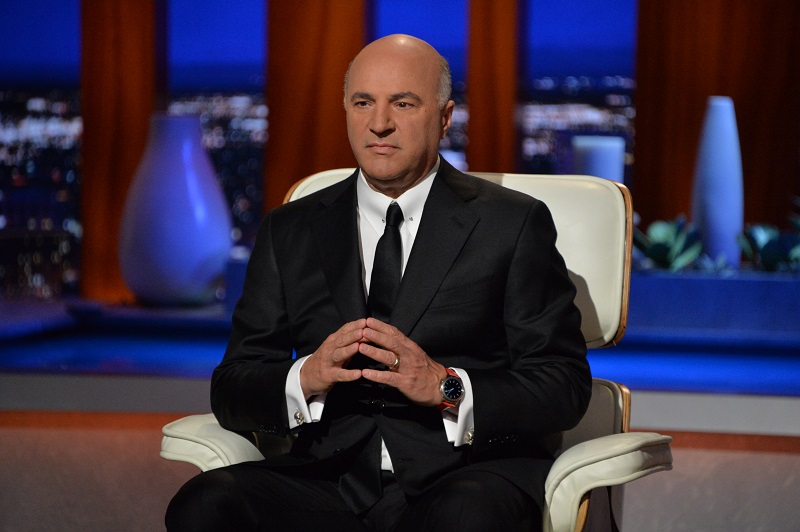

Shark Tank’s Kevin O’Leary Doesn’t Think Crypto is Garbage Anymore

Shark Tank investor and chairman of O’Shares ETF, Kevin O’Leary, is on the crypto bandwagon it seems.

He has told Yahoo Finance Live that he has allocated 3% of his portfolio to the world’s largest cyrptocurrency, Bitcoin.

O’Leary made the move after his native Canada, as well as a handful of other countries eased their restrictions on being able to institutionally buy the digital asset.

According to the Shark Tank investor, bitcoin is now like digital gold and a hedge against inflation that will appreciate over time. O’Leary has also warned however that “there’s a big problem brewing” in the crypto space around how and where the coins are mined.

“I don’t own random ETFs with blood coin in them,” O’Leary said. “The industry has done a poor job in lobbying its case around sustainability.”

Cambridge Bitcoin Electricity Consumption Index has found that a single transaction of bitcoin has the same carbon footprint as 680,000 Visa transactions or 51,210 hours of watching YouTube.

The institute had found that a dollar’s worth of bitcoin took 17 megajoules of energy and this could be threatening to the environment.

“Currently 60% of coins mined in Bitcoin come from China where they don’t care about sustainability and they certainly have issues around human rights,” O’Leary said. “The actual provenance of a coin over time, one that’s mined sustainably, could be worth more than just a generic coin that can’t prove its provenance.”

It was in March that O’Leary said that he would be adding bitcoin to his portfolio. He said at the time that he had received “a mountain of calls” from institutional investors inquiring if he knew where the coins originated.

“I know the provenance of where my wallet coins were mined now, and that means I’ve had to take equity positions in miners. I’ve had to start investing in them with the covenants in place that I would like be paid back in a royalty of a clean coin,” he said.

O’Leary is currently in the process of organizing a “council of sustainability.”

“I spent a lot of time talking to CEOs of miners and various entities that want me to invest in their mining operations” he said. “There’s no reason a North American miner can’t lead the way and take away the leadership from the Chinese who do not mine [coins] sustainably.”