Lithium Bull Market Continues to Roar:

Historic Shift in Energy Demand Means High Upside Potential for Investors

Grounded Lithium Corp. (TSX.V: GRD)(OTC: GRDAF) appears to offer a potent combination of a high-upside property… in the right location… at precisely the right time.

Led by an experienced team with a long record of resource development, this company right now appears to be significantly undervalued

A historic shift is now underway in global energy demand as consumers, corporations and municipalities are all now moving in the direction of renewable energy.

Nowhere is this shift more apparent than in the explosion in demand for electric vehicles.

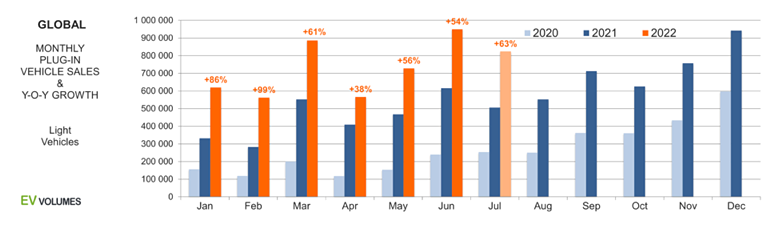

Global electric vehicle sales were up a staggering 62% in the first six months of 2022 even in the face of an overall decline in auto sales.

“Lithium prices have tripled in a year…it is a good time to invest in the lithium market given that the long-term growth prospects for [EVs] and energy storage remain strong, and both technologies will likely require lithium for the foreseeable future.”

9/29/22[i]

This shift in global energy consumption – and the continued strong demand for lithium – has triggered a remarkable growth opportunity for companies in the lithium resource development.

One Canadian company – Grounded Lithium Corp. (TSX.V: GRD) (OTC: GRDAF) – now stands apart from others in the space as an opportunity that brings significant upside potential, but also appears to be greatly undervalued.

One Canadian company – Grounded Lithium Corp. (TSX.V: GRD) (OTC: GRDAF) – now stands apart from others in the space as an opportunity that brings significant upside potential, but also appears to be greatly undervalued.

The company focuses on lithium extraction from the production of its subsurface brines in western Canada.

Given the state of the lithium market and this company’s property, management and business plan, Grounded Lithium Corp. (TSX.V: GRD) (OTC: GRDAF) is worth a close look from investors looking to potentially cash in on the red-hot lithium bull market.

Investment Summary:

Grounded Lithium Corp. (TSX.V: GRD) (OTC: GRDAF) offers investors an early stage investment opportunity to take advantage of the massive shift in global energy demand as well as soaring lithium prices. With a proven, experienced management team…a sizable lithium-brine property in Western Canada…and a clear vision for future growth, investors should consider this as one of the best ways to play the lithium boom for maximum upside potential.

7 Vital Reasons Why You Should Strongly Consider Grounded Lithium Corp. (TSX.V: GRD)(OTC: GRDAF) Today

Vital Reason #1: Lithium supply/demand imbalance fuels long-term bull market and creates investment opportunity.

The surge in demand for electric vehicles – with sales up 62% in the first half of 2022 – is just the beginning. All over the globe, demand is rising for electric vehicles…and many countries are now limiting or banning the sales of combustion engine vehicles.

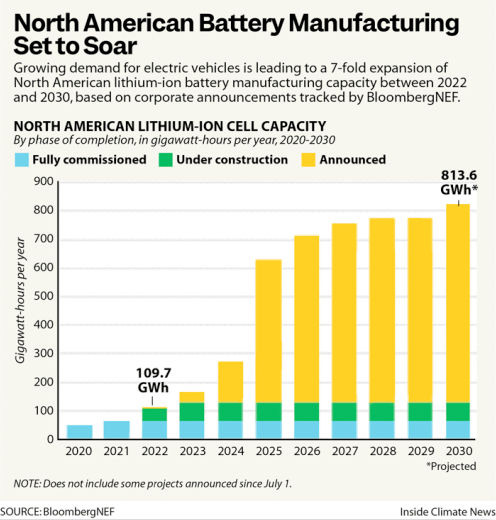

Soaring EV demand has also triggered a massive investment in new lithium battery production plants in North America with more than $40 billion – and counting – invested in new battery gigafactories.

The unprecedented level of investment in new lithium-ion battery gigafactories is projected to lead to a seven-fold expansion of manufacturing capacity by 2030 according to BloombergNEF.

But there’s one important thing to remember about these new battery plants – and the EVs they’re hoping to power:

They all need lithium. Lots and lots of lithium.

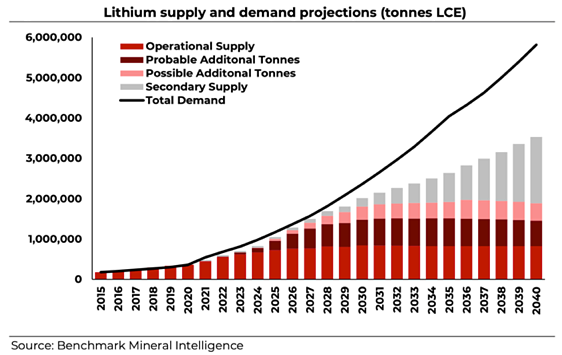

And there’s already a significant supply/demand imbalance that is fueling higher lithium prices today…and a sustained bull market for lithium in the long run.

These continued high lithium prices are not only leading to a frenzy of lithium exploration activity in North America, they’re also helping incentivize investment into new technologies.

These new technologies include Direct Lithium Extraction (DLE), which is an innovative technology that uses a highly selective absorbent to extract lithium from brine water.

The root technology that powers DLE has been around for decades and has already been successfully commercialized in other mining industries. It’s a proven technology that is known to work.

And as DLE technology is brought to the lithium market, it could quickly become a game-changer for lithium production in North America. That’s because DLE could hold the key to unlocking the energy potential of massive subsurface brines located in resource-rich Western Canada.

Vital Reason #2: Grounded Lithium Corp. (TSX.V: GRD) (OTC: GRDAF) is focused on developing Western Canada’s untapped lithium resources.

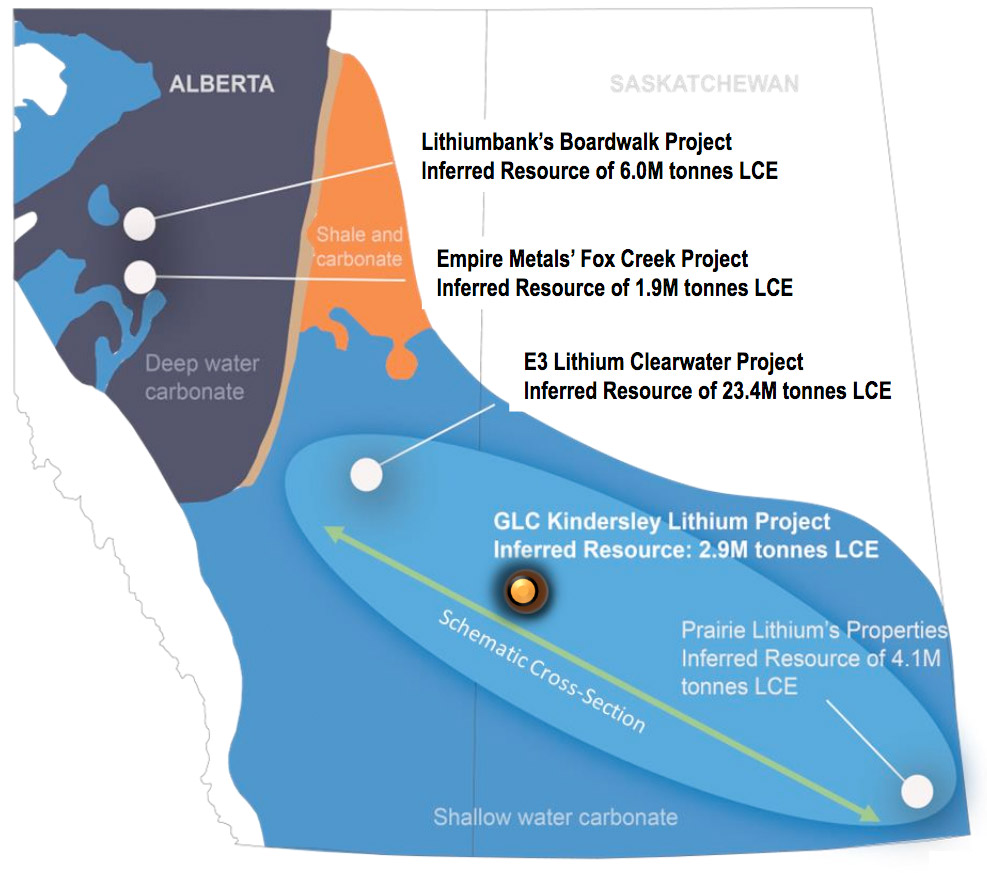

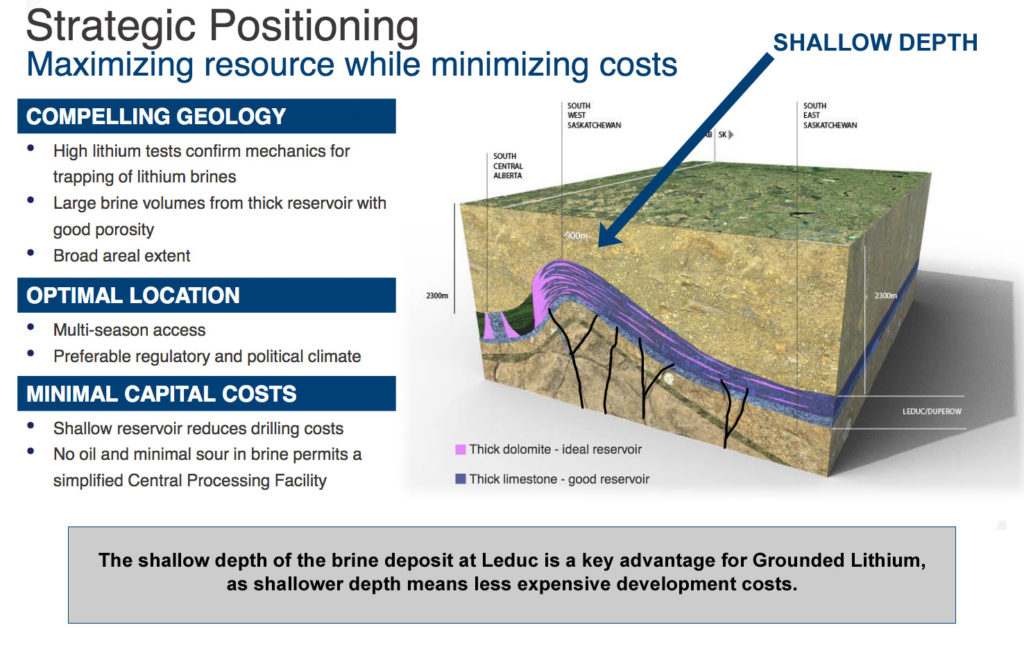

The Leduc formation is an extensively dolomitized ancient carbonate complex that spans 100 square kilometers and is over 200 meters thick.

Both Southern Alberta and Saskatchewan have massive shallow water carbonate structures which are ideal conduits for massive lithium-rich brine reservoirs.

And because there were decades of oil and gas development in the region previously, these reservoirs are well understood.

The company’s long-term vision is to delineate lithium-brine resources across multiple standalone projects in Western Canada, with each project capable of supporting operations of up to 20,000 tons per year.

The Leduc formation is an extensively dolomitized ancient carbonate complex that spans 100 square kilometers and is over 200 meters thick.

Both Southern Alberta and Saskatchewan have massive shallow water carbonate structures which are ideal conduits for massive lithium-rich brine reservoirs.

And because there were decades of oil and gas development in the region previously, these reservoirs are well understood.

The company’s long-term vision is to delineate lithium-brine resources across multiple standalone projects in Western Canada, with each project capable of supporting operations of up to 20,000 tons per year.

Vital Reason #3: Western Canada is one of the most mining-friendly regions in the world…and lithium exploration is growing there.

The Western Canada region – including Saskatchewan and Alberta – is an extremely mining-friendly area. In fact, the Mining Journal Intelligence World Risk Report ranks Saskatchewan among the very top jurisdictions globally for doing business in the mining sector.[vi]

Western Canada offers the key advantage of favorable infrastructure thanks to the region being the second largest oil producer in Canada. This means an extensive network of pipelines, rail transportation and easy power access are all in place. In addition, the province offers a friendly regulatory environment and a sensible tax landscape for resource development companies.

With all of these advantages, it’s not surprising that lithium exploration activity in the region is growing.

For example, E3 Lithium has a defined inferred resource of 23.4M tons of LCE and PEA at its Bashaw Project. And Prarie Lithium has raised C$7.5 million to fund initial drilling at its properties in Southeast Saskatchewan.

This activity is a strong positive indicator as to the potential for Grounded Lithium’s Kindersley Lithium-Brine Project.

And it’s a key reason why the company is focused on acquiring additional lithium-brine resources in Western Canada in the months ahead.

Vital Reason #4: Grounded Lithium’s management team has a proven track record of success…and skin in the game.

When it comes to evaluating the potential of any exploration investment, the strength of the management team is always one of the most critical factors.

You can have a great resource – and Grounded Lithium Corp. certainly does in Western Canada – but without an experienced leadership team to guide the company, that resource alone is no guarantee of success.

In the case of Grounded Lithium Corp. (TSX.V: GRD)(OTC: GRDAF), the company is led by a group with a proven record of success in resource development.

CEO Gregg Smith has over 35 years combined technical and managerial experience and served as a COO with both PetroBank and PetroBakken Resources. At Petrobank he led the Canadian Business unit’s growth from 2,000 BOEPD to over 50,000 boepd, providing investors with >10X MOIC

CEO Gregg Smith has over 35 years combined technical and managerial experience and served as a COO with both PetroBank and PetroBakken Resources. At Petrobank he led the Canadian Business unit’s growth from 2,000 BOEPD to over 50,000 boepd, providing investors with >10X MOIC

In 2009, Smith was named “Saskatchewan Oilman of the Year” for the achievements of the multi-discipline team he led in optimizing drilling and completion techniques in the PetroBakken play providing a major increase in oil productivity per well.

CFO and VP of Finance Greg Phaneuf brings over 28 years of combined experience in finance and leadership disciplines. He was formerly co-founder and CFO of two upstream resource companies (Seven Generations Energy, Toro Oil & Gas), and served as CFO of two technology companies.

CFO and VP of Finance Greg Phaneuf brings over 28 years of combined experience in finance and leadership disciplines. He was formerly co-founder and CFO of two upstream resource companies (Seven Generations Energy, Toro Oil & Gas), and served as CFO of two technology companies.

He was the Treasurer and part of the deal team for Western Oil Sands’ C$7 billion corporate divestiture to Marathon Oil. Over his career, Mr. Phaneuf has led or assisted in financings in excess of C$2 billion and was involved in M&A transactions, inclusive of the Western Oil Sands’ divestiture, in excess of C$7.5 billion.

In addition…

* VP of Operations Dale Shipman has over 30 years of progressive experience in technical leadership and managerial experience in the oil and gas industry, with extensive knowledge of diverse reservoirs across the Western Canadian Sedimentary Basin.

* VP of Exploration Geoff Spears has 15 years of experience in exploration, drilling and acquisitions and initiated and managed the development plans for over C$1.0B of investment in the drilling of over 300 wellbores including 150+ horizontal multi-stage stimulated wellbores across the Western Canadian Sedimentary Basin while serving as Senior Geologist at Pengrowth Energy Corporation.

* VP of Geophysics and IT Wayne Gaskin brings over 27 years of combined expertise in data analysis for mining and petroleum exploration and development. Mr. Gaskin has provided geophysical drilling support for 300+ wells with 97% success rate and 30 MMBOE of reserves.

* VP of Land & Regulatory Lawrence Fisher brings over 30 years of industry and university experience. Served as VP Land of PetroBakken, managing all aspects of that department and effectively led numerous acquisition and divestiture mandates. As a university instructor, he trained many of the industry and governmental professional land negotiators and administrators.

This outstanding team’s proven history of resource development success gives the company a sizable advantage over its competitors, as does their network of contacts and resources in the broader energy space which can allow the company to move quickly when opportunity arises.

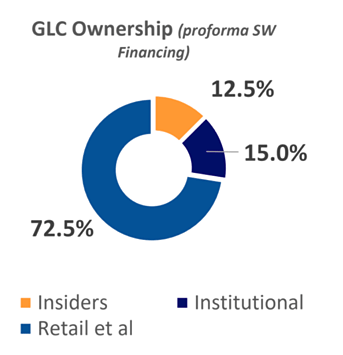

In addition, the company’s management has skin in the game. Management has invested at every level of financing to date and intends to participate in every round in the future.

This means that management’s interest and shareholder interest are perfectly aligned…something that isn’t always the case with resource exploration companies.

Vital Reason #5: Brine lithium offers greater potential than hard rock in the current supply/demand environment.

Not only is the extraction process for brine lithium far less expensive than for hard rock mining…brine lithium also offers the critical advantage of speed.

Given the current lithium supply/demand imbalance – and the race to bring new sources of lithium production online to help with EV production – time is very much of the essence.

So when evaluating investment opportunities in the lithium space, it’s important to keep in mind that hard rock lithium mines can take up to 10-15 years to bring online…whereas brine lithium production can begin in as little as four to five years.

With the aggressive production schedules – and government mandates virtually eliminating sales of combustion engine vehicles in some places – that ability to bring brine lithium projects online more quickly is a valuable advantage.

Vital Reason #6: Grounded Lithium Corp. appears to be significantly undervalued.

Based on the company’s existing resource alone, Grounded Lithium Corp. (TSX.V: GRD) (OTC: GRDAF) appears to be trading at a steep discount compared to its peers.

The company’s current enterprise value (EV) is approximately $20 million. Based on the estimates of the company’s resource in Saskatchewan of 2.9 million tons of LCE, this would represent a value of roughly $7 CAD per ton.

Comparable companies, however, are seeing their inferred resources valued significantly higher at $10 CAD per ton.

This means that – based on the company’s current resource in Western Canada – Grounded Lithium Corp. may already be trading at a significant discount to its peers…and as such represents a high-upside opportunity when the company is fairly valued.

That calculation, of course, does not factor in additional potential resources on the company’s property in Saskatchewan…or any future possible acquisitions by a management team that has demonstrated a history of finding high-upside resource properties in the region.

As word begins to spread about the potential associated with Grounded Lithium Corp. (TSX.V: GRD) (OTC: GRDAF), early investors could potentially reap the rewards of the current undervaluation.

Vital Reason #7: Grounded Lithium Corp. offers a “pure play” resource opportunity.

One of the key elements of Grounded Lithium Corp. is that the company knows its areas of strength…and it knows where it should rely on others.

This makes the company a “pure play” opportunity for investors.

Many resource companies offer great stories, but they can be reliant on the development or demonstration of a complex technology in order to drive value.

That’s not the case with Grounded Lithium Corp. (TSX.V: GRD) (OTC: GRDAF).

Grounded Lithium understands that their strengths involve identifying and acquiring potentially valuable properties…not developing new technology.

So when it comes to the Direct Lithium Extraction (DLE) technology needed for the resource development, Grounded Lithium prefers to “stand on the shoulders of giants” rather than perform the research and development itself.

The company is in collaborations with various DLE technology providers to provide samples to test concentrations and extraction flowsheets and will then license and deploy the technology that achieves the highest, repeatable, reliable results.

In fact, just recently – on October 19 – Grounded Lithium announced that it had engaged Hatch Ltd., an internationally recognized engineering, project management and professional services firm.

The company has engaged Hatch Ltd. to help evaluate available DLE alternatives and choose the one that preferentially extracts lithium from the company’s brine resources.

Hatch Ltd. has considerable experience in direct lithium extraction starting its engineering services in this area in 2010 completing noteworthy reviews, assessments and project commissioning in over 50 different lithium projects worldwide ranging from unconventional brine resources in legacy oilfields, salars, geothermal, tailings and other lithium resources. In particular, Hatch has relevant experience on other Western Canadian lithium brine projects.

Grounded Lithium’s in-house consultant, Wayne Monnery, who holds a PhD. in chemical engineering with experience in DLE technologies, will work closely with Hatch to advance the company’s understanding of a variety of unique technology providers leading to a selection of a preferred vendor.

Investment Summary:

Grounded Lithium Corp. (TSX.V: GRD) (OTC: GRDAF) offers investors an early stage investment opportunity to take advantage of the massive shift in global energy demand as well as soaring lithium prices. With a proven, experienced management team…a sizable lithium-brine property in Western Canada…and a clear vision for future growth, investors should consider this as one of the best ways to play the lithium boom for maximum upside potential.

Resources

[i] https://www.ev-volumes.com/#:~:text=Global%20EV%20Sales%20for%202022%20H1&text=Global%20EV%20sales

%20continue%20strong,growth%20pattern%20is%20shifting%2C%20though.

[ii] https://www.morningstar.com/news/marketwatch/20220929495/supply-lag-helps-lithium-triple-its-prices-in-a-year

[iii] https://www.dallasfed.org/research/economics/2022/1011?utm_source=newsletter&utm_medium=email

&utm_campaign=newsletter_axiosgenerate&stream=top

[iv] https://insideclimatenews.org/news/27102022/the-ev-battery-boom-is-here-with-manufacturers-investing-billions-in-midwest-factories/

[v] Inferrred Mineral Resources outlined in NI43-101 report for Kindersley Project Area by RPS Energy Canada Ltd. 15/04/2022

[vi] https://www.saskatchewan.ca/government/news-and-media/2021/january/13/saskatchewan-gets-top-global-ranking-in-international-mining-report

Disclaimer: This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. ArgusJournal.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.

Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of Grounded Lithium Corp. and its securities. Jade Cabbage Media, LLC d/b/a STOXmedia.com has received up to $10,000 USD dollars (11/19/22) by Winning Media LLC as a total production budget for this advertising effort. Neither Wallstreetnation.com or STOXmedia currently hold the securities of Grounded Lithium Corp. and do not currently intend to purchase such securities.

The issuer, Grounded Lithium Corp. has paid Winning Media LLC the sum total of one hundred thousand dollars USD total production budget to manage a digital media campaign for three months.

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business objectives, financing initiatives, industry trends including rising demand for electronic vehicles, upward trend in lithium prices and current lithium supply and demand imbalance, cost of brine lithium extraction, expectations with respect to future production costs and capacity, impact of DLE technology on the lithium market, the Company’s intention to grow its business and commercialize operations and future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding arrangements, availability of equity or other financings on reasonable terms, timing and ability to evaluate available technology, timing and results of exploration and drilling activities, Company’s ability acquire additional lithium-brine resources in Western Canada, regulatory and tax environment in locations where the Company plans to expand, ability to successfully market its products in competitive industries, the future price of lithium, accuracy of budged exploration and development costs, future interest rates, ability to attract and retain skilled labour and staff or to effectively implement its business plan or strategies . To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Whether actual results, performance or achievements will conform to the Company’s expectations and predictions is subject to known and unknown risks including, among others, the Company’s exposure to operating hazards and risks in the mining industry, global economic, credit and political conditions, geographical and weather conditions, dependence on adequate infrastructure, volatility of market price for the Company’s common shares, the Company’s ability to obtain certain licenses and permits and exposure to litigation.

The Company does not provide any representation or assurance as to the accuracy or completeness of external data and other statistical information obtained from public resources, independent industry publications and other independent sources and, accordingly, disclaims any liability in relation to such information and data.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.