Sponsored – Est. Read 7 Min

High Upside Alert:

This Undervalued Early-Stage

Gold Stock Could Offer Windfall

Profit Potential for Early Investors

With scalable growth potential in a premier mining jurisdiction, Gold Hunter Resources (OTCQB: HNTRF) (CSE: HUNT) (FSE: 6RH) appears poised to emerge as 2025’s biggest gold stock breakout.

URGENT: These dominoes have already begun to fall in this fast-moving, high-upside scenario!

Webinar

Welcome! You are invited to join a webinar: Gold Hunter Resources Inc. (CSE: HUNT) – Webinar with CEO Sean Kingsley

Date & Time: Apr 23, 2025, 2PM Eastern

Gold Hunter Resources Could Be Unlocking

Canada’s Next Big Gold Discovery

Gold Hunter Resources (OTCQB: HNTRF) (CSE: HUNT) (FSE: 6RH) is an aggressive early-stage explorer racing to develop what could be a major gold discovery in one of Canada’s hottest mining districts.

The company’s flagship Great Northern Project spans a massive 49.2 kilometers in Newfoundand, a province that has become one the world’s premier gold regions.

Here’s why this opportunity is so important:

Gold Hunter Resources has secured and consolidated a district-scale land package…compiled extensive historic data…and is now aggressively targeting multiple high-grade gold zones with serious upside potential.

This is a true ground floor opportunity for investors. It’s a virtually undiscovered microcap exploration company that is moving fast – and drilling smart. With experienced leadership guiding their efforts, the company is chasing high-grade gold at a time when gold prices remain near all-time highs.

As this is a fast-moving, high-upside scenario I have put together the most important points of the story into this brief summary. Here now for you to consider are…

7 Powerful Reasons Why You Should Take a Close Look at Gold Hunter Resources (OTCQB: HNTRF) (CSE: HUNT) (FSE: 6RH) Today:

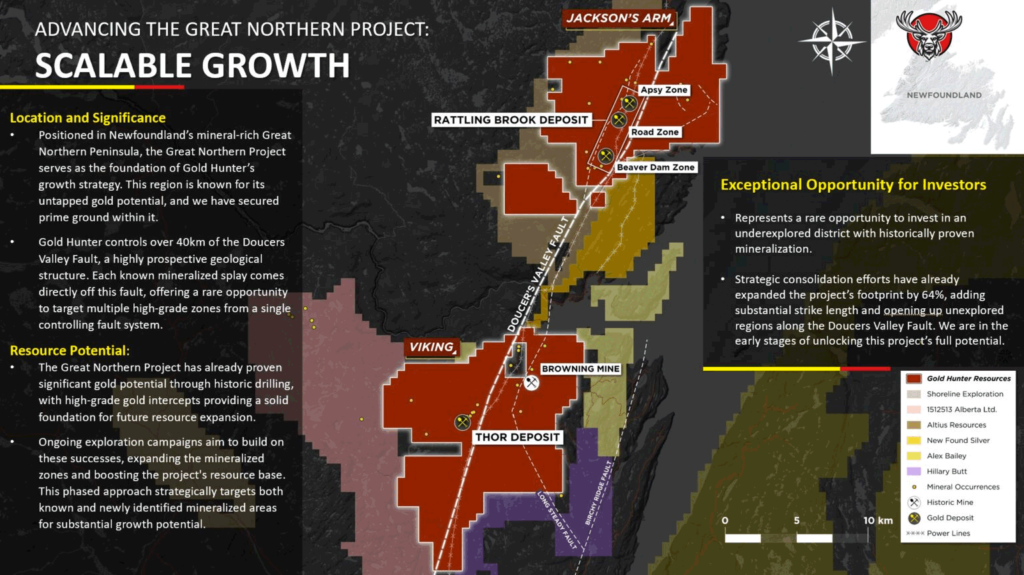

1. District-Scale Land Package with Significant Upside Potential: Gold Hunter Resources has strategically consolidated an entire mineral-rich district in Newfoundland, creating a 40,000-hectare land package known as the Great Northern Project. This property spans 49.2 kilometers along the highlight prospective Doucers Valley Fault, a proven gold-bearing structure, presenting a district-scale opportunity with significant exploration upside.

2. Strong Geological Case for Continued Discovery & Expansion: The Great Northern Project is home to over 18 mineralized zones, including a NI 43-101 Inferred and Indicated resource estimate, three historic resource estimates, and even a past-producing mine from the early 1900s. Historic drilling and sampling have already identified high-grade gold mineralization, reinforcing the potential for future discoveries and future resource expansion.

3. Following the Proven “Valentine” Blueprint: Gold Hunter Resources’ Great Northern Project is mirroring the early steps of the Valentine Gold Project, which grew into a 5+ million-ounce deposit and was recently acquired by Calibre Mining Corp. (OTCQX: CXBMF); (TSX: CXB), a USD$1.65 billion market cap company. Gold Hunter is 10 years earlier on a similar trajectory – and moving fast to unlock similar value.

4. Perfect Timing in a Booming Gold Market: With gold prices near all-time highs, Gold Hunter Resources’ newly consolidated Great Northern project offers investors significant upside potential as the company advances its exploration efforts in a bullish gold market.

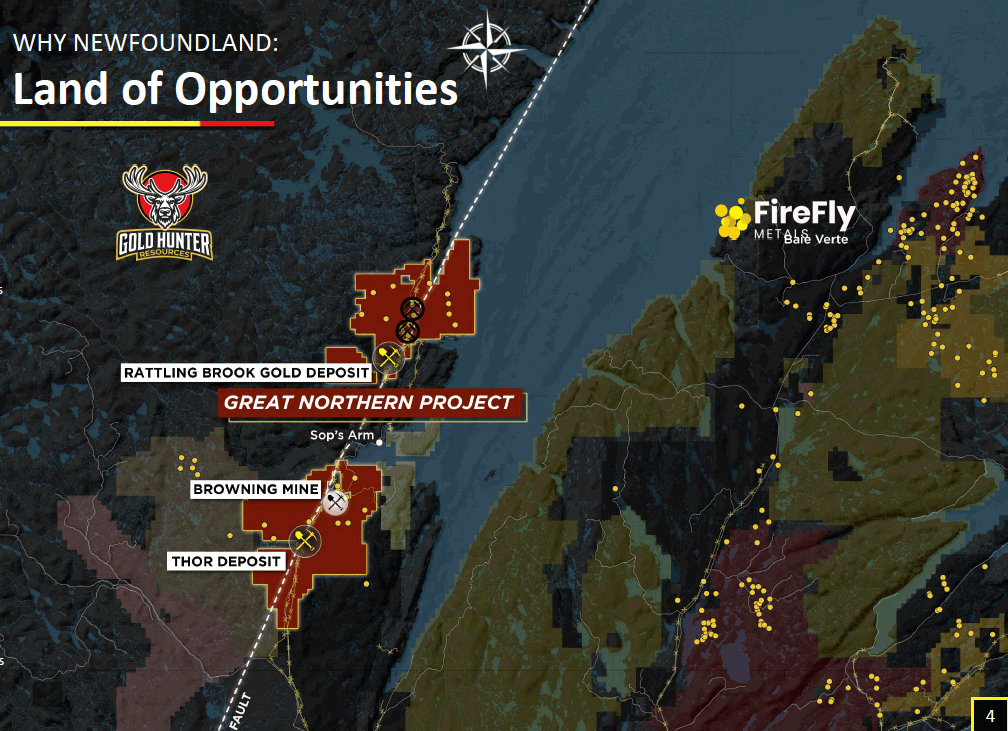

5. A $30 Million Shareholder Payout – Already in the Books: In 2024, Gold Hunter sold a previous asset to FireFly Metals (TSX: FFM) in a deal valued at over $30 million – then returned more than 25 million shares to its investors. This is a company with a real track record of creating and delivering value – and a management team that puts shareholders first.

6. Backed by Legends – and Oversubscribed by 50%: The company has strong insider ownership, with management, strategic investors, family and friends owning roughly 65% of the shares. In addition, the company recently completed a non-brokered private placement to raise $1.2 million… that was oversubscribed by nearly 50%. The investor registry included legendary Canadian investors Eric Sprott, Wade Dawe, Mark Zaret and many others that continue to support Gold Hunter Resources as they all were existing shareholders during last years asset sale to FireFly Metals (ASX: FFM) (TSX: FFM).

7. Experienced Leadership with Over 300 Years of Combined Experience: Gold Hunter Resources’ management team has extensive experience in the mining industry, with a track record of success in exploration, development, and value creation. In addition, the company’s technical team has been further bolstered by seasoned experts who have worked on some of Canada’s most prominent gold discoveries, including:

- Rory Kutluoglu – Former Exploration Manager for Kaminak Gold Corp., where he led the team that delivered the maiden and updated resource estimates on the Coffee Gold Project prior to Kaminak’s acquisition by Goldcorp. (He also oversaw a feasibility study, culminating in a successful $520 million sale to Goldcorp, now Newmont.)

- David Copeland – A key part of the team that helped grow the Goldboro Gold Project from just a few hundred thousand ounces of gold to approximately 3.2 million ounces.

- Tanya Tantellar – Former Exploration Manager at Marathon Gold, playing a pivotal role in developing the Valentine Lake Gold Project, which evolved into a multi-million-ounce gold deposit in Newfoundland.

Breaking News

Gold Hunter Resources Targets Aggressive 2025 Exploration at Near-Surface High-Grade Great Northern Gold Project and Expands Global Market Presence

On April 1, 2025, Gold Hunter Resources Inc. (OTCQB: HNTRF) (CSE: HUNT) provided an update on its Great Northern Project in Newfoundland, where historic mining, near-surface mineralization, and both current and historic resources converge to create an exciting, high-grade exploration story in one of Canada’s most dynamic mining districts. Alongside this, the Company is expanding its marketing and investor relations initiatives to share this compelling opportunity with a global audience, positioning Gold Hunter for accelerated growth in 2025.

For more information:

Gold Hunter Resources, Inc. (OTCQB: HNTRF) (CSE: HUNT) (FSE: 6RH) is Working to Unlock the Potential of a Strategic, District-Scale Project in One of Canada’s Premier Mining Jurisdictions

Gold Hunter Resources (OTCQB: HNTRF) (CSE: HUNT) (FSE: 6RH) is an under-the-radar exploration company that is focused on delivering shareholder value by advancing its district-scale project in the premier mining jurisdiction of Newfoundland, Canada.

Gold Hunter Resources’ Great Northern Project is a true district-scale opportunity that the company has strategically consolidated…and recent data compilation is now allowing the company to unlock the true exploration potential of this 49.2-kilometer property.

As the company is an early-stage play pursuing high-grade gold targets in an underexplored region, Gold Hunter Resources offers investors exposure to a high-potential exploration story at a time when gold prices are at or near an all-time high.

The company has quickly made substantial strides in advancing its Great Northern Project as it is central to the company’s focus on high-value, resource-rich regions with promising exploration upside.

A $30 Million Windfall:

Gold Hunter Resources Has a Proven History of

Delivering Value for Shareholders

Before diving into the opportunity with the company’s next major gold play, it’s worth understanding why Gold Hunter Resources has already earned a reputation for delivering real value to its shareholders.

While many companies were barely surviving the last down cycle, Gold Hunter Resources was making smart deals and locking down highly strategic claims in Newfoundland when prices were depressed and competition was minimal.

In early 2024, that groundwork paid off in a big way.

Gold Hunter sold off one of its flagship properties to FireFly Metals Ltd. (TSX: FFM) in a deal worth over $30 million, receiving approximately 30 million shares of FireFly stock.

And in a rare win for retail investors, more than 25 million of those shares were distributed directly to Gold Hunter shareholders.

That move wasn’t just a profitable one for the company…it also helped cement the company’s reputation and gave investors a reason to pay attention to what’s coming next.

And what’s next?

Yet another bold new land grab. In May 2024, the company announced it had acquired an option to purchase 100% interest in Magna Terra Minerals’ Great Northern and Viking Projects, and in June 2024 the acquisition was completed.

This acquisition, along with previously announced acquisitions of 195 additional mineral claims surrounding and adjacent to the projects, set the wheels in motion for Gold Hunter Resources’ new exploration plans in the region.

This means that Gold Hunter Resources – a company with a history of delivering value for shareholders – is building again. And this time the upside could be even bigger…

The Great Northern Project: Scalable Growth Potential in a Premier Jurisdiction

The Great Northern Project encompasses a 40 kilometer stretch of the Doucers Valley Fault, a prominent geological feature hosting numerous gold occurrences.

Upon acquisition of the property, Gold Hunter Resources (OTCQB: HNTRF) (CSE: HUNT) (FSE: 6RH) quickly went to work building upon the historical exploration conducted by Magna Terra.

The company was able to strategically expand the Great Northern and Viking project by 64%, increasing the strike length from 30 kilometers to an impressive 49.2 kilometers along the Doucers Valley Fault in Newfoundland.

This consolidation has significantly increased the project’s exploration potential, unlocking previously untested areas within the district-scale land package.

The Great Northern Project features 18 identified mineralized zones including one inferred and indicated resource estimate and three historic estimates, plus one past-producing mine.

This offers exposure to a high-potential exploration story in a historically rich district that was fragmented until Gold Hunter Resources consolidated it.

Media Spotlight:

Ea$t Van $peculator:

The Case for Gold Hunter

The team at Gold Hunter has largely completed the data compilation and analysis of their Great Northern project in Newfoundland…

Gold Hunter has attracted legendary billionaire mining investor Eric Sprott, and the sellers of land have accepted a combination of cash and shares in Gold Hunter as compensation.

Gold Hunter Resources is Moving Quickly to Advance the Project and Expand its Potential

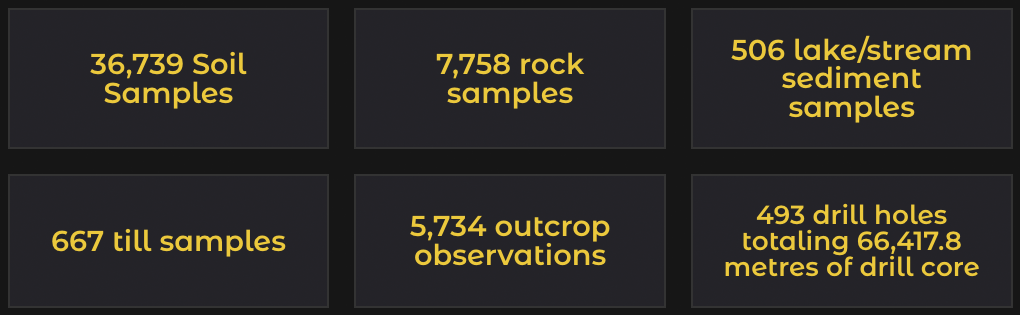

Exploration at the Great Northern Project dates back to the early 1900s, starting with the historic Browning Mine.

Subsequent surveys and drilling programs by Noranda Exploration Company Limited and Esso Minerals Canada led to key discoveries, including the Rattling Brook and Thor deposits. These historical efforts laid the groundwork for Gold Hunter’s ongoing exploration initiatives.

Today, Gold Hunter Resources is advancing toward the completion of a full property Geotech VTEM Airborne Survey, which will play a crucial role in prioritizing drill targets.

By integrating this new data with the existing datasets, Gold Hunter ensures a focused exploration strategy targeting the most promising areas.

The company’s data compilation effort includes incorporating a dataset featuring a substantial amount of historical exploration work, providing the company with a strong foundation for future exploration and development.

This extensive data compilation supports informed exploration strategies, allowing Gold Hunter Resources to maximize the potential of its Great Northern Project.

With a priority on adding significant gold ounces, Gold Hunter Resources aims to expand the project’s resource base through targeted drilling on promising areas in the coming months.

Could Gold Hunter Resources (OTCQB: HNTRF) (CSE: HUNT) (FSE: 6RH) Emerge as “The Next Calibre Mining Corp.?”

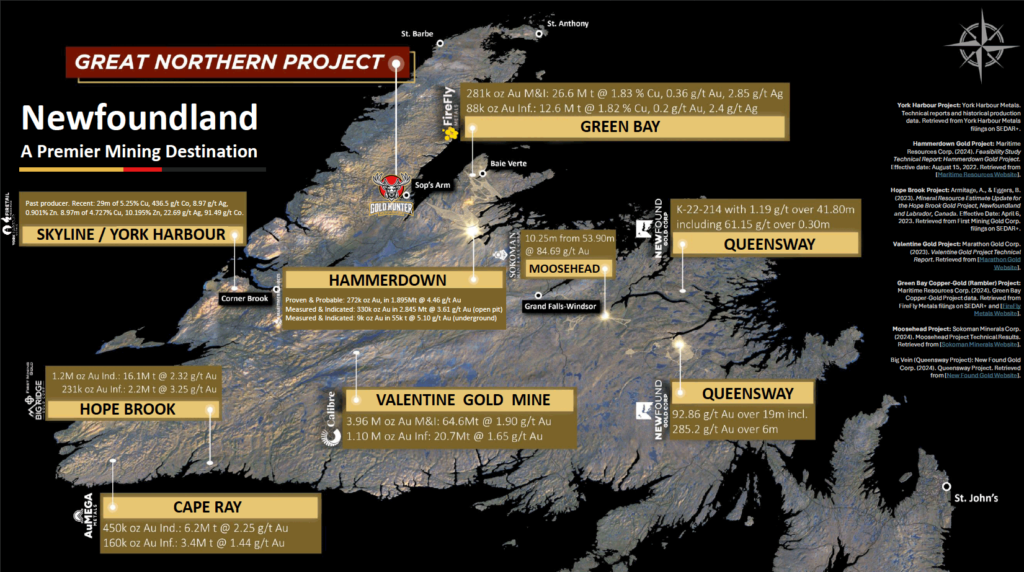

Calibre Mining Corp. (OTCQX: CXBMF); (TSX: CXB) is a $2.4 billion market cap company whose Valentine Gold Project is located in the central region of Newfoundland.

The projects are, however, comparable in size and geology…with Calibre’s Valentine Gold Project scheduled to go into production in Q2 2025.

In a major development, Calibre Mining recently merged with Equinox Gold, creating a top 12 global gold producer and signaling continued consolidation in the gold space. While Gold Hunter Resources’ Great Northern Project is similar in geology to the Valentine Gold Mine, it is much earlier in its development stage.

This, naturally, leads to potentially greater upside potential as there is more speculative potential associated with earlier-stage projects.

But it’s important to know that Gold Hunter Resources is working to accelerate the timeline of advancing the Great Northern Project, potentially looking to move toward production in roughly half of the ten-year-timeline that Calibre required to advance at Valentine.

While it’s true that Gold Hunter Resources (OTCQB: HNTRF) (CSE: HUNT) (FSE: 6RH) is still in its exploration stage of development, the path taken by a company with a comparable property does provide a suggestion of the potential that could exist for the company.

Gold Hunter Resources, with its present-day market cap of just $4.7 million, could see the potential for a significant increase in valuation as it progresses along the Lassonde Curve.

The early-stage nature of this project – combined with the sustained bull market for gold – make Gold Hunter Resources (OTCQB: HNTRF) (CSE: HUNT) (FSE: 6RH) an especially attractive potential opportunity for those investors looking for high upside in the natural resource space.

Newfoundland Is One of the Most Exciting – and Underexplored – Mining Jurisdictions in North America

A century-long history of mining in northwestern Newfoundland has created a strong community base supportive of mining ventures.

The region includes favorable geology, strong government support of mining operations and a rapidly growing infrastructure.

Additionally, Newfoundland’s government is highly supporting of mining initiatives, offering incentives that reduce exploration risk and improve project economics as well as a transparent permitting process.

This ensures a favorable environment for Gold Hunter Resources to advance its now fully-consolidated Great Northern Project.

Seasoned Management Team with Over 150 Years of Combined Experience

The Gold Hunter Resources team is deeply connected within Newfoundland, and has extensive technical prowess and relationships built over three decades.

This experienced team has the knowledge to deliver exponential growth potential, and the company has demonstrated that its strategic decisions have consistently created value for shareholders.

This impressive team includes:

Sean Kingsley – CEO, President & Director

Mr. Kingsley is a mining investor, communicator, educator and entrepreneur. He has 17 years experience specializing in corporate development, corporate strategy, strategic marketing, investor relations and corporate communications, advising and raising capital globally. He has a firm understanding of the financial markets and broad experience in utilizing diverse methods for public communications and raising capital.

Brandon Schwabe – CFO & Director

Mr. Schwabe has served as Chief Financial Officer for several junior public companies in the natural resource sector and is a Chartered Professional Accountant with over 15 years of corporate accounting and financial reporting experience.

Michael Williams – Director

Mr. Williams has over 25 years of experience as a senior executive within the mining industry. He has served in all capacities of numerous publicly traded companies. Experience includes the structuring of, administrating, raising capital globally and marketing TSX listed companies and was a Founder of Underworld Resources, which was acquired by Kinross Gold in 2010 for $138 million.

John Theobald – Director

Mr. Theobald is a mining executive with over 40 years of international experience in gold, base metals, and other minerals. His career encompasses exploration, operations, management, investment management, royalty finance, and business development. Mr. Theobald has significant capital markets and board experience with companies listed on the LSE, CSE, TSX, TSXV, and ASX.

Rory Kutluoglu – Consulting Technical Lead

Mr. Kutluoglu has over 20 years of exploration experience across Europe, Africa, North and South America. He served as the Exploration Manager for Kaminak Gold Corp. and led the team that delivered the maiden and updated resource estimates on the Coffee Gold Project prior to Kaminak’s $520 million acquisition by Goldcorp (now Newmont).

James Rogers – Technical & Corporate Advisor

Mr. Rogers has 15 years of international experience in the mining industry globally. He was principal of Longford Exploration Services, where he led multiple extensive exploration and drilling programs.

David Copeland – Technical Advisor

Copeland played a significant role in turning the Goldboro Gold Project from just a few hundred thousand ounces of gold into an impressive 3.2 million-ounce resource.

7 Powerful Reasons Why You Should Take a Close Look at Gold Hunter Resources (OTCQB: HNTRF) (CSE: HUNT) (FSE: 6RH) Today:

1. District-Scale Land Package with Significant Upside Potential: Gold Hunter Resources has strategically consolidated an entire mineral-rich district in Newfoundland, creating a 40,000-hectare land package known as the Great Northern Project. This property spans 49.2 kilometers along the highlight prospective Doucers Valley Fault, a proven gold-bearing structure, presenting a district-scale opportunity with significant exploration upside.

2. Strong Geological Case for Continued Discovery & Expansion: The Great Northern Project is home to over 18 mineralized zones, including a NI 43-101 Inferred and Indicated resource estimate, three historic resource estimates, and even a past-producing mine from the early 1900s. Historic drilling and sampling have already identified high-grade gold mineralization, reinforcing the potential for future discoveries and future resource expansion.

3. Following the Proven “Valentine” Blueprint: Gold Hunter Resources’ Great Northern Project is mirroring the early steps of the Valentine Gold Project, which grew into a 5+ million-ounce deposit and was recently acquired by Calibre Mining Corp. (OTCQX: CXBMF); (TSX: CXB), a USD$1.65 billion market cap company. Gold Hunter is 10 years earlier on a similar trajectory – and moving fast to unlock similar value.

4. Perfect Timing in a Booming Gold Market: With gold prices near all-time highs, Gold Hunter Resources’ newly consolidated Great Northern project offers investors significant upside potential as the company advances its exploration efforts in a bullish gold market.

5. A $30 Million Shareholder Payout – Already in the Books: In 2024, Gold Hunter sold a previous asset to FireFly Metals (TSX: FFM) in a deal valued at over $30 million – then returned more than 25 million shares to its investors. This is a company with a real track record of creating and delivering value – and a management team that puts shareholders first.

6. Backed by Legends – and Oversubscribed by 50%: The company has strong insider ownership, with management, strategic investors, family and friends owning roughly 65% of the shares. In addition, the company recently completed a non-brokered private placement to raise $1.2 million… that was oversubscribed by nearly 50%. The investor registry included legendary Canadian investors Eric Sprott, Wade Dawe, Mark Zaret and many others that continue to support Gold Hunter Resources as they all were existing shareholders during last years asset sale to FireFly Metals (ASX: FFM) (TSX: FFM).

7. Experienced Leadership with Over 300 Years of Combined Experience: Gold Hunter Resources’ management team has extensive experience in the mining industry, with a track record of success in exploration, development, and value creation. In addition, the company’s technical team has been further bolstered by seasoned experts who have worked on some of Canada’s most prominent gold discoveries, including:

- Rory Kutluoglu – Former Exploration Manager for Kaminak Gold Corp., where he led the team that delivered the maiden and updated resource estimates on the Coffee Gold Project prior to Kaminak’s acquisition by Goldcorp. (He also oversaw a feasibility study, culminating in a successful $520 million sale to Goldcorp, now Newmont.)

- David Copeland – A key part of the team that helped grow the Goldboro Gold Project from just a few hundred thousand ounces of gold to approximately 3.2 million ounces.

- Tanya Tantellar – Former Exploration Manager at Marathon Gold, playing a pivotal role in developing the Valentine Lake Gold Project, which evolved into a multi-million-ounce gold deposit in Newfoundland.

[i] https://goldhunterresources.com/gold-hunter-announces-the-completion-of-the-transaction-with-firefly-metals/

[ii] https://goldhunterresources.com/gold-hunter-announces-the-completion-of-the-transaction-with-firefly-metals/

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer Gold Hunter Resources Inc. (HUNT), Winning Media LLC has been hired for a period beginning on 3/6/25 and ending on 4/14/25 to conduct investor relations advertising and marketing and publicly disseminate information about Gold Hunter Resources Inc. (HUNT) via Website, Email and SMS. Winning Media has been compensated the sum total of one hundred thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Gold Hunter Resources Inc. (HUNT).

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (HUNT). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.