Sponsored – Est. Read 7 Min

This Under-the-Radar Drone Company Could Be the Next High-Upside Defense and Tech Opportunity

With a unique “Uber for Drones” model – along with military grade zones and recurring revenue streams – ZenaTech, Inc. (Nasdaq: ZENA) appears to offer investors the best way to play the rapidly growing drone market for maximum upside.

In the midst of a rapidly growing global drone market – which is projected to soar from $8.8 billion to more than $82.5 billion by 2032 – one company is attracting attention for its potential to transform a number of key industries.

That company is ZenaTech, Inc. (Nasdaq: ZENA) a unique, forward-thinking drone company that’s helping to supply and support a new world where autonomous aerial systems handle a wide variety of tasks.

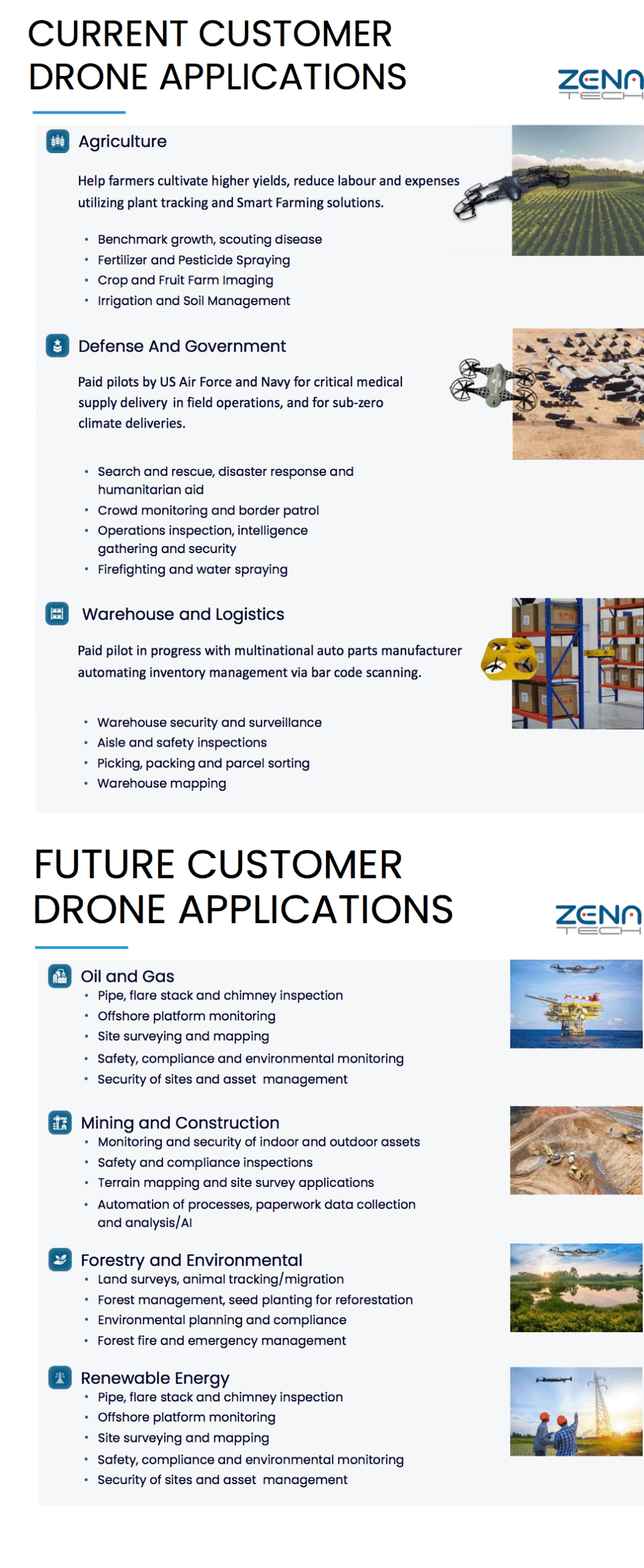

This includes everything from drone solutions for smart farming or accessing medical supplies on the battlefield, to software applications used by law enforcement, field service technicians, and plant managers.

With a potentially disruptive “Drone-as-a-Service” model…paid military trials already underway…and key acquisitions stacking up, ZenaTech, Inc. is moving quickly to become the first true end-to-end commercial drone platform.

Recent executive orders from the Trump administration have created unprecedented tailwinds for American drone manufacturers like ZenaTech. The June 6, 2025 White House executive order ‘Unleashing American Drone Dominance’ accelerates FAA approvals and prioritizes US-made drones, directly benefiting companies with dual-use capabilities.

For ZenaTech, this means potentially faster regulatory approval pathways for both commercial and defense applications, streamlined government procurement processes, and expanded market access through federal prioritization of NDAA-compliant, domestically manufactured drones.

For investors, this is a company that appears to have massive potential upside. As this is a rapidly-developing scenario – with high potential upside – I have summarized the most important points of the story below. Here now for you to consider are…

8 Key Reasons Why You Should Take a Close Look at ZenaTech, Inc. (Nasdaq: ZENA) Today

1

The Drone Industry is Already Massive…and Still Growing Fast!

The commercial drone industry is in the midst of an impressive growth phase, with experts suggesting the industry will grow from $8.8 billion in 2022 to a projected $82.5 billion by 2032[i]. As part of this growth, the military drone market is also soaring, with projections calling for it to reach a size of $47 billion by 2032 from $14 billion in 2023. With a dual focus on both commercial and defense applications, ZenaTech is well-positioned to compete in both of these important verticals.

2

Disruptive Drone-as-a-Service (DaaS) Model: An “Uber for Drones”

ZenaTech is dramatically redefining drone deployment in North America with a model that mirrors Uber or Amazon Web Services. ZenaTech’s customers pay for drone services on a turnkey basis, including hardware, pilots, sensor, data analytics and regulatory compliance. No major competitor to the company currently offers this level of integration and convenience at scale, and early traction has already helped trigger significant early revenue growth.

3

Ban on Chinese Drones and Parts Creates Opportunity for U.S. Companies

Chinese manufacturers currently dominate the global drone market, with market share estimated anywhere from 70% to 90%[ii]. But that scenario is now changing in a big way. The U.S. defense industry…state and local law enforcement agencies…and even commercial entities are banning Chinese-made drones and components due to national security concerns. ZenaTech’s fully compliant systems offer an alternative solution that could benefit from federal and state purchasing mandates, favorable tariffs and U.S.-initiated reshoring trends.

4

Trump’s Executive Orders Create Fast-Track Opportunities for Dual-Use Drone Companies

President Trump’s historic June 6, 2025 executive order “Unleashing American Drone Dominance” has fundamentally reshaped the regulatory landscape for American drone companies, and ZenaTech is positioned to be one of the primary beneficiaries. The directive fast-tracks FAA approvals, reduces regulatory red tape, and mandates federal prioritization of US-made, NDAA-compliant drones in government procurement. Most importantly for ZenaTech, the order specifically supports “dual-use” drones, which are those designed and certified for both civilian and military applications. This designation allows ZenaTech’s drones to qualify for streamlined approvals across both defense and commercial markets simultaneously, eliminating the months-long certification processes that previously created separate approval pathways. With ZenaTech actively pursuing Green UAS certification as a stepping stone to Blue UAS approval for federal agency use, these executive orders could significantly accelerate the company’s path to major government contracts while simultaneously expanding commercial opportunities.

5

Critical U.S. Defense Validation is Already Underway

Few early-stage drone companies can say they’ve conducted paid pilot programs with both the U.S. Air Force and Navy. These early validations build critical credibility for the company and open the door to future government contracts. ZenaTech is also working toward Green UAS and Blue UAS certifications, which are required to supply the Department of Defense and other federal buyers.

6

Strategic Acquisitions Are Building Market Share and Infrastructure

ZenaTech has already acquired six land survey firms, giving the company access to immediate revenue, customer bases and regional infrastructure for deploying its drones. With more than 20 additional targets in the pipeline, the company is using M&A to accelerate market penetration and deploy its unique DaaS revenue model faster than any of its competitors.

7

ZenaTech Represents an Undervalued Opportunity for Investors

With a current market cap of just over $150 million, no major analyst coverage and a strong insider ownership base, ZenaTech appears early in its growth curve. And for that reason it is currently flying beneath Wall Street’s radar. But that could change quickly, as company leadership expects drone-related revenue to continue growing in addition to its DaaS income. This revenue growth could position the company for potential re-rating as its commercial and defense momentum accelerates. As Wall Street becomes more aware of this unique drone company’s revenue model and potential, it could see a rise in valuation that approaches some of its larger peers.

8

The Company is Guided by a Deep, Experienced Leadership Team

ZenaTech is led by a group of seasoned executives with decades of experience in software, drone tech, defense contracting and public company growth. CEO Dr. Shaun Passley has more than 25 years of expertise in the software industry and more than 10 years of experience leading public companies. The leadership team includes veterans of several top-tier global technology firms, giving ZenaTech the vision and execution power to scale.

BREAKING NEWS

ZenaTech to Highlight Progress on Drone as a Service and US Defense Business at Multiple Upcoming Investor Conferences

Vancouver, British Columbia, (September 04, 2025) — ZenaTech, Inc. (Nasdaq: ZENA) (FSE: 49Q) (BMV: ZENA) (“ZenaTech”), a business technology solution provider specializing in AI (Artificial Intelligence) drones, Drone as a Service (DaaS), Enterprise SaaS, and Quantum Computing solutions, today announces the company’s participation in multiple upcoming investor conferences across the US and a European roadshow over the next two months. These events feature a combination of presentation opportunities and engagement in one-on-one meetings with key institutional investors, fund managers and family offices. Company executives will highlight the latest developments and progress regarding the company’s Drone as a Service business roll out, commercial drone solution developments, and its US defense business advancements.

ZenaTech, Inc. (Nasdaq: ZENA) is Bringing an “Uber for Drones” Model to a Number of High-Growth Industries

The commercial drone market is right now experiencing explosive growth, with the commercial sector alone projected to expand from $8.8 billion in 2022 to $82.5 billion by 2032.

This rapid expansion is driven by a number of factors, the most important of which could be the banning of Chinese drones and components by the U.S. government.

One under-the-radar company is right now at the intersection of this high-growth market, offering both drone manufacturing and design as well as a unique Drones-as-a-Service opportunity.

It’s a company that is executing a unique – and potentially disruptive – business model that is turning AI-powered drones into a scalable service.

That company is ZenaTech, Inc. (Nasdaq: ZENA)…and its vision could be years ahead of anyone else in the space.

While most companies in the drone space are busy selling hardware or niche services…

ZenaTech is building a comprehensive platform.

The company is truly an AI drone, Drone-as-a-Service (DaaS), Quantum Computing and enterprise SaaS software company with a portfolio of solutions that help business and government customers improve mission-critical operations.

Essentially, ZenaTech is now rolling out a revolutionary business model designed to work like Uber or Amazon Web Services for the skies.

Imagine a company being able to summon a drone – complete with pilot, software, regulatory compliance and mission-specific hardware – the way a business today might book cloud storage or arrange for a delivery van.

That’s the first element to the impressive ZenaTech opportunity: a turnkey, pay-as-you-go model that could completely transform the way industries like agriculture, defense, infrastructure and logistics adopt drone technology.

The company’s ZenaDrone solutions are currently used for agriculture, defense, warehouse and logistics and land survey applications.

Its Enterprise Software solutions are used by customers in law enforcement, health and industrial sectors for a variety of compliance, safety, field service and records management applications.

ZenaTech’s emergence as a software company that also designs and manufactures drones gives it a key advantage over other, more traditional drone companies.

That’s because the company has recurring revenue from its existing software sales that has helped establish a foundation for the company’s growth.

And the marketing, development, sales and training associated with the software business helped ZenaTech understand the true potential of its Drone-as-a-Service model.

In fact, the company’s integration of its land surveying acquisitions – with six acquisitions complete and 20 more in pipeline – has allowed the company to lead the industry in Drone-as-a-Service pay-per-use and subscription-based drone services for multiple applications.

ZenaTech’s In-House Drone Manufacturing Gives the Company Full Control Over Quality, Compliance and Scale

The second element to ZenaTech’s unique opportunity is the company’s drone manufacturing business.

While many of today’s most well-known drone companies rely on outsourced manufacturing, ZenaTech designs, tests and builds its own drones.

This is a key strategic advantage that gives the company full control over quality, customization and compliance.

ZenaTech operates dedicated drone manufacturing facilities in Sharjah, UAE and Phoenix, Arizona, where it conducts aerial testing, research & development and domestic assembly. Together, these facilities allow ZenaTech to produce:

- 10-15 units per month of its flagship ZenaDrone 1000, which is designed for military, agriculture and industrial applications. The ZenaDrone 1000 is built with a lift capacity of up to 88 pounds.

- 25+ units per month of the smaller IQ Nano/Indoor Series, which is purpose-built for warehouse inventory, safety inspections and facility automation.

The company’s drone manufacturing comes at a critical time as the U.S. defense industry – as well as many other entities – have taken steps to ban Chinese-made drones and components due to national security concerns.

Think about it: Chinese manufacturers currently dominate the global drone market, with market share estimated anywhere from 70% to 90%.

And the demand for drones and drone technology is projected to continue increasing. So with Chinese-made drones no longer an option, those companies that have the potential to fill the void could see significant potential upside.

And it’s important to note that ZenaTech is building its supply chain with U.S. military compliance in mind. The company has worked hard to secure U.S.-compliant camera systems and drone components, helping it meet the strict standards required for federal and defense contracts.

For investors, ZenaTech’s ability to manufacture in-house could mean faster time-to-market, tighter cost controls and more leverage as it expands its Drones-as-a-Service platform globally.

Proven Leadership Team with Over 100 Years of Combined Experience

The ZenaTech leadership team features an impressive blend of experience spanning enterprise software, drone technology, finance, public markets and global business development.

This positions the team well to execute on the company’s unique strategy and guide it through what looks to be a significant early growth period.

This impressive team includes:

Shaun Passley, PhD – Chairman & Chief Executive Officer

Mr. Passley has over 25 years of experience in the software industry and more than 10 years of experience leading public companies. He holds a PhD in Business Management and a master’s in business administration from Benedictine University.

James Sherman, CPA – Chief Financial Officer

Mr. Sherman has worked for 30 years as a Certified Public Accountant (CPA) and graduated with Honors from Northern Illinois University. He began his career at a Fortune 500 telecommunications firm…served as Treasurer for a $3.5 billion division of Sprint Corporation…served as CFO of a $90 million national transportation and distribution company and served as CFO for Carry Corporation, a $250 million division of Mitsubishi Corporation.

Sajjad Asif – Chief Technology Officer

Mr. Asif has 18 years of professional experience and expertise in software and drone technologies. He previously held leadership positions with the ZenaTech group of companies and was CTO and held other leadership and technical roles for multiple European technology firms.

Linda Montgomery – VP Corporate Development

Ms. Montgomery has over 20 years of global technology industry background leading investor relations, business development and marketing. She has led investor relations for multiple companies and for six IPOs and previously held national marketing leader roles at IBM, KPMG and Telesat Canada.

Simon Henry – VP of Business Development, EMEA

Mr. Henry has over 20 years of sales and client service management experience in various industries, including finance with the Bank of Ireland.

Philander Franklin – VP of Business Development, NA

Mr. Frankin has over 25 years of professional experience in sales and operations leadership and was previously a sales leader in the healthcare industry for Blue Cross Blue Shield provider, GoHealth, achieving top awards for sales and revenue.

ZenaTech, Inc. (Nasdaq: ZENA) Appears to Offer a High-Upside, Undervalued Investment Opportunity

For those looking for smart exposure to the rapidly growing drone market, ZenaTech, Inc. (Nasdaq: ZENA) appears to offer significant potential upside.

When compared to others in the drone space, ZenaTech has a much smaller market cap in spite of its advantages, including U.S. military trials…domestic manufacturing capabilities…and its unique Drones-as-a-Service business model.

One of ZenaTech’s closest comparables, Red Cat Holdings, Inc. (Nasdaq: RCAT) has a market cap of $540 million compared to just over $150 million for ZenaTech.

In fact, Red Cat is a compelling comparable for ZenaTech, as it would appear that ZenaTech is now at a stage comparable to where Red Cat was just two years ago…when its market cap was roughly one-fourth of its current $540 million.

As Wall Street begins to learn more about ZenaTech’s unique business model…its recurring revenue streams…and its exposure to multiple, fast-growing sectors, it’s possible that the company could see a significant increase in valuation.

Additionally, the company’s favorable capital structure – with at least 60% founder and management team-owned – also indicates strong insider alignment, which is important when evaluating any emerging company.

And importantly, the company is delivering impressive results, with 2Q 2025 revenue announced at $2.24 million, a 503% increase from Q2 2024…and a 250% revenue increase for the first six months of the year compared to the same period in 2024.

For investors, the opportunity with ZenaTech, Inc. (Nasdaq: ZENA) represents smart exposure with a forward-thinking company – executing a potentially disruptive business model – in the middle of a rapidly-growing industry.

RECENT MILESTONES

[i] Sources: Skyquest and Straights Research (ZENA investor deck slide 4)

[ii] https://www.technologyreview.com/2024/06/26/1094249/china-commercial-drone-dji-security/

Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer, ZenaTech, Inc. (ZENA), Winning Media LLC has been hired for a period beginning on 6/4/25 and ending on 12/31/25 to conduct investor relations advertising and marketing and publicly disseminate information about ZenaTech, Inc. (ZENA) via Website, Email and SMS. Winning Media has been compensated the sum total of three hundred thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for ZenaTech, Inc. (ZENA).

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (ZENA). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.