Roku and Netflix Shares Jump on Price Target Increases

Shares of streaming device maker Roku and streaming giant Netflix were climbing higher on Monday.

Roku shares received a price target bump from Needham analyst Laura Martin while Netflix shares received an increase from Credit Suisse analyst Doug Mitchelson.

Doug Mitchelson wrote Monday that Netflix’s content slate “is shaping up to be meaningfully stronger” next year than it is this year.

He added, “This bodes well for 2019 subscriber growth as scaling quality content should benefit both marketing and churn.”

“While predicting a new hit in 2019 is difficult, the year will see an increased number of new releases, or more ‘swings at the plate,’ and, at a minimum, Netflix will not face a difficult comparison like 2Q18’s struggle vs. 2Q17’s ’13 Reasons Why’ debut,” he wrote.

The analyst reiterated its outperform rating on Netflix with a price target of 400.

Martin has raised her price target on Roku from $60 to $85 and according to FactSet, it is now the highest listed price target.

According to Martin, she prefers Roku shares over Netflix Inc. shares “owing to its better margins, lower content risk, event upside and better competitive profile.”

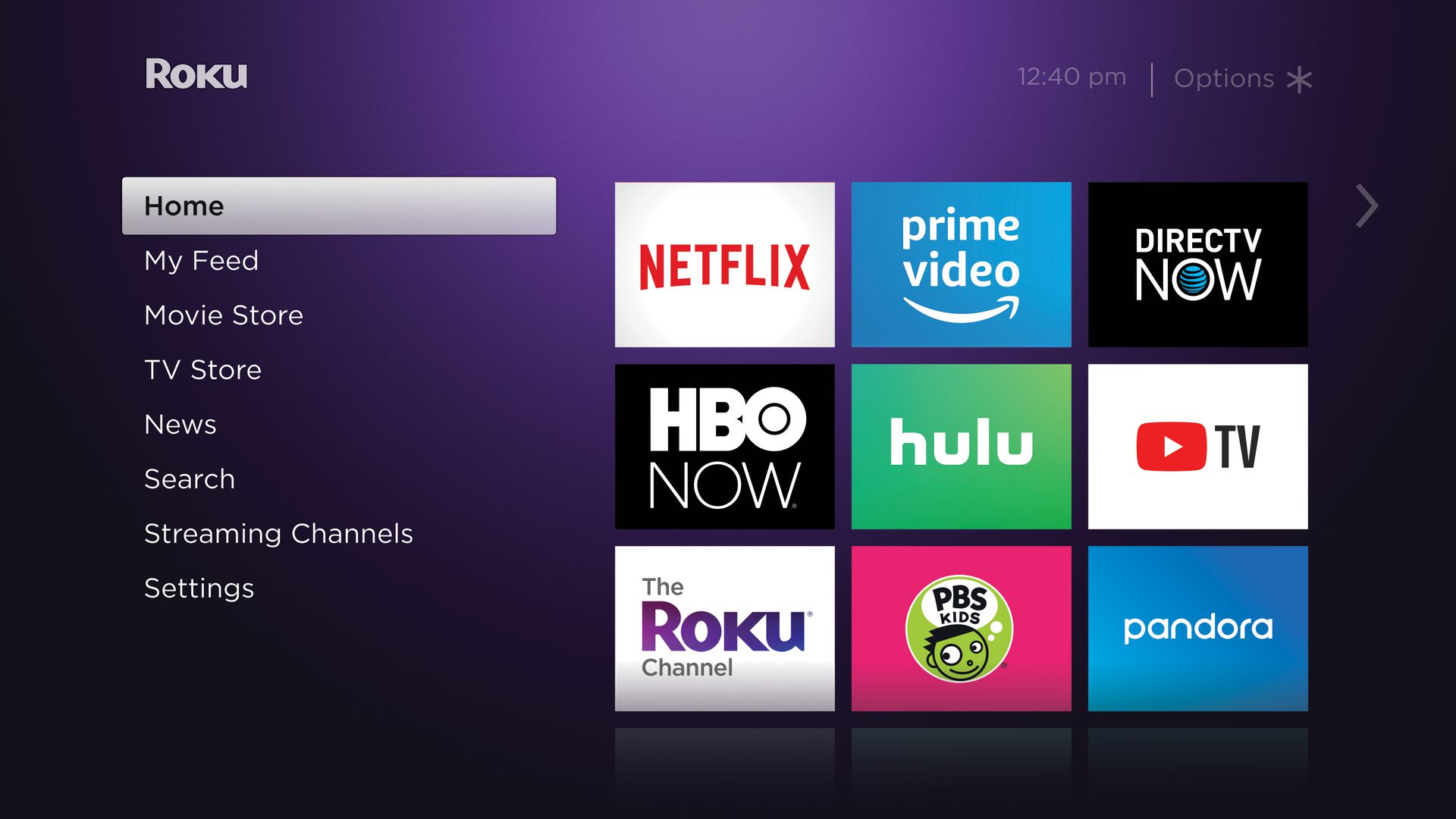

The analyst believes that Roku benefits from the addition of new over-the-top channels while Netflix must compete against them. Martin has a “buy” rating on the stock.

Roku shares have gained 77% in the last three months.

Disclaimer: We have no position in Roku Inc. (NASDAQ: ROKU) nor Netflix, Inc. (NASDAQ: NFLX) and and have not been compensated for this article.