Nasdaq: LRHC

Sponsored – Est. Read 8 Min

High Upside Alert:

This Little-Known Nasdaq Company is Poised to Bring Massive Disruption to a $113.6 Trillion-a-Year Industry

With diversified revenue streams and an AI-powered “secret weapon,” La Rosa Holdings Corp. (Nasdaq: LRHC) could become the next small cap superstar.

An innovative company – just recently listed on the Nasdaq – appears to be on the verge of transforming a massive industry that is badly in need of change.

This industry is currently generating over $113.6 trillion each year – and it’s projected to grow by nearly 5% per year through 2028[a]…

But it’s also an industry that has been stuck on “auto-pilot” – doing things the same way for fifty years.

This combination of an industry in need of change – combined with continued projected growth – means that tremendous potential now exists for a truly disruptive company.

Small cap investors should pay close attention because that’s precisely the scenario that is unfolding right now in the real estate industry.

One company – La Rosa Holdings Corp. (Nasdaq: LRHC) – is threatening to disrupt the $113.6 trillion real estate industry with its innovative platform and business model.

Windfall Profit Potential for Investors

Early investors in this transformative company could see potential windfall profits in the months ahead as the company continues its impressive growth and brings sorely-needed transformation to the real estate industry.

Small cap investors have heard time and time again about opportunities in sectors such as healthcare, biotech and energy.

But the real estate sector right now is an overlooked sector that is right now offering significant high-upside potential for those small cap investors who know where to look.

At this moment, La Rosa Holdings Corp. (Nasdaq: LRHC), with its game-changing approach to the industry, appears to be the best way to play this market for maximum upside potential.

La Rosa Holdings Corp. is an end-to-end real estate services platform integrating residential, brokerage, mortgage, title and insurance with a state of the art educational support platform.

So what is it that La Rosa Holdings Corp. that makes it so unique and worthy of closer examination by investors?

What La Rosa Holdings Corp. (Nasdaq: LRHC) is Doing That is Unlike Anyone Else in the Market

First and foremost, La Rosa Holdings Corp. has recently been posting some impressive numbers.

BY THE NUMBERS

*FY2022

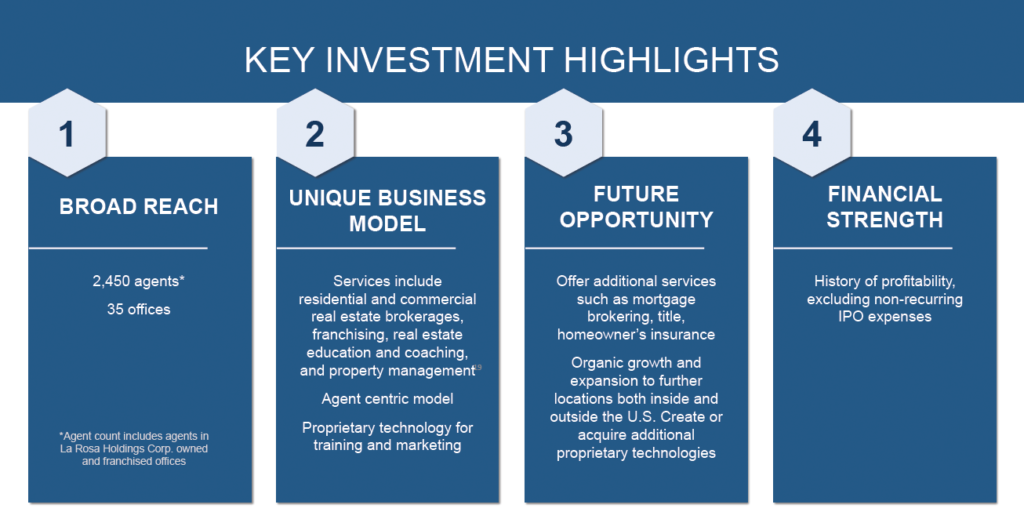

In 2022, the company completed $2.9 billion in total transaction volume…opened offices in six states…completed 8,300 total transactions…and logged an agent headcount of 2,450.

But it’s the company’s one-of-a-kind approach to the business that could propel even faster growth in the months ahead.

Here’s what I mean:

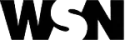

La Rosa Holdings Corp. is unique primarily due to its agent-centric commission model where the agent keeps 100% of their commission.

The company’s strategy is to drive exponential growth through rollup expansion, allowing it to take advantage of the changing agency model trends taking place in the real estate industry.

This means that instead of taking a hefty chunk of an agent’s commission – like most of the more well-known real estate brokerage companies – agents at La Rosa get to keep 100% of their commissions.

In other words, La Rosa realty agents simply earn more than agents from other brokerage companies. It’s a a win-win-win proposition whereby buyers, sellers, and agents benefit.

That’s because La Rosa Holdings Corp. also empowers its agents with a full suite of trainings and workshops designed to help ensure the agents’ success. And the company’s leadership – specifically Chairman & CEO Joe La Rosa – maintain a business culture dedicated to listening to the agents in order to best understand and meet their needs.

In the past, other real estate brokerage firms have offered 100% commissions to their agents…but without providing the support needed to allow those agents to achieve success.

La Rosa Holdings Corp. is offering something truly unique: 100% commissions plus the training, coaching support and technology that the agents truly need. This includes:

- Education – La Rosa offers a robust, best-in-class training platform for sales agents, both new and experienced. Daily in-person educational classes are available, plus virtual support 24/7.

- Marketing – La Rosa provides marketing support via an AI-integrated CRM software platform. Each franchise and agent is given their own personalized website.

- Intranet – Agents have access to a proprietary company intranet called My Agent Account that includes an Internal Referral Network, Ticket Support System and a Streamlined Onboarding System.

- Opportunities – La Rosa is working to create new proprietary technologies to expand its offerings and is looking for opportunistic acquisitions of technology the company believes will fuel growth.

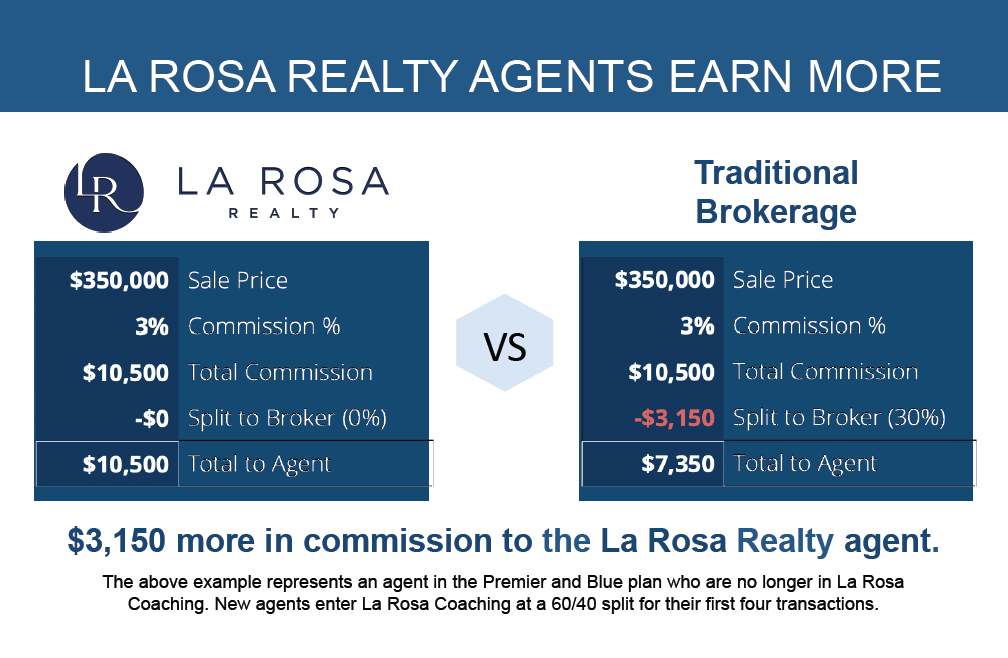

Here’s what that total package looks like when comparing La Rosa Holdings Corp. (Nasdaq: LRHC) to others in the industry:

What makes La Rosa Holdings Corp. (Nasdaq: LRHC) such a potential disruptor is the fact that the company is possibly the only agent-centric real estate company that is focused on creating the greatest value for its agents. Other companies say this is their goal, but their commission structure – or their lack of support – does not reflect it.

How La Rosa Holdings Corp. is Poised for Rapid Revenue Growth in the Months Ahead

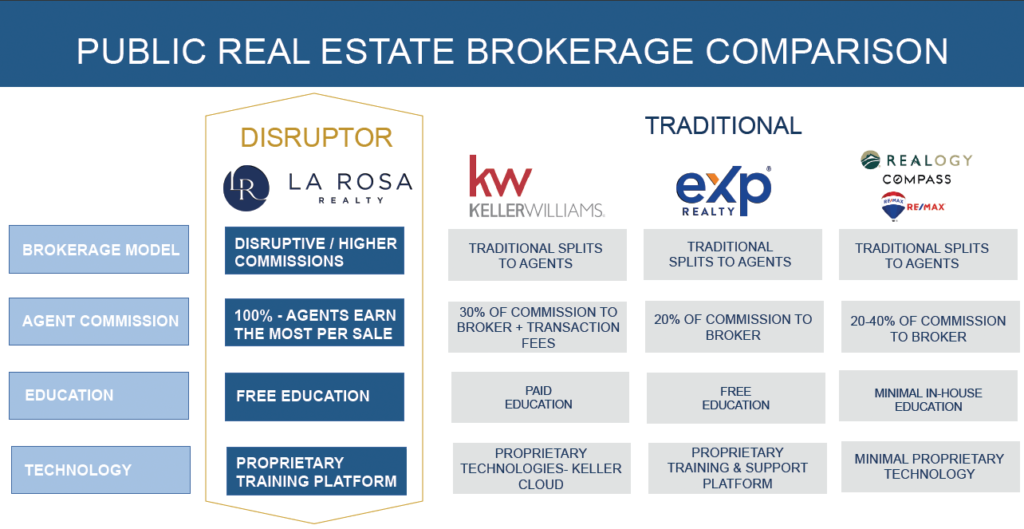

Here’s a quick overview of how La Rosa Holdings Corp. (Nasdaq: LRHC) earns revenue with its unique business model.

The company earns revenues from franchising, member dues, and a 10% commission from commercial transactions.

Another revenue stream is from the franchisees, who pay a one-time upfront fee and monthly dues, currently $75.

La Rosa Holdings Corp. also earns revenue from ancillary services and from late fees, interest, and audits.

The company generated revenues of over $26.2 million in FY2022, higher by over 8% from the $24.1 million earned in FY2020.

Even during the historic market disruption caused by COVID, La Rosa Holdings Corp. generated FY2021 total revenues of $28.7 million.

Heading into Q4 and 2024, the company is confident that scoring higher revenues is not only a target but is already in the crosshairs.

La Rosa Holdings Corp.’s Exclusive Artificial Intelligence Tools Are a Game-Changer

Over the past several months, La Rosa Holdings Corp. has developed a new, AI-powered back-end technology that is potentially the first of its kind in the market.

It’s known as Jaeme (pronounced Jaime) – and it was built via a partnership with OpenAI.

Using JAEME, realtors can analyze data about their target audience, identify trends and preferences, and tailor their marketing strategies accordingly. For example, JAEME can help realtors identify which neighborhoods or types of properties are most in demand, or which marketing channels are most effective in reaching potential buyers.

JAEME can also assist realtors in creating more personalized and engaging marketing experiences for their clients. By analyzing past interactions and behavior, JAEME can help realtors deliver customized content and recommendations that resonate with each individual client.

Finally, JAEME can automate many repetitive marketing tasks, freeing up realtors to focus on more high-level strategic work. For example, AI can help generate personalized email campaigns or social media posts, schedule follow-up calls or meetings, and even identify new leads in real-time.

Overall, JAEME is a powerful AI-powered tool – available exclusively to La Rosa realtors – that can help realtors stay ahead of the game in today’s competitive market.

La Rosa Holdings Corp.’s Diversified Revenue Streams Provide Another Significant Advantage

There are a total of five companies currently under the La Rosa Holdings Corp. (Nasdaq: LRHC) umbrella.

Each of these companies is designed to help empower the company’s real estate agents to thrive with fee-based and franchising services.

These affiliated companies serve dual purposes.

First, they are intended to fully support the company’s agents. But additionally, these affiliated companies also offer La Rosa Holdings Corp. additional revenue streams with strong potential for future growth.

This unique business model – with a number of impactful, diversified revenue streams – is another key differentiator for La Rosa Holdings Corp. (Nasdaq: LRHC).

In both thriving and challenging real estate markets, La Rosa Holdings Corp. will continue to see revenue flowing.

Compare this with more traditional real estate brokers who are solely dependent on a strong market.

La Rosa’s diversification not only allows the company to survive during slow real estate markets…it also helps the company thrive as those difficult times will attract more agents looking for better commissions and support.

This ability to expand the company’s roster of agents even in a difficult market helps position the company for even greater potential expansion as a challenging market begins to transition into a thriving one.

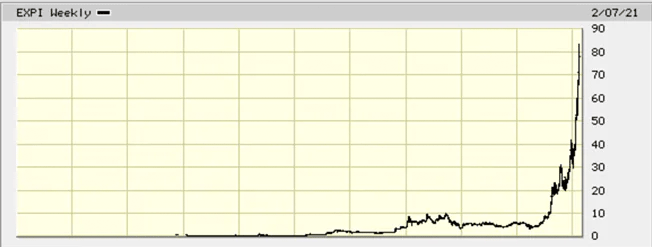

From $40 Million to $2.4 Billion Market Cap: Could La Rosa Holdings Corp. (Nasdaq: LRHC) Become The Next eXp Realty?

When considering the investment potential for La Rosa Holdings Corp. (Nasdaq: LRHC), it’s important to look at other real estate brokerage companies that are publicly traded.

The largest of these is eXp World Holdings, Inc. (Nasdaq: EXPI), an independent real estate company with more than 89,000 agents worldwide.

eXp World Holdings went public back in 2011 and saw significant growth as it offered agency-ownership to its agents.

The company currently has a market cap of over $2.4 billion, demonstrating the type of potential that can exist in this market for La Rosa Holdings Corp. (Nasdaq: LRHC), which currently has a market cap of just $40 million.

Early investors in eXp World Holdings had an opportunity to collect significant profits, as the company’s shares soared to a high of nearly $78 per share back in February 2021.

Imagine having the opportunity to get in early with a company like eXp World Holdings back at the time of its IPO.

Well that’s what the scenario unfolding for La Rosa Holdings Corp. could potentially look like.

In fact, with its diversified revenue streams…AI-powered support technology…and its true 100% commission structure, it could be argued that La Rosa Holdings Corp. (Nasdaq: LRHC) is actually better positioned for growth today than eXp World Holdings was back at the time of its IPO.

Investors looking for the next small cap with significant upside potential should consider La Rosa Holdings Corp. (Nasdaq: LRHC) as it looks to bring Netflix-style disruption to today’s rapidly growing real estate market.

[a] https://www.statista.com/outlook/fmo/real-estate/united-states#_blank

[i] https://www.nar.realtor/magazine/real-estate-news/economy

/nar-economist-housing-recession-is-over

[ii] https://www.researchandmarkets.com/reports/4514489/real-estate-

market-size-share-and-trends-analysis

[iii] https://www.benzinga.com/news/23/04/31897095/if-you-invested-

1-000-in-netflix-stock-at-its-ipo-heres-how-much-youd-have-to

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media and the third party, One Eye Jack enterprises, Winning Media has been hired for a period beginning on 10/10/23 and ending on 11/10/23 to conduct investor relations advertising and marketing and publicly disseminate information about (LRHC) via Website, Email and SMS. Winning Media has been compensated the sum total of one hundred thousand dollars via bank wire transfer. Furthermore, Winning Media has paid up to twenty five thousand dollars to Jade Cabbage Media to manage the production budget and digital media campaign for La Rosa Holdings Corp.

According to an agreement between Winning Media and One-Eyed Jack Media., Winning Media has been hired for the time period beginning on 11/10/23 and ending on 12/15/23 to publicly disseminate information about (LRHC) via digital marketing and has been paid one hundred thousand dollars USD. To date we have been paid two hundred thousand dollars USD to disseminate information about (LRHC) via digital marketing. We own zero shares of (LRHC).

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (LRHC). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party (One Eye Jack enterprises). The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.