Sponsored – Estimated 8min Read

Investor Alert: The Smartest Way to Play the North American Lithium Boom…and Receive a 20% “Share Dividend”

7 Key Reasons Why You Should Consider USHA Resources Ltd. (TSXV: USHA); (OTC: USHAF) Today

01

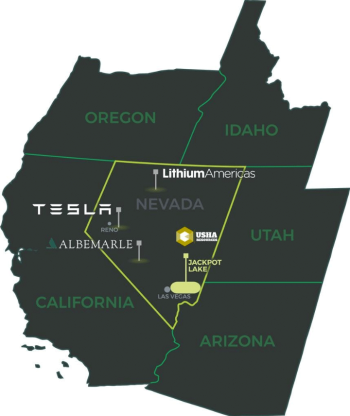

North American Lithium Boom Now Underway: The explosion in demand for electric vehicles has triggered a significant profit opportunity in the lithium exploration space. 2022 saw lithium prices soar…and continued high demand and limited supplies will mean higher prices in the months ahead. With just one producing lithium mine in North America, the race is on to bring new production online as quickly as possible… and USHA Resources appears to be well-positioned to take advantage of this opportunity.

02

Unprecedented 20% Share Dividend Now Available: One of the things that makes USHA Resources Ltd. (TSXV: USHA); (OTC: USHAF) such a unique investment is that it’s the only lithium exploration investment that actually offers a 20% “bonus” for investing. Shareholders who own shares on or about March 7, 2023 will receive a 20% “share dividend” into USHA’s nickel-focused spinout, Formation Metals, with one share of Formation Metals received for every five shares of USHA owned prior to the record date.

03

USHA Has an Impressive Portfolio of Exceptional Assets: USHA’s properties are well-located and have significant upside potential. The company’s flagship Jackpot property is a drill-ready lithium brine project in Nevada that shows tremendous potential as a significant, high-grade project. 129 historic core samples on the property were taken by the USGS with a sampled high lithium value of 550 ppm and an average lithium value of 175 ppm – well above the 100 ppm threshold considered for potential project success.

04

Jackpot Lake is a Lithium Brine “Clone” to Albermarle’s Silver Peak: The only producing lithium mine in North America currently is Albermarle’s Silver Peak Mine. This mine produces lithium from brine extracted from the Clayton Valley basin in Nevada…and evidence to date from the drilling underway suggests a close geological relationship between USHA Resources’ Jackpot Lake project and Albemarle’s Silver Peak Nevada lithium mine, just a four-hour drive away.

05

Drilling is Underway Now at Jackpot Lake: Drilling has commenced for USHA Resources’ Jackpot Lake Lithium Brine Project drill program. USHA has permitted 2,700 metres over six holes and intends to commence its maiden drill program with the goal of defining a 43-101 resource by Q2 of 2023. Once this 43-101 is released, USHA Resources Ltd. (TSXV: USHA); (OTC: USHAF) could quickly move from a speculative opportunity into a different class of lithium companies with a defined resource.

06

USHA Resources Appears Significantly Undervalued in Relation to Other Explorers: Companies that are comparable to USHA Resources in Nevada have significantly higher market caps – for the time being – than USHA’s modest CAD $9.5 million. This includes Pure Energy Metals (CAD $18 million)… Ameriwest Lithium (CAD $18 million)… and ACME Lithium Inc. (CAD $44 million). ACME Lithium in particular is an interesting comparable because its flagship property is significantly smaller than USHA’s Jackpot Lake, yet their market cap is more than four times USHA’s.

07

USHA Resources’ Experienced Leadership Team Has a History of Success: Led by CEO Deepak Varshney, the company’s leadership group has more than 150 years of experience in exploration and finance, with an extensive track record of success in natural resource exploration.

USHA Resources’ Flagship Jackpot Lake Project:

2,800 Acres of Potential High-Grade Lithium

USHA Resources Ltd. (TSXV: USHA); (OTC: USHAF) is a Canadian junior exploration company focused on exploring and advancing early stage high-grade battery and precious metal projects across North America.

The company’s Jackpot Lake Lithium Brine Property is located within Clark County, 35 kilometers northeast of Las Vegas, Nevada, and is comprised of 140 mineral claims that total 2,800 acres.

The geologic model is similar to that of Albemarle’s Silver Peak Nevada Lithium Mine, the only producing lithium mine in North America, which has operated continuously since 1966, where sediments from lithium‑rich surrounding source rocks accumulate and fill the deposit leading to a potential concentration of lithium brine due to successive evaporation and concentration events.

USHA Resources has permitted 2,700 meters over 6 holes and intends on commencing its maiden drill program with the goal of defining a 43-101 resource by Q2 of 2023.

The project target comprises their entire 2,800 claim block, is open in all directions and was identified based on the following work that suggests the presence of a highly concentrated brine.

129 core samples were collected by the USGS with an average lithium value of 175 ppm with a high of 550 ppm and spectrographic and atomic-absorption analyses of 135 stream sediment samples confirming the potential for lithium mineral deposits. For comparison, the present average brine grade for Albemarle’s project is approximately 121 ppm.

Growing Lithium Supply Gap Triggers

Extreme Upside Opportunity for Investors

in the Lithium Exploration Space

The global shift toward renewable energy sources has created an explosion in demand for battery metals such as lithium, cobalt and nickel.

Of course, one of the main drivers for the increase in demand for battery metals is the growth of the electric vehicle (EV) market.

Thanks to a historic surge in demand for electric vehicles – up 62% in the first half of 2022 alone – electric vehicle manufacturers are scrambling for new lithium sources to feed their battery manufacturing plants.

This surge in demand from EV manufacturing has caused lithium prices to more than triple over the past year.

Looking ahead, the IEA forecasts there will be a combined 145 million EV cars and trucks on the road by 2030. There were just 16.5 million on the road at the end of 2021.

The batteries for all these EV’s will require millions of tons of lithium.

This soaring demand has touched off a red-hot bull market for lithium – with prices climbing higher and higher.

And it has also triggered a significant security issue in North America where only one producing lithium mine exists and the majority of the supply chain comes from outside the continent.

This means any North American exploration company that shows the potential for bringing new sources of lithium into production will generate immediate attention – and likely become an immediate takeover target as the larger companies jockey for position.

Investors in junior exploration companies who become buyout candidates – including companies like USHA Resources Ltd. (TSXV: USHA); (OTC: USHAF) could see their investments move sharply higher upon news of a potential takeover.

USHA Resources Ltd. (TSXV: USHA); (OTC: USHAF) Appears to Be Significantly Undervalued

in Relation to its Peers

Investors considering USHA Resources would be wise to take a look at the valuations of some of the other lithium explorers with significant projects in Nevada.

What you’ll find is that other lithium exploration companies in the region – including some with significantly smaller properties than USHA Resources – have market caps that are significantly higher than USHA Resources Ltd. (TSXV: USHA); (OTC: USHAF) does at the moment.

With drilling underway at the company’s Jackpot Lake project – and a 43-101 expected by Q2 2023 – it appears as though USHA Resources now presents an extremely undervalued growth opportunity for early investors.

An Investment in USHA Resources Offers Unique Value Creation with Unprecedented 20% Share Dividend

One of the things that makes USHA Resources Ltd. (TSXV: USHA); (OTC: USHAF) such a unique investment is that it’s the only lithium exploration investment that actually offers a 20% “bonus” for investing.

Shareholders will receive a 20% “share dividend” into USHA’s nickel-focused spinout, Formation Metals, with one share of Formation Metals received for every five shares of USHA owned prior to the record date of March 7, 2023.

This “share dividend” is provided to USHA shareholders at absolutely no cost and it provides investors with smart exposure to the bull market in nickel.

BHP Group Ltd. – the world’s largest miner – recently projected that nickel demand will grow as much as fourfold over the next 30 years.[i]

The flagship project for the new Formation Metals Inc. spinout is the Nicobat project – a nickel-copper-cobalt project located in northwest Ontario, Canada.

Historic work on the property includes over 15,000 meters of drilling and metallurgical studies on numerous bulk samples between 1952 and 1972.

Modern exploration includes over 4,000 meters of drilling that has identified high-grade nickel including 64 meters of 1.05% Ni from surface and 10 meters of 1.92% Ni from 54 to 64 meters depth.

USHA Resources’ Management Team Has a Proven Track Record of Success…and Over 150 Years of Experience in the Exploration Sector

Deepak Varshney – P.Geo – CEO & Director

Deepak Varshney is a professional geologist and has over 15 years of experience in the capital markets and mineral exploration and development sector. As CEO, Mr. Varshney is involved in the company’s marketing, financing and corporate development. He has developed long-standing relationships with an extensive network of high net worth retail investors, brokers, and private equity groups and has been responsible for raising millions of dollars in equity financings.

Khalid Naeem – CPA, CGA – CFO

Khalid Naeem is a Canadian Chartered Professional Accountant (CPA) with over 15 years of financial and executive experience. Mr. Naeem has extensive experience in tax and compliance, public and private enterprises’ financial policy, management and internal financial reporting, including senior roles at junior mining and oil and gas public companies and the Canada Revenue Agency.

Adrian Smith – P.Geo – Director

Adrian Smith, P.Geo., B.Sc., is a professional geologist and has over 15 years of experience working in the Mining and Exploration industries. Mr. Smith began working for Exploration Companies as an Underground Mine Geologist in the Shasta Gold-Silver Mine in Northern BC. He then began work for North American Tungsten Corp. at the Cantung Mine in the Northwest Territories where he was involved in successfully identifying, modeling, and producing ore in addition to known reserves. Currently Mr. Smith is CEO of ArcPacific Resources and sits on the boards of a number of public companies including Go Metals Corp.

Mike Rosko – P.G. – Qualified Professional

Mr. Rosko is a professional geologist with over 30 years of experience, spending significant time assessing aquifer conditions in arid environments throughout the southwestern United States and South America. Mike has extensive experience with lithium brine projects including resource estimation at top-tier projects including Tier 1 assets such as Galaxy’s Sal de Vida, Millennial Lithium’s Pasto Grandes, and Lithium America’s Cauchari-Olaroz Deposits.

7 Key Reasons Why You Should Consider USHA Resources Ltd. (TSXV: USHA); (OTC: USHAF) Today

01

North American Lithium Boom Now Underway: The explosion in demand for electric vehicles has triggered a significant profit opportunity in the lithium exploration space. 2022 saw lithium prices soar…and continued high demand and limited supplies will mean higher prices in the months ahead. With just one producing lithium mine in North America, the race is on to bring new production online as quickly as possible… and USHA Resources appears to be well-positioned to take advantage of this opportunity.

02

Unprecedented 20% Share Dividend Now Available: One of the things that makes USHA Resources Ltd. (TSXV: USHA); (OTC: USHAF) such a unique investment is that it’s the only lithium exploration investment that actually offers a 20% “bonus” for investing. Shareholders who own shares on or about March 7, 2023 will receive a 20% “share dividend” into USHA’s nickel-focused spinout, Formation Metals, with one share of Formation Metals received for every five shares of USHA owned prior to the record date.

03

USHA Has an Impressive Portfolio of Exceptional Assets: USHA’s properties are well-located and have significant upside potential. The company’s flagship Jackpot property is a drill-ready lithium brine project in Nevada that shows tremendous potential as a significant, high-grade project. 129 historic core samples on the property were taken by the USGS with a sampled high lithium value of 550 ppm and an average lithium value of 175 ppm – well above the 100 ppm threshold considered for potential project success.

04

Jackpot Lake is a Lithium Brine “Clone” to Albermarle’s Silver Peak: The only producing lithium mine in North America currently is Albermarle’s Silver Peak Mine. This mine produces lithium from brine extracted from the Clayton Valley basin in Nevada…and evidence to date from the drilling underway suggests a close geological relationship between USHA Resources’ Jackpot Lake project and Albemarle’s Silver Peak Nevada lithium mine, just a four-hour drive away.

05

Drilling is Underway Now at Jackpot Lake: Drilling has commenced for USHA Resources’ Jackpot Lake Lithium Brine Project drill program. USHA has permitted 2,700 metres over six holes and intends to commence its maiden drill program with the goal of defining a 43-101 resource by Q2 of 2023. Once this 43-101 is released, USHA Resources Ltd. (TSXV: USHA); (OTC: USHAF) could quickly move from a speculative opportunity into a different class of lithium companies with a defined resource.

06

USHA Resources Appears Significantly Undervalued in Relation to Other Explorers: Companies that are comparable to USHA Resources in Nevada have significantly higher market caps – for the time being – than USHA’s modest CAD $9.5 million. This includes Pure Energy Metals (CAD $18 million)… Ameriwest Lithium (CAD $18 million)… and ACME Lithium Inc. (CAD $44 million). ACME Lithium in particular is an interesting comparable because its flagship property is significantly smaller than USHA’s Jackpot Lake, yet their market cap is more than four times USHA’s.

07

USHA Resources’ Experienced Leadership Team Has a History of Success: Led by CEO Deepak Varshney, the company’s leadership group has more than 150 years of experience in exploration and finance, with an extensive track record of success in natural resource exploration.

[i] https://www.bnnbloomberg.ca/bhp-sees-nickel-demand-rising-fourfold-by-2050-on-ev-boom-1.1840872

Disclaimer: This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. WallStreetNation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.

Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of USHA Resources Ltd. and its securities. Jade Cabbage Media, LLC d/b/a STOXmedia.com has received up to $20,000 USD dollars (1/27/23) by Winning Media LLC as a total production budget for this advertising effort. Neither WallStreetNation.com, Winning Media LLC or Jade Cabbage Media LLC currently hold the securities of USHA Resources Ltd. and do not currently intend to purchase such securities.

The issuer, USHA Resources Ltd. has compensated Winning Media LLC the sum total of fifty thousand dollars USD total production budget to manage a digital media campaign for thirty days.

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.