Sponsored – Est. Read 7 Min

Investor Alert:

Unique, High-Upside Potential from What Could Be a Multi-Year Bull Market

URGENT: With limited global supply and soaring demand for copper, an early-stage growth opportunity is rapidly emerging…

Gladiator Metals (TSXV: GLAD); (OTCQB: GDTRF) now offers investors significant upside potential thanks to its expanding, high-grade copper prospects.

7 Key Reasons Why You Should Strongly Consider Gladiator Metals (TSXV: GLAD); (OTCQB: GDTRF) Today

1

The Perfect Time: A Long-term Bull Market for Copper Has Just Begun

Copper is now in the early stages of what appears to be a long-term, multi-year bull market. With soaring demand for the copper needed in electric vehicles, the power grid, data centers and more there is significant upside potential for those companies bringing copper supplies online.

2

The Perfect Location: The Whitehorse Copper Belt

The Whitehorse Copper Belt in Yukon, Canada is a Tier 1 jurisdiction with a rich history of mining and home to multiple gold and base metal resource projects owned by some of the world’s largest miners. In addition, the Whitehorse Copper location offers year-round access, convenient infrastructure and a skilled local workforce.

3

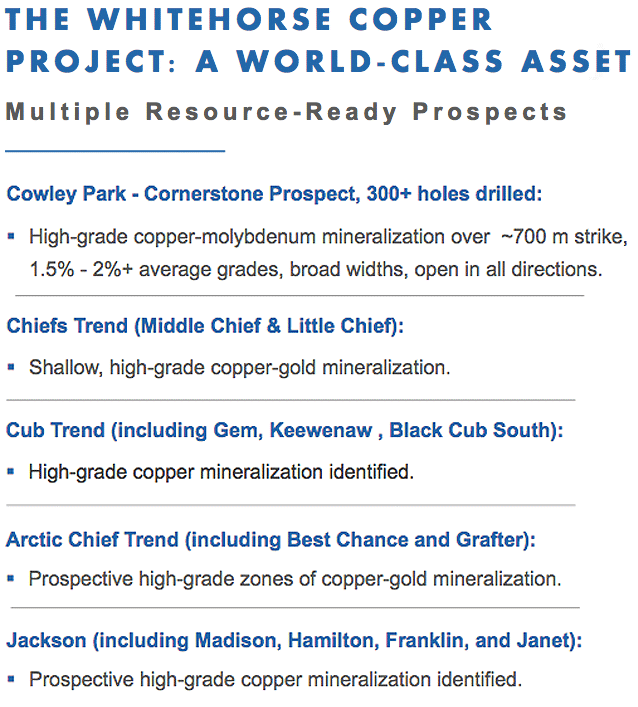

A Potentially World-Class Copper Asset with Multiple High-Grade Prospects

Gladiator Metals’ Whitehorse Copper Project is a potential world class asset with multiple resource potential prospects. This includes the Cowley Park copper prospect, where, historically, over 300 holes have been drilled and is preparing for an initial resource definition drill campaign.

4

An Expansive Drilling Campaign is Now Underway

For those investors looking to take advantage of the high-upside supply/demand scenario for copper, the time to act is now. And when it comes to Gladiator Metals, the timing is key because the drilling program now underway – at high-grade copper skarns throughout the Whitehorse Copper Belt – could elevate the company on its way to establishing a significant, high-grade copper resource.

5

The Company’s Projects Appear to Offer High-Grade Copper Potential

Typical grades for copper resources range from .3% to .6% yet many of Gladiator Metals’ prospects appear to offer significantly higher grades. Drill results at Cowley Park have indicated average grades of 1.5% – 2% or more with similar, high-grade copper mineralization also identified at its other locations within the company’s Whitehorse Copper Project.

6

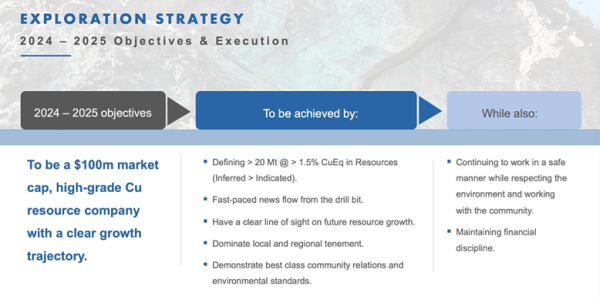

Compared to its Peers, Gladiator Metals Could Be Significantly Undervalued

Gladiator Metals (TSXV: GLAD); (OTCQB: GDTRF) exploration plans are targeting a potential for up to a 100mt+, high-grade copper resource company with a clear growth trajectory. As it moves along its timeline, the company offers what appears to be tremendous value when compared with other companies with high grade copper resources in Tier 1 jurisdictions. When compared with companies such as Foran Mining (TSX: FOM), with a CAD $1.4 billion market capand Arizona Metals Corp (TSX: AMC), with a CAD $210 million market cap, Gladiator Metals’ CAD $23 million market cap appears to have plenty of room for growth.

7

An Experienced Management Team with a Proven Track Record

The company is led by an experienced team of resource company builders with a proven track record of finding and bringing deposits into production. This includes CEO and Director Jason Bontempo, with over 20 years in public company management… President Marcus Harden, with over 20 years leading global exploration projects worldwide… Director Shawn Khunkhun, with over 20 years of experience in capital markets and mineral exploration… and VP of Exploration Kell Nielsen, a geologist with over 30 years of experience and who was instrumental in the development of a number of large resource projects for Placer Dome.

Breaking News

Gladiator Recommences Drilling with Two Rigs at Cowley Park

On August 27, 2024, Gladiator Metals (TSXV: GLAD); (OTCQB: GDTRF) announced that drilling had recommenced with two rigs at the company’s high-grade advanced Cowley Park copper prospect.

To learn more, click here

With Copper in the Early Stages of a Multi-Year Bull Market, Gladiator Metals (TSXV: GLAD); (OTCQB: GDTRF) Offers Significant Upside Potential

We are – at this very moment – in the early stages of what is shaping up to be a multi-year bull market for copper.

After bottoming at around $2.00 per pound back in 2016, copper has seen a steady climb.

Within the past year – between September 2023 and June 2024 – the price of copper shot up more than 26% to $4.82 before pulling back a bit in late summer.

Why has copper performed so well? And what makes it likely to see a sustained, long-term bull market?

The answer is demand.

Copper is a critical component of the world’s energy transition.

Electric vehicles, for example, use over twice as much copper as gasoline-powered cars. Millions of feet of copper wiring are needed to help strengthen the world’s grids. And wind and solar farms will require thousands of tons of copper as well.

Mining.com recently wrote that, “According to the experts at McKinsey, global electrification is expected to increase annual copper demand to 36.6 million tonnes by 2031, compared to the current demand of roughly 25 million tonnes. However, the consultancy firm forecasts copper supply to be around 30.1 million tonnes, leaving a gap of 6.5 million tonnes by the start of next decade.”[i]

And the experts at S&P Global Market Intelligence project that by 2035, global copper demand will nearly double to more than 50 million tons per year.[ii]

Compare that with last year’s global copper mine production of 22 million tons…and you can see that the supply-demand imbalance becomes even greater.

Legendary investor Stanley Druckenmiller – owner of one of the most impressive Wall Street track record ever seen – is extremely bullish on copper, recently saying:

As this bull market for copper unfolds, investors may find a number of ways to play this scenario, including investing in major copper producers or even a copper ETF.

But one little-known Canadian company that is right now advancing the exploration of multiple, high-grade copper assets may offer the highest upside potential in copper.

That company is Gladiator Metals (TSXV: GLAD); (OTCQB: GDTRF).

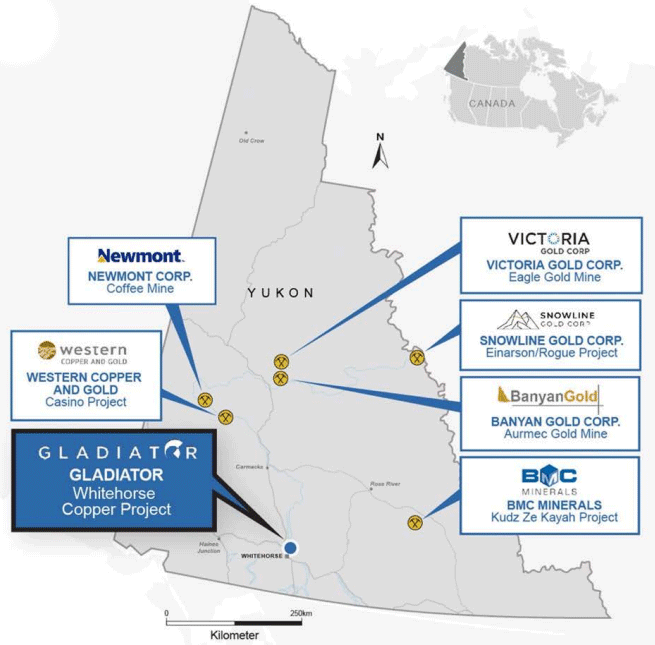

The Yukon: Home to Multiple Gold and Base Betal Resource Projects Owned by Some of the World’s Largest Miners

The Whitehorse Copper Belt is located in Yukon, Canada and consists of a roughly 35-kilometer belt of copper-gold ore deposits and mineral occurrences.

The region is home to multiple copper and gold resource projects owned by some of the world’s largest miners, including Newmont Corp., Snowline Gold Corp, Banyan Gold Corp., Western Copper and Gold and more.

This is a stable, Tier 1 jurisdiction that offers world-class discovery potential yet today remains vastly under-explored. The Whitehorse Copper Belt, due to its location on the western margin of Whitehorse City, is home to year-round access, convenient infrastructure and a skilled local workforce in addition to other key benefits.

Within the Whitehorse Copper Belt, Gladiator Metals (TSXV: GLAD); (OTCQB: GDTRF) is strategically advancing its multiple resource-ready prospects.

Cowley Park: A “Sleeping Giant” of a Property

Gladiator Metals’ Cowley Park is its cornerstone project with more than 300 holes historically drilled on the property.

The project features high-grade copper-molybdenum mineralization over 700 meters of strike, broad widths, and is open in all directions.

Most importantly, the mineralization is at average grades of 1.5% – 2%+.

Drilling completed by Gladiator has confirmed broad widths and continuity of copper- molybdenum mineralization from near surface consistent with historical results.

Additionally, a new copper-molybdenum mineralization zone (CPG-015) from 204m was discovered 50 meters south and underneath of the historical drilling area, highlighting the potential exploration upside and under-explored nature of Cowley Park.

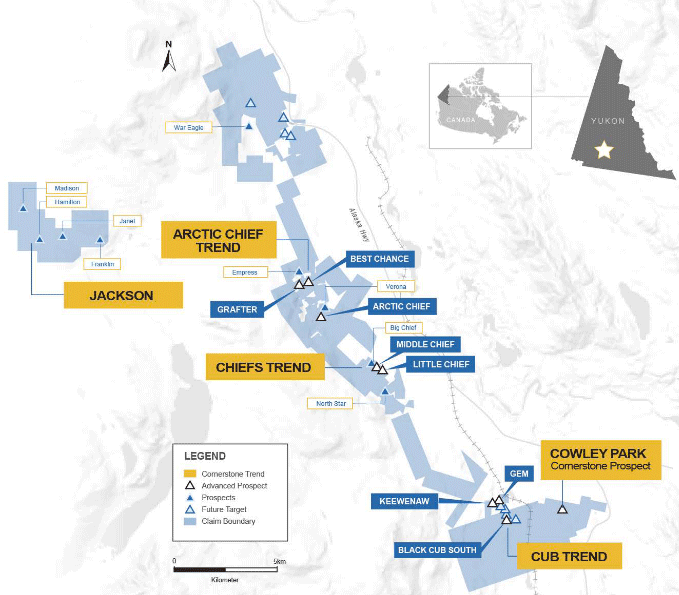

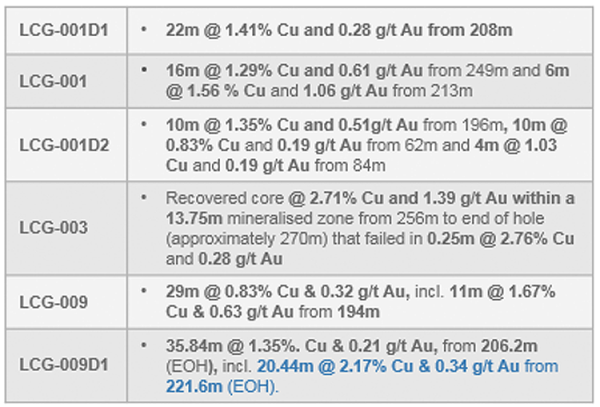

Drill results have indicated high-grade copper skarn mineralization open along strike and at depth, including:

Refer to Gladiator Metals News Release dated XXXX

Urgent: Drilling Has Recommenced at Cowley Park as Gladiator Metals Wakes This Potential Sleeping Giant

What is most interesting about the company’s Cowley Park project, however, is what is happening right now.

That’s because Gladiator Metals is right now working to wake this potential “sleeping giant” of a property, having recently announced that drilling has recommenced with two rigs at the project.

5,000 meters within a fully funded and planned 13,000-meter summer drill program is scheduled over four sections at Cowley Park targeting both the resource potential and exploration upside of high-grade copper skarn mineralization.

Drilling will test exciting new shallow, undrilled, chargeability anomalies identified from recently completed Induced Polarization (IP) surveys, potentially related to unrecognized copper sulphide bodies.

Recent geological modelling of the Cowley Park prospect has identified multiple areas of significant exploration upside, which will be the subject of planned exploration drilling, including:

Whitehorse Copper Project Highlights:

>

Southeastern extension: The interval in CP-159 represents the most south easterly intercept of copper skarn mineralization to date, with mineralization remaining open under cover.

>

Northeastern extension: The most north-easterly copper-skarn intercept at Cowley Park is 43.28m @ 2.24% Cu from 93.27m, including 13.72m @ 5.41% Cu (19-CP-08) with mineralization remaining open to the east under cover.

>

Sub Parallel trends: Additional, unexplored sub-parallel trends under cover indicated by initial drilling including 10m @ 1.23% Cu from 204m in CPG-015.

>

Western extension: Recent mapping undertaken at Cowley Park has identified a significant fault that may have displaced the main mineralized body on the western side, opening up significant potential for the mineralization to extend west.

>

Depth extensions: Mineralization remains open at depth with the deepest intervals drilled to date, including 14.33m @ 1.22% Cu from 130.15m (18-CP-03) including 5m @ 2.78% Cu, remaining open at depth.

The drilling program now underway at Cowley Park has the potential to significantly advance the value of Gladiator Metals (TSXV: GLAD); (OTCQB: GDTRF).

Here’s why:

While the Cowley Park prospect has the historical work to serve as a guide, the work that is being done on-site now is designed to confirm the true potential of Cowley Park with modern technology and up-to-date information.

The true potential of Cowley Park – given the multiple areas of exploration upside that have been identified – could be the catalyst that propels the company forward in a major way.

Let’s say that this drilling program confirms that the potential exists at the property for 20 million tons – or more – of 1.5% grade copper.

That has the potential at current copper prices to translate into net free cash flow of roughly $1 billion over 10 years.

Again, that’s an absolute game-changer for an under-the-radar company whose current market cap is just CAD $21 million.

And Cowley Park is just one of the company’s multiple resource-ready prospects in the Whitehorse Copper Belt.

Chiefs Trend: Significant Copper Mineralization

and Upside Potential

The Little Chief prospect is the largest historically producing mine in the Whitehorse Copper Belt with total mining production of 8.54 million tons grading at >1.5% Copper and ~0.85% gold[5].

And the company appears confident that it will see more potential at this site in the future.

Mineralization at Little Chief appears to be intact and open to the south, down plunge and up dip.

The Middle Chief prospect contains historic drilling completed from underground drives. Compiled historical data at this prospect indicates a significant body of shallow mineralization (120 meters below surface) may exist at the Middle Chief prospect.

Minimal drilling has been completed from surface, meaning significant potential for “up dip” mineralization remains.

Gladiator Metals commenced a diamond drill program at the Middle Chief prospect in early 2024 and mineralization has now been defined with over 500 meters of strike.

Drill results received for 20 holes returned significant copper and gold mineralization, including:

The Bottom Line: Gladiator Metals (TSXV: GLAD); (OTCQB: GDTRF) Appears Poised for Significant Growth and Offers Investors Smart Exposure to the Copper Bull

Gladiator Metals (TSXV: GLAD); (OTCQB: GDTRF) right now offers investors a unique opportunity in the copper exploration space.

The company’s significant resource potential – located in a Tier 1 jurisdiction with a strong history of production – is especially attractive.

Given the potential for a multi-year bull market in copper, Gladiator Metals would appear to offer smart exposure to copper with a high-upside resource in an outstanding location.

In addition, the company’s current market cap of just CAD $23 million means there is significant re-rate potential as the size and scope of its resource becomes more clear through its current drill program.

Another important point to consider is risk…

This is a CAD $23 million market cap company with $9 million in the bank…and at the completion of its current drill program it will have earned 100% of its high-upside, high-grade copper project based on its earn-in option agreement.

Given the potential upside associated with copper exploration at this point in the bull market, Gladiator Metals represents a significant opportunity with limited downside risk and is worthy of strong consideration.

7 Key Reasons Why You Should Strongly Consider Gladiator Metals (TSXV: GLAD); (OTCQB: GDTRF) Today

1

The Perfect Time: A Long-term Bull Market for Copper Has Just Begun

Copper is now in the early stages of what appears to be a long-term, multi-year bull market. With soaring demand for the copper needed in electric vehicles, the power grid, data centers and more there is significant upside potential for those companies bringing copper supplies online.

2

The Perfect Location: The Whitehorse Copper Belt

The Whitehorse Copper Belt in Yukon, Canada is a Tier 1 jurisdiction with a rich history of mining and home to multiple gold and base metal resource projects owned by some of the world’s largest miners. In addition, the Whitehorse Copper location offers year-round access, convenient infrastructure and a skilled local workforce.

3

A Potentially World-Class Copper Asset with Multiple High-Grade Prospects

Gladiator Metals’ Whitehorse Copper Project is a potential world class asset with multiple resource potential prospects. This includes the Cowley Park copper prospect, where, historically, over 300 holes have been drilled and is preparing for an initial resource definition drill campaign.

4

An Expansive Drilling Campaign is Now Underway

For those investors looking to take advantage of the high-upside supply/demand scenario for copper, the time to act is now. And when it comes to Gladiator Metals, the timing is key because the drilling program now underway – at high-grade copper skarns throughout the Whitehorse Copper Belt – could elevate the company on its way to establishing a significant, high-grade copper resource.

5

The Company’s Projects Appear to Offer High-Grade Copper Potential

Typical grades for copper resources range from .3% to .6% yet many of Gladiator Metals’ prospects appear to offer significantly higher grades. Drill results at Cowley Park have indicated average grades of 1.5% – 2% or more with similar, high-grade copper mineralization also identified at its other locations within the company’s Whitehorse Copper Project.

6

Compared to its Peers, Gladiator Metals Could Be Significantly Undervalued

Gladiator Metals (TSXV: GLAD); (OTCQB: GDTRF) exploration plans are targeting a potential for up to a 100mt+, high-grade copper resource company with a clear growth trajectory. As it moves along its timeline, the company offers what appears to be tremendous value when compared with other companies with high grade copper resources in Tier 1 jurisdictions. When compared with companies such as Foran Mining (TSX: FOM), with a CAD $1.4 billion market capand Arizona Metals Corp (TSX: AMC), with a CAD $210 million market cap, Gladiator Metals’ CAD $23 million market cap appears to have plenty of room for growth.

7

An Experienced Management Team with a Proven Track Record

The company is led by an experienced team of resource company builders with a proven track record of finding and bringing deposits into production. This includes CEO and Director Jason Bontempo, with over 20 years in public company management… President Marcus Harden, with over 20 years leading global exploration projects worldwide… Director Shawn Khunkhun, with over 20 years of experience in capital markets and mineral exploration… and VP of Exploration Kell Nielsen, a geologist with over 30 years of experience and who was instrumental in the development of a number of large resource projects for Placer Dome.

[i] https://www.mining.com/the-global-copper-market-is-entering-an-age-of-extremely-large-deficits/

[ii] https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/energy-

transition/071422-world-copper-deficit-could-hit-record-demand-seen-doubling-by-2035-s-p-global

[iii]https://www.nmlegis.gov/handouts/REOTF%

20091922%20Item%202%20%20The%20Future

%20of%20Copper%20Executive%20Report.pdf

[iv] https://finance.yahoo.com/news/copper-why-multi-bull-market-124600246.html

[v] https://www.gladiatormetals.com/projects

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer Gladiator Metals Corp., Winning Media LLC has been hired for a period beginning on 09/08/24 and ending on 10/08/24 to conduct investor relations advertising and marketing and publicly disseminate information about Gladiator Metals Corp. via Website, Email and SMS. Winning Media has been compensated the sum total of eighty thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Gladiator Metals Corp.

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (GLAD). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.