Sponsored – Est. Read 7 Min

Potential Breakthrough Investment Opportunity

9,500-Room Global Shortfall Creates Massive Opportunity for Undervalued Company That Just Acquired a $300 Million Cancer Treatment Platform

How LIXTE Biotechnology (Nasdaq: LIXT) acquisition of the revolutionary LiGHT Proton Therapy Platform could transform cancer care and deliver outsized returns for early investors

Get ready…this one could be a fast-mover.

LIXTE Biotechnology Holdings, Inc. (Nasdaq: LIXT)has just announced a game-changing acquisition that could transform the company from a $25 million market cap stock into something far more significant.

The company has acquired Liora Technologies and its revolutionary LiGHT proton therapy platform…

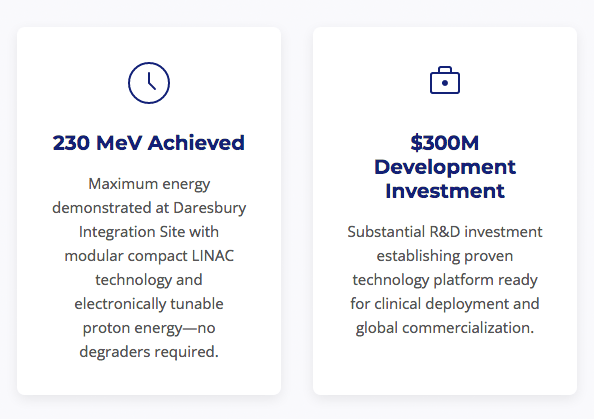

This platform is a breakthrough technology that has already had $300 million invested in its development…proven clinical validation at 230 MeV…and breakthrough economics that could finally make precision cancer treatment accessible to millions of patients worldwide.

Here’s why this matters:

Proton therapy is widely recognized as the most precise and effective radiotherapy treatment for cancer available today.

Unlike traditional radiotherapy that damages healthy tissue surrounding tumors, proton beams can be much more controlled and accurate. The LiGHT proton therapy platform raises the bar far beyond the reach of legacy proton therapy with pinpoint accuracy, stopping exactly at the tumor site and move with almost 3D capability, all whilst sparing critical organs and minimizing devastating long-term side effects.

For many patients – including those with tumors near vital organs – the LiGHT proton therapy can mean the difference between a cure where quality of life remains intact…or a cure that comes with permanent damage to healthy tissue.

Think about a child with a brain tumor. Traditional radiation can cure the cancer…but it can also cause permanent cognitive impairment, hormone deficiencies, and developmental delays that affect the child for life.

LiGHT proton therapy can deliver the cure while sparing the developing brain from unnecessary radiation exposure.

For elderly patients with prostate cancer near the bladder and rectum, traditional radiation often causes long-term incontinence and bowel problems. The LiGHT proton therapy targets only the tumor, preserving quality of life.

These are ultimately life-changing differences for real patients…and there are millions of patients who need this treatment but can’t access it because there simply aren’t enough facilities.

That’s because traditional proton therapy systems, albeit much more accurate than traditional radiotherapy, have cost $200 to $300 million per facility and required massive infrastructure as well as a 3-5 year installation timeline.

As a result, only about 300 treatment rooms exist worldwide, meaning that fewer than 5% of cancer patients who could benefit from proton therapy currently have access to it.

That means there’s a 9,500-room global shortfall…creating billions of dollars in unmet demand from the millions of patients who need this treatment but can’t get it.

That could now be changing – in a meaningful way – thanks to LIXTE (Nasdaq: LIXT) and the company’s recent acquisition of Liora’s LiGHT proton therapy platform.

Liora’s LiGHT platform changes everything.

At roughly $85 million for a facility with up to 4 treatment rooms, which is just 30% the cost of legacy systems…the LiGHT platform can offer not only more affordable and accessible proton therapy, but also proton therapy based on technology with accuracy and capability that will be a game change in proton therapy.

It’s the same transformation that happened when affordable MRI machines went from a handful of research centers to thousands of hospitals worldwide.

With world-class scientific leadership from CERN, a $300 million already invested in the LiGHT platform development, a proven 230 MeV proton beam achieved at the Daresbury facility in the UK, and potential revenue of around $130 million at capacity, LIXTE is now targeting the $500+ billion oncology market addressing the 9,500-room global shortfall.

Yet despite this transformational acquisition, LIXTE remains dramatically undervalued with a market cap of just $25 million.

Here’s why early investors could see outsized returns…and why this opportunity may not stay under the radar for long.

7 Reasons Why LIXTE (Nasdaq: LIXT)

Acquisition of Liora Technologies Could Deliver Potential Windfall Profits for Early Investors

1

$300 Million Has Already Been Invested in Liora Technologies’ LiGHT Platform

LIXTE didn’t acquire early-stage science or unproven concepts. $300 million was spent on developing Liora Technologies LiGHT platform, with roots in CERN and TERA…the very same institutions behind the Large Hadron Collider. The technology has achieved a validated 230 MeV proton beam at the Daresbury facility in the UK, proving the system works. For investors, this dramatically de-risks the opportunity, so you’re not betting on whether the technology can work, but on whether LIXTE can commercialize technology that’s already been proven. And LIXTE acquired these proven assets at a tiny fraction of what was invested.

2

Revolutionary LINAC Technology Is the Key Differentiator

What makes LiGHT truly revolutionary is that it uses LINAC-based proton therapy instead of legacy cyclotron systems. To put it mildly, this is a massive upgrade. While cyclotrons (the industry standard) have significant limitations in beam control and radiation management, the specific LINAC technology developed for the Liora LiGHT platform, modifies the proton beam 200 times per second. This results in substantially less radiation exposure while increasing treatment effectiveness. Even more impressive, LINAC precision will in time allow for treating certain tumors in a single intense session…and that’s something cyclotrons simply cannot achieve. The efficiency improvements mean patients need fewer treatment sessions, allowing facilities to treat far more patients overall because each patient will require fewer visits.

3

Game-Changing Economics: 70% Cost Reduction Makes Access Infinitely More Affordable

Traditional proton therapy systems cost $200-300 million per facility and require massive infrastructure including multi-story buildings, heavy shielding, and installation can take 3-5 years. But Liora’s LiGHT platform costs approximately $85 million for a facility with up to 4 treatment rooms, which is just 30% of legacy system costs. The LiGHT platform is more compact than traditional proton therapy systems and can be operational in 12-18 months. In other words, Liora’s LiGHT platform can transform a technology available to just a limited number of research centers into something thousands of hospitals worldwide could afford.

4

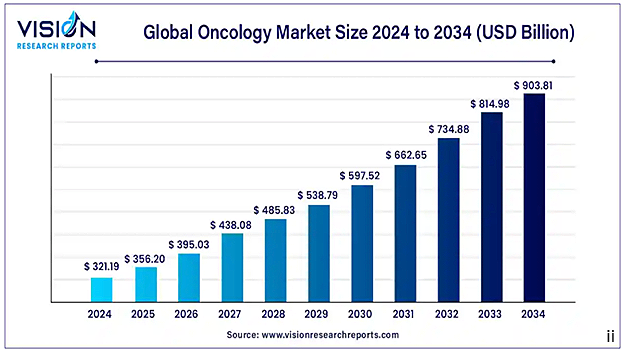

Targeting a $500 Billion Market with a Global 9,500-Room Shortfall

The global oncology market exceeds $500 billion annually and continues to grow as people live longer. Yet fewer than 5% of cancer patients who could benefit from proton therapy currently have access to it. There are only about 300 treatment rooms available worldwide, while more than 9,500 are needed to meet current demand. The LiGHT platform addresses this critical gap. Even capturing a small fraction of this underserved market represents billions in potential revenue for LIXTE.

5

Proven Business Model with Ongoing Revenue Potential

LIXTE’s revenue model is designed for sustainable, long-term cash flow. Rather than selling equipment for one-time payments, facilities operate as joint ventures with clinical partners. LIXTE retains technology ownership and generates ongoing revenue from operations, typically targeting greater than 50% ownership. Revenue projections of approximately $130 million assume an average four-room facility. The system requires continuous maintenance by on-site teams, creating additional recurring revenue streams through maintenance, financing, and leasing arrangements.

6

World-Class Scientific Credibility: CERN Leadership and UK Government Partnership

LIXTE’s acquisition of Liora Technologies LiGHT platform brings immediate access to world-class scientific expertise that a $25 million company could never normally attract. Liora’s Chief Scientist, Professor Steve Myers OBE, former Director of Accelerators and Technology at CERN, provides globally recognized technology leadership. The partnership with STFC (Science and Technology Facilities Council), part of UKRI, provides access to a team of engineers and scientists focused on accelerator research. These are scientists who work collaboratively with CERN and have extensive accelerator experience. The original Liora accelerator at Daresbury now owned by LIXTE, is approaching completion and certification, with all IP, know-how, and technical documentation part of the acquisition. This combination of proven technology, world-class scientific leadership, and institutional partnership provides important credibility for the company as it moves forward.

7

Clear Path to Commercialization with Multiple Catalysts

The company’s pathway to revenue generation is straightforward and achievable. Clinical certification requires treating one patient successfully, then submitting data for regulatory review, which is typically achieved within 3-4 months after successful treatment. LIXTE is only proving this specific machine is safe and effective; proton therapy itself has been used medically for decades, so the general concept isn’t new. Within two years, LIXTE targets regulatory certification. Within three years, the company expects full commercial operations with multiple treatment rooms operational at Daresbury and expansion to additional sites. Each milestone represents a potential catalyst for share price appreciation.

Transforming cancer care with electronically controlled beam energy

Massive Market Opportunity:

LIXTE (Nasdaq: LIXT) Now Targets Over $500 Billion in Cancer Treatment

Every once in a while, a small company makes an acquisition that completely changes its trajectory.

LIXTE Biotechnology Holdings (NASDAQ: LIXT) just made exactly that kind of move.

With the Liora acquisition, LIXTE is now positioned to capitalize on one of oncology’s most significant opportunities: advanced proton therapy that addresses a massive, unmet global need.

The Proton Therapy Opportunity Is Staggering

The global oncology market is poised to soon move beyond $500 billion annually[i] and continues rising as populations age and new therapies emerge.

Within this massive market, radiation therapy represents approximately $7 billion annually…but the real opportunity lies in what’s not being treated.

Proton therapy is the most precise and effective radiotherapy treatment for cancer available today. Unlike conventional radiation that damages healthy tissue surrounding tumors, proton beams can be more controlled and more accurate, minimizing long-term side effects.

“Proton therapy has been shown to reduce side effects by up to 60% compared to traditional radiation, particularly critical for pediatric patients and tumors near vital organs like the brain, heart and spine.”

Yet despite its proven superiority for many cancer types, fewer than 5% of patients who could benefit from proton therapy currently have access to it.

The reason? Economics and infrastructure.

Traditional proton therapy systems cost $200-300 million per facility, require large, specialized structures and take 3-5 years to install. There are currently only about 300+ treatment rooms available worldwide, while more than 9,500+ are needed to meet current demand.

Liora’s LiGHT Platform Changes the Economics and Treatment Capability Completely

At approximately $85 million for a facility with up to 4 treatment rooms, which is just 30% the cost of legacy systems, the LiGHT platform can offer more affordable and accessible proton therapy. Moreover, it can modify and adjust the proton beam 200 times per second (vs 4-5 times for cyclotron proton beams), which means it can treat a tumor in an almost 3D approach.

This is the same type of transformation that happened when MRI technology became affordable and compact enough to move from a handful of research centers to thousands of hospitals worldwide. The market exploded because the economics finally made sense.

With the acquisition of Liora Technologies’ LiGHT platform, LIXTE is positioned to capture a significant share of this 9,500-room global shortfall. Even at conservative penetration rates, we’re talking about a multi-billion-dollar opportunity.

How LIXTE’s LiGHT Platform Makes Proton Therapy Affordable and Accessible

Proton therapy has been around for decades, but it’s remained out of reach for most patients because of the massive infrastructure required. Traditional systems use cyclotrons or synchrotrons housed in buildings that can be 3-4 stories tall and require hundreds of tons of shielding.

Liora Technologies’ LiGHT platform changes the game with a fundamentally different approach.

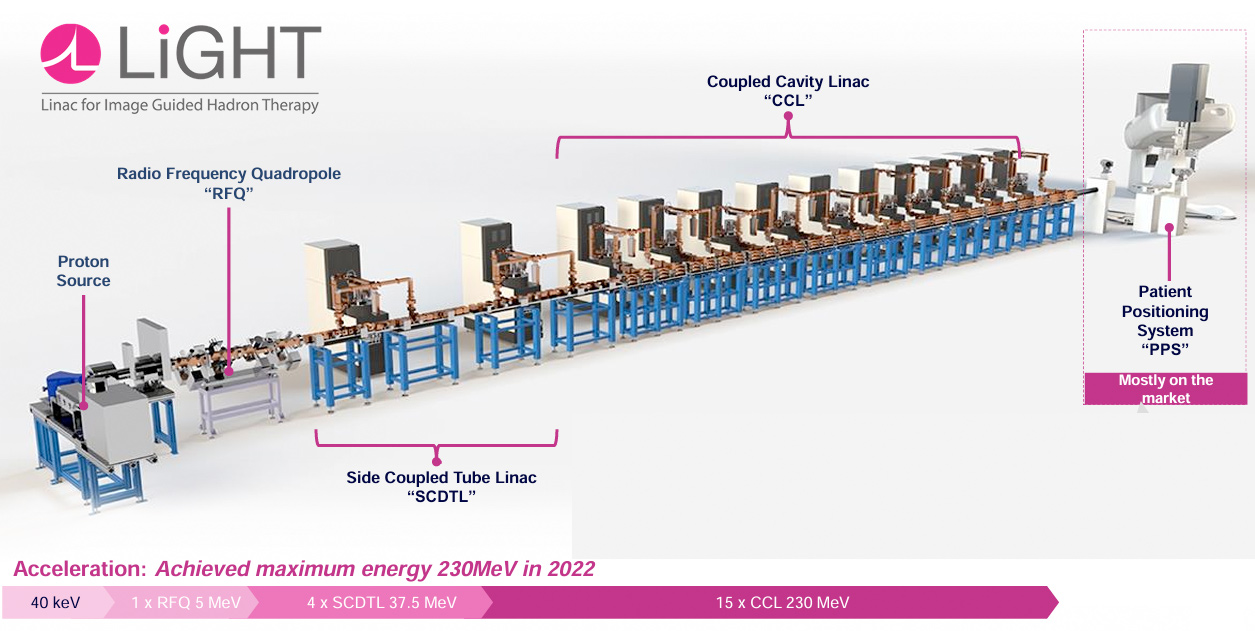

LiGHT uses a modular linear accelerator (LINAC) design that’s 20-30 times smaller than legacy gantry systems. Instead of requiring massive concrete vaults and multi-ton rotating equipment, LiGHT’s components fit in smaller treatment rooms and require lighter shielding.

How The LiGHT System Works

LiGHT (Linac for Image Guided Hadron Therapy) represents a paradigm shift in proton therapy delivery.

- Modular Compact LINAC: Side Coupled Tube Linac (SCDTL) and Coupled Cavity Linac (CCL) architecture delivers unprecedented compactness without sacrificing clinical capability.

- Electronic Energy Tuning: Eliminates mechanical energy degraders, reducing proton loss and enabling rapid, precise energy selection for optimal dose conformity.

- Integrated Systems: Radio Frequency Quadrupole (RFQ) proton source and Patient Positioning System (PPS) work seamlessly within a 4-room configuration.

- Clinical Versatility: From standard fractionation to ultra-high dose rate FLASH therapy—all through software control.

The system delivers electronically adjustable proton beam energy in real time – up to 200 adjustments per second. This enables precision 3D tumor targeting with the same accuracy as traditional systems but in a fraction of the space and at a fraction of the cost.

Key Advantages:

- Modular and compact: 20-30x smaller footprint than legacy systems

- Cost efficient: ~$85M for 4-room system vs. $200-300M for traditional facilities

- Faster installation: 12-18 months vs. 3-5 years for legacy systems

- Validated performance: 230 MeV proton beam achieved at Daresbury facility

- Future-proof design: Software upgrades will enable advanced protocols like FLASH therapy to be implanted in the future without hardware changes

The LiGHT System Advantage

Proven at Daresbury

LiGHT isn’t theoretical. The technology has been validated at the Science and Technology Facilities Council (STFC) laboratory at Daresbury in the UK, where the system achieved its target 230 MeV beam energy, which is the highest level needed for clinical needs.

With proven technology, established manufacturing partnerships, and a clear path to certification in both the UK and US markets, LiGHT is ready to scale.

A Business Model Built for Recurring Revenue…NOT One-Time Equipment Sales

Here’s where the LIXTE opportunity gets even more compelling: the company isn’t just selling machines and walking away.

Instead of the traditional medical equipment sales model, where a manufacturer sells a $200-300 million system for a one-time payment and hopes for service contract revenue, LIXTE structures each facility as a joint venture partnership with the clinical operator.

LIXTE finances the equipment and construction, the clinical partner provides the land and handles patient care, and both parties share in the ongoing treatment revenues. LIXTE typically targets greater than 50% ownership in these joint ventures, which means the company participates directly in every patient treatment over the life of the facility.

The economics are substantial. A typical four-room facility can generate approximately $130 million in annual revenue once fully operational.

The LiGHT system requires continuous calibration and maintenance by specialized on-site technical teams, creating additional revenue streams through maintenance contracts, financing arrangements, and equipment leasing that flow through the joint venture structure. A material part of the recurring revenues to Lixte can therefore be made up of these streams, depending on the terms of the joint venture structure.

This approach fundamentally changes the investment potential. Rather than a medical device company with lumpy, project-based revenues, LIXTE is building a portfolio of cash-flowing assets that generate predictable, recurring income. Each new facility adds another stream of long-term revenues.

For investors, this means LIXTE’s revenue potential compounds with each new site…and with a 9,500-room global shortfall to address, the growth runway is enormous.

Multiple Catalysts and Proven Assets Create Near-Term Opportunities for LIXTE (Nasdaq: LIXT)

Liora Technologies’ LiGHT platform is on a fast-moving timeline to become operational and advancing toward commercial deployment. The Daresbury facility in the UK has already validated the system with a proven 230 MeV proton beam. Now the focus shifts to completing the platform to facilitate patient treatments and global expansion.

Key upcoming milestones include facility completion and first patient treatments at Daresbury in 2027, UK certification progress that lays groundwork for FDA approval, second site going live in 2028, and international expansion accelerating through joint venture partnerships. By 2033, LIXTE targets 100+ operational treatment rooms globally.

Each milestone represents a potential catalyst for share price appreciation as the first patient treatment demonstrates clinical viability, certification advances will validate regulatory pathways, new site announcements prove scalability, and revenue from operational facilities confirms the business model.

World-Class Leadership:

The Team Behind LIXTE’s Scientific Vision

The credibility of any breakthrough technology depends entirely on the team behind it, and the LiGHT platform brings world-class scientific leadership that would be impossible for a $25 million company to attract on its own.

Chief Scientist Professor Steve Myers OBE brings unparalleled expertise to the LiGHT platform. As the former Director of Accelerators and Technology at CERN (the European Organization for Nuclear Research), Professor Myers also led the team responsible for operating the Large Hadron Collider, the world’s most powerful particle accelerator. His expertise in accelerator physics is globally recognized, and his involvement with the LiGHT platform provides the kind of scientific credibility that institutional investors and regulatory bodies take seriously.

The STFC Partnership represents another major validation point. The Science and Technology Facilities Council (STFC), part of UK Research and Innovation (UKRI), operates the Daresbury Laboratory where approximately 200 people are dedicated to accelerator related work. This facility works collaboratively with CERN and represents the UK equivalent of institutions like Brookhaven National Laboratory in the United States.

The STFC team brings decades of combined accelerator experience, access to world-class testing facilities, and the institutional expertise needed to bring the LiGHT platform from proven prototype to commercial deployment. With the original Liora machine at Daresbury approaching completion and certification, LIXTE now owns all the equipment, intellectual property, technical documentation, and manufacturing know-how developed through this partnership.

This combination of proven technology, globally recognized scientific leadership, and institutional partnership provides the credibility pathway needed for successful commercialization and positions LIXTE for regulatory approval and market acceptance.

Why This Opportunity Won’t Stay Under the Radar for Long

Three key elements are aligned right now that make this the ideal moment for early investors to take a position in LIXTE (Nasdaq: LIXT):

First, the technology is proven. The LiGHT platform has achieved 230 MeV at Daresbury, which is the validation milestone that proves the system works at the required level. LIXTE isn’t betting on science that might work someday. The company acquired technology that’s already been de-risked through $300 million in development investment.

Second, the market is desperate for a solution. With a 9,500-room global shortfall and fewer than 5% of eligible patients getting access to proton therapy, hospitals worldwide are actively seeking affordable alternatives to $200-300 million legacy systems. LiGHT’s breakthrough pricing ($85 million for a 4-room facility) finally makes proton therapy economically viable for thousands of hospitals that were previously priced out of the market.

Third, the commercialization timeline is immediate. Unlike early-stage biotechs that might be 5-10 years from revenue, LIXTE is targeting first patient treatments within 2 years and full commercial operations within 3 years. The Daresbury facility is already in advanced stage to become operational, regulatory pathways are well-defined (proton therapy has been used for decades), and the joint venture business model is designed for rapid, capital-efficient expansion.

When a $25 million company acquires $300 million in proven technology that addresses a multi-billion-dollar market gap, and the commercialization timeline is measured in years, not decades, institutional investors and market makers tend to take notice quickly.

The opportunity for early investors exists today precisely because the market hasn’t fully recognized what LIXTE just acquired. That window won’t stay open indefinitely.

The Bottom Line:

Why Early Investors in LIXTE Biotechnology (Nasdaq: LIXT) Could See Potential Outsized Returns

LIXTE Biotechnology (NASDAQ: LIXT) has repositioned itself through a single, transformational acquisition.

The company’s acquisition of Liora Technologies and its revolutionary LiGHT platform addresses one of healthcare’s most critical gaps: the 9,500-room global shortfall in proton therapy capacity.

With $300 million already invested in development, proven clinical validation at 230 MeV, breakthrough LINAC technology that modifies beams 200 times per second and economics that reduce costs by 70%, LiGHT represents the “affordable MRI moment” for cancer treatment.

At approximately $85 million for a facility with up to 4 treatment rooms, which is just 30% the cost of legacy systems, LiGHT makes proton therapy accessible for the first time to thousands of hospitals worldwide. The joint venture business model generates potential revenue of approximately $130 million per facility with 4 treatment rooms, offering significant upside potential.

With a clear 2-to-3-year commercialization timeline, world-class scientific leadership from CERN, partnership with UK government research facilities, and multiple near-term catalysts including first patient treatments, certification milestones, and site expansion announcements, LIXTE offers investors numerous opportunities for value creation.

For investors, LIXTE Biotechnology (NASDAQ: LIXT) represents a compelling opportunity: a tiny company that just acquired massive, proven technology and is trading at a fraction of what it could ultimately be worth.

[i] https://www.visionresearchreports.com/oncology-market/41161#:~:text=Oncology%20Market%20(By%2

0Cancer%20Diagnostics,Outlook%20and%20Forecast

%202025%2D2034&text=The%20global%20oncology

%20market%20size,period%20of%202025%20to%202034.

[ii] https://www.visionresearchreports.com/oncology-market/41161#:~:text=Oncology%20Market%20(By%2

0Cancer%20Diagnostics,Outlook%20and%20Forecast

%202025%2D2034&text=The%20global%20oncology

%20market%20size,period%20of%202025%20to%202034.

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and a third party,Lixte Biotechnology Holdings Inc. (LIXT), Winning Media LLC has been hired for a period beginning on 11/10/25 and ending on 11/24/25 to conduct investor relations advertising and marketing and publicly disseminate information about Lixte Biotechnology Holdings Inc. (LIXT) via Website, Email and SMS. Winning Media has been compensated the sum total of fifty thousand dollars via bank wire transfer from a third party (One Eye Jack Media LLC). Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Lixte Biotechnology Holdings Inc. (LIXT)

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of Lixte Biotechnology Holdings Inc. (LIXT). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.