Sponsored – Est. 9 Min Read

North American Lithium Crisis:

Unprecedented Demand Has Triggered Once-in-a-Generation Opportunity for Investors

With significant near-term catalysts, LithiumBank Resources (TSXV: LBNK); (OTC: LBNKF); (FRA: HT9) offers investors a unique, high-upside opportunity in North American direct brine extraction lithium.

Here’s why this company – and its impressive properties – appear to be significantly undervalued right now.

BREAKING NEWS: LithiumBank Resources Announces Intellectual Property License Agreement with G2L Greenview Resources Inc. for Direct Lithium Extraction Technology, Pilot Plant Testing and Commercialization

From historic problems come historic opportunities.

Right now we have a historic problem in North America in that our annual lithium production is less than 2% of global demand.

And that demand is poised to soar – in a huge way.

North America’s urgent need for lithium has triggered a significant opportunity for investors in the lithium exploration space.

Any company that shows clear potential for bringing new lithium supply to market in North America will enjoy a great deal of attention – from auto manufacturers…the U.S. government…and Wall Street.

One lithium exploration company that appears poised to present investors with significant upside potential is LithiumBank Resources (TSXV: LBNK); (OTC: LBNKF); (FRA: HT9).

This company – still an unknown to many investors – is developing a sizable strategic lithium resource in Western Canada consisting of over four million acres of mineral tiles. The company is focused on lithium-enriched brine projects where low-impact direct lithium extraction (DLE) technology can be deployed to advance these projects to production.

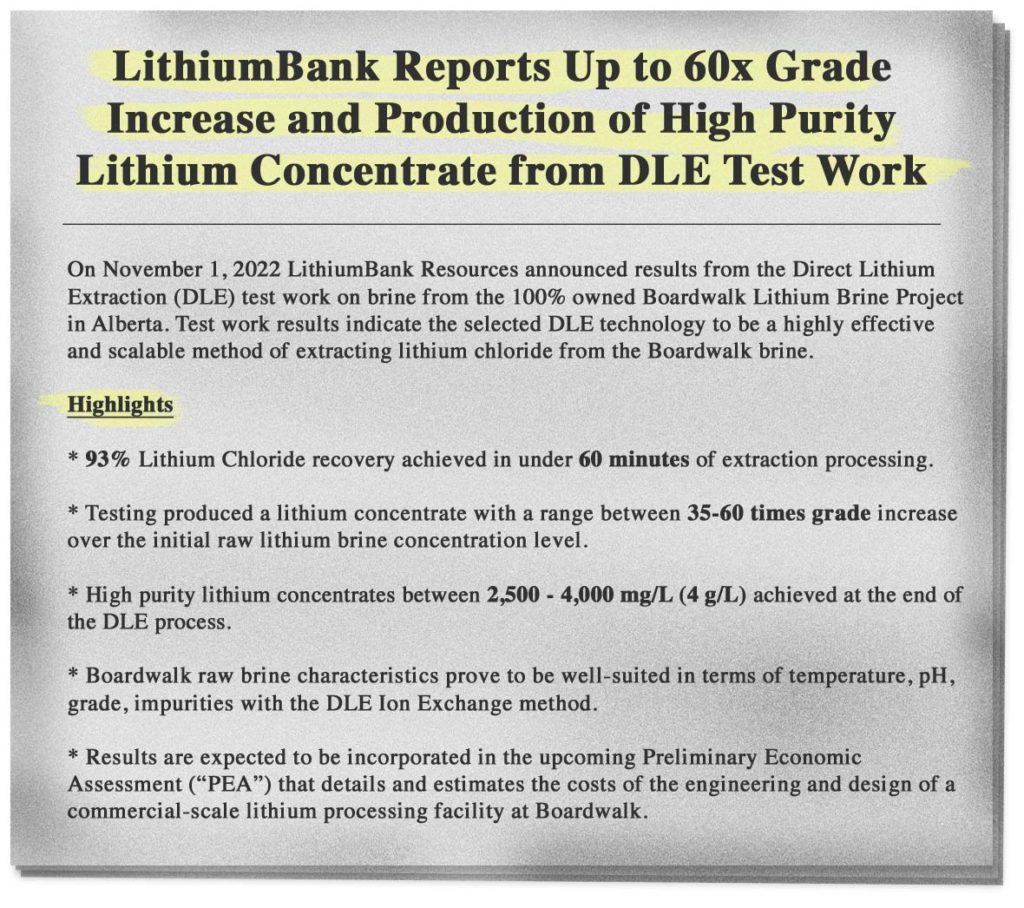

LithiumBank Resources’ highly prospective properties – and the potential for a compelling Preliminary Economic Assessment (PEA) in early 2023 – appears likely to generate a great deal of attention from investors.

This attention, in fact, could come quickly as LithiumBank Resources has a significant catalyst ahead that could trigger a fast-moving, high-upside opportunity.

The PEA is just one of six key reasons why investors should pay close attention to LithiumBank Resources (TSXV: LBNK); (OTC: LBNKF); (FRA: HT9) in the weeks ahead.

6 Key Reasons Why LithiumBank Resources (TSXV: LBNK); (OTC: LBNKF); (FRA: HT9) Appears to Be the Best Way to Play the White-Hot Lithium Market for Maximum Upside Potential

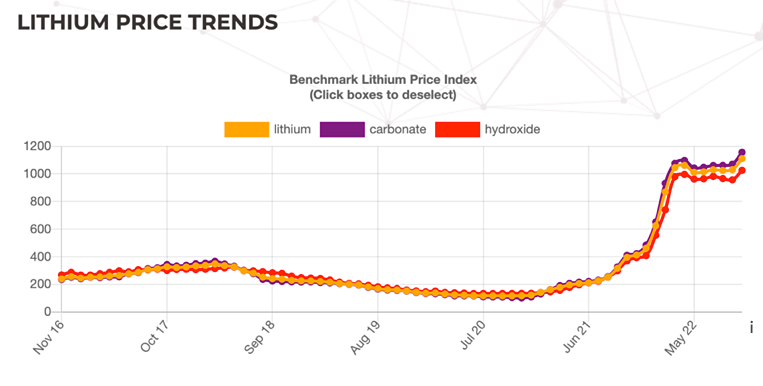

Key Reason #1: EV Demand is causing lithium prices to soar – and they could climb even higher in the months ahead.

Thanks to a historic surge in demand for electric vehicles – up 62% in the first half of 2022 alone – electric vehicle manufacturers are scrambling for new lithium sources to feed their battery manufacturing plants.i

This surge in demand from EV manufacturing has caused lithium prices to more than triple over the past year.

Looking ahead, the IEA forecasts there will be a combined 145 million EV cars and trucks on the road by 2030. There were just 16.5 million on the road at the end of 2021, just over 11% of what is forecasted.

The batteries for all these EV’s will require millions of tons of lithium.

For example, Tesla is building a $375 million lithium refinery in Texas[i]…BMW is investing $1.7 billion to build EVs and EV batteries in South Carolina[ii]…Honda Motor Corporation, together with LG Energy, is building a $4.4 EV battery plant in Ohio…and Volkswagen has announced plans to build a C$7 billion battery plant in Ontario. [iii] [i]

“The United States has a lithium supply problem…The price of lithium is soaring, up 280% since Jan. 2021, and establishing a domestic supply of lithium has become the modern-day version of oil security.”

“The United States needs to quickly find new supplies of lithium as automakers ramp up manufacturing of electric vehicles.”

In order for EV manufacturers to feed those new billion-dollar battery manufacturing plants they’re building – and to continue producing the lithium needed to power the batteries in smartphones, laptop computers and more – new sources of production need to be brought online as quickly as possible.

And that’s precisely where LithiumBank Resources (TSXV: LBNK); (OTC: LBNKF) enters the picture, with a pair of impressive projects in Western Canada likely to soon generate a great deal of interest.

Key Reason #2:

LithiumBank Resources is advancing two large flagship projects in known high-grade lithium hot spots.

Lithium Bank Resources is developing a world class battery grade strategic lithium resource in Western Canada.

There are over 1,100 wells on LithiumBank’s claims that can be leveraged to quickly and cost effectively establish large-scale lithium resources.

Billions of dollars have been spent to date by oil and gas companies on the infrastructure in the area – including roads, rail, pipelines and power – that can be repurposed to fast-track lithium production.

LithiumBank’s claims are positioned in reservoirs that provide a unique combination of scale, grade and exceptional flow rates that are necessary for direct brine lithium production.

The company’s two large flagship projects – covering over 2.14 million acres of mineral tiles – contain well-known, highly prospective brine aquifers where direct lithium extraction (DLE) technology may be effective.

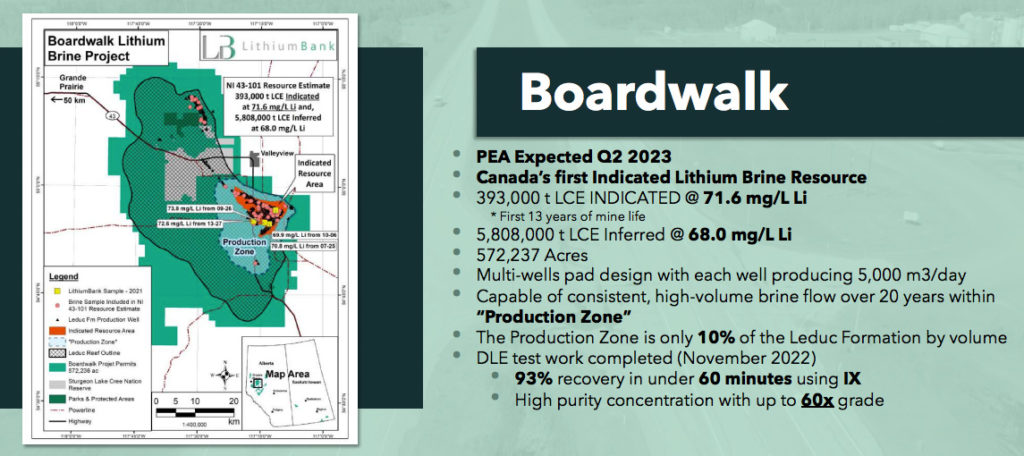

Flagship Project #1: Boardwalk

The Boardwalk Lithium Brine Project is located in west-central Alberta, approximately 85 km east of the City of Grande Prairie and 270 km northwest of the City of Edmonton.

The Project consists of 40 Alberta Metallic and Industrial Mineral contiguous permits covering an area of 572,237 acres, within a LithiumBank total land package of approximately 3.44 million acres in west-central Alberta

A hydrogeological study was completed on the property in October 2022 that showed it was capable of consistent, high-volume brine flow over 20 years within the “production zone.”

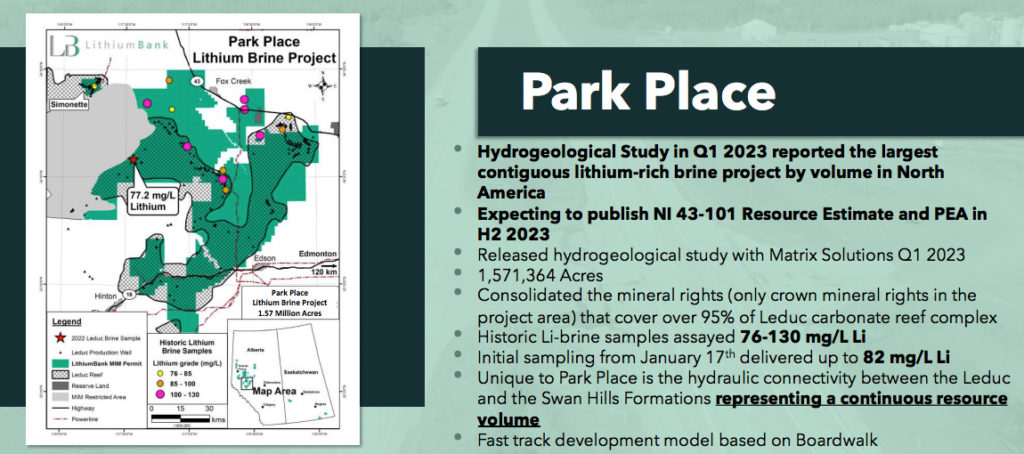

Flagship Project #2: Park Place

The Park Place land acquisition is strategic for LithiumBank as the Leduc Carbonate Reef Complex (Woodbend Group) and the underlying Swan Hills Carbonate Complex (Beaverhill Lake Group) have historically been known to host the highest grades of lithium-in-brine concentrations in Alberta.

Historical samples collected by multiple petro-operators and donated to the Alberta Geological Survey, range from 76 mg/l to 130 mg/l lithium are located within LithiumBank’s Park Place Metallic and Industrial Mineral permit area.

In addition to the Boardwalk and Park Place projects, the company also holds 336,595 acres of mineral permits across three separate property areas in:

- Kindersley – 111,483 acres

- South Property – 134,229 acres

- Estevan – 90,883 acres.

LithiumBank will be performing geological studies and water sampling with plans to estimate a resource at these properties in 2023.

Key Reason #3: LithiumBank Direct comparable companies show significant growth potential for LithiumBank Resources (TSXV: LBNK); (OTC: LBNKF); (FRA: HT9).

By focusing on direct lithium extraction (DLE), LithiumBank Resources enjoys several advantages over conventional lithium production sources.

Hard rock and salar lithium come with high production costs…long development timelines…and significant environmental challenges.

But DLE brine is much faster to bring to market – something that is especially critical now – as well as less costly and more environmentally friendly.

LithiumBank Resources (TSXV: LBNK); (OTC: LBNKF); (FRA: HT9) is now entering a fascinating stage of its development.

The company is nearing its transition – with the expected release of its PEA in early 2023 – and taking the next important step toward production.

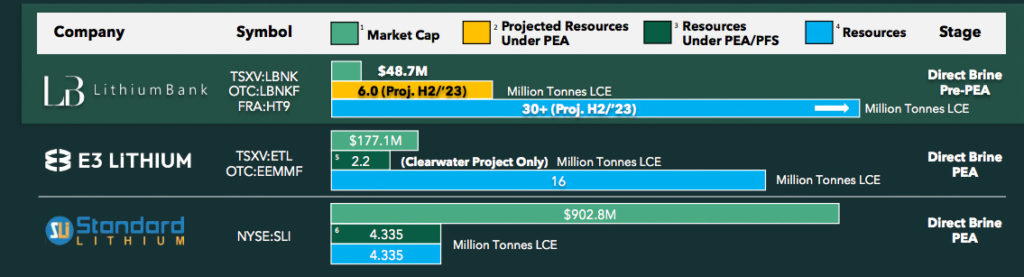

At the moment, the company is on a small list of comparable companies, as there are only a handful of direct brine lithium opportunities in North America.

And when you look at that list – you can see the extraordinary potential for LithiumBank Resources:

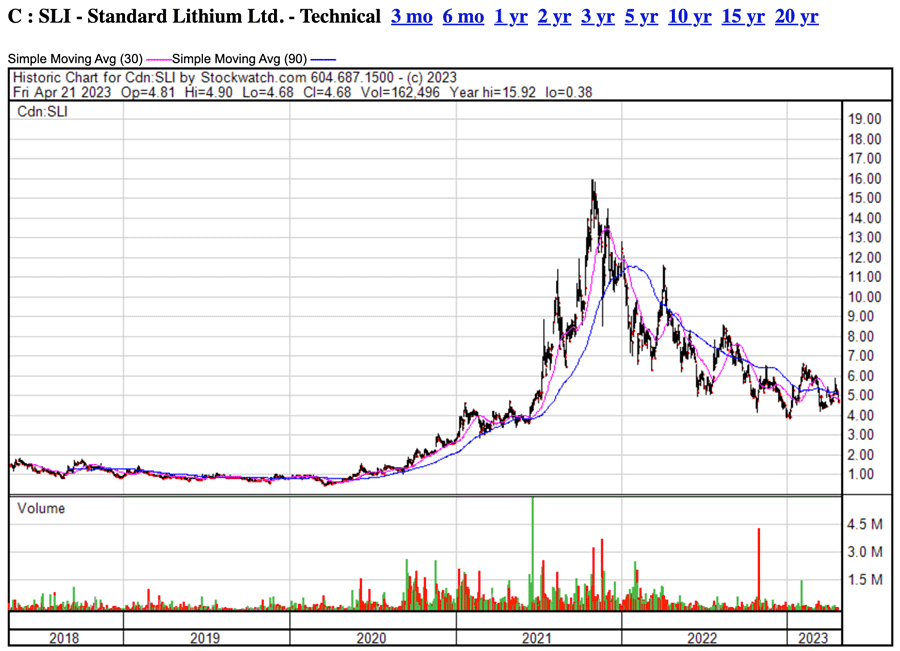

Now, each of the other three companies on this list have already released their PEAs – just as LithiumBank plans to do in early 2023.

But each of the other three companies have market caps significantly higher than LithiumBank Resources – at the moment.

Just two years ago, however – when these companies were at a stage similar to where LithiumBank is currently – they each had market caps of less than $50 million.

So you can see just how much growth they’ve seen in a short period of time.

LithiumBank Resources’ expectation is that by the end of 2023 it will have as many as three PEAs released – on up to three projects – with potentially more lithium tonnage under PEA than all three of the companies on this list combined.

This appears to be a significantly undervalued opportunity when compared with the other direct brine lithium companies in North America…one with the potential to move very quickly.

Key Reason #4:

LithiumBank Resources’ Boardwalk Project could be Western Canada’s easiest to permit direct brine lithium project.

When most people evaluate a lithium property, they first think of the project’s geology, grade and deliverability.

One of the characteristics that is most overlooked, however, is how permittable a project can be for the company.

That is a huge issue because obtaining necessary permits is a critical part of the process.

The reality, however, is that whoever gets their lithium to market first will receive hugely preferential pricing.

The “secret sauce” in getting to market first is the company who can fly through the permitting process. That means a company that has few oil and gas operators in the region…zero (or few) farmers and ranchers with claims in the acreage…and zero (or few) producing wells to consider for potential impact.

Now here’s the good news for LithiumBank Resources: The company owns 1,005 of the claims at Boardwalk with no freehold parties. And there is just one oil and gas operator — with zero producing wells — in the area to consider.

This means that when the company is ready to move forward – which could come as soon as 2023 – it believes it will move through the permitting process much more quickly than other direct brine lithium companies…which would allow it to be first into the market and receive premium pricing for its lithium.

Simply put, LithiumBank’s Boardwalk Project is called “Boardwalk” for a very good reason: It’s in the optimum position on the monopoly board of Western Canada’s direct brine lithium opportunities when it comes to obtaining permits and approvals.

Key Reason #5: LithiumBank Resources is led by a team with decades of experience in exploration and finance.

LithiumBank is run by a highly skilled management team that brings significant industry and governance experience, along with an accomplished board of directors that offer a broad array of experiences.

* Chairman and CEO Robert Shewchuk has 25 years of experience in the capital markets and served as Chairman of Standard Securities Capital Corp. as well as Managing Director of Wolverton Securities, Ltd.

* Chairman and CEO Robert Shewchuk has 25 years of experience in the capital markets and served as Chairman of Standard Securities Capital Corp. as well as Managing Director of Wolverton Securities, Ltd.

Mr. Shewchuk currently serves on the Board of Directors of Graphene Manufacturing Group Pty Ltd., Hydroflex Global Pty Ltd and Spectre Capital Corp. He is a Partner and Director of Caerus Capital Partners Inc.

* The company’s board of directors includes Mr. Paul Matysek, a geologist/geochemist and entrepreneur with over 40 years of experience in the mining industry. During his tenure as CEO or Executive Chairman, Mr. Matysek was involved in the sale of five publicly listed exploration and development companies with aggregate value greater than $2 billion.

* The company’s board of directors includes Mr. Paul Matysek, a geologist/geochemist and entrepreneur with over 40 years of experience in the mining industry. During his tenure as CEO or Executive Chairman, Mr. Matysek was involved in the sale of five publicly listed exploration and development companies with aggregate value greater than $2 billion.

More recently, Mr. Matysek served as Executive Chairman of Lithium X Energy Corp., which was sold to Nextview New Energy Lion Hong Kong Limited for $265 million in cash. He was previously CEO of Lithium One, which merged with Galaxy Resources of Australia to create a multi-billion-dollar integrated lithium company.

* Chief Operating Officer Kevin Piepgrass is a University of Alberta graduate and professional geologist registered at APEGBC.

* Chief Operating Officer Kevin Piepgrass is a University of Alberta graduate and professional geologist registered at APEGBC.

Mr. Piepgrass has over 15 years of experience managing the exploration and development of commodities including gold, silver, copper, lithium and rare earth elements. He is a Qualified Person pursuant to National Instrument 43-101 standards for disclosure for mineral projects.

* Vice President of Exploration Jon LaMothe has 15 years of experience in the oil and gas industry in Canada, the United States, and abroad. Mr. LaMothe has held positions at junior, intermediate, and major oil and gas companies, including Tasman Exploration, Black Swan Energy, and Talisman Energy.

* Vice President of Exploration Jon LaMothe has 15 years of experience in the oil and gas industry in Canada, the United States, and abroad. Mr. LaMothe has held positions at junior, intermediate, and major oil and gas companies, including Tasman Exploration, Black Swan Energy, and Talisman Energy.

He led the discovery of several fields with over two billion dollars spent to date on targets he identified. He helped bring Black Swan Energy from no production to making Black Swan Energy the fourth largest private producer of oil and gas in Canada.

* Director Katya Zotova has spent 25 years in strategy and corporate finance, private equity and investment banking across Europe, Middle East, Africa, Asia and the Americas. Ms. Zotova is currently an Advisor on Energy Transition, Infrastructure and Industrials at Antler VC Fund and a non executive director for Harland & Wolff plc. Prior to joining Antler, Ms. Zotova led Investment Banking Coverage for Corporates across Europe, Middle East and Africa for Mizuho International plc, acted as a Senior Advisor on M&A and Private Equity for McKinsey & Co.

* Director Katya Zotova has spent 25 years in strategy and corporate finance, private equity and investment banking across Europe, Middle East, Africa, Asia and the Americas. Ms. Zotova is currently an Advisor on Energy Transition, Infrastructure and Industrials at Antler VC Fund and a non executive director for Harland & Wolff plc. Prior to joining Antler, Ms. Zotova led Investment Banking Coverage for Corporates across Europe, Middle East and Africa for Mizuho International plc, acted as a Senior Advisor on M&A and Private Equity for McKinsey & Co.

Key Reason #6: LithiumBank Resources has significant catalysts that can make this a fast-moving opportunity.

One of the most important elements of any potential investment are catalyst that can drive significant growth in the near-term.

In the case of LithiumBank Resources (TSXV: LBNK); (OTC: LBNKF); (FRA: HT9) there are two catalysts which investors shouldn’t miss.

First…the company is expecting to release its Preliminary Economic Assessment (PEA) for its Boardwalk Project in early 2023.

The release of this PEA will help advance and define the project and will move the company into the same stage as North American comparables such as E3 Lithium and working towards a PFS in 2023 like its peers Standard Lithium and Lake Resources.

LithiumBank is also working to have its PEA released by the end of 2023 for its Park Place Project as well as potentially its Kindersley Project. Should each of these PEAs be released in 2023, the company will then have more projects under PEA than any of its competitors.

Another catalyst for the company that could come as soon as 2023 involves one of its direct brine lithium competitors moving into production.

Both Standard Lithium and Lake Resources have the potential to become producers in 2023 and once that happens – proving the effectiveness of direct lithium extraction technology – all companies in the space should receive a boost.

Investor’s Summary:

LithiumBank Resources (TSXV: LBNK); (OTC: LBNKF); (FRA: HT9) offers investors smart exposure to the white-hot lithium market with an investment in North American development. As one of just a handful of direct brine lithium opportunities in North America, investors have a unique opportunity to take advantage of a company moving quickly to bring a desperately-needed resource to market while prices remain high.

Resources

[i] https://www.benchmarkminerals.com/lithium-prices/

[ii] https://www.dallasfed.org/research/economics/2022/1011?utm_source=newsletter&

utm_medium=email&utm_campaign=newsletter_axiosgenerate&stream=top

[iii] https://www.mining.com/web/tesla-confirms-plans-to-build-lithium-refinery-in-texas%EF%BF%BC/

[iv] https://techcrunch.com/2022/10/19/bmw-to-invest-1-7b-to-build-evs-in-south-carolina/?guccounter=1&

guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&

guce_referrer_sig=

AQAAAA91FNcyow8CViwOv5JOKGbiWm4yGoe40qheLBW7Ron2vP5fzrbx

m5YTC9EDED2CFBzbYeUxTk45wCrY5wX1nSsMU4HstjlWKIu5sTezkwTChfz

_kBKDrjUI9TBOkZscwz7VwTnCKqnxwwSez4e_8DTpujmpbUe80MfUa-rtFLX2

[v] https://www.cnbc.com/2022/10/11/hondas-new-4point4-billion-ev-battery-plant-will-be-built-in-ohio.html

[vi] https://www.cnbc.com/2022/01/15/how-the-us-fell-way-behind-in-lithium-white-gold-for-evs.html

[vii] https://www.nytimes.com/2021/05/07/business/the-electric-vehicle-race-is-creating-a-gold-rush-

for-lithium-raising-environmental-concerns.html

[viii] https://www.forbes.com/sites/forbesbusinesscouncil/2023/02/28/how-to-break-into-the-growing-electric-vehicle-industry/?sh=6c19a7c422aa

[ix] https://www.nytimes.com/2023/04/21/business/energy-environment/volkswagen-battery-canada.html

Legal Disclaimer

This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. WallStreetNation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.

Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of Lithium Bank Resources Corp and its securities. Jade Cabbage Media, LLC d/b/a STOXmedia.com has received up to $10,000 USD dollars (11/30/22) by Winning Media LLC as a total production budget for this advertising effort. Neither WallStreetNation.com, Winning Media LLC or Jade Cabbage Media LLC currently hold the securities of Lithium Bank Resources Corp. and do not currently intend to purchase such securities.

The issuer, Lithium Bank Resources Corp has paid Winning Media LLC the sum total of twenty five thousand dollars USD total production budget to manage a digital media campaign for thirty days.

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.