Sponsored / 5- min Read

Why You Should Not Sleep On This Expected $100 Billion Dollar Market Opportunity(1)

Wake Up And See

Why Analysts Adore This

Little-Known Company.(2)

Quipt Home Medical Corp.

(NASDAQ: QIPT) (TSXV: QIPT)

Proven M&A strategy: In this highly fragmented industry that has over 6,000 providers, M&A has been and is expected to remain Quipt’s largest growth component.

Quipt’s management team has over 100 years of combined experience in healthcare

management and acquisitions with over $500 million in transactions. With nearly $40M of available liquidity, Quipt is positioned to pursue more and larger deals going forward.(8)

Wall Street analysts are practically salivating over this company.(2)

And once you start your research on Quipt Home Medical Corp. (NASDAQ: QIPT) (TSXV: QIPT) you may find yourself agreeing with some of these analysts…

In the US, Quipt is listed on the NASDAQ under the symbol “QIPT”

In Canada, Quipt is also listed under the symbol “QIPT”

The average Price Target assigned by analysts is $10.01 which would represent a potential upside of +120.00% as of April 12th, 2022’s closing price around $4.55.(2)

But as you’ll see, some analysts believe that QIPT could go much much higher (key details below)…(10)(11)(12)(13)(14)

Calculating a rise from the 04/12/2022 opening price of $4.55 to the Beacon Securities Price Target of $16.00 would be an incredible +251.65% Move.

Home Respiratory Device Market Show No Signs Of Slowing Down Post The CV19 Era.(18)

Obesity, smoking, an aging population, and CV19-related illnesses are reportedly contributing to a rise in the need for home therapeutic respiratory devices.(18)

From the onset of chronic obstructive pulmonary disease (COPD) to the demand for continuous positive airway pressure (CPAP) machines, the prevalence of respiratory disorders has pushed the device market to a valuation of $47 billion and projections to reach more than $68 billion by 2032, according to a study by Future Market Insights. (18)

The Global Initiative for Asthma statistics found that an estimated 100 million people will be diagnosed with asthma by 2025.

Numbers like those have contributed to an increase in the need for home humidifiers, nebulizers and oxygen concentrators.

Home Healthcare Market to Receive Overwhelming Hike in Revenues by 2028

According to a report by Transparency Market Research, the global home healthcare market was valued at US$ 238.1 Billion in 2020 and is projected to expand at a CAGR of 10.5% from 2021 to 2028. (19).

Zion market research says the global Home healthcare market accounted for $370.7 Billion in 2020 and is expected to reach $839 Billion by 2028, growing at a CAGR of around 10.1% between 2021 and 2028.(21)

The home healthcare market involves a wide range of medical devices and services that help patients to treat or diagnose various chronic diseases. (19)

These devices and services play an important role in providing cost-effective healthcare to patients.(19)

Home healthcare promises lucrative business opportunities due to an increase in acceptance of home healthcare, technological advancements, and cost-effective alternatives compared to other modalities (i.e. hospital visits). (19)

Factors such as the aging population and the increase in the number of people diagnosed with chronic diseases such as diabetes, cardiac disorders, and respiratory diseases boost the growth of the global home healthcare market. (19)

According to the World Health Organization (WHO), the number of people aged 65 years and above is expected to increase from 605 million to 2 billion by 2050.(19)

Rise in Demand for Home Care Therapeutic Devices (19)

An increase in healthcare costs has led to a rise in patient preference for home-based treatments. Products such as ventilators, nebulizers, and continuous positive airway pressure (CPAP) devices are used by patients to treat, diagnose, and monitor various respiratory diseases in home care settings. (19)

These devices, along with home care services, provide cost-effective healthcare to patients. (19)

Rapid increase in the global geriatric population, the surge in incidence of chronic diseases (including COPD and asthma), and cost advantages of home care devices and services (compared to hospital visits) are the major factors driving the global home healthcare market. (19)

Companies in the global home healthcare market should accelerate their product development and unlock revenue opportunities to obtain competitive benefits. (20)

Market stakeholders are extending their services arms to gain a competitive edge.(20)

Increasing incidences of cardiovascular disorders, diabetes, and respiratory issues boost the demand for home healthcare services. (20)

Market contributors in the global home healthcare market should focus on effective and cost-efficient treatments for the patients. (20)

The awareness for home healthcare services has increased since the past few years, as these services are safer and cost-effective alternatives than the hospital services. (20)

Service providers are expanding their product portfolio by offering at-home services after a deadly respiratory disease recently crippled the globe.(20)

Which could be why so many analysts are issuing a “BUY RATING” on shares of Quipt Home Medical Corp.(2)

Quipt Home Medical Corp. (NASDAQ: QIPT), (TSXV: QIPT) provides in-home medical equipment and supplies, and respiratory and durable medical equipment in the United States. The company also offers management of various chronic disease states focusing on patients with heart and pulmonary disease, sleep disorders, reduced mobility, and other chronic health conditions. In addition, Quipt provides nebulizers, oxygen concentrators, CPAP and BiPAP units, ventilator equipment and aids, daily and ambulatory aides, equipment solutions, power wheelchairs, oxygen therapy, bariatric equipment, bathroom safety products, bilevel positive airway pressure, canes/crutches, continuous positive airway pressure, CPAP masks and accessories, hospital beds, humidifiers, compressors, patient lifts, walkers, products for wound care, and medical equipment for home-based sleep apnea and chronic obstructive pulmonary disease treatments, as well as rents respiratory equipment.(3)

Quipt Services:(4)

Sleep Apnea & Pap Treatment:

In the past 25 years the number of sleep apnea patients in the United States have increased rapidly with some studies putting the figures as high as a 70% increase over this period. As obesity has been proven to be a strong contributing factor in the development of these disorders the number of patients requiring assistance with sleep apnea will likely continue to increase.(4) While the number of patients likely in need of assistance with their sleep apnea is rising, getting assistance and monitoring can be difficult. Quipt Home Medical uses a simple, comfortable and convenient sleep testing system to allow their patients to test at home and simply mail the results back. Once the test is received it is reviewed by one of their board certified sleep doctors and the results returned in a secure fashion. If the patient’s physician then prescribes an assistive airway device Quipt Home Medical is then perfectly positioned to assist the patient with their PAP needs as well. (4)

Home Ventilation:

Quipt Home Medical specializes in the provision of ventilator equipment and aids. QHM enables the ventilator-dependent patient to have as much normalcy as possible in their life while still receiving complex medical treatment. Quipt Home Medical provides both Invasive and Non-Invasive ventilator treatments.(4) Invasive Ventilator treatment can involve ventilation being administered through an endotracheal tube being inserted through the mouth or nose, or through a tracheostomy tube inserted into an incision the neck.(4) Non-Invasive Ventilator treatment involves breathing support through an external interface like nasal prongs or a mask.(4)

Equipment Solutions:

With obesity and its serious array of comorbidities on the rise such as COPD, the need for medical equipment has never been so apparent. (4) Coupled with an increasing number of elderly patients in the United States, you have a skyrocketing demand base for medical equipment ranging from mobility assistance to airway management equipment. (4) With such a varied base of disease states requiring assistive equipment, patients and health systems desire a single solution for their equipment needs.(4) Quipt Home Medical is uniquely positioned to offer a one solution opportunity for patients, hospitals, and physician groups for an overall improved and easier experience.(4)

Daily and Ambulatory Aides:

With a wide variety of products for independent living and mobility, Quipt Home Medical is a leading provider of daily living aids. Quipt offers a wide range of simple and practical aids for everyday activities like eating, dressing, bathing and walking, helping to make life a little easier. (4) With Quipt Home Medical patients can rediscover their independence using our complete range of walking aids, get a good night’s sleep with our sleeping and resting solutions and make everyday life easier with our independent living products. Quipt’s patients can also relax in comfort and safety with the company’s wide range of home aids, enjoy cooking, eating and drinking with its general kitchen aids and bath independently with its bathroom solutions.(4)

Power Mobility:

Quipt Home Medical is committed to offering a wide variety of complex power wheelchair options, each incorporating specific items and components to address it’s patients specific needs.(4) Whether it be addressing its patient’s seating and positioning concerns, alternative drive opportunities, or access and maneuverability in its patient’s home and environment the company’s certified ATPs will find the complex power wheelchair that helps conquer the patient’s challenges of daily living. (4)

Respiratory Equipment Rental:

Quipt Home Medical takes pride in making sure every piece of medical equipment it rents is maintained to the highest quality standards. From BiPAP and CPAP machines to Oxygen Concentrator and Ventilators. QHM rents a variety of the latest and most popular respiratory therapy equipment for adult and pediatric respiratory care. (4) QHM allows facilities to offer critical therapies to their patients without any upfront investment in equipment through our equipment rental program. (4) Quipt enables its patients to rent stand-alone equipment or a complete therapy option with or without the services of a Respiratory Therapist. (4) Quipt offers flexible rental options to meet the needs of any facility whether its patients are a SNF with a 25-bed ventilator wing or a nursing home wishing to have only one ventilator on-hand in case of an emergency. (4) Quipt rents its equipment by as little as the day and provides volume discounts with no long-term contracts. (4)

Oxygen Therapy:(4)

Recent studies have shown an aggressive increase in the utilization of oxygen among COPD patients. (4) With this increase of over 15% in just a few years alongside the growth of other disease states the home oxygen market is undergoing rapid expansion. (4)

Quipt Home Medical is poised to effectively serve this expanding market through both current geographical distribution alongside a large team of respiratory therapists trained to help reduce readmissions from disease state complications.(4)

Easy access and higher quality results are a keystone of QHM’s philosophy. (4)

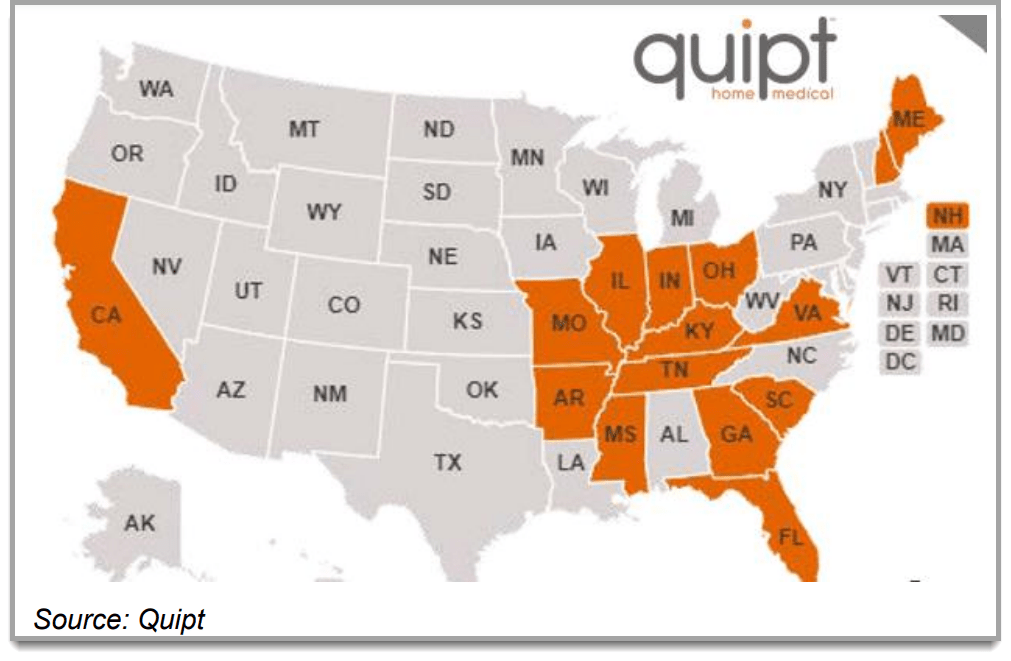

Quipt now has reached 170,000 active patients, 19,000 referring physicians and 76 locations throughout 15 states.

In a nearly $60B market that is growing more than 5% and highly fragmented, QIPT has established a 3-year revenue CAGR of nearly 30% comprised of a disciplined M&A strategy and nearly 10% organic growth, which management believes can accelerate with increasing focus on faster growing respiratory products and services (now 80% of Quipt’s book), reimbursement tailwinds and plans to double the sales team by the end of this year.(6)

On January 27 of this year, Quipt Home Medical Reported Record Fourth Quarter and Fiscal Year 2021 Financial Results(22)

Financial Highlights:

Revenue for fiscal year 2021 was $102.4 million compared to $72.6 million for fiscal year 2020, representing a 41% increase in revenue year-over-year. Compared to fiscal year 2020, the Company experienced organic growth of 10%.(22)

Recurring revenue as of fiscal year 2021 continues to be strong and exceeds 77% of total revenue.(22)

Adjusted EBITDA (defined below) for fiscal year 2021 was $21.4 million (21.1% margin), compared to Adjusted EBITDA for fiscal year 2020 of $15.5 million, representing a 38.3% increase year-over-year. Adjusted EBITDA margin was impacted by one-time costs related to the Company’s NASDAQ CM listing. On May 27, 2021, the Company commenced trading on NASDAQ CM.(22)

Revenue for Q4 2021 was $29.1 million compared to $19.7 million for Q4 2020, representing a 48% increase in revenue year-over-year. Compared to Q3 2021, the Company experienced strong organic growth of 14%, excluding new acquisitions, in the fourth quarter.(22)

Adjusted EBITDA for Q4 2021 was $5.6 million (19.2% margin). Adjusted EBITDA margin was impacted by the expenses related to acquisitions completed in fiscal Q4 as well as lower pre-integration margins than the Company’s overall margin profile. (22)

The Company anticipates margins normalizing above 20% when full integration is completed.(22)

Operating Expense for fiscal year 2021 was 51.55% compared to 53.18% for fiscal year 2020.(22)

Cash flow from continuing operations was $18.7 million for the year ended September 30, 2021 compared to $14.1 million for the year ended September 30, 2020.(22)

For fiscal year 2021, bad debt expense was 8% compared to 9% for fiscal year 2020, an improvement of 1%. (22)

This exemplifies the ability to scale and add more revenue through add-on acquisitions without compromising our billing capabilities.(22)

The Company reported $34.6 million of cash on hand as at September 30, 2021 compared to $29.2 million as at September 30, 2020.(22)

The Company has an undrawn credit facility of $20 million as at September 30, 2021.

Operational Highlights:(22)

Through the Company’s continued use of technology and centralized intake processes, respiratory resupply set-ups and/or deliveries increased to 158,072 for the year ended September 30, 2021, compared to 61,468 for the year ended September 30, 2020, an increase of 157.2%.(22)

Quipt’s customer base increased 53.8% year over year to 140,996 unique patients served in fiscal year 2021 from 91,650 unique patients in fiscal year 2020.

Compared to 253,113 unique set-ups/deliveries in fiscal year 2020, the Company completed 364,367 unique set-ups/deliveries in fiscal year 2021, an increase of 44%.(22)

The Company changed its name from Protech Home Medical Corp. to Quipt Home Medical Corp. in May 2021 and is focused on expansion into a national homecare provider throughout the United States, with a patient centric model to meet the one-of-a-kind needs of every patient in its ecosystem.(22)

Quipt has expanded its sales reach across fifteen U.S. states by the addition of experienced sales personnel.(22)

Added two exceptionally experienced Healthcare executives with a specific focus on the Home Medical Equipment and Services Industry to serve as EVP of Operations and VP of Acquisitions and Integration, both coming from two of the largest home medical equipment companies in the industry, further complementing Quipt’s robust leadership team.(22)

They completed six acquisitions during fiscal year 2021.(22)

The Company has reached 170,000 active patients, 19,000 referring physicians and 76 locations throughout 15 U.S. states. (22)

Acquisition Related Updates Subsequent to Fiscal Year 2021:(22)

On October 1, 2021, the Company acquired a business with operations in Mississippi, reporting unaudited trailing 12-month annual revenues of approximately $2.7 million, anticipated $0.5 million in Adjusted EBITDA post integration, and 4,000 active patients. (22)

In addition, on November 1, 2021, the Company acquired a business with operations in Central Illinois reporting unaudited trailing 12-month annual revenues of approximately $2.5 million, anticipated $0.6 million in Adjusted EBITDA post integration, and 3,700 active patients. Integration on both acquisitions is well underway.(22)

On November 17, 2021, the Company acquired a privately held biomedical services company, with operations in the Southeastern United States, reporting unaudited trailing 12-month annual revenues of approximately $1.5 million, and $225,000 in net income. (22)

The acquisition provides the Company a synergistic opportunity to expand into a brand-new service line of biomedical repair services for respiratory equipment including preventative maintenance. (22)

The Company is now able to assist healthcare providers to improve the operational efficiency of their respiratory equipment program.(22)

On December 31, 2021, the Company acquired At Home Health Equipment, Inc, a business with operations in Indiana, reporting unaudited trailing 12-month annual revenues of approximately $13 million and $1.6 million in net income with anticipated Adjusted EBITDA of $2.9 million (22% margin) post integration. The acquisition adds over 15,000 active patients. Integration is underway.(22)

Reiteration of Outlook for Calendar End 2022 (Fiscal Year Q1 2023):(22))

Based on the current operations, market trends and completed and prospective acquisitions, the Company is reiterating its outlook for its annual run-rate revenue by the end of calendar 2022 (Fiscal Q1 2023) to be $180-$190 million with $38-$43 million in run-rate Adjusted EBITDA.(22)

Management Commentary:(22)

“The record results experienced in the fourth quarter and fiscal year 2021 are a direct result of the significant expansion of our patient centric ecosystem into favorable geographies, through organic and inorganic activities across the United States.

Our robust interconnected operating platform we have built, and dedicated integration team drives our ability to transform lower margin business units we acquire into higher margin businesses that more closely align with our overall margin profile.

It is consistent and steady integration efforts that will allow us to maintain over 20% margins for calendar 2022 amid an aggressive acquisition pace,” said CEO and Chairman Greg Crawford. “There is no question that Quipt is in the strongest position in the history of the Company, with a distinct industry position as a leader in at-home clinical respiratory care, now serving 170,000 active patients across fifteen states.

Tailwinds driven by a favorable regulatory landscape, continued heightened demand for respiratory products and services, bullish demographic trends, as well as ongoing execution displayed across the organization, we see 2022 as another record year.

We have the financial resources and operating expertise to leverage the scalable service intensive model we have, and we expect to be extremely active on the acquisition front throughout 2022, focused on the growing need for at home clinical respiratory care.”

Chief Financial Officer Hardik Mehta added, “We are extremely proud of breaching the $100 million mark in annual revenue for fiscal year 2021, whilst maintaining an above 20% Adjusted EBITDA margin, a major milestone. Our continued progress in strategically building scale utilizing the infrastructure we have in place is producing consistent financial results, inclusive of over 77% of our revenue being classified as recurring. Driven through higher volumes, stronger cash collections and continuing to support the business with lower operating costs, we have begun to see what a more meaningful scale will look like for our financial model.

Moreover, organic growth has been a top priority for the team, and the 10% organic growth achieved year-over-year signifies the ongoing execution company-wide. Our deep acquisition pipeline consists of a wide range of targets, in terms of size and scale and the exemplary financial position we have provides us the ability to target more meaningful acquisition candidates that work significantly to move the needle throughout favorable geographical regions in the United States.

We are extremely excited for 2022 and look forward to driving shareholder value with continued operating excellence.”

Meet Quipt Home Medical Corp.’s World Class Leadership Team(23)

Greg Crawford, CEO & Chairman

Greg has 24 years of healthcare services experience. Greg brings substantial operating, integration, and M&A experience to his role as Quipt’s Chief Executive Officer. A hands-on problem solver, Greg has demonstrated significant skill at growing HME businesses both organically and by acquisition and has been the force behind the successful integration of the seven acquisitions made by Quipt. Greg joined Quipt through Quipt’s purchase of Patient-Aids, Inc. He began working at Patient-Aids in 1994, becoming a partner 3 years later and Patient-Aids sole owner in 2004. During the period of his ownership, Patient-Aids grew at an annual rate of approximately 25% and from 2013 through 2015 more than doubled its revenue and quadrupled its earnings as it acquired and successfully integrated 5 home medical equipment businesses.

Hardik Mehta - Chief Financial Officer

Hardik is an astute finance professional. Prior to QHM, he was an investment banker and finance advisor at investment banking and advisory firm, Silverstone Capital Advisors for nearly ten years. Mr. Mehta has significant acquisition, transaction finance, accounting and negotiating experience. Mr. Mehta has been an advisor on more than 30 M&A and funding transactions, including buy-side transactions, across various industries and company sizes, in which he oversaw quality of earnings analysis, due diligence and post-transaction integration planning.

Thomas Roehrig, EVP Finance

Tom is a CPA and has over 30 years of hands-on experience in accounting and finance. His background includes being the Chief Accounting Officer of a publicly-traded US company. He brings significant experience in public company financial reporting, debt and equity financings, inventory management, and acquisition transactions. His prolific career significantly broadens QHM’s internal capabilities in these areas at this pivotal point in the company’s development.

Proven M&A strategy: In this highly fragmented industry that has over 6,000 providers, M&A has been and is expected to remain Quipt’s largest growth component.

Quipt’s management team has over 100 years of combined experience in healthcare

management and acquisitions with over $500 million in transactions. With nearly $40M of available liquidity, Quipt is positioned to pursue more and larger deals going forward.(8)

Sources:

1.) https://www.prnewswire.com/news-releases/sleeping-aids-market-size-is-projected-to-reach-118-

31-billion-by-2030–cagr-7-1–polaris-market-research-301501849.html

2.) https://www.tipranks.com/stocks/qipt/forecast

3.) https://quipthomemedical.com/investor-presentation/

4.) https://quipthomemedical.com/our-services/

5.) https://www.alliedmarketresearch.com/sleep-aids-market#:~:text=

The%20global%20sleep%20aids%20market,6.9%25%20from%202021%20to%202030.

6.) https://quipthomemedical.com/inc/uploads/2021/05/Benchmark_QIPT-02.02.22.pdf

7.) https://quipthomemedical.com/inc/uploads/2021/05/a37e3491-518c-473b-ba34-b21f225cfb64.pdf

8.) https://quipthomemedical.com/inc/uploads/2021/05/QIPT-02-15-22-StifelGMP.pdf

9.) https://quipthomemedical.com/inc/uploads/2021/05/QIPT021522.pdf

10.) https://quipthomemedical.com/inc/uploads/2021/05/M-Partners-QIPT-At-Home-Health-Acquisition.pdf

11.) https://quipthomemedical.com/inc/uploads/2021/05/Q1_F22-Sets-QIPT-Up-for-Another-Rapid-Growth-Year.pdf

12.) https://quipthomemedical.com/inc/uploads/2021/05/QIPT_2022_02_16.pdf

13.) https://quipthomemedical.com/inc/uploads/2021/05/QIPT-BEACON-2022-02-15.pdf

14.) https://www.cantechletter.com/2022/01/quipt-home-medical-is-more-than-a-double-beacon-securities-says/#

15.) http://www.convertalot.com/percentage_gain_calculator.html

16.) https://www.prnewswire.com/news-releases/sleeping-aids-market-size-is-projected-to-reach-118-31-billion-by-2030–

cagr-7-1–polaris-market-research-301501849.html

17.) https://quipthomemedical.com/investor-presentation/

18.) https://bit.ly/3ruPmEX

19.) https://www.digitaljournal.com/pr/home-healthcare-market-to-receive-overwhelming-hike-in-revenues-by-2028

20.) https://www.transparencymarketresearch.com/home-healthcare-market.html

21.) https://www.zionmarketresearch.com/news/global-home-healthcare-market

22.) https://www.globenewswire.com/news-release/2022/01/27/2374786/0/en/Quipt-Home-Medical-Reports-Record-

Fourth-Quarter-and-Fiscal-Year-2021-Financial-Results.html

23.) https://quipthomemedical.com/leadership/

Legal Disclaimer