Sponsored / Est. 8 Min

Massive Upside Alert:

$130 Million Market Cap North American Gold and Copper Mining Development Company – with $4.5 Billion Worth of Metal in the Ground – is Fully Permitted and Fast Tracked to Production

High-Upside Potential for U.S. Gold Corp. (Nasdaq: USAU): A Company with The Right Metals…in the Right Place…at the Right Time

8 Reasons Why You Should Strongly Consider U.S. Gold Corp. (Nasdaq: USAU) Today

This $130 Million Market Cap Company Potentially Has $4.5 Billion Worth of Metal in the Ground – U.S. Gold Corp.’s proven and probable reserve of 1.022 million ounces of gold – plus an additional 259.7 million pounds of copper – means the company is sitting on potentially over $3.34 Billion worth of gold and $1.18 Billion worth of copper at today’s prices. Given the speed at which the company is moving ahead to bring some of this gold to market, the window of opportunity to invest at the current lower price may close quickly.

U.S. Gold Corp. is Fully Permitted and Ready to Launch – The company’s flagship CK Gold Project in Wyoming has received full, unconditional approval for development. This makes it potentially the only fully permitted, bucket ready gold/copper project in the United States owned by a junior mining company that is fast-tracked for immediate development. At a time when the Trump Administration is looking to “green light” domestic production of critical minerals, U.S. Gold Corp. has already secured all necessary permits and is ready to move forward and potentially emerge as the next 110,000+ oz./yr. gold-copper producer.

Red-Hot Bull Market for Gold Sends U.S. Gold Corp.’s Reserve Value Higher – Gold prices have been soaring to all-time highs, recently passing $3,300 per ounce. With ongoing inflationary concerns as well as geopolitical instability worldwide, many experts are projecting a sustained, long-term bull market for gold. This continued high gold price is exceptionally good news for mining companies like U.S. Gold Corp, who will continue to see the value of their resources increase.

U.S. Gold Corp. Has a Diverse Portfolio off World-Class Projects – The company’s current mining projects – each in mining-friendly U.S. jurisdictions – offer both near-term gold-copper production potential with blue-sky exploration upside. The company is now fully permitted at its CK Gold Project in Wyoming, which will give it a critical advantage over its competitors. And its exploration projects in Nevada and Idaho each offer longer-term upside potential for the company.

The CK Gold Project Offers Exposure to Compelling Value and Near-Term Production – The company’s flagship project in southeast Wyoming has been shown to have 1.672 million ounces of proven and probable gold equivalent reserves. This includes 1.022 million ounces of gold and 259.7 million pounds of copper. Given the current bull markets for gold and copper – plus the “shovel-ready” nature of the CK Gold Project – U.S. Gold Corp. right now appears to offer one of North America’s most attractive gold and copper investment opportunities.

U.S. Gold Corp. is Well-Positioned Amid Global Copper Shortage – 30% of U.S. Gold Corp.’s revenue currently comes from copper. And right now the world finds itself dealing with a potentially devastating copper shortage at a time when copper has become absolutely essential for a number of industries. This has led to significantly higher copper prices and forecasts of sustained high prices amid continued surging demand. This means that the value of the copper resource at U.S. Gold Corp.’s properties has the potential to continue climbing significantly higher.

U.S. Gold Corp. is Led by One of North America’s Most Experienced Mine Builders – President & CEO George Bee has taken several mines from development to production at companies like Barrick Gold, Rio Tinto and Anglo American. He leads a team of accomplished explorers and proven company builders at U.S. Gold Corp., who have made and financed the discovery and development of numerous world class gold assets.

This Nasdaq-Listed Company is Financially Well-Positioned to Move Forward Quickly – Having completed $47 million in capital raises and with $9 million in cash on its balance sheet, U.S. Gold Corp. is in excellent shape to being moving toward opening its mine at the CK Gold Project in Wyoming. At the Wyoming site, all feasibility and environmental studies have already been paid for in previous financing rounds. This means the project has essentially been de-risked and the company is now in great position to move forward as there are no longer any expensive undertakings around the project.

Fast-Track Alert:

With Up to $4.5 Billion in Proven and Probable Reserves,U.S. Gold Corp. (Nasdaq: USAU) is Fully Permittedand Racing Toward Production

The massive run-up we’ve seen in gold prices over the past three years has captured the attention of many investors. There’s no question that the economic turmoil we’ve seen – both within North America and all over the globe – has helped launch what appears to be a long-term bull market for gold.

“Gold is in the early days of a bull market…the deepest pockets on the planet are buying gold. That’s central banks.”

As this bull market for gold continues to roar, one North American company – one with a handful of unique advantages in the market – appears to offer investors significant upside potential.

In fact, over the past year this company has already demonstrated impressive growth, moving from a market cap of around $45 million one year ago to $130 million today – and climbing.

The rise in gold and copper prices, combined with the company’s updated prefeasibility study and acquisition of full permitting for its CK Gold Project in Wyoming, has contributed to its impressive growth over the past year, yet still…

The company – U.S. Gold Corp. (Nasdaq: USAU) – still appears to be significantly undervalued based solely on the amount of gold and copper at its flagship property alone given the ongoing bull markets for gold and copper.

U.S. Gold Corp. (Nasdaq: USAU) Checks Off Each of the “3 P’s” for Junior Exploration Success

When evaluating the potential associated with any junior mining stock, investors have traditionally focused on the “3 P’s”: People…Project…and Permits.

In the case of U.S. Gold Corp., the company appears impressive with each of these three critical building blocks for success:

People

The company is led by President & CEO George Bee, a world-class mine builder who has taken several mines from development to production at companies like Barrick Gold, Rio Tinto and Anglo American.

Project

U.S. Gold Corp.’s CK Gold Project has a proven and probable reserve of 1.022 million ounces of gold – plus an additional 259.7 million pounds of copper. This means the company is potentially sitting on nearly $4.5 billion worth of gold and copper combined at today’s prices.

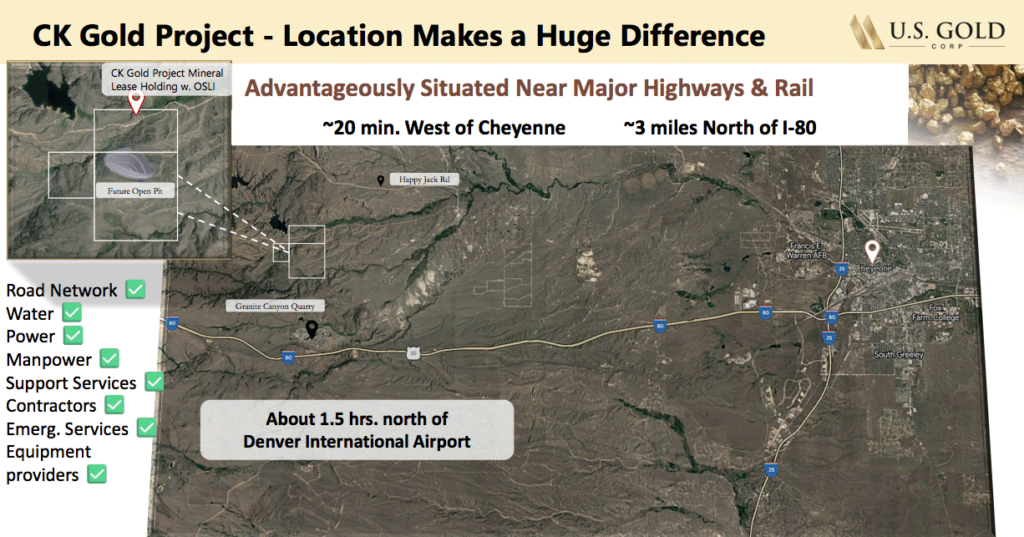

And this project is in an incredible location – just outside of Cheyenne, Wyoming and only three miles north of the $30 billion Martin Marietta Materials’ (NYSE: MLM) Granite Canyon Quarry Mine.

Permits

Permitting is a huge issue for most exploration companies with new projects throughout North America, with many projects taking years to permit.

That’s not the case for U.S. Gold Corp., whose CK Gold Project is located entirely on state ground in the state of Wyoming. And the company has secured a full permit to begin construction on this project.

This permitting could soon lead to a significant re-rating of the valuation for the company. Permitted projects typically trade at 50+% of their Net Present Value (NPV).

In the case of the CK Gold Project, that pre-tax NPV is $459 million…meaning 50% of that would translate into a potential valuation of more than $229 million. Yet the current valuation remains – for the time being – at just over $130 million.

With just under 12.6 million shares outstanding, that could mean a share price for U.S. Gold Corp. (Nasdaq: USAU) approaching $17 after permit approval…and that represents substantial short-term upside potential from the current share price.

Indeed – Paradigm Capital Analyst Don Blyth has a current $16.50 price target on USAU. And Alliance Global Partners Top Rated Mining Analyst Jake Sekelsky has a current $18.00 price target on USAU, representing a significant potential upside from current market levels.

With Potentially $3 Billion Worth of Metal in the Ground, this $37 Million Market Cap Company Appears Curiously Undervalued

U.S. Gold Corp. (Nasdaq: USAU) is an extremely attractive company with three U.S.-based, high-potential development projects in its portfolio.

The company is looking to aggressively advance each of its three projects…and given the current market conditions it appears to be doing so at precisely the right time.

Before taking a closer look at what’s happening at each of the company’s three projects, it’s important to understand the simple value proposition the company offers.

At U.S. Gold Corp.’s flagship project – the CK Gold Project in southeast Wyoming – prefeasibility studies showed mineral reserves consisting of 1.022 million ounces of gold and 259.7 million pounds of copper.

Those prefeasibility studies were done based on a gold price of $2,100 per ounce and a copper price of $4.10 per pound. And the economics of the project were already outstanding even based on those outdated benchmark values.

But the fact of the matter is, we’ve since blown way beyond those prices. So let’s do some quick math to bring things up to date.

At today’s gold price of around $3,300 per ounce…those 1.022 million ounces of gold are potentially worth $3.34 billion.

And with copper prices at $4.55 per pound…those 259.7 million pounds of copper are potentially worth $1.18 billion.

That’s roughly $4.5 billion worth of gold and copper – combined – sitting in the ground.

Yet in spite of this incredible reserve – as well as U.S. Gold Corp.’s proven leadership team…the fact that its CK Gold Project is fully permitted…and the company’s other projects in Nevada and Idaho…

Somehow the company still has a market cap of just around $130 million.

But given all that U.S. Gold Corp. (Nasdaq: USAU) has going for it, the opportunity for investors to get in at today’s discounted price is not likely to last much longer.

The CK Gold Project: A Development-Stage, At Surface, Open-Pit, Large-Tonnage Gold-Copper Project in Resource-Friendly Wyoming

As mentioned earlier, U.S. Gold Corp.’s flagship project is the CK Gold Project, located in the Silver Crown mining district of southeast Wyoming.

The property comprises about 1,120 acres (2 square miles) and is 100% owned by U.S. Gold Corp. In February, 2025, the company released the project’s updated SK-1300 Technical Report Preliminary Feasibility Study, PFS. The project offers the company near-term, open-pit production potential as well as compelling value.

The CK Gold Project deposit is a development stage, large-tonnage, gold-copper deposit with high-grade mineralization exposed at the surface surrounded by a large, low-grade zone with high potential for expanding resources.

The CK Gold Project resource is based upon 160 drill holes totaling 28,500m and contains oxide, mixed oxide-sulfide, and sulfide rock types. The CK Gold Project mineralization is characterized by an extraordinary even distribution of metal grades occurring as a large body of disseminated and vein / stockwork gold, silver, and copper mineralization.

The updated SK-1300 PFS study using base case prices of $2100/oz gold and $4.10/lb copper indicates a 10-year project with a manageable capital requirement of $277 million. Over the project life a total of 259.7 million pounds of copper and 1,022,000 ounces of gold are projected to be produced based on the PFS throughput assumptions.

And keep in mind: U.S. Gold Corp. is fully permitted – with an approved Mine Operating Permit in place – and advancing towards development at this project in an extremely resource-friendly jurisdiction.

U.S. Gold Corp.’s Keystone Project: Exploring the Next Major Gold District on the Cortez Trend, Nevada

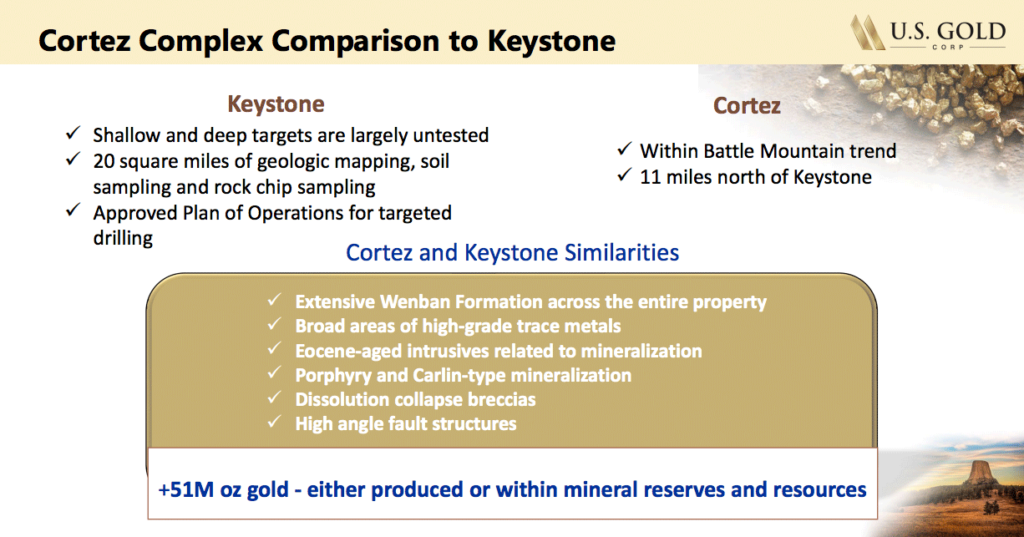

U.S. Gold Corp.’s Keystone project is a potential Carlin-type gold deposit exploration project located on Nevada’s Cortez Trend, one of the world’s most prolific gold mining trends and home to some of North America’s largest mines.

The Keystone project is an under-explored, early-Tertiary (34.1+/-0.7 Ma), complex intrusive-centered, large gold-bearing hydrothermal system developed in domed permissive, lower-plate, carbonate host rocks. U.S. Gold Corp. has consolidated this entire prospective gold Cortez Trend district currently with 20 square miles of mineral rights control.

This is the first time in history of the district that both the entire district has been consolidated by one company, and is being evaluated by systematic, comprehensive, model-driven exploration.

U.S. Gold Corp.’s work to date on the project has illustrated many similarities between Keystone and some of the major mines on both the Cortez and Carlin Trends in Nevada – with evidence of similar stratigraphy, lithologic characteristics, structure, and alteration – factors important to the discovery of significant Carlin-type deposits.

- The Cortez Trend is one of the world’s most productive trends, producing approximately one million ounces of gold per year.

- The trend hosts numerous world class deposits, including NGM’s Pipeline (~21M oz gold), Cortez Hills (~15M oz gold) and Goldrush (~10M oz gold).

- Significant discoveries are still being made on the Cortez Trend, such as Barrick’s Fourmile Project.

- * The NNW-trending Sr .706 line likely represents a major crustal suture favorable for development of gold-bearing hydrothermal systems and deposits.

- Keystone exhibits certain similarities to NGM’s deposits to the north, including host rock, stratigraphy, and an intrusive-centered dome.

Global Copper Shortage Amid Soaring Demand is Pushing Prices Higher and Driving Up the Value of U.S. Gold Corp.’s Impressive Copper Resource

There’s no question that copper has emerged as one of the world’s most critical metals thanks to its essential role in the green economy as well as many other vital industries.

In fact, all the way back in August 2023, the U.S. Department of Energy officially added copper to its list of critical raw materials. Yet we are still staring a potentially devastating global shortage square in the face.

Within days of taking office in early 2025, President Trump issued an Executive Order – EO 14220 – regarding “the role that copper and its derivative products play in defense applications, infrastructure, and emerging technologies, including clean energy, electric vehicles, and advanced electronics.”[i]

“Demand for copper is surging…but mining companies are having a hard time keeping up. There’s a massive copper shortage.”

— CNBC[ii]

Here’s why this is a potential game-changer for U.S. Gold Corp. (Nasdaq: USAU):

Given the increasing demand for copper…its numerous essential uses…and the potentially devastating global shortage we are now seeing, the copper price is likely to remain high for the foreseeable future.

Most of the existing copper production within North America is nearing the end of its life cycle, making it more even more critically important that new sources of domestic copper production are brought online as soon as possible.

With an estimated 259.7 million pounds of copper in the ground at its CK Gold Project in Wyoming, U.S. Gold Corp. could see the value of its resource continue to rise.

And with this project fully permitted and potentially fast-tracked for production within the next 18 months, U.S. Gold Corp. could soon become one of just a limited number of options for U.S.-based copper production.

U.S. Gold Corp.’s Management Team Has Several Decades of Proven, Mine-Building Experience

Now that the permitting has been secured for the company’s CK Gold Project, the next important step will be getting a productive mine up and running.

Fortunately, the company is led by a team of experienced industry veterans with an outstanding track record of doing just that.

Many junior exploration companies that move into production often struggle because they are led by geologists or entrepreneurs with more experience in capital markets than in building a successful mining operation.

In the case of U.S. Gold Corp., however, the company is led by President and CEO George Bee, one of the most successful mine builders in all of North America.

The company’s leadership team includes:

George Bee – President & CEO, Director

Mr. Bee has managed multiple world-class mining projects in 8 countries for major and junior mining companies. He has taken several mines from development to production and recently was a Sr. VP for Barrick Gold. He also worked for Rio Tinto and Anglo American as well as several junior mining companies in his distinguished mining career.

Luke Norman – Executive Chairman

Mr. Norman has 20 years of experience in Venture Capital Markets and has raised more than $300 million dollars for mining companies. He is also a Co-founder of U.S. Gold Corp.

Kevin Francis – VP Exploration and Tech Services

Mr. Francis has held many senior roles in the mining industry, including VP of Project Development for Aurcana Corporation, VP of Technical Services for Oracle Mining Corporation, VP of Resources for NovaGold Resources and Principal Geologist for AMEC Mining and Metals.

Robert Schafer – Director

Mr. Schafer is a geologist with over 35 years international experience exploring for and discovering mineral deposits. Past projects include four producing mines including the Briggs (over one million ounces) and Griffon gold mines in the Western United States and Birkachan (over one million ounces) gold mine in far east Russia.

8 Reasons Why You Should Strongly Consider U.S. Gold Corp. (Nasdaq: USAU) Today

This $130 Million Market Cap Company Potentially Has $4.5 Billion Worth of Metal in the Ground – U.S. Gold Corp.’s proven and probable reserve of 1.022 million ounces of gold – plus an additional 259.7 million pounds of copper – means the company is sitting on potentially over $3.34 Billion worth of gold and $1.18 Billion worth of copper at today’s prices. Given the speed at which the company is moving ahead to bring some of this gold to market, the window of opportunity to invest at the current lower price may close quickly.

U.S. Gold Corp. is Fully Permitted and Ready to Launch – The company’s flagship CK Gold Project in Wyoming has received full, unconditional approval for development. This makes it potentially the only fully permitted, bucket ready gold/copper project in the United States owned by a junior mining company that is fast-tracked for immediate development. At a time when the Trump Administration is looking to “green light” domestic production of critical minerals, U.S. Gold Corp. has already secured all necessary permits and is ready to move forward and potentially emerge as the next 110,000+ oz./yr. gold-copper producer.

Red-Hot Bull Market for Gold Sends U.S. Gold Corp.’s Reserve Value Higher – Gold prices have been soaring to all-time highs, recently passing $3,300 per ounce. With ongoing inflationary concerns as well as geopolitical instability worldwide, many experts are projecting a sustained, long-term bull market for gold. This continued high gold price is exceptionally good news for mining companies like U.S. Gold Corp, who will continue to see the value of their resources increase.

U.S. Gold Corp. Has a Diverse Portfolio off World-Class Projects – The company’s current mining projects – each in mining-friendly U.S. jurisdictions – offer both near-term gold-copper production potential with blue-sky exploration upside. The company is now fully permitted at its CK Gold Project in Wyoming, which will give it a critical advantage over its competitors. And its exploration projects in Nevada and Idaho each offer longer-term upside potential for the company.

The CK Gold Project Offers Exposure to Compelling Value and Near-Term Production – The company’s flagship project in southeast Wyoming has been shown to have 1.672 million ounces of proven and probable gold equivalent reserves. This includes 1.022 million ounces of gold and 259.7 million pounds of copper. Given the current bull markets for gold and copper – plus the “shovel-ready” nature of the CK Gold Project – U.S. Gold Corp. right now appears to offer one of North America’s most attractive gold and copper investment opportunities.

U.S. Gold Corp. is Well-Positioned Amid Global Copper Shortage – 30% of U.S. Gold Corp.’s revenue currently comes from copper. And right now the world finds itself dealing with a potentially devastating copper shortage at a time when copper has become absolutely essential for a number of industries. This has led to significantly higher copper prices and forecasts of sustained high prices amid continued surging demand. This means that the value of the copper resource at U.S. Gold Corp.’s properties has the potential to continue climbing significantly higher.

U.S. Gold Corp. is Led by One of North America’s Most Experienced Mine Builders – President & CEO George Bee has taken several mines from development to production at companies like Barrick Gold, Rio Tinto and Anglo American. He leads a team of accomplished explorers and proven company builders at U.S. Gold Corp., who have made and financed the discovery and development of numerous world class gold assets.

This Nasdaq-Listed Company is Financially Well-Positioned to Move Forward Quickly – Having completed $47 million in capital raises and with $9 million in cash on its balance sheet, U.S. Gold Corp. is in excellent shape to being moving toward opening its mine at the CK Gold Project in Wyoming. At the Wyoming site, all feasibility and environmental studies have already been paid for in previous financing rounds. This means the project has essentially been de-risked and the company is now in great position to move forward as there are no longer any expensive undertakings around the project.

[i] https://perkinscoie.com/insights/update/trump-administration-takes-next-step-advance-domestic-mineral-production

[ii] https://www.cnbc.com/2024/05/31/why-theres-a-massive-copper-shortage.html

This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. WallStreetNation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.

Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of US Gold Corp and its securities. Jade Cabbage Media, LLC d/b/a STOXmedia.com has received up to $20,000 USD dollars by Winning Media LLC as a total production budget for this advertising effort. Neither WallStreetNation.com, Winning Media LLC or Jade Cabbage Media LLC currently hold the securities of US Gold Corp and do not currently intend to purchase such securities.

On April 17th, 2024, Winning Media LLC was compensated up to the sum total of four hundred fifty thousand dollars USD total production budget to manage a digital media campaign for ninety days by US Gold Corp. Any future compensation or changes will be reflected and updated.

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.