Sponsored – Est. Read 9 Min

America’s Next Great

Gold Discovery?

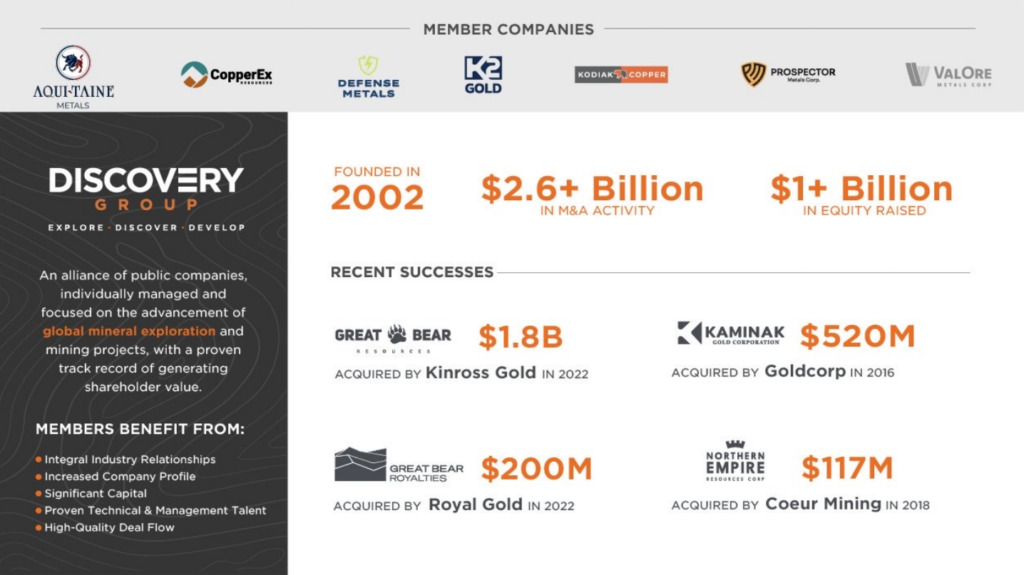

The Team Behind $2.6 Billion in Gold Transactions Just Got the Green Light

INVESTOR ALERT:

After years of permitting delays, K2 Gold Corp. (TSXV: KTO); (OTCQB: KTGDF) has finally received federal clearance to drill its flagship Mojave project.

This means K2 Gold’s Mojave project has successfully cleared the most rigorous permitting hurdle in the U.S. federal system and is now positioned for the concluding Record of Decision.

With a proven discovery team in place, over C$10.5 million in cash, and drilling set to begin, this could be one of the most compelling opportunities in the red-hot gold exploration market.

The wait is over…

And the team responsible for over $2.6 billion worth of gold transactions is about to start drilling again.

After engineering Kaminak Gold’s C$520 million sale to Goldcorp…Great Bear Resources’ C$1.8 billion sale to Kinross…and Great Bear Royalties’ C$200 million sale to Royal Gold…this experienced team now stands poised to do it again with a company, K2 Gold Corp. (TSXV: KTO); (OTCQB: KTGDF), that could offer even greater upside potential.

Chairman John Robins helped turn Kaminak into a half-billion-dollar success story. Now he’s running K2 Gold with two exceptional drill-ready targets in the U.S. Southwest.

And as you’re about to see…K2 Gold Corp. is a company that has the potential to move quickly.

Here’s what’s happening:

For years, this team was stuck in a “permitting purgatory”, waiting on federal permits. Those days are behind them.

The U.S. Bureau of Land Management has published the Final Environmental Impact Statement (EIS) for K2 Gold Corp.’s flagship Mojave project, clearing the way for drilling to begin.

Completion of the Final EIS marks a defining milestone for Mojave, confirming that the project has met the most stringent federal review standards and is progressing through the final steps of the U.S. permitting framework.

Of course, the timing couldn’t be better with the gold market running hot.

Gold has surged past $4,400 an ounce, hitting all-time highs. Central banks are buying at a record pace. And forecasts calling for $6,000 gold – or higher – no longer seem far-fetched.

K2 Gold is fully funded with over C$10.5 million in cash. Drilling starts in January 2026. And as that drilling program ramps up, the story could accelerate quickly.

This is a company with a proven team…that’s permitted and fully funded…that’s set to drill two high-potential targets…and offers investors an entry point with significant upside potential at its current share price.

To understand why this opportunity deserves your attention, here are…

7 Key Reasons

Why You Should Strongly Consider K2 Gold Corp. (TSXV: KTO); (OTCQB: KTGDF) Right Now

1

This Team Is Responsible for Over $2.6 Billion in Gold Transactions. Now They’re Set Up for Their Next Big Move

K2 Gold Corp. is led by a team that has delivered over $2.6 billion worth of gold transactions, including Great Bear Resources’ C$1.8 billion sale to Kinross and Kaminak Gold’s sale to Goldcorp for approximately C$520 million…and the key players behind that success are now running K2 Gold. Chairman John Robins, who also chaired Kaminak, is now poised to deliver yet again for K2 Gold. In addition, K2 Gold is part of Discovery Group, an alliance of companies responsible for the discovery of over 10 million ounces of gold. Chris Taylor, who previously held the Mojave property at Great Bear Resources, now serves as an advisor to K2 Gold…bringing direct familiarity with the project’s potential. When a team has a proven track record of success across multiple properties and gets another shot with fully funded, permitted targets, that’s not something to ignore.

2

Years of Permitting Risk Have Been Converted Into a Major Competitive Advantage

For years, K2 Gold was stuck in permitting limbo, waiting on the U.S. Bureau of Land Management to approve exploration at its flagship Mojave project. That wait is now over. The Final Environmental Impact Statement (EIS) has been published, representing the highest level of federal permitting in the United States. Rather than taking shortcuts under a more lenient regulatory environment, the company pushed through the most rigorous review process possible. The result is a fully permitted project built to withstand scrutiny for the long term. This clears one of the biggest hurdles in early-stage mining and allows K2 Gold to focus entirely on what matters now: drilling and discovery.

3

K2 Gold Is Perfectly Positioned to Take Advantage of Soaring Gold Prices

Take a look at gold right now: Up more than 67% over the past 12 months and likely moving higher. That’s because central banks are accumulating gold at a record pace and the U.S. dollar is facing increasing pressure as a reserve currency. A growing chorus of analysts and institutions are now calling for gold prices of $6,000 gold or higher in the years ahead. K2 Gold Corp. is perfectly positioned for this bull market as the company is permitted, fully funded, and ready to drill. Strong gold prices alone are nice…but when they coincide with experienced teams and compelling geology, they can accelerate outcomes dramatically.

4

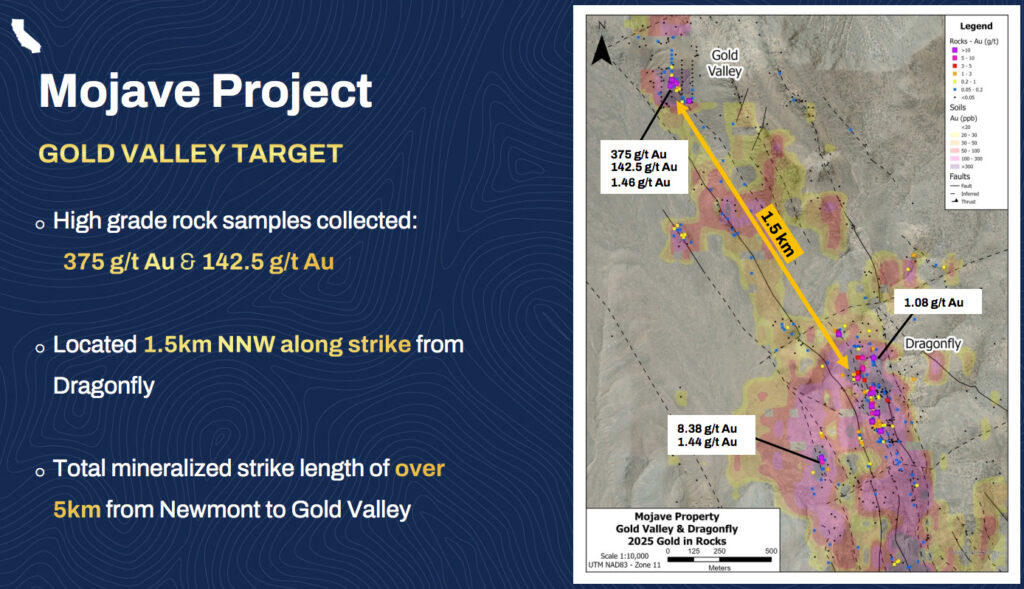

High-Grade Gold Results Starting Right at Surface

K2 Gold Corp. has already delivered the kind of drill results that demand attention within the industry. The company’s best hole to date at Mojave returned 86.9 meters grading 4.0 g/t gold, all oxide material starting from surface. That combination of grade, width, and near-surface oxide mineralization is exactly what experienced geologists look for. And it may just be the beginning. Surface sampling approximately 1.5 kilometers north of that best drill hole has returned grab samples as high as 375 g/t gold (over 12 ounces per ton) and 142.5 g/t gold. That area has never been drilled, meaning multi-ounce gold samples are sitting on surface in virgin territory waiting to be tested. The known system could just be scratching the surface of what’s actually there.

5

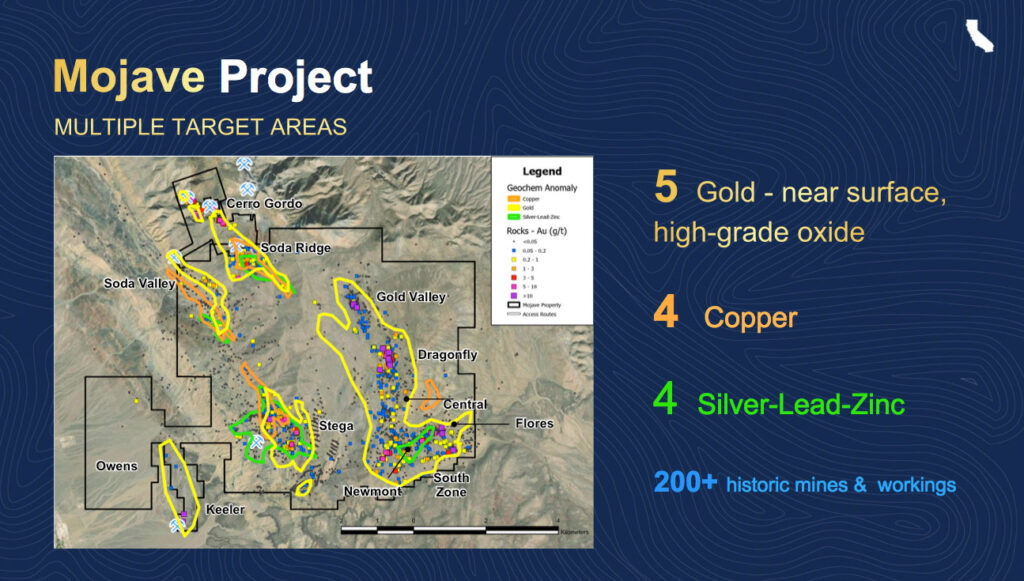

A Flagship Project With District-Scale Polymetallic Potential

The company’s flagship Mojave project spans over 6,000 hectares in an active and historic mining region and it hosts a true polymetallic system. While the current focus is on a 5-kilometer oxide gold trend on the east side of the property, Mojave also contains five distinct gold target areas, four copper target areas, and four silver-lead-zinc target areas. There are more than 200 historic mines and workings on the property, and it sits directly adjacent to the historic Cerro Gordo silver mine, one of California’s largest silver producers in the 19th century. K2 Gold Corp. is the first company to consolidate this land package under single ownership and operate it at this scale. With permitting now in hand and over C$10.5 million in the treasury, Mojave is ready to drill. Beyond the primary gold focus, copper, silver, lead, and zinc targets across the property offer significant additional upside.

6

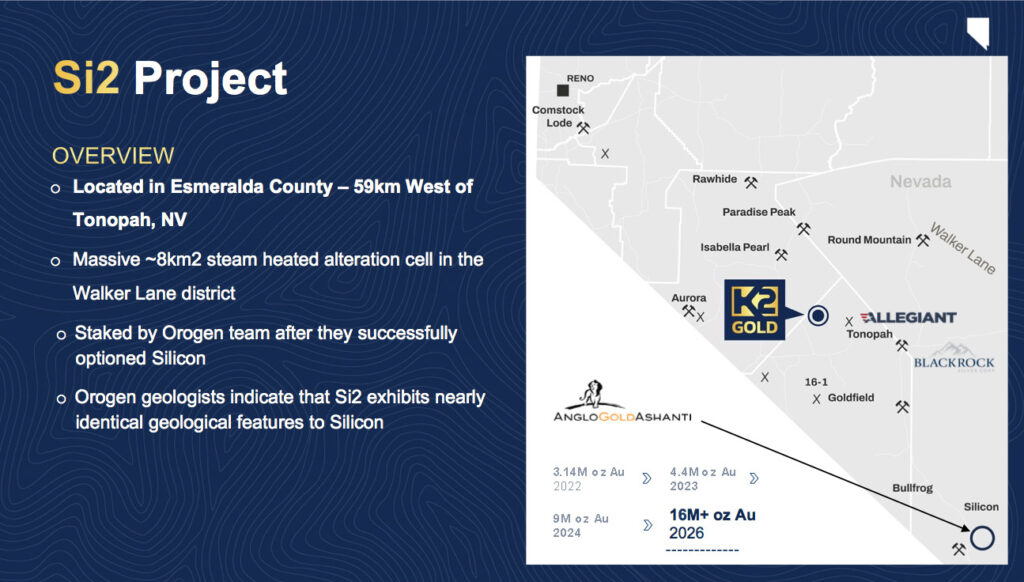

A Second High-Potential Target in Nevada Adds Meaningful Upside

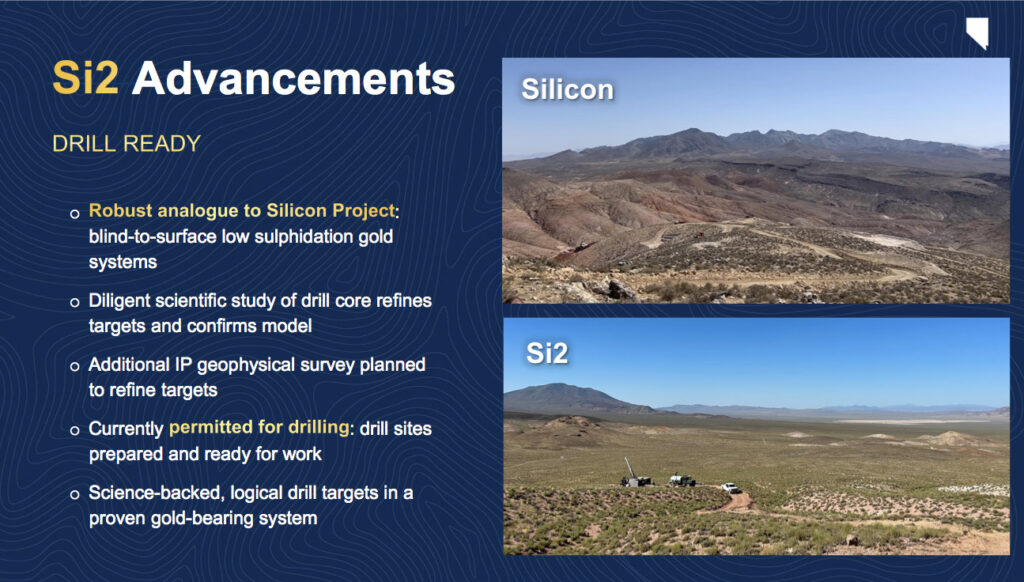

Mojave is the flagship, but K2 Gold’s Si2 Project in Nevada provides additional potential growth for the company. Si2 is an analogue to AngloGold Ashanti’s Silicon deposit, one of the most exciting gold discoveries in the region in recent years. Silicon started with a maiden resource of 3.14 million ounces in early 2021. Today it stands at over 16 million ounces and counting. Both Si2 and Silicon were originally identified and acquired from the same group, Orogen Royalties, before anyone else recognized their potential. K2 Gold’s 2023 drilling at Si2 confirmed a robust system, with one hole returning 185 meters of continuous gold mineralization. Technical work has since indicated that higher-grade zones likely exist at slightly greater depth. With the company fully funded, Si2 will be the first target drilled when K2 Gold mobilizes in January 2026.

7

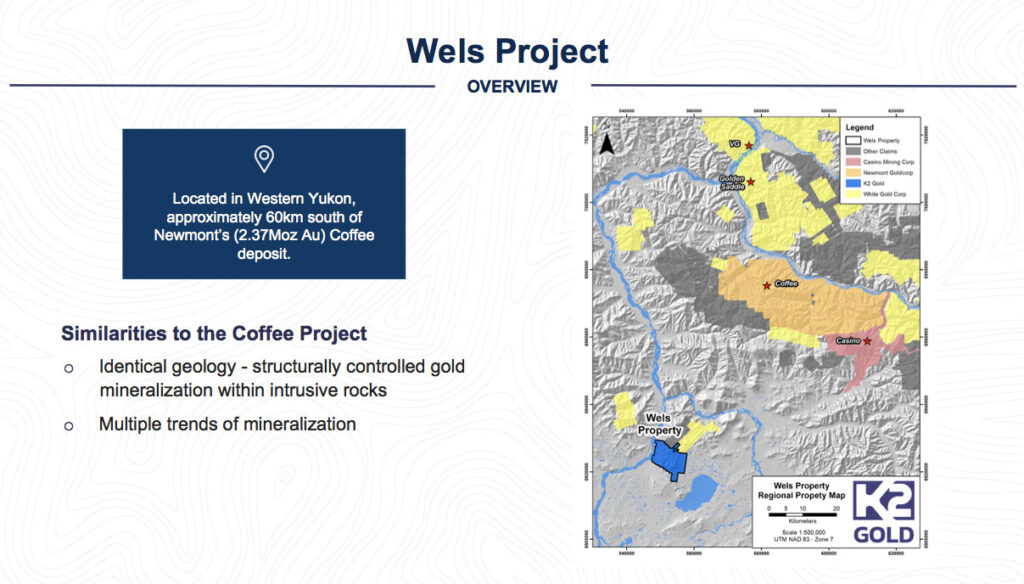

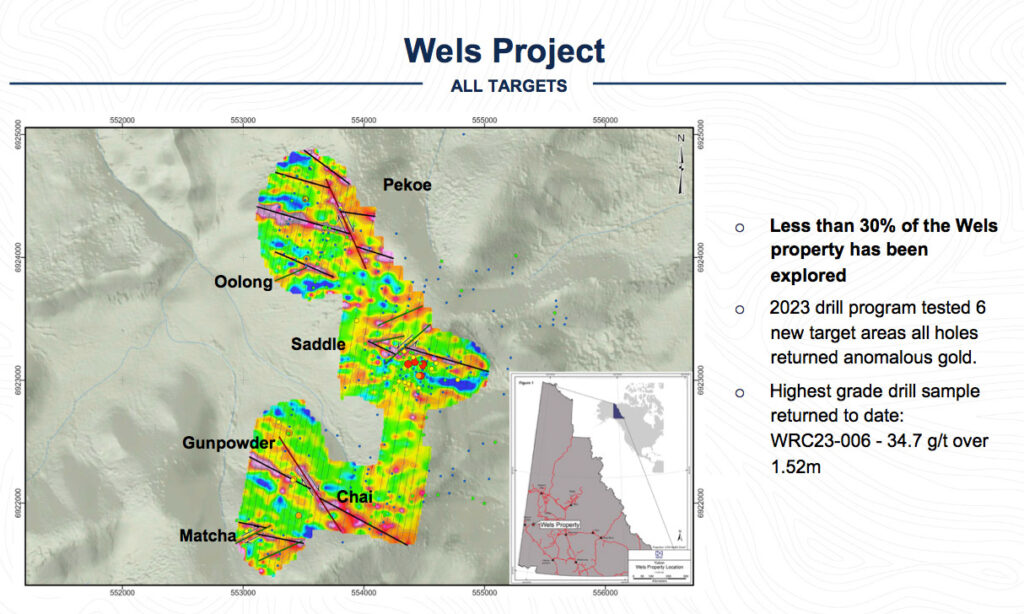

A Third Project in the Yukon…Right Next Door to Where This Team Made History

K2 Gold Corp’s. Wels Project in the Yukon adds another layer of upside to an already compelling story. Wels sits just 60 kilometers south of the Coffee deposit, the 2.8 million-ounce gold discovery that Kaminak Gold made before selling to Goldcorp for approximately C$520 million. The geology at Wels shares key similarities with Coffee, and the team that discovered Coffee knows this district better than anyone. Drilling at Wels has already returned strong results, including 5.08 g/t gold over 12.5 meters and 2.37 g/t gold over 28.5 meters, with 80% of the property still unexplored. For investors, Wels represents a chance to back the same team, in the same neighborhood, looking for the same type of deposit that made them famous in the first place.

The Team That Built a C$500 Million Discovery Is Running K2 Gold Corp. (TSXV: KTO); (OTCQB: KTGDF)

In resource exploration, management can literally make or break a company.

A great asset in the wrong hands can go nowhere. But a solid asset in the right hands can become a company-making discovery.

K2 Gold is in the right hands.

Chairman John Robins is one of the most successful exploration financiers in Canadian mining history. He chaired Kaminak Gold through its discovery and development of the Coffee Gold Project in the Yukon, which ultimately sold to Goldcorp for approximately C$520 million. Now he’s applying the same approach to K2 Gold.

Robins has been instrumental in over C$3 billion in M&A activity and was awarded PDAC’s Viola R. MacMillan Award in 2025 for leadership excellence in exploration financing

In addition, Robins is also a co-founder of Discovery Group, a private company that has been involved in the discovery and development of multiple major mining assets. The group’s track record includes involvement in Great Bear Resources, which sold to Kinross for approximately C$1.8 billion.

K2 Gold’s advisor Chris Taylor previously held the Mojave property at Great Bear Resources before it was spun out. He knows the asset firsthand and now provides strategic guidance to the K2 Gold team.

“One of the best projects I ever saw in my life”

Chris Taylor on the Mojave project

The team’s track record also includes Northern Empire Resources Corp., which acquired the Sterling Gold Project for approximately US$13 million and sold it roughly 17 months later for C$117 million.

This track record of success is critically important in the exploration space. Those who know the industry understand that the same people keep showing up in deals that work.

And that’s precisely what we see with the K2 Gold team. This is a group that understands how to identify targets…how to advance them…and how to create liquidity events for shareholders.

K2 Gold Corp. is their next vehicle. And with permits and capital in the bank, the team is finally in position to execute.

It’s “Go” Time: The Permitting Logjam Is Finally Broken

For years, K2 Gold Corp. (TSXV: KTO); (OTCQB: KTGDF) had the team, the targets, and the capital. What they didn’t have was permission to drill.

The company’s flagship Mojave project required approval from the U.S. Bureau of Land Management, and that process took far longer than anyone anticipated. While competitors moved forward elsewhere, K2 Gold was forced to wait.

That wait is now over.

The BLM has published the Final Environmental Impact Statement for Mojave, representing the highest level of federal environmental review in the United States. This is not a preliminary approval or a “conditional” green light.

“K2 Gold Reaches Critical Federal Permitting Benchmark with Release of Final EIS”

“December 1, 2025 – K2 Gold Corporation announced today that the United States Bureau of Land Management issued a Final Environmental Impact Statement (FEIS) for K2’s Mojave Exploration Drilling Project in Inyo County, CA. This milestone follows rigorous independent review, over 100 days of public comment and scoping, and consultation with local communities representing a significant step forward in de-risking and advancing one of the most compelling exploration projects in the United States.”[1]

What makes this even more valuable is how the company achieved it.

Rather than taking shortcuts under a friendlier regulatory environment, K2 Gold pushed through the most rigorous review process possible. The result is a project that is built to withstand scrutiny for years to come.

For a team that has been waiting years to execute, the path is now wide open.

The Mojave Project: A District-Scale

Opportunity in California

K2 Gold’s flagship Mojave project spans over 6,000 hectares in Inyo County, California, within one of the most historically prolific mining regions in the western United States.

The project sits in a district that hosts more than 200 historic mines and workings. Three operating mines are located within 120 kilometers.

And the property lies directly adjacent to the historic Cerro Gordo mine, often described as the mine that helped build Los Angeles during the late 19th century silver boom.

But Mojave is not a historical curiosity. It’s a modern exploration target with real drill results.

The company’s best hole to date returned 86.9 meters grading 4.0 g/t gold, all oxide material starting from surface. That combination of grade, width, and near-surface mineralization is exactly what exploration teams look for when evaluating a new discovery.

And there’s strong evidence that the known system is just the beginning.

Surface sampling approximately 1.5 kilometers north of that best drill hole has returned grab samples as high as 375 g/t gold (over 12 ounces per ton) and 142.5 g/t gold. None of that ground has ever been drilled.

Beyond gold, Mojave hosts a true polymetallic system. The property contains five distinct gold target areas, four copper target areas, and four silver-lead-zinc target areas. K2 Gold is the first company to consolidate this land package under single ownership and operate it at this scale.

As one experienced mining executive put it, “the best place to look for a new mine is in the shadow of an old headframe.”

Mojave sits in exactly that kind of neighborhood: an active and historic mining district with more than 200 past-producing workings and multiple operating mines nearby.

The upcoming drill program will focus first on expanding the known 5-kilometer oxide gold trend on the east side of the property, then move into new undrilled target areas. The goal is to demonstrate both scale and the polymetallic nature of the system.

In short, Mojave offers the kind of setup exploration teams dream about: proven high-grade mineralization, significant expansion potential, and a permitted path forward.

K2 Gold’s Si2 Project in Nevada Could Be

Another Major Discovery in the Making

While Mojave is the flagship, K2 Gold’s Si2 project in Nevada provides serious additional upside.

Si2 sits near AngloGold Ashanti’s Silicon deposit, one of the most exciting gold discoveries in the region in recent years. Silicon started with a maiden resource of 3.14 million ounces in early 2021. Today it stands at over 16 million ounces and counting.

The same team that originally identified Silicon also identified Si2. They saw the same characteristics in both properties before anyone else recognized their potential.

K2 Gold’s 2023 drilling at Si2 confirmed a robust system. One hole returned 185 meters of continuous gold mineralization, proving that the system is moving significant volumes of gold-bearing fluid. Technical work completed since then has indicated that higher-grade zones likely exist at slightly greater depth.

Si2 will be drilled K2 Gold imminently. If results confirm what the technical work suggests, this project alone could drive a significant re-rating of the stock.

For investors, Si2 represents a second shot on goal with a geologic analog that has already grown into a 12-million-ounce deposit nearby.

The Wels Project: A Third Shot on Goal in Familiar Territory

K2 Gold’s Wels Project in the Yukon brings the story full circle.

Wels sits just 60 kilometers south of the Coffee deposit, the 2.8-million-ounce gold discovery that put Kaminak Gold on the map and ultimately led to its C$500 million sale to Goldcorp. The team that made that discovery is now running K2 Gold. And they know this district as well as anyone in the industry.

The geology at Wels shares key characteristics with Coffee, including structurally controlled gold mineralization within similar rock types. The project covers 7,200 hectares in the heart of the Tintina Gold Belt, one of the most prolific gold districts in North America.

Drilling has already returned encouraging results. Highlights include 5.08 g/t gold over 12.5 meters, 2.37 g/t gold over 28.5 meters, and trench sampling that returned 8.8 g/t gold over 45 meters at the Saddle Zone. Multiple additional targets across the property remain untested, with approximately 80% of the land package still unexplored.

For investors, Wels represents something rare: a chance to back the same team, in the same neighborhood, looking for the same type of deposit that made them famous in the first place.

Why the Timing for K2 Gold Couldn’t Be Better

Gold is trading at all-time highs above $4,400 an ounce. Central banks continue to accumulate reserves at a historic pace.

The U.S. dollar faces increasing pressure as a reserve currency. And institutional forecasts for $5,000 gold no longer seem far-fetched.

“Gold could soar to $6,000 if there’s even a miniscule shift away from US assets, analysts say.”

“Veteran analyst issues surprise $6,000 gold price target for 2026.”

This is the environment K2 Gold is drilling into.

After years of waiting on permits, the company is finally cleared to move forward. The cash is in the bank. The targets are defined. And drilling is set to begin in early 2026.

This is all coming together at precisely the right time, with the gold market continuing to push higher.

And when a proven discovery team with exceptional targets launches a fully funded drill campaign into a market like this one, the conditions for outsized returns are in place.

A Proven Track Record Suggests

Significant Upside Potential

K2 Gold Corp. (TSXV: KTO); (OTCQB: KTGDF) currently has a market cap of approximately C$152 million.

Compare that to what this team has built before:

- Kaminak Gold sold for approximately C$500 million.

- Great Bear Resources, where several K2 advisors played key roles, sold for approximately C$1.8 billion.

- Northern Empire acquired Sterling for roughly US$13 million and sold it for C$117 million in about 17 months.

To be clear…K2 Gold is not Kaminak or Great Bear.

Every project is different, and exploration carries real risk. But the team running this company has repeatedly demonstrated the ability to identify quality assets, advance them efficiently, and create significant value for shareholders.

And this is a team that believes passionately in the potential of the company’s projects…as management currently owns 22% of the outstanding shares.

At the current valuation, K2 Gold offers investors the chance to back this team’s impressive track record at an early stage, before drilling results have a chance to re-rate the stock.

If the team executes again, the gap between where K2 Gold offers sits today and what they’ve achieved in the past suggests meaningful room to run.

7 Key Reasons

Why You Should Strongly Consider K2 Gold Corp. (TSXV: KTO); (OTCQB: KTGDF) Right Now

1

This Team Is Responsible for Over $2.6 Billion in Gold Transactions. Now They’re Set Up for Their Next Big Move

K2 Gold Corp. is led by a team that has delivered over $2.6 billion worth of gold transactions, including Great Bear Resources’ C$1.8 billion sale to Kinross and Kaminak Gold’s sale to Goldcorp for approximately C$520 million…and the key players behind that success are now running K2 Gold. Chairman John Robins, who also chaired Kaminak, is now poised to deliver yet again for K2 Gold. In addition, K2 Gold is part of Discovery Group, an alliance of companies responsible for the discovery of over 10 million ounces of gold. Chris Taylor, who previously held the Mojave property at Great Bear Resources, now serves as an advisor to K2 Gold…bringing direct familiarity with the project’s potential. When a team has a proven track record of success across multiple properties and gets another shot with fully funded, permitted targets, that’s not something to ignore.

2

Years of Permitting Risk Have Been Converted Into a Major Competitive Advantage

For years, K2 Gold was stuck in permitting limbo, waiting on the U.S. Bureau of Land Management to approve exploration at its flagship Mojave project. That wait is now over. The Final Environmental Impact Statement (EIS) has been published, representing the highest level of federal permitting in the United States. Rather than taking shortcuts under a more lenient regulatory environment, the company pushed through the most rigorous review process possible. The result is a fully permitted project built to withstand scrutiny for the long term. This clears one of the biggest hurdles in early-stage mining and allows K2 Gold to focus entirely on what matters now: drilling and discovery.

3

K2 Gold Is Perfectly Positioned to Take Advantage of Soaring Gold Prices

Take a look at gold right now: Up more than 67% over the past 12 months and likely moving higher. That’s because central banks are accumulating gold at a record pace and the U.S. dollar is facing increasing pressure as a reserve currency. A growing chorus of analysts and institutions are now calling for gold prices of $6,000 gold or higher in the years ahead. K2 Gold Corp. is perfectly positioned for this bull market as the company is permitted, fully funded, and ready to drill. Strong gold prices alone are nice…but when they coincide with experienced teams and compelling geology, they can accelerate outcomes dramatically.

4

High-Grade Gold Results Starting Right at Surface

K2 Gold Corp. has already delivered the kind of drill results that demand attention within the industry. The company’s best hole to date at Mojave returned 86.9 meters grading 4.0 g/t gold, all oxide material starting from surface. That combination of grade, width, and near-surface oxide mineralization is exactly what experienced geologists look for. And it may just be the beginning. Surface sampling approximately 1.5 kilometers north of that best drill hole has returned grab samples as high as 375 g/t gold (over 12 ounces per ton) and 142.5 g/t gold. That area has never been drilled, meaning multi-ounce gold samples are sitting on surface in virgin territory waiting to be tested. The known system could just be scratching the surface of what’s actually there.

5

A Flagship Project With District-Scale Polymetallic Potential

The company’s flagship Mojave project spans over 6,000 hectares in an active and historic mining region and it hosts a true polymetallic system. While the current focus is on a 5-kilometer oxide gold trend on the east side of the property, Mojave also contains five distinct gold target areas, four copper target areas, and four silver-lead-zinc target areas. There are more than 200 historic mines and workings on the property, and it sits directly adjacent to the historic Cerro Gordo silver mine, one of California’s largest silver producers in the 19th century. K2 Gold Corp. is the first company to consolidate this land package under single ownership and operate it at this scale. With permitting now in hand and over C$10.5 million in the treasury, Mojave is ready to drill. Beyond the primary gold focus, copper, silver, lead, and zinc targets across the property offer significant additional upside.

6

A Second High-Potential Target in Nevada Adds Meaningful Upside

Mojave is the flagship, but K2 Gold’s Si2 Project in Nevada provides additional potential growth for the company. Si2 is an analogue to AngloGold Ashanti’s Silicon deposit, one of the most exciting gold discoveries in the region in recent years. Silicon started with a maiden resource of 3.14 million ounces in early 2021. Today it stands at over 16 million ounces and counting. Both Si2 and Silicon were originally identified and acquired from the same group, Orogen Royalties, before anyone else recognized their potential. K2 Gold’s 2023 drilling at Si2 confirmed a robust system, with one hole returning 185 meters of continuous gold mineralization. Technical work has since indicated that higher-grade zones likely exist at slightly greater depth. With the company fully funded, Si2 will be the first target drilled when K2 Gold mobilizes in January 2026.

7

A Third Project in the Yukon…Right Next Door to Where This Team Made History

K2 Gold Corp’s. Wels Project in the Yukon adds another layer of upside to an already compelling story. Wels sits just 60 kilometers south of the Coffee deposit, the 2.8 million-ounce gold discovery that Kaminak Gold made before selling to Goldcorp for approximately C$520 million. The geology at Wels shares key similarities with Coffee, and the team that discovered Coffee knows this district better than anyone. Drilling at Wels has already returned strong results, including 5.08 g/t gold over 12.5 meters and 2.37 g/t gold over 28.5 meters, with 80% of the property still unexplored. For investors, Wels represents a chance to back the same team, in the same neighborhood, looking for the same type of deposit that made them famous in the first place.

[1] https://www.miningandenergy.ca/read/goldcorp-announces-acquisition-of-kaminak-gold-corporation-in-520-million-d

[2] https://magazine.cim.org/en/news/2021/kinross-to-acquire-great-bear-resources-in-18-billion-deal-en/

[3] https://www.newswire.ca/news-releases/royal-gold-to-acquire-great-bear-royalties-in-an-all-cash-transaction-for-c-200-million-814587101.html

[4] https://finance.yahoo.com/news/k2-gold-reaches-critical-federal-142900165.html

[5] https://fortune.com/2025/05/10/gold-price-outlook-6000-foreign-investors-us-asset-rotation/

[6] https://www.thestreet.com/investing/veteran-analyst-issues-surprise-gold-price-target-for-2026

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer, K2 Gold Corp. (KTO), Winning Media LLC has been hired for a period beginning on 1/12/26 and ending on 2/14/26 to conduct investor relations advertising and marketing and publicly disseminate information about K2 Gold Corp. (KTO) via Website, Email and SMS. Winning Media has been compensated the sum total of one hundred thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for K2 Gold Corp. (KTO).

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of K2 Gold Corp. (KTO). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.