Sponsored – Est. Read 9 Min

Largely ignored by the mainstream media, one remote region in northern Canada is on the way to becoming…

North America’s Next Great Energy Source

Here’s why a little-known uranium exploration company – Lexston Mining Corporation (CSE: LEXT); (OTC: LEXTF) – now offers investors extraordinary upside potential

Executive Summary:

6 Key Reasons Why Investors Should Consider

Lexston Mining Corp. (CSE: LEXT); (OTC: LEXTF) Today

1

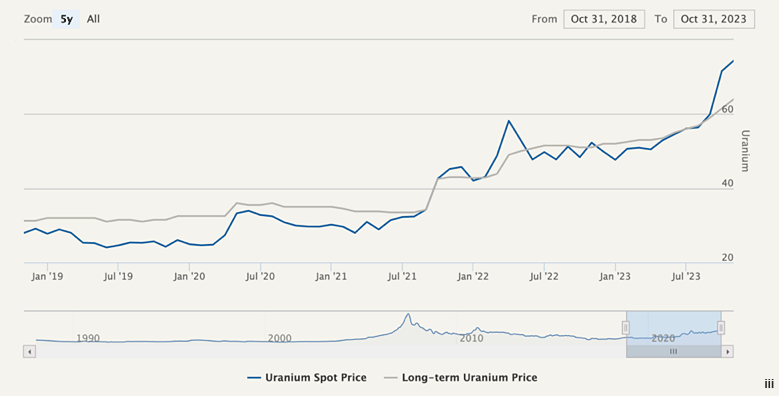

Red-Hot Uranium Bull Market: With uranium prices now at 15-year highs – and experts projecting even higher prices in the months ahead – we are still in the early stages of a long-term uranium bull market. This creates an extremely attractive environment for exploration companies throughout North America.

2

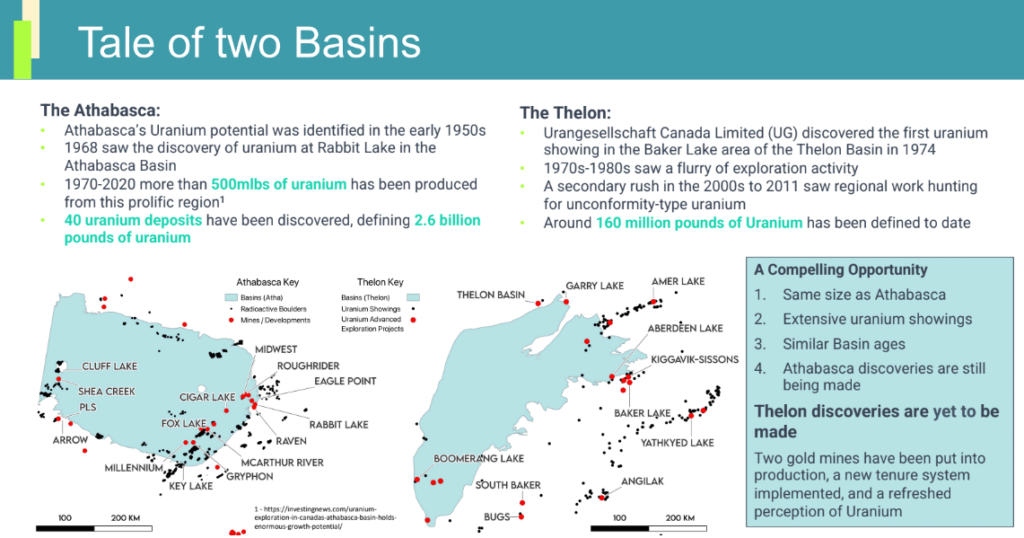

Up-and-Coming Thelon Basin Represents Massive Opportunity: While still under the radar of most investors, this potentially resource-rich basin has massive upside potential. Experts at the University of Manitoba and the IAEA have stated that it has similar potential to the Athabasca Basin, which currently produces nearly one-quarter of the world’s high-grade uranium.

3

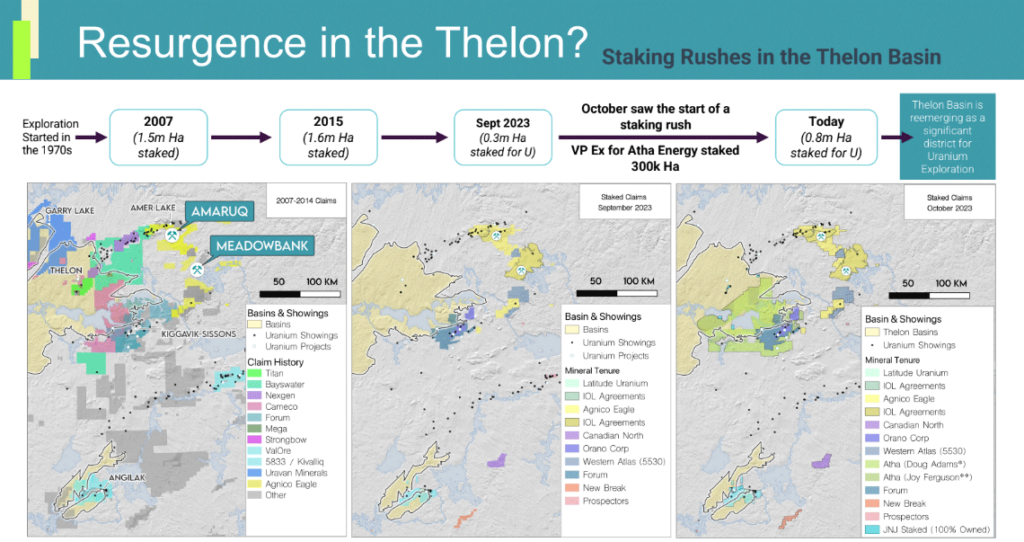

The Thelon Basin Contains High-Grade Uranium: Historical data shows the potential for high-grade uranium deposits in the region. This has triggered a staking rush at the basin, with other companies – including Forum Energy Metals (TSXV: FMC) – active in the region.

4

Lexston Mining Corp.’s Projects Offer High Upside Potential: The company’s initial projects within the Thelon Basin are both within strong land positions that have been shown to contain the highest-grade uranium samples in the Basin. With strong claims in the historically most attractive areas, Lexston Mining Corp. is well-positioned to be a leader in this up-and-coming region.

5

Lexston Mining Corp. is Building a Strong Portfolio: The company’s first two projects are just part of what is expected to be a strong portfolio of properties designed to help take maximum advantage of the ongoing uranium bull market.

6

Nearby Competitors Demonstrate Room for Significant Upward Growth: With other exploration companies in the Nunavat region carrying significantly higher market caps than Lexston Mining Corp., this represents a unique undervalued opportunity for investors. Lexston Mining Corp.’s current market cap of just $2.4 million means there is considerable room for upside growth. Even climbing to a valuation half that of Forum Energy would represent more than 6x growth for Lexston Mining Corp.

Located in an extremely northern area of Central Canada – more than 1,000 miles north of Winnipeg – sits a potentially game-changing uranium deposit that could help investors collect a fortune.

In fact, the uranium basin at this site is so large that it could prove to be one of the three largest in the world.

Some have gone so far as to suggest that this basin – known as the Thelon Basin – could have similar potential to Canada’s famous Athabasca Basin…the world’s foremost source of high-grade uranium.

What’s happening at the Thelon Basin right now isn’t receiving a lot of mainstream media coverage – but it could prove to be one of the most lucrative investment opportunities to come along in years.

At this moment – very quietly – a staking “rush” is taking place in the Thelon Basin as exploration companies jockey for position.

One under-the-radar company is now at the forefront of this opportunity, having made critical strategic moves in the region. And right now this company presents investors with unique potential for windfall profits.

The company is Lexston Mining Corporation (CSE: LEXT); (OTC: LEXTF)…and they’ve quickly established a strong foothold in a data-rich region of the Thelon Basin.

Lexston Mining Corp. currently has two projects underway at the Thelon Basin within the most prospective region of the Basin that contains the highest grade uranium samples.

So why is this little-known company’s activity in an area 1,000 miles north of Winnipeg worthy of your immediate attention?

The answer is simple: We are right now in the early stages of a new uranium bull market.

The race is on to bring new, North American supplies of uranium online as quickly as possible to help meet soaring demand…

And the Thelon Basin represents one of the best opportunities to do just that – and in the process deliver extreme upside potential.

Here’s what I mean:

Uranium Prices Have Soared to 15-Year Highs, Triggering a Fast-Moving Profit Opportunity for Investors

Soaring energy demand in North America – including demand for nuclear power – has helped propel a strong market for uranium over the past 12 months.

This continued robust demand for energy, combined with tight supply, should mean a prolonged bull market for uranium and high upside potential for companies in the exploration space.

Steve Schoffstall, Director of ETF Product Management for Sprott Asset Management, recently wrote, “We believe we’re in the midst of a new uranium bull market.”

Schoffstall continued, “Increasingly, global governments are recognizing nuclear power’s vital role as a carbon-free energy source and are supporting growth in the industry…The increasing demand for uranium is providing attractive investment opportunities in uranium miners.”[iv]

And there is no more attractive opportunity for uranium miners than a large, sandstone basin in northern Canada that could prove to be the next Athabasca Basin.

The Thelon Basin Offers Extraordinary Upside Potential for Exploration Companies…including Lexston Mining Corp. (CSE: LEXT); (OTC: LEXTF)

The Thelon Basin located in northern Canada is 1.7 billion years old and is a large sandstone basin very similar in composition to the Athabasca Basin, the world’s leading source of high-grade uranium.

The International Atomic Energy Agency (IAEA) says that “The Thelon Basin is a…basin similar to the Athabasca basin in tectonic setting, age and depositional environments… The genetic models developed for the uranium deposits in the region of the Athabasca basin apply equally well to those in the geologically similar region of the Thelon basin. They imply a high resource potential for the Thelon basin region.”[vi]

And according to the University of Manitoba, the Thelon Basin displays “many similarities to the uranium-producing Athabasca Basin located in Northern Saskatchewan and may share similar economic potential.”[vii]

With nearly one-quarter of the world’s uranium currently being produced in the Athabasca Basin, you can see why sharing “similar economic potential” is driving so many exploration companies to jockey for position within the Thelon Basin.

Lexston Mining Corp. (CSE: LEXT); (OTC: LEXTF) Has High-Upside Projects in the Region with the Highest-Grade Uranium Samples

The continued bull market for uranium has triggered higher spot prices, and has helped spark a wave of new exploration activity throughout North America.

With a pair of high-upside projects in the Thelon Basin – a region generating tremendous interest within the exploration community – Lexston Mining Corp. (CSE: LEXT); (OTC: LEXTF) appears exceptionally well-positioned for the months ahead.

Lexston Mining Corp.’s two projects are both within the most prospective region of the Thelon Basin and contain the highest-grade uranium oxide samples.

These projects offer:

- Smart exposure to – and strong land position within – the up-and-coming Thelon Basin

- Extensive historical data available to guide exploration planning

- Historical high-grade Uranium occurrences

- Previous exploration programs terminated without extensive drill testing

- Multiple projects that cover the spectrum from conceptual exploration targets to near-drill ready targets.

On November 27, 2023 the company announced it had entered into an option agreement to acquire 100% interest in two properties: Project 176 and Project Itza, located in the Thelon Basin and occupying a total area of 5661.93 hectares.

Jag Bal, President and CEO of Lexston Mining Corp. states, “We remain steadfast in our commitment to exploration, drilling, and value creation through advancing our portfolio of properties. This option agreement provides an opportunity to get a foothold in a data-rich part of the Thelon Basin. High-resolution, modern geophysics has not been deployed to the project before, providing an advantage for Lexston to leverage the $2,000,000 in previous uranium exploration in the area.”

Here’s a closer look at each of the potentially lucrative projects for Lexston Mining Corp. (CSE: LEXT); (OTC: LEXTF):

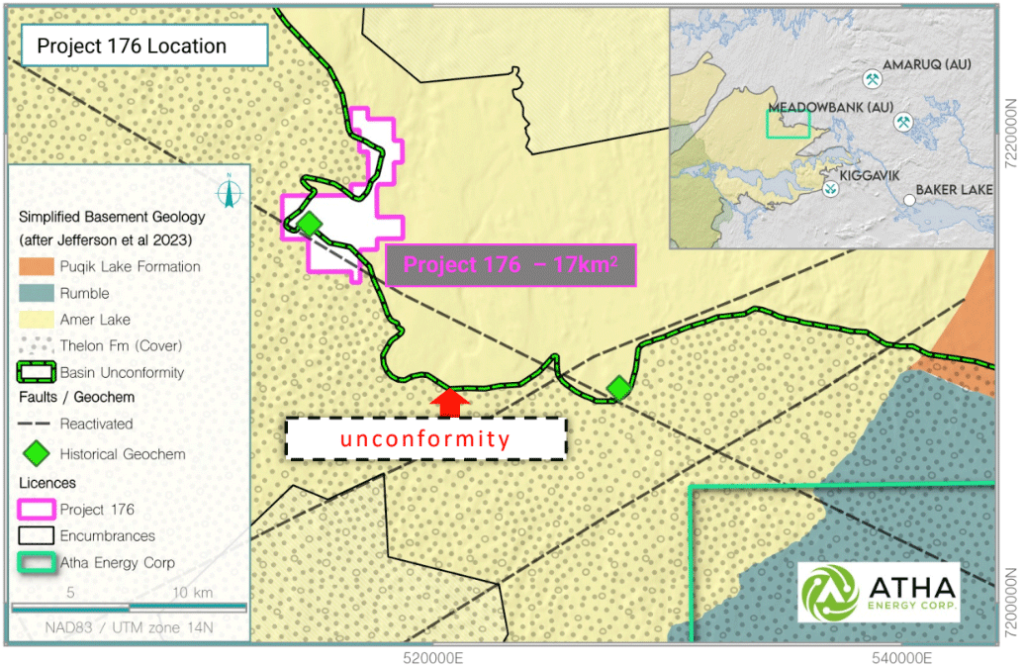

Project 176 – 1708Ha / 17km2

Project 176 is located within the Northeastern portion of the Thelon Basin…the most prospective region of the basin that contains the highest-grade uranium sample – 380,000ppm uranium.

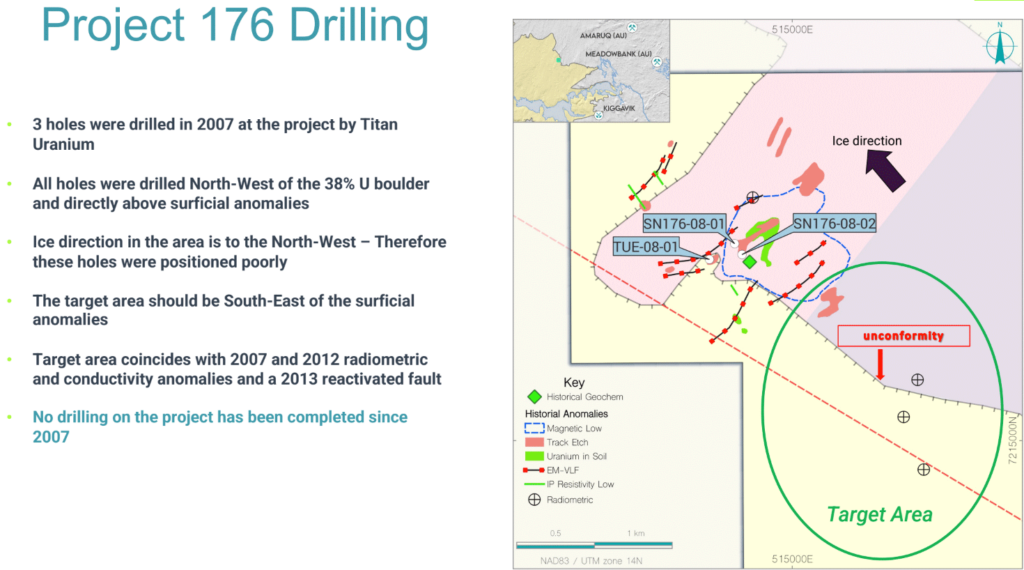

Project 176 was previously owned and explored by NexGen Energy who purchased the project from Mega Uranium in 2012. Following the uranium price collapse at that time, NexGen let the licenses lapse without drill testing any anomalies defined in 2012 regional work.

Extremely high-grade boulders have been discovered on the property, with assays up to 38% uranium.

Multiple coincident anomalies:

- Magnetic Low

- VLF Electromagnetic

- Gravity Low

- Radiometric

- Uranium in Soil

- Track-etch Anomalies

The combination of the anomalies defined historically provides prime ingredients for discovering a high-grade uranium deposit within the project area.

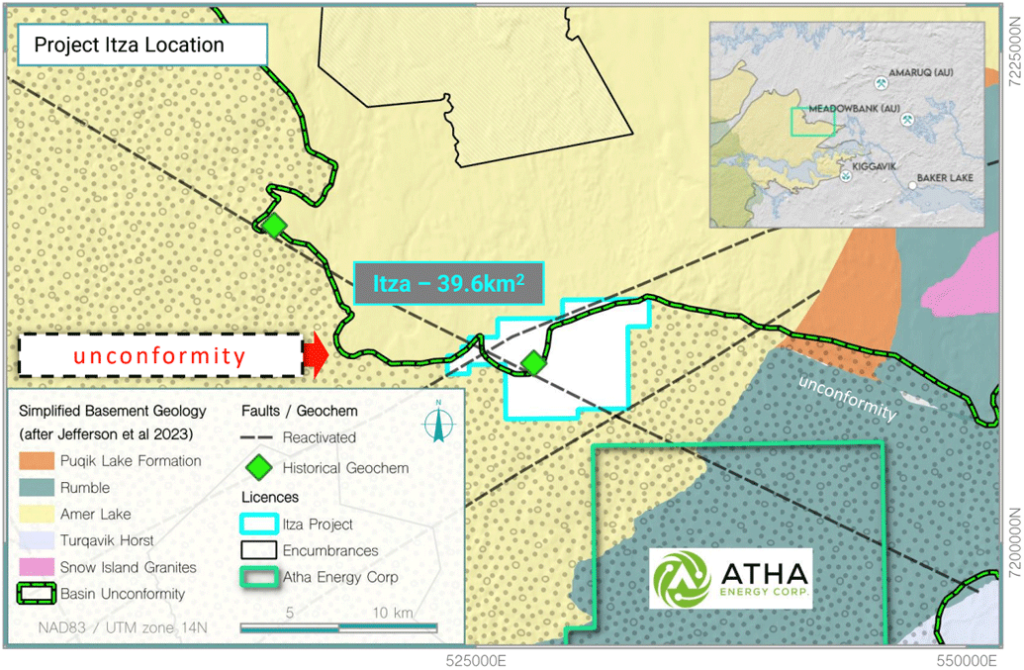

Project Itza – 3955ha / 39.6 km2

Project Itza is located in the Northeastern portion of the Thelon Basin.

Itza was identified before the staking rush took place and is within the most prospective region of the Thelon Basin that contains the high-grade uranium oxide samples.

A 0.88% uranium oxide boulder sits within the project and planned drilling in 2007 was never completed. At least 3 radioactive boulder trains are located, and the source is yet to be tested.

Project Itza sits at the mapped unconformity between the Thelon Formation and the underlying Amer Lake Metasediments. It contains reactivated Faults identified in 2013 – not identified when the properties were last explored (2012). The intersection of reactivated faults and unconformities is highly prospective for uranium deposits. e.g. Cigar Lake, Key Lake.

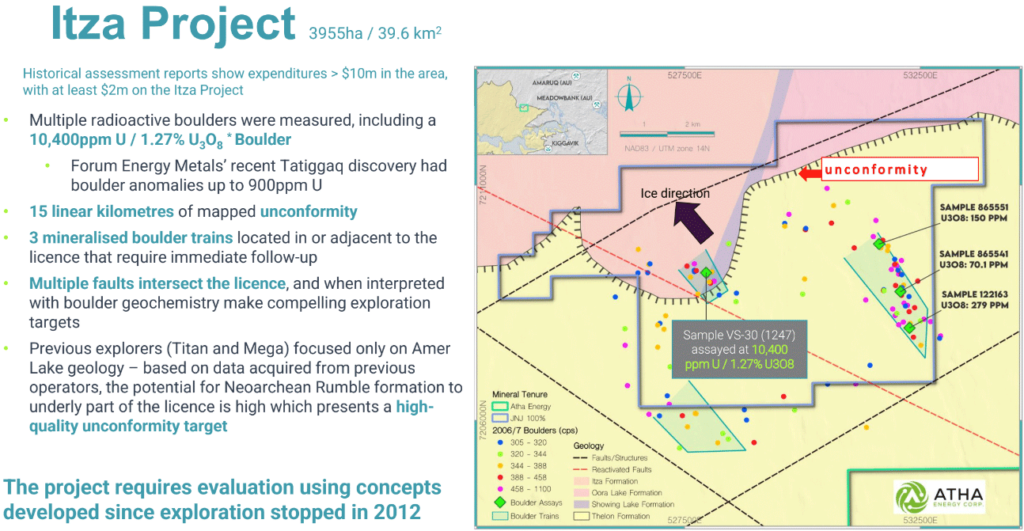

Historical assessment reports show expenditures of more than $10 million in the area, with at least $2 million on the Itza Project.

Multiple radioactive boulders were measured, including a 10,400ppm Uranium / 1.27% uranium oxide.

Previous explorers (Titan and Mega) focused only on Amer Lake geology based on data acquired from previous operators, the potential for Neoarchean Rumble formation to underly part of the license is high which presents a high-quality unconformity target.

The project requires evaluation using concepts developed since exploration stopped in 2012.

Executive Summary:

6 Key Reasons Why Investors Should Consider

Lexston Mining Corp. (CSE: LEXT); (OTC: LEXTF) Today

1

Red-Hot Uranium Bull Market: With uranium prices now at 15-year highs – and experts projecting even higher prices in the months ahead – we are still in the early stages of a long-term uranium bull market. This creates an extremely attractive environment for exploration companies throughout North America.

2

Up-and-Coming Thelon Basin Represents Massive Opportunity: While still under the radar of most investors, this potentially resource-rich basin has massive upside potential. Experts at the University of Manitoba and the IAEA have stated that it has similar potential to the Athabasca Basin, which currently produces nearly one-quarter of the world’s high-grade uranium.

3

The Thelon Basin Contains High-Grade Uranium: Historical data shows the potential for high-grade uranium deposits in the region. This has triggered a staking rush at the basin, with other companies – including Forum Energy Metals (TSXV: FMC) – active in the region.

4

Lexston Mining Corp.’s Projects Offer High Upside Potential: The company’s initial projects within the Thelon Basin are both within strong land positions that have been shown to contain the highest-grade uranium samples in the Basin. With strong claims in the historically most attractive areas, Lexston Mining Corp. is well-positioned to be a leader in this up-and-coming region.

5

Lexston Mining Corp. is Building a Strong Portfolio: The company’s first two projects are just part of what is expected to be a strong portfolio of properties designed to help take maximum advantage of the ongoing uranium bull market.

6

Nearby Competitors Demonstrate Room for Significant Upward Growth: With other exploration companies in the Nunavat region carrying significantly higher market caps than Lexston Mining Corp., this represents a unique undervalued opportunity for investors. Lexston Mining Corp.’s current market cap of just $2.4 million means there is considerable room for upside growth. Even climbing to a valuation half that of Forum Energy would represent more than 6x growth for Lexston Mining Corp.

[i] https://finance.yahoo.com/news/nuclear-energy-boom-sends-uranium-165716482.html

[ii] https://www.reuters.com/business/energy/investors-are-turning-bullish-nuclear-2023-11-16/

[iii] https://www.cameco.com/invest/markets/uranium-price

[iv] https://www.nasdaq.com/articles/the-uranium-bull-still-has-room-to-run

[v] https://en.wikipedia.org/wiki/Thelon_River

[vi] https://inis.iaea.org/search/search.aspx?orig_q=RN:20065626

[vii] https://mspace.lib.umanitoba.ca/items/61cccd67-5a5d-4bd1-979c-1e875829de34

[viii] https://docs.google.com/viewer?url=https%3A%2F%2Fimg1.wsimg.com%2Fblobby

%2Fgo%2F97842632-2256-4a94-84d2-1a152a361ac6%2Fdownloads%2FProject%2520176

%2520-%2520Thelon%2520Basin.pdf%3Fver%3D1701110937777

This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. WallStreetNation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.

Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of Lexston Mining Corp. and its securities. Jade Cabbage Media, LLC d/b/a STOXmedia.com has received up to $10,000 USD dollars by Winning Media LLC as a total production budget for this advertising effort. Neither WallStreetNation.com, Winning Media LLC or Jade Cabbage Media LLC currently hold the securities of Lexston Mining Corp. and do not currently intend to purchase such securities.

The issuer, Lexston Mining Corp.. has compensated Winning Media LLC the sum total of thirty five thousand dollars USD total production budget to manage a digital media campaign for thirty days (11-27-23 to 12-29-23).

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.