Unique, Actively Managed ETF Offers the Potential for Absolute Returns… and the Wisdom of an Experienced, Highly Successful Fund Manager

The popularity of ETFs has exploded in recent years, eclipsing the $7 trillion mark in assets under management in the United States alone.

In addition, the industry recently hit a milestone of more than 3,000 ETFs trading at once – an increase of 30% in less than two years.[i]

Part of the reason for the surge in ETF investment has been the shift toward more active ETF strategies.

Instead of choosing from simply a menu of very broad index funds – the only choices available when ETFs were first launched 30 years ago – the industry has evolved to include single-stock ETFs, thematic ETFs and more actively managed ETFs.

This helps explain why in 2021 alone over $40 billion dollars of assets converted from mutual fund structure directly to ETFs listed at the NYSE.

This move from traditional funds to actively managed ETFs is due in large part to the greater accessibility and transparency of ETFs along with their lower fee structures.

Among the more intriguing ETFs for investors to consider is one launched in September 2022: The Noble Absolute Return ETF (NYSE: NOPE).

This actively managed fund is managed by veteran global hedge fund manager George Nobel, and offers individual investors a chance – via this unique investment vehicle – to access what was previously reserved only for high-net worth and institutional investors.

For the first time, access to this manager’s successful hedge-fund investing strategies are available – and at a tiny fraction of the fees one would normally expect.

This access is just one of four key reasons to consider the Noble Absolute Return ETF (NYSE: NOPE) in the weeks ahead.

Reason #1.

Highly experienced – and successful – investment management.

The Noble Absolute Return ETF (NYSE: NOPE) is run by a veteran investment manager with an extensive track record of success using absolute return strategies over many market cycles.

The fund is constructed and managed by George Noble, and employs the same investment principles and strategies he has used for over 40 years with institutional investors to navigate the world’s economic and financial market cycles.

Prior to forming Noble-Impact Capital, Mr. Noble spent more than 40 years managing institutional investment portfolios.

He began his career at Fidelity Investments in 1981, working closely with legendary fund manager Peter Lynch before becoming the initial portfolio manager of Fidelity’s international equity fund earning a top ranking spanning six years.

Mr. Noble then went on to manage two separate hedge funds, each of which grew to more than $1 billion in assets.

Mr. Noble is highly respected – and well-known – for his no-nonsense style as well as his deep network of industry research connections.

According to Forbes, Noble is “frustrated by what he considers to be nauseatingly unskeptical cheerleading on CNBC (which he refers to as the Cartoon Network)[iv]” and has created a large social media following where he presents no-holds-barred research and analysis.

It is this no-nonsense approach – along with his highly successful asset management strategies – that Noble now brings to individual investors through the Noble Absolute Return ETF (NYSE: NOPE).

Reason #2.

The critical flexibility and advantage of active management.

As mentioned earlier, the Noble Absolute Return ETF is an actively managed fund, allowing investors the unique opportunity to benefit from the skill of an experienced portfolio manager via the ETF structure.

In the case of the Noble Absolute Return ETF, the fund seeks positive returns over a full market cycle across a variety of regions, sectors and factors.

In other words…it’s designed to make returns regardless of market direction.

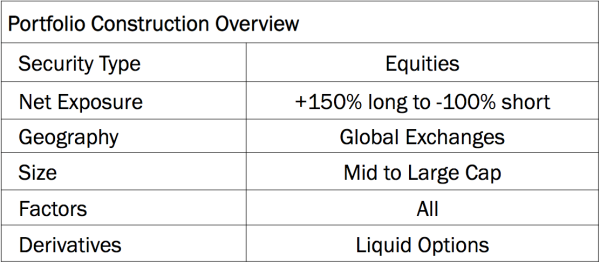

Unlike most ETFs, which are passively managed, the Noble Absolute Return ETF could be long or short…and at times it can even be both long and short.

That active management – and the fund’s ultra-flexibility – can be an absolute game-changer in a market like the one we’re experiencing right now.

The fund has the mandate to capture long and short opportunities across various regions, sectors and factors.

What this means is that the Noble Absolute Return ETF looks at virtually all available opportunities in the public markets in order to generate strong returns…rather than being limited to any one specific niche.

But in addition to the assets themselves…

Reason #3.

The Noble Absolute Return ETF is built on the philosophy of saying “NOPE” to passive investing…”NOPE” to ignoring valuations…and “NOPE” to asset bubbles.

And given what we’ve seen in the markets over the past two years…that idea seems especially important.

How many investors were clobbered by falling equity prices as inflation soared…got squeezed as the crypto market imploded…or fell victim to over-hyped, overvalued story stocks that ultimately collapsed?

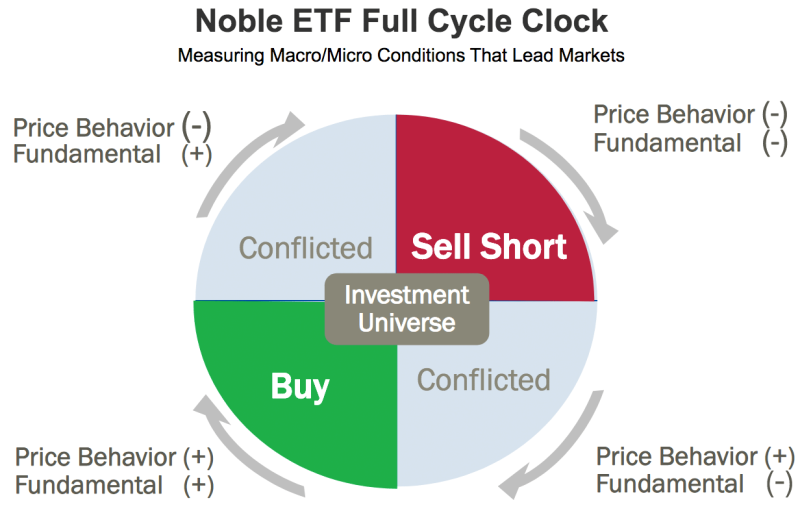

The Noble Absolute Return ETF offers a smart alternative for today’s market environment in that it is designed to consider both the strength of an underlying asset as well as the macro conditions driving the market.

The NOPE ETFs process uses leading micro-macro investment drivers of changing market conditions to identify investable opportunities.

And the fund is designed to capitalize on only the best opportunities as its investment selection process focuses on the securities that will benefit and deteriorate the most from overall changing conditions.

Again, this allows the fund to identify opportunities to go both long and short depending on the scenario.

The NOPE ETF will establish long positions in the best securities with improving circumstances. And it will establish short positions in the best securities with deteriorating circumstances.

Reason #4.

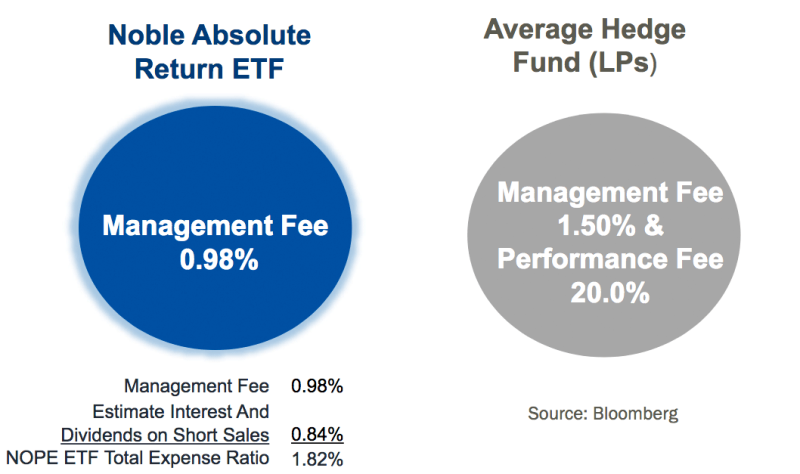

One of the key advantages of the actively managed ETF model is that it allows investors to access hedge fund-style management at fees generally much lower than those associated with hedge funds…or even mutual funds.

And that is also the case with the Noble Absolute Return ETF (NYSE: NOPE).

The fund is listed as having an expense ratio of 1.82%. This means that a shareholder with $1,000 invested over a calendar year would expect to pay just $18.20 in fees over that period.

By way of transparency, this expense ratio includes estimated Interest and Dividends on Short Sales in the amount of 0.84%. If these expenses were excluded, the expense ratio would be just 0.98%.

These fees are significantly lower than those associate with the average hedge fund and help make the Noble Absolute Return ETF (NYSE: NOPE) such an attractive alternative for individual investors.

Investor Summary

The Noble Absolute Return ETF (NYSE: NOPE) appears to be a most unique, actively managed offering in the ETF space.

The fund provides an opportunity – at relatively low cost – for investors to benefit from the experience and trading strategy of 40-plus-year asset management veteran George Noble.

What makes this opportunity especially attractive in today’s market environment is its flexibility.

By combining active management and a research-driven approach, this fund seeks to capture returns – using both long and short positions — in a variety of regions, sectors and factors.

This “go anywhere” approach could mean exposure to opportunities many would never consider while at the same time avoiding long stretches of sitting on the sidelines waiting for the next opportunity.

[i] https://www.cnbc.com/2022/09/24/wall-street-milestone-etf-popularity-hits-record-number-.html

[ii] https://www.wealthmanagement.com/etfs/us-etfs-hit-7-trillion-milestone

[iii] https://www.barrons.com/articles/actively-managed-etfs-coming-soon-2023-51673648692

[iv] https://www.forbes.com/sites/christopherhelman/2022/06/14/star-stockpicker-finds-new-crusade-raging-against-the-everything-bubble/?sh=27b7bc0e4ad2