Sponsored – Est. Read 7 Min

Windfall Profit Alert:

Little-Known Canadian Company Could Be the Best Way to Play Rising Gold Prices for Maximum Upside Potential

With one of the largest land packages in a region called “the high-grade gold capital of the world,” Renegade Gold (TSXV: RAGE); (OTCQX: TGLDF) appears perfectly positioned to soar

7

Critical Reasons Why You Should Consider Renegade Gold (TSXV: RAGE); (OTCQX: TGLDF) Today

1

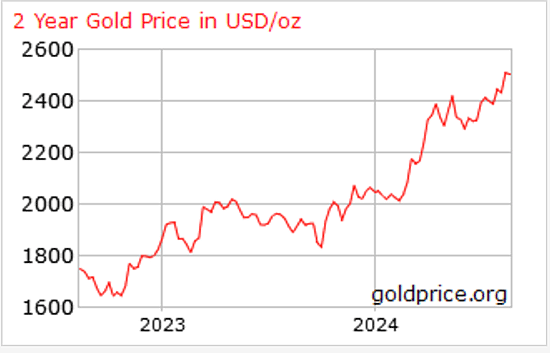

Rising Gold Prices Make Now a Great Time to Invest –

Gold prices have been steadily climbing for more than two years, sending the potential value of many deposits sharply higher. With gold now trading above $2,500 per ounce, Renegade Gold appears perfectly positioned to provide smart exposure to the continued gold bull market.

2

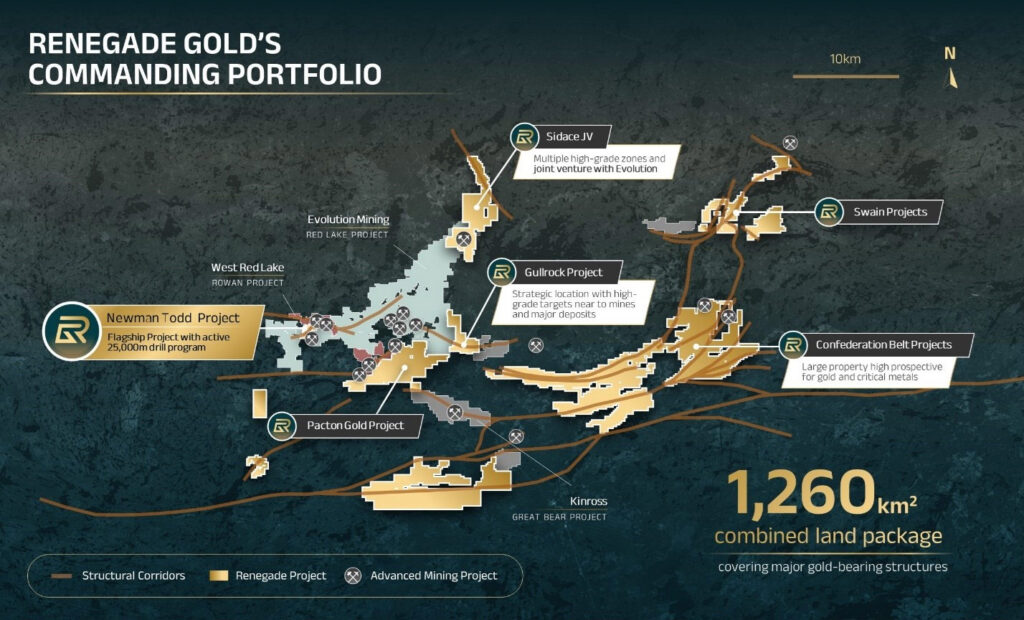

Ontario’s Red Lake District is a well-established mining district with over 30 million ounces of gold production since the 1920s. The region has a number of major mines and projects, many of which are adjacent to Renegade Gold’s high-grade gold deposits. With one of the largest land packages in the district – over 1,260 km2 in total – the company is set to pounce on what appears to be an outstanding exploration opportunity.

3

Renegade Gold is focused on a high-grade gold model rather than exploring for bulk, low-grade opportunities. This is consistent with both the company’s experience and the history of the Red Lake District, which has been driven by high-grade deposits for over 100 years. At the company’s flagship project, drill results include high-grade intercepts such as 129.79 g/t Au over 1.3 m, including 561 g/t Au over 0.30 m.

4

Investors looking to take advantage of higher gold prices have several ways to play this trend. Specifically, within the Red Lake District – one of Canada’s greatest mining regions – there are opportunities with major producers such as Kinross Gold Corpration (NYSE: KGC), a US $11 billion market cap company. Investors could also look to companies closer to becoming mid-tier gold producers such as West Red Lake Gold Mines Ltd. (TSXV: WRLG), a CAD $189 million market cap company. But an under-the-radar opportunity like Renegade Gold – with a market cap of less than CAD $10 million – would appear to offer the highest upside potential as it continues exploration of its significant land package right next to companies like Kinross and West Red Lake in the region.

5

Just recently, the company announced that it was expanding the surface exploration campaigns at key regional targets on its Red Lake District projects. Additionally, the company recently completed a successful 25,000 m drill campaign at its Newman Todd Deposit, with results to be announced.

6

Compared to other exploration companies in the region, Renegade Gold appears to be trading at a significant discount. This company has flown beneath the radar of many investors, but the combination of Renegade Gold expanding its resource size plus higher gold prices could mean significant re-rate potential. Early investors could see this company’s less-than CAD $10 million market cap move quickly in the months ahead.

7

The company is led by a team that includes over 10 highly-qualified geologists with decades of experience. And more importantly, the company’s leadership team has a history of building strong models to expand opportunities at resource deposits like those it is exploring in the Red Lake District.

Breaking News

Renegade Gold Expands Exploration Activity at Red Lake, Ontario; Mobilizes Crews to Regional Targets

On August 14, 2024, Renegade Gold (TSXV: RAGE); (OTCQX: TGLDF) announced the expansion of the surface exploration campaign at its Red Lake gold projects in northwest Ontario. Field crews have been deployed to key regional targets to conduct comprehensive prospecting, mapping and sampling activities.

To learn more, click here.

Why Little-Known Renegade Gold (TSXV: RAGE); (OTCQX: TGLDF) Could Move Quickly…and Offer the Best Way to Play this Gold Bull Market for Maximum Upside

A significant, high-upside opportunity appears to be unfolding now in the gold exploration space.

Here’s what’s happening:

The price of gold has been climbing steadily over the past two years, pushing past $2,500 per ounce.

And experts are convinced that this gold bull market is still very much in its early stages.

- “We are in a multi-year bullish breakout for gold, and it is likely going to play out over the next few years,” says Anthony Rousseau, head of brokerage solutions at TradeStation Group.[i]

- JPMorgan says that “With the structural bull case for gold remaining intact, JP Morgan has upgraded its gold price targets for this year and 2025…forecasting an average prices of $2,600/oz in 2025.”[ii]

- Chris Gaffney, president of world markets at EverBank, recently stated, “Yes, I do believe gold will hit $3,000 over time…I believe the next big move for gold will occur possibly this September.”[iii]

In the midst of what appears to be a sustained, long-term bull market for gold…one under-the-radar company is emerging as perhaps the best way to play the gold bull for maximum upside.

That company is Renegade Gold (TSXV: RAGE); (OTCQX: TGLDF), a Canadian company focused on the exploration and development of its mineral properties located in the Red Lake Mining District of Northern Ontario, Canada.

The Prolific Red Lake Mining District Has Seen a Surge of Interest Following a $1.8 Billion Buyout

The Red Lake Mining District is one of Canada’s most prolific and intriguing mining regions,

In fact, the Red Lake District has been called “the high-grade gold capital of the world.[iv]” And with good reason, as over 30 million ounces of gold has been produced from high-grade zones in the region since the 1920s.

This well-established district has access to good infrastructure, a skilled workforce, and has a mill with high capacity.

The recent success of Great Bear Resources’ Dixie Project within the district, which helped trigger a $1.8 billion buyout of the company by Kinross Gold Corporation, has reignited interest in the region and makes the opportunity with Renegade Gold so potentially attractive.

Modern exploration in the region is focused on expanding and developing resources and a number of major mines and projects are currently generating attention in the Red Lake district. This includes Evolution’s Red Lake Mine and West Red Lake Gold’s Madsen Mine in addition to Kinross Gold’s Great Bear Project.

In the midst of this region, Renegade Gold has quietly assembled one of the largest prospective land packages in and around the Red Lake mining district.

Renegade Gold holds over 1,200 km2 of property in the Red Lake gold district of Ontario, including key areas adjacent to Evolution’s Red Lake Mine, Kinross’ Great Bear Project, West Lake Gold Mine’s Madsen Mine and First Mining Gold’s Springpole Project.

The company’s 89,600 hectares prospective and diversified exploration portfolio includes early-stage projects with numerous gold and critical metals occurrences, all the way up to advanced projects with large, open trends hosting high-grade and widespread gold mineralization.

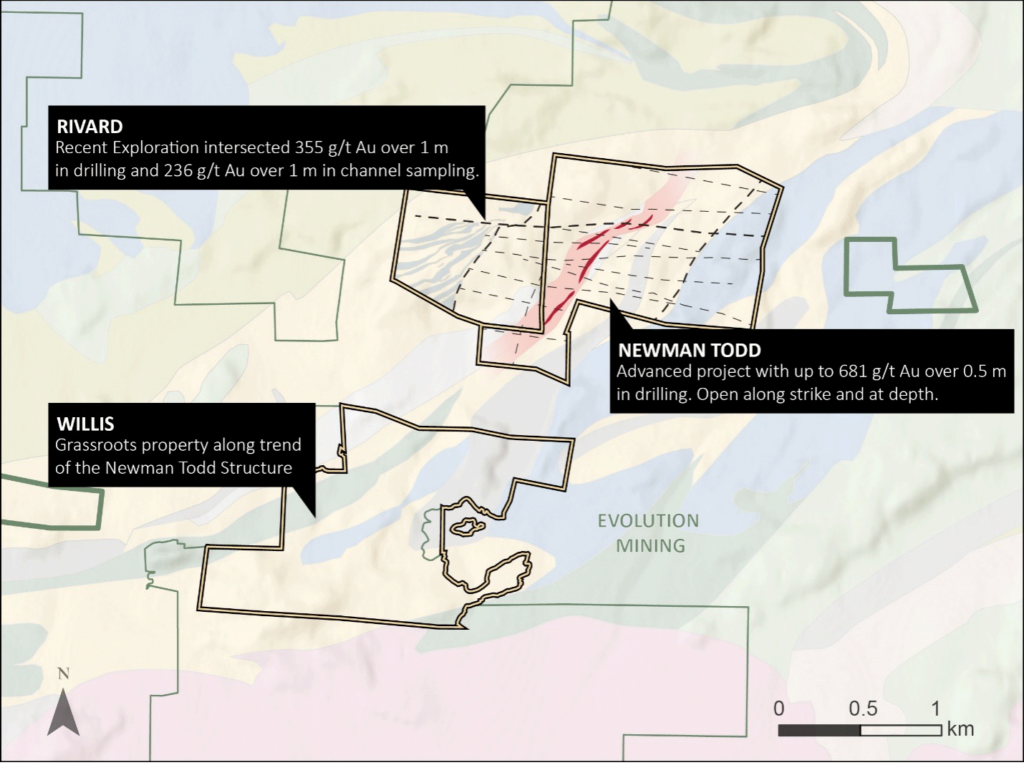

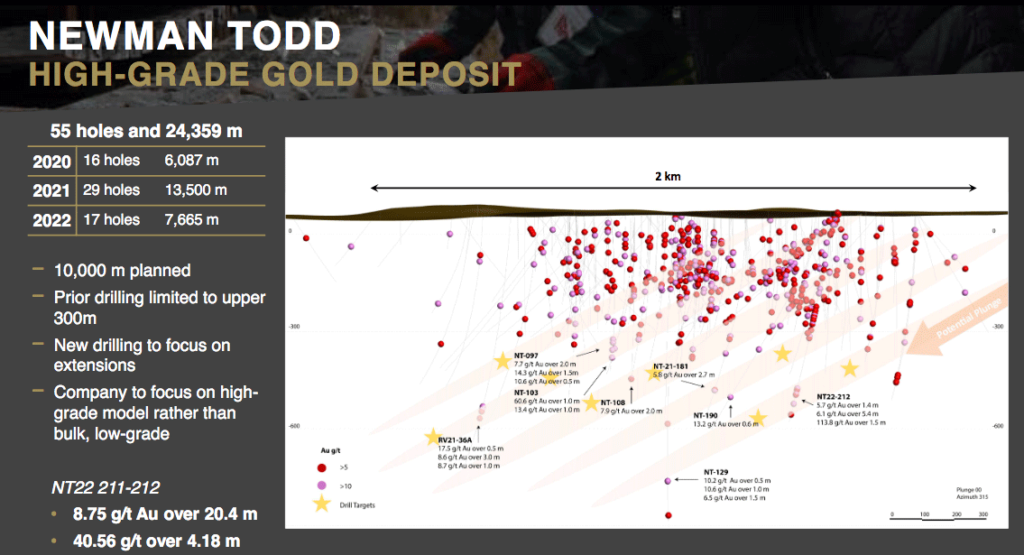

Renegade Gold’s Newman Todd Deposit: An Advanced Gold Deposit with Significant Growth Potential

The Newman Todd Deposit is the company’s primary focus. The structure of this property extends over 2.2 kilometers and to a depth of 300 meters, beyond which has not been drill tested.

The outstanding technical team at Renegade Gold has a proven track record of applying modern understanding to past exploration work to build a model for identifying the true potential of a property.

In the case of the Newman Todd property, Renegade Gold has expanded the scope beyond the historic footprint and identified significant mineralization in new and exciting zones.

Newman Todd Project Highlights:

>

Deposit with high-grade and widespread mineralization within a 2.2 km strike with a large, shallow historic 43-101 compliant Mineral Resource

>

Gold mineralization is open in every direction with minimal drilling at below 300m depth. The few holes drilled to depth in 2022 encountered high-grade mineralization.

>

Drill results include high-grade intercepts such as 129.79 g/t Au over 1.3 m, including 561 g/t Au over 0.30 m.

>

An extensive drilling and sampling database has outlined a clear path for prioritizing high-grade growth in Renegade’s expansion drill program.

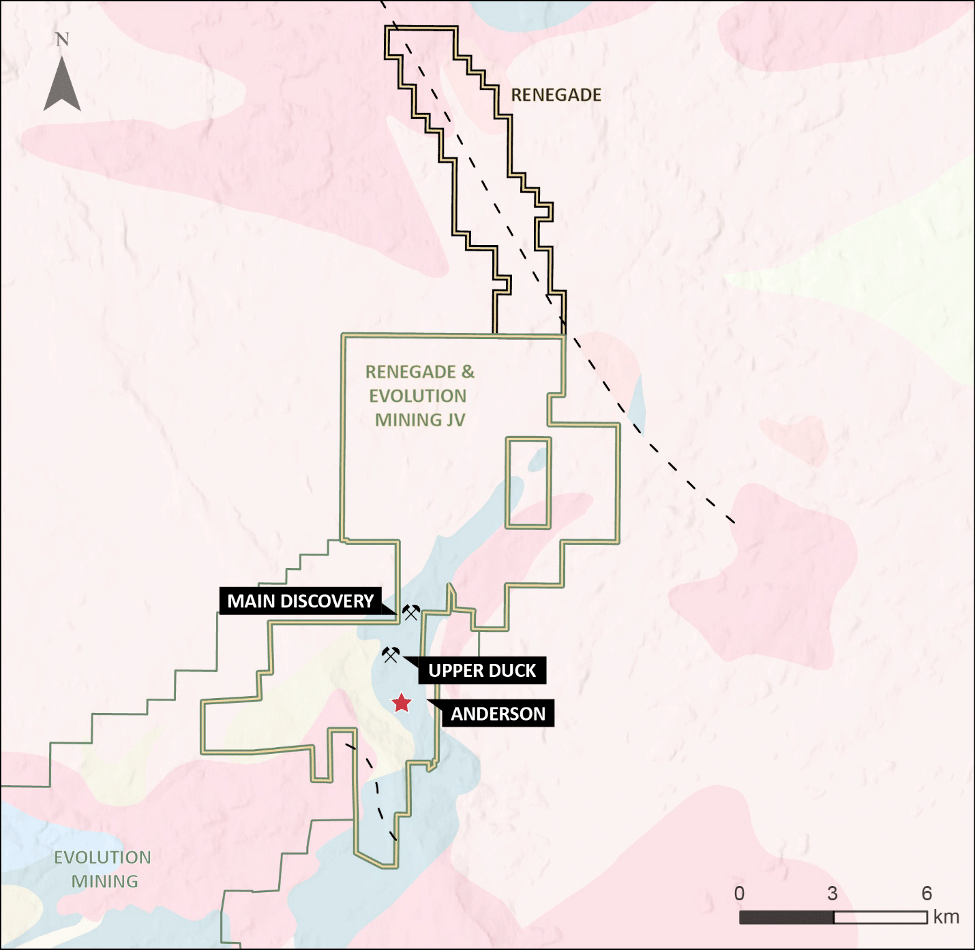

Renegade Gold’s Sidace Project is an Advanced Joint Venture Project with Evolution Mining

The company’s other projects within the Red Lake Mining District include the Sidace Project, a joint venture with Evolution Mining, the senior producer in the Red Lake region.

The project is located 28 km north east of Red Lake, at the northern extent of the Red Lake Greenstone Belt. The property is underlain by a north east trending belt of felsic to mafic metavolcanics and intercalated sediments which have been intruded by granitic batholiths. Mineralization is associated with quartz veining and silicification.

Sidace is an advanced gold project with more than 80,000 meters of drilling. 18 drillholes were completed in 2020 and 2021 for a total of 11,575 m drilled.

Sidace Project Highlights:

>

Joint Venture with Evolution Mining (Evolution 53.3% / Renegade 46.7%)

>

8,600-hectare property adjacent to Evolution’s Bateman gold project

>

Over 80,000 meters of historic drilling across three zones that contain both high-grade and widespread gold mineralization

>

In the latest drill campaign (2020/21), 17 of 18 holes intersected gold mineralization across all zones which remain open along strike and at depth

Renegade Gold (TSXV: RAGE); (OTCQX: TGLDF) Offers Investors a High-Upside, Undervalued Opportunity

When considering the growth potential for Renegade Gold (TSXV: RAGE); (OTCQX: TGLDF), you don’t have to look far to see what future growth could look like.

West Red Lake Gold Mines Ltd. (TSVV: WRLG); (OTCBQ: WRLGF) is the company’s neighbor in the Red Lake Mining District…in fact, at Renegade’s Newman Todd Deposit, the company is drilling some of the same deposits as West Red Lake.

West Red Lake Gold Mines is currently working to advance a 47 km2 land package in the Red Lake district and is nearing production.

West Red Lake Gold Mines has a market cap of $189 million CAD, as compared with Renegade Gold’s $9 million CAD market cap…so you can see just how much growth potential exists for Renegade Gold.

Another company to look at would be Great Bear Resources Ltd., which was working in the region on a number of exploration projects before its discovery of a top-tier deposit with long-term potential: the Dixie project.

The extraordinary potential of the Dixie project helped trigger a great deal of interest in the company, and it was eventually acquired by Kinross Gold Corp. for $1.8 billion in December 2021.

The team leading the way at Renegade Gold (TSXV: RAGE); (OTCQX: TGLDF) has a unique track record that appears well-matched for this specific opportunity in the Red Lake District.

The company’s leadership has a proven history of taking previous exploration activity and enhancing it with modern analysis and techniques to build out strong models to guide new, expanded opportunities at gold deposits.

In the past 15 years, the company has assembled a team that includes over 10 highly-qualified geologists with a history of success.

This impressive team is led by…

Nav Dhaliwal – President and CEO/Director

Mr. Dhaliwal is a capital markets expert with 20+ years of maximizing shareholder value in the mining sector. He has a top tier track record of identifying undervalued companies and facilitating growth through improved market awareness, optimal financing, and astute corporate leadership. Mr. Dhaliwal is backed by an award-winning technical team and has also built a global financial network of institutional investors, family offices, analysts, brokers, and high net worth investors. He has long standing relationships with all major gold and energy metal funds and has raised over $1 Billion for exploration and development companies. Mr. Dhaliwal is currently president, CEO and director, of Renegade Gold, as well as executive chairman of Badlands Resources, and director of Mason Graphite.

Dale Ginn, P.Geo. – Executive Chairman/Director

Dale Ginn is an experienced mining executive and geologist of over 30 years based in central Canada. He is the founder of over ten exploration and mining companies and has led and participated in a variety of gold and base metal discoveries, many of which have entered production. Mr. Ginn has led or was part of the discovery teams for the Gladiator, Hinge, 007, 777, Trout Lake, Photo, Edleston and Tartan Lake deposits. His contributions have led to approximately 10 million ounces in resource generation as well as over C$500 million in capital raised for exploration and development projects.

David Velisek – Director

David Velisek has been involved in the capital markets for over 25 years. He has been a licensed trader of equities, options and futures, as well as an Investment Advisor. He has also held roles in investor relations as well as providing consulting services to public companies. He is currently a director of Renegade Gold Inc. and Penbar Capital Ltd. He has previously held the role of director in many publicly listed companies including Trillium Gold Mines, Datinvest International, Cognetivity Neurosciences, Lifestyle Delivery Systems, Amador Gold Corp, Novo Resources, Finore Mining, and Delon Resources.

Nathan Tribble – Director

Mr. Tribble has over 15 years of professional experience in exploration and mining, with a particular focus on gold and base metal exploration and project evaluation. Past experience includes Senior Principal Geologist for Sprott Mining, Senior Geologist for Bonterra Resources, Jerritt Canyon Gold, Kerr Mines, Northern Gold, Lake Shore Gold and Vale Inco. He was also part of the exploration team that discovered the 8.2 million-ounce Côté Lake gold deposit for Trelawney Mining and Exploration Inc.

7

Critical Reasons Why You Should Consider Renegade Gold (TSXV: RAGE); (OTCQX: TGLDF) Today

1

Rising Gold Prices Make Now a Great Time to Invest –

Gold prices have been steadily climbing for more than two years, sending the potential value of many deposits sharply higher. With gold now trading above $2,500 per ounce, Renegade Gold appears perfectly positioned to provide smart exposure to the continued gold bull market.

2

Ontario’s Red Lake District is a well-established mining district with over 30 million ounces of gold production since the 1920s. The region has a number of major mines and projects, many of which are adjacent to Renegade Gold’s high-grade gold deposits. With one of the largest land packages in the district – over 1,260 km2 in total – the company is set to pounce on what appears to be an outstanding exploration opportunity.

3

Renegade Gold is focused on a high-grade gold model rather than exploring for bulk, low-grade opportunities. This is consistent with both the company’s experience and the history of the Red Lake District, which has been driven by high-grade deposits for over 100 years. At the company’s flagship project, drill results include high-grade intercepts such as 129.79 g/t Au over 1.3 m, including 561 g/t Au over 0.30 m.

4

Investors looking to take advantage of higher gold prices have several ways to play this trend. Specifically, within the Red Lake District – one of Canada’s greatest mining regions – there are opportunities with major producers such as Kinross Gold Corpration (NYSE: KGC), a US $11 billion market cap company. Investors could also look to companies closer to becoming mid-tier gold producers such as West Red Lake Gold Mines Ltd. (TSXV: WRLG), a CAD $189 million market cap company. But an under-the-radar opportunity like Renegade Gold – with a market cap of less than CAD $10 million – would appear to offer the highest upside potential as it continues exploration of its significant land package right next to companies like Kinross and West Red Lake in the region.

5

Just recently, the company announced that it was expanding the surface exploration campaigns at key regional targets on its Red Lake District projects. Additionally, the company recently completed a successful 25,000 m drill campaign at its Newman Todd Deposit, with results to be announced.

6

Compared to other exploration companies in the region, Renegade Gold appears to be trading at a significant discount. This company has flown beneath the radar of many investors, but the combination of Renegade Gold expanding its resource size plus higher gold prices could mean significant re-rate potential. Early investors could see this company’s less-than CAD $10 million market cap move quickly in the months ahead.

7

The company is led by a team that includes over 10 highly-qualified geologists with decades of experience. And more importantly, the company’s leadership team has a history of building strong models to expand opportunities at resource deposits like those it is exploring in the Red Lake District.

[i] https://www.cbsnews.com/news/have-gold-prices-peaked-for-2024-heres-what-experts-say/

[ii] https://www.jpmorgan.com/insights/global-research/commodities/gold-prices

[iii] https://www.cbsnews.com/news/when-will-gold-prices-hit-3000-per-ounce-heres-what-experts-think/

[iv] https://www.visualcapitalist.com/red-lake-the-high-grade-gold-capital-of-the-world/

[v] https://evolutionmining.com.au/red-lake/

[vi] https://www.northernminer.com/subscribe-login/?id=1003837147

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer Renegade Gold Inc., Winning Media LLC has been hired for a period beginning on 08/27/24 and ending on 09/27/24 to conduct investor relations advertising and marketing and publicly disseminate information about Renegade Gold Inc. via Website, Email and SMS. Winning Media has been compensated the sum total of one hundred thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Renegade Gold Inc.

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (RAGE). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct.

Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.