This High Grade Nickel Company – with a $25 Million Market Cap – Now Qualifies for $200 Million in Government Grants and Credits

Power Nickel’s (TSXV: PNPN); (OTC: PNPNF) impressive drill results – plus its eligibility for up to 8 times its market value in government incentives – translate into high-upside opportunity

9 Critical Reasons Why You Should Consider Power Nickel (TSXV: PNPN); (OTC: PNPNF) Right Now

Power Nickel’s Flagship Nisk Property Offers Game-Changing Potential

Power Nickel (TSXV: PNPN); (OTC: PNPNF) is a Canadian junior exploration company focusing on high-potential copper, gold and battery metal prospects in Canada in Chile.

The company’s flagship Nisk property comprises a large land position (20 kilometers of strike length) with numerous high-grade intercepts for multiple battery metals, including copper, cobalt, palladium, platinum and class-1 nickel.

Located near James Bay in Quebec, Nisk enjoys the advantage of easy access to low-cost, low-carbon hydro power in order to help sustainably develop its resources.

Power Nickel is committed to developing Nisk into one of the most sustainable sources of battery metals and class-1 nickel in the world.

Evidence from historic drilling – along with more recent drilling programs – has shown that Nisk has four distinct target areas covering over 7 kilometers of strike length.ii

Recent assay results from the property continue to demonstrate high grade Ni-Cu-Co and PGE mineralization.

Significant results from the most recent batch of assays include:

- 40.3 metres of 0.88% Ni, 0.56% Cu, 0.06% Co, 1.64 ppm Pd and 0.15 ppm Pt in PN 22-009

- 25.86 metres of 1.17% Ni, 0.80% Cu, 0.08% Co, 1.46 ppm Pd and 0.23 ppm Pt in PN 22-009

- 10.25 metres of 1.4% Ni, 0.88% Cu, 0.09% Co, and 2.52 g/t Pd, 0.56 g/t Pt in PN-22-012

- 6.85 metres 1.93% Ni, 1.06% Cu, 0.12% Co, and 3.60 g/t Pd, 0.29 g/t Platinum in PN-22-012

- 5.2 metres 0.99% Ni, 0.68 Cu, 0.06% Co, and .99 g/t Pd, 0.52 g/t Pt in PN-22-011

- 3.5 metres of 1.23% Ni, 0.73% Cu, 0.07% Co and 3.17 g/t Pd, 0.36 Pt in hole PN-22-014

- 3.2 metres of 1.15% Ni, 0.39% Cu, 0.09% Co and .83 g/t Pd, 0.10 Pt in hole PN-22-017iii

The Nisk Project is only currently working one square kilometer of its 45 square kilometer land package. This means that less than 2.5% of the property has been explored!

Here’s what is important to know about Power Nickel’s Nisk property: Nisk is an Ultramacific ore body.

Other ore bodies of this type in Canada include the Lynn Lake Mine in Manitoba, which produced 22 million tons of nickel…and the famous Voisey’s Bay Mine in Newfoundland, which contains over 50 million tons of nickel.

Given that all Nickel sulfate mines are multi-pod – and that Nisk Main, which is the pod Power Nickel is currently drilling – leads the company to expect that it could get to a commercial tonnage on the one pod while also exploring opportunities at Nisk West and other additional targets.

This would make it seem likely that the Nisk property – and Power Nickel as a whole – is not only highly undervalued today but has excellent potential for growth via the discovery of nearby pods.

While the existing resource estimates at the Nisk project are of historic nature and the company’s geology team has not yet completed work to confirm a NI 43-101 compliant mineral resource, for informational purposes only these historic estimates show Nickel, Copper, Cobalt and Palladium on the property.

Historical Resource Estimate figures for respective confidence categories at the NISK-1 deposit, After RSW Inc 2009: Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Quebec.

Results from the company’s 2021 and 2022 drilling program appear to confirm what was represented in the historic work and successfully demonstrated the existence of Nisk’s main mineralized lense. The company does look at the property as having the potential for multiple pods and believes like other Ultramafic deposits like Lynn Lake and Voiseys Bay that Nisk has the potential to not only be a commercial mine but a sizeable one!

Power Nickel releases its complete drill data enabling modelers to model the deposit as Power Nickel does.

This is because the company strongly believes that transparency is confidence. Confident investors will realize the value proposition associated with the company and make the right investment decision.

Additional data on the Nisk property, including a database of drill holes and other information on the property’s potential is available for review here.

The company expects to take the results from the historic drilling programs, its initial program in late 2021, the current drill program, and a new metallurgical study and prepare a new 43-101 which it expects to deliver in early Q3 2023.

Potential confirmation of 7 to 8 million metric tons of nickel at Nisk could be an absolute game-changer for Power Nickel (TSXV: PNPN); (OTC: PNPNF), vaulting it from a speculative exploration opportunity to a company that the market would view as a commercial opportunity to develop a significant source of nickel.

Severely Undervalued Opportunity: How Power Nickel’s Market Cap Compares to its Peers

One of the most compelling angles of the Power Nickel story for investors is the upside potential that exists for shareholders.

Other nickel companies – with similar tonnage on their properties and comparable grade nickel – have market caps that are significantly higher than Power Nickel (TSXV: PNPN); (OTC: PNPNF).

While the historic drill results on the Nisk property are still yet to be confirmed by an updated 43-101 (expected in early Q3 2023), the company believes the promising results from the fall drill program make it highly likely that they have discovered a commercial nickel ore body.

That type of potential – along with grades comparable to the others on the chart above – would suggest that with a market cap of just under US$25 million, Power Nickel could present an extremely undervalued growth opportunity for early investors.

Should results from the company’s ongoing drilling program continue to line up with those historic estimates – and Power Nickel moves closer to becoming a truly viable commercial development opportunity – its market cap could potentially more closely resemble some of the others on the chart above. And that would represent significant upside opportunity for investors who were in on Power Nickel (TSXV: PNPN); (OTC: PNPNF) ahead of the curve.

Power Nickel Offers Investors Smart Access to the Red-Hot Nickel Market…at Precisely the Right Time

The timing for Power Nickel appears to be just right.

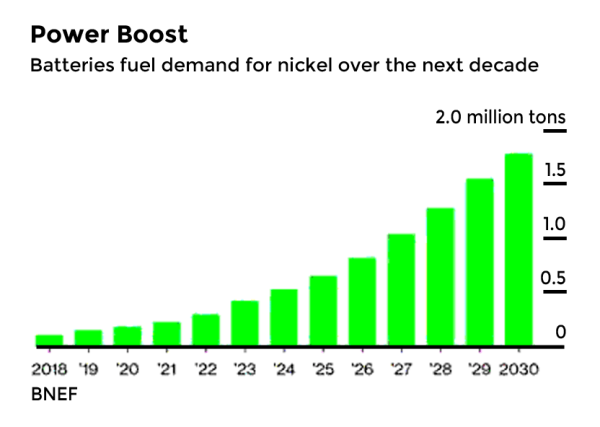

The company is moving forward with its drilling program at Nisk – designed to offer confirmation of a commercial development opportunity – just as demand for nickel is soaring.

According to BHP Group Ltd. – the world’s largest miner – global demand for nickel will grow fourfold over the next 30 years thanks to the electric vehicle boom.

“We anticipate demand for nickel in the next 30 years will be 200% to 300% of the demand in the previous 30 years,” said Jess Farrell, BHP’s asset president of Nickel West.

In fact, at this very moment governments and companies are scrambling for control of sources of all battery metals – including nickel.

In August, Tesla CEO Elon Musk signed a deal to buy $5 billion worth of nickel from the Indonesian governmentii…but that’s only a small portion of the nickel Tesla and other EV manufacturers will need going forward to hit production targets.

Governments all over the globe are also supporting the development of mines for battery metals such as nickel.

Quebec and Canada have established the world’s best financial incentives for the exploration and development of Critical Mineral assets. Power Nickel’s Nisk project has the potential to receive up to 50% of exploration expenditures and 50% of capital costs.

Power Nickel has received nearly $4 million in benefits in the last six months and anticipates total government subsidies and credits to exceed $200 million if a mine is built.

In the U.S., the Inflation Reduction Act – signed into law by President Biden in summer 2022 – offers hundreds of millions in grants, incentives and tax breaks to help facilitate more rapid mining development.

One example is Talon Metals Corp., which saw its shares surge on news recently that its subsidiary was chosen to receive a $114 million grant from the U.S. Department of Energy – which works out to 27% of the total project cost for building a new battery mine in Minnesota.

Similar opportunities are also likely to be given to companies throughout North America as the U.S. looks to lock down supplies of nickel to help reduce its dependence on foreign imports as electric vehicle demand continues to soar.

Power Nickel is Utilizing Cutting-Edge, Space Age Technology to Expedite Resource Expansion

Power Nickel announced a deal with Australian-based Fleet Space Technologies, a developer and operator of a constellation of microsatellites that delivers universal connectivity across the globe, including the exploration of Nickel ore deposits at its NISK project.

This arrangement calls for the use of innovative sound mapping technology from Fleet Space to locate additional high-grade nickel sulfide deposits with a greater level of accuracy.

Called “ExoSphere,” a rapid mineral exploration solution, Fleet Space mapping technology has already delivered promising results in exploration projects for high-grade nickel in Michigan and Minnesota. The satellite-enabled earth scanning technique is called Ambient Noise Tomography (ANT).

This technology will be used to look both for ways to expand the existing resource at Nisk Main, look deeper at Nisk main as Nickel systems are often stacked and then look along the balance of the Ultramafic sequence for similar signatures.

These signatures will identify highly attractive new drill targets on the property and help facilitate the development of the next Pods.

Power Nickel is Working to Build the World’s First Carbon Neutral Mine

Not all nickel is created using the same amount of CO2. The world is very focused on minimizing CO2 output and indeed this Electrification movement is what is driving demand.

However, the reality is governments and consumers are very much watching how much emissions go into creating Nickel. Sadly many existing Nickel mines will be hard pressed to ever deliver a positive CO2 reduction even with their Nickel being used in EVs.

This will give projects like Power Nickel’s Nisk Project a tremendous sustainable competitive advantage. It will make us much more attractive to develop and will be sought out by ESG investment groups as a way to promote constructive change

Power Nickel’s bold plan to be the world’s first carbon neutral mine is focused around four key factors

- Use Quebec’s abundant Hydro power which not only provides green power but extremely cost competitive energy.

- Sustainable plant design – There are cleaner more sustainable plant and mine designs and there are dirtier ones. Nisk will be focused on the clean sustainable design.

- The very nature of the rock that contains the nickel is Ultramafic. Ultramafic rock naturally sequesters carbon and certain processes can amplify that.

- Power Nickel’s Karbon X. Partnership. Where the company has a carbon footprint, Power Nickel offsets it by acquiring legitimate UN approved Carbon credits (see link: https://www.accesswire.com/736829/Power-Nickel-Retains-Karbon-X-to-Offset-their-2023-Drill-Program-of-up-to-40000-metres-with-Voluntary-Carbon-Offsets). Where Power Nickel generates Carbon in the future, it will offset this generation either through purchasing credits or possibly through generating carbon credits through its manufacturing process.

We Need 72 New Nickel Mines to Meet Projected 2030 EV Demand. That’s Great News for Power Nickel (PNPN.V).

Battery Nickel Demand is Forecasting Major Growth by 2030. Power Nickel (TSXV: PNPN); (OTC: PNPNF) is in an Excellent Position to Capitalize.

- Automakers to double EV battery spend to $1.2 trillion by 2030 – Nickel Demand Expected to Explode.

- Power Nickel’s (TSXV: PNPN); (OTC: PNPNF) Nisk deposit has the lowest market cap per pound of NiEQ in ground – with Class 1 nickel.

- An “ultra mafic” deposit with comparables at Lynn Lake (22m tons) and Voisey’s Bay (50m tons), which sold for $4.5 billion.

- Located in Quebec – a top North American jurisdiction for mine development with financing incentives.

Well-Connected, Experienced Leadership Team is Guiding Power Nickel (TSXV: PNPN); (OTC: PNPNF) on a Path to Success

Terry Lynch – Chief Executive Officer

Mr. Lynch is currently CEO of Power Nickel Inc. a publicly held mining company with the advanced stage Nisk Nickel project south of James Bay Quebec. It also has projects in BC’s Golden Triangle and Chile. Mr. Lynch is also the Founder and Managing Director of Save Canadian Mining.

Save Canadian Mining was launched in November2019 to unify Canada’s junior mining sector in requesting regulatory changes in Canada’s capital markets. The organization is supported by the TSX Venture Exchange, the Ontario Mining Association, the Ontario Prospectors Association, as well as mining industry leaders like Eric Sprott (Sprott Mining) Sean Roosen (Osisko Mining), Keith Neumeyer (First Majestic Silver Corp), and Rod McEwan (McEwan Mining Inc) and over 25 junior mining companies and over 3,000 members.

Mr. Lynch graduated in 1981 from St. Francis Xavier University with a joint honours degree in Economics and BBA. Prior to becoming a director with International PBX Ventures in 2012, Mr. Lynch had been CEO of privately held Nevada-focused Relief Gold. He also had been a director and later CEO of TSX-listed Firstgold Corp. He assumed the CEO position after the company had run into financial difficulty bringing its Relief Canyon mine into production. He arranged a sale of 51% of the company for a total capital injection of $26.5 million from Northwest Non-Ferrous Metals, one of China’s largest mining engineering and consulting groups.

From 2005 to 2008 Mr. Lynch was a partner with Kingsmill Capital Partners, a financial advisory firm specializing in advising public and private early stage growth companies. Prior to joining Kingsmill Capital he spent 15 years operating start-up companies in industrial products, oil and gas and media. Mr. Lynch was also the Cofounder of TSX and NASDAQ listed Cardiol Therapeutics. A leader in producing Pharmaceutical CBD and developer of ground breaking therapies for heart disease.

Peter Kent – Chairman

Fomerly with the TecSyn Group of Companies where he was Vice President general Counsel and Corporate Secretary. Peter brings over 25 years of business experience regarding complex business and legal affairs. In addition to his time at Tecsyn Peter also was a corporate commercial lawyer at Bassel Sullivan a Toronto based boutique law firm.

Ximena Perez – MD Chile

Ms. Perex has 13 years of experience in Chile as an exploration and production geologist. The first 5 years as a production geologist in underground mining in Cu. Then, she developed a career as an Exploration Geologist with extensive experience in drilling program supervision, data management and geological modeling. She participated in the exploration for the expansion of Skarn Las Cenizas (Cu-Ag), Talcuna (stratabound and veins Cu-Au) deposits; Punitaqui (stratabound and veins Cu-Ag-Au) and Dayton (epithermal of Au), in these last two as Chief Exploration Geologist.

Greg McKenzie LL.B, MBA – Director

Greg is a senior investment banker with 20 years of experience in financing, M&A, financial advisory, valuation, and strategic advice primarily to mid-cap companies. His transactions are valued in excess of $18 billion. Mr. McKenzie has worked in New York and Toronto and has held positions with Morgan Stanley, CIBC World Markets, Haywood Securities and Salman Partners. While at these firms, Greg advised managements and boards of companies in various sectors including: metals & mining, industrials, consumer products, technology and healthcare.

Les Mallard – Director

Mr. Mallard has spent 30+ years in the Canadian Produce Industry employed in various capacities with Chiquita Canada and Chiquita Brands North America. Retiring from Chiquita in 2017, he has started Mallard Produce Solutions, a produce consulting company focused on providing North American and Latin American clients business solutions to expand their market potential. Les is on the Board of Directors for the Canadian Produce Marketing Association.

9 Critical Reasons Why You Should Consider Power Nickel (TSXV: PNPN); (OTC: PNPNF) Right Now

Resources

[i] https://www.bnnbloomberg.ca/bhp-sees-nickel-demand-rising-fourfold-by-2050-on-ev-boom-1.1840872

[ii] https://powernickel.com/nisk/

[iii] https://powernickel.com/power_nickel_extends_nickel_mineralization_in_

multiple_holes_on_its_fall_2022_drill_program/

[iv] https://powernickel.com/nisk/

[v] https://electrek.co/2022/08/08/tesla-tsla-secures-deal-5-billion-worth-nickel-indonesia-official/

[vi] https://www.reuters.com/article/us-tesla-nickel/please-mine-more-nickel-musk-urges-as-tesla-boosts-production-idUSKCN24O0RV

[vii] https://www.bnnbloomberg.ca/bhp-sees-nickel-demand-rising-fourfold-by-2050-on-ev-boom-1.1840872

Legal Disclaimer

This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. WallStreetNation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.

Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of Power Nickel Inc. and its securities. Jade Cabbage Media, LLC d/b/a STOXmedia.com has received up to $10,000 USD dollars (11/25/22) by Winning Media LLC as a total production budget for this advertising effort. Neither WallStreetNation.com, Winning Media LLC or Jade Cabbage Media LLC currently hold the securities of Power Nickel Inc. and do not currently intend to purchase such securities.

The issuer, Power Nickel Inc. has paid Winning Media LLC the sum total of fifty thousand dollars USD total production budget to manage a digital media campaign for thirty days.

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.