Sponsored – Est. Read 7 Min

“Win-Win” Investment Opportunity:

Windfall Profit Potential from One Company’s Proprietary Solution to a Massive Environmental Problem

Northstar Clean Technologies Inc. (TSXV: ROOF); (OTCQB: ROOOF) is an under-the-radar clean technology company that appears poised for significant growth

Breaking News

Northstar Announces First Draw Under $8.75 Million Project Loan Facility from BDC

On September 12, 2024, Northstar Clean Technologies announced that it had completed its first draw of approximately C$1.6 million under its C$8.75 million non-revolving senior secured project loan facility with the Business Development Bank of Canada (BDC).

To learn more, click here.

Northstar Clean Technologies Inc. (TSXV: ROOF); (OTCQB: ROOOF) is a company that is rapidly emerging as a leader in helping solve one of the most “hidden” problems with construction & demolition (C&D) waste diversion in North America.

Asphalt shingles are the undisputed most popular roofing material in North America, and they are on the roofs of an estimated 84% of single-family detached homes in the United States.[1] Point is: they are going nowhere and a problem for landfills for the indefinite future.

Yet asphalt shingles are a top-5 contributor to construction and demolition waste globally.[1]

Even though they remain popular, the lifespan of asphalt shingles is finite. Yes, they typically are durable, long-lasting, have excellent warranties and are cost effective, but they do not last forever on a roof.

And right now we’re seeing massive amounts – as much as an estimated 16.5 million tonnes per year – of asphalt shingles sent to landfills annually in Canada and the United States.[2]

These asphalt shingles create a significant environmental problem as they account for 20 million barrels of oil equivalent sent to landfills annually.[3]

In the view of Northstar, this is one of the most hidden, but obvious, environmental problems with C&D waste in North America right now.

And Northstar Clean Technologies appears to have a market-leading solution to this problem.

The company has developed a proprietary, patent-protected process for extracting the recoverable components from asphalt shingles that would otherwise be sent to already- over-crowded landfills.

From an environmental perspective, this company appears to offer huge potential in that it offers a sustainable solution for municipalities for what would normally be a single-use product at a time when solutions to C&D waste are in demand. Simply put, this is a company working to make the world a cleaner place and divert asphalt shingles away from landfills.

And from an investment perspective, the company offers significant growth upside thanks to a huge total addressable market, a unique multiple-stream revenue business model, a low capex modular roll-out plan, and a powerful first-mover advantage.

It could be a true “win-win” investment opportunity that has the potential to help many major cities in North America reduce their environmental burden associated with diverting these products away from landfills…while at the same time presenting investors with exciting growth potential.

The company’s sustainable solution to this massive environmental problem is just one of seven key reasons why investors should pay close attention to Northstar Clean Technologies Inc. (TSXV: ROOF); (OTCQB: ROOOF) in the weeks ahead.

7

Key Reasons Why Northstar Clean Technologies Inc. (TSXV: ROOF); (OTCQB: ROOOF) Offers Investors High Upside Potential Right Now

Make no mistake…the problem of single-use asphalt shingles is a massive one…and it’s not going away any time soon.

Here’s what I mean:

>

C&D waste represents an estimated 30% of total waste produced globally.[6] And each year, 16.5 million tons of asphalt shingles are sent to landfills in Canada and the United States.

>

With 16.5 million tons of shingles heading to landfills annually in Canada and the United States, that equates to roughly 20 million barrels of oil being sent to landfills each year!

This, obviously, is a major problem as worn-out asphalt shingles do not biodegrade or decompose in a landfill.

That’s why some governments, municipalities and industry associations are potentially seeking to establish goals to reduce landfill disposal of these materials.

Under the U.S. Environmental Protection Agency’s 2022 Sustainable Materials Management (SMM) Plan, objective #1 is to decrease disposal rate, aiming to reduce the amount of material sent to landfills.

And the Asphalt Roofing Manufacturers Association (ARMA) has stated that its industry goals are to reduce landfill disposal of asphalt-based roofing materials to 50% by 2035 and to approach 0% by 2050.

The question is…how will these goals be achieved?

Now along comes Northstar Clean Technologies…a company whose potentially game-changing clean technology presents a unique opportunity to divert these materials from landfills and extract the liquid asphalt, fiber and aggregate for re-purposed usage.

And Northstar is moving forward with this game-changing technology at precisely the right time.

Key Reason #2: How Northstar is Solving this Massive Problem

Northstar’s proprietary process design is its Bitumen Extraction and Separation Technology (BEST).

This process separates the three primary component parts of an asphalt shingle into three outputs: liquid asphalt (estimated at 25%), fiber (estimated at 25%) and aggregate (estimated at 50%).

These three outputs are then be sold back into the market as repurposed materials and can then be re-used for construction items like roads and embankments as well as new shingles.

What Northstar Clean Technologies Inc. (TSXV: ROOF); (OTCQB: ROOOF) has done, essentially, is transform asphalt shingles from being a single-use product that ends up in landfills…into a product that that has the potential to be a fully circular solution.

Northstar Clean Technologies has developed this technology…and it has proved this technology at its Empower Pilot Facility in greater Vancouver, Canada.

The Empower Pilot Facility is a fully constructed, fully permitted 20,000 square foot facility located near the Vancouver landfill that serves as a proven proof of concept for the company’s clean technology.

The de-risking completed at the pilot facility allowed the company to identify opportunities for increased efficiencies and optimization as it moves forward with its first commercial production plant in Calgary, Alberta.

Northstar’s commercial Calgary facility is located just four kilometers from the City of Calgary’s SE landfill and is targeting 150 tonnes per day (base case) of processing capacity, which equates to about 40,000 tonnes per year. This is the base case, but Northstar believes it could also potentially process 80,000 tonnes per year at its facilities.

With the Calgary facility scheduled to be built, commissioned and fully operating in 2025, the company is moving forward quickly. Truly around the corner.

In fact, Northstar signed a five-year take-or-pay offtake agreement with McAsphalt Industries, Ltd., one of Canada’s leading asphalt experts and a Canadian subsidiary of Colas SA, a world leader in the construction, recycling, and maintenance of transportation infrastructure.

This offtake agreement means that McAsphalt will buy 100% of the liquid asphalt production from Northstar’s Calgary facility – at a market-based price (i.e. not at bulk discount pricing) – as soon as the facility comes online.

Key Reason #3: Northstar Could Have a Massive First-Mover Advantage in a Huge Addressable Market

With Northstar’s proven proof-of-concept pilot facility …and with the company moving forward to completing its first commercial-stage processing facility in Calgary, Alberta, Canada in 2025…

That means Northstar Clean Technologies Inc. (TSXV: ROOF); (OTCQB: ROOOF) figures to enjoy a significant first-mover advantage in what is already a huge addressable market.

Given their dominant position in the roofing market – with 84% of all homes using asphalt shingles – that market will continue to remain large.

But at the same time those shingles remain in demand, major cities all over the world are now pledging to reduce their municipal solid waste at a significant pace.

In fact, over 96 cities – representing over 800 million people and 22%[7] of the global economy – have now committed to reducing their municipal solid waste by 50% by 2030.[8]

And this is all happening just as Northstar Clean Technologies is bringing their patent-protected, proprietary technology to market ahead of everyone else.

In fact, at this time Northstar is the only public company focused on asphalt shingle reprocessing.

Let’s consider the potential for growth once Northstar has opened its first commercial scale facility in Calgary in 2025.

Given the planned capacity of Northstar’s facilities, that 20 million barrels of oil would mean that as many as 400 Northstar facilities could be supported in the U.S. and Canada alone.

And how quickly could Northstar Clean Technologies move to meet this demand?

Given the modular roll-out design associated with its Calgary facility, the potential exists for the company to scale up quickly and service many municipalities across Canada and the United States.

Think of it as being similar to a fast-food franchise. As the company works to bring its facilities to new cities – as they continue to demand new cleantech solutions – the design and building process remains the same for each facility. This is the first-ever known “blueprint” for reprocessing this particular type of product.

That means Northstar Clean Technologies could move quickly to expand into new cities… all the while enjoying the advantages that come with being a first-mover into the market and the protection of Northstar’s patented intellectual property.

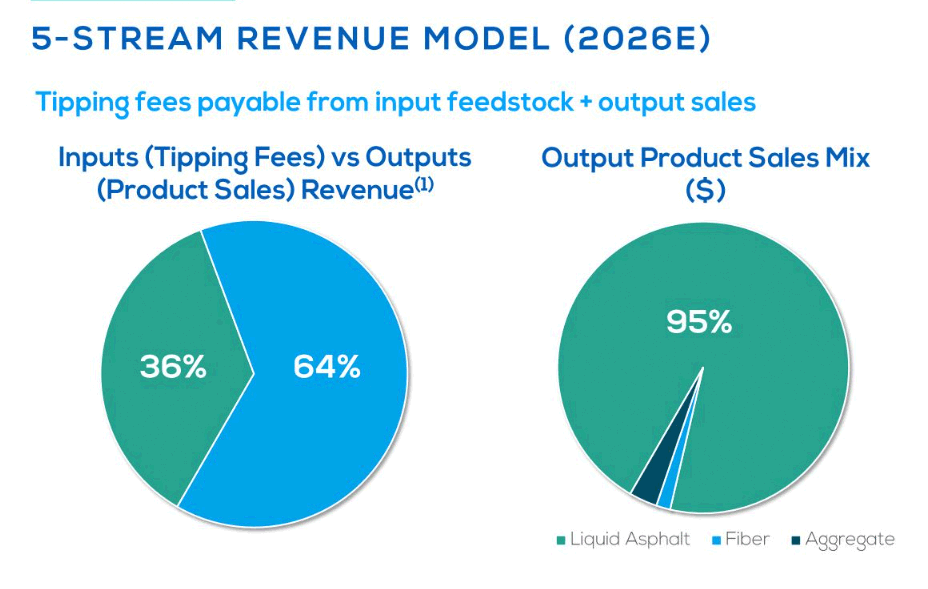

Key Reason #4: The Company’s Unique, 5-Stream Revenue Model

One of the things that makes Northstar Clean Technologies Inc. (TSXV: ROOF); (OTCQB: ROOOF) such a unique, high-upside opportunity is the company’s revenue model.

Northstar has a 5-stream potential revenue model that is a combination of tipping fees (paid to Northstar for the intake of asphalt shingles), product sales revenue (paid to Northstar for the output of its three products) and, eventually, potential carbon credit sales.

The company estimates potential annual revenue of approximately $10M per facility per year through reprocessing 40,000 tonnes of shingles under base case operating conditions of 15 tonnes per hour, 10 hours per day and 6 days per week. Economic upside therefore exists for the Northstar business from improved operating conditions.

Tipping Fees: The fees paid to dispose of waste at a landfill is known as a tipping fee, and it is designed to offset the cost of maintaining the landfill site.

Tipping fees in the City of Calgary, where Northstar is working to open its commercial scale facility, are $113 per tonne.[9]

Northstar is a truly unique business in that the company is paid tipping fees from companies to take the raw materials off their hands (rather than dumping in a landfill).

It’s roughly the equivalent of having your grocery store pay you to take the ingredients you need in order to make tonight’s dinner.

Northstar projects that the tipping fees it collects for the waste material it takes in will represent a modest but consistent revenue stream moving forward.

Product Sales Revenue: Revenue generated from sales of the company’s output are projected to make up the majority of Northstar’s revenues. This includes a combination of sales of liquid asphalt, fiber and aggregate.

Liquid asphalt will make up the overwhelming majority of this revenue stream, and to that end, Northstar has already signed a five-year offtake agreement with McAsphalt Industries for its Calgary facility.

This agreement calls for McAsphalt to buy 100% of Northstar’s liquid asphalt production from its Calgary facility at market-based price.

Carbon Credit Sales: The potential sales of carbon credits are the company’s planned fifth revenue stream, which would potentially allow Northstar to capture the economics related to the CO2e emission savings from asphalt shingle reprocessing. This potential revenue steam is excluded from the company’s estimated revenue calculation and thus represents further economic upside for Northstar.

Key Reason #5: Strategic Equity Investment and Royalty Agreements Provide Validation for Northstar’s Potential

It’s important to know that major financial, government and industry partners have offered their own confirmation and validation as to the potential for Northstar Clean Technologies.

Just recently, in September 2024, Northstar closed a $14 million royalty transaction with CVW CleanTech, Inc. (TSXV: CVW).

CVW CleanTech is working to create a leading cleantech royalty platform and selected Northstar Clean Technologies for its very first cleantech royalty transaction and partnership.

In announcing the investment, CVW CleanTech CEO Akshay Dubey said, “Through extensive technical, legal and commercial due diligence, it was clear to us that the Northstar team has significantly de-risked their technology through diligent piloting and are only a few quarters away from commercialization at their first commercial facility in Calgary.”

This agreement comes on the heels of a significant strategic investment from TAMKO Building Products, LLC, one of the largest shingle manufacturers in the United States.

The agreement with TAMKO – a company with 80 years of manufacturing experience – serves as a huge vote of confidence in the Northstar technology and its applicability to asphalt shingle manufacturing.

Northstar and TAMKO have also signed a U.S. expansion memorandum of understanding and have selected a location for Northstar’s first U.S. asphalt shingle reprocessing facility in the Mid-Atlantic Region. TAMKO has exclusivity for 4 future Northstar facilities.

In the while ahead, Northstar and TAMKO will work together to find the ideal location for both the optimal supply to TAMKO’s asphalt shingle production facility in Frederick, Maryland, and Northstar’s reprocessing facility for asphalt shingles. This collaborative effort has the goal of delivering the optimal site for Northstar’s first U.S. facility.

These agreements are significant for investors as they serve as confirmation that leading companies have done their due diligence on Northstar Clean Technologies and, after consideration, have decided to invest in the company…

…and TAMKO invested US$10 million into Northstar.

Key Reason #6: Northstar’s Impressive Intellectual Property Portfolio

In order to protect its technological advantage – and establish a critical moat for the company – Northstar has received patents from both the United States Patent & Trademark Office (USPTO) as well as the Canadian Intellectual Property Office (CIPO).

In November 2022, Northstar was awarded its first patent by the USPTO for its proprietary technology for reprocessing asphalt shingles. This first patent is expected to remain in force until 2042.

In May 2024, Northstar was awarded a follow-on patent by the USPTO, which was the first of three follow-on patents and the second of four (including the initial patent awarded in November 2022).

This means that the first two steps of the company’s four-step processing technology have now been fully patented in the US, with the third follow-on patent submitted and patent-pending.

And in June 2024, Northstar was awarded its first patent by CIPO for its proprietary technology for reprocessing asphalt shingles in Canada. Northstar was granted advance examination of its patent application for reprocessing asphalt shingles on the grounds that the application related to green technology that helps either resolve or mitigate environmental impacts or conserves the natural environment or natural resources. In May 2024, Northstar filed the follow-on patent in Canada.

Key Reason #7: The Company’s Experienced Leadership Team Has a History of Success… and Plenty of Skin in the Game

Northstar Clean Technologies is led by an impressive group with significant operational, commercial, sustainability and capital markets experience.

Additionally, company insiders and management own approximately 13% of Northstar’s shares, demonstrating their commitment to success.

Investor’s Summary

Northstar Clean Technologies Inc. (TSXV: ROOF); (OTCQB: ROOOF) offers investors a true “win-win” potential investment opportunity that has the potential to help every city in North America reduce its environmental burden…while at the same time presenting investors with exciting growth potential.

By helping solve one of North America’s most significant environmental problems, the company’s proprietary technology offers the potential for rapid growth as the company enjoys a powerful first-mover advantage.

Investors looking for a unique, high-upside opportunity that can make a powerful environmental impact should strongly consider the potential for Northstar Clean Technologies Inc. (TSXV: ROOF); (OTCQB: ROOOF).

[1] Source: Which Residential Roofing Products Are Right for You?, IKO Industries Ltd. (accessed May 3, 2022), online: https://www.iko.com/na/pro/building-professional-tools/roofing-101/buyers-guide-to-residential-roofing-materials/.

[2] Source: National Association of Home Builders, National Energy Research Council, EPA (2018), ASMI, Statista (Sept 2022), Foth Infrastructure & Environment. Shingle Recycling Forum 2022

[3] Note: Tons to barrels of oil assumes 25% asphalt oil composition and 6 barrels per tonne.

[4] Source: National Association of Home Builders, National Energy Research Council, EPA (2018), ASMI, Statista (Sept 2022), Foth Infrastructure & Environment. Shingle Recycling Forum 2022.

[6] Source: Papargyropoulou E., Preece C., Padfield R., Abdullah A.A. Sustainable construction waste management in Malaysia: A contractor’s perspective; Proceedings of the Management and Innovation for a Sustainable Built Environment MISBE 2011; Amsterdam, The Netherlands. 20–23 June 2011.

[7] Source: Oxford Economics data + C40 modelling and World Bank for global GDP.

[8] Source: C40 cities. https://www.c40.org/

[9] Source: City of Calgary. https://www.calgary.ca/waste/drop-off/landfill-rates.html

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer Northstar Clean Technologies Inc., Winning Media LLC has been hired for a period beginning on 09/16/24 and ending on 12/16/24 to conduct investor relations advertising and marketing and publicly disseminate information about Northstar Clean Technologies Inc. via Website, Email and SMS. Winning Media has been compensated the sum total of thirty five thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Northstar Clean Technologies Inc.

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (ROOF). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.