Sponsored – Est. Read 7 Min

Upside Alert:

Under-the-Radar $10 Million Junior Potentially Sitting on a Massive Silver-Gold Deposit

A proven geological model, extensive historical exploration and a newly unified project could trigger one of the most compelling silver-gold opportunities in Peru’s prolific mining belt.

It could be happening again.

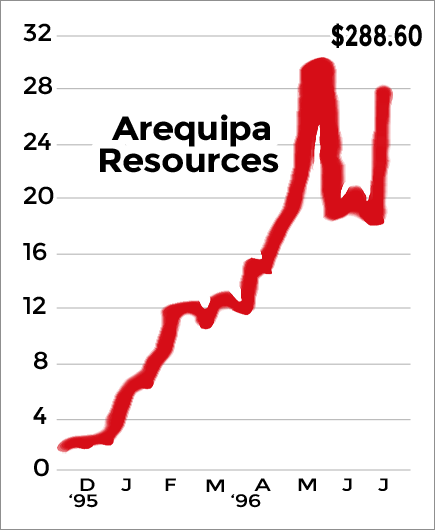

Back in 1996 a little-known explorer named Arequipa Resources captured the attention of the mining world when its stock soared from 37 cents to over $34 in a short period of time just before the company was snapped up by Barrick Gold for $800 million.

Now, nearly three decades later, another company – Magma Silver Corp. (TSXV: MGMA);(OTCQB: MAGMF);(FSE: BC21) – appears to be positioning itself for a similar potential breakout.

Here’s how this intriguing scenario is now unfolding:

Magma Silver Corp. recently acquired 100% control of the Niñobamba Project in southern Peru. This project shares the same deposit type and structural setting that made Arequipa’s discovery in northern Peru so valuable…a high-sulfidation epithermal system with district-scale potential.

It’s early, but the blue sky potential with this company is especially attractive.

Magma Silver Corp. has historical non-compliant modeling indicating a potential for more than 47 million ounces of silver and 550,000 ounces of gold (Note that this exploration-potential estimate is based on historical work, formatted to comply with NI 43-101 Section 2.3(2), and considered relevant as it provides a conceptual evaluation of the historical work and an exploration target for further work. The quantity and grade of the exploration-potential target is conceptual in nature, as a QP has not done sufficient work to validate this exploration-potential estimate and Magma Silver Corp. is not treating this exploration-potential estimate as a current mineral resource and there is no assurance that a compliant report will confirm the historical estimates)

And with a market cap of just $10 million as of this writing, the potential exists for Magma Silver Corp. (TSXV: MGMA);(OTCQB: MAGMF);(FSE: BC21) to move quickly.

To help you understand this fast-moving scenario with high-upside potential, I have summarized the most important points of the story below. Here now for you to consider are…

7 Key Reasons

Why You Should Strongly Consider Magma Silver Corp. (TSXV: MGMA);(OTCQB: MAGMF);(FSE: BC21) Today

1

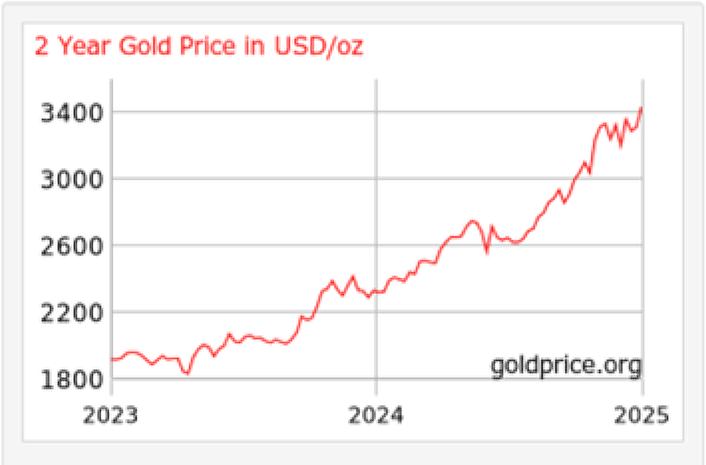

A Long-term Precious Metals Bull Market Is Still in its Early Stages

Over the past year, both gold and silver prices have continued to climb higher with gold up more than 30% and silver up over 40%. With central banks stockpiling gold, industrial demand for silver accelerating and both geopolitical and economic uncertainty rising, many experts believe these precious metals bull market rallies have many years to run. Magma Silver (TSXV: MGMA);(OTCQB: MAGMF);(FSE: BC21) offers smart exposure to both silver and gold at precisely the right time for maximum potential upside.

2

Massive, Underexplored Resource in Peru’s Most Prolific Mining Belt

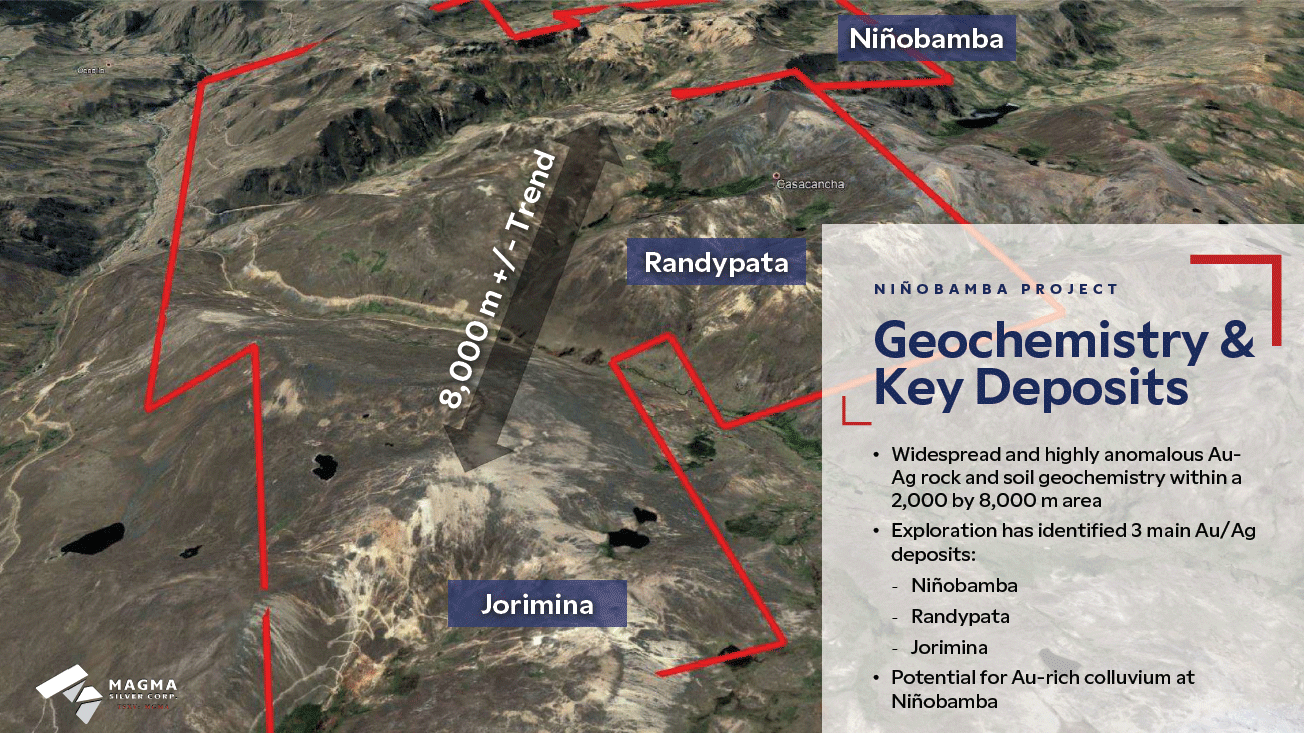

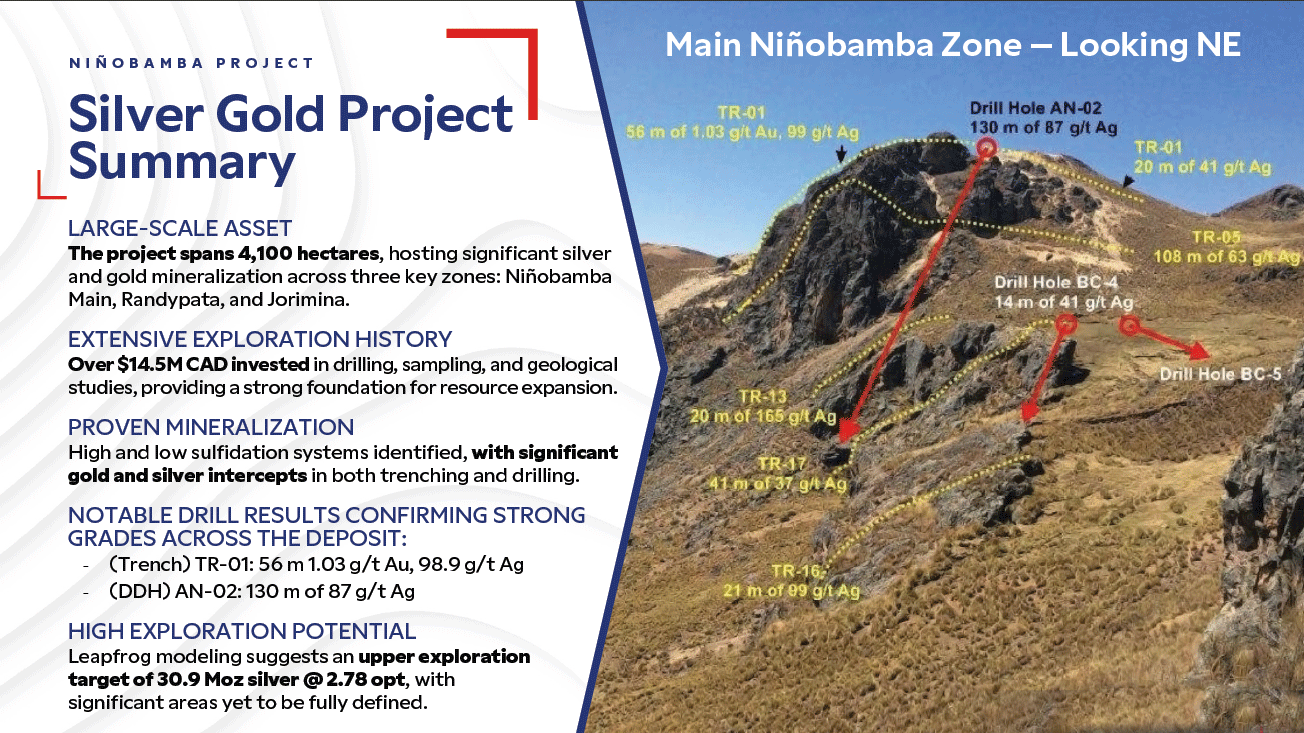

The company’s flagship Niñobamba Project covers an expansive 8-kilometer mineralized corridor that spans over 4,100 hectares in Peru’s highly prospective geological belt. This same belt hosts multiple world-class deposits – including Yanacocha, Latin America’s largest gold mine – underscoring the region’s extraordinary mineral resources. With three significant mineralized zones and historical results showcasing promising gold and silver grades, Magma’s project holds immense exploration potential.

3

Could Magma Silver Be the Next Arequipa-Like Success Story?

In 1996, Arequipa Resources was acquired for $800 million after a legendary run from 37 cents to $34. There’s no question that a run like that is exceptionally rare. But here’s the thing: With its vuggy silica, high-sulfidation signatures and district-scale potential, Magma’s Niñobamba Project exhibits many of the same geological traits that put Arequipa on the map. It may be speculative…but for some investors the potential exists for a remarkable journey ahead.

4

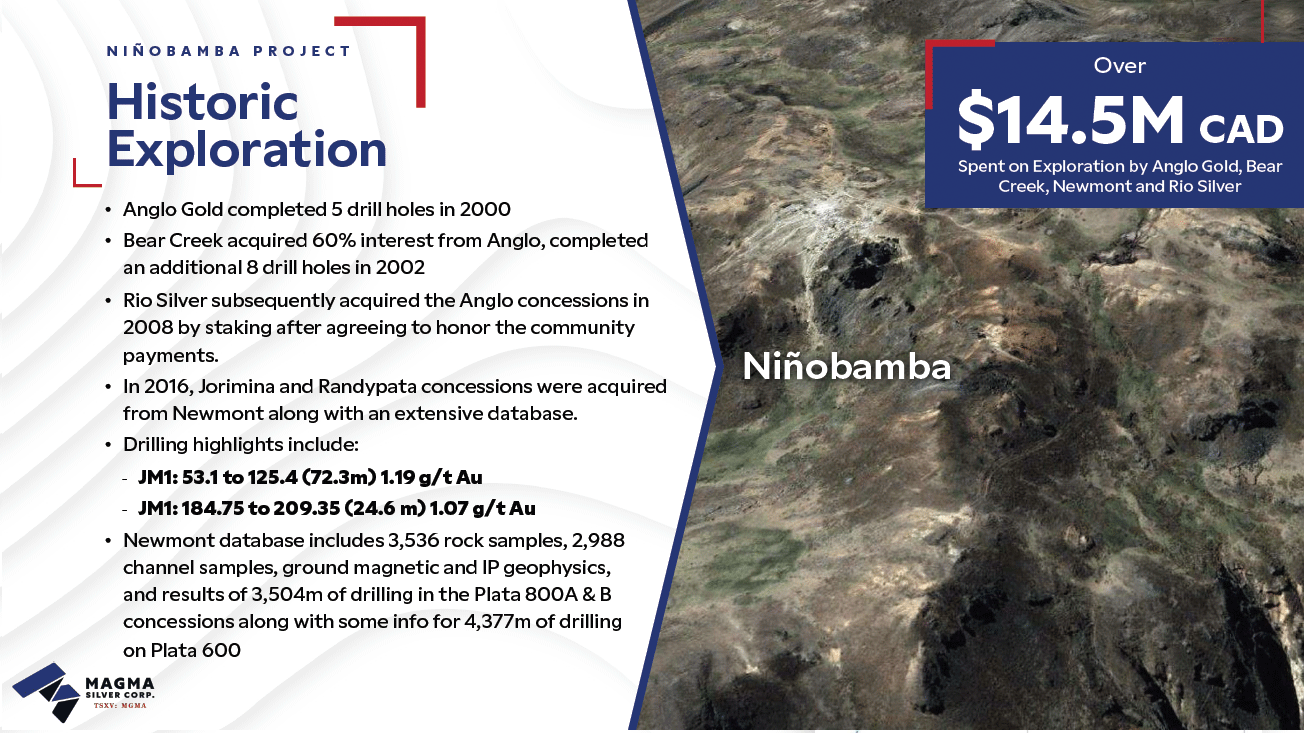

A Foundation of Historical Work by Newmont and Others

Benefiting from over $14.5 million CAD in exploration investments by industry leaders like Newmont, AngloGold and Bear Creek Mining, Magma Silver is now working to advance a project with advanced-stage exploration data. Newmont even conducted a pre-feasibility-level review, complete with metallurgy and fatal flaw assessments. This is not raw ground…Magma has inherited a well-researched target with an extensive data set and a strong technical foundation.

5

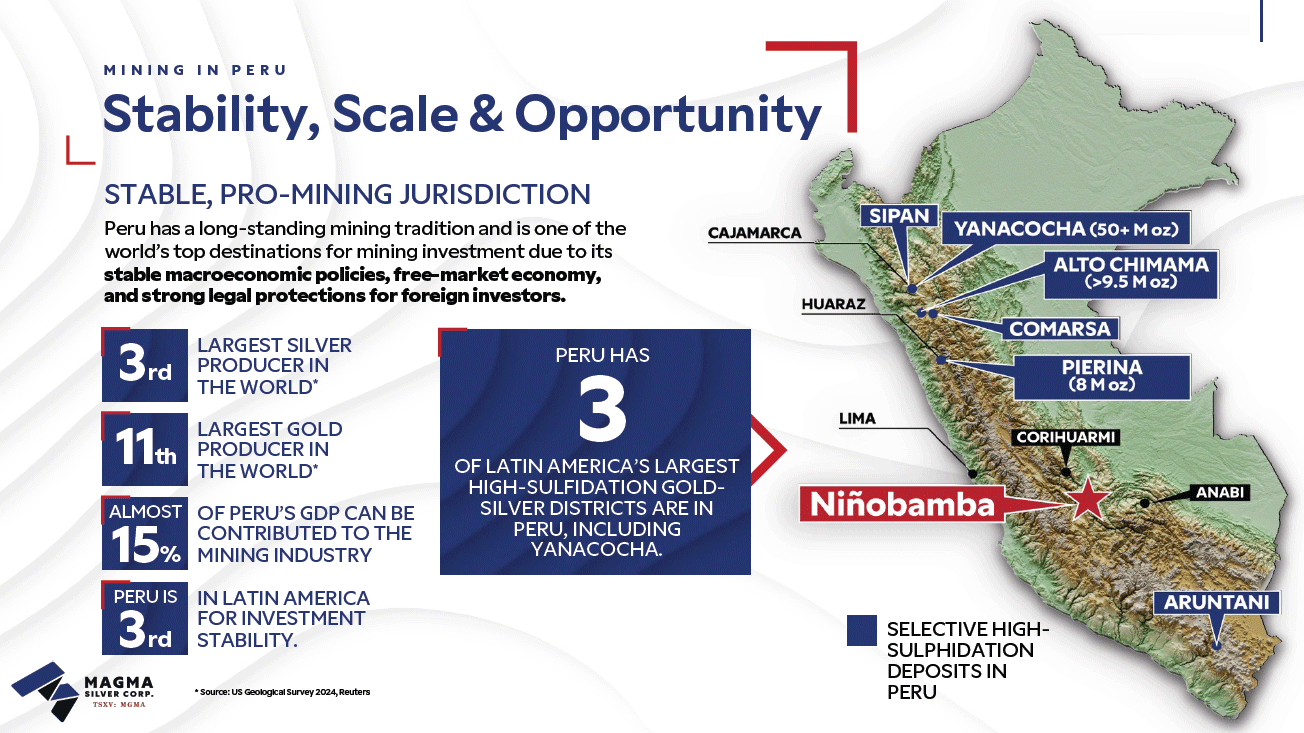

Mining-Friendly Peru Offers World-Class Infrastructure and Stability

Peru is ranked as the world’s #3 silver producer and #11 for gold, contributing nearly 15% of its GDP to mining. Its Ayacucho region, home to the Niñobamba Project, offers excellent infrastructure, including highway access, power lines and daily flights to Lima. With a strong mining legacy, supportive policies and a skilled local workforce, Peru remains one of the most attractive jurisdictions globally for precious metals exploration and development.

6

An Experienced Management Team that Knows How to Build Value

Magma Silver is led by a veteran team with deep expertise in mineral discovery, corporate finance and public markets. CEO Stephen Barley has over 40 years of experience guiding TSX-listed resource companies, while Directors Jason Baker and Michael Townsend each bring extensive backgrounds in capital markets and junior mining strategy. Together, this team has raised hundreds of millions in project funding and overseen successful asset acquisitions, positioning the company to move quickly and effectively as exploration advances.

7

Near-Term Catalysts Could Trigger Significant Market Re-Rating

With drill permit applications already submitted and one community agreement in hand and the second about to get underway, Magma Silver is preparing for a Phase I exploration push that includes trench extensions and targeted drilling across its most promising zones. The goal of this push is to confirm and expand known mineralization and move toward an NI 43-101 compliant resource estimate. Any of these milestones – particularly drilling success – could significantly boost the company’s profile in the market and set the stage for a potential re-rating in the months ahead.

Magma Silver Corp. (TSXV: MGMA);(OTCQB: MAGMF);(FSE: BC21) Offers Smart Exposure to the Red-Hot Bull Markets in Both Gold AND Silver

The bull market in precious metals continues to roll on and shows no signs of slowing down.

Over the past 12 months alone, gold has surged more than 30%, while silver has soared over 40%. These gains have been driven largely by a combination of inflation concerns, global instability and surging demand from both investors and industry.

In fact, in 2024 silver experienced its largest supply deficit on record, driven by high industrial demand and tightening mine supply. Silver demand from solar energy and EV manufacturers rose 6% year-over-year, while total mine production fell by 5 million ounces.

And gold prices have recently set new all-time highs, driven by gold’s role as a safe-haven asset during times of geopolitical and economic uncertainty.

Additionally, rising demand from jewelry and energy transition technologies continues to bolster gold prices. And in the 17 years since the 2008 financial crisis, central banks have shifted toward gold, with central bank demand the highest since 1967 in 2023-2024.

“JP Morgan forecasts gold prices crossing $4,000 by Q2 2026”

Many analysts believe that this new bull market in gold and silver is still in its early stages.

And the best way to play this bull market for maximum upside could be with retail-focused junior exploration companies, like Magma Silver (TSXV: MGMA);(OTCQB: MAGMF);(FSE: BC21), that provide leverage to both gold and silver.

Magma Silver’s Niñobamba Project: Scale, Substance and Blue Sky Potential

Located in Peru’s prolific Ayacucho region, the Niñobamba Project spans 4,100 hectares and stretches across an 8-kilometer mineralized corridor.

Accessible by highway and located just 45 minutes from an airport with daily service to Lima, the project offers rare scale in an extremely mining-friendly jurisdiction.

The Niñobamba Project has already seen over CAD $14.5 million in exploration spending by three major companies, including Newmont, AngloGold and Bear Creek.

Together, these three companies completed over 65 drill holes, thousands of channel and rock samples and detailed geophysics and metallurgy studies.

Newmont also conducted a pre-feasibility level internal review, including metallurgical testing and a fatal flaw assessment. Their conclusion was that the project was worthy of advancement.

The extensive exploration by these companies has demonstrated significant resource potential and Magma Silver is now advancing the project using modern geological modeling and a strategic development plan.

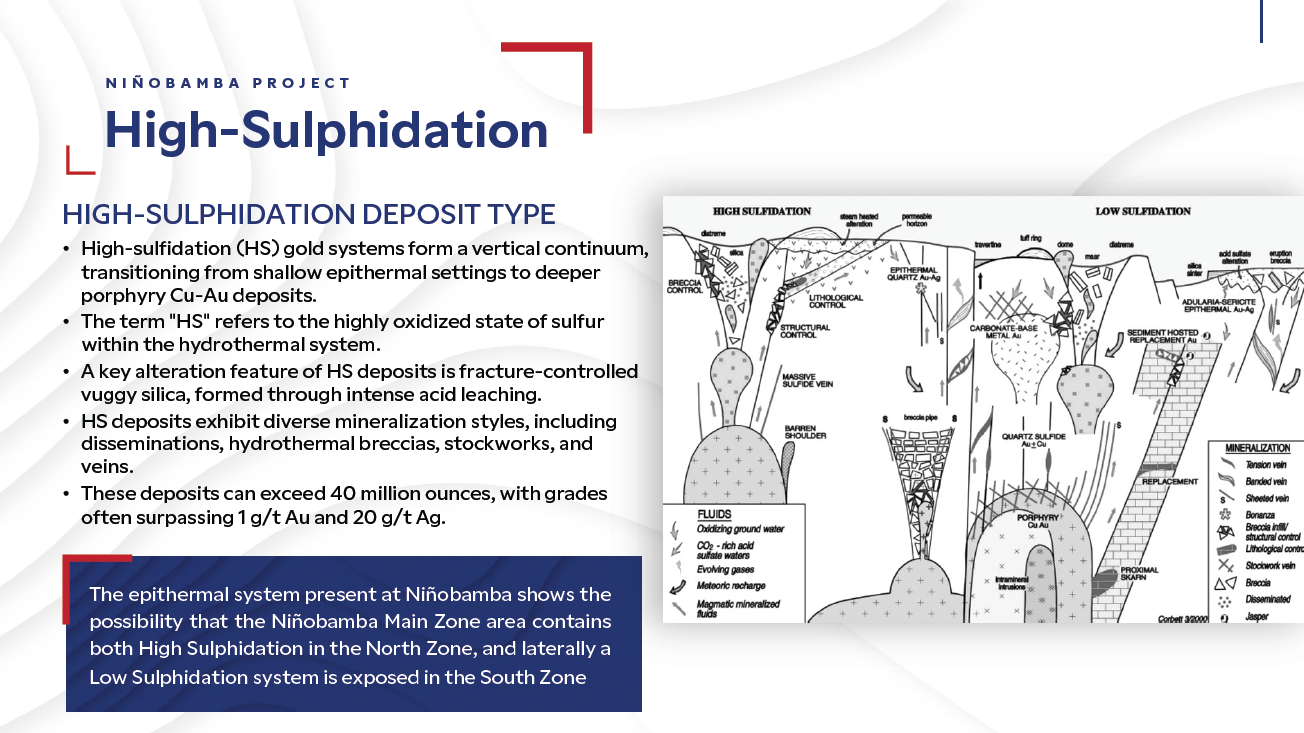

The Niñobamba Project Features Similar Geology to Some of the World’s Largest Gold and Silver Deposits

Niñobamba hosts a textbook high-sulfidation epithermal system, marked by vuggy silica and intense alteration. That’s the same geological signature to some of the world’s largest gold-silver deposits.

These systems often link to deep porphyry-style deposits, and they can host multi-million-ounce discoveries.

The presence of both high- and low-sulfidation features across the property opens the door to multiple mineralizing events and potentially a much larger system than previously recognized.

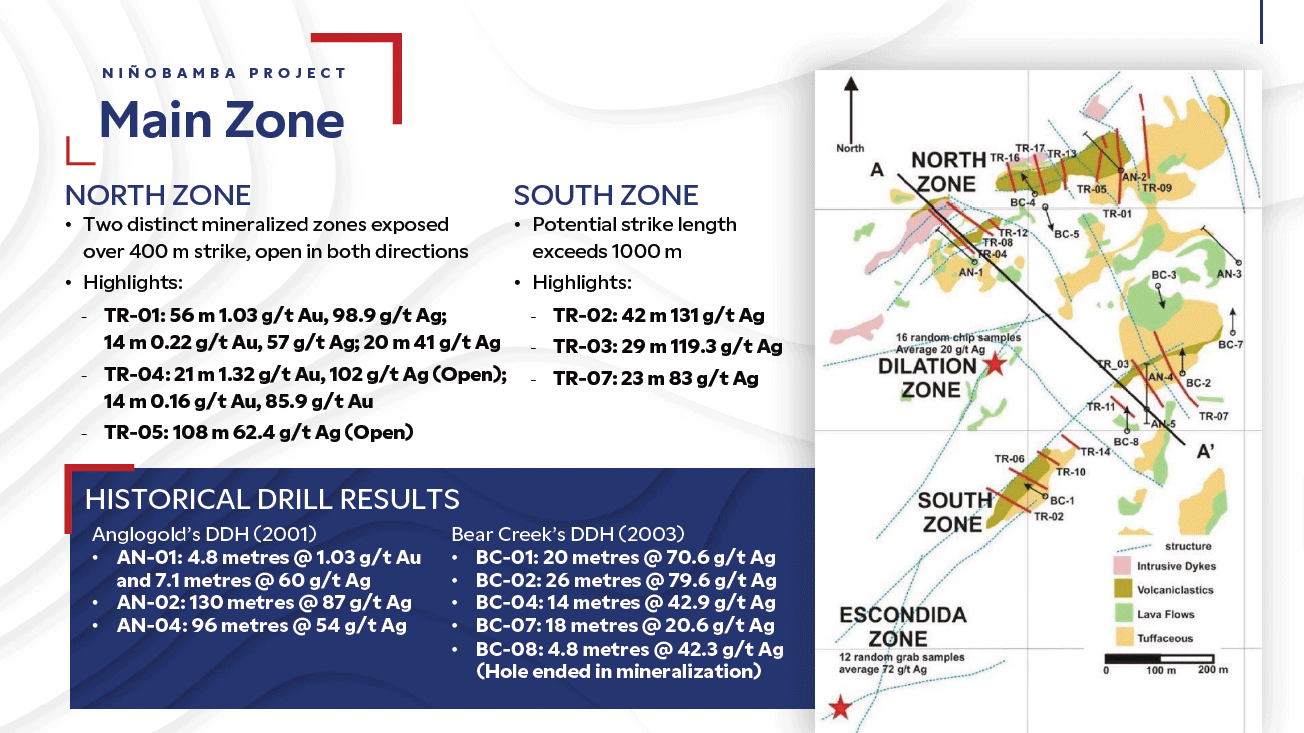

Multiple Zones with Expanding Potential

Niñobamba includes several distinct mineralized zones, including:

- Jormina, where Newmont drilled 4,300+ meters and identified a large gold-silver footprint

- Randypata, with over 3,500 meters of drilling and channel samples showing strong gold-silver values

- Niñobamba Main, where trench results include 56 meters of 1.03 g/t gold and 98.9 g/t silver

These zones have never been part of a unified exploration program until now.

Magma Silver (TSXV: MGMA);(OTCQB: MAGMF);(FSE: BC21) is the first company to consolidate the entire district, and it believes the combined resource could be far greater than the historical figures suggest.

Could Magma Resources Become the Next Arequipa Resources “37 Cents to $34.75” Success Story?

As stated earlier, in 1996 a small Canadian junior named Arequipa Resources stunned the mining world. Backed by early financing from Kathren McLeod at just 37 cents per share, the company began exploring a high-sulfidation gold system in Peru.

Arequipa’s deposit was of the same deposit type and structural setting s Magma Silver’s Niñobamba Project today.

Arequipa’s drill results were so compelling that within a year, the company attracted an $800 million buyout from Barrick Gold.

“Arequipa Accepts Sweetened Bid of $800 Million from Barrick”

Its share price exploded, soaring from 37 cents to $34.75, delivering one of the most legendary returns in Canadian mining history.

Today Magma Silver controls a similarly structured system, with modern geological modeling, underexplored trench extensions and a tight share structure.

The setting is familiar. The early signs are promising. The opportunity is at hand.

Could Magma Silver (TSXV: MGMA);(OTCQB: MAGMF);(FSE: BC21) become the next great Peruvian success story?

Magma Silver’s Management Team Has a Proven Track Record of Success

Magma Silver (TSXV: MGMA);(OTCQB: MAGMF);(FSE: BC21) is led by a seasoned group of professionals with experience in exploration, capital markets and M&A.

This impressive team includes:

Stephen Barley – CEO & Executive Chairman

Mr. Barley has over 40 years of experience in public corporate affairs, corporate finance, and securities law. After 15 years in private practice, he became president of CHM Financial Services Inc. in 1997, advising and investing in resource and technology companies. He has held executive and director roles in TSX-listed resource firms with major international projects.

Michael Townsend – Director

Mr. Townsend has extensive experience in corporate finance spanning over 30 years in Capital Markets. Mr. Townsend is one of the founding partners of Altus Capital Partners, a boutique investment bank based in Vancouver, B.C. Altus has been involved in raising over $180-million in equity financings over the past five years. Mr. Townsend co-founded Hemptown, Patriot One Technologies Inc., and Body and Mind Inc., Raytec Metals Corp., and previously served as CEO of Lateegra Gold Corp. and CEO of West Hawk Development Corp.

Jason Baker – Director, CFO & Corporate Secretary

Mr. Baker has a solid background in accounting and financial analysis, including over 15 years of experience in the service industry, which has enriched his expertise in investor relations and corporate development. His experience extends to junior mining companies, including Scorpio Gold, where he has contributed to strategic growth and investor communications.

Joe Sandberg, MBA – Advisor

Mr. Sandberg is a Professional Geologist and holds an MBA. He has over 45+ years’ experience in exploration on precious metals and copper porphyry systems. He was the President and CEO of a TSX-listed copper exploration company that was successfully sold to another public company. Under Canadian NI 43-101 regulations, he is defined as a Qualified Person who can sign public reports (reporting mineral exploration results).

Arndt Roehlig – Director

Mr. Roehlig is an independent director who has served on numerous Canadian public company boards operating in the resource and technology sectors. As president and chief executive officer of various companies, Mr. Roehlig has raised millions of dollars for TSX Venture Exchange and CSE listed companies.

Jeffrey J. Reeder, P. Geo – Technical Advisor

Mr. Reeder has a B.Sc. from the University of Alberta and since 1992 has been registered as a professional geologist with the Association of Professional Engineers and Geoscientists of British Columbia. Mr. Reeder has over 30 years of experience in Peru and is fluent in Spanish. Mr. Reeder is responsible for identifying and acquiring both Aguila Copper-Moly being developed by Mexican mining company Industrias Peñoles and Pinaya Copper-Gold project currently being explored by Kaizen Discovery.

Investor’s Summary

Magma Silver (TSXV: MGMA);(OTCQB: MAGMF);(FSE: BC21) Offers Significant Upside Potential

Magma Silver (TSXV: MGMA);(OTCQB: MAGMF);(FSE: BC21) could be one of the most compelling, high-upside exploration opportunities available to investors today. Here’s why:

- Massive Resource Potential: The company has 100% interest in a large-scale asset spanning 4,100 hectares where over CAD $14.5 million in drilling, sampling and geological studies have been conducted

- Tight Share Structure: Fewer than 45 million shares fully diluted

- Proven Mineralized System: Drill, trench and metallurgy work have already confirmed a large, near-surface mineralized system

- Large-Scale Upside Potential: Multiple zones over 8 km, with potential to link into one large system

- Bull Market Opportunity: The company is well-positioned to benefit from rising gold and silver prices over the coming months

- Near-Term Catalysts: Drill permits, community agreements and trenching/drilling are planned in the coming quarters

With a sub-$10 million market cap and a proven asset in a world-class jurisdiction, Magma Silver (TSXV: MGMA);(OTCQB: MAGMF);(FSE: BC21) offers early investors a rare opportunity to get in on an exploration stock that could become the next Arequipa-style success story.

[i] https://www.reuters.com/markets/commodities/jp-morgan-see-gold-prices-crossing-4000oz-by-q2-2026-2025-04-22/

[ii] https://www.wsj.com/articles/SB84021309867994000?gaa_at=eafs&gaa_n=ASWzDAilSvminC

bhOebewV0OyboGPMtjSKHUwZtXDrVhU8hKcQ

B3WmwxoOqZbrPluwQ%3D&gaa_ts=68505d6

3&gaa_sig=ulIfkINLDSMIsbtfV0L9sYBu7AeAT_

JiNizlcqTtnKZ0d0Q1n2kOdHO1J5-30Igq

x74wKx6QBa1olnR7walUIg%3D%3D

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer, Magma Silver Corp. (MGMA), Winning Media LLC has been hired for a period beginning on 6/26/25 and ending on 7/26/25 to conduct investor relations advertising and marketing and publicly disseminate information about Magma Silver Corp. (MGMA)) via Website, Email and SMS. Winning Media has been compensated the sum total of fifty thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Magma Silver Corp. (MGMA)

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of Magma Silver Corp. (MGMA). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.