Sponsored – Est. 8 Min Read

High Upside Alert:

This Visionary, “High Grade-Focused” Uranium Company Appears Significantly Undervalued

Here’s why this company could be a fast mover.

7 Key Reasons Why You Should Consider Kraken Energy (CSE: UUSA); (OTC: UUSAF) Today

1

High-Upside Property in World Class Uranium Jurisdiction: On July 5th, 2023 Kraken Energy Corp. announced it had entered into an option agreement to acquire up to a 75% interest in the Harts Point Uranium Property in southeast Utah. The property is located in the center of the Colorado Plateau, which has produced over 328 million pounds of uranium at 0.2 to 0.4% U3O8 since the 1950s. The Company has plans in place for 2023 to drill up to 25 exploration holes and is located between several historic mines with proven production history of over 80 million pounds of uranium.

2

Kraken Energy’s Vision Involves Proven Criteria for Property Selection: One of the unique things about Kraken Energy (CSE: UUSA); (OTC: UUSAF) when compared to other resource companies is its unique vision for success. Kraken Energy is building a U.S.-based uranium hub and spoke model to service domestic energy demand…and in doing so they are completely bypassing the stage of greenfield exploration and the large risk associated with it. The company instead insists that all potential property acquisitions meet a checklist of selection criteria that includes – among other characteristics – a history of past production or a pre-defined resource on the property.

3

Kraken Energy’s Portfolio Includes 3 High-Grade Nevada-Based Projects with Significant Upside: In addition to the new Harts Point Property, the company’s Garfield Hills Uranium Project has completed a maiden exploration program at their Garfield Hills Property with results of up to 1.007% U3O8. Kraken Energy’s Apex Uranium Mine is Nevada’s largest past-producing mine – representing 50% of the state’s historic uranium output – and has an average grade of ~0.25% U3O8 and current grab samples up to 3.19% U3O8 . In addition, the company’s Huber Hills Uranium Project is Elko County’s largest uranium past producer with past production of ~10,000 pounds of U3O8 at 0.24% U3O8.

4

High-Upside Opportunity to Leverage Uranium Bull Market: With four high-potential uranium projects, Kraken Energy offers significant upside potential – and smart exposure to soaring uranium prices – as it advances its assets. Of course, the company’s potential could also make it an attractive candidate for a buyout from a major looking to add a stable of high-grade uranium properties in North America. Either scenario could be potentially lucrative for investors in Kraken Energy (CSE: UUSA); (OTC: UUSAF).

5

Government Incentives Provide Huge Tailwind for the Industry: The U.S. government clearly believes nuclear power is a crucial source of virtually carbon-free electricity needed to meet its clean energy goals. To that end, the Biden administration recently announced the offering of a fresh $1.2 billion in aid to extend the life of distressed nuclear power plants.[ii] In addition, the U.S. strategic uranium reserve recently awarded its first contracts – at a price as high as $70 per pound when uranium spot prices are currently around $65.[ii] This likely reflects U.S. desire to discontinue reliance on Russia or any other non-friendly countries for critical supply chains.

6

Kraken Has An Incredibly Strong Treasury: As of this writing, Kraken Energy (CSE: UUSA); (OTC: UUSAF) has roughly CAD $5M in cash with a market cap of $16M This is very significant as many junior uranium explorers are under-capitalized and are unable to raise money for the exploration programs. This makes Kraken stand out from the rest and if you consider that they are proving out their geological model with the cash on hand, (with lots of room), a significant discovery could lead to a re-rate in the market. Investors looking for the best way to take advantage of North American energy demand should consider this potentially fast-moving opportunity. Kraken Energy appears to be very well positioned with the potential to see a significant change in valuation as word begins to spread about its uranium projects.

7

Kraken Energy is Led by a Highly Successful Group of Professionals: The Kraken Energy team is a highly respected group with a full spectrum of uranium experience and a proven history of success. This includes everything from exploration and discovery all the way through production.

Breaking News

Kraken Energy Significantly Expands Project Size at the Apex Uranium Property, Nevada

On August 28, 2023, Kraken Energy announced that it had expanded its 100%-owned Apex Uranium Property in Central Nevada by 117 contiguous claims located on Bureau of Land Management ground along strike with a property-wide mineralized trend.

For more information, click here.

Kraken Energy (CSE: UUSA); (OTC: UUSAF) is Building a U.S.-based Uranium Hub and Spoke Model to Service Domestic Energy Demand

Kraken Energy (CSE: UUSA); (OTC: UUSAF) is exploring four high-potential uranium projects, including the Harts Point Uranium Property as well as the Apex Uranium Mine – Nevada’s largest past-producing uranium mine.

The company is focused on significant uranium projects with the potential for production to be fast-tracked in order to help meet North America’s growing energy demands in a realistic way.

Kraken Energy focuses on conventional, high-grade assets in the United States, in Tier-1 mining jurisdictions that have access to infrastructure, regionally high grades and the potential for fast-tracking production.

Unlike other junior exploration companies whose properties may have advanced infrastructure needs – and require 15 to 20 years to reach production – Kraken Energy focuses exclusively on those properties with the easiest path forward.

And each of Kraken Energy’s three properties has significantly higher grades than are found with other exploration companies. This includes historic production at ~0.25% U3O8…bulk samples up to 0.70% U3O8…and grab samples up to 3.19% U3O8.

The Harts Point Uranium Property is located in the center of the Colorado Plateau, referred to by some as “the US version of the Athabasca Basin,” and is 64 kilometers (“km”) (40 miles) north of the White Mesa Uranium Mill, the only fully licensed and operating conventional uranium mill in the United States.

This is a world class uranium jurisdiction, one which has produced over 328 million pounds of U3O8 at 0.2 to 0.4% U3O8 since the 1950s.

The Harts Point Property comprises 324 mining claims (~6,480 acres) on Bureau of Land Management ground, which covers the east flank of the Harts Point anticline.

Several historic mines located 11 km west of the Harts Point Property produced approximately 280,000 pounds of U3O8 at 0.3% U3O8 from the favorable Chinle Formation host rock.

The Harts Point Anticline is analogous to the Lisbon Valley Anticline, located 31 km to the east of the Harts Point Property, which produced approximately 80 million pounds of U3O8 at 0.3% U3O8.

The Harts Point Property has plans in place to drill up to 25 exploration drill holes in 2023.

There is excellent infrastructure in the region, as the property is located approximate 64 km (40 miles) north of the White Mesa uranium processing facility. There is excellent access throughout the property, which is situation 45 km (28 miles) from the town of Monticello, Utah.

Project #2: Garfield Hills Uranium Project Has an Active Drill Program with Significant Upside

The Garfield Hills Uranium Project is a 3,060-acre property located 12 kilometers east of Hawthorne in Mineral County, Nevada.

The property is comprised of 153 unpatented mineral claims, allowing for quick turnaround permitting and has easy access to roads, electricity, and water.

Kraken Energy has the option to acquire 100% ownership in the property and the maiden drill program was completed in early 2023 with very encouraging results.

Five new drilling targets have been identified on the property as well as significant correlations between strongly anomalous radioactivity and elevated UAV spectrometer readings.

Additional surface exploration continues to further understand additional target areas on the property and plan for a Phase II drilling program in 2024.

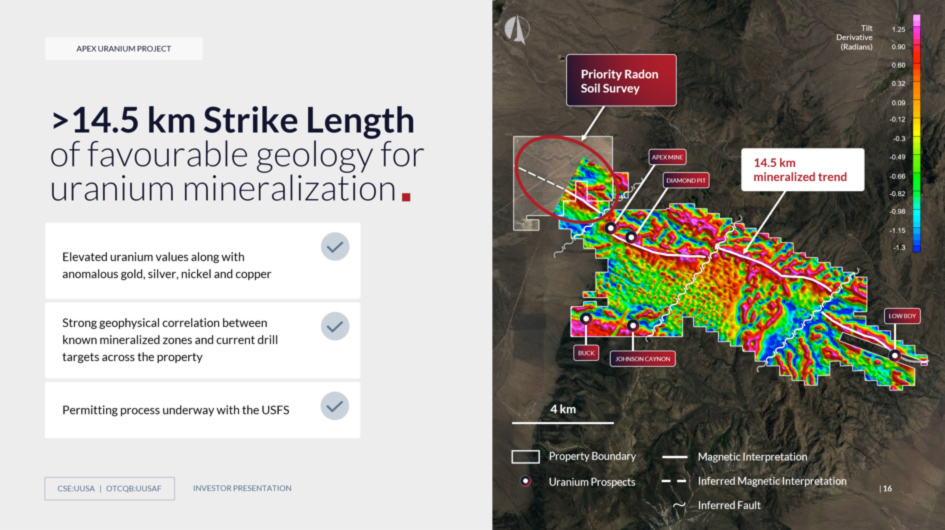

Project #3: Apex Uranium Mine is Nevada’s Largest Past-Producing Mine

The Apex Uranium Mine represents 50% of Nevada’s historic uranium output. The property is 15.4 km x 9.5 km and is located approximately 275 km from Reno, Nevada.

Kraken Energy has 100% ownership in the property, which is 15 minutes from Highway 50 as well as well-developed local roads and has easy access to water and electricity.

Multiple samples on the property have been reported with grades over 0.5% U3O8 and up to 3.19% U3O8:

- A 250-ton bulk sample from Adit 2 assayed at 0.7% U3O8 or better…

- A “new discovery” in Adit O assayed at 3.19% U3O8…

- Drill hole “H” averaged 1.33% U3O8 over 3 m; similar values found in “each succeeding hole drilled westerly from this ‘H’ hole”…

- And grab samples from “Diamond Pit” hilltop reportedly ran 1.00% U3O8; a 6.4 m cut across the pit-face reportedly assayed 0.41% U3O8.

In addition, silver, gold and copper all have been reported to occur within the Apex mine area potentially adding value beyond the uranium potential to the property.

Project #4: Huber Hills Uranium Project is Elko County’s Largest Uranium Past Producer

Kraken Energy’s newest property is the Huber Hills Uranium Project, which has past production totals of ~10,000 pounds of U3O8 at a grade of 0.24%.

The property spans 5.5 km x 3.9 km across 129 unpatented lode claims and is located 2 km east of Mountain City, Nevada.

Huber Hills is accessible year-round via Highway 225 and has easy access to needed infrastructure.

The company’s work program for the property includes drone magnetics, radiometric, geological mapping and prospecting to confirm existing targets and outline new anomalies in the first half of 2023 with a plan to commence drilling in the second half of the year.

A Highly Successful Team of Proven Industry Experts is Leading the Way at Kraken Energy Corp.

The Kraken Energy team is a highly respected group with a full spectrum of uranium experience and a proven history of success. This includes everything from exploration and discovery all the way through production.

This management experience and expertise is a critical advantage for the company, as these are proven veterans who have delivered before with companies like NexGen Energy, Rio Tinto, Hathor Exploration and more.

Now these veterans are taking the knowledge and experience they’ve acquired over the years and using to execute a unique vision for fast-tracking high-grade uranium properties…at a time when energy demand is soaring in North America.

Matthew Schwab – CEO, Director & Qualified Person

Mr. Schwab was previously a co-founder and Senior Vice President of Axiom Exploration Group Ltd. as well as former Senior Exploration Geologist at NexGen Energy Ltd. and was instrumental in the discovery of the Arrow uranium deposit in 2014. Mr. Schwab was also a member of the Hathor Exploration Ltd. development team contributing to the sale of the Roughrider deposit to Rio Tinto for $654 million. In addition, Mr. Schwab is a former President, Senior Advisor and Founder of multiple successful private mineral exploration and E&P consulting firms in the Canadian mining and petroleum industries.

Garrett Ainsworth – Chairman

Mr. Ainsworth is a former VP of Exploration & Development at uranium and exploration companies such as NexGen Energy and Alpha Minerals. He took a lead role in the discovery of the Patterson Lake South high-grade uranium boulder field, and drill discovery of the Triple R uranium deposit. Mr. Ainsworth was a co-recipient of the AMEBC Colin Spence Award for the Triple R discovery, and PDAC Bill Dennis Award for the Arrow discovery.

Zachery Hibdon, B.Sc. – VP Exploration

Mr. Hibdon is an exploration professional with over 20 years of experience in North and Central America and Africa. He previously led near-mine exploration at Barrick Gold Corporation’s Goldstrike UG Mine, overseeing extensive RC and core drilling programs, and was part of the exploration team at Nevada Pacific Gold before its takeover by U.S. Gold in 2007.

Carson Halliday, CPA – CFO

Mr. Halliday is an experienced financial reporting professional with a background in serving public companies in various sectors, primarily in mineral exploration and mining. He currently provides advisory and financial reporting support to several publicly traded companies with Sentinel Corporate Services and was previously a manager with Deloitte Canada, serving clients across the mining life cycle.

Madeline Berry – Senior Geologist

Ms. Berry is an experienced geologist, having worked with several mineral exploration companies including NexGen Energy Ltd., Northern Star Resources and White Gold Corp. Ms. Berry has been involved in a full spectrum of exploration activities, including logging core, overseeing QA/QC, collecting samples and planning and managing drilling programs.

7 Key Reasons Why You Should Consider Kraken Energy (CSE: UUSA); (OTC: UUSAF) Today

1

High-Upside Property in World Class Uranium Jurisdiction: On July 5th, 2023 Kraken Energy Corp. announced it had entered into an option agreement to acquire up to a 75% interest in the Harts Point Uranium Property in southeast Utah. The property is located in the center of the Colorado Plateau, which has produced over 328 million pounds of uranium at 0.2 to 0.4% U3O8 since the 1950s. The Company has plans in place for 2023 to drill up to 25 exploration holes and is located between several historic mines with proven production history of over 80 million pounds of uranium.

2

Kraken Energy’s Vision Involves Proven Criteria for Property Selection: One of the unique things about Kraken Energy (CSE: UUSA); (OTC: UUSAF) when compared to other resource companies is its unique vision for success. Kraken Energy is building a U.S.-based uranium hub and spoke model to service domestic energy demand…and in doing so they are completely bypassing the stage of greenfield exploration and the large risk associated with it. The company instead insists that all potential property acquisitions meet a checklist of selection criteria that includes – among other characteristics – a history of past production or a pre-defined resource on the property.

3

Kraken Energy’s Portfolio Includes 3 High-Grade Nevada-Based Projects with Significant Upside: In addition to the new Harts Point Property, the company’s Garfield Hills Uranium Project has completed a maiden exploration program at their Garfield Hills Property with results of up to 1.007% U3O8. Kraken Energy’s Apex Uranium Mine is Nevada’s largest past-producing mine – representing 50% of the state’s historic uranium output – and has an average grade of ~0.25% U3O8 and current grab samples up to 3.19% U3O8 . In addition, the company’s Huber Hills Uranium Project is Elko County’s largest uranium past producer with past production of ~10,000 pounds of U3O8 at 0.24% U3O8.

4

High-Upside Opportunity to Leverage Uranium Bull Market: With four high-potential uranium projects, Kraken Energy offers significant upside potential – and smart exposure to soaring uranium prices – as it advances its assets. Of course, the company’s potential could also make it an attractive candidate for a buyout from a major looking to add a stable of high-grade uranium properties in North America. Either scenario could be potentially lucrative for investors in Kraken Energy (CSE: UUSA); (OTC: UUSAF).

5

Government Incentives Provide Huge Tailwind for the Industry: The U.S. government clearly believes nuclear power is a crucial source of virtually carbon-free electricity needed to meet its clean energy goals. To that end, the Biden administration recently announced the offering of a fresh $1.2 billion in aid to extend the life of distressed nuclear power plants.[ii] In addition, the U.S. strategic uranium reserve recently awarded its first contracts – at a price as high as $70 per pound when uranium spot prices are currently around $65.[ii] This likely reflects U.S. desire to discontinue reliance on Russia or any other non-friendly countries for critical supply chains.

6

Kraken Has An Incredibly Strong Treasury: As of this writing, Kraken Energy (CSE: UUSA); (OTC: UUSAF) has roughly CAD $5M in cash with a market cap of $16M This is very significant as many junior uranium explorers are under-capitalized and are unable to raise money for the exploration programs. This makes Kraken stand out from the rest and if you consider that they are proving out their geological model with the cash on hand, (with lots of room), a significant discovery could lead to a re-rate in the market. Investors looking for the best way to take advantage of North American energy demand should consider this potentially fast-moving opportunity. Kraken Energy appears to be very well positioned with the potential to see a significant change in valuation as word begins to spread about its uranium projects.

7

Kraken Energy is Led by a Highly Successful Group of Professionals: The Kraken Energy team is a highly respected group with a full spectrum of uranium experience and a proven history of success. This includes everything from exploration and discovery all the way through production.

Sources

[i] https://www.prnewswire.com/news-releases/why-2023-is-projected-to-be-a-bull-market-for-uranium-301763304.html

[ii] https://archive.ph/u7mh8

[iii] https://www.mining.com/chart-uraniums-third-bull-market-since-1968-has-further-to-run/

[iv] https://www.prnewswire.com/news-releases/why-2023-is-projected-to-be-a-bull-market-for-uranium-301763304.html

[v] https://archive.ph/u7mh8

[vi] https://www.mining.com/chart-uraniums-third-bull-market-since-1968-has-further-to-run/

Disclaimer: This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. WallStreetNation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.

Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of Kraken Energy Corp. and its securities. Neither WallStreetNation.com, Winning Media LLC or Jade Cabbage Media LLC currently hold the securities of Kraken Energy Corp. and do not currently intend to purchase such securities.

The issuer, Kraken Energy Corp. has compensated Winning Media LLC the sum total of eighty thousand dollars USD total production budget to manage a digital media campaign for thirty days.

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.