Sponsored – Est. 8min Read

POTENTIAL TAKEOVER ALERT:

Little-Known North American Gold Exploration Company Offers Intriguing High Upside Potential

Golden Cariboo Resources (CSE:GCC);(OTC:GCCFF);(WKN:A402CQ);(FSE:3TZ) could be a fast-mover as the company appears to be in the right location …at the right time… with the right team in place

For those investors looking for an upside in the junior gold exploration space, one under-the-radar company appears to have the potential to move quickly. Located in a mining friendly jurisdiction in central British Columbia, Canada.

Golden Cariboo Resources (CSE:GCC);(OTC:GCCFF);(WKN:A402CQ);(FSE:3TZ) is targeting a potential multimillion-ounce gold resource in a region with a 160-year mining and exploration history.

But that’s only part of the story.

This is a unique, high-upside investment opportunity that is very much driven by location and management.

Breaking News

Golden Cariboo Intersects 136.51m (447.87 ft) of 1.46 g/t Gold Near Surface at New Discovery in the Halo Zone

Vancouver, Canada – Golden Cariboo Resources Ltd. (CSE:GCC) (OTC:GCCFF) (WKN:A402CQ) (FSE:3TZ) wishes to announce the discovery of a broad, near surface intersection of gold mineralization over 136.51m (447.87 ft) averaging 1.46 g/tonne gold in drill hole QGQ24-13. Bedrock was intersected at 6.86m (22.51 ft), while mineralization consisting of quartz-carbonate veining, was first intersected at a depth of 9.49m (31.14 ft). Mineralization is present as quartz-carbonate veining containing low to moderate concentrations of pyrite +/- visible gold within broad iron-carbonate+/- sericite alteration envelopes.

For more information, click here.

That’s because Golden Cariboo Resources’ Quesnelle Gold Quartz Mine Property – which has been consolidated by Golden Cariboo’s team over the last five years – has a history of production dating all the way back to 1866.

And it’s along the trend to the 5.3 million ounce deposit, Cariboo Gold Project owned by Barkerville Gold Mines Ltd., a wholly owned subsidiary of Osisko Development Corp. (TSXV:ODV); (NYSE:ODV), which is targeted to move into production during the fourth quarter this year. They anticipate producing 220,000 ounces of gold per year for the first three years, and 160,000 ounces of gold per year for the next nine years.

Leading Golden Cariboo Resources team are players who started Barkerville Gold Mines Ltd., and put 2 gold mines into production in the area. In 2000 this team discovered and developed the Bonanza Ledge Mine and assembeled the 64 km long Cariboo Gold Project. In 2010 this team purchased the Quesnel River (QR) Mine from receivership and put the mine back into gold production as an underground mine. This same team 2014 achieved permitting the Bonanza Ledge Mine, having taken it from discovery to overseeing ore trucked to the QR Mill to process and pour the first gold bar from the Bonanza Ledge Mine.

And now that team is using the same exploration model—and knowledge of the region’s geology—to drive success yet again with Golden Cariboo Resources (CSE:GCC);(OTC:GCCFF);(WKN:A402CQ);(FSE:3TZ).

5 Critical Reasons Why Golden Cariboo Resources Looks to Be One of the World’s Most Attractive Junior Gold Exploration Opportunities

Critical Reason #1: Golden Cariboo Resources’ flagship property has extraordinary potential.

The company’s Quesnelle Gold Quartz Mine Property has a history of production as well as high-grade potential targets, and is almost fully encircled by Osisko Development Corp. — a CDN $240 million market-cap mining company.

The property is located 4 kilometers northeast of Hixon, in central British Columbia, and is accessible year-round by road.

The Property includes the Quesnelle Quartz gold-silver deposit, discovered in 1865 in conjunction with placer mining activities. In 1932 and 1939, it produced 2,048 tonnes grading 3.14 g/t Au and 4.18 g/t Ag, with an additional 217 tonnes of unknown grade reported in 1878.

Hixon Creek, which dissects the Quesnelle Gold Quartz Mine property, is a placer creek that has seen limited, small-scale placer production since the mid-1860s. From Ministry of Mines Reports before 1945, estimates of up to $2,000,000 worth of placer gold were mined from Hixon Creek.

The deposit model for the Property is the orogenic type, consisting of gold bearing quartz veins and quartz-carbonate-pyrite replacement style mineralization such as at Osisko Development’s Cariboo Gold Project, centered 75 km to the southeast of the Property.

Diamond Drilling

- Phase 1 drill program consisting of 3 holes completed in winter 2023 (complete)

- Phase 2, 2500-5000m drill program started in spring 2024 and is ongoing

Trenching

- Excavator trenching is planned to continue along the strike to the northwest of the Main and East zones. This will test the extensions of the recent Halo zone discovery and the North Hixon showing. Localized shallow overburden and positive initial results are encouraging, and additional trenching activities are planned to continue.

Mapping

- Differential GPS survey of the trenches and pits, old workings and infrastructure that were uncovered during the 2019-2022 exploration programs

- Detailed mapping and sampling of the property, including the Pioneer mine and Cayenne showings, the North Hixon zone and the Morrison-Hercules adit areas,

- Ground truthing of specific features from the LiDAR survey that require verification or confirmation

The NI 43-101 compliant resource for the Cariboo Gold Project includes 21.4 million tonnes grading 4.6 g/t Au in the measured and indicated resource category, and 21.6 million tonnes grading 3.9 g/t Au in the inferred resource category, using a cut-off grade of 2.1 g/t Au (Beausoleil and Pelletier, 2020).

NOTE: The resource information is not necessarily indicative of the mineralization on the Quesnelle Gold Quartz Mine Property

Historical exploration work on the Quesnelle Gold Quartz Mine Property has included:

- approximately 1250m of early underground development; prospecting, mapping and sampling,

- a LiDAR and orthoimagery survey over the entire property in 2018,

- a recent airborne magnetic and electromagnetic survey on adjacent ground which overlaps the Property area, and

- 2863m of diamond drilling in 22 holes, much of which was completed prior to 1989.

- Historical diamond drill results include: 5.72 g/t Au, 20.6 g/t Ag over 1.5m in DDH 83-1 and 6.75 g/t Au and 54.5 g/t Ag over 3m from DDH 07-1 from the Main zone and; 5.2 g/t Au over 2.75m in DDH 88-5 and 11.8 g/t Au and 12.9 g/t Ag over 1.5m in DDH 07-3 from the East zone.

Exploration activities by Golden Cariboo from 2019 to end of 2022 include about 985m3 of excavation in 46 trenches and pits, a 268m NQ diamond drill hole at the North Hixon zone, which targeted 9.8 g/t Au from local float, two NQ diamond drill holes totaling 466m at the Main Zone targeting the greenstone-schist contact and adjacent mineralization, bedrock mapping and sampling as well as trail construction and maintenance. One NQ diamond drill hole was completed in June 2023 which targeted the southern extension of new mineralization zones discovered on the west side of the contact at the Main Zone, beyond the historical mine workings which typically stayed to the east side of the contact and did not appear to target the gold bearing unit on the west side of the contact.

US Gold Corp CK Gold Project & Exciting Exploration Plans

Critical Reason #2: Golden Cariboo Resources (CSE:GCC);(OTC:GCCFF);(WKN:A402CQ);(FSE:3TZ) is led by the same team that put two mines into production in the region.

In many cases, the company’s leadership is the primary driving factor in success in the junior resource exploration space.

When evaluating any opportunity, you have to ask one important question: Do the people leading this team know what they’re doing?

In the case of Golden Cariboo Resources, the answer is not only “yes” – it’s also one of the company’s most impressive assets.

That’s because the Golden Cariboo Resources team is intimately familiar with the geology in this region, having led the acqusition and development of the neighboring Cariboo Gold Project which was subsequently acquired by Osisko Development Corp for $338 million.

What this successful team was able to accomplish in the early 2000’s and into the 2010’s – that those 1860’s miners were never able to achieve – was for the first time in 150 years, assemble a land package under one company’s ownership allowing for large-scale exploration, development and production.

That experience led to significant discovery of Bonanza Ledge in early 2000, and then small scale production in 2014 and ultimately what will become a producing gold mine yielding 220k oz of gold per year for the first 3 years.and 160,000 oz of gold per year for the ensuing 9 years for the first 2 million plus ounces of gold.

And now that same potential opportunity – in the similar rocks – is presenting itself again.

And now they stand poised to leverage that experience and do it again, which is one reason why investors are beginning to take note of this high-upside opportunity.

Critical Reason #3: Location, location, location – the Quesnelle Gold Quartz Mine Property is in an ideal spot.

The Quesnelle Gold Quartz Mine Property has the potential for a multimillion-ounce gold resource that is in an exceptional location.

The Property is a 100% owned, 3,814 hectare property covering a 10 kilometer east-west and 10 kilometer north-south trend within the historic Cariboo Mining District in British Columbia with no royalties.

As mentioned earlier, the property is contiguous to the Cariboo Gold Project, including the Cariboo Gold Mine, which is slated to begin production this year.

The Quesnelle Gold Quartz Mine Property was one of the first underground mines in production in British Columbia back in 1866.

The property’s geology is in many ways analogous to the Abitibi Gold Belt, stretching from Wawa, Ontario to Val-d’Or Quebec, which has produced over 220 million ounces of gold.

NOTE: The production information is not necessarily indicative of the mineralization on the Quesnelle Gold Quartz Mine Property

And the company’s recent activity on the property has been especially encouraging. Here’s a brief look:

Highlights from the 2019 trenching program include:

- 5 g/t Au and 61.5 g/t Ag over the 0.6m wide accessible portion of the 1.75m wide Koch vein and 1.94 g/t Au over 0.5m from the footwall,9 g/t Au with >100 g/t Ag from a grab of pyritic Koch vein boulders,

- 2 g/t Au and 25.3 g/t Ag as an average from 3 grab samples of quartz vein boulders at the Main shaft

- 2 g/t Au, with 10.1 g/t Ag over 0.4m and 7.65 g/t Au over 1.7m from Main shaft area.

Results from the 2022 trenching and drilling program include:

- The North Hixon zone was extended 100m to the southwest

- grab samples of mineralized greenstone-listwanite returned 0.76 g/t and 0.52 g/t gold

- silicified greenstone ran 1.31 g/t gold, and a mineralized quartz vein yielded 1.02 g/t gold

- 78 g/t gold across 0.25m from silicified greenstone

- A new showing, the Halo, zone, was discovered 800m northwest of the Main zone

- grab samples of clay-altered phyllite returned 5.08, 2.97, and 1.01 g/t gold with 2.23 g/t gold from a sheared fault zone and 1.63 and 0.88 g/t gold from sericitic, fuchsite-rich phyllite

- one channel sample returned 0.45 g/t gold over 1m from clay-sericite altered phyllite

- Drilling at the North Hixon zone highlighted 0.87 g/t gold (0.57g/t cut) over 32.0m (105 ft) from QGQ22-01, including a high grade value of 29.2 g/t gold over 0.5m (1.6 ft), from a fault zone, which, when capped at 10 g/t gold to moderate the nugget effect of gold, results in 4.04 g/t gold (1.73 g/t cut) over 4.15m (13.6 ft) from the fault zone, followed by elevated to significant grades within pyritic, replacement style mineralization hosted by the phyllitic metasedimentary rocks, similar to those encountered in the Main zone.

- Drilling at the Main zone, located about 800m southeast of the North Hixon zone, returned 4.76 g/t gold over 4.7m and 0.69 g/t gold over 22.3m in QGQ22-02.

- QGQ22-03 was also drilled at the Main zone and showed that mineralized zone diverged to the north, returning two separate intervals of 2.61 g/t Au over 1.85m and 0.97 g/t Au over 1.55m and with a lower interval of 0.98 g/t Au over 2.55m.

The 2023 exploration drilling program revealed considerable results:

- Drill hole QGQ23-04, previously referred to as QGQ23-01, of the Main zone was reported as containing several gold intercepts

- QGQ23-04 intersected a broad zone of replacement mineralization, which returned 4.65 g/t Au over 7.15m (23.5 ft) and 1.12 g/t Au over 18.7m (61.4 ft), below the probable historical Koch Vein. Of significant interest is that the entire interval, including the intervening 0.08 g/t Au interval over 15.15m (49.7 ft), grades 1.35 g/t Au over 41.0m (134.5 ft). This represents a significant increase in size and tenor up-dip and to the south of the 0.69 g/t Au over 22.3m (73.2 ft) intercept obtained in QGQ22-02 (April 25, 2023 News Release).

- Additional replacement mineralization returning 2.77 g/t Au over 6.25m (20.5 ft) and 2.96 g/t Au over 0.65m (2.1 ft).was identified in the lower portion of the hole

- Mineralization is observed both in quartz-carbonate-pyrite veining and in variably sericitic altered metamorphosed fine clastic sedimentary rocks, which lie proximal to the greenstone contact and a lamprophyre dyke.

- Mineralization is open in all directions.

The 2024 exploration drilling program revealed considerable results:

Significant assay results from the 2024 exploration program received so far include infill sample results from drill hole QGQ22-01, which are highlighted below, as well as some results from holes QGQ24-05 through to QGQ24-15:

Holes QGQ24-05 to QGQ24-07 were drilled on the Main zone

- QGQ24-05 targeted a suspected F2 fold closure northwest of the intercept in QGQ23-04, which yielded 1.35 g/t Au over 41.0m (134.5 ft). QGQ24-05, drilled to 321.60m, yielded a number of greater than 1 g/t gold intercepts over narrow down hole intervals (0.4-1.4 g/t gold) and is thought to have been drilled completely in the hanging wall of the mineralized zone.

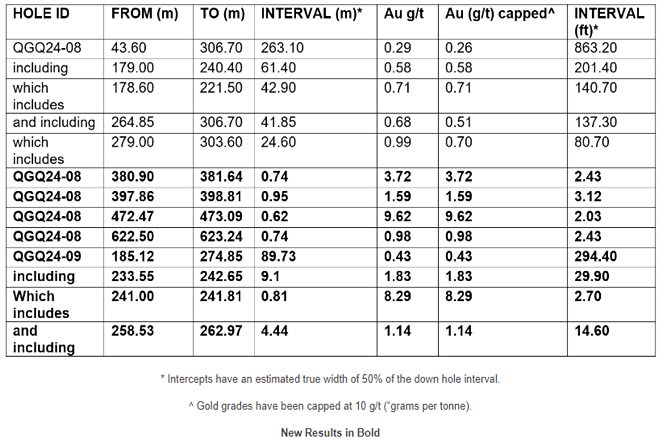

Holes QGQ24-08 and QGQ24-09 were collared at the North Hixon zone

- Assay results from QGQ24-08 has returned 0.29 g/t gold over 263.1m (863.2 ft), including 0.68 g/t gold over 41.85m (137.3 ft) with assays variable through the zone and reflect fault, replacement, and vein styles of mineralization, highlighting an up-dip extension of mineralization found in the Company’s inaugural QGQ22-01 drill hole at the North Hixon zone. Additional results to the end of the 712.0m (2,336 ft) hole are highlighted in the table below.

- Hole QGQ24-09, collared about 100m northwest of QGQ22-01, returned 0.43 g/t gold over 294.4m (933 ft), including 1.83 g/t gold over 29.9m (98 ft), and including 1.14 g/t gold over 14.6m (48 ft). These results, along with geological indicators, show a northern extension of mineralization at the North Hixon zone and continues to be open to the north-northwest.

Holes QGQ24-10 through to QGQ24-15 were collared at the Halo zone

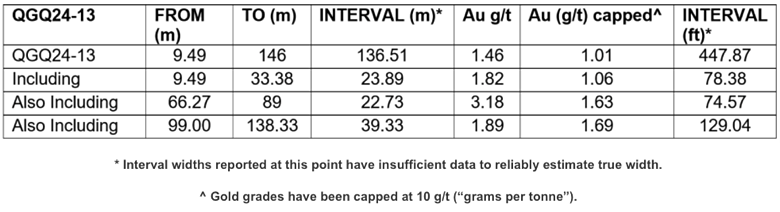

Drilling activities have also commenced at the Company’s most recent discovery, the Halo zone which is located about 500m (1,640 ft) west-northwest of the North Hixon zone and about 800m northwest of the Main zone. QGQ24-10 through to QGQ24-15 have been completed to date and visible gold has been reported in three of the Halo zone holes. Results from two of the six holes at the Halo zone have been received with the balance of the assays pending:

Hole QGQ24-13 returned an amazing 136.51m (447.9 ft) intercept of 1.46 g/t Au including 3.18 g/t Au over 22.73m (74.6 ft) (News Release dated September 10, 2024).

But here’s what is so unique about Golden Cariboo Resources’ (CSE:GCC);(OTC:GCCFF);(WKN:A402CQ);(FSE:3TZ) property in British Columbia:

It’s surrounded on 3 sides by Osisko Development Corp.

Over the past five years, Golden Cariboo Resources has been consolidating this project – and now it is the only public company other than Osisko Development Corp. to solely own property in this region.

In terms of the geography, it is best described as a bookshelf where on one end of the bookshelf we see the Spanish Mountain Gold Deposit (4.7 millon oz) to the south, the ‘beach head’ Cariboo Gold Project (5.3 million oz) in the middle and ,to the north, is the Quesnelle Gold Quartz Mine Property.

And at the other end sits Golden Cariboo Resources’ Quesnelle Gold Quartz Mine Property – in very similar rocks – with access to virtually all of the same infrastructure and resources.

Critical Reason #4: Golden Cariboo Resources (CSE:GCC);(OTC:GCCFF);(WKN:A402CQ);(FSE:3TZ) appears to be significantly undervalued…for the time being.

Obviously there are many factors to consider when it comes to valuing the potential for a junior gold exploration company.

In the case of Golden Cariboo Resources – based on the potential gold in the ground alone – there appears to be an opportunity for investors to see high upside as the company’s property begins to attract more attention.

Take a look at neighboring Osisko Development Corp. (NYSE: ODV). The company currently has a market cap of CDN $240 million, and its shares trade for around $3.

While Osisko Development Corp. has other projects in its portfolio in addition to its Cariboo Gold Project, that type of potential stands in stark comparison to where investors can buy shares of Golden Cariboo Resources right now.

With Golden Cariboo Resources (CSE:GCC);(OTC:GCCFF);(WKN:A402CQ);(FSE:3TZ) trading at just under CDN $0.20 per share, the upside potential is extraordinary.

Given the size of the company next door, once the market begins to realize the potential for the company’s Quesnelle Gold Quartz Mine Property, the share price could move rapidly.

Speaking of which, that leads us to…

Critical Reason #5: Golden Cariboo Resources “checks all the boxes” for an attractive takeover target.

Golden Cariboo Resources Summary

In the case of Golden Cariboo Resources (CSE:GCC);(OTC:GCCFF);(WKN:A402CQ);(FSE:3TZ), the company appears to check all the boxes as an attractive takeover target.

- The company is in the right place – with a high-upside property located right next to a larger company that is headed for production.

- They’re the only other game in town, as no other public companies solely own property that is surrounded by Osisko Development Corp. (TSXV: ODV); (NYSE: ODV)

- And the company is led by the right team – including the very same experts who helped turn Osisko’s Cariboo Gold Project into a reality before they were ultimately bought out by Osisko for approximately $338M Canadian back in 2016.

That history – and the high upside potential for Golden Cariboo’s Quesnelle Quartz Gold Mine Property – make the company a very intriguing takeover target…and that’s a scenario that could lead to a rapid change in valuation for those shareholders on board at the time.

Discover Golden Cariboo’s Latest News

Disclaimer:

This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. WallStreetNation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.

Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of Golden Cariboo Resources LTD and its securities. Jade Cabbage Media, LLC d/b/a STOXmedia.com has received up to $20,000 USD dollars by Winning Media LLC as a total production budget for this advertising effort. Neither WallStreetNation.com, Winning Media LLC or Jade Cabbage Media LLC currently hold the securities of Golden Cariboo Resources LTD and do not currently intend to purchase such securities.

The issuer, Golden Cariboo Resources LTD. has compensated Winning Media llc the sum total of one hundred thousand dollars USD total production budget to manage a digital media campaign for thirty days.

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.