Sponsored – Est. 7 Min Read

With one of North America’s largest lithium resources, little-known Li-FT Power (TSXV: LIFT: LIFT); (OTCQX: LIFFF) offers…

Massive Buyout Potential:

Massive Buyout Potential:

Consider this High-Upside Lithium Stock Now

Breaking News

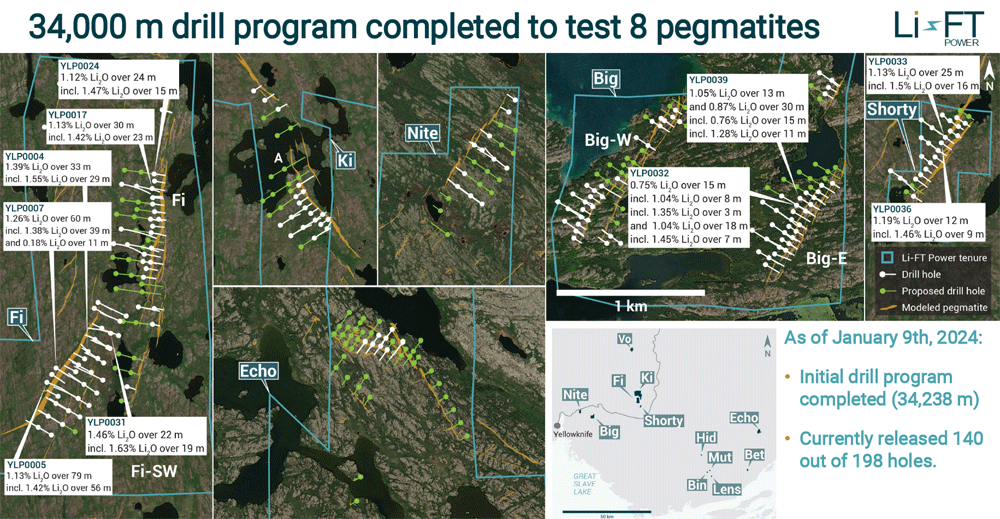

VANCOUVER, British Columbia, Jan. 03, 2024 (GLOBE NEWSWIRE) — Li-FT Power Ltd. (“LIFT” or the “Company”) (TSXV: LIFT) (OTCQX: LIFFF) (Frankfurt: WS0) is pleased to report assays from 8 drill holes completed at the BIG East, Echo, Shorty, & BIG West pegmatites within the Yellowknife Lithium Project (“YLP”) located outside the city of Yellowknife, Northwest Territories

There’s a massive boom underway right now in the lithium sector.

Unprecedented demand for electric vehicles has triggered this boom…creating a huge profit opportunity in the lithium market.

Since 2015, the global EV market has grown by more than 50% per year – and electric vehicle demand was up 62% in the first half of 2022 alone.

- The International Energy Association recently forecast that there will be 145 million EVs on global highways by the end of this decade – a staggering increase from the 16.5 million on the road at the end of 2021.

- And in order for all of these new electric vehicles to actually hit the road in the coming months and years…they’ll all need batteries. And that means lithium. Tons and tons of lithium.

How much lithium do we need?

The World Economic Forum projects that global demand will reach over 3 million metric tons by 2030…

Yet the world produced just 540,000 metric tons of lithium as recently as 2021.ii

That means the race is on for new lithium supplies.

At this very moment, exploration and mining companies – as well as auto manufacturers – are on a furious hunt for large lithium deposits.

Obviously this can be a very lucrative proposition for those companies who show potential for bringing large new supplies of lithium to market.

In fact, a “buyout frenzy” in the lithium sector may already be underway.

For example…

- In July 2023, Develop Global, a company backed by lithium producer Mineral Resources, acquired lithium developer Essential Metals for a reported $102 million…v

- In May of last year, lithium companies Allkem Ltd. and Livent Corp. combined in a $10.6 billion deal to create the world’s third-largest lithium producer…vi

- And in January 2023, General Motors agreed to invest $650 million in Lithium Americas – a company based in Vancouver, BC – to develop the Thacker Pass mine in Nevada.vii

Each of these acquisitions created massive gains for shareholders.

And as the race for the next great lithium deposit continues, so does the race for the next lucrative takeover.

In the midst of this exceptionally lucrative market, there is one massive lithium deposit that has been curiously overlooked.

This deposit is known as the Yellowknife Lithium Project…and it’s owned by an under-the-radar company called Li-FT Power (TSXV: LIFT: LIFT); (OTCQX: LIFFF).

The story of the Yellowknife Lithium Project is likely to be told for generations…

50 years ago, a group of geologists went searching for the largest lithium deposit in the world.

This team of experienced geologists looked everywhere – in North and South America…and even in Australia.

Finally, they located what – in their opinion – was the massive deposit they had been searching for.

This deposit was verified by an oil company that eventually became Exxon Mobil…and they drilled on the property thinking they could be developing the largest lithium resource in the western world.

But suddenly this oil company was acquired – and the lithium project was forgotten about.

Decades passed…and all the knowledge and technical information about the lithium deposit was stashed away in abandoned moving boxes.

Fast-forward to just a few years ago…when a new team of geologists went looking for large lithium deposits.

Out of the blue – thanks to satellite imagery – the geologists discovered something they couldn’t believe.

They saw huge dykes – which are usually the best source for lithium. And these deposits were plainly visible on the satellite imagery!

It took this new team from Li-FT Power (TSXV: LIFT); (OTCQX: LIFFF) two years…but they were eventually able to track down the old geologists – and they were able to locate and acquire the old data that had been gathered on the project years ago.

This past summer, the team finally started to drill on the property and as they expected…they found huge amounts of high-grade lithium.

The Yellowknife Lithium Project has quickly emerged as one of the largest exploration programs in the world – and very soon the team intends to prove that this is the massive lithium resource the old team of geologists was dreaming of back in the 1950s.

Let me walk you through what’s happening at what could be one of North America’s largest lithium resources.

And, yes – it’s absolutely true that…

The Yellowknife Lithium Project could Produce North America’s Largest Hard Rock Lithium Resource

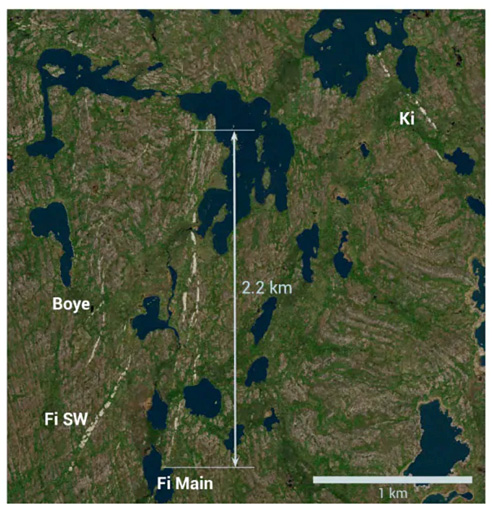

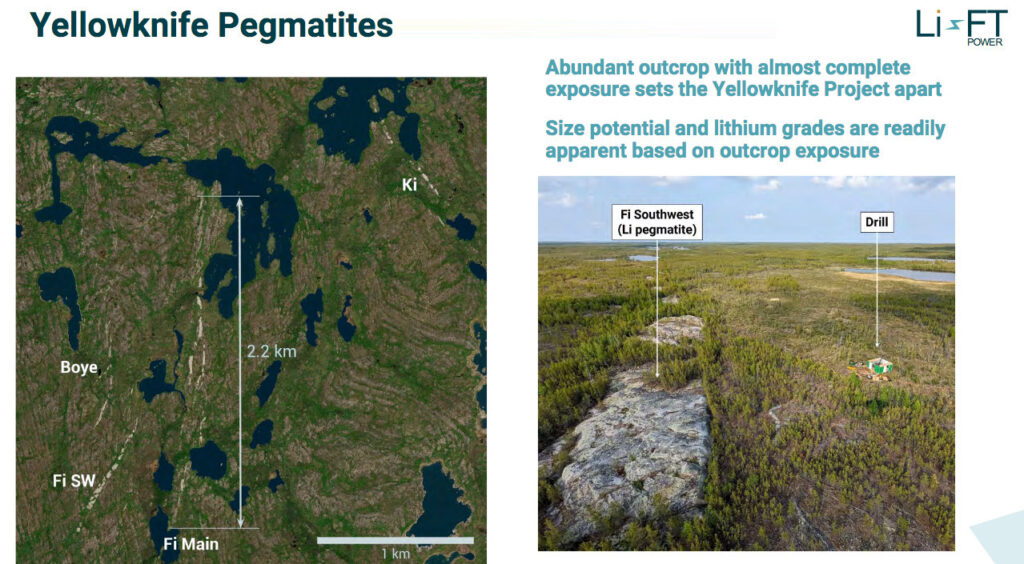

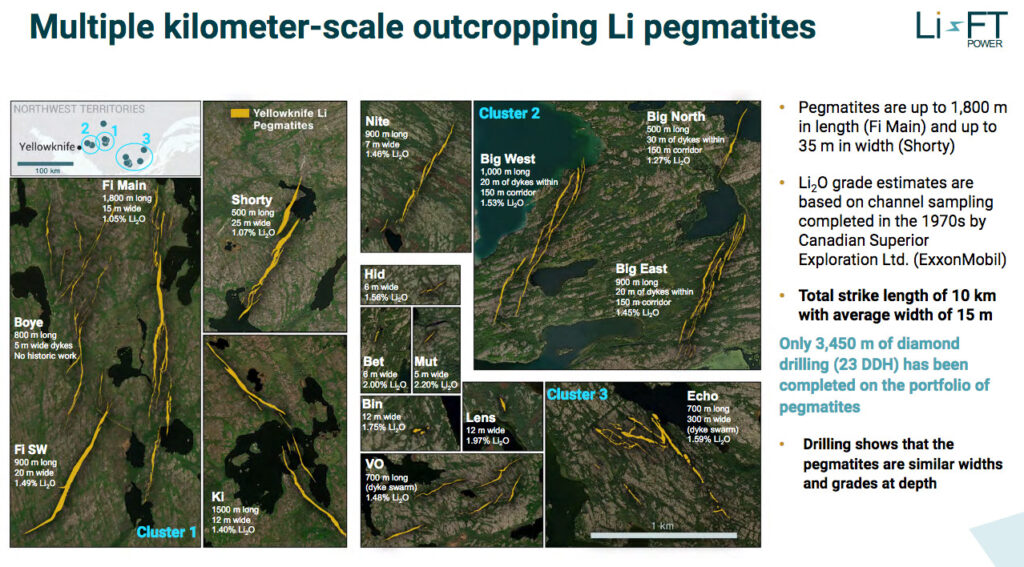

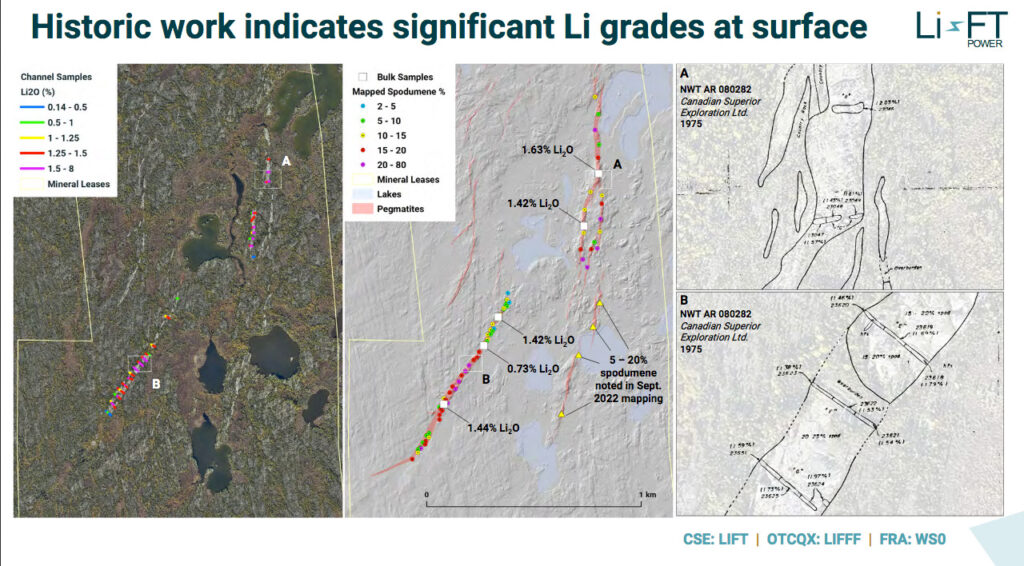

Take a look at the satellite photo on the left below…the white veins you see crossing the landscape are actually the lithium deposits at Li-FT Power’s Yellowknife Lithium Project.

The image on the right was taken from a helicopter and provides a closer view of the deposit along with the diamond drill rig on-site.

With deposits this large it’s easy to see the extraordinary potential for the Yellowknife project…a project that could produce the largest hard rock lithium resource in North America.

The project contains 13 spodumene pegmatites with average grades of 1.07 – 2.20% Li2O.

Drilling on the project began on June 2 with a goal of 34,000 meters to be drilled by the end of October.

As of November, 2023 34,238 meters of drilling – at 198 holes – had been completed. The company’s summer drill program was completed on-time and under budget.

Drill results from 35 drill holes indicate extensive widths and excellent grades:

60 meters at 1.26% Li2O (YLP0007)

30 meters at 1.13% Li2O (YLP0017)

24 meters at 1.12% Li2O (YLP0024)

22 meters at 1.46% Li2O (YLP0031)

Decades of Work Suggest There Are Economic Grades of Lithium On-Site

Previous exploration work at Li-FT Power’s Yellowknife site – from the 1950s through the 1980s – has suggested there could be high-grade lithium deposits on the site.

In fact, the Yellowknife lithium district experienced a major exploration effort dating back to 1955.

Early exploration at the site was because of large lithium hydroxide purchases made by the U.S. Atomic Energy Commission.

From 1975 to 1979, Canadian Superior Exploration Limited (TSXVL), the exploration arm of Superior Oil, completed systematic mapping, spodumene crystal counts, blasting-trenching, channel sampling and diamond drilling in the area.

Superior Oil was acquired by Mobil in 1984 which led to the divestment of the TSXVL mineral properties and the claims holding the largest lithium pegmatites were transferred to a private company.

Since 1987, very little exploration work was completed on any of the pegmatites. That is, until Li-FT Power arrived on the scene.

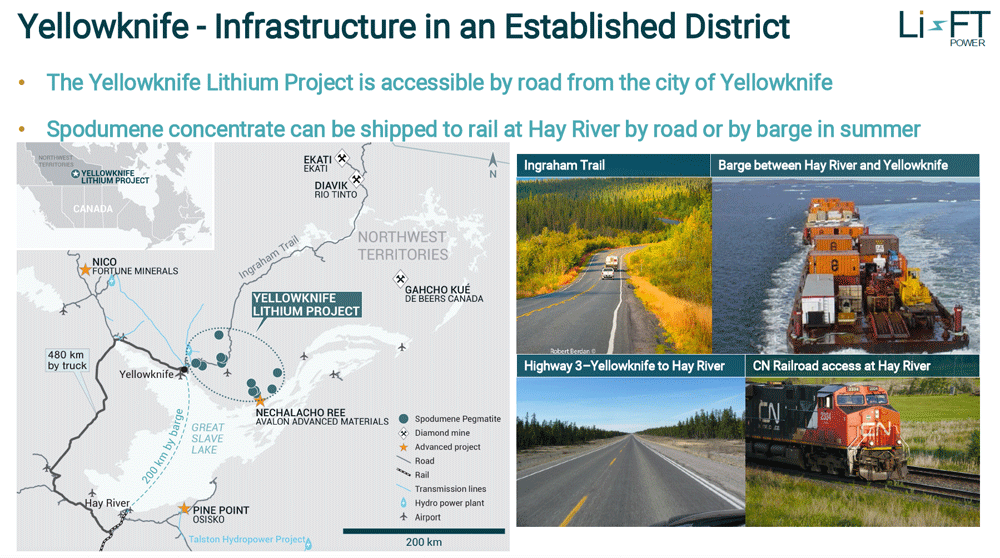

With Easy Access to Rail, Road or Barge, Li-FT Power Has a Clear Infrastructure Advantage at its Yellowknife Project

Take a look at the map below of the company’s Yellowknife Lithium Project, where each one of the green dots represents a lithium deposit that is owned by Li-FT Power:

What’s important to note about the Yellowknife Project is the infrastructure nearby…including a road that goes through seven of the company’s lithium deposits.

At the bottom of the map, you can also see that the rail line begins at Hay River. This provides critical access to railway shipping for the spodumene concentrate produced at the mining site.

With so many of the lithium exploration stories we hear about these days, we’re only told about the potential size of the deposit…often because these deposits can be as far as 1,200 kilometers away from the nearest railway.

Take Patriot Battery Metals, for example, whose 109.2-million-ton lithium deposit in Quebec has garnered a great deal of attention.

While Patriot’s deposit is located 15 kilometers from all-weather road access, there is not convenient rail access nearby. And the amount of gravel involved in production can make shipping via truck inconvenient, expensive and far from environmentally friendly.

Li-FT Power (TSXV: LIFT); (OTCQX: LIFFF) has the key advantage of truly easy access to shipping by road, barge or rail at Yellowknife, which makes Li-FT especially attractive in comparison to other lithium exploration companies.

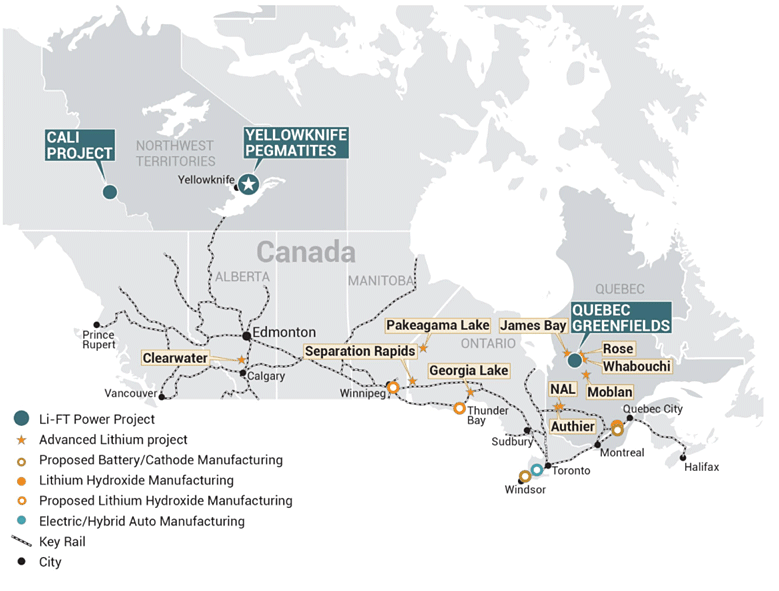

Li-FT Power’s Exploration Portfolio Includes Additional Projects with High Upside Potential

The exploration portfolio for Li-FT Power (TSXV: LIFT); (OTCQX: LIFFF) is one of the most exciting in the world…and it consists of more than just the Yellowknife Lithium Project.

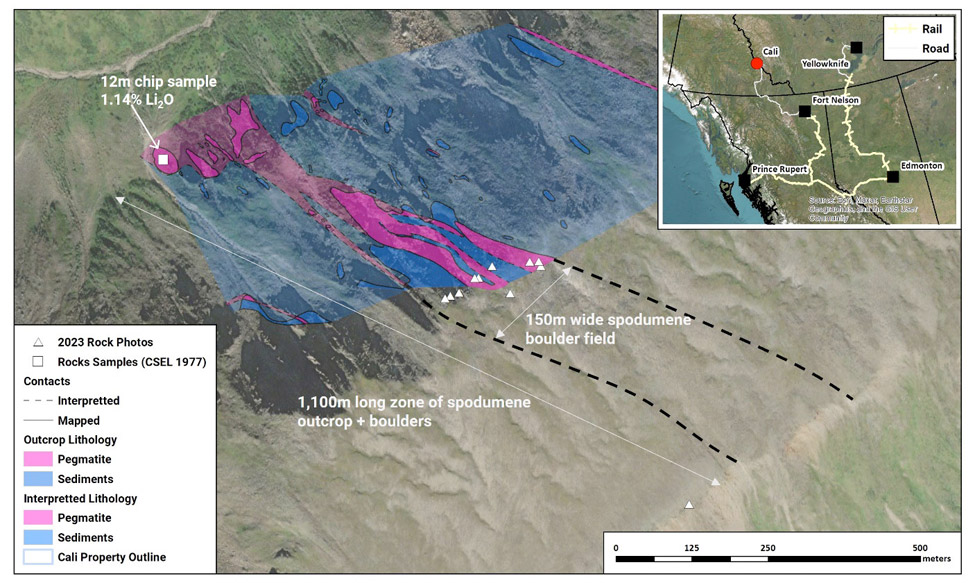

The company’s Cali Project, also located in the Northwest Territories near the Yukon border, was acquired in 2022 along with the Yellowknife project.

The area was mapped by Canadian Superior Exploration Ltd. (TSXVL) in 1977 and found to have a spodumene pegmatite that outcropped over 500 meters of strike and up to 60 meters wide with a vertical extent of 300 meters.

Field work completed by Li-FT Power in June 2023 confirms this historic work, suggesting that the Cali Project is a spodumene pegmatite dyke swarm with many dykes occurring over a 150-meter-wide corridor.

In August 2023, Li-FT commenced surface exploration program, which has been designed to better understand the average grade across the dyke’s exposed strike length to 300 meters vertical with systematic rock sampling and mapping.

Prospecting for other parallel dykes and dyke extensions trending onto the Cali project from the south will also be carried out through detailed soil sampling.

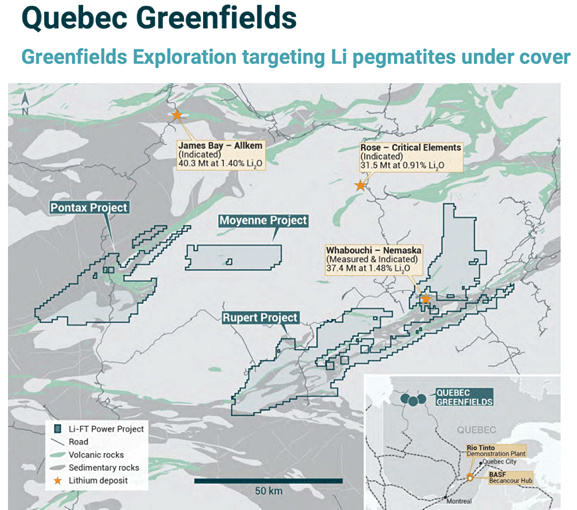

In addition, the company’s portfolio also includes three projects – with a combined 2,300 km2 land position – in the James Bay region of Quebec.

The Rupert Project surrounds the Whabouchi Li deposit and covers approximately 1,000 km2 of similar geology.

The Pontax Project contains the most extensive Li anomaly within Li-FT’s Quebec portfolio and has highway access.

And the Moyenne Project contains 25,145 hectares of property…is 100% owned by the company…and is accessible by helicopter.

Early stage exploration work is now being conducted at the Rupert and Pontax projects to fill the company’s pipeline with additional drill targets for 2024.

Li-FT Power (TSXV: LIFT); (OTCQX: LIFFF) Appears Significantly Undervalued Compared to Its Peers

When evaluating the potential for any lithium exploration and development company, it’s important to understand how a company’s peers are currently being valued by investors.

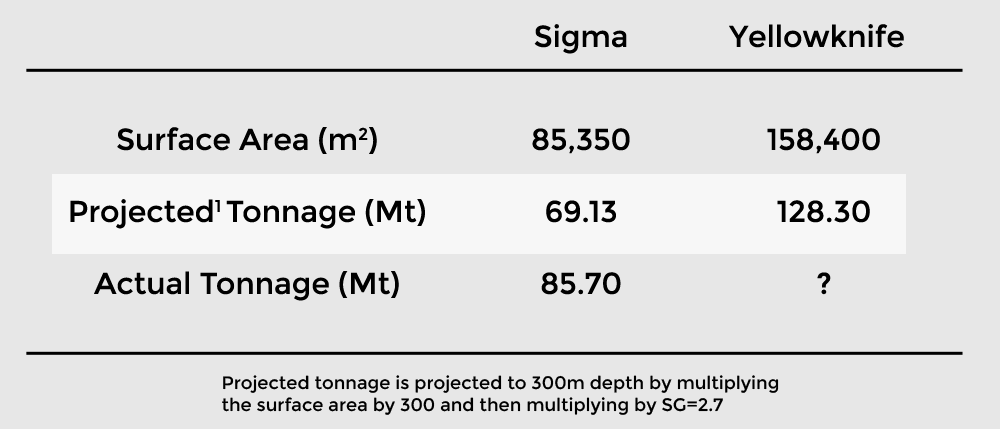

In the lithium exploration space, Sigma Lithium Corp. (TSXV: SGML) is a company worth considering as it relates to Li-FT Power.

Sigma Lithium is further along in its development stage than Li-FT Power…but based on surface projections of mineralization, Li-FT Power’s Yellowknife Project has the potential to produce a significantly larger global resource than Sigma Lithium’s Grota Do Cirilo project.

So if Li-FT Power’s Yellowknife Project has the potential to be significantly larger than Sigma Lithium’s Grota Do Cirilo project…

…and Sigma Lithium is currently trading at a $5 billion valuation…

…what could the future hold for Li-FT Power and its current market cap of just $300 million?

Strong, Experienced Management Team Gives Li-FT Power Yet Another Critical Advantage

Another critical differentiator for Li-FT Power (TSXV: LIFT); (OTCQX: LIFFF) is the company’s proven leadership team.

The company is being guided by a team loaded with experienced executives who have a track record of success in lithium as well as other commodities. This impressive team includes:

Francis MacDonald – CEO & Director

Mr. MacDonald has 15 years of experience in the mining industry and is an exploration geologist. He co-founded Kenorland Minerals, a North America-focused company generating greenfield exploration opportunities across different commodities. Prior to 2016, Mr. MacDonald worked with Newmont Mining doing greenfield exploration in Nunavut, West Africa, and East Africa.

Alex Langer – President & Director

Mr. Langer is a public markets specialist in equity financing. He worked with Canaccord Genuity to fund over 100 private and publicly listed companies in various sectors, including mining and technology. Mr. Langer, as VP of Capital Markets, was instrumental in the success of Millennial Lithium, bringing worldwide financial support and industry partners. He is the CEO & President of Sierra Madre Gold & Silver.

David Smithson – Senior Vice President, Geology

Mr. Smithson is an ore deposit geologist. He worked as a global specialist for Newmont and contributed to gold reserve expansions in West Africa and South America. Mr. Smithson has held senior VP exploration positions generating opportunities throughout the Americas. He is a co-founder of Tier One Silver, a silver-focused explorer in Peru, and holds an M.Sc in Economic Geology from the University of British Columbia.

Andrew Marshall – Chief Financial Officer

Mr. Marshall is a Chartered Accountant and Chartered Financial Analyst with 20 years of accounting, finance and CFO experience in the mining sector. He was recently the CFO at a Canadian gold development company and is currently the CFO at a European base metals exploration/development company.

April Hayward – Chief Sustainability Officer

Dr. Hayward has over 25 years of experience in environment and sustainability with a track record of developing collaborative relationships with key stakeholders and successfully navigating projects through the regulatory system to operating permits in the Northwest Territories. She has held managerial and executive roles with the Ekati mine and Mountain Province Diamonds.

Don Hains – Advisor

Mr. Hains is an industrial minerals exploration and economic geologist with many years’ experience in development, use, and analysis of industrial minerals properties and materials. His experience covers most of the industrial minerals and several specialty metals, especially lithium, tantalum, niobium, gallium, germanium, and rare earths. He is a registered professional geoscientist in Ontario.

Investor’s Summary

The global EV megatrend has presented an unprecedented opportunity for investors. Staggering demand for new EVs means that new sources of lithium will need to be brought online – and quickly! – in order to supply the batteries that will power these cars and trucks.

For companies in the lithium exploration and development space, that can mean the potential for rapid growth. One company in particular – Li-FT Power (TSXV: LIFT); (OTCQX: LIFFF) – right now offers investors a truly unique investment opportunity.

Led by a proven leadership team – and with what could be one of North America’s largest lithium resources – LiFT Power also offers something truly rare among lithium exploration companies…

The lithium deposits on its Yellowknife Lithium Poject are so large they’re actually visible from space.

Investors should consider the potential for Li-FT Power (TSXV: LIFT); (OTCQX: LIFFF) as the company now appears to be significantly undervalued when compared to its peers.

Its ongoing drilling program at the Yellowknife Lithium Project could continue to provide incentive for more attention from Wall Street…and it could ultimately make the company an even more attractive takeover target.

[i] https://www.cnbc.com/2023/08/29/a-worldwide-lithium-shortage-could-come-as-soon-as-2025.html

[ii] https://www.cnbc.com/2023/08/29/a-worldwide-lithium-shortage-could-come-as-soon-as-2025.html

[iii] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/

geopolitical-fears-soaring-prices-spur-lithium-m-a-frenzy-in-china-70642094

[iv] https://cen.acs.org/energy/energy-storage-/Albemarle-buy-Australian-lithium-miner/101/i30

[v] https://www.reuters.com/article/essential-metals-m-a-develop-global/

australias-develop-global-to-acquire-essential-metals-for-102-million-idUSKBN2YJ020

[vi] https://www.reuters.com/markets/deals/allkem-merge-with-us-lithium-producer-livent-

corp-10-bln-deal-report-2023-05-10/

[vii] https://www.nytimes.com/2023/07/02/business/lithium-mining-automakers-electric-vehicles.html

This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. WallStreetNation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.

Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of Li-FT Power Ltd. and its securities. Jade Cabbage Media, LLC d/b/a STOXmedia.com has received up to $10,000 USD dollars by Winning Media LLC as a total production budget for this advertising effort. Neither WallStreetNation.com, Winning Media LLC or Jade Cabbage Media LLC currently hold the securities of Li-FT Power Ltd. and do not currently intend to purchase such securities.

The issuer, Li-FT Power Ltd. has compensated Winning Media LLC the sum total of two hundred thousand dollars USD total production budget to manage a digital media campaign for ninety days.

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.