Sponsored – Est. 10 Min Read

How undervalued European Energy Metals Corp. (TSXV: FIN); (USOTC: EUEMF) could help investors ride the Electric Vehicle megatrend to potential windfall profits

All over the globe, demand is soaring for new electric vehicles.

Worldwide, EV demand increased a staggering 68% year-over-year from 2021 to 2022 according to the Wall Street Journal.[i] [ii]

But that growth is just the tip of the iceberg.

Consumer demand for EVs is projected to climb even higher in the months and years ahead. And now governments are fueling even further EV growth by passing legislation outlawing gas- and diesel-powered cars and trucks in the years ahead.

This historic demand for EVs – backed by legislation in many parts of the world – has triggered a long-term “mega bull” market for the lithium that’s needed for the batteries that will power all of these EVs.

And that long-term lithium bull market right now offers investors a remarkably attractive profit opportunity.

But the supply-demand story for lithium is so powerful, the super cycle in lithium appears to have resumed…and the next leg of this “mega bull” market could offer even greater potential than the initial rally.

With the massive amount of lithium that’s needed to keep up with the electric vehicle market alone – not to mention continued strong demand for lithium to power laptops, tablets and smartphones – a historic opportunity now exists in the lithium exploration market.

And as you might expect, investors have seen and heard about a number of opportunities for potential new lithium production in North America.

But one under-the-radar company – European Energy Metals Corp. (TSXV: FIN); (USOTC: EUEMF) – right now offers investors a unique way to play soaring global demand for lithium for the highest potential upside.

How is European Energy Metals Corp. unique in the lithium exploration space?

Simple:

The company is one of a select few that is focused on the exploration and development of lithium projects in Finland…positioning it perfectly to help supply the gigafactories being built in Europe to help Europeans successfully transition to electric vehicles.

Investment Summary:

When examining the potential for European Energy Metals Corp. (TSXV: FIN); (USOTC: EUEMF), one thing quickly becomes apparent:

This is not another North American lithium play.

Instead, this company offers something most North American investors haven’t been exposed to: an opportunity to take advantage of Europe’s soaring lithium demand and its aggressive targets for transitioning to electric vehicles.

Europe desperately needs to bring domestic supplies of lithium online as quickly as possible in order to meet their targets, and now has over 34 gigafactories either built or operational within the continent.

This means that any exploration company that shows potential within Europe could have tremendous upside. This has already been seen with Sibanye Stillwater (NYSE: SBSW), a US $5 billion market cap company – located just 11 miles away from European Energy Metals’ projects – that is now building a €588M mine that will be operational in 2025.

With a potential interest in up to 5 projects – all well-located in Finland just 11 miles away from a large project currently in construction – European Energy Metals Corp. appears to be a company in the right place at the right time.

As the company moves forward with its exploration program in the weeks and months ahead, positive news could be a catalyst for rapid growth, presenting early investors with a unique high-upside opportunity in the lithium exploration space.

5 Key Reasons Why You Should Strongly Consider the Upside Potential for European Energy Metals Corp. (TSXV: FIN); (USOTC: EUEMF) Today

As I just mentioned, EV demand continues to soar…and it’s pushing the lithium market forward with great speed. EV penetration is projected to reach 15% in 2025 and 35% by 2030.

But let’s think about the growth in EV demand in terms of raw numbers.

“Global electric vehicle numbers set to hit 145 million by end of the decade, IEA says.”

Just a little more than a year ago – at the end of 2021 – there were only 16.5 million electric cars and trucks on the road.

But the IEA now projects that number will climb to 145 million by 2030.

That’s more than 128 million new EVs on the road in a span of just nine years.

And here’s the thing:

In order for each of those new EVs to hit the road…they’re going to need batteries. And that means lithium.

Lots and lots of lithium.

And that EV demand is on top of increasing applications for lithium from energy storage, consumer devices – like smartphones, laptops and tablets – as well as Internet of Things (IoT) infrastructure.

But as things currently stand…the lithium supply-demand story is very much out of balance.

According to S&P Global Market Intelligence, “Even if the 53 lithium-producing projects currently in the…pipeline are developed aggressively, the market will reach a deficit of 605,000 tonnes of lithium carbonate equivalent, or LCE, by 2030.”i

Simply put…there isn’t enough lithium in the development pipeline to match the soaring growth in demand.

And while this supply-demand imbalance threatens to delay the transition to electric vehicles, it also provides consistent pressure for higher lithium prices.

In that type of environment, any exploration company that shows it has strong potential for bringing new sources of lithium into production could see explosive upside potential.

That includes companies like European Energy Metals Corp. (TSXV: FIN); (USOTC: EUEMF), as positive news about the company’s lithium projects could quickly generate strong interest from Wall Street as well as major producing companies.

Europe has established some of the world’s most aggressive goals for transitioning to electric vehicles, including a ban on sales of new gas- and diesel-powered cars by 2035.

The aggressive targets established by governments within Europe mean that demand for lithium – according to the Financial Times – “is set to surge fivefold by 2030 to 550,000 tonnes per year – more than double the 200,000 tonnes the region will be able to produce.”v

And the transition to electric vehicles has also sparked a massive wave of construction for new battery gigafactories within the continent.

- Finnish Minerals Group and Beijing Easpring Material Technology have been investigating and negotiating the possibility to establish a CAM plant in Kotka, Finland with the initial capacity of 50,000 t/a.

- Freyr Battery intends to build Finland’s first Gigawatt-hour-scale battery cell production facility and has already initiated an Environmental Impact Assessment (EIA) for the project.

- And Norway’s first lithium-ion (Li-ion) battery factory has taken a key stride toward construction with a NKr142m ($16.4) grant being given to developer Freyr by the Nordic country’s ministry of climate and environment.

Clearly, Europe is looking to increase domestic production of lithium in the years ahead as a way of reducing its dependence on Chinese lithium supplies…and to help meet the very goals established by its own governments for phasing out gas-powered vehicles.

To that end, governing bodies in Europe and Finland are legislating environmentally friendly and energy independent laws and policies as a way of helping encourage exploration and development.

Europe has no plans to back away from its commitment to the environment – and to the conversion to electric vehicles. In fact over 34 gigafactories are currently being built within the European area. All needing a domestic supply.

That provides an outstanding environment for new exploration opportunities – including for companies like European Energy Metals Corp. (TSXV: FIN); (USOTC: EUEMF).

The goals are aggressive – and governments are supporting and incentivizing development as much as possible.

Positive news regarding the potential for new domestic production within Europe from companies like European Energy Metals Corp. (TSXV: FIN); (USOTC: EUEMF) could generate considerable attention in the short- and long-term.

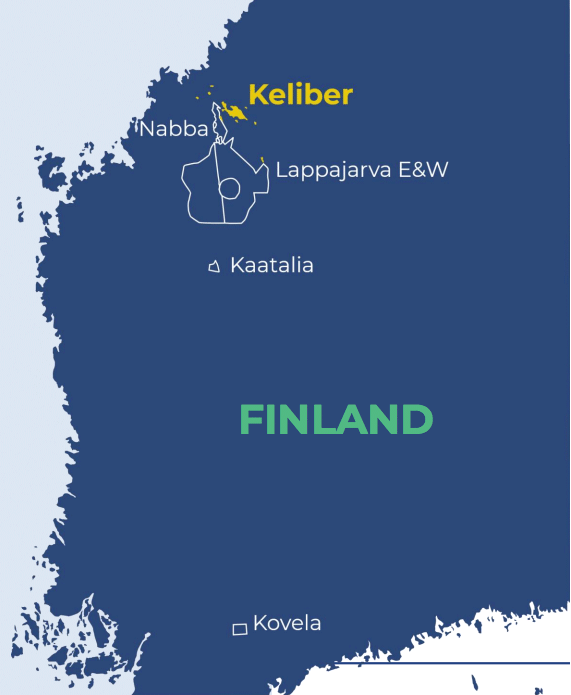

European Energy Metals Corp. (TSXV: FIN); (USOTC: EUEMF) is currently focused on the Lithium-Cesium-Tantalum Finnish Pegmatite Project in central Finland.

The Finland Pegmatite Project consists of four exploration concessions in central Finland and one exploration concession in southern Finland.

The company has an option to acquire up to an 80% interest in five projects within the Finnish Pegmatite fields, four of which are located next to the Keliber project, which belongs to US $5 billion market cap Sibanye Stillwater (NYSE: SBSW).

Sibanye Stillwater has commenced construction on the €588M Keliber project and refinery, representing the development of a lithium supply chain in Finland.

The Keliber project is expected to commence production in H2/2025 and produce 15,000 tonnes of battery-grade lithium hydroxide (LiOH) annually at a cash cost of €6,750 per tonne over a 16-year life.

Keliber has already signed several off-take agreements with global customers for its battery-grade lithium hydroxide, including BASF, LG Energy, and Sichuan Yahua Industrial Group, indicating a strong demand for its product.

European Energy Corp.’s projects are located approximately within 11 miles of Keliber and has similar geology European Energy stands to benefit from potential downstream capacity and infrastructure that is currently being developed.

On June 6, 2023 the company announced the engagement of Resourceful Geoscience Solutions Inc. to design and implement the company’s 2023 exploration program.

European Energy Metals’ phase one exploration programs will focus on evaluating over 2,300 square kilometers of prospective concessions with the focus of identifying high priority targets for phase 2 drilling targeted for late 2023 or early 2024 as the company continues to work toward developing its Finland Pegmatite Project portfolio into one of Europe’s major sources of lithium.

With US $5 billion market cap Sibanye Stillwater working a property just 11 miles away from European Energy Metals Corp. (TSXV: FIN); (USOTC: EUEMF), the region appears to be primed for development.

Sibanye Stillwater is investing over €600 million in the project…and its supply has already been sold.

Clearly, there is enormous demand for domestic production of lithium within Europe – and that’s great news for European Energy Metals Corp. And the existence of a larger company virtually next door could bode well for a potential acquisition should European Energy Metals Corp.’s exploration programs prove successful.

But in terms of companies that could be considered peers of European Energy Metals Corp. it looks as though the company has room for significant potential growth in valuation.

Companies like Patriot Battery Metals Inc. (TSXV: PMET), with a market cap of C$1.6 billion, and Li-FT Power Ltd. (CNSX: LIFT), with a market cap of C$376 million, show the type of potential that exists for a junior lithium exploration company in today’s market environment.

With European Energy Metals Corp. (TSXV: FIN); (USOTC: EUEMF) currently at a market cap of just C$13 million, investors have an opportunity to get in on the ground floor of what could become one of Europe’s trailblazing lithium exploration companies.

One of the most important considerations for any potential exploration investment is the strength and experience of the company’s management team.

European Energy Metals Corp. is led by CEO Jeremy Poirier, who brings nearly two decades of capital markets experience in the natural resource and technology sectors. He has served in various senior officer and corporate development roles at exploration mining companies.

From September 2016 through December 2019, Mr. Poirier was CEO of Bearing Lithium Corp. and was instrumental in the Company’s acquisition of Li3 Energy. In December 2022, Bearing Lithium was sold to Lithium Power International Ltd. (ASX: LPI) for an estimated $32 million.

Prior to Bearing Lithium, Mr. Poirier held senior roles at Pure Energy Minerals Ltd. During his time at Pure Energy Minerals, the company’s flagship project – the Clayton Valley Project in Nevada – was acquired, with an inferred mineral resource of over 800,000 tons of lithium carbonate equivalent.

In addition, during Mr. Poirier’s time at Pure Energy Minerals, the company signed a lithium supply agreement with Tesla Motors (Nasdaq: TSLA) where Tesla committed to annual purchases over a five-year period.

Mr. Poirier is also currently the CEO of European Energy Metals.

Chairman Gino DeMichele is currently President and Chief Executive Officer of A2 Capital Management Inc. Previously Vice President and Senior Investment Advisor at Various Canadian brokerage firms. Over 30+ years of finance, public and private equity, merger and acquisition expertise.

On the technical side, European Energy Metals Corp.’s Independent Director Tim Hennberry is a professional geoscientist registered in British Columbia with over 42 years of experience in domestic and international exploration and production for base and precious metals and industrial minerals. Mr. Henneberry has been involved in the management side of public companies for the past 16 years, including: founding, senior management and/or directorships.

And Independent Director Christos Doulis has over 25 years of experience in the metals and mining space having held senior positions in mining equity research, investment banking and in industry. He was an award-winning research analyst at Stonecap Securities and PI Financial from 2010 to 2015. Prior to that Christos was a partner at Gryphon Partners as well as VP Investment Banking (Mining) at TD Securities. Most recently, Christos served as CEO for several exploration companies focused on Western Newfoundland and in Nevada.

Investment Summary:

When examining the potential for European Energy Metals Corp. (TSXV: FIN); (USOTC: EUEMF), one thing quickly becomes apparent:

This is not another North American lithium play.

Instead, this company offers something most North American investors haven’t been exposed to: an opportunity to take advantage of Europe’s soaring lithium demand and its aggressive targets for transitioning to electric vehicles.

Europe desperately needs to bring domestic supplies of lithium online as quickly as possible in order to meet their targets, and now has over 34 gigafactories either built or operational within the continent.

This means that any exploration company that shows potential within Europe could have tremendous upside. This has already been seen with Sibanye Stillwater (NYSE: SBSW), a US $5 billion market cap company – located just 11 miles away from European Energy Metals’ projects – that is now building a €588M mine that will be operational in 2025.

With a potential interest in up to 5 projects – all well-located in Finland just 11 miles away from a large project currently in construction – European Energy Metals Corp. appears to be a company in the right place at the right time.

As the company moves forward with its exploration program in the weeks and months ahead, positive news could be a catalyst for rapid growth, presenting early investors with a unique high-upside opportunity in the lithium exploration space.

i https://www.wsj.com/articles/evs-made-up-10-of-all-new-cars-sold-last-year-11673818385?mod=hp_lead_pos2

ii https://www.businessinsider.com/electric-vehicles-accounted-global-auto-sales-could-quadruple-2030-report-2023-1

iii https://www.wsj.com/articles/evs-made-up-10-of-all-new-cars-sold-last-year-11673818385?mod=hp_lead_pos2

iv https://www.spglobal.com/marketintelligence/en/news-insights/research/lithium-project-pipeline-insufficient-to-meet-looming-major-deficit

v https://www.ft.com/content/154c53aa-5a9a-4004-abf9-2e6e5396dca4

vi https://www.lemonde.fr/en/economy/article/2023/05/15/battery-gigafactories-are-flourishing-across-europe_6026710_19.html

vii https://www.ft.com/content/154c53aa-5a9a-4004-abf9-2e6e5396dca4

This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. WallStreetNation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.

Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of European Energy Metals Corp. and its securities. Jade Cabbage Media, LLC d/b/a STOXmedia.com has received up to $10,000 USD dollars by Winning Media LLC as a total production budget for this advertising effort. Neither WallStreetNation.com, Winning Media LLC or Jade Cabbage Media LLC currently hold the securities of European Energy Metals Corp. and do not currently intend to purchase such securities.

The issuer, European Energy Metals Corp. has compensated Winning Media LLC the sum total of one hundred fifty thousand dollars USD total production budget to manage a digital media campaign for ninety days.

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.