America’s Next Top Copper Producer is Trading at a Significant Discount

The U.S. just declared a national emergency over copper.

Used in everything from electric vehicles and data centers to power grids and defense systems, copper prices are exploding with massive supply-demand issues.

It’s just part of the reason why copper ran from about $4.25/lb. to more than $5.40 – with more upside likely – since the year began, especially with growing demand for artificial intelligence data centers all over the United States.

For example, data centers require significant amounts of copper for their construction, most notably for their power networks, circuit boards, and cooling systems. According to BHP, “A study of Microsoft’s US$500 million data center facility in Chicago found it used 2,177 tonnes of copper, equivalent to 27 tonnes of copper for every megawatt (MW) of applied power.”

In addition, according to the International Energy Agency (IEA), hyperscale data centers have power demand of 100 MW or more, an annual electricity consumption equivalent to that used by around 350,000 to 400,000 electric cars, as also noted by BHP.

Moving forward, the amount of copper used in data centers globally, could grow six-fold by 2050 from about half a million tonnes today. Plus, global electricity consumption from data centers could run from about 2% of global electricity demand to 9% by 2050.

All of which puts even more stress on copper supply and demand issues – especially when you consider that the U.S. still relies heavily on foreign resources for supply.

Needless to say, the supply-demand issues are creating big opportunity for U.S. copper stocks – especially when the Defense Production Act hands out tax credits to companies that can bring domestic copper production and refining online.

Look at Gunnison Copper (TSX: GCU) (OTCQB: GCUMF), for example.

Already producing at Johnson Camp and advancing its flagship Gunnison Project, Gunnison Copper is quickly becoming American’s net top copper producer.

Its Johnson Camp Mine in Arizona began producing pure copper cathode in August 2025, with first sales in September…and the project has a production capacity of up to 25 million pounds per year of domestic copper.

This copper in intended to be sold directly into U.S. energy, defense and manufacturing supply chains. This is critically important because it means that no overseas smelter is required.

The progress at the Johnson Camp Mine is possible because the project has been fully funded by Nuton LLC, a Rio Tinto venture, which has invested funds to prove out proprietary technology that processes sulfide copper material on U.S. soil through SXEW production. Nuton LLC will recover its investment from copper revenues at the Johnson Camp Mine.

And the upside for this proprietary technology is huge, as it eliminates the expensive, time-consuming step of shipping concentrate to Asia for refining…a true breakthrough that could revolutionize how America produces copper.

But that’s just the start.

The real upside for Gunnison is with its flagship Gunnison Copper Project, a large-scale open-pit development with the potential to produce roughly 167 million pounds of copper cathode per year over the first 16-years of mine life and 2,712 million pounds of copper cathode total over the 18-year mine life. That’s roughly 8% of America’s annual copper supply — a serious chunk for a new domestic producer.

A December 2024 Preliminary Economic Assessment (PEA) shows a $1.26 billion after-tax NPV (8%), 20.9% IRR and four-year payback.

That’s before incorporating recent optimization work that has shown the potential to improve material grades and reduce acid consumption by 75%.

And yet, the Gunnison Copper Corp. stock trades with a market cap of just CAD $128 million.

In short…

This is an “American Copper” story that is rapidly developing at exactly the right moment.

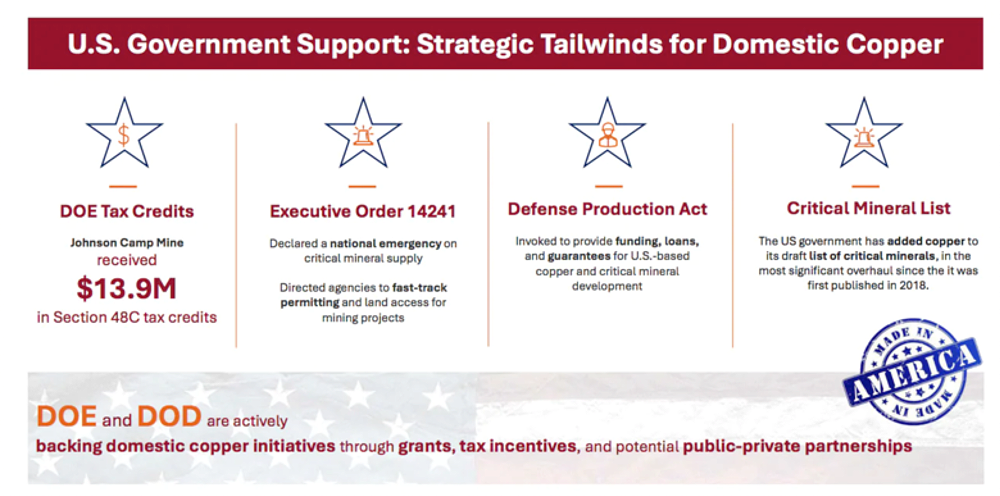

The U.S. government has declared a national emergency on critical minerals, added copper to the critical minerals list, and invoked the Defense Production Act to support domestic supply, all while awarding Gunnison $13.9 million in 48C tax credits (with the final amount subject to certification and the requirements of the program).

Looking ahead, the near-term catalyst calendar is a busy one with tax credit monetization and partial debt paydown before year-end, and — most importantly — an updated Gunnison PEA that same quarter. By mid-2026, the company is targeting the onboarding of a strategic investor and the launch of a Pre-Feasibility Study, advancing the project toward construction readiness and a potential strategic transaction.