Sponsored – Est. Read 8 Min

Rising Global Demand for Critical Minerals Signals Potential High-Upside Play for Investors

Note: Significant growth scenario may be unfolding for one little-known company…

Here’s why Troy Minerals (CSE: TROY); (OTCQB: TROYF) could be a fast mover.

7 Critical Reasons Why You Should Consider Troy Minerals (CSE: TROY); (OTCQB: TROYF) Today

1

Smart Exposure to a Growing Megatrend – Global demand for strategic minerals, such as high-purity silica, vanadium and titanium is increasing rapidly thanks to the shift toward renewable energy, electric vehicles and advanced technologies. But the markets for these critical minerals are currently dominated by China, meaning that the race is on to bring new supplies online and reduce the West’s dependence on China’s supply.

2

Troy Minerals Boasts an Impressive Portfolio of Assets – With a diverse lineup of four projects in strategic locations, Troy Minerals is well-positioned for growth. The company is aiming to move towards production at its first project – a high-purity silica project in Mongolia – in Q3 2025. The company is also advancing a North American silica project as well as a vanadium/titanium project in Wyoming and a Rare Earth Elements (REE) project in Quebec.**

3

This is Not Your Father’s Mining Company – Unlike gold mining stocks, whose success is often tied to the fluctuating price of gold, strategic industrial metals and minerals operate in a very different market environment. These smaller markets, which are currently seeing increasing demand, often lead to more predictable futures for exploration companies, as offtake agreements can be struck in advance of production.

4

5

Quick to Revenue Projects – Troy Minerals is unique in that at least two of its projects are positioned to generate revenue more quickly than ordinary mining ventures. Unlike, for example, copper projects which can have a ten-year lead time and need massive capital investments in processing plants – thanks to permitting and other issues – from discovery to production, Troy Minerals is well positioned to move quickly on projects with near-term cash flow potential.

6

Troy Minerals Represents an Undervalued Opportunity –

Troy Minerals is trading at a valuation that provides for significant potential growth as its projects advance, using comparisons to other companies focused on silica and other critical metals. For example Homerun Resources (TSXV: HMR) which holds silica projects in Canada and Brazil, has a market cap more than six times greater than Troy Minerals, with Troy Minerals holding not only similar assets in the silica space, but also being well diversified with the vanadium, titanium and REE projects. That exemplifies the potential for short-term valuation growth for early investors with Troy Minerals.

7

Experienced, Strong Leadership is Guiding this Venture – Troy Minerals is led by a team with decades of industry experience and a strong track record in transformative acquisitions, mining discoveries, project execution and strategic growth. CEO Rana Vig alone has more than 30 years of business experience and has repeatedly delivered value for shareholders. Troy’s new President Yannis Tsitos has more than 35 years of experience in diverse jurisdictions across the globe, including economic mining discoveries, mergers and acquisitions and project development from inaugural drill hole to mineral off-take agreements and sales.

Breaking News: Troy Minerals Submits Drilling Permit Application for Table Mountain Silica Project, British Columbia

On December 11, 2024 Troy Minerals Inc. (CSE: TROY); (OTCQB: TROYF) announced the submission of a drilling permit application for the Table Mountain Silica Project in British Columbia, a key milestone for the company.

Troy Minerals (CSE: TROY); (OTCQB: TROYF) Appears Well Positioned to Offer Significant Upside Potential in Both the Short- and Long-Term

One of 2025’s most attractive “megatrend” opportunities is now unfolding…

And it’s happening in a market that has been largely overlooked by the mainstream media.

The rapid adoption of electric vehicles, renewable energy and advanced technologies has triggered a growing global megatrend.

Without question, the world’s energy needs are changing rapidly, and as a result global demand for strategic minerals is also increasing.

This includes high-purity silica, vanadium and titanium.

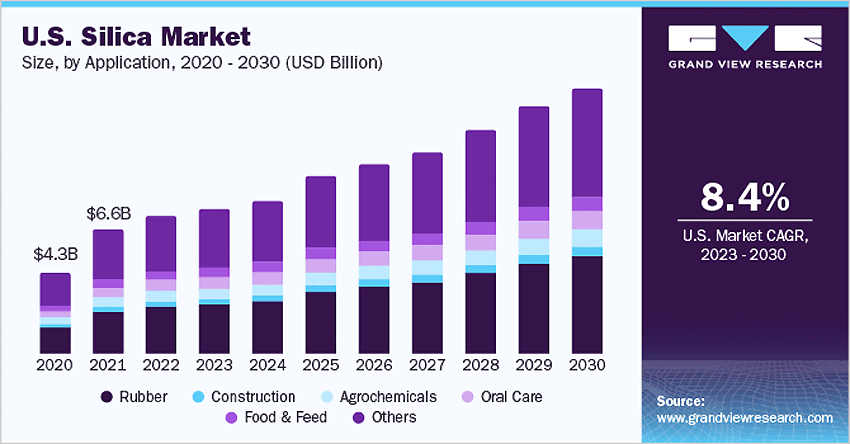

According to the experts at Grand View Research, the global market for silica was most recently valued at $49.12 billion…and this market is projected to grow at a compound annual growth rate (CAGR) of 9.9% — to $104.34 billion – by 2030.[ii]

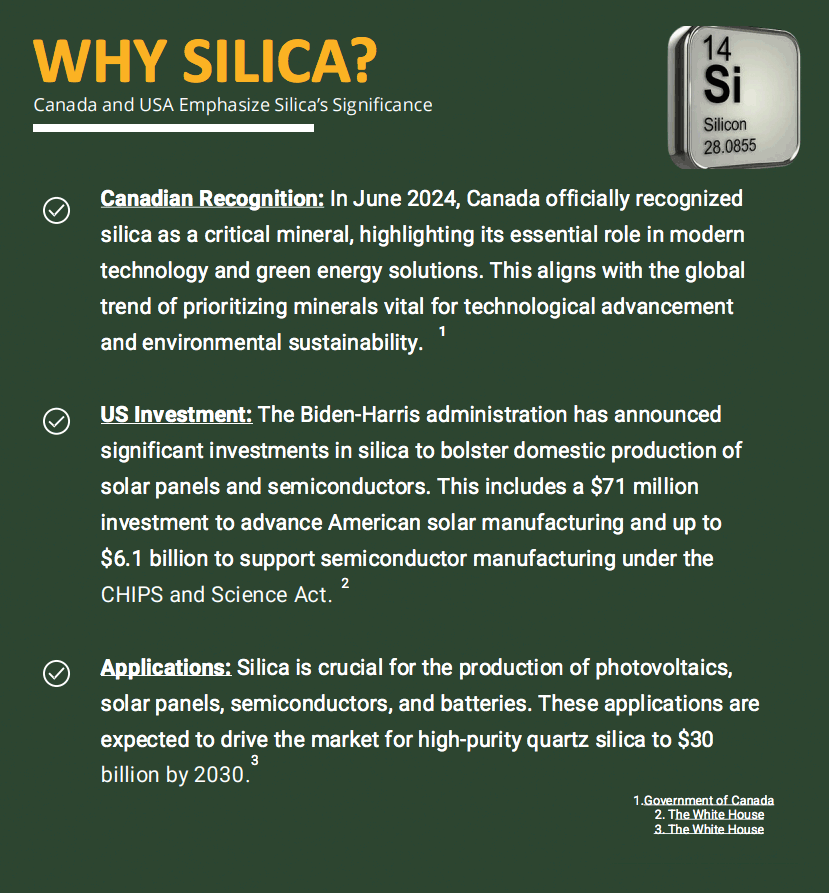

That’s because silica has proven to be essential for its wide range of applications in things such as high-performance glass, semiconductors, solar panels, concrete, pharmaceuticals and more.

But just as the world is seeing rapidly increasing growth in demand for strategic minerals such as silica…the silica market is largely being controlled by China, which accounts for roughly 70% of global production.[iii]

Obviously, given the importance of critical minerals such as silica, the Western world is moving quickly to establish new sources of supply and break free from China’s near-monopoly.

For example, the U.S. government recently announced significant investments in silica to bolster domestic production of solar panels and semiconductors.v

And Canadian Sinova Global, of the highly successful mining entrepreneur, Sir Mick Davis, is currently investing $150 million to build a state-of-the-art silicon metal production facility in Tennessee.[iv]

This push to move away from reliance on Chinese supply means that those companies who show the potential for bringing new supplies online in the near-term could generate a significant amount of attention and potentially see swift increases in valuation.

One such company is Troy Minerals Inc. (CSE: TROY); (OTCQB: TROYF).

Troy Minerals is a company that’s positioning itself to be at the forefront of the exploration and development of strategic minerals essential for modern technology and green energy solutions.

The process is relatively easy for HPS (High-Purity Silica) rock: Blast – Scoop – Load!

The company is currently aiming to move towards near-term production of its strategic minerals silica projects, part of what is fueling the global energy transition.

And Troy Minerals is positioning itself to potentially become a key player in the high-purity silica market with projects that offer significant near-term upside potential.

With an impressive portfolio of assets – including four strategically-chosen properties – the company aims to do extensive exploration and advancement of its projects to position itself to play an important role in helping the Western world reduce its dependence on foreign supplies of strategic minerals.

Troy Minerals following its strategic acquisition of CBGB Ventures in 2024, appears to be in great position for potential investors looking for significant upside potential in 2025. It offers near-term production potential as well as significant blue sky in a market that is seeing an historic surge in demand in all three main jurisdictions, North America, Asia and Europe.ii

The company is led by an experienced management team with a proven track record of success and Troy Minerals is in good financial position while its shares still appear to be undervalued.

Troy Minerals is Advancing an Impressive

Portfolio of Strategic Mineral Projects with

Significant Near-Term Upside Potential

Troy Minerals’ projects include the Tsagaan Zalaa silica rock project in Mongolia; the Table Mountain high-purity silica rock project in British Columbia; the Lac St. Jacques Rare Earth Elements (REE) in Quebec Canada, and the Lake Owen vanadium, titanium and iron ore project in Wyoming.

These projects were chosen for their significant upside potential as well as their ease of access, all located close to regional infrastructure. Troy Minerals specifically targets high-purity as well as important resources in strategic locations and looks to ensure operational efficiency.

To put it another way, unlike more complex mining projects, Troy Minerals is focused on at least two opportunities that offer the potential to simply (1) Blast, (2) Scoop, and (3) Load.

Here’s a quick look at their high-purity silica, vanadium and REE projects which appear well positioned for substantial growth:

Project #1: Tsagaan Zalaa Silica Project

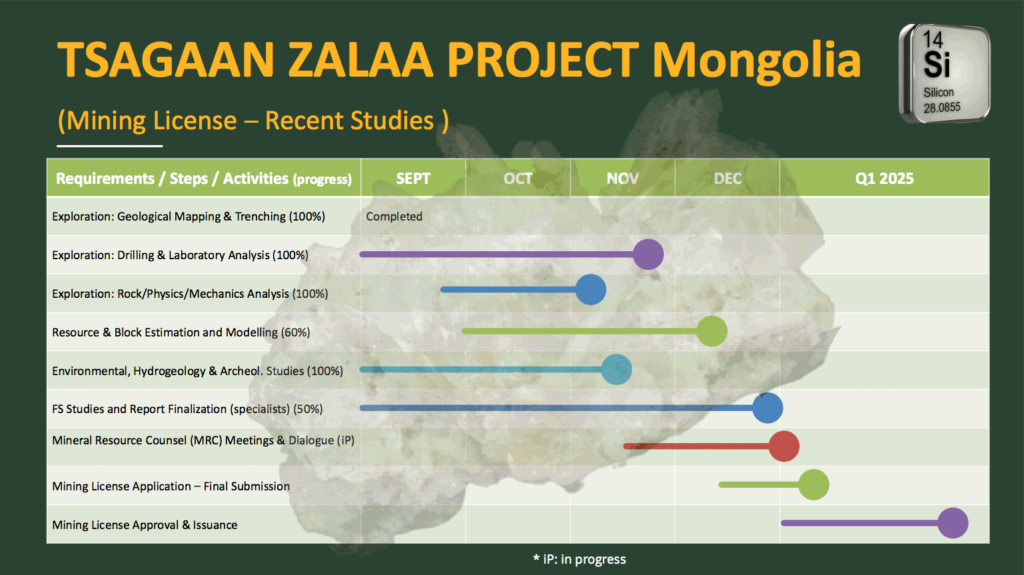

Troy Minerals’ (CSE: TROY); (OTCQB: TROYF) Tsagaan Zalaa Silica Project is located in Mongolia, near the China-Mongolia border.

The property is strategically positioned next to major high-purity silica-consuming countries which helps reduce transportation costs and simplify supply chain logistics to countries with high levels of demand, including China, Korea and Japan.

This property is a significant landholding with a 10-tonne bulk sample reporting 99.98% SiO2 purity after beneficiation with run of mine material. (For more information see news release June 10, 2024).

The geology of the region is key, as the property is in close proximity to other rich deposits of high-purity silica.

Project Highlights:

•

•

•

•

Currently completed drilling and environmental studies with Mining License Application being prepared for submission before Feburary 15, 2025 with an aim to be in production targeted within 2025.**

Project #2: Table Mountain Silica Project

In British Columbia, Troy Minerals’ Table Mountain Silica Project is a 1,698-hectare property – with accessible infrastructure including roads, power and natural gas – located 8 km east of Golden, BC Canada.

Troy Minerals is working in collaboration with local and regional authorities to ensure efficient project development and production and is aiming a 2026 start for production.**

Project Highlights:

•

•

Relatively quick permitting process and environmentally friendly mining practices

•

Fast cash flow potential with production being targeted to start in 2026**

•

Located on the same lithological unit and in proximity to the Sinova Quartz quarry (six km southwest) and the historic Moberly silica mine (7.5 km northwest)

Project #3: Lake Owen Project

The company’s Lake Owen Project is a 782-hectare prospective vanadium, titanium and iron ore project consisting of 100 mineral claims located approximately 50 km southwest of Laramie Wyoming.

Vanadium is an element essential for steel production and is also widely used in advanced energy storage solutions such as redox flow batteries.

The Lake Owen Project has a large potential of semi-massive to massive titanomagnetite with V2O5 and Ti2O. The tops of cumulates (Reefs) has anomalous PGE (Platinum Group Elements)+- Au. Stillwater PGE Reef potential. Basal zones offer massive sulfide potential. Additional rare metals such as Scandium could be present in such a geological environment.

Historical drilling by Chevron showed strong PGE mineralization in several of the drill holes.

Additionally, the company’s Lake Owen project benefits from the U.S. Geological Survey’s ‘Large-scale Earth MRI’ program, providing geological insights that reduce exploration costs.

Project #4: Lac St. Jacques Rare Earth Project

Troy Minerals’ Lac St. Jacques Project is a 1,169-hectare property with excellent accessibility via roads located 250 km north of Montreal, Quebec.

Rare Earth Elements (REEs) are essential in the building of smartphones, electric vehicles, wind turbines and more.

Rare Earth Elements mineralization associated with pegmatitic syenite to granite intrusives. 2023 drilling returned 0.25% Total Rare Earth Oxide (“TREO”) over 9 meters including 0.71% TREO over 1 meter (LJ23-01) and 0.26% TREO over 5 meters including 0.62% over 1 meter.NR2

For additional information on Lac St. Jacques results see News Release Feb 5, 2024

Troy Minerals is Led by an Experienced Leadership Team with a Strong Track Record of Success

With any exploration/production company one of the most important elements of success is the track record of the team leading the way.

Investors often find that the most successful investments are those where the leaders have a strong track record of building value for shareholders.

And that’s precisely what you’ll find with Troy Minerals.

Troy Minerals is led by a team of industry veterans with decades of experience and proven success in transformative acquisitions, discoveries, project execution and strategic growth.

CEO/Director Rana Vig has over 30 years of professional experience and is building shareholder value at companies like Blue Lagoon Resources where their Dome Mountain Mine just received a Draft Mine Permit for gold and silver production. In 2018, he became the chief executive officer of Lead Ventures Inc. and oversaw and executed on the acquisition and $5-billion-plus reverse takeover of Curaleaf Holdings Inc., which raised $520-million. Also, in 2018, he took the helm of Rockbridge Resources, which he successfully restructured by acquiring, through a reverse takeover, the $2-billion-plus Harvest Health & Recreation, which closed a $300-million financing.

President Yannis Tsitos has over 35 years of experience in the mining industry, having spent 19 of those years with the BHP Billiton group. In his time in the industry, he has lived and worked in South Africa, Ecuador, Greece and United Kingdom, and has been working in Canada since 2000.

He has been instrumental in the identification, negotiation and execution of more than 50 exploration agreements over 11 different commodities with juniors, majors, as well as with state exploration and mining companies. Mr. Tsitos has also been part of two discovery teams with BHP Billiton in porphyry-copper and nickel-sulphide deposits.

On the industrial minerals industry in the last decade, Mr. Tsitos, his partners and their team at First Bauxite Corporation discovered the Bonasika Bauxite deposit (one of the highest average bauxite grade deposits in the world) in Guyana, South America, which is now in production, exporting high quality bauxite to Europe, Americas and China.

Director Norman Brewster has enjoyed a mineral industry career that includes serving on various company boards, financing, and developing the Aguas Tenidas Mine in Spain, and negotiating the purchase of the Condestable Mine in Peru. He also led the committee in reviewing the successful acquisition of Iberian Minerals Corp. by Trafigura Group Pte. Ltd. in an all-cash takeover valued at around $497.8 million.

Bill Cronk, P.Geo, an American geologist with very long experience in the exploration and mining industry has worked with mining leaders such as Dundee Precious Metals and Northern Empire, acquired by New York listed Coeur Mining. In addition, Troy’s contractual collaboration with external technical groups like the European based Mine+ and Canadian based Claimhunt teams provide an exceptional breadth into the metals and minerals exploration and development industry.

The Bottom Line: Troy Minerals (CSE: TROY); (OTCQB: TROYF) Offers Investors Attractive Upside Potential

in a High-Demand and Growing Market

Troy Minerals Inc. (CSE: TROY); (OTCQB: TROYF) offers investors smart exposure to a number of key strategic minerals…

And the company offers this exposure in a carefully-targeted way and a diversifiedproject portfolio, where at least two of its projects are aiming to generate a quick path to cash flow.

The shift toward renewable energy and electric vehicles – combined with soaring demand for advanced technologies – means that strategic minerals are seeing a rapid increase in global demand.

Troy Minerals offers the potential of a fast path to production – with its Tsagaan Zalaa Silica Project aiming to begin production within months in 2025 – as the Western world looks to break free from its reliance on Chinese supplies of these minerals.**

Troy Minerals appears to be a unique exploration and production company that is well-positioned to take advantage of this global megatrend. And given the current valuation of the company’s shares, the potential exists for this overlooked, undervalued company to deliver significant upside in the months ahead.

7 Critical Reasons Why You Should Consider Troy Minerals (CSE: TROY); (OTCQB: TROYF) Today

1

Smart Exposure to a Growing Megatrend – Global demand for strategic minerals, such as high-purity silica, vanadium and titanium is increasing rapidly thanks to the shift toward renewable energy, electric vehicles and advanced technologies. But the markets for these critical minerals are currently dominated by China, meaning that the race is on to bring new supplies online and reduce the West’s dependence on China’s supply.

2

Troy Minerals Boasts an Impressive Portfolio of Assets – With a diverse lineup of four projects in strategic locations, Troy Minerals is well-positioned for growth. The company is aiming to move towards production at its first project – a high-purity silica project in Mongolia – in Q3 2025. The company is also advancing a North American silica project as well as a vanadium/titanium project in Wyoming and a Rare Earth Elements (REE) project in Quebec.**

3

This is Not Your Father’s Mining Company – Unlike gold mining stocks, whose success is often tied to the fluctuating price of gold, strategic industrial metals and minerals operate in a very different market environment. These smaller markets, which are currently seeing increasing demand, often lead to more predictable futures for exploration companies, as offtake agreements can be struck in advance of production.

4

Ideal Timing and Favorable Market Conditions – Demand for strategic metals and minerals is soaring, with silica in especially high demand.ii Simply put, these minerals are desperately needed – from sources other than China – and that means companies showing the potential to bring new supplies online could be handsomely rewarded. And in the midst of this rapidly growing market, Troy Minerals is at an ideal stage, with its first high-purity silica aiming to move towards production within 2025.**

5

Quick to Revenue Projects – Troy Minerals is unique in that at least two of its projects are positioned to generate revenue more quickly than ordinary mining ventures. Unlike, for example, copper projects which can have a ten-year lead time and need massive capital investments in processing plants – thanks to permitting and other issues – from discovery to production, Troy Minerals is well positioned to move quickly on projects with near-term cash flow potential.

6

Troy Minerals Represents an Undervalued Opportunity –

Troy Minerals is trading at a valuation that provides for significant potential growth as its projects advance, using comparisons to other companies focused on silica and other critical metals. For example Homerun Resources (TSXV: HMR) which holds silica projects in Canada and Brazil, has a market cap more than six times greater than Troy Minerals, with Troy Minerals holding not only similar assets in the silica space, but also being well diversified with the vanadium, titanium and REE projects. That exemplifies the potential for short-term valuation growth for early investors with Troy Minerals.

7

Experienced, Strong Leadership is Guiding this Venture – Troy Minerals is led by a team with decades of industry experience and proven success in transformative acquisitions, mining discoveries, project execution and strategic growth. CEO Rana Vig alone has more than 30 years of business experience and has repeatedly delivered value for shareholders. Troy’s new President Yannis Tsitos has more than 35 years of experience in diverse jurisdictions across the globe, including economic mining discoveries, mergers and acquisitions and project development from inaugural drill hole to mineral off-take agreements and sales.

* Cautionary Note

The reader is cautioned that grab samples are selective by nature and may not represent the true grade or style of mineralization across the property.

**Note: The potential for production at Troy’s projects is not based on a feasibility study of mineral reserves demonstrating economic and technical viability, and any production decision made in the absence of such study is subject to increased economic and technical risks of failure. A production decision is subject to the company completing additional and confirmatory exploration work on those projects, and obtaining all necessary permits and licenses required for production.

[i] https://www.cnn.com/2024/05/17/business/critical-minerals-shortage-clean-energy/index.html

[ii] https://www.grandviewresearch.com/industry-analysis/silica-market

[iii] https://waferpro.com/chinas-dominance-in-the-global-silicon-supply/#:~:text=While%20China%20already%20represents%20around,

insulating%20against%20global%20price%20dynamics.

[iv] https://businessfacilities.com/sinova-global-to-establish-silicon-metal-refining-plant-in-tennessee/

[v] https://www.commerce.gov/news/press-releases/2024/10/biden-harris-administration-announces-preliminary-terms-wolfspeed

[NR] https://www.nasdaq.com/press-release/troy-minerals-enters-binding-letter-intent-acquire-cbgb-ventures-corp-2024-06-10

[NR2] https://troyminerals.com/wp-content/uploads/2024/02/TROY-NR_2024-Drill-Results_2024-02-05.pdf

Forward-Looking Statements

This article includes certain statements that may be deemed “forward-looking statements”. All statements in this article, other than statements of historical facts, that address events or developments that Troy Resources Inc. (the “Company”) expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential”, “aims”, “aiming” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include results of exploration activities may not show quality and quantity necessary for further exploration or future exploitation of minerals deposits, volatility of commodity prices, and continued availability of capital and financing, permitting and other approvals, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and Wagner Media, Winning Media LLC has been hired for a period beginning on 2/3/25 and ending on 3/05/25 to conduct investor relations advertising and marketing and publicly disseminate information about Troy Minerals Inc. (TROY via Website, Email and SMS. Winning Media has been compensated the sum total of one hundred twenty five thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Wagner Media.

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (TROY). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.