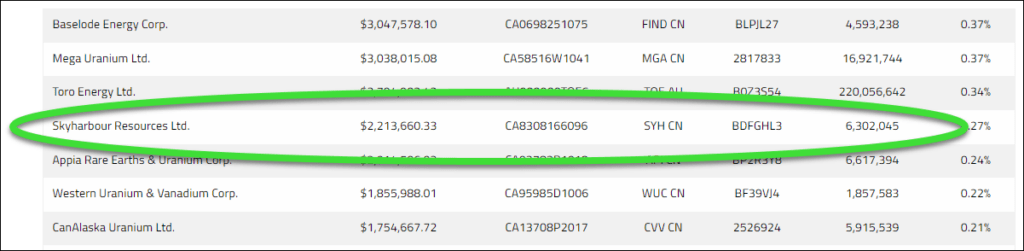

Maybe that’s why institutions are quietly accumulating millions of shares in Skyharbour Resources (OTCQB: SYHBF) (TSXV: SYH)(24)(25)

October 20, 2022

“We welcome Rio Tinto as a new strategic shareholder and project partner. We have a shared vision for the exploration of the various prospective target areas that remain to be fully tested on the Property using modern exploration methods and techniques. We look forward to working with Rio Tinto to generate a new meaningful discovery in the years to come.”

Jordan Trimble, President, and CEO of Skyharbour Resources17

Jordan Trimble, President, and CEO of Skyharbour Resources17

5 Key Reasons Why Skyharbour Resources

(OTCQBX: SYHBF) (TSXV: SYH) Could Have a Breakout Year in 2023.

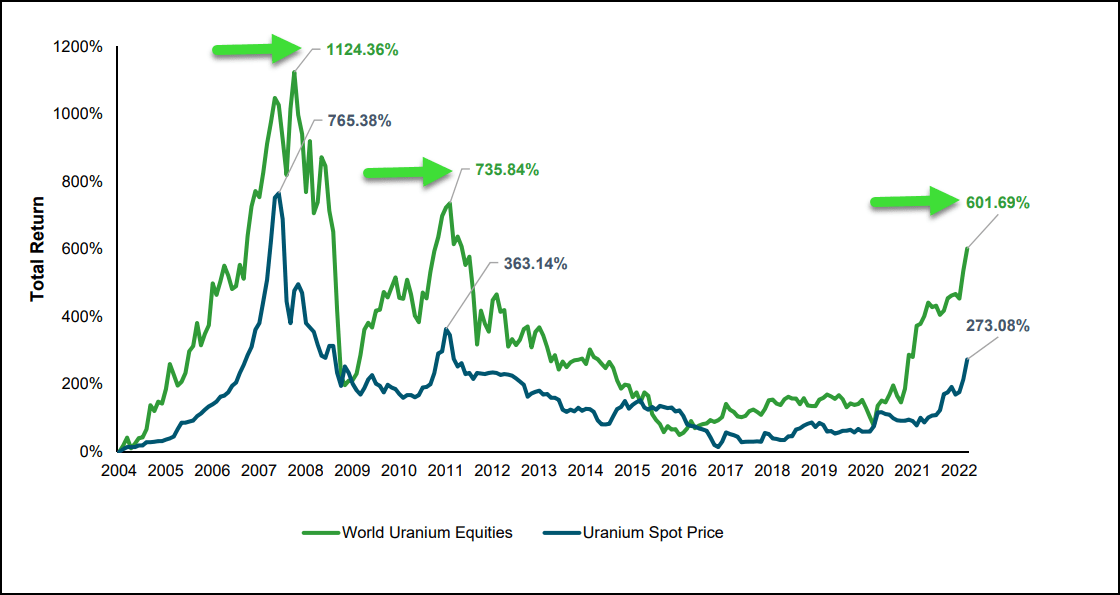

“Uranium Stocks” Have Outperformed “Spot Prices”(27) During Uranium Bull Markets Years…

Bull Markets of World Uranium Equities

2004 – 2007 = +1,124.36%

2009 – 2011 = +735.84%

*2020 – 2022 = +601.69%

*Current Bull Market

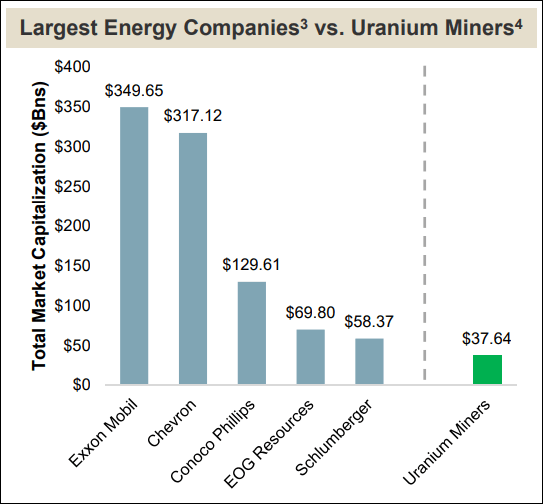

Institutions have been accumulating millions of shares of Skyharbour Resources (OTCQB: SYHBF) (TSXV: SYH)

![]() Sprott Asset Management is a leading independent asset manager focused on delivering value to investors through alternative asset management strategies. Headquartered in Toronto, Canada, the mining finance center of the world, Sprott manages several billion dollars in precious metals investments, including the Sprott Physical Bullion Trusts which trade on the NYSE Arca. (28)

Sprott Asset Management is a leading independent asset manager focused on delivering value to investors through alternative asset management strategies. Headquartered in Toronto, Canada, the mining finance center of the world, Sprott manages several billion dollars in precious metals investments, including the Sprott Physical Bullion Trusts which trade on the NYSE Arca. (28)

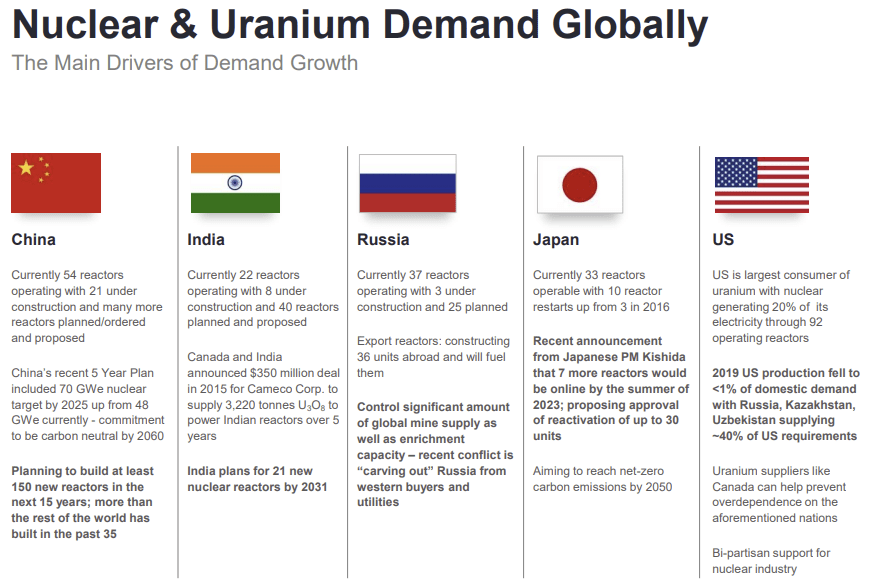

Global Demand For Uranium Is Growing, Shortages Possible (37)

![]() The lion’s share of uranium is traded under long-term contracts between uranium producers and utility companies. The rest is sold on the spot market. The primary driver of the demand for uranium is the capacity of nuclear reactors used to generate electricity.(37)

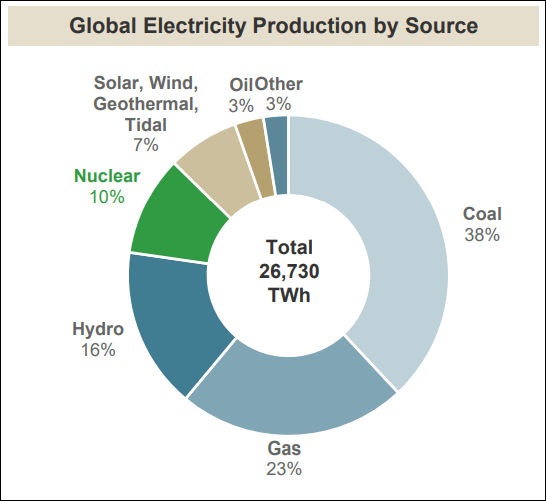

The lion’s share of uranium is traded under long-term contracts between uranium producers and utility companies. The rest is sold on the spot market. The primary driver of the demand for uranium is the capacity of nuclear reactors used to generate electricity.(37)

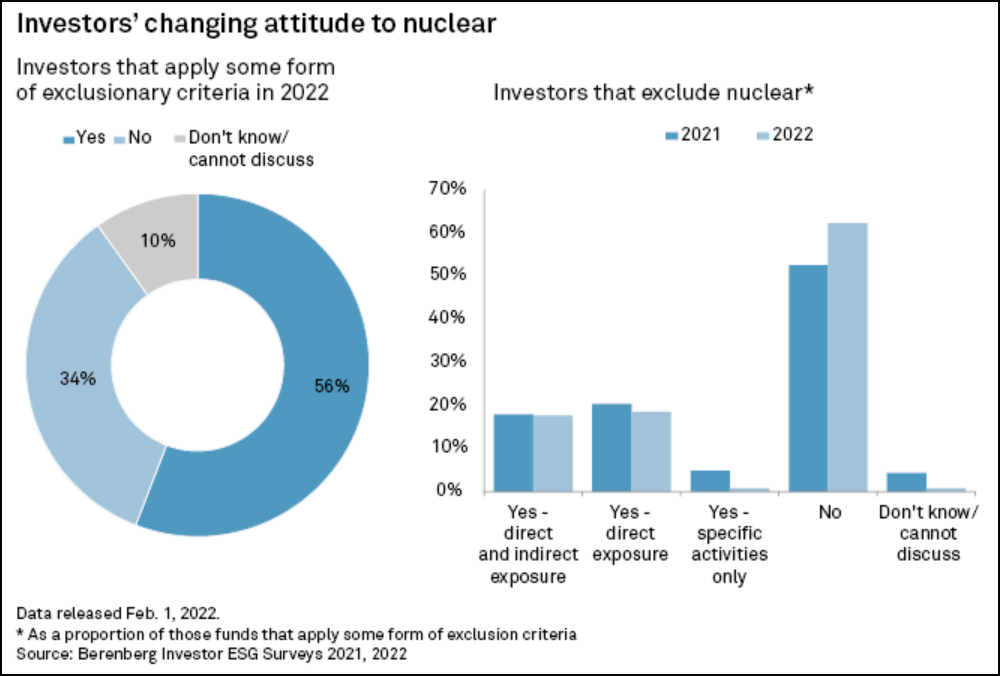

Industry experts project that, given the number of new reactors planned and the worldwide growing demand for electricity, the demand for uranium will grow significantly over the next decade.(37)

Only freshly-mined uranium may satisfy the growing demand.(37)

The current annual global consumption is 190 million pounds, while annual global mine production is 140 million pounds, resulting in a 50-million pound deficit.(37)

Inventory drawdowns and the down-blending of weapons-grade material currently make up the difference. Industry experts, however, project that the supply of these secondary sources will decrease by 50% over the next decade, while global demand for uranium will increase, widening the supply-demand gap.(37)

Only primary sources of uranium—i.e., the supply produced from mines—can make up the coming shortfall, because the stockpiles will be gone.(37)

There are 439 operating nuclear power plants in the world, and 62 new plants are currently under construction.(37)

In the next two decades, China, India, Russia, Europe, the Middle East, and Southeast Asia will dramatically expand their use of nuclear energy, causing fierce competition for mined uranium.(37)

According to the World Nuclear Association, 139 new plants are in the planning stage and 326 new plants are in the proposal stage.(37)

China will build 50 new reactors by 2030 (500% increase), and India will build 35 (150% increase).(37)

China alone will consume the equivalent of one-third of today’s global uranium market.(37)

China and Russia have already begun aggressively buying up huge stakes in uranium mining operations around the world in order to stockpile uranium to meet their rising domestic demand.(37)

Just Who is Skyharbour Resources Ltd.?

![]()

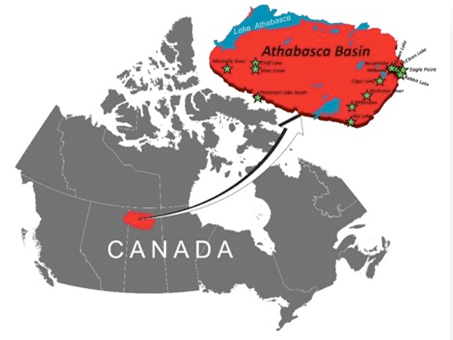

Skyharbour is a preeminent uranium exploration and early-stage development company with projects in the prolific Athabasca Basin of Saskatchewan in Canada – home to the world’s largest and highest grade uranium mining and milling operations.(33)

Skyharbour is a preeminent uranium exploration and early-stage development company with projects in the prolific Athabasca Basin of Saskatchewan in Canada – home to the world’s largest and highest grade uranium mining and milling operations.(33)

Skyharbour Holds an Extensive Portfolio of Drill Ready Uranium Exploration Projects in “Friendly” Canada.

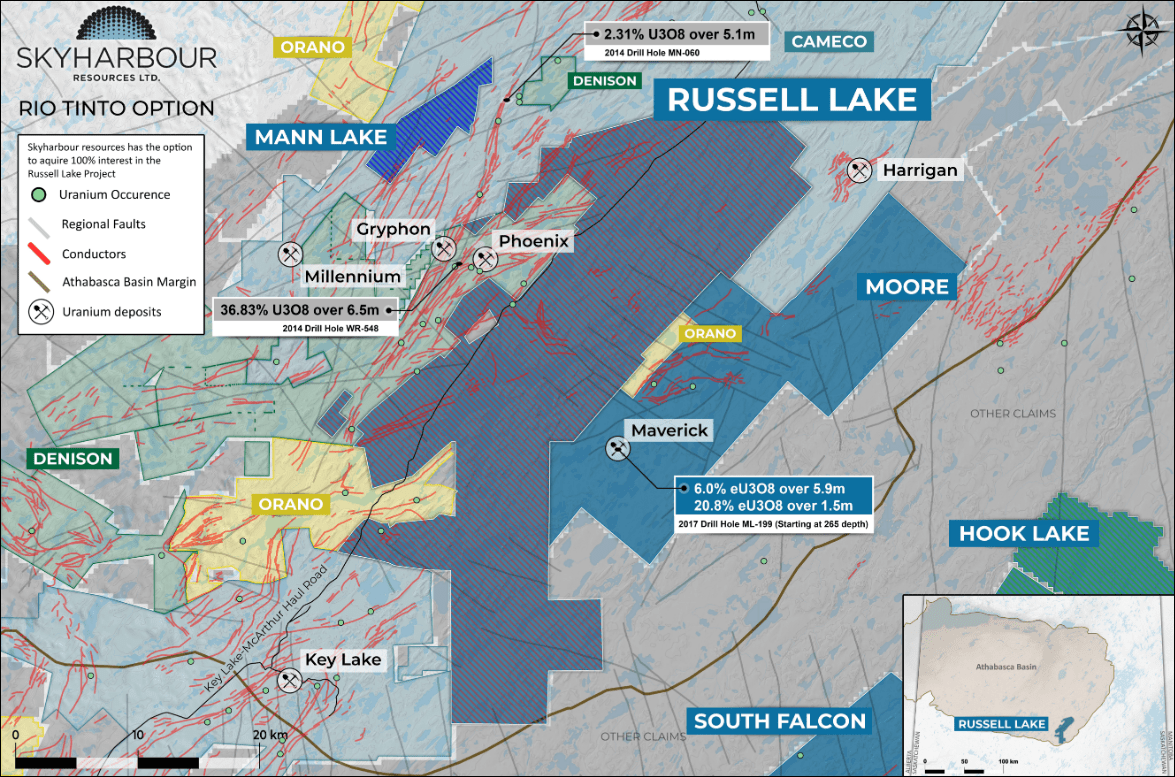

Russell Lake (New Project with Rio Tinto)

Skyharbour has acquired from Denison Mines, a large strategic shareholder of the Company, a 100% interest in the Moore Uranium Project which is located 15 kilometers east of Denison’s Wheeler River project and 39 kilometers south of Cameco’s McArthur River uranium mine. (38)

Moore is an advanced stage uranium exploration property with high-grade uranium mineralization at the Maverick Zone that returned drill results of up to 6.0% U3O8 over 5.9 meters including 20.8% U3O8 over 1.5 meters at a vertical depth of 265 meters.(38)

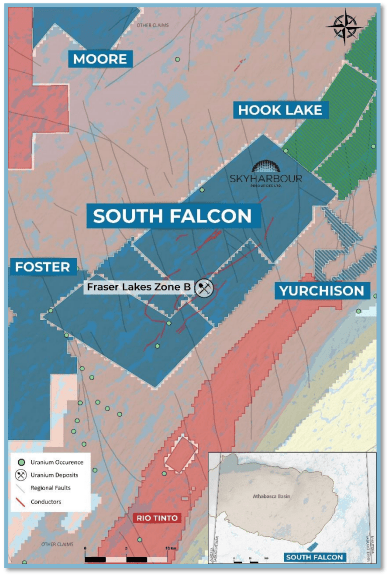

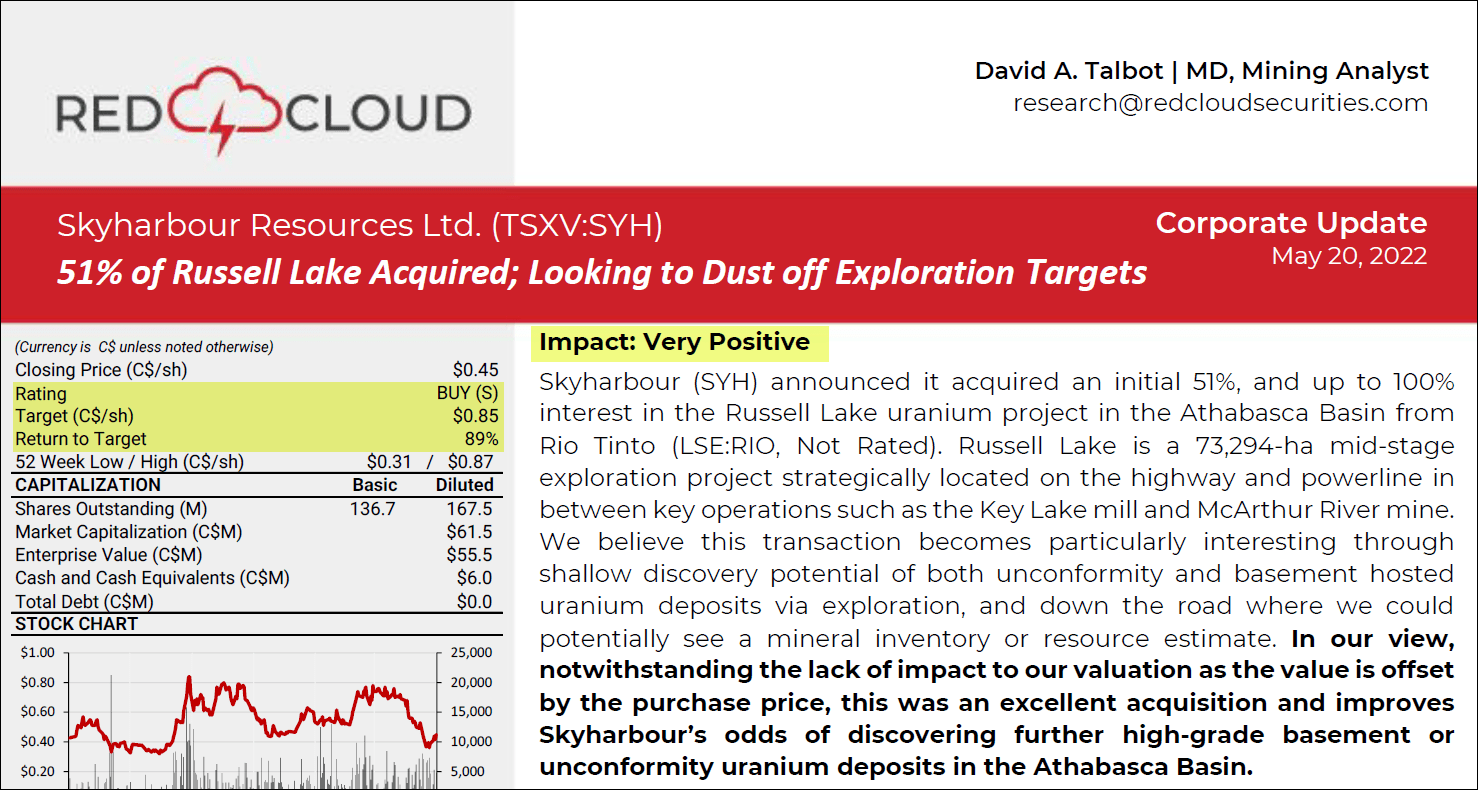

Furthermore, Skyharbour owns a 100% interest in the 44,470 ha South Falcon Point Project located in the eastern perimeter of the Basin, which contains a NI 43-101 inferred resource totaling 7.0 million pounds of U3O8 at 0.03% and 5.3 million pounds of ThO2 at 0.023%. Adjacent to the Moore Uranium Project is Skyharbour’s recently optioned Russell Lake Uranium Project from Rio Tinto, which hosts historical high-grade drill intercepts over a large property area with robust exploration upside potential.(38)

Skyharbour has the option to acquire an initial 51% and up to 100% of Rio Tinto’s 73,294 hectare, Russell Lake Uranium Property strategically located in the central core of the Eastern Athabasca Basin of northern Saskatchewan. The Company is actively advancing these projects through exploration and drill programs.(38)

Russell Lake Uranium Project, which comprises 26 claims covering 73,294 hectares of prospective exploration ground strategically situated between the Company’s Moore Uranium project (to the east) and Denison Mines’ Wheeler River project (to the west) in the eastern portion of the Athabasca.(17)

The Project is a premier, advanced-stage exploration property given its large size, proximity to critical regional infrastructure, and the significant amount of historical exploration carried out on the property, which has identified numerous prospective target areas and several high-grade uranium showings as well as drill hole intercepts. The Property is centrally located between Cameco Corp.’s Key Lake mill to the south and the McArthur River mine to the north.(17)

Access to the Property is via Highway 914, which services the McArthur River Mine and runs through the western extent of the Property along with a high-voltage powerline that energizes the existing mining operations in the eastern portion of the Athabasca Basin.(17)

Highlights:

Option to acquire an initial 51% and up to 100% of Rio Tinto’s 73,294 ha Russell Lake Uranium Property strategically located in the central core of the Eastern Athabasca Basin of northern Saskatchewan.(17)

Both Highway 914 servicing McArthur River and a high-voltage power line connected to the provincial power grid run through the Property’s western claims.(17)

Skyharbour, as an operator, can earn an initial 51% interest in the Property by paying CAD $508,200 in cash, issuing 3,584,014 common shares to RTEC, and funding CAD $5,717,250 in exploration on the Project, inclusive of a 10% management fee to Skyharbour, over a period of 3 years.(17)

Skyharbour has a second option to earn an additional 19% interest for a total of 70%, and a further possible option to obtain the remaining 30% interest in the Project for an undivided 100% ownership interest.(17)

The Property has been the subject of significant historical exploration efforts including over 95,000 meters of drilling in over 220 drill holes. This provides the Company with an excellent dataset to direct subsequent exploration of high-priority areas with the potential for near-term discovery of high-grade uranium mineralization.(17)

Previous exploration work has identified numerous highly prospective target areas, some of which host high-grade uranium mineralization in historical drill holes. Furthermore, there are over 35 kilometers of untested conductors on the Property in magnetic lows, which are indicative of pelitic basement rocks conducive to uranium deposition in the Athabasca Basin.(17)

The Property has a permitted and functional exploration camp suitable for over forty people and is conveniently located near Highway 914 and within 5 km kilometers of Denison’s Phoenix deposit. The Property’s claims are in good standing for 2-22 years from banked assessment credits.(17)

This transaction adds another drill-ready, advanced-stage uranium exploration asset to Skyharbour’s project portfolio and offers significant operational and explore synergies with the adjacent Moore uranium project.(17)

Additional Skyharbour Projects info can be found here.

Skyharbour Projects

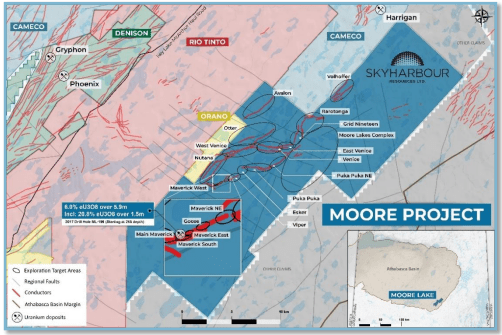

Moore Uranium Project

Skyharbour owns 100% of the 35,705 hectares Moore Uranium Project located 42 kilometers northeast of the Key Lake mill, approx. 15 kilometers east of Denison’s Wheeler River project, and 39 kilometers south of Cameco’s McArthur River mine.(42)

Unconformity-hosted uranium mineralization was discovered on the property at the Maverick Zone in the early 2000s at relatively shallow depths. Skyharbour has carried out several drill programs with multiple holes intersecting high-grade uranium mineralization over the 4km long Maverick corridor.(42)

Drill results include 20.8% U3O8 over 1.5m at 264m depth in hole ML-199, 9.12% U3O8 over 1.4m at 278m in hole ML-202, and 5.29% over 2.5m U3O8 at 279m depth in hole ML-200. Hole ML-202 represents a new high-grade discovery and illustrates the strong discovery potential of additional high-grade lenses along strike.(42)(42)

The Company is planning additional drill programs to expand the known high-grade Maverick Zone and to test basement-hosted targets as well as regional targets.(42)

- 12 contiguous claims totalling 35,705 hectares(42)

- Strategically located just east of the midpoint between the Key Lake mine and mill complex and the producing McArthur River mine (42)

- The property has been the subject of extensive historic exploration with over $40 million in expenditures, and over 140,000 meters of diamond drilling completed in +380 drill holes (42)

High grade and relatively shallow “Maverick Zone”:(42)

- Drill hole ML-61 returned 4.03% eU3O8 over 10 meters, including 20% eU3O8 over 1.4 meters, starting at a depth of 264.68 meters(42)

- Drill holes ML-55 and ML-47 also encountered high-grade mineralization, returning 5.14% U3O8 over 6.2 meters, and 4.01% U3O8 over 4.7 meters, respectively(42)

In addition to offering high-grade uranium discovery potential at its 100% owned Moore Lake, Skyharbour also boasts seven partner companies advancing its other projects. The option agreements and JV’s with these companies combine for CAD $34.35 million in exploration expenditures, $14.85 million in cash payments, and over $20 million in share issuances from these partner companies assuming they complete their respective earn-ins.

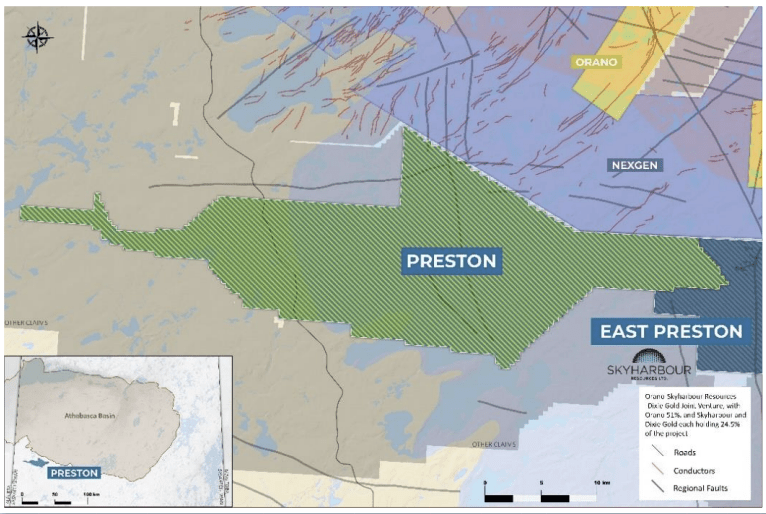

Skyharbour has a joint venture with industry leader Orano (France’s largest uranium mining and nuclear fuel cycle company) at the Preston Project whereby Orano has earned a 51% interest in the project through exploration expenditures and cash payments. Skyharbour now owns a 24.5% interest in the Project.(42)

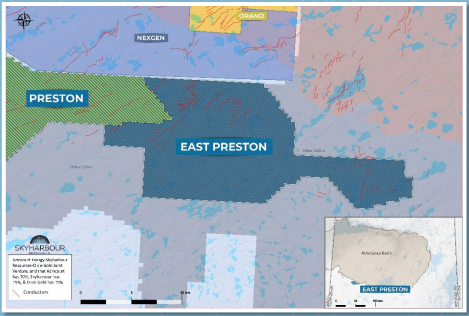

Skyharbour also has a joint venture with Azincourt Energy at the East Preston Project whereby Azincourt has earned a 70% interest in the project through exploration expenditures, cash payments, and share issuance. Skyharbour now owns a 15% interest in the Project. Preston and East Preston are large, geologically prospective properties proximal to Fission Uranium’s Triple R deposit as well as NexGen Energy’s Arrow deposit.(42)

In addition, Skyharbour also has several active option partners including:

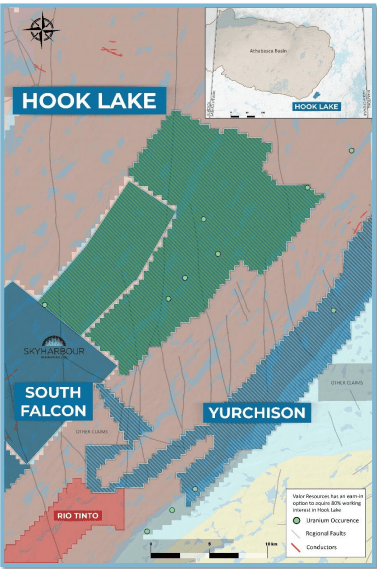

– ASX-listed Valor Resources on the Hook Lake Uranium Project whereby Valor can earn-in 80% of the project through CAD $3,500,000 in exploration expenditures, $475,000 in cash payments over three years, and an initial share issuance.(43)

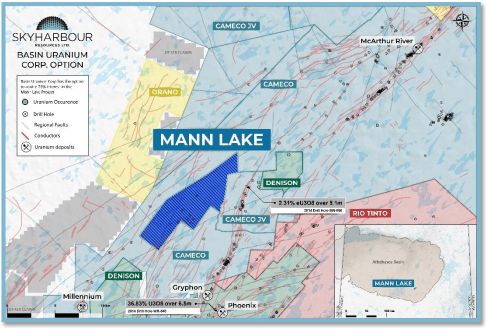

– CSE-listed Basin Uranium Corp. on the Mann Lake Uranium Project whereby Basin Uranium can earn-in 75% of the project through $4,000,000 in exploration expenditures, $850,000 in cash payments as well as share issuances over three years.(44)

– and CSE-listed Medaro Mining Corp. on the Yurchison Project whereby Medaro can earn-in an initial 70% of the project through $5,000,000 in exploration expenditures, $800,000 in cash payments as well as share issuances over three years followed by the option to acquire the remaining 30% of the project through a payment of $7,500,000 in cash and $7,500,000 worth of shares.(33)

– Australian company Yellow Rocks Energy on the Usam and Wallee Uranium Projects whereby Yellow Rocks can earn-in 80% of the projects through AUD $50,000 in cash payments to Skyharbour, AUD $4,500,000 in exploration, and issue a total of AUD $2,025,000 worth of Yellow Rock shares to Skyharbour over 39-month period (subject to ASX listing and financing)

– and TSX.V-listed Tisdale Clean Energy on the South Falcon East Project whereby Tisdale can earn-in up to 75% of the project through the issuance of 1,111,111 shares upfront, fund exploration expenditures totaling CAD $10,500,000, and pay Skyharbour $11,100,000 in cash of which $6,500,000 can be settled for shares over a five year earn-in (subject to Exchange approval)

Skyharbour’s goal is to maximize shareholder value through new mineral discoveries, committed long-term partnerships, and the advancement of exploration projects in geopolitically favorable jurisdictions.(45)

South Falcon Uranium & Thorium Project(46)

Uranium and thorium mineralization discovered to date at Falcon Point is shallow and is hosted in two geological settings, with the southern half hosting classic Athabasca-style basement mineralization associated with well-developed EM conductors which include EWA, Walker and Fraser Lakes zones.(46)

Drilling to date on the Falcon Point Project totals over 22,000 meters in more than 110 holes. Over $15 million has been invested in exploration consisting of airborne and ground geophysics, multi-phased diamond drill campaigns, detailed geochemical sampling and surveys, and ground-based prospecting culminating in an extensive geological database for the project area.(46)

The company owns a 100% interest in the South Falcon Uranium Project. Skyharbour has optioned a portion of South Falcon, called the South Falcon East Project, consisting of 12,464 hectares to Tisdale Clean Energy. Skyharbour will retain a minority interest in South Falcon East assuming the earn-in is completed as well as a 100% interest in the remaining and adjacent 32,006 hectare South Falcon Project.

The Preston Project (47)

The Preston Project is a large land position totaling 49,635 hectares strategically located proximal to NexGen Energy’s (TSX-V: NXE) high-grade Arrow uranium deposit and Fission Uranium’s (TSX: FCU) Patterson Lake South Triple R deposit. In March 2017, Skyharbour and its Preston partner company Clean Commodities signed an option agreement with Orano Canada Inc. (formerly AREVA and France’s largest uranium mining and nuclear fuel cycle company).

In March 2021, Orano completed its earn-in of 51%, by completing $4,800,000 in exploration expenditures and making a total of $200,000 in cash payments over three years, thus forming a joint venture with Skyharbour Resources and Dixie Gold both retaining a 24.5% interest. The Preston Uranium Project is a strategic, district-scale property with robust exploration upside potential and Skyharbour is utilizing the prospect generator model to advance this project with strategic partners.(47)

The East Preston Project(48)

The East Preston Uranium Project is a large land position totaling 25,329 hectares, representing the eastern region of the larger Preston Project strategically located near NexGen Energy Ltd’s high-grade Arrow deposit on its Rook-1 property and Fission Uranium Corp Triple R deposit located within their PLS Project area.(48)

The Hook Lake Project (48)

The Hook Lake Project (formerly North Falcon Point) consists of 16 contiguous mining claims covering 25,846 hectares, located 60 km east of the Key Lake Uranium Mine in northern Saskatchewan. The Project is host to several prospective areas of uranium mineralization including the Hook Lake / Zone S High-grade surface outcrop with reported grades in grab samples up to 68% U3O8. A bio-geochemical survey carried out over the trenches in 2015 responded positively with along-strike anomalies 2 km to the northeast.(43)

The Mann Lake Project (44)

The 3,473 hectare Mann Lake Uranium Project is strategically located in the eastern Athabasca Basin 25 km southwest of the McArthur River Mine and adjacent to the Mann Lake Joint Venture operated by Cameco (52.5%) with partners Denison Mines (30%) and Orano (formerly AREVA) (17.5%). Denison acquired International Enexco and its 30% interest on this adjacent project after a 2014 winter drill program discovered high-grade, basement-hosted uranium mineralization. In 2014, Skyharbour completed an EM survey on its Mann Lake Project that was successful in confirming the presence of a broad, NE-SW trending corridor of conductive basement rocks. In October 2021, an option agreement was signed with Basin Uranium Corp providing them with an earn-in option to acquire up to a 75% interest in the Mann Lake Uranium Project.(44)

Additional information on Skyharbour Projects info can be found here.

![]()

Skyharbour Resources Ltd. is led by strong management and geological teams with a solid track record of success.

The team includes:

Recapping Skyharbour Resources

(OTCQB: SYHBF) (TSXV: SYH)

Mining Giant Just Took a Major Interest in This Junior Explorer… (17)

Rio Tinto seemingly handpicked its next joint venture partner. (17)

Institutions are piling in and have been accumulating millions of shares of Skyharbour Resources (OTCQB: SYHBF) (TSXV: SYH) (24)(25)

5 Key Reasons Why Skyharbour Resources

(OTCQX: SYHBF) (TSXV: SYH) Could Have a Breakout Year in 2023.

Source List:

Source 1: https://tradingeconomics.com/commodity/uranium

Source 2: https://www.bnnbloomberg.ca/skyharbour-resources-has-positioned-itself-to-capitalize-on-the-bullish-uranium-market-1.1600720

Source 3: https://www.bloomberg.com/news/features/2021-11-02/china-climate-goals-hinge-on-440-billion-nuclear-power-plan-to-rival-u-s

Source 4: https://skyharbourltd.com/_resources/presentations/corporate-presentation.pdf

Source 5: https://www.cnbc.com/2021/04/22/biden-pledges-to-slash-greenhouse-gas-emissions-in-half-by-2030.html

Source 6: https://www.bbc.com/news/world-europe-56828383

Source 7: https://www.scientificamerican.com/article/china-says-it-will-stop-releasing-co2-within-40-years/

Source 8: https://www.energy.gov/ne/articles/3-reasons-why-nuclear-clean-and-sustainable

Source 9: https://www.spglobal.com/platts/en/market-insights/latest-news/metals/072921-uranium-demand-rising-while-supply-remains-uncertain-cameco

Source 10: https://news.un.org/en/story/2021/08/1097572

Source 11: https://investorintel.com/markets/uranium-energy/uranium-energy-intel/canadas-athabasca-basin-the-worlds-richest-uranium-play/

Source 12: https://www.globenewswire.com/news-release/2021/09/14/2296344/36591/en/Skyharbour-Intersects-High-Grade-Uranium-Mineralization-at-Maverick-East-Zone-with-Drill-Results-of-2-54-U3O8-over-6-0m-including-6-80-U3O8-over-2-0m-Additional-Assays-Pending-and-.html

Source 13: https://skyharbourltd.com/projects/projects-overview/

Source 14: https://stockcharts.com/h-sc/ui?s=SYH.V

Source 15: https://www.barchart.com/stocks/quotes/SYH.VN/overview

Source 16: https://www.reuters.com/business/energy/russias-yamal-europe-westbound-gas-pipeline-flows-stopped-friday-2022-03-04/

Source 17: https://www.globenewswire.com/news-release/2022/05/19/2446685/36591/en/Skyharbour-Secures-Option-to-Acquire-an-Initial-51-and-Up-to-100-of-the-Russell-Lake-Uranium-Project-from-Rio-Tinto-in-the-Athabasca-Basin-of-Saskatchewan.html

Source 18: http://skyharbourltd.com/_resources/presentations/corporate-presentation.pdf?v=0.844

19.)https://www.prnewswire.com/news-releases/value-of-uranium-rising-as-demand-grows-for-nuclear-energy-generation-around-the-globe-301548646.html

20.)https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/esg-investors-warm-to-nuclear-power-after-eu-green-label-award-69002267

21.)https://redcloudresearch.com/skyharbour-resources-ltd-tsxvsyh-51-of-russell-lake-acquired-looking-to-dust-off-exploration-targets/

22.) http://skyharbourltd.com/_resources/presentations/corporate-presentation.pdf?v=0.844

23.) https://www.world-nuclear.org/information-library/nuclear-fuel-cycle/mining-of-uranium/uranium-mining-overview.aspx

24.) https://sprottetfs.com/urnm-sprott-uranium-miners-etf/#

25.) https://www.globalxetfs.com/funds/ura/

26.) https://www.pinnacledigest.com/energy-stocks/is-uranium-the-ultimate-esg-investment/

27.) https://sprottetfs.com/media/5199/sprott-uranium-miners-etf-presentation.pdf

28.) https://sprottetfs.com/about-us

29.) https://denisonmines.com/projects/core-projects/wheeler-river-project/

30.) https://etfdb.com/gold-silver-investing-channel/uranium-bull-market-is-just-getting-started/

31.)https://biz.crast.net/bank-of-america-says-uranium-prices-are-up-50-this-year-and-is-set-to-climb-further-on-sanctions-on-russias-exports-and-the-risk-of-stockpiling/

32.)https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/esg-investors-warm-to-nuclear-power-after-eu-green-label-award-69002267

33.) http://skyharbourltd.com/_resources/presentations/corporate-presentation.pdf?v=0.249

34) https://www.eenews.net/articles/could-russias-invasion-of-ukraine-revive-u-s-uranium-mining/

35.) https://www.globalxetfs.com/about/

36.) https://www.energy.gov/ne/articles/3-reasons-why-nuclear-clean-and-sustainable

37.) https://www.virginiauranium.com/uranium-101/uranium-market-u-s-uranium-sources/

38.) http://skyharbourltd.com/

39.) http://skyharbourltd.com/_resources/images/SKY-SaskProject-Locator-20220324.jpg

40.) https://skyharbourltd.com/_resources/images/SKY-RussellLake-20220325-Inset.jpg

41.) https://skyharbourltd.com/projects/uranium-projects/russell-lake/

42.) https://skyharbourltd.com/projects/uranium-projects/moore-lake/

43.) https://skyharbourltd.com/projects/uranium-projects/north-falcon-point/

44.) https://skyharbourltd.com/projects/uranium-projects/mann-lake/

45.) https://skyharbourltd.com/corporate/corporate-overview/

46.) https://skyharbourltd.com/staging/skyharbourltd.com/projects/uranium-projects/south-falcon-point/

47.) https://skyharbourltd.com/projects/uranium-projects/preston/

48.) https://skyharbourltd.com/projects/uranium-projects/east-preston/

49.) https://skyharbourltd.com/corporate/management-team/

Scientific & Technical Information

The scientific and technical information disclosed herein about Skyharbour Resources has been reviewed and approved by David Billard, P.Geo, a qualified person and a consulting geologist of Skyharbour Resources Ltd.

SEDAR

The information disclosed on this web page is only summary information about Skyharbour Resources Ltd. and the industry in which it operates in. Visit www.sedar.com to review additional disclosures and filings for Skyharbour Resources Ltd.

43-101 Technical Reports

Visit www.sedar.com to view technical reports and other disclosures of the Company including:

- Technical Report on the Russell Lake Property, Northern Saskatchewan, Canada, National Instrument 43-101, with an effective date of June 6, 2022 and filed on SEDAR on July 19, 2022; and

- Technical Report on the Moore Lake Property, Northern Saskatchewan, Canada, National Instrument 43-101, with an effective date of October 3, 2016 and filed on SEDAR on October 6, 2016.

Market & Industry Data

The information contained herein includes market and industry data that has been obtained from third party sources, including industry publications. The Company believes that its industry data is accurate and that its estimates and assumptions are reasonable, but there is no assurance as to the accuracy or completeness of this data. Third party sources generally state that the information contained therein has been obtained from sources believed to be reliable, but there is no assurance as to the accuracy or completeness of included information. Although the data is believed to be reliable, the Company has not independently verified any of the data from third party sources referred to in this presentation or ascertained the underlying economic assumptions relied upon by such sources.

Cautionary Statement Regarding “Forward-Looking” Information

This contains “forward‐looking information or statements” within the meaning of applicable securities laws, which may include, without limitation, statements relating to advancing the Company’s Projects, the Company’s plans for its Projects, expected results and outcomes, the technical, financial and business prospects of the Company, its projects and other matters. All statements herein other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of uranium, the anticipated costs and expenditures, the ability to achieve its goals, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms. Such forward-looking information reflects the Company’s views with respect to future events and is subject to risks, uncertainties and assumptions, including the risks and uncertainties relating to the interpretation of exploration results, risks related to the inherent uncertainty of exploration and cost estimates, the potential for unexpected costs and expenses and those other risks filed under the Company’s profile on SEDAR at www.sedar.com. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, adverse weather and climate conditions, failure to maintain or obtain all necessary government permits, approvals and authorizations, failure to maintain community acceptance (including First Nations), risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of personnel, materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters), risks relating to inaccurate geological and engineering assumptions, decrease in the price of uranium, the impact of Covid-19 or other viruses and diseases on the Company’s ability to operate, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to, the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, loss of key employees, consultants, or directors, increase in costs, delayed drilling results, litigation, and failure of counterparties to perform their contractual obligations. The Company does not undertake to update forward‐looking statements or forward‐looking information, except as required by law.

Image Source (24)

Image Source (24)

Jordan Trimble is an entrepreneur and has worked in the resource industry in various roles with numerous companies specializing in management, corporate finance and strategy, shareholder communications, business development, and capital raising. Previous to Skyharbour, he was the Corporate Development Manager for Bayfield Ventures, a gold company with projects in Ontario which was successfully acquired by New Gold in 2014. (49)

Jordan Trimble is an entrepreneur and has worked in the resource industry in various roles with numerous companies specializing in management, corporate finance and strategy, shareholder communications, business development, and capital raising. Previous to Skyharbour, he was the Corporate Development Manager for Bayfield Ventures, a gold company with projects in Ontario which was successfully acquired by New Gold in 2014. (49)