“Why is the Future of American Uranium Mining Trading for Just Pennies on the Dollar?”

Discover Anfield Energy’s Nearly 75% Discounted Value Before the Public Catches On!

Anfield Energy

Analyst Coverage:

5 Powerful Reasons Anfield Energy (OTCQB: ANLDF) (TSX:AEC) (FSE:OAD) Could Be 2022’s Hottest Energy Play

Anfield Energy (OTCQB:ANLDF) (TSX:AEC) (FSE:OAD):

The Inconvenient Truth About Our Green Future

The number of countries announcing pledges to achieve net-zero emissions over the coming decades continues to grow. But the pledges by governments to date – even if fully achieved – fall well short of what is required to bring global energy-related carbon dioxide emissions to net-zero by 2050.(8)

The number of countries announcing pledges to achieve net-zero emissions over the coming decades continues to grow. But the pledges by governments to date – even if fully achieved – fall well short of what is required to bring global energy-related carbon dioxide emissions to net-zero by 2050.(8)

Wind and solar PV look to dominate the global electricity mix by 2050, with each technology source having a 31% share. But this roll-out of renewables will not be enough to meet the goals of the Paris Climate Agreement, according to a new analysis by DNV GL.(9)

Everyone Wants a Steady Supply of Electricity Without Relying on Coal

That is why nuclear could very well be a climate solution, satisfying both technical and economic needs.

There are 93 operating nuclear reactors in the U.S.; combined, they supply 20% of U.S. electricity, and 50% of its carbon-free electricity.(10)(11)

Globally, demand for uranium is set to rise. For one, Europe is again embracing nuclear power again after years of vowing to move away from it. French President Emmanuel Macron, for example, called for a “nuclear renaissance,” as noted by Fox Business. The UK reversed course on nuclear power. In fact, the UK has previously outlined a plan that will “involve building new plants as quickly as possible to get Britain back to getting 25% or more of its electric power from nuclear power.”

Even Japan, Germany and France are either supporting the restart of nuclear reactors, or the extension of their use.

This is the key to the tremendous opportunity for Anfield Energy that’s happening right now!

The Drumbeats of War Have Driven Uranium Prices to Higher Highs and Could Cripple US Imports

We all know what’s happening in the world right now…and it isn’t good.

But the part not being talked about is this, the one country that controls up to 50% of uranium flows holds the cards.(16)

Russia.

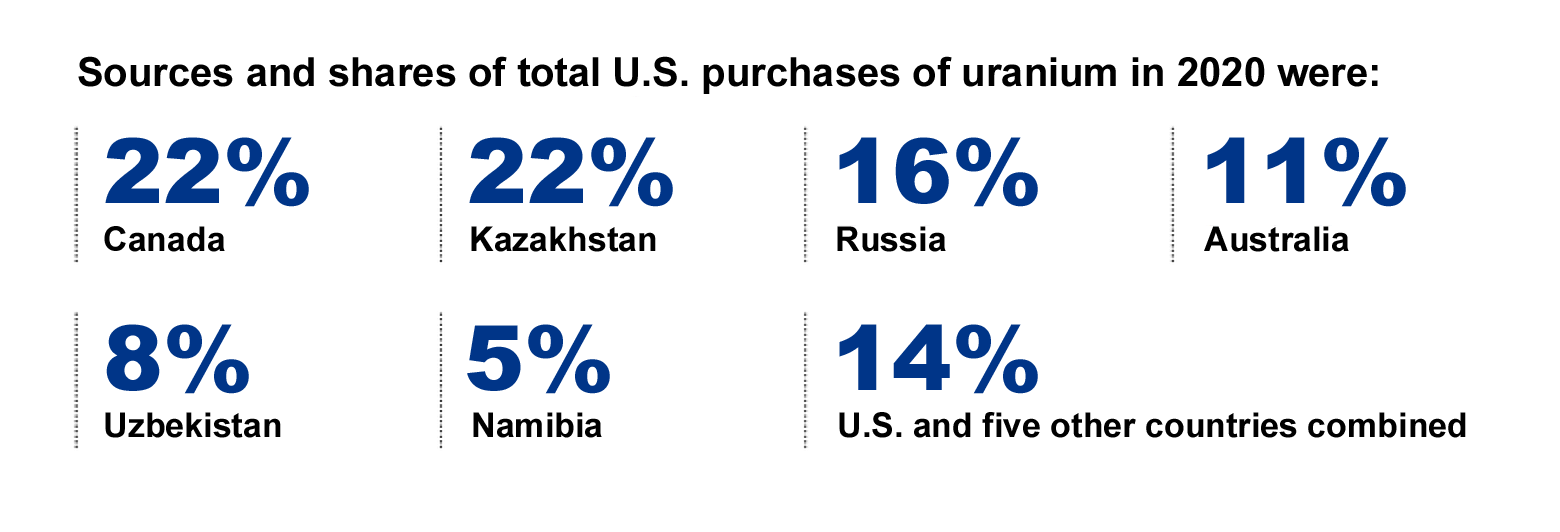

It is the third-largest supplier of U.S. uranium and accounts for about 16% of our total imports.(17)

Due to economic sanctions against Russia, the West’s supply of uranium is in danger of getting cut off.

Russian news agency TASS reported the country is now considering a ban on uranium exports.

As expected, the news drove uranium stocks to fresh highs on the year.(17)

In addition, according to The Guardian: (18)

“John Barrasso, a senator from Wyoming, recently introduced a bill that calls for a ban on all forms of uranium imported from Russia. Uranium fuels America’s nuclear power plants, and about 20% of that comes from Russia, while close to another 30% is imported from the Russian allies of Kazakhstan and Uzbekistan. Such a ban would shift American uranium production into overdrive.”

Huge U.S. Investments at Risk

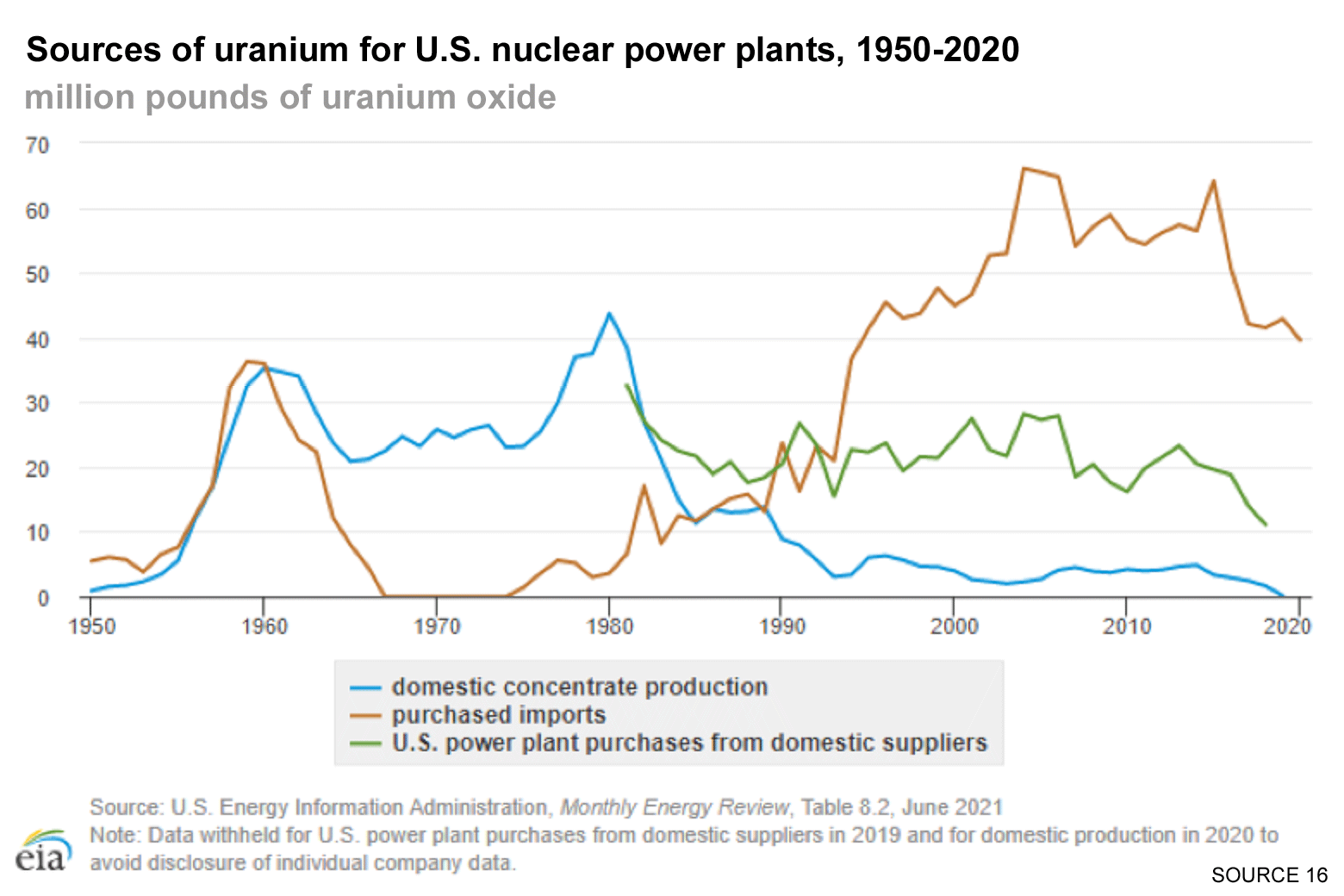

Since its highs in the 1980s domestic uranium production has dwindled to a little more than a trickle.

Almost 50% of US Uranium supplies come from Kazakhstan, Russia, and Uzbekistan.(16)

Almost 50% of US Uranium supplies come from Kazakhstan, Russia, and Uzbekistan.(16)

One thing is for sure, it’s an uncomfortable reminder that an over-reliance on any one source of supply is very risky for the American nuclear energy supply.

Anfield Energy (OTCQB:ANLDF) (TSX:AEC) (FSE:OAD): Sitting Perfectly to Help the US Overcome Geopolitical Supply Concerns

Now let’s take a closer look at Anfield Energy.

The company is a US-based development and near-production story. It has one of only three licensed, permitted and constructed conventional uranium mills in the U.S. (7)

The company is a US-based development and near-production story. It has one of only three licensed, permitted and constructed conventional uranium mills in the U.S. (7)

The company also owns the Velvet-Wood Project, a 2,425-acre property in Utah, which produced about 400,000 tons of mined uranium between 1979 and 1984 This translates into 4Mlbs of uranium production and 5Mlbs of vanadium production. Velvet-Wood has a current uranium resource of 4.6Mlbs.

There’s also the West Slope Project, a 6,913-acre property in southwestern Colorado, which hosts about nine historic uranium and vanadium mines. This one has a historic measured resource estimate of about 11 million pounds of uranium and 53 million pounds of vanadium.

The Company Has A Solid Path to Production and Cash Flow Generation

At current uranium and vanadium prices, the company can refurbish Shootaring within 24 months ahead of producing uranium and vanadium from the hard-rock mines in its portfolio.

So what does all this mean for the company outlook? Simple.

- Access to existing processing structures

- Low permitting risk

- Low capital costs

- Greater opportunity as uranium price rises

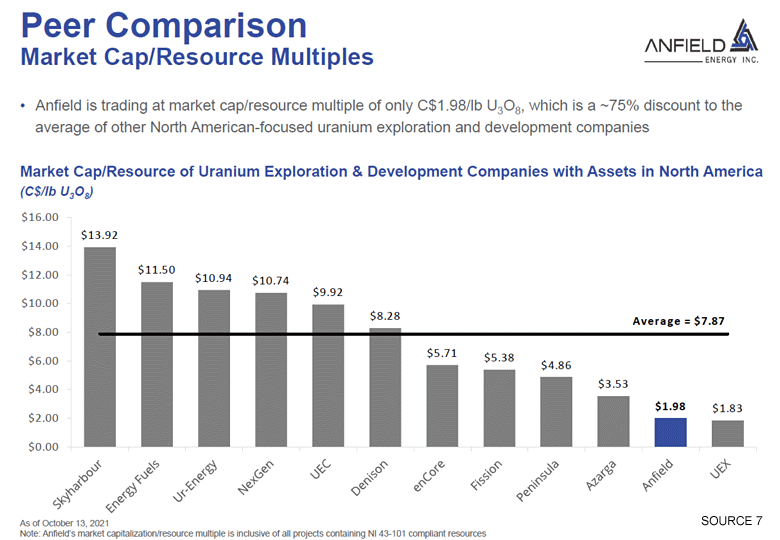

Anfield Energy (OTCQB:ANLDF) (TSX:AEC) (FSE:OAD): Compared to the Rest Anfield Energy Could Be a Screaming Deal

When considering Anfield Energy you have to remember this is NOT an exploration idea. And it’s not your typical short-term “penny stock” idea where when the company has a find they cut, sell, and run.

Anfield Energy is in this for the long haul and has the properties and expertise to be one of the best if not top Uranium providers in the United States.

Of course, the US would not be the only market to sell in. The company is also looking to potentially provide supply to Japan.

In fact, Japanese Industry Minister Hagiuda stated that nuclear power is indispensable to decarbonizing their country. (7)

Here’s Why Savvy Investors See Anfield as Very Undervalued

This tiny company has the potential to profit from a larger percentage of the local and global uranium market than most of its peers.

This tiny company has the potential to profit from a larger percentage of the local and global uranium market than most of its peers.

As the global markets rush to decarbonization, civil unrest takes hold in the largest uranium-producing countries, and local supplies become more and more scarce…

We may be at the crossroads of a very historic and very lucrative opportunity here.

5 Powerful Reasons Anfield Energy (OTCQB: ANLDF) (TSX:AEC) (FSE:OAD) Could Be 2022’s Hottest Energy Play

Resources

Source 1: https://www.windpowermonthly.com/article/1693818/energy-transition-too-slow-though-renewables-will-dominate-2050

Source 2: https://world-nuclear.org/nuclear-essentials/how-can-nuclear-combat-climate-change.aspx

Source 3: https://www.aljazeera.com/economy/2022/1/6/bb-uranium-prices-surge-on-kazakhstan-unrest

Source 4: https://realmoney.thestreet.com/investing/stocks/should-unrest-in-kazakhstan-concern-energy-investors–15885380

Source 5: https://deq.utah.gov/businesses-facilities/shootaring-canyon-uranium-mill

Source 6: https://www.globenewswire.com/news-release/2021/11/11/2332856/0/en/Anfield-Energy-Provides-Corporate-Update.html

Source 7: https://anfieldenergy.com/presentations/

Source 8: https://www.un.org/en/climatechange/net-zero-coalition

Source 9: https://www.windpowermonthly.com/article/1693818/energy-transition-too-slow-though-renewables-will-dominate-2050

Source 10: https://www.nrc.gov/reactors/operating/list-power-reactor-units.html

Source 11: https://www.eia.gov/tools/faqs/faq.php?id=427&t=3

Source 12: http://www.world-nuclear.org/information-library/nuclear-fuel-cycle/mining-of-uranium/world-uranium-mining-production.aspx

Source 13: https://www.crisisgroup.org/europe-central-asia/central-asia/kazakhstan/behind-unrest-kazakhstan

Source 14: https://www.aljazeera.com/economy/2022/1/6/bb-uranium-prices-surge-on-kazakhstan-unrest

Source 15: https://www.proactiveinvestors.com/companies/news/118395/uranium-price-forecast-adjusted-higher-at-cantor-fitzgerald-to-reflect-cost-reality-118395.html

Source 16: https://www.eia.gov/energyexplained/nuclear/where-our-uranium-comes-from.php

Source 17: https://oilprice.com/Energy/Energy-General/Russias-Proposed-Ban-On-Uranium-Exports-Sends-Stocks-Soaring.html

Source 18: https://www.theguardian.com/us-news/2022/mar/28/native-americans-ban-russian-uranium

Disclaimer: This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. Wallstreetnation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of Anfield Energy Inc. and its securities. Jade Cabbage Media, LLC d/b/a STOXmedia.com expects to be paid up to $20,000 USD dollars by Winning Media LLC as a total production budget for this advertising effort. At this time, Winning Media LLC has been received $120,000 to manage a media budget from the issuer, Anfield Energy Inc. USD. Neither Wallstreetnation.com or STOXmedia currently hold the securities of Anfield Energy Inc. and do not currently intend to purchase such securities. This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are a number of important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur. More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.