Sponsored – Est. Read 8 Min

This Article is Published on Behalf of SuperQ Quantum Computing Inc.

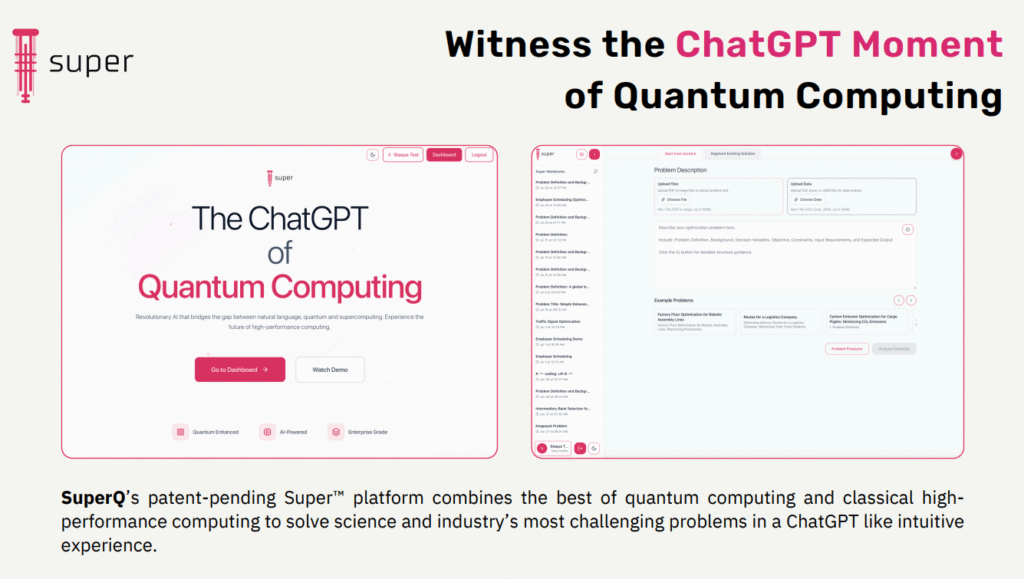

The “ChatGPT Moment” for Quantum Computing Has Arrived

SuperQ Quantum Computing Inc. (CSE: QBTQ); (OTC: QBTQF); (FSE: 25X) combines an impressive customer base, viable products and an ongoing revenue stream.

No one saw this coming.

But in a shocking twist, the quantum computing race has an emerging leader.

By making quantum computing as intuitive as ChatGPT, SuperQ Quantum Computing Inc. (CSE: QBTQ); (OTC: QBTQF) has unlocked a market that was previously accessible only to PhDs and research labs. Businesses can now solve complex optimization problems in minutes that would take traditional supercomputers millions of years.

SuperQ right now has a growing base of paying customers…has launched commercial products…established operational Super Hubs across three continents…and secured key partnerships with industry leaders including D-Wave and NVIDIA.

Most quantum computing companies are still figuring out their go-to-market strategy…while SuperQ is already successfully executing one.

And it’s clear that the market hasn’t caught on to the opportunity with SuperQ Quantum Computing Inc. (CSE: QBTQ); (OTC: QBTQF) just yet.

5 Key Reasons Why You Should Consider SuperQ Quantum Computing Inc. (CSE: QBTQ); (OTC: QBTQF)

01

The “ChatGPT Moment” for Quantum is Here… And SuperQ Built It

Just as ChatGPT made AI accessible to everyone, SuperQ has built a proprietary platform that is democratizing quantum computing. No PhD is required to use it and no specialized training is needed. Users simply describe their problem in plain language, and the company’s Super™ platform handles the complex quantum computing behind the scenes. This breakthrough in accessibility is unlocking a massive market that was previously limited to elite research institutions and deep-pocketed enterprises.

02

Validated by Industry Giants, Including D-Wave, NVIDIA and IEEE

SuperQ has secured key partnerships with some of the biggest names in technology, including D-Wave (the quantum computing leader), NVIDIA (the AI chip giant), and the IEEE Computer Society. These partnerships provide access to cutting-edge hardware, validate SuperQ’s technology and open doors to enterprise customers worldwide. When industry leaders choose to partner with you rather than compete against you, it’s a powerful signal.

03

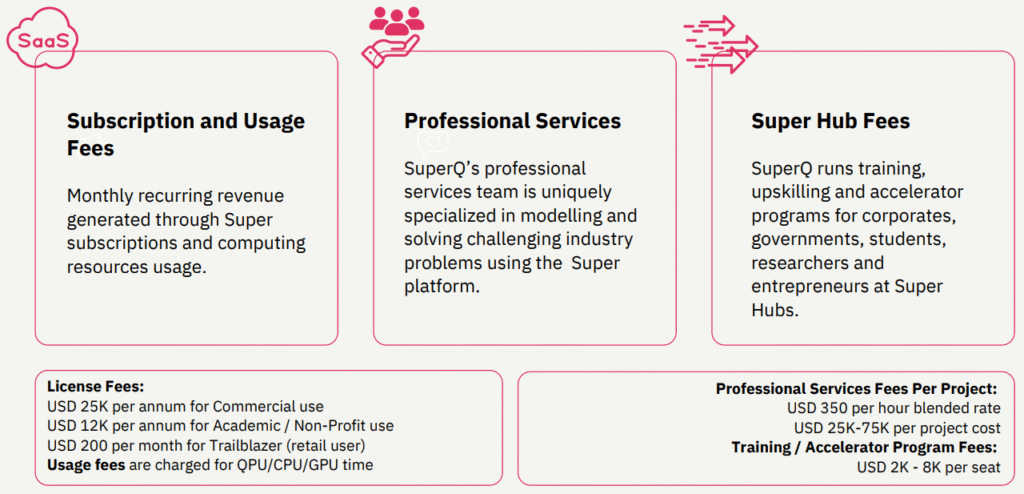

SuperQ Has Built Three Diversified Revenue Streams

SuperQ doesn’t rely on a single business model. The company generates revenue through: (1) SaaS subscriptions to its Super™ platform, (2) high-value professional services projects (available for $200K-$300K each), and (3) training programs through its Super Hubs. This diversified revenue model reduces risk and provides multiple paths to growth as the quantum computing market expands. If one channel slows, two others keep driving revenue.

04

SuperQ Is Building a Global Quantum Network Via Its Super Hubs

SuperQ is establishing Super Hubs, which are quantum computing centers where researchers, businesses, and entrepreneurs can access the platform with expert support. These Super Hubs have been described as the “cyber cafes of the quantum world”…and the first hubs are already operational in Canada, UAE, and India, with more planned for the US and Europe. These Super Hubs generate recurring revenue for the company while building a global network effect that strengthens SuperQ’s competitive position.

05

A Pipeline of Near-Term Catalysts

SuperQ’s growth story is packed with tangible milestones ahead. These include new Super Hub openings across multiple regions, the potential for additional enterprise and government contracts, upcoming technical showcases, and expanding ecosystem partnerships. Every one of these represents a clear, measurable step toward larger revenue and brand visibility for the company.

BREAKING NEWS

SuperQ Quantum Closes Brokered LIFE Financing

On October 21, 2025, SuperQ Quantum Computing Inc. (CSE: QBTQ); (OTC: QBTQF) announced that it has closed its previously announced commercially reasonable efforts offering, through Hampton Securities Limited, pursuant to which the Company issued a total of 3,285,713 units at a price of $1.05 per Unit for aggregate gross proceeds of $3,450,000 including exercise in full of the over-allotment option.

The Quantum Computing Market is Poised to Explode…

Analysts project the quantum computing market could reach $100 billion in the next decade.

And we are right now reaching a critical point in the industry’s growth where potential fortunes can be made.

For decades, quantum computing was limited to research laboratories and academic papers. While it was fascinating science and appeared to have wildly promising potential…it had no clear path to commercialization.

But that reality is now changing in a significant way.

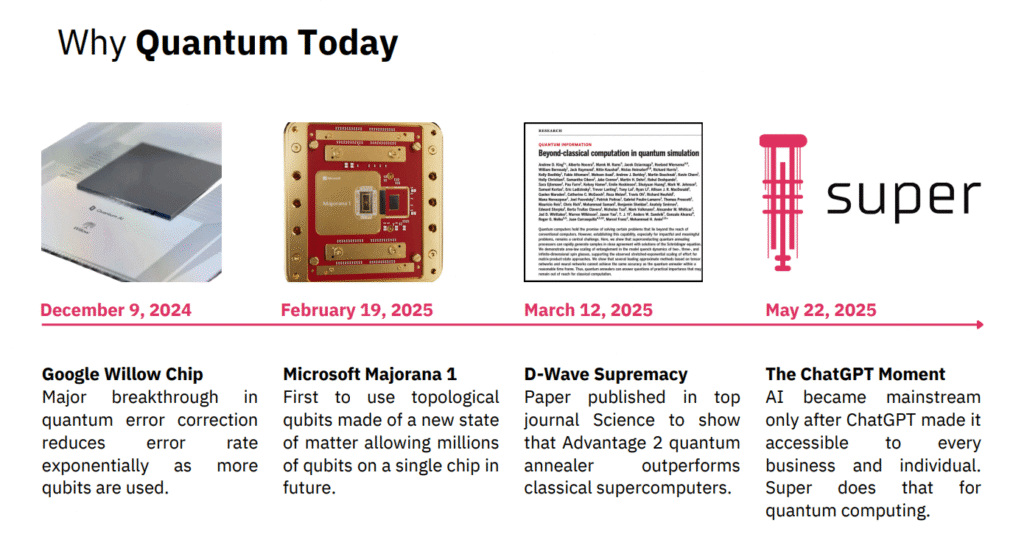

In December 2024, Google unveiled its Willow chip, a major breakthrough in quantum error correction that solved a 30-year challenge in the field. The chip completed calculations in under five minutes that would take the world’s fastest supercomputers longer than the age of the universe.

Two months later, Microsoft announced Majorana 1, the first quantum processing unit built on topological qubits, a new state of matter that could enable millions of qubits on a single chip.

And then in March 2025, D-Wave published research in the journal Science proving that its quantum annealers outperform classical supercomputers on real-world problems.

This group of announcements offered the world proof that quantum computing had taken the significant step of moving beyond “theoretical” to becoming practical.

“Quantum technology investment hits a ‘magic moment’: Globally, investment volume in QT (Quantum Technology) increased 50 percent year over year, growing from $1.3 billion in 2023 to $2 billion in 2024…Because QT is moving from research to deployment, investors now have the opportunity to help shape the landscape.”

– McKinsey & Company, October 27, 2025[ii]

And the market is responding quickly.

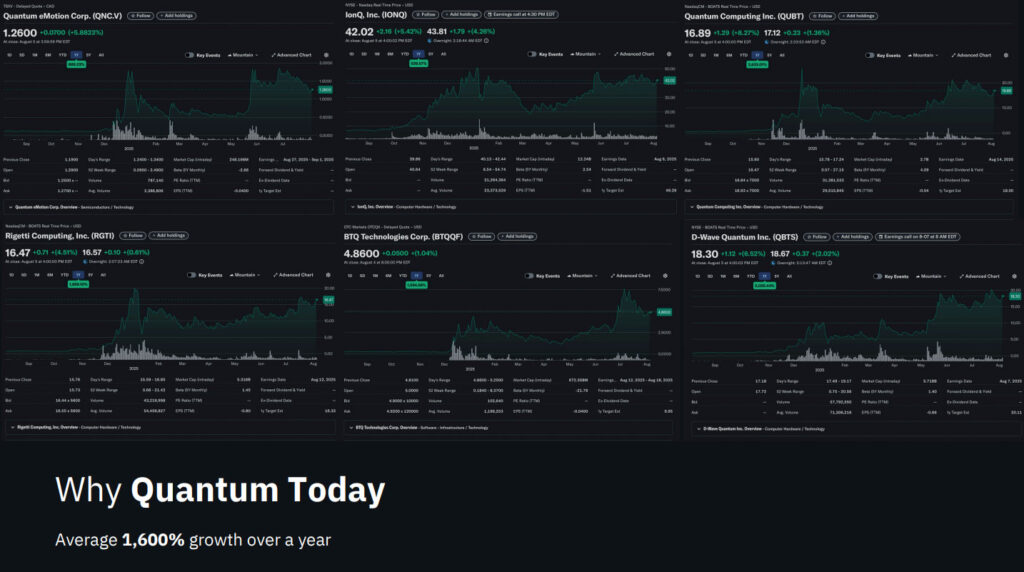

Major publicly-traded quantum computing stocks like IonQ, Inc. (NYSE: IONQ) and Rigetti Computing, Inc. (Nasdaq: RGTI) have experienced explosive growth over the past year as investors recognize the technology is reaching commercial viability.

In fact, from early September 2024 through mid-October 2025, IONQ and RGTI have gained a staggering 792.2% and 5,056.25% respectively!

The gains seen in publicly-traded quantum computing stocks have undoubtedly been impressive, but it’s important to keep in mind that the quantum computing market is about so much more than just hardware.

It’s true that building better quantum chips matters.

But the real value, and the real opportunity in this market is in making quantum computing accessible and useful for businesses that need it. That’s the difference between owning a supercomputer and actually solving problems with it.

And as you’re about to see, that’s where SuperQ’s advantage becomes so abundantly clear.

As the quantum computing market sees its budgets grow – and its industry applications spread – SuperQ appears uniquely positioned at the critical gateway.

Unlike so many others in this space, SuperQ is emerging as a platform that makes all quantum computing accessible and practical for enterprise customers.

This is a massive market that is already seeing rapid growth and impressive technological breakthroughs. And SuperQ is perfectly positioned and generating revenue while others are still building prototypes.

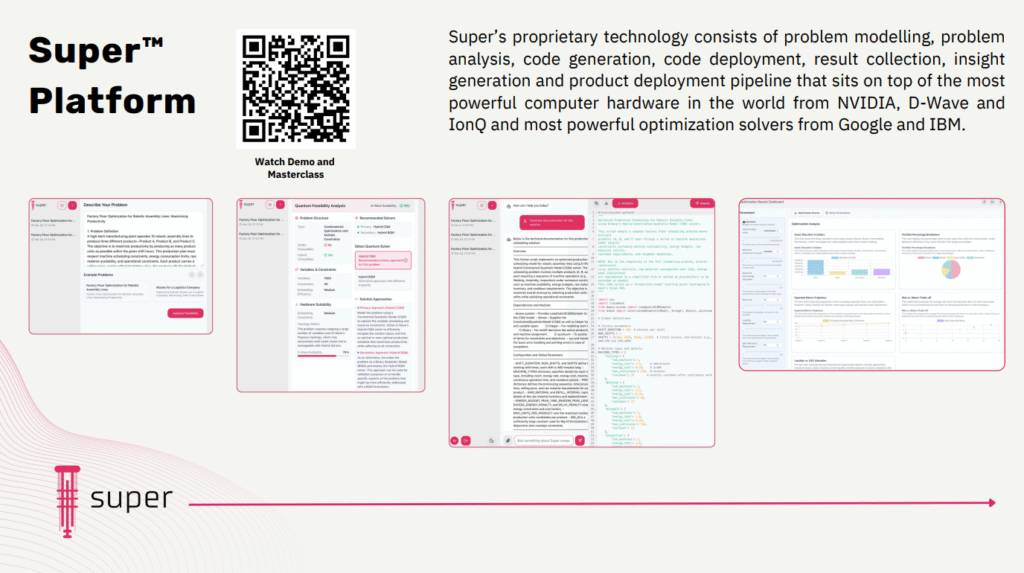

The Super™ Platform:

The ChatGPT of Quantum and Supercomputing

SuperQ has solved a fundamental problem that was facing the quantum computing world.

Quantum computing was brilliant technology…but almost no one could use it.

In order to run calculations on a quantum computer you needed a PhD in quantum physics, expertise in specialized programming languages and deep knowledge or quantum algorithms.

Even large enterprises with significant R&D budgets struggled to extract value from quantum systems because of the complexity.

But SuperQ’s Super™ platform has changed all of that.

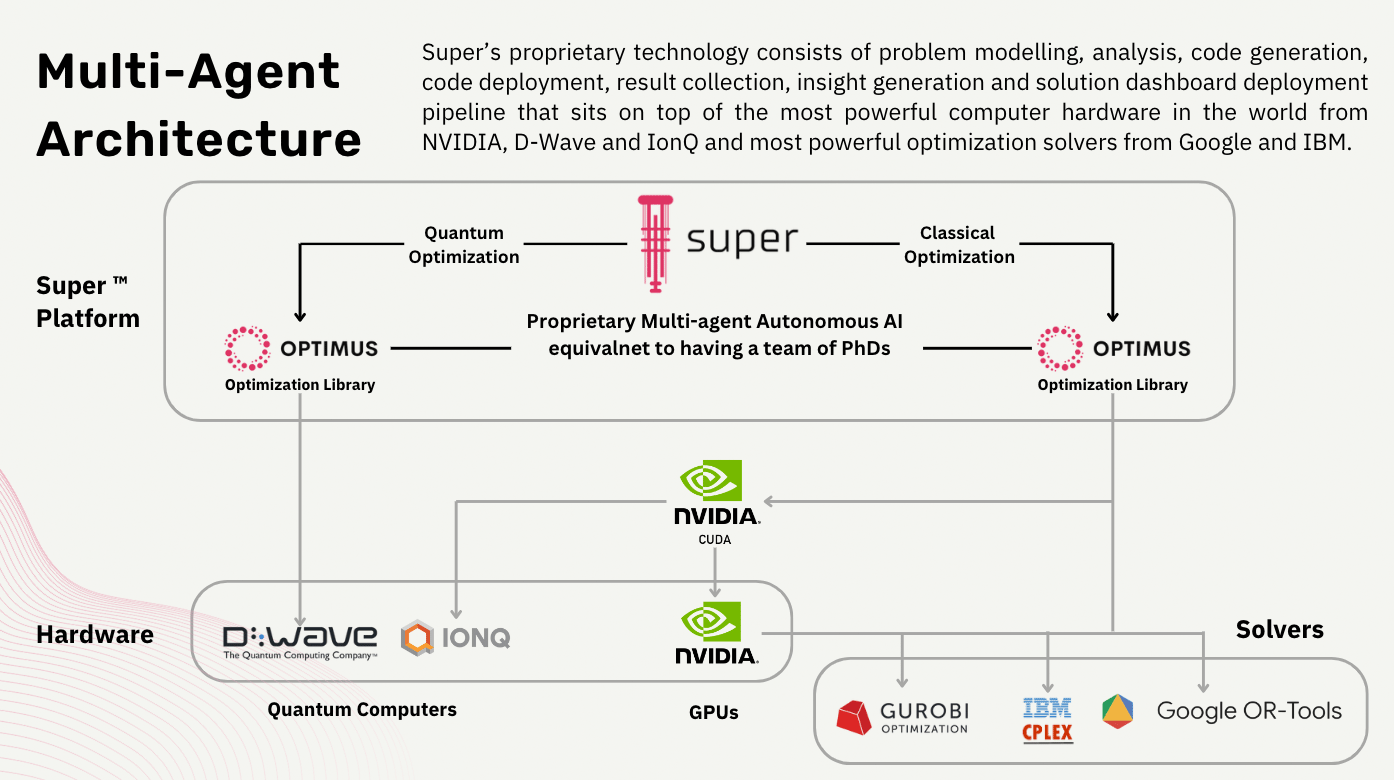

The platform works like ChatGPT for quantum computing. Users simply describe their problem in plain language and Super™ immediately:

- Analyzes the problem…

- Determines whether quantum computing offers an advantage…

- Automatically generates the necessary code…

- Deploys it on the appropriate hardware (such as quantum computers from D-Wave and IonQ or classical GPUs from NVIDIA)…

- Runs the calculations…

- …and returns actionable results.

There is no quantum expertise required… no PhD necessary…and no specialized training involved.

This breakthrough in accessibility allows SuperQ to unlock a potentially massive market. Instead of limiting quantum computing to elite research labs and deep-pocketed enterprises with quantum teams, Super™ opens it up to any business facing complex optimization problems.

That’s why SuperQ already has paying customers in industries like agriculture, logistics, healthcare and AI, as these are industries that need quantum computing’s power but lack quantum computing expertise.

Super™ is already deployed, generating revenue and solving real business problems today.

Companies are using the platform to optimize supply chains, potentially saving millions on distribution costs. And pharmaceutical firms are working to accelerate drug discovery and cut years off research timelines.

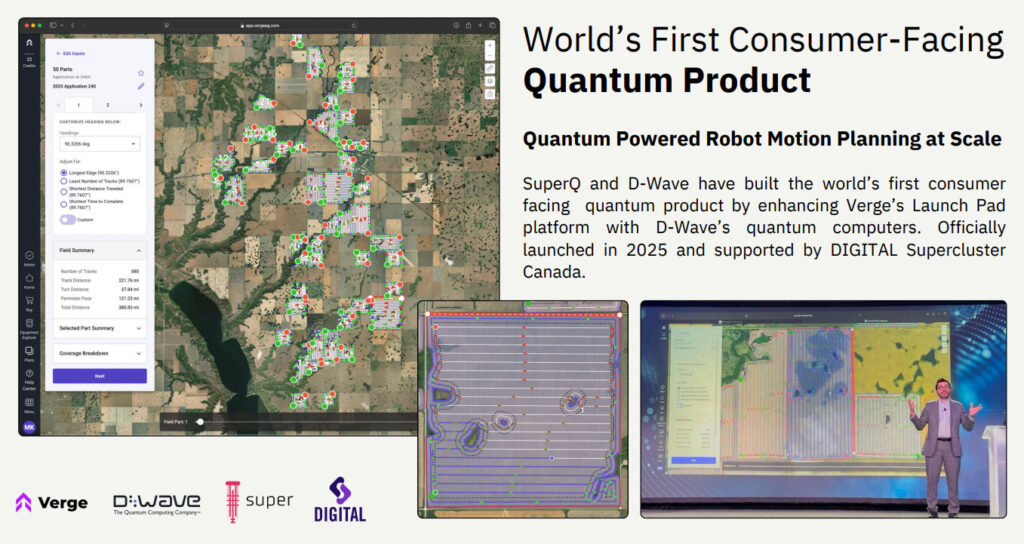

SuperQ has even launched the world’s first consumer-facing quantum product. Working with D-Wave and agricultural robotics company Verge, SuperQ built quantum-powered motion planning for autonomous farm equipment.

The system plans optimal paths across large farming operations in just minutes…where it would normally take traditional computers hours or days.

Again, this is not a prototype; this is an actual product that is running on farms right now.

While competitors are still figuring out how to make quantum computing usable, SuperQ is already getting paid to execute.

When thinking of the potential for a company like SuperQ Quantum Computing Inc. (CSE: QBTQ); (OTC: QBTQF) it’s important to look at what’s happening with other companies in the same space.

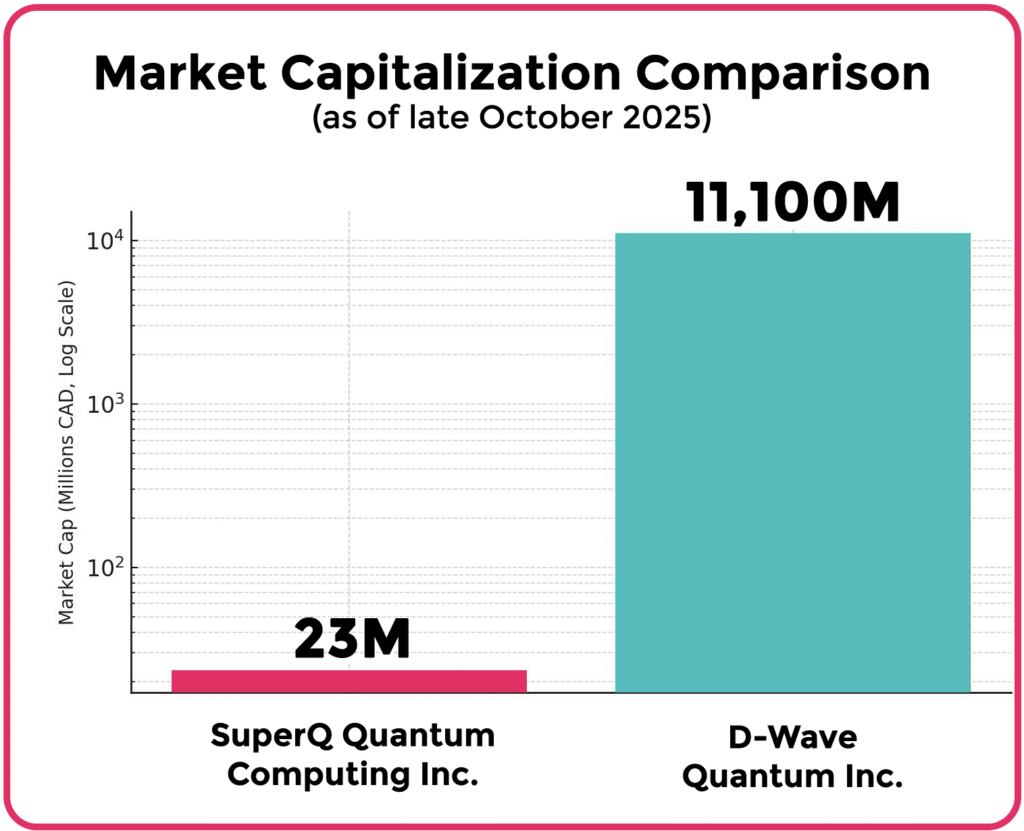

D-Wave Quantum Inc. (NYSE: QBTS) trades at a market cap of $12 billion. That’s more than 1,000 times its revenue.

SuperQ launched the world’s first consumer-facing quantum product and generate revenue from three distinct business lines.

The market is treating SuperQ like an early-stage research project while some of its unprofitable competitors are priced like established commercial operations.

But how much longer can that last?

The market simply hasn’t caught on yet. But the gap between SuperQ’s fundamentals and its valuation is too wide to ignore forever.

Building the ASML of Quantum Computing

If you want to understand the true power of SuperQ’s long-term potential, you need to understand ASML.

ASML Holding N.V. (Nasdaq: ASML) is a Dutch company that makes lithography machines, which are the equipment need to manufacture advanced computer chips.

If you’re NVIDIA and you want to make the world’s most powerful AI chips, you have to buy your machines from ASML. Apple, Intel and Samsung…they all depend on ASML. The company owns that critical step.

In other words, they own the chokepoint.

SuperQ is now working to do the exact same thing for quantum computing.

IBM, Google, Microsoft, D-Wave and IonQ…they’re all building quantum hardware. They’re competing to create better qubits, reduce error rates and increase their processing power. It’s an expensive race where no clear winner has emerged yet.

But SuperQ isn’t competing in that race. Instead, they’re building the essential gateway that sits on top of all that hardware.

It’s the platform layer that makes quantum computing actually usable for businesses. When companies want to harness quantum computing without hiring quantum physicists, they’ll need to pass through SuperQ’s platform.

Another way to think of this is what has happened with Palantir Technologies Inc. (Nasdaq: PLTR).

Palantir built the platform that lets large organizations deploy AI at scale without needing teams of AI experts. That platform layer, which is the interface between complex technology and business users, is where Palantir created enormous value.

SuperQ is doing the same thing for quantum computing.

The Super™ platform sits between quantum hardware and business applications, translating plain-language problems into quantum solutions automatically. As more businesses adopt quantum computing, that translation layer becomes increasingly valuable and difficult to displace.

This is how you build a strong, powerful moat. Not by competing on hardware that becomes obsolete in three years, but by owning the infrastructure layer that everyone needs regardless of which hardware wins.

That’s the playbook used so successfully by ASML and Palantir…and it’s exactly what SuperQ is now working to replicate with quantum computing.

SuperQ is Led By an Experienced Team of Silicon Valley Veterans with Proven Quantum Expertise

The company is led by Dr. Muhammad Khan, a Silicon Valley entrepreneur and Cambridge graduate with more than 18 years of experience building AI and quantum computing companies.

Before founding SuperQ, Dr. Khan built Staque, an NVIDIA and DataStax partner focused on autonomous AI. He’s worked at top-tier universities globally and has a track record of building companies, raising capital and delivering successful outcomes.

The company’s strong executive team also includes Krishna Ganesh (COO), who is a seasoned data scientist and former Big Four consultant. Manoj Joseph (CBO) is a B2B enterprise sales leader with deep experience in cross-border market expansion and partnerships. And Brian Shin (CFO) is a veteran public company CFO who understands compliance and financial reporting inside and out.

Strategic advisors to the company add additional firepower. Dr. Edgar Bermudez is an AI and neuroscience expert and AMII fellow. Dr. Raees Tonse brings quantum computing investment experience along with his background as an oncologist and MBA, bridging technical knowledge with business acumen.

This is a team that has built companies, raised capital, secured partnerships with Fortune 500 companies and knows how to effectively commercialize complex technology in a way that delivers value for shareholders.

Executive Summary

While competitors burn cash, SuperQ generates revenue from three distinct business lines and posts positive net income.

The company’s Super™ platform has already solved quantum computing’s commercialization problem, making it as accessible as ChatGPT. SuperQ is a company with an impressive customer base, viable products and an ongoing revenue stream.

The company is smartly positioning itself as the essential infrastructure layer for quantum computing…essentially the ASML of the quantum revolution. With proven management, strategic partnerships and commercial traction today, SuperQ Quantum Computing Inc. (CSE: QBTQ); (OTC: QBTQF) offers a rare opportunity.

SuperQ Quantum Computing

LATEST NEWS

[i] https://www.mckinsey.com/featured-insights/the-rise-of-quantum-computing

[ii] https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/tech-forward/quantum-technology-investment-hits-a-magic-moment

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer, SuperQ Quantum Computing Inc. (QBTQ), Winning Media LLC has been hired for a period beginning on 10/29/25 and ending on 11/26/25 to conduct investor relations advertising and marketing and publicly disseminate information about SuperQ Quantum Computing Inc. (QBTQ) via Website, Email and SMS. Winning Media has been compensated the sum total of fifty thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for SuperQ Quantum Computing Inc. (QBTQ).

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of SuperQ Quantum Computing Inc. (QBTQ). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.