Sponsored – Est. Read 9 Min

Investor Alert:

This Under-the-Radar Canadian Silver Company Appears Poised to Become North America’s Next Breakout Metals Stock

With silver in the early stages of a prolonged bull market, Dolly Varden Silver Corp. (TSXV: DV); (OTCQX: DOLLF) offers investors something virtually unprecedented in the resource space: A large, high-grade silver project located in a safe jurisdiction.

In just four years’ time, Dolly Varden Silver Corp. has grown from a $20 million valuation to more than $215 million… and the company appears poised for even faster growth in the months ahead.

Get ready: This could be the single greatest North American precious metals opportunity seen in decades.

Right now – with silver in the early stages of what looks to be a long-term bull market – one under-the-radar company appears to offer investors a massive advantage…and smart exposure to this red-hot market.

That company is Dolly Varden Silver Corp. (TSXV: DV); (OTCQX: DOLLF), a mineral exploration company focused on advancing its 100% held Kitsault Valley Project located in the Golden Triangle of British Columbia, Canada.

That’s right – the company’s project is a large, high-grade silver and gold project…and it’s located in BC’s Golden Triangle.

Not Argentina…not Bolivia…and not Mexico.

Those countries where the majority of today’s pure silver mines are located. And each of those locations presents significant uncertainties when it comes to both exploration and safety.

But Dolly Varden Silver Corp. is located in mining-friendly British Columbia, right along the richest 20 kilometers on the planet for gold and silver mineralization.

This forward-thinking company is growing rapidly and lists some of North America’s most successful resource experts among its prominent shareholders, including a Canadian billionaire investor, Eric Sprott, and one of the America’s largest silver producers, Hecla Mining.

And now – just as this silver bull market begins to take off and while the company remains under the radar of most investors – could be the perfect time to invest in a company poised to become the next “Legend of the Golden Triangle.”

I’ll explain how that scenario could unfold in just a minute.

For now, here are 7 key reasons why Dolly Varden Silver Corp. (TSXV: DV); (OTCQX: DOLLF) appears ready to deliver high-upside profit potential in the months ahead:

7 Key Reasons

Why Dolly Varden Silver Corp. (TSXV: DV); (OTCQX: DOLLF) Appears Poised to Soar

Key Reason #1

Dolly Varden Silver Corp. offers investors the massive advantage of a large, high-grade silver project in a safe jurisdiction.

Dolly Varden Silver Corp. offers investors a truly unique opportunity:

The chance to invest in a past producing pure silver mine – with a high-grade silver project – located in one of the world’s safest, most resource-friendly jurisdictions.

Most of the world’s pure silver mines today are located in Argentina, Bolivia or Mexico. And those countries can present a number of challenges for mining operations in terms of both getting the silver out of the ground as well as the safety of the operation.

But Dolly Varden Silver Corp.’s project is located in British Columbia, Canada and that is a tremendous advantage for the company not only for the region’s safety and infrastructure, but also its rich history.

Here’s what I mean:

British Columbia’s Golden Triangle has a storied history of gold and silver exploration success dating back to the late 1890s.

Dolly Varden Silver Corp.’s Kitsault Valley silver project is located at the southern end of the Golden Triangle in what is the richest 20 kilometers on the planet for gold, silver and copper mineralization.

The region was thriving in the early 20th century – and modern mining techniques have brought the promise of reawakening many of the region’s past treasures.

In fact, this is already happening throughout the region in a big way.

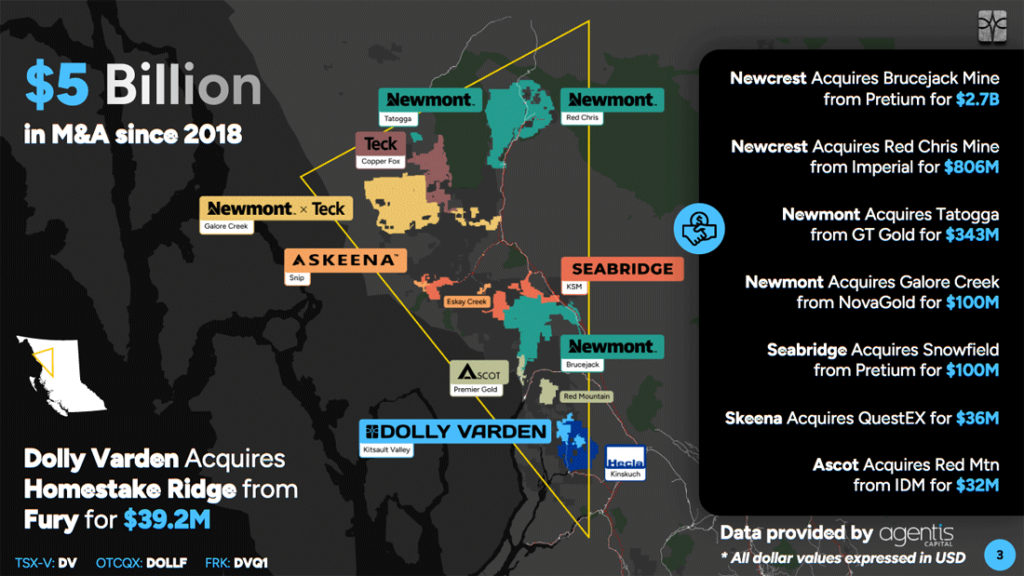

There has been more than $5 billion in M&A activity in the Golden Triangle since 2018, further demonstrating just how potentially lucrative the properties in this region can be for investors.

And Dolly Varden Silver’s Kitsault Valley Project is located amidst all of this activity and infrastructure, offering investors tremendous upside potential from a safe, mining-friendly jurisdiction.

Key Reason #2

Now is a great time to invest because rising gold and silver prices could give the company a powerful boost.

Over the past four years – at a time when mining equities have lagged the metals prices for gold and silver – Dolly Varden Silver Corp. has continued to grow.

In 2020 – at the time CEO Shawn Khunkhun took over – the company had a $20 million valuation and had approximately 44 million ounces of silver in the ground.

Just four years later, the company now has approximately 64 million ounces of silver (34.7 million ounces Indicated and 29.3 million ounces Inferred) – and almost one million ounces of gold (170 thousand ounces Indicated and 817 Inferred – in the ground. Additionally, the company’s market cap has grown by over 15 times and its share price has gone up by 600% over what has been a fairly challenging market for resource companies.

But now – with precious metals in the early stages of a long-term bull market – the company could receive a powerful boost, potentially propelling its shares even higher.

“A booming solar-power industry is driving a surge in the demand for silver…we may be seeing the start of a silver bull market”

You see…silver has historically outperformed gold during precious metals bull markets. The price of silver has climbed steadily over the past two years, largely mirroring the gains seen in the gold price.

Moving forward, however, the silver market figures to be significantly impacted by soaring demand for silver needed for solar panels to computing to healthcare.

“This could be a banner year for silver, with prices potentially hitting a decade-high.”

Many experts and large institutional investors have forecast higher silver prices in the months ahead.

And as the price of silver continues to climb, that could drive the value of Dolly Varden Silver Corp.’s Kitsault Valley Project sharply higher.

Key Reason #3

Dolly Varden Silver Corp.’s Kitsault Valley project offers both high grades and significant expansion potential.

Dolly Varden Silver’s Kitsault Valley is one of the largest high-grade, undeveloped precious metals assets in the entirety of British Columbia’s Golden Triangle.

The project is located in the southern tip of the Golden Triangle, just south of the high-grade Brucejack and Eskay Creek gold mines owned by Newmont Corporation (NYSE: NEM) and Skeena Resources Ltd. (NYSE: SKE) respectively.

The 163 square kilometer Kitsault Valley project hosts the high-grade silver and gold resources of Dolly Varden and Homestake Ridge along with the past producing Dolly Varden and Torbrit silver mines.

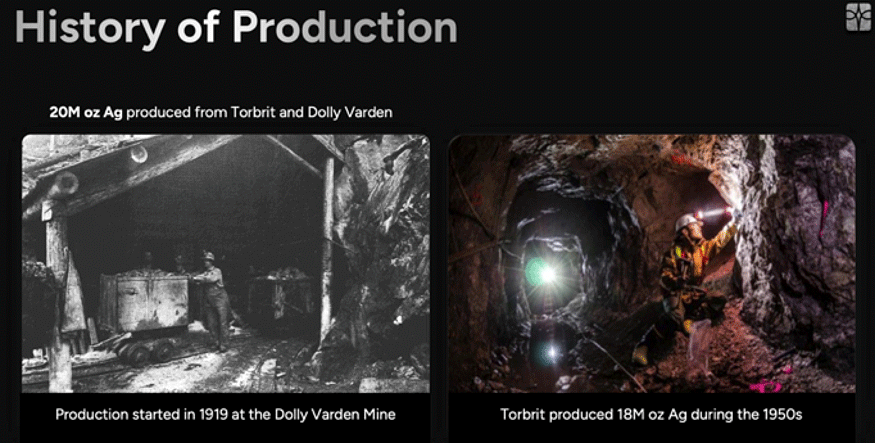

The original Dolly Varden silver mine was opened in 1919 and at the time it was the richest silver mine in the entire British empire.

By the 1950s, the Torbrit silver mine was Canada’s third-largest silver mine and produced approximately 20 million ounces of silver.

The property is considered to be prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other, on-trend, high-grade deposits, such as Eskay Creek and Brucejack.

The project also contains the Big Bulk property which is prospective for porphyry and skarn style copper and gold mineralization, similar to other such deposits in the region (Red Mountain, KSM, Red Chris).

Surface geochemistry of gold and silver on the Kitsault Valley along with geophysics and geological modelling suggest discovery potential of additional mineral deposits between South Reef and Wolf deposits.

Combined silver and gold resources of the Kitsault Valley project include:

Key Reason #4

Future expansion could turn Dolly Varden Silver Corp. into the next “Legend of the Golden Triangle.”

Dolly Varden Silver Corp.’s results from drilling programs in both 2022 and 2023 were among the highest-grade gold and silver intercepts anywhere in the Golden Triangle.

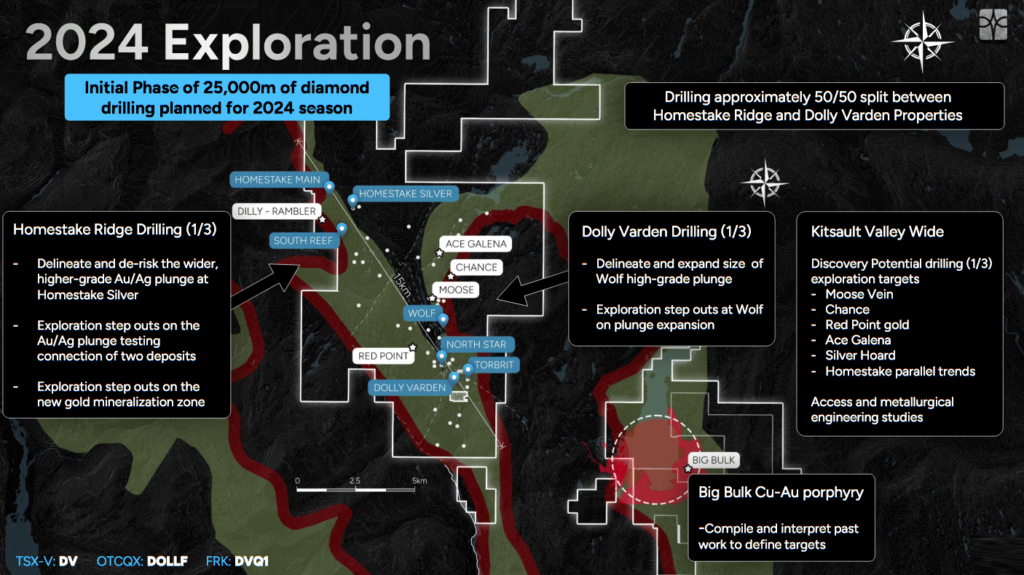

The company has continued to build on the momentum from these impressive results with a 2024 drill program that calls for an initial 25,000 meters of diamond drilling, starting with three drills.

The focus will be on following up on new discoveries as well as stepping out from wide, higher-grade intercepts from the 2023 drilling.

This drilling program – a $15 million program – is underway right now, with three rigs drilling 24 hours per day. The company has plans to continue increasing its drill program as it seeks to expand the size of its silver resource.

In addition to its discovery and exploration efforts, however, Dolly Varden Silver Corp. is also looking to grow through potential acquisition. And as stated earlier, the Golden Triangle is a region where acquisition has become common over the past several years.

The purpose of this growth is clear: Dolly Varden Silver Corp. is looking to become the next “Legend of the Golden Triangle.”

What that means for investors looking for smart exposure to rising silver prices is simple: You could invest in physical silver at roughly $30 per ounce…or you could invest in a company like Dolly Varden Silver Corp. (TSXV: DV); (OTCQX: DOLLF) and get exposure to 65 million ounces of silver – and counting.

As the company continues on its mission to grow via exploration as well as acquisition, the potential is enormous.

Other “Legends of the Golden Triangle” include Newmont’s Brucejack gold mine, one of the highest-grade operating gold mines in the world. The Brucejack has produced roughly 300,000 ounces of gold per year over the past six years.

Another “Legend of the Golden Triangle” is Skeena’s Eskay Creek Project, which produces 320,000 ounces of high-grade gold per year right in the heart of British Columbia’s Golden Triangle region.

So in addition to its already high upside, could Dolly Varden Silver Corp. continue its rapid growth and offer its investors the explosive upside potential of becoming the next “Legend of the Golden Triangle”?

It’s entirely possible, as great silver deposits can often become great gold systems.

Key Reason #5

Dolly Varden Silver Corp. appears to be significantly undervalued compared to its peers.

With a current market cap of approximately US $215 million, Dolly Varden Silver Corp. appears to be a company with significant re-rate potential.

Take a look at a few of Dolly Varden’s closest comparable companies:

- Discovery Silver Corp. (TO: DSV) owns a potentially significant undeveloped silver deposit, located in Chihuahua State, Mexico. The company has a current market cap of approximately US $248 million.

- GoGold Resources, Inc. (TO: GGD) is a Canadian-based silver and gold producer focused on the exploration and development of high quality projects in Mexico. The company has a current market cap of US $329 million.

- And Vizsla Silver Corp. (NYSE: VZLA) owns 100% interest in the Panuco silver-gold project located in Sinaloa, Mexico. Despite the project’s location – in the hometown of the Sinaloa Cartel, one of the world’s most powerful criminal groups – the company has a market cap of nearly US $500 million…more than double that of Dolly Varden Silver Corp.

Each of these comparable companies has a significantly higher market cap than Dolly Varden Silver Corp…in spite of the fact that they each operate in Mexico.

Contrast that with Dolly Varden, which has a large, high-grade silver project in a safe jurisdiction – Canada’s Golden Triangle – with a rich history of resource production.

And as good news continues to roll in for the company, the potential exists for Dolly Varden Silver Corp. (TSXV: DV); (OTCQX: DOLLF) to see a significant increase in its market cap in the months ahead.

Key Reason #6

An investment in Dolly Varden Silver Corp. would place you alongside some of the world’s most astute, successful investors.

One of the unique aspects to the Dolly Varden Silver Corp. story is its capital structure.

48% of the company is owned by institutional investors, including Fidelity, Sprott, U.S. Global Investors and Delbrook Capital.

Another 15% of the company is owned by Hecla Mining Company, one of the world’s fastest-growing silver mining companies.

And in March 2024, Dolly Varden Silver Corp. announced the closing of a bought deal public offering which included participation from legendary Canadian investor Eric Sprott, who currently owns over 10% of the company’s shares.

This level of investment from those who know the industry best – including Eric Sprott, the “Elon Musk of Mining” – serves as confirmation of the tremendous upside potential that exists for Dolly Varden Silver Corp. (TSXV: DV); (OTCQX: DOLLF).

Key Reason #7

Dolly Varden Silver Corp. is led by a technical team with an impressive record of exploration success.

When evaluating the potential for any investment in the resource exploration space, it’s important to consider the experience level of those running the company.

In the case of Dolly Varden Silver Corp., there are outstanding leadership and technical teams in place with a history of exploration success. The Dolly Varden team includes:

Shawn Khunkhun – CEO, President & Director

Mr. Khunkhun has over 20 years of experience in the capital markets, mineral exploration and development sector with a focus on enhancing shareholder value. He has served in a variety of strategic roles including Investor Relations, Corporate Development, CEO, Director and Executive Chairman. Mr. Khunkhun has been instrumental in creating awareness for undervalued companies including grass root explorers, developers and producers.

Robert Van Egmond, P. Geo. – Vice-President, Exploration

Rob van Egmond is a professional geologist with over 25 years of experience in the international mining industry. His career encompasses a wide spectrum of experiences ranging from grass roots project generation to pre-feasibility level resource development and mine geology. He has worked with major mining companies (Cominco, BHP, Kennecott) and junior explorers (Orex Minerals, Platinum Group Metals, Candente, Northern Dynasty, Keewatin) gaining experience in a wide variety of commodities and deposit types spanning locations North and South America as well as Africa.

Michael Henrichsen – Director

Michael Henrichsen is a structural geologist and leads the Fury Gold Mines Ltd. technical team as their SVP, Exploration. Previously, Mr. Henrichsen was the global structural geologist at Newmont, where his contributions significantly increased the reserves and resources base in the Ahafo district in Ghana. Mr. Henrichsen has also worked extensively at other major gold camps in South America, the Carlin Trend, Guinea and Canada.

Robert McLeod – Director

Mr. McLeod is a professional geoscientist with over 25 years of experience in mineral exploration and mining, working for a variety of major and junior mining and exploration companies. He was most recently president and CEO of IDM Mining Ltd., that recently combined with Ascot Resources Ltd. Born and raised in Stewart, B.C., he is a third-generation miner and explorer with significant exploration and development experience. Previously, he was a founder and vice-president of exploration of Underworld Resources that was acquired by Kinross Gold Corp. for $140-million after an initial resource estimate of over 1.4 million ounces gold at the White Gold deposit in the Yukon.

Kurt Allen – Technical Committee

Kurt Allen has over 25 years’ experience in the mineral exploration and mining industry, with emphasis on volcanic and sediment hosed epithermal gold-silver deposits. Mr. Allen is currently the Director – New Projects for Hecla Mining Company, one of the world’s fastest-growing silver mining companies. He has worked for Hecla since 1991 holding various positions, including Senior Mine Geologist, Chief Geologist, Manager of Exploration at Hecla’s Rosebud deposit and operation from 1995 – 2000, and District Geologist, Chief Geologist, Exploration Manager, and General Manager at Hecla’s San Sebastian deposit in Durango, Mexico from 2000 – 2010.

Investor’s Summary

Dolly Varden Silver Corp. (TSXV: DV); (OTCQX: DOLLF) offers investors smart, leveraged exposure to the precious metals bull market. The company is advancing one of the largest, high grade, undeveloped precious metals assets in British Columbia’s Golden Triangle.

This location offers not only significant resource potential but also the clear advantage of exposure to a large, high-grade silver project in a safe mining jurisdiction. And with the company’s continued drill program and potential acquisitions, it is working to expand its resources and potentially become the next “Legend of the Golden Triangle.”

[i] https://www.wsj.com/articles/the-global-solar-power-boom-is-driving-a-surge-in-silver-demand-4ac20435

[ii] https://www.cnbc.com/2024/02/07/silver-could-hit-10-year-high-and-outperform-gold-says-silver-institute.html

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer Dolly Varden Silver Corp., Winning Media LLC has been hired for a period beginning on 08/12/24 and ending on 09/15/24 to conduct investor relations advertising and marketing and publicly disseminate information about Dolly Varden Silver Corp. via Website, Email and SMS. Winning Media has been compensated the sum total of one hundred thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Dolly Varden Silver Corp.

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (DV). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.