Sponsored – Est. Read 7 Min

$24 Million Revenue Acquisition Could Triple This Tech Company… While It Trades at One-Quarter Its Peers’ Valuations

With 280+ channel partners and a proven $250/user SaaS model, Turnium Technology Group (TSXV: TTGI) is positioning for a breakout many investors could miss.

Many of the biggest gains seen in small cap tech stocks come from companies that – for one reason or another – have been completely overlooked by Wall Street.

Often, these are companies making strategic moves setting up potentially significant growth…while still trading at a fraction of their peers’ valuations.

That’s exactly what’s happening right now with Turnium Technology Group Inc. (TSXV: TTGI).

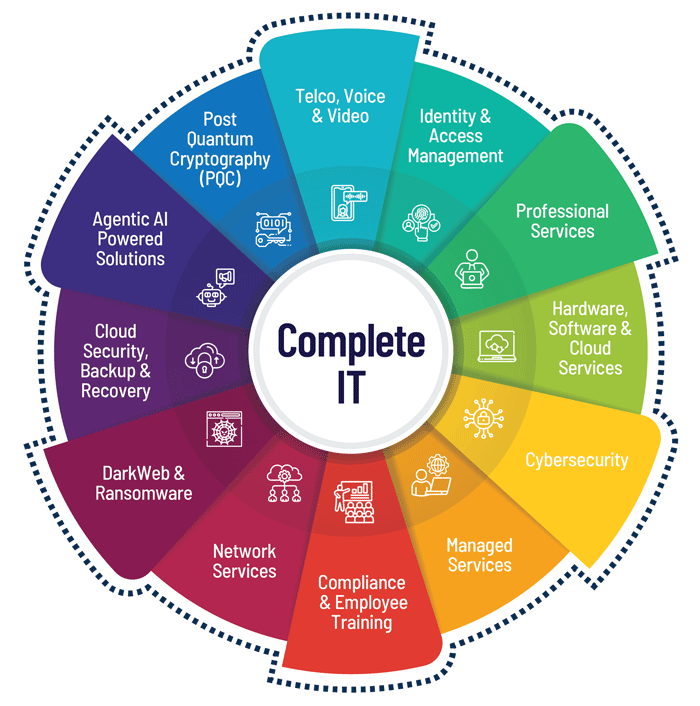

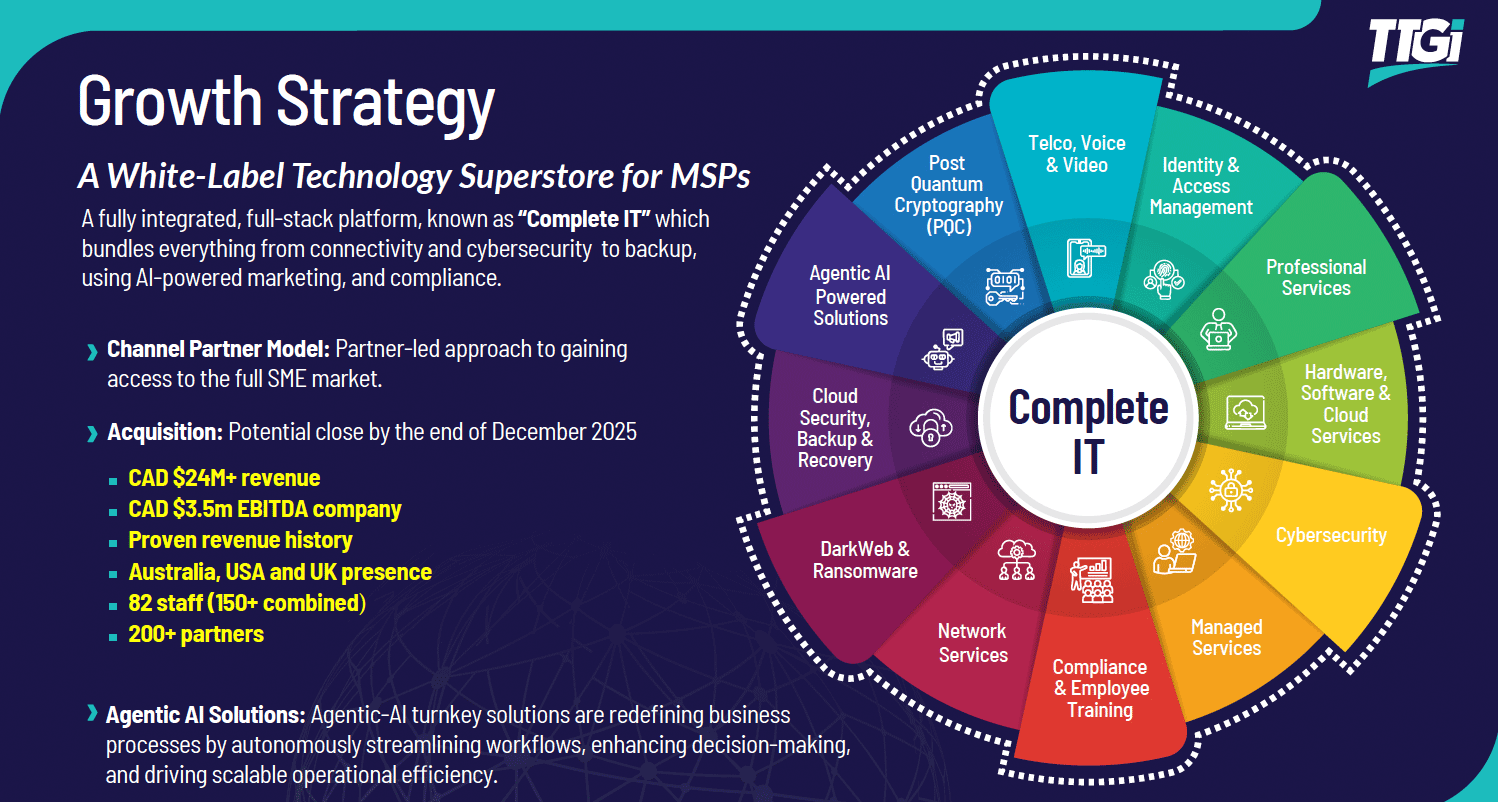

TTGI provides “Complete IT,” which is a comprehensive technology platform bundling everything small- and mid-market business need into a single, scalable solution delivered through a network of channel partners.

What type of things are they bundling?

For starters, cybersecurity…agentic AI…cloud services…managed IT…compliance…and hardware.

Think of TTGI as a white-label Technology Super store for MSPs, ISPs and VARs serving businesses ranging from 10 to 1,000 employees.

This is a massive, underserved market that’s too small for enterprise vendors…but also too complex for DIY or “off-the-shelf” solutions.

TTGI’s economics are strong, with an average of $250 per user per month in recurring revenue and an impressive 63% gross margin.

But what makes TTGI particularly compelling right now is that while many Canadian SaaS companies trade at 5-6x revenue on average, TTGI is currently valued at just 1-2x revenue…despite announcing an acquisition that management expects could potentially triple the size of the business.

That’s right – triple the size of the business with one acquisition!

On November 9, 2025 TTGI entered into a Letter of Intent to acquire Insentra Holdings, a 16-year-old Australian IT services firm with a proven track record, over 200 channel partners and CAD $24 million in annual revenue.

The transaction, pending final agreement, would immediately transform TTGI from a company with about $8 million in revenue into a ~$32 million combined entity with a clear pathway to $100 million in revenue and $20 million in EBITDA by fiscal 2027.

Yet the market hasn’t caught up.

TTGI shares still remain deeply undervalued when compared to other small cap SaaS companies in the space, creating what could be a compelling entry point for investors who understand the potential for this stock.

GAME-CHANGING ACQUISITION

7 Critical Reasons Why Turnium Technology Group Inc. (TSXV: TTGI) Deserves Your Attention Right Now

1

Transformative Acquisition Could Triple Revenue Overnight

On November 9, 2025, TTGI entered into a Letter of Intent to acquire Insentra Holdings, a 16-year-old Australian IT services firm generating CAD $24M+ in annual revenue with over 200 channel partners across Australia, the US, and UK. The deal, pending completion, would transform TTGI from an ~$8M company into a ~$32M+ combined entity. Management projects the combined business could reach $100M in revenue and $20M in EBITDA by fiscal 2027.

2

TTGI Is Trading at a Fraction Of Its Peers’ Valuations

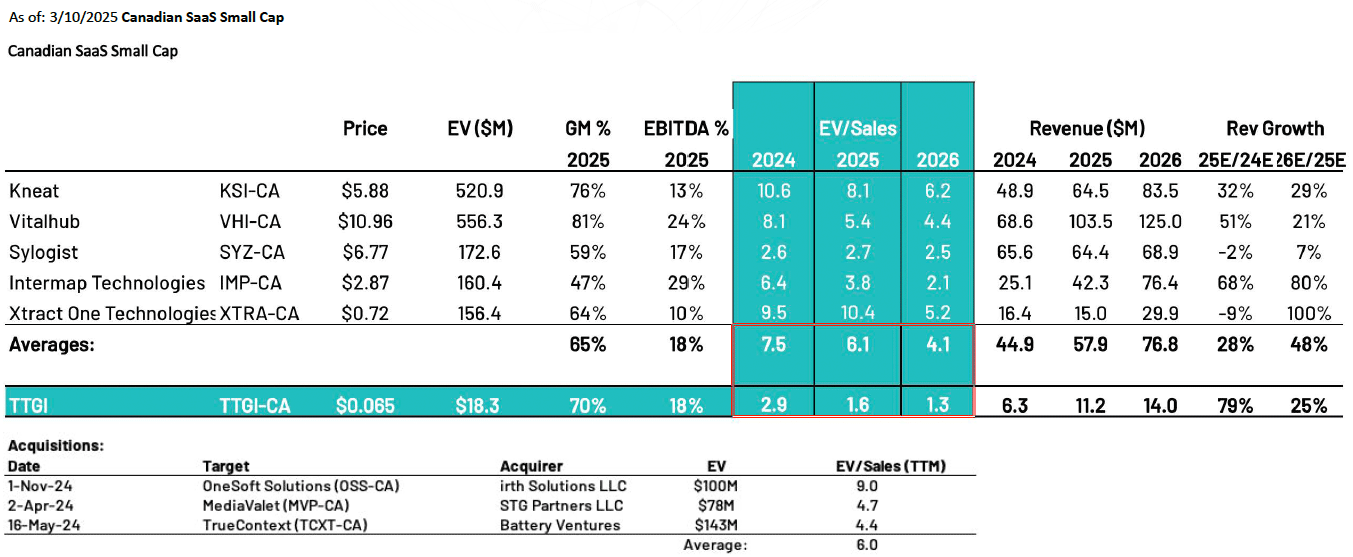

TTGI currently trades at approximately 1.6x forward revenue. Comparable Canadian small-cap SaaS companies such as Kneat (TSX: KSI), Vitalhub (TSX: VSI), Sylogist (TSX: SYZ), Intermap Technologies (TSX: IMP) and Xtract One (TSX: XTRA) trade at an average of 6.1x revenue. That’s a 4x valuation gap. If TTGI simply traded at the peer average, the implied market cap would be roughly $68M versus today’s ~$18M valuation. Add the Insentra acquisition to the equation, and the gap becomes even more compelling. The market hasn’t yet priced in the transformation underway…and that creates a potentially high-upside investment opportunity.

3

Strong Unit Economics: 63% Margins on Recurring Revenue

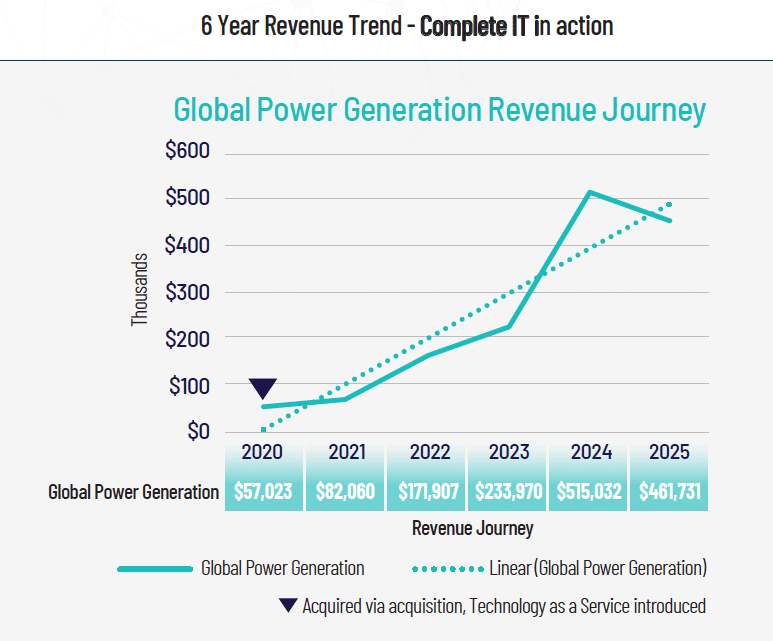

TTGI’s Complete IT platform generates an average of $250 per user per month in recurring revenue with 63% gross margins. A mid-market company with 100 employees produces $25,000 in monthly revenue and $189,000 in annual gross profit. The model is proven…and it’s already generating revenue today with customers like Global Power Generation, which scaled from a small account to $460K+ annually.

4

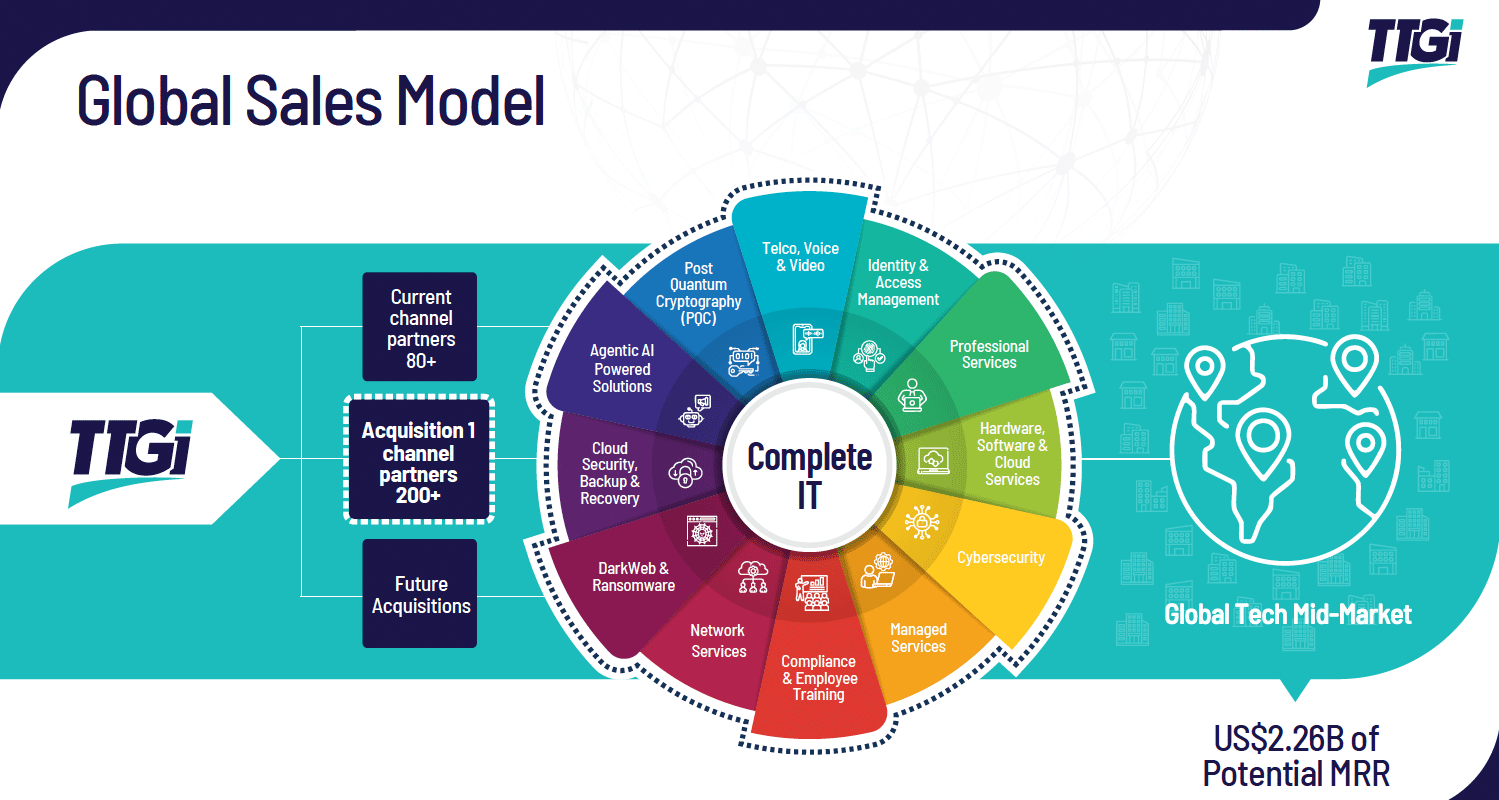

280+ Channel Partners Means Built-In Distribution

A huge advantage for TTGI is that the company doesn’t need to spend heavily on sales and marketing. The company sells through a network of MSPs, ISPs, and VARs that already have customer relationships. TTGI currently has ~80 partners and its pending Insentra acquisition brings 200+ more, creating a combined network of 280+ partners upon deal close. This channel-first model provides instant market access, lower customer acquisition costs, faster geographic expansion, and stickier revenue.

5

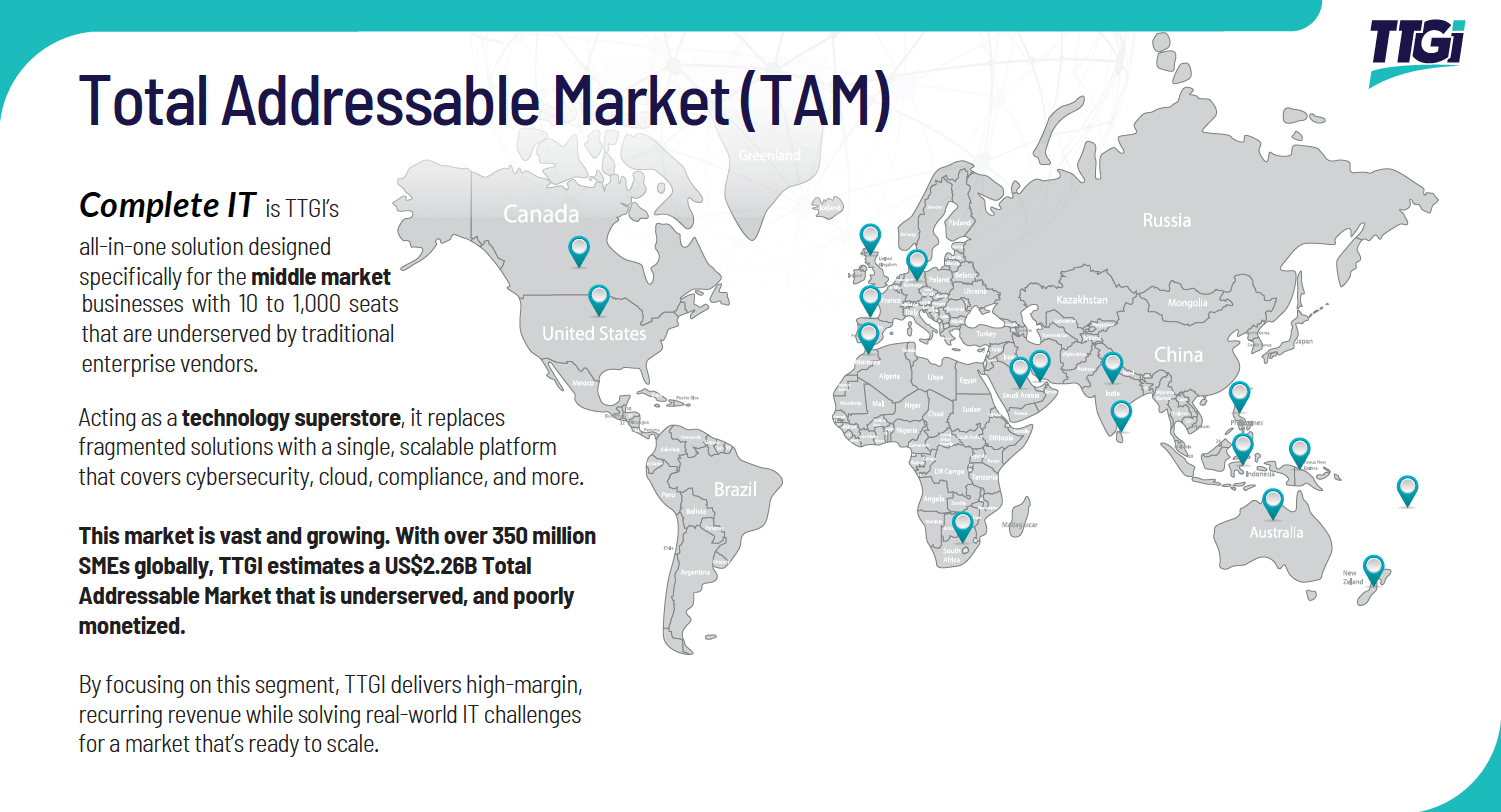

Potential Rapid Growth In a $2.26 Billion MRR Market That’s Underserved

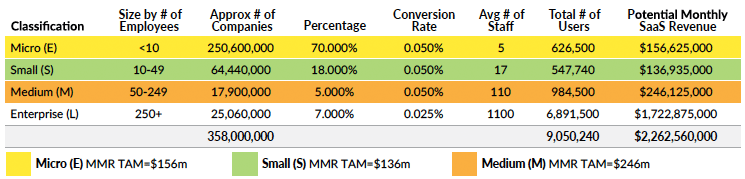

Mid-market businesses (those ranging from 10 to 1,000 employees) are stuck between low-cost DIY solutions and expensive enterprise platforms. TTGI fills that gap with enterprise-quality technology at mid-market prices. With 358 million SMEs globally and just 0.05% penetration, management estimates a $2.26B addressable market in monthly recurring revenue (MRR). Macro trends such as cybersecurity threats, remote work complexity and vendor fatigue are accelerating demand right now. The market is ready; TTGI’s platform is ready; the timing is right.

6

Real Customer Proof: From $0 to $460K Annually

Global Power Generation (GPG), a subsidiary of Naturgy Group operating in 8 countries, started as a small customer needing basic IT support. Today, they generate over $460K in annual recurring revenue (ARR) through TTGI’s Australian division. That’s proof that the Complete IT model works, as customers start small…see value…expand their usage…and become locked in because switching costs are prohibitive. Repeat that pattern across 280+ partners and you see the potential for significant scalability.

7

Experienced Management Team Executing a Roll-Up Strategy

Global CEO Doug Childress brings 40+ years of experience building, acquiring, and scaling channel-based tech businesses. He’s done this before…successfully integrating acquisitions and growing customers like Global Power Generation into six-figure accounts. TTGI isn’t stopping with Insentra; management is actively pursuing a roll-up strategy to acquire complementary businesses at reasonable valuations. It’s the same playbook that built multi-billion-dollar companies like Kaseya and N-able. TTGI is right now executing at a smaller scale, but the fundamentals are identical.

358 Million Businesses Are Stuck Between Bad Options; Here’s Why That’s Worth $2.26 Billion in Monthly Revenue

Mid-market businesses face a nearly impossible choice when it comes to technology.

Option 1: Low-cost DIY solutions that lack sophistication, security, and support. These might work for a solo entrepreneur, but they collapse under the weight of 50 or 100 employees who need reliable systems, robust cybersecurity, and compliance with industry standards.

Option 2: Enterprise-grade platforms from Microsoft, Cisco, and other major vendors. These can deliver excellent technology but they also often come with enterprise-level complexity and pricing. Small and mid-sized companies can’t afford the six-figure implementations, dedicated IT staff, or ongoing management these systems require.

The result? 358 million businesses globally are underserved, forced to cobble together fragmented solutions from multiple vendors, manage it themselves, or simply accept inadequate technology that puts them at risk.

Providing Complete IT as a SaaS solution

A one-stop-shop model that combines deep expertise with a broad product and service offering, tailored for the mid-market, that:

This is where TTGI’s Complete IT platform comes in. By delivering enterprise-quality solutions at mid-market prices through a network of trusted channel partners, TTGI fills the gap that traditional vendors can’t or won’t address.

The opportunity is massive. With 358 million small and mid-sized businesses globally, the total addressable market for Complete IT solutions represents tens of billions in annual revenue potential. These companies, ranging from micro businesses (under 10 employees) to medium-sized firms (50-249 employees), are all hungry for better technology but lack good options.

Even if TTGI captures just 0.05% of this market, meaning only 1 in every 2,000 businesses…the company estimates $2.26 billion in monthly recurring revenue (MRR), or roughly $27 billion annually.

That’s merely the baseline scenario for meaningful market penetration.

And the timing couldn’t be better. Cybersecurity threats, remote work complexity, AI adoption, and vendor fatigue are all accelerating demand for comprehensive, managed IT solutions. The market is ready. TTGI’s platform is ready. Now it’s about execution and scale.

From Cybersecurity to Cloud Storage…

All in One Scalable Package

TTGI’s Complete IT platform is exactly what the name suggests: a comprehensive, fully integrated technology solution that bundles everything a mid-market business needs into a single, scalable offering.

Complete IT includes:

- Cybersecurity – endpoint protection, threat monitoring, compliance management, post-quantum cryptography (PQC)

- Cloud services – secure backup, disaster recovery, infrastructure

- Agentic AI solutions – autonomously streamlining workflows, enhancing decision-making, and driving scalable operational efficiency

- Network services – connectivity, VoIP, video conferencing

- Managed IT support – 24/7 monitoring, helpdesk, technical resources

- Hardware and devices – laptops, servers, networking equipment

- Identity and access management – secure login, authentication, permissions

- Professional services – implementation, training, consulting

- Compliance and employee training – regulatory requirements, security awareness

Instead of forcing businesses to manage relationships with a dozen different vendors, Complete IT delivers everything through a single platform with unified billing, support, and management.

TTGI delivers Complete IT as a white-label technology super store through channel partners, including MSPs (managed service providers), ISPs (internet service providers), and VARs (value-added resellers). These partners sell directly to end customers under their own brand, while TTGI provides the underlying technology, infrastructure, and support.

And consider the economics: TTGI generates an average of $250 per user per month in recurring revenue with 63% gross margins.

A typical mid-market customer with 100 employees produces $25,000 in monthly revenue and $15,750 in monthly gross profit. Because the revenue is recurring and the platform is scalable, customers that start small often expand significantly over time…as has already happened with one of TTGI’s customers.

They Started With a Broken CD-ROM Drive… Today They’re a $460,000 Customer

To understand the potential for TTGI’s Complete IT platform to generate sticky, expanding revenue look no further than Global Power Generation (GPG).

GPG is a subsidiary of Naturgy Group operating in 8 countries with over 4GW of installed energy capacity, first engaged TTGI’s Australian division (Claratti) as a very small customer. They had a handful of staff, a broken CD-ROM drive, and no internal IT resources.

Today, GPG operates a complex network across more than 10 Australian sites and generate over $460,000 in annual recurring revenue for TTGI.

Why this matters: GPG’s growth illustrates three critical points.

First, the platform works, as customers don’t expand from $57K to $460K unless the technology delivers and the service is reliable.

Second, the revenue is sticky since once integrated, switching becomes prohibitively expensive and disruptive.

And third, the model is repeatable. GPG’s growth offers proof of what happens when mid-market businesses find a comprehensive IT solution that actually solves their problems.

Now imagine this pattern replicated across 280+ channel partners serving thousands of businesses globally.

How a $24 Million Revenue Acquisition Could Triple TTGI Overnight… And Set the Stage for $100 Million by 2027

On November 9, 2025, TTGI announced a Letter of Intent to acquire substantially all assets of Insentra Holdings in a deal that could fundamentally transform the company’s scale, capabilities, and growth trajectory.

What TTGI is acquiring:

Insentra is a 16-year-old Australian IT services firm with deep expertise in managed services, cybersecurity, and cloud solutions. The company operates a 100% channel-only model (perfectly aligned with TTGI’s strategy) and serves enterprise clients across energy, infrastructure, and technology sectors in Australia, the US, and UK.

The acquisition brings:

- CAD $24M+ in annual revenue (based on fiscal 2025 trailing twelve months)

- 200+ established channel partners across three major markets

- 82 experienced staff members including senior management and technical experts

- Proven operational history with blue-chip clients in demanding industries

- Projected $2.4M-$3.0M in adjusted EBITDA for fiscal 2026

This acquisition could potentially transform TTGI for one simple reason:

The company is currently on track for roughly $8.5M in revenue for fiscal 2025. Add Insentra’s $24M+, and the combined company immediately jumps to $32M+ in annual revenue…nearly tripling the business overnight.

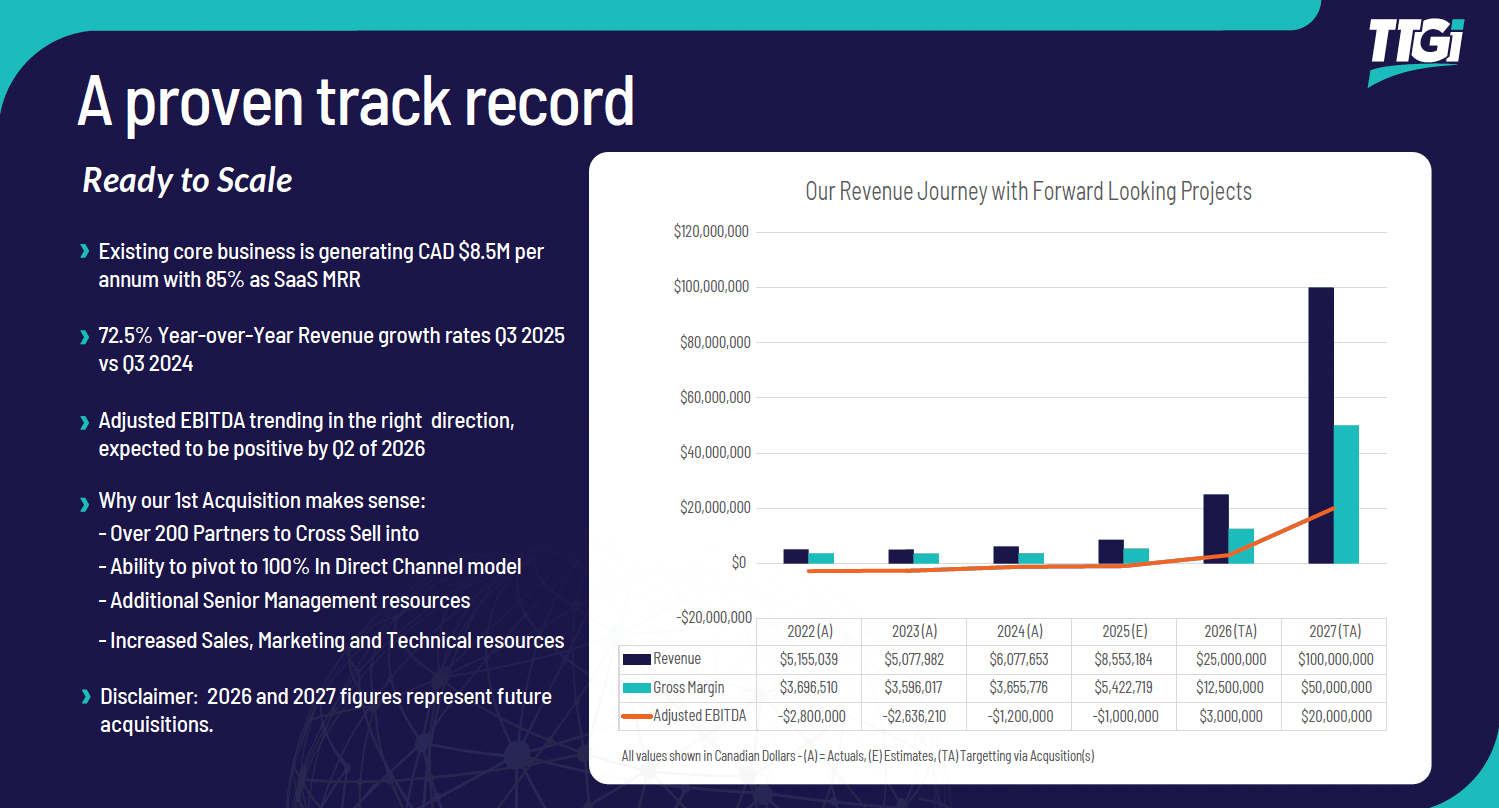

But the story doesn’t stop there. Management has laid out a clear roadmap: $100M in revenue and $20M in EBITDA by fiscal 2027 (ending September 30, 2027), assuming market conditions remain favorable.

Here’s the financial trajectory:

- 2022: $5.2M revenue, -$2.8M adjusted EBITDA (building the platform)

- 2024: $6.1M revenue, -$1.2M adjusted EBITDA (margins improving)

- 2025: $8.5M+ revenue, approaching EBITDA breakeven (inflection point)

- 2026 (with Insentra): $24M-$26M revenue, $2.4M-$3.0M adjusted EBITDA (immediately profitable)

- 2027 (target): $100M revenue, $20M EBITDA (15-20% margins at scale)

It’s important to note that this trajectory is grounded in reality, as TTGI is acquiring a profitable business with established revenue and a proven customer base. The combined entity would be EBITDA-positive from day one of deal close.

And with 280+ channel partners selling Complete IT into a $27 billion annual market, the path from $32M to $100M over 18-24 months becomes achievable through a combination of organic growth, partner expansion, and potential additional acquisitions.

The Insentra deal delivers more than just scale…it also creates the operating leverage where margins expand and the business generates significant cash flow. That’s when the market typically re-rates small-cap tech stocks.

This Valuation Gap is Impossible to Ignore: TTGI Is Trading at 1.6x Revenue While Peers Trade at 6.1x

The valuation story is where this opportunity becomes clear.

TTGI currently trades at approximately 1.6x its projected 2025 revenue. Meanwhile, comparable Canadian small-cap SaaS companies trade at an average of 6.1x forward revenue.

Here’s the comparison:

The math here is pretty simple: If TTGI traded at the peer average of 6.1x revenue on its projected $11.2M for 2026, the implied market cap would be roughly $68M versus today’s $18M valuation. That’s nearly 4x higher.

Now add the Insentra acquisition. If the deal closes and TTGI achieves projected combined revenue of $25M for fiscal 2026, applying the 6.1x peer multiple implies a valuation of $152M, which is more than 8x the current market cap.

Valuation disconnects don’t last forever. When companies deliver on major catalysts, such as closing a transformative acquisition and hitting profitability, multiples tend to re-rate quickly.

More Than 40 Years of Proven Experience:

And Now The TTGI Appears to Be Doing It Again

TTGI’s transformation doesn’t happen without strong leadership. The company is led by experienced operators who’ve built, acquired, and scaled technology businesses in the channel sector before.

Doug Childress – Founder of Claratti, Global CEO of TTGI

Doug brings over 40 years of experience in channel-led technology businesses, including managed services, B2B solutions, and telecommunications. He founded Claratti (TTGI’s Australian operation) and has successfully executed acquisitions and integrations before, including the track record that turned Global Power Generation from a small customer into a $460K+ annual revenue account.

Ralph Garcea, P. Eng, MBA – Chairman

Ralph co-founded Focus Merchant Group in 2018 and brings over 22 years of senior-level experience in finance, mergers and acquisitions, and strategic investments. He’s an aerospace engineer with expertise running large-scale technology companies and sits on the boards of TSX-listed Converge Technology Solutions and TSXV-listed Edgewater Wireless Systems. His M&A background is directly relevant to TTGI’s roll-up strategy.

This is a team of experienced operators with track records in M&A, channel sales, public company governance, and scaling technology businesses. They’ve done this before…and now they’re poised to do it again with TTGI.

And it’s a leadership team with significant skin in the game, as management and strategic investors hold approximately 48.5% of outstanding shares, meaning their success is directly tied to shareholder returns.

7 Critical Reasons Why Turnium Technology Group Inc. (TSXV: TTGI) Deserves Your Attention Right Now

1

Transformative Acquisition Could Triple Revenue Overnight

On November 9, 2025, TTGI entered into a Letter of Intent to acquire Insentra Holdings, a 16-year-old Australian IT services firm generating CAD $24M+ in annual revenue with over 200 channel partners across Australia, the US, and UK. The deal, pending completion, would transform TTGI from an ~$8M company into a ~$32M+ combined entity. Management projects the combined business could reach $100M in revenue and $20M in EBITDA by fiscal 2027.

2

TTGI Is Trading at a Fraction Of Its Peers’ Valuations

TTGI currently trades at approximately 1.6x forward revenue. Comparable Canadian small-cap SaaS companies such as Kneat (TSX: KSI), Vitalhub (TSX: VSI), Sylogist (TSX: SYZ), Intermap Technologies (TSX: IMP) and Xtract One (TSX: XTRA) trade at an average of 6.1x revenue. That’s a 4x valuation gap. If TTGI simply traded at the peer average, the implied market cap would be roughly $68M versus today’s ~$18M valuation. Add the Insentra acquisition to the equation, and the gap becomes even more compelling. The market hasn’t yet priced in the transformation underway…and that creates a potentially high-upside investment opportunity.

3

Strong Unit Economics: 63% Margins on Recurring Revenue

TTGI’s Complete IT platform generates an average of $250 per user per month in recurring revenue with 63% gross margins. A mid-market company with 100 employees produces $25,000 in monthly revenue and $189,000 in annual gross profit. The model is proven…and it’s already generating revenue today with customers like Global Power Generation, which scaled from a small account to $460K+ annually.

4

280+ Channel Partners Means Built-In Distribution

A huge advantage for TTGI is that the company doesn’t need to spend heavily on sales and marketing. The company sells through a network of MSPs, ISPs, and VARs that already have customer relationships. TTGI currently has ~80 partners and its pending Insentra acquisition brings 200+ more, creating a combined network of 280+ partners upon deal close. This channel-first model provides instant market access, lower customer acquisition costs, faster geographic expansion, and stickier revenue.

5

Potential Rapid Growth In a $2.26 Billion MRR Market That’s Underserved

Mid-market businesses (those ranging from 10 to 1,000 employees) are stuck between low-cost DIY solutions and expensive enterprise platforms. TTGI fills that gap with enterprise-quality technology at mid-market prices. With 358 million SMEs globally and just 0.05% penetration, management estimates a $2.26B addressable market in monthly recurring revenue (MRR). Macro trends such as cybersecurity threats, remote work complexity and vendor fatigue are accelerating demand right now. The market is ready; TTGI’s platform is ready; the timing is right.

6

Real Customer Proof: From $0 to $460K Annually

Global Power Generation (GPG), a subsidiary of Naturgy Group operating in 8 countries, started as a small customer needing basic IT support. Today, they generate over $460K in annual recurring revenue (ARR) through TTGI’s Australian division. That’s proof that the Complete IT model works, as customers start small…see value…expand their usage…and become locked in because switching costs are prohibitive. Repeat that pattern across 280+ partners and you see the potential for significant scalability.

7

Experienced Management Team Executing a Roll-Up Strategy

Global CEO Doug Childress brings 40+ years of experience building, acquiring, and scaling channel-based tech businesses. He’s done this before…successfully integrating acquisitions and growing customers like Global Power Generation into six-figure accounts. TTGI isn’t stopping with Insentra; management is actively pursuing a roll-up strategy to acquire complementary businesses at reasonable valuations. It’s the same playbook that built multi-billion-dollar companies like Kaseya and N-able. TTGI is right now executing at a smaller scale, but the fundamentals are identical.

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer, Turnium Technology Group Inc. (TTGI), Winning Media LLC has been hired for a period beginning on 11/10/25 and ending on 2/6/26 to conduct investor relations advertising and marketing and publicly disseminate information about Turnium Technology Group Inc. (TTGI) via Website, Email and SMS. Winning Media has been compensated the sum total of one hundred thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Turnium Technology Group Inc. (TTGI).

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of Turnium Technology Group Inc. (TTGI). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.