NYSE: CEI is a little-known energy company that may be about to make some big noise!

Greetings Investors,

The energy sector is vital to the global economy as it produces and supplies the fuels and electricity needed to keep the economy humming along.

Whether it’s renewable energy or oil that creates the electricity our world needs, one thing is evident, energy plays a big role on Wall Street….

This is evident when you look at the market caps of companies like oil giant Chevron or renewable energy pioneer Nextera Energy.

And with the rising prices of oil and natural gas, this makes it an even greater time to take a closer look at one energy stock that is beginning to capture some major attention on the NYSE.

Trading at under $1, Camber Energy, Inc. (NYSE: CEI), a growth-oriented diversified energy company, has started to see significant investor attention with trading volume higher than usual!

The stock has been on a northward climb in recent days, and this breakout may be connected to one very big piece of news that was announced this week….

NYSE: CEI has officially closed on its acquisition of Viking Energy Group, Inc., pursuant to which the company has acquired all of the issued and outstanding securities of Viking not already owned by Camber.

Effective August 1, 2023, Viking became a wholly-owned subsidiary of Camber, and Viking’s securities ceased trading on the OTC: QB. Camber remains the sole publicly traded entity.

Why is this an important acquisition?

Viking Energy Group, Inc. is a growth-oriented energy company, targeting opportunities in the power generation, clean energy & resource sectors.

Through various majority-owned subsidiaries, Viking provides custom energy & power solutions to commercial and industrial clients in North America and owns interests in oil and natural gas assets in the United States.

The company also holds an exclusive license in Canada to a patented carbon-capture system.

With this monumental acquisition, NYSE: CEI has gained:

- Custom Energy & Power Solutions Business (Simson Maxwell)

- Exclusive License to a Patented Clean Energy & Carbon-Capture system; (ESG Clean Energy)

- Intellectual property rights to a fully developed, patented ready-for-market proprietary Medical & Bio-Hazard Waste Treatment system using Ozone Technology; and

- Patent-pending ready-for-market proprietary Open Conductor Detection systems.

“This is merely an early, albeit significant, step within our comprehensive plan to transform this organization into what we firmly believe will be a revolutionary and profitable participant in the energy industry,” commented James Doris, President & CEO of Camber.

Let’s dig in and explore some of what NYSE: CEI has gained through this acquisition!

Viking Energy Group, Inc. is a party to an Intellectual Property License Agreement with ESG Clean Energy, LLC (“ESG”) regarding ESG’s patent rights and know-how related to stationary electric power generation, including methods to utilize heat and capture carbon dioxide (the “ESG Clean Energy System”).

The license agreement is exclusive for all of Canada (unlimited number of systems), and non-exclusive for up to twenty-five locations in the United States.

The ESG Clean Energy System is designed to generate clean electricity from internal combustion engines and utilize waste heat to capture ⁓ 100% of the carbon dioxide (CO2) emitted from the engine without loss of efficiency, and in a manner to facilitate the production of precious commodities (e.g. distilled/ de-ionized water; UREA (NH4); ammonia (NH3); ethanol; and methanol) for sale.

ESG’s technology is designed to capture nearly 100% of CO2 while generating electricity from natural gas and then converting the carbon dioxide into needed commodities!

As part of the acquisition, CEI is now connected to Simson-Maxwell, Ltd. a majority-owned subsidiary of Viking.

Simson-Maxwell, Ltd. is a leading manufacturer and supplier of power generation products, services and custom energy solutions.

Operating for over 80 years, Simson Maxwell’s seven branches assist with servicing over 4,000 existing maintenance contracts and meeting the energy and power-solution demands of the company’s other customers!

Check out some of the company’s projects here: https://www.simson-maxwell.com/about-us/our-projects/

Simson-Maxwell, Ltd. provides commercial and industrial clients with efficient, flexible, environmentally responsible and clean-tech energy systems involving a wide variety of products, including: CHP (combined heat and power), tier 4 final diesel and natural gas industrial engines, solar, wind and storage.

The company also designs and assembles a complete line of electrical control equipment including switch gear, synchronization and paralleling gear, distribution, Bi-Fuel and complete power generation production controls.

Excitingly Simson-Maxwell, Ltd. has diversified its strategy and has added a focus on digital asset power solutions! This puts the company ahead of the curve re: Clean energy, ESG, and digital asset initiatives!

The company is well positioned for expansion throughout North America.

With the acquisition of Viking, NYSE: CEI has also got its hands on a game-changing bio-hazard waste treatment system!

An urgent need for sustainable waste treatment…

Properly processing and disposing of regulated medical waste (RMW), biohazardous waste, and general waste is critical to ensure public safety. Laboratories, hospitals, military facilities, care centres, aircraft, ships and prisons are all sources of bio-hazardous waste. Each one of these facilities or sources requires a safe and sustainable solution to process the waste close to its source of origin. Eliminating pathogens, bacteria, viruses, fungi, spores and any other potentially harmful substances from entering the environment is critical.

The company’s proprietary system is the industry-leading solution and has a big market!

Introducing The All-New Viking Ozone Technology VKIN-6000

The VKIN-6000 is a revolutionary advancement in the world of waste treatment.

By combining the company’s technology with the use of ozone, it offers an environmentally sustainable and cost-effective alternative to incineration, chemical treatment, autoclave and heat treatments for regulated medical waste, bio-hazardous waste and general waste.

VKIN-6000 reduces the amount of energy required to process waste, which conserves resources, and operating costs and reduces greenhouse gas emissions, resulting in a cleaner, safer environment.

The Viking acquisition has also given NYSE: CEI oil and gas resources in the U.S.!

Through its wholly-owned subsidiary, Petrodome Energy, LLC, Viking owns interest in certain oil and gas fields in Texas, Louisiana and Mississippi.

Properties include active, conventional oil & gas wells, along with development prospects.

The wells produce hydrocarbons from known reservoirs/sands in the on-shore Gulf Coast region.

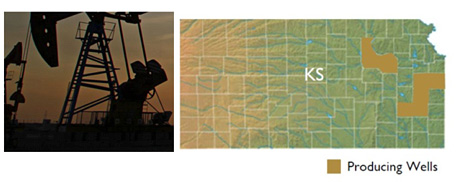

Viking, through its wholly-owned subsidiaries, Mid-Con Petroleum, LLC and Mid-Con Drilling, LLC, owns working interests in certain oil leases in Kansas, which includes an undivided interest in all oil wells, equipment and fixtures located upon the leased properties.

Applicable formations and zones include the Cherokee, Conglomerate, Viola and Simpson Sandstone at depths ranging from 600 ft. to 3,300 ft. Other target formations and sands may include Arbuckle, Kansas City, Topeka Limestone and Kinderhook.

The majority of Viking’s oil and gas assets are managed by its subsidiary, Petrodome Operating, LLC, a licensed operator in applicable States.

In Summary…

The acquisition of Viking could be a catalyst for major activity as Wall Street digests the news!

The company brings to NYSE: CEI a long-standing custom energy and power solutions business, along with a portfolio of diverse, ready-for-market technologies in the clean energy, carbon-capture, waste treatment and utility sectors.

Viking also brings an exemplary team of professionals, extensive industry relationships and additional opportunities for growth.

NYSE: CEI is leveraging its expertise and relationships to build a diversified organization with profitable business segments to increase stakeholder value. This balanced approach can expedite growth while reducing dependence on any particular division.

The company’s aim is to acquire a majority interest in assets or entities with current revenue streams and realistic upside potential.

NYSE: CEI intends to pursue opportunities recognizing the immediate dependence on current energy sources as well as the need to explore sustainable and profitable alternatives.

The energy arena is colossal and finding an emerging player at under $1 with this much happening doesn’t happen every day… hurry and start your own research!

There could be enormous untapped potential here for NYSE: CEI to grow its market cap!

Copyright – 2023 Small Cap Stox All rights reserved. Disclaimer and Privacy Policy For more Information please contact info@smallcapstox.com

ALL STOCK ALERTS ARE COMPENSATED BY EITHER A THIRD PARTY OR THE ISSUER OF THE SECURITY. PLEASE READ THE INDIVIDUAL DISCLAIMER WHEN ANY COMMUNICATION MENTIONS AS SPECIFIC SECURITY.

SmallCapStox.com is owned by Jade Cabbage Media LLC. We were compensated ten thousand dollars cash from Winning Media LLC for a three day digital media advertising campaign for Camber Energy Corp. Winning Media LLC was compensated the sum total of twenty thousand USD for a three day digital marketing media campaign by One Eye Jack Media LLC. on 8/1/2023. Both Jade Cabbage Media LLC or Winning Media LLC do not own shares of CEI and do not intend to purchase shares of CEI in the foreseeable future.

This website provides information about the stock market and other investments. This website does not provide investment advice and should not be used as a replacement for investment advice from a qualified professional. This website is for informational purposes only. The Author of this website is not a registered investment advisor and does not offer investment advice. You, the reader, bear responsibility for your own investment decisions and should seek the advice of a qualified securities professional before making any investment.

Third Party Pixels and Cookies

When you visit our website, log in, register or open an email, cookies, ad beacons, and similar technologies may be used by our online data partners or vendors to associate these activities with information they or others have about you, including your email address. We (or service providers on our behalf) may then send communications and marketing to these email addresses.