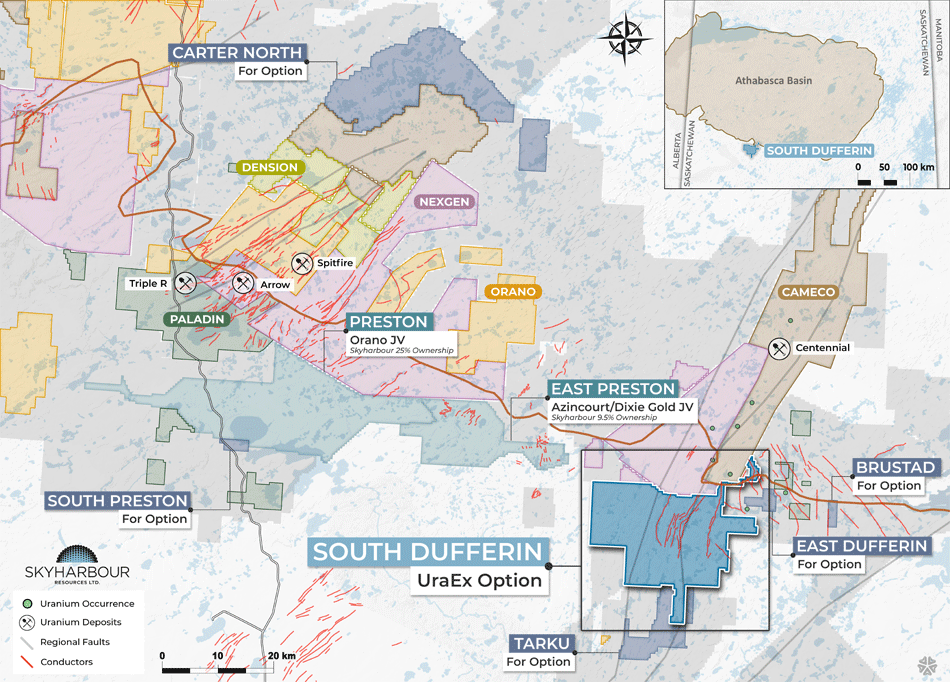

The Preston Project(47)

The Preston Project is a large land position totaling 49,635 hectares strategically located proximal to NexGen Energy’s (TSX-V: NXE) high-grade Arrow uranium deposit and Fission Uranium’s (TSX: FCU) Patterson Lake South Triple R deposit. In 2017, Skyharbour signed an option agreement with industry-leader and strategic partner Orano (formerly AREVA) Resources Canada to option a majority stake in the Preston Project. In early 2021, Orano fulfilled their earn-in option interest in the project through funding exploration expenditures and making cash payments. Orano now holds a 74.7% interest in the joint venture and is the operator, with the remaining minority 25.3% interest owned by Skyharbour.

The Preston Uranium Project is a strategic, district-scale property with robust exploration upside potential and Skyharbour is utilizing the prospect generator model to advance this project with strategic partners.(47) Orano commenced a comprehensive 2024 field campaign, which marked the first exploration program carried out by Orano since 2020. In 2025, the Preston Uranium Project exploration program completed 5,565 metres of diamond drilling in 17 holes across priority targets including Johnson Lake, Canoe Lake, and FSAN. Drilling confirmed uranium-fertile structural and alteration systems, validated key EM conductors, and identified multiple high-priority targets for follow-up drilling. In 2026, exploration will include an airborne and ground gravity survey program to refine targets at FSAN and Canoe Lake, followed by approximately 3,000–3,500 metres of helicopter-supported drilling focused on FSAN and the underexplored Area B conductive corridor.

The East Preston Project(48)

The East Preston Uranium Project is a large land position totaling 20,674 hectares, representing the eastern region of the larger Preston Project strategically located near NexGen Energy Ltd’s high-grade Arrow deposit on its Rook-1 property and Fission Uranium Corp Triple R deposit located within their PLS Project area.(48)

In February 2021, Azincourt earned their interest in the project by completing CAD $2.5 million in staged exploration expenditures and making a total of CAD $1 million in cash payments over the previous four years as well as issuing a total of 9.5 million common shares of Azincourt divided evenly between Skyharbour and Dixie Gold. Skyharbour’s current ownership of the East Preston Project is 9.5% with Dixie owning 4.7%.

In 2023, Azincourt drilled 3,066 metres in 13 holes, confirming uranium enrichment within the established clay alteration zones at the K and H target areas. The 2024 winter program added 1,086 metres in four holes, focused on following up the 2023 results and testing the transition zone between the K and H areas where clay alteration and elevated uranium were previously identified.

The Hook Lake Project (48)

The Hook Lake Project consists of 16 contiguous mining claims covering 25,846 hectares, located 60 km east of the Key Lake Uranium Mine in northern Saskatchewan. The Project is host to several prospective areas of uranium mineralization including the Hook Lake / Zone S High-grade surface outcrop with reported grades in grab samples up to 68% U3O8. In February 2024, Thunderbird Resources completed an earn-in of 80% interest in the Hook Lake Uranium Project through exploration expenditures as well as cash and share payments to Skyharbour, forming a joint venture partnership.

Thunderbird Resources completed its maiden drilling program at the Hook Lake Project earlier in 2022. The drilling program comprised eight drill holes for 1,757m, with six holes at the S-Zone prospect and two at the V-Grid prospect. A total of 305 samples were collected from the program and submitted to the lab.

Thunderbird also completed an airborne gravity gradiometry survey in the summer of 2022 and following an interpretation of the data, eleven new targets were defined. The airborne gravity survey has confirmed eleven new targets which provides Thunderbird with excellent potential drill targets at the project.

The Mann Lake Project (44)

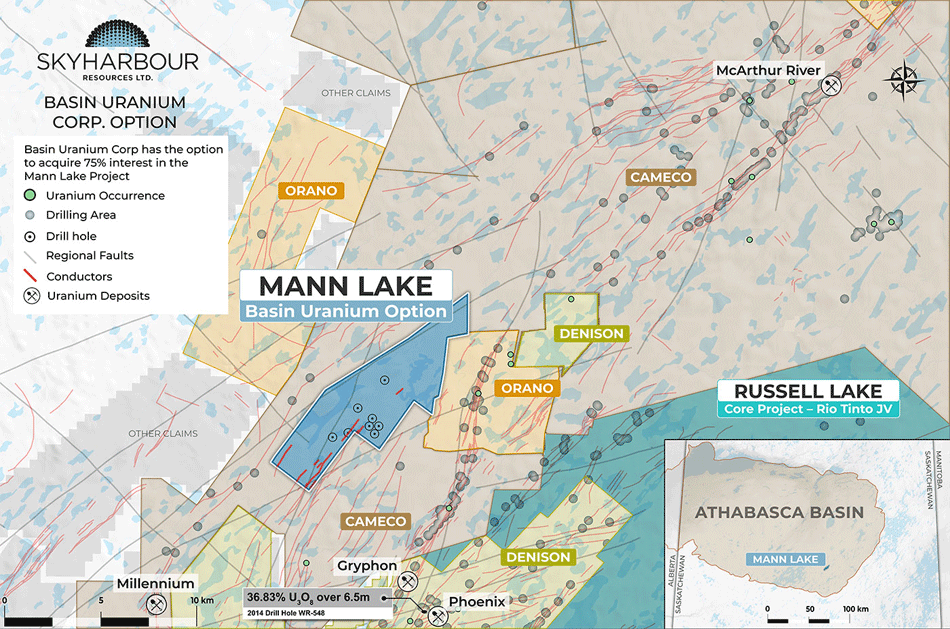

The 3,473 hectare Mann Lake Uranium Project lies in the eastern Athabasca Basin, 25 km southwest of the McArthur River Mine and adjacent to the Cameco-operated Mann Lake JV (Cameco 52.5%, Denison 30%, Orano 17.5%). Skyharbour’s 2014 EM survey outlined a broad NE-SW conductive corridor prospective for basement-hosted uranium. In 2021, Skyharbour optioned the project to Nexus uranium Corp., granting them the ability to earn up to a 75% interest.(44)

In 2022, Nexus Uranium (previously Basin Uranium) completed two phases of drilling totalling 6,279m in nine holes which intersected anomalous uranium mineralization. Nexus has plans to carry out additional exploration and drilling in 2025.

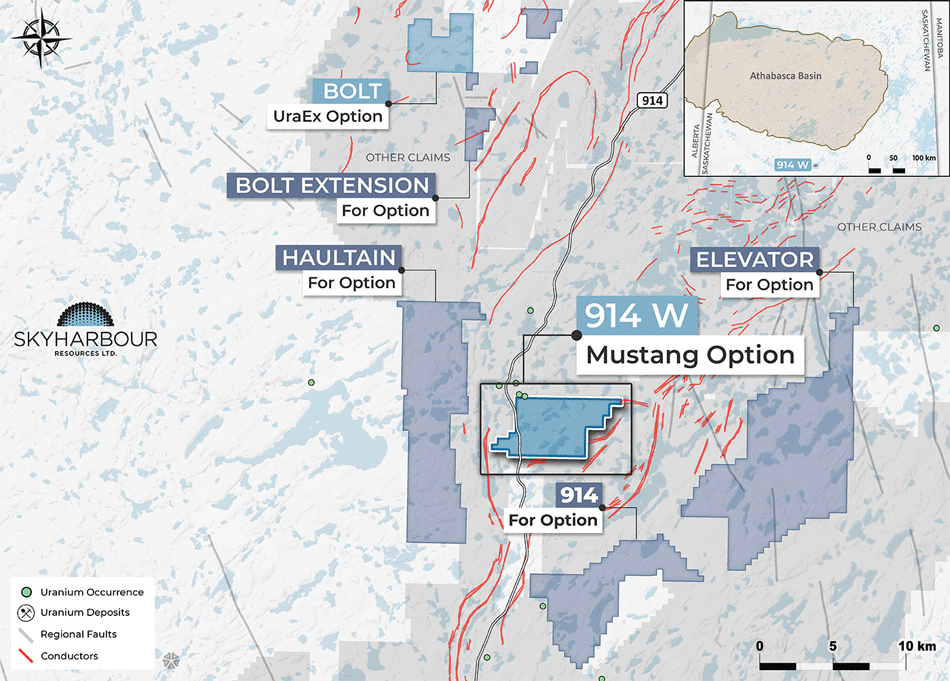

The 914W Project

The 914W Project covers 2,442 hectares approximately 48 km southwest of Cameco’s Key Lake Operation, with Highway 914 running along the western boundary and providing excellent access.

Skyharbour optioned the project to Mustang Energy, which can earn up to 75% through staged cash payments, share issuances, and exploration expenditures totaling approximately $1.55 million over three years.

Mustang recently completed a high-resolution helicopter-borne TDEM survey totaling 136 line-km. The survey outlined a strong, continuous conductive zone interpreted to represent graphitic basement rocks or fault-related alteration — key features associated with Athabasca-style uranium deposits — and has helped refine high-priority drill targets for future programs.

The South Dufferin Project

The South Dufferin Project covers 13,204 hectares just south of the Athabasca Basin, along the southern extension of the Virgin River Shear Zone, a major uranium-bearing structural corridor that hosts Cameco’s Dufferin Lake zone and the Centennial deposit to the north.

In 2024, Skyharbour optioned the project to UraEx Resources, which can earn up to 100% through staged cash, share, and exploration commitments totaling $9.8 million over five years. UraEx has begun advancing the project under the prospect-generator model.

UraEx commenced a fully funded 2025 summer drill program totaling approximately 2,600 metres in 8–12 helicopter-supported holes. The program is designed to test extensions of key structural corridors and high-priority targets prospective for basement-hosted uranium mineralization.

Skyharbour has several other properties in their portfolio that they look to either option, JV or sell, as they continue to bolster their robust prospect generator model.

Additional information on Skyharbour Projects info can be found here.

The team includes:

Jordan Trimble B.SC., CFA

Director, President, CEO

Jordan Trimble is the President and Chief Executive Officer as well as a Director of Skyharbour Resources Ltd. By background, he is an entrepreneur and has worked in the resource industry in various roles with numerous companies specializing in management, corporate finance and strategy, shareholder communications, business development and capital raising. Previous to Skyharbour, he was the Corporate Development Manager for Bayfield Ventures, a gold company with projects in Ontario which was successfully acquired by New Gold (TSX: NGD) in 2014. Bayfield made a high grade gold and silver discovery at its Burns Block property in the Rainy River district which is now a part of the producing Rainy River Mine.

Through his career Mr. Trimble has founded and helped manage several public and private companies and has been instrumental in raising substantial amounts of capital for mining companies with his extensive network of institutional and retail investors. He is a frequent speaker at resource and mining conferences globally and has appeared on various media outlets including BNN and the Financial Post. In recognition of his leadership and contributions to the mining and resource sector, he was named one of Business in Vancouver’s Forty Under 40 award recipients for 2025. Mr. Trimble holds a Bachelor of Science Degree with a Minor in Commerce from the University of British Columbia and he is a CFA® Charterholder and served a full term as a Director of the CFA Society Vancouver.

David Cates, CPA, MAcc.

Director

David Cates, CPA, MAcc, is a Director of Skyharbour. He is the President and CEO of Denison Mines (TSX: DML). Prior to being appointed the President and CEO position Mr. Cates served as Denison’s Vice President Finance, Tax and Chief Financial Officer. As Chief Financial Officer, Mr. Cates played a key role in the Company’s mergers and acquisitions activities – leading the acquisition of Rockgate Capital Corp. and International Enexco Ltd. Mr. Cates joined Denison in 2008 and held the position of Director, Taxation prior to his appointment as Chief Financial Officer. Prior to joining the Company, Mr. Cates held positions at Kinross Gold Corp. and PwC LLP with a focus on the resource industry.

Paul Matysek, M.Sc., P.Geo.

Strategic Advisor

Paul Matysek is a Strategic Advisor for Skyharbour and is a mining entrepreneur, professional geochemist and geologist with over 35 years of experience in the mining industry. He was the Founder, President and CEO of Energy Metals Corporation, a premier uranium company that traded on the New York and Toronto Stock Exchanges. Mr. Matysek led EMC as one of the fastest growing Canadian companies in recent years, increasing its market capitalization from $10 million in 2004 to approximately $1.8 billion when it was acquired by a larger uranium producer, Uranium One Inc., in 2007. (49)

In addition to serving as Chairman of Lithium X before its recent sale, Mr. Matysek was President and CEO of Goldrock Mines Corp. which on June 7th, 2016 announced it had entered into a definitive agreement to be acquired by Fortuna Silver Mines (NYSE:FSM) (TSX:FVI) for $129 million on a fully-diluted in-the-money basis. Previously, He was also the President and CEO of Lithium One Inc., which developed a high quality lithium project in northern Argentina. In July 2012, Lithium One and Galaxy Resources merged with a $112 million plan to create a fully integrated lithium company. Prior to Lithium One, Mr. Matysek was the President and CEO of Potash One Inc. where he was the architect of the $434 million friendly takeover of Potash One by K+S Ag, which closed in early 2011.(49)

Jim Pettit

Chairman and Director

Jim Pettit brings over 30 years of experience in the resource industry specializing in finance, corporate governance, management, and compliance and was previously Chairman and CEO of Bayfield Ventures Corp. which was sold to New Gold in 2014. (49)

Dave Billard, P.GEO.

Consulting Geologist

Dave Billard is a geologist with over 40 years of exploration and development experience, searching for uranium, gold and base metals in western Canada and the western US. He is a graduate of the University of Saskatchewan (1984) and Professional Geoscientist registered in Saskatchewan. He was Chief Operating Officer, Vice President Exploration and Director for JNR Resources Inc, prior to their acquisition by Denison Mines in 2013. Dave was instrumental in the discovery of JNR’s Maverick and Fraser Lakes B zones and, earlier in his career, participated in the discovery and development of several significant gold deposits in northern Saskatchewan. Before joining JNR Dave was a geological consultant specializing in uranium exploration in the Athabasca Basin of Saskatchewan and prior to that, was employed by Cameco Corporation for over 12 years. Mr. Billard is currently a geological consultant based in Saskatoon and is a director and Chair of the board for Abasca Resources. (49)

Sedar Donmez, P.GEO.

VP of Exploration

As a highly experienced geoscientist with nearly two decades of expertise in uranium exploration and development, Mr. Donmez has played an active role in numerous grassroots and advanced uranium exploration projects in northern Saskatchewan and Zambia. Mr. Donmez has an Engineering Degree in Geology and is a registered Professional Geoscientist with the Association of Professional Engineers and Geoscientists of Saskatchewan.

During his 17-year tenure at Denison Mines Corp., Mr. Donmez was pivotal in advancing numerous uranium exploration and development projects. He was involved in various capacities with the Phoenix and Gryphon uranium deposits on Denison’s Wheeler River project, from initial discovery to the completion of the Feasibility Study in 2023. As Resource Geology Manager, he was integral to the development of mineral resource estimates and NI 43-101 technical reports for several advanced exploration projects in the Athabasca Basin. Additionally, he was part of a team exploring the application of in-situ recovery mining techniques for high-grade uranium deposits in the Athabasca Basin.

Christine McKechnie, M.SC.

Senior Project Geologist

Christine McKechnie is a geologist specializing in uranium deposits, in particular basement-hosted unconformity-related deposits in the Athabasca Basin and surrounding area. Since starting her career, she has worked for several companies (Claude Resources Inc., JNR Resources Inc., CanAlaska Uranium Ltd., and Cameco Corp.) carrying out gold and uranium exploration and working underground at the Eagle Point Mine; in addition to a summer mapping with the Saskatchewan Geological Survey. She completed her B.Sc. (High Honors) in 2008 from the University of Saskatchewan (U of S), and in early 2013, she completed a M.Sc. thesis at the U of S on the geology and origin of the Fraser Lakes Zone B pegmatite-/leucogranite-hosted U-Th-REE deposit in northern Saskatchewan. As part of her thesis, she co-authored four peer-reviewed journal papers on the Fraser Lakes Zone B deposit and other basement-hosted uranium prospects in northern Saskatchewan. Her paper (co-authored with Dr. Irvine Annesley and Dr. Kevin Ansdell) entitled “Geological Setting, Petrology, and Geochemistry of Granitic Pegmatites and Leucogranites Hosting U-Th-REE Mineralization at Fraser Lakes Zone B, Wollaston Domain, Northern Saskatchewan, Canada” received the 2015 CIM Barlow Medal for Best Geological Paper.(49)

Dr. Andrew Ramcharan PH.D., P.ENG, FAUSIMM

Senior Vice President of Corporate Development

Dr. Ramcharan has an extensive background in corporate development, mining and exploration, project evaluation, and investment banking spanning over twenty years. Previously, as Manager of Corporate Development for IAMGOLD, Dr. Ramcharan was involved in raising over $600 million in equity financings and worked on project acquisitions totaling over $800 million. Prior to that, he was at SRK Consulting for several years and worked with uranium companies including SXR Uranium One, Ur-Energy, and UraMin which eventually sold for $2.5 billion in 2007 to Areva. Dr. Ramcharan has also held senior roles with Sprott and Resource Capital Funds, where he performed over 300 project evaluations and helped complete numerous debt and equity financings. More recently he was the Executive Vice President of Corporate Development and Investor Relations for Roscan Gold where he has been instrumental in raising over $40 million.(49)

Dr. Ramcharan holds a Ph.D. and M.Sc. in Mining Engineering and Mineral Economics, and attended the Colorado School of Mines, University of Leoben, and Harvard Business School Continuing Education Program. Dr. Ramcharan is a P.Eng. in Ontario, a Registered Member of The Society for Mining, Metallurgy and Exploration (SME) in USA, a Fellow of both The Australasian Institute of Mining and Metallurgy (AusIMM) and The South African Institute of Mining and Metallurgy (SAIMM).

Investor’s Summary:

Why You Should Consider Skyharbour Resources

(OTCQX: SYHBF) (TSXV: SYH) Today

- Skyharbour is well positioned with one of the largest uranium project portfolios in the Athabasca Basin (over 1.6M acres of mineral tenure)

- The Company is well funded and is about to embark on its largest combined drill campaign across several projects

- Offers investors to upside high-grade uranium discovery potential at the co-flagship Russell and Moore uranium projects while partners advance some of the secondary projects

- Two larger strategic partners in Denison Mines and Orano

- Institutions are piling in and have been accumulating millions of shares of Skyharbour Resources (OTCQX: SYHBF) (TSXV: SYH)(24)(25)

- Prospect Generator Business – 10 partner companies potentially

spending over CAD $118M in combined project consideration at numerous other Skyharbour projects

Source List:

1A: https://skyharbourltd.com/news-media/news/skyharbour-enters-into-major-strategic-agreement-with-denison-mines-to-form-four-new-joint-ventures-at-russell-lake-combined-project-consideration-of-up-to-615-million

A: https://sprottetfs.com/urnm-sprott-uranium-miners-etf/?

gclid=Cj0KCQiAtOmsBhCnARIsAGPa5yaPSHZVKMDWcPph

4i6Bek5QLZbXg5-UU2qWJdSoxjehezOAGVuKUJ4aArZ4EALw_wcB

Source 1: https://tradingeconomics.com/commodity/uranium

Source 2: https://www.bnnbloomberg.ca/skyharbour-resources-has-positioned-itself-to-capitalize-on-the-bullish-uranium-market-1.1600720

Source 3: https://www.bloomberg.com/news/features/2021-11-02/china-climate-goals-hinge-on-440-billion-nuclear-power-plan-to-rival-u-s

Source 4: https://skyharbourltd.com/_resources/presentations/corporate-presentation.pdf

Source 5: https://www.cnbc.com/2021/04/22/biden-pledges-to-slash-greenhouse-gas-emissions-in-half-by-2030.html

Source 6: https://www.bbc.com/news/world-europe-56828383

Source 7: https://www.scientificamerican.com/article/china-says-it-will-stop-releasing-co2-within-40-years/

Source 8: https://www.energy.gov/ne/articles/3-reasons-why-nuclear-clean-and-sustainable

Source 9: https://www.spglobal.com/platts/en/market-insights/latest-news/metals/072921-uranium-demand-rising-while-supply-remains-uncertain-cameco

Source 10: https://news.un.org/en/story/2021/08/1097572

Source 11: https://investorintel.com/markets/uranium-energy/uranium-energy-intel/canadas-athabasca-basin-the-worlds-richest-uranium-play/

Source 12: https://www.globenewswire.com/news-release/2021/09/14/2296344/36591/en/Skyharbour-Intersects-High-Grade-Uranium-Mineralization-at-Maverick-East-Zone-with-Drill-Results-of-2-54-U3O8-over-6-0m-including-6-80-U3O8-over-2-0m-Additional-Assays-Pending-and-.html

Source 13: https://skyharbourltd.com/projects/projects-overview/

Source 14: https://stockcharts.com/h-sc/ui?s=SYH.V

Source 15: https://www.barchart.com/stocks/quotes/SYH.VN/overview

Source 16: https://www.reuters.com/business/energy/russias-yamal-europe-westbound-gas-pipeline-flows-stopped-friday-2022-03-04/

Source 17: https://www.globenewswire.com/news-release/2022/05/19/2446685/36591/en/Skyharbour-Secures-Option-to-Acquire-an-Initial-51-and-Up-to-100-of-the-Russell-Lake-Uranium-Project-from-Rio-Tinto-in-the-Athabasca-Basin-of-Saskatchewan.html

Source 18: http://skyharbourltd.com/_resources/presentations/corporate-presentation.pdf?v=0.844

19.)https://www.prnewswire.com/news-releases/value-of-uranium-rising-as-demand-grows-for-nuclear-energy-generation-around-the-globe-301548646.html

20.)https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/esg-investors-warm-to-nuclear-power-after-eu-green-label-award-69002267

21.)https://redcloudresearch.com/skyharbour-resources-ltd-tsxvsyh-51-of-russell-lake-acquired-looking-to-dust-off-exploration-targets/

22.) http://skyharbourltd.com/_resources/presentations/corporate-presentation.pdf?v=0.844

23.) https://www.world-nuclear.org/information-library/nuclear-fuel-cycle/mining-of-uranium/uranium-mining-overview.aspx

24.) https://sprottetfs.com/urnm-sprott-uranium-miners-etf/#

25.) https://www.globalxetfs.com/funds/ura/

26.) https://www.pinnacledigest.com/energy-stocks/is-uranium-the-ultimate-esg-investment/

27.) https://sprottetfs.com/media/5199/sprott-uranium-miners-etf-presentation.pdf

28.) https://sprottetfs.com/about-us

29.) https://denisonmines.com/projects/core-projects/wheeler-river-project/

30.) https://etfdb.com/gold-silver-investing-channel/uranium-bull-market-is-just-getting-started/

31.)https://biz.crast.net/bank-of-america-says-uranium-prices-are-up-50-this-year-and-is-set-to-climb-further-on-sanctions-on-russias-exports-and-the-risk-of-stockpiling/

32.)https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/esg-investors-warm-to-nuclear-power-after-eu-green-label-award-69002267

33.) http://skyharbourltd.com/_resources/presentations/corporate-presentation.pdf?v=0.249

34) https://www.eenews.net/articles/could-russias-invasion-of-ukraine-revive-u-s-uranium-mining/

35.) https://www.globalxetfs.com/about/

36.) https://www.energy.gov/ne/articles/3-reasons-why-nuclear-clean-and-sustainable

37.) https://world-nuclear.org/information-library/current-and-future-generation/plans-for-new-reactors-worldwide#:~:text=Nuclear%20

reactors%20planned%20and%20

proposed,and%20rapidly%

2Drising%20electricity%20demand

38.) http://skyharbourltd.com/

39.) http://skyharbourltd.com/_resources/images/SKY-SaskProject-Locator-20220324.jpg

40.) https://skyharbourltd.com/_resources/images/SKY-RussellLake-20220325-Inset.jpg

41.) https://skyharbourltd.com/projects/uranium-projects/russell-lake/

42.) https://skyharbourltd.com/projects/uranium-projects/moore-lake/

43.) https://skyharbourltd.com/projects/uranium-projects/north-falcon-point/

44.) https://skyharbourltd.com/projects/uranium-projects/mann-lake/

45.) https://skyharbourltd.com/corporate/corporate-overview/

46.) https://skyharbourltd.com/staging/skyharbourltd.com/projects/uranium-projects/south-falcon-point/

47.) https://skyharbourltd.com/projects/uranium-projects/preston/

48.) https://skyharbourltd.com/projects/uranium-projects/east-preston/

49.) https://skyharbourltd.com/corporate/management-team/

[1] https://www.cnbc.com/video/2023/11/06/uranium-rally-in-early-innings-sprott-asset-management-ceo-suggests.html

[2] https://www.nytimes.com/2023/12/02/climate/cop28-nuclear-power.html

[i] https://www.nbcnews.com/tech/tech-news/nuclear-power-oklo-sam-altman-ai-energy-rcna139094

[ii] https://www.cnbc.com/video/2023/11/06/uranium-rally-in-early-innings-sprott-asset-management-ceo-suggests.html

[iii] https://www.nytimes.com/2023/12/02/climate/cop28-nuclear-power.html

[iv] https://world-nuclear.org/news-and-media/press-statements/

six-more-countries-endorse-the-declaration-to-triple-nuclear-

energy-by-2050-at-cop29#:~:text=The%2031%20nations%20

endorsing%20the,%2C%20Poland

%2C%20Romania%2C%20Slovakia%2C

Disclaimer: This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. Wallstreetnation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Please review all investment decisions with a licensed investment advisor.

This Advertorial was paid for in an effort to enhance public awareness of Skyharbour Resources Ltd. and its securities. Jade Cabbage Media, LLC d/b/a STOXmedia.com has $30,000 USD dollars (9/27/22) by Skyharbour Resources Ltd. as a total production budget for this advertising effort. Neither Wallstreetnation.com or STOXmedia currently hold the securities of Skyharbour Resources Ltd. and do not currently intend to purchase such securities. This Advertorial contains forward-looking statements that involve risks and uncertainties.

According to an agreement between Winning Media LLC and Skyharbour Resources Ltd., Winning Media has been hired for the time period beginning on 11.20.23 and ending on 12.29.23 to publicly disseminate information about (V:SYH) via digital marketing and has been paid thirty thousand dollars USD. To date, Winning Media has been paid four hundred fifteen thousand dollars USD to disseminate information about (V:SYH) via digital marketing. We own zero shares of (V:SYH).

This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are a number of important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies.

To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated.

Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur. More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.

Scientific & Technical Information

The scientific and technical information disclosed herein about Skyharbour Resources has been reviewed and approved by David Billard, P.Geo, a qualified person and a consulting geologist of Skyharbour Resources Ltd.

SEDAR

The information disclosed on this web page is only summary information about Skyharbour Resources Ltd. and the industry in which it operates in. Visit www.sedar.com to review additional disclosures and filings for Skyharbour Resources Ltd.

43-101 Technical Reports

Visit www.sedar.com to view technical reports and other disclosures of the Company including:

- Technical Report on the Russell Lake Property, Northern Saskatchewan, Canada, National Instrument 43-101, with an effective date of June 6, 2022 and filed on SEDAR on July 19, 2022; and

- Technical Report on the Moore Lake Property, Northern Saskatchewan, Canada, National Instrument 43-101, with an effective date of October 3, 2016 and filed on SEDAR on October 6, 2016.

Market & Industry Data

The information contained herein includes market and industry data that has been obtained from third party sources, including industry publications. The Company believes that its industry data is accurate and that its estimates and assumptions are reasonable, but there is no assurance as to the accuracy or completeness of this data. Third party sources generally state that the information contained therein has been obtained from sources believed to be reliable, but there is no assurance as to the accuracy or completeness of included information. Although the data is believed to be reliable, the Company has not independently verified any of the data from third party sources referred to in this presentation or ascertained the underlying economic assumptions relied upon by such sources.

Cautionary Statement Regarding “Forward-Looking” Information

This contains “forward‐looking information or statements” within the meaning of applicable securities laws, which may include, without limitation, statements relating to advancing the Company’s Projects, the Company’s plans for its Projects, expected results and outcomes, the technical, financial and business prospects of the Company, its projects and other matters. All statements herein other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of uranium, the anticipated costs and expenditures, the ability to achieve its goals, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms. Such forward-looking information reflects the Company’s views with respect to future events and is subject to risks, uncertainties and assumptions, including the risks and uncertainties relating to the interpretation of exploration results, risks related to the inherent uncertainty of exploration and cost estimates, the potential for unexpected costs and expenses and those other risks filed under the Company’s profile on SEDAR at www.sedar.com. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, adverse weather and climate conditions, failure to maintain or obtain all necessary government permits, approvals and authorizations, failure to maintain community acceptance (including First Nations), risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of personnel, materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters), risks relating to inaccurate geological and engineering assumptions, decrease in the price of uranium, the impact of Covid-19 or other viruses and diseases on the Company’s ability to operate, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to, the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, loss of key employees, consultants, or directors, increase in costs, delayed drilling results, litigation, and failure of counterparties to perform their contractual obligations. The Company does not undertake to update forward‐looking statements or forward‐looking information, except as required by law.