Sponsored – Est. Read 7 Min

Investor Alert:

Explosive Sales Growth – and the Potential for Lucrative Acquisition – Make this Company One of 2025’s Highest Upside Investments

TRUBAR Inc. (TSXV: TRBR); (OTCQX: TRBRF) has demonstrated impressive growth – in a short period of time – for its popular TRUBAR™ brand in the rapidly-growing healthy snack bar market.

Are you hungry for healthy profits in 2025?

An intriguing, high-upside investment opportunity is now unfolding in one of North America’s fastest-growing industries: the global snack bar market.

According to the experts at Allied Market Research, the global nutritional food and drink market generated $105.3 billion in 2022, and is anticipated to generate $320.7 billion by 2032, rising at a CAGR of 12.1% from 2023 to 2032.

And right now one company has quietly emerged as an intriguing play for investors with significant upside potential thanks to its accelerated revenue growth and its attractiveness as a potential takeover candidate.

That company is TRUBAR Inc. (TSXV: TRBR); (OTCQX: TRBRF).

TRUBAR Inc. is an impressive company focused on the rapidly growing plant-based, natural and active lifestyle base. This segment of the industry – the “Better-for-You” category of healthier products – is projected to grow at a CAGR of 15.9% over the next five years.

The company’s “hero” brand is TRUBAR™, a plant-based line of protein bars that are the first-of-its-kind to blur the lines between healthy and delicious.

From just $1 million in sales in 2021 the company grew to $10 million in 2022…$24.7 million in 2023 and more than $45 million in 2024.

And with distribution expansion into more than 9,500 additional retailers across North America – including CVS, WalMart, Costco, Whole Foods, GNC and Giant among others – the company is now in over 15,000 stores total and appears to be on the fast-track to a potential $100 million in annual sales.

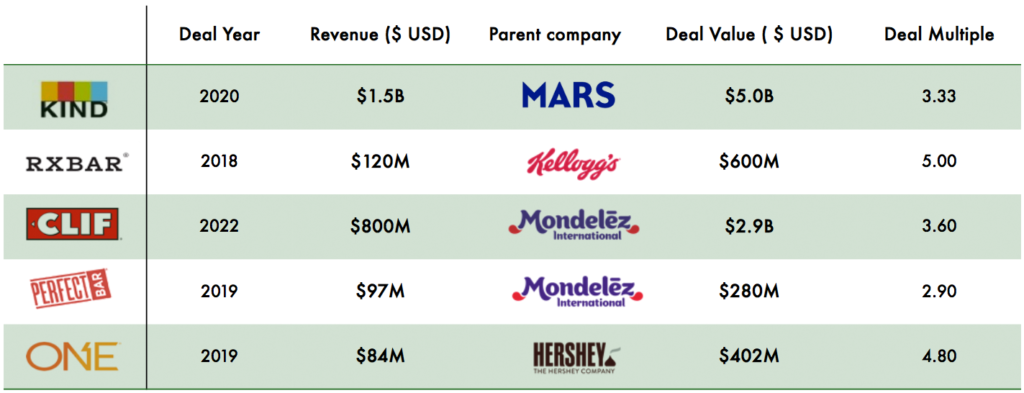

All of this is happening in a market that has seen a significant amount of M&A activity over the past several years, with companies of the size TRUBAR™, approaching selling for 3x revenues or more.

The company’s impressive revenue growth and distribution expansion amidst a rapidly growing industry are among the seven key reasons why investors should pay close attention to TRUBAR Inc. (TSXV: TRBR); (OTCQX: TRBRF) in the coming weeks.

7

Reasons Why TRUBAR Inc. (TSXV: TRBR); (OTCQX: TRBRF) Offers High Upside Potential to Investors Right Now

Key Reason #1:

Explosive Sales Growth Puts Company On a “Fast-Track” to $100 Million

Since 2021, under the leadership of TRUBAR Founder and CEO Erica Groussman, TRUBAR™ has grown from $1 million in sales to more than $45 million in 2024. And the company plans to maintain this historical growth rate over the next 12-18 months.

Just how impressive has the growth been in TRUBAR sales to date?

From $1 million in 2021, sales grew to $10 million in 2022…then more than doubled to $24.7 million in 2023…and then nearly doubled again, hitting $45.3 million in 2024.

This growth trajectory puts the company on a clear path to reaching $100 million in annual revenue, which is a critical milestone for potential M&A activity as established by recent acquisitions. (See “Key Reason #5 below.)

On April 22, 2025 the company announced that its 2024 TRUBAR revenues had grown 77% year-over-year – its gross profit was also up 77% year-over-year as well.

This growth was driven by wholesale shipments into many new or expanded retail listings during the year as well as an increase in direct-to-consumer online sales.

In recent months, the company has completed a restructuring, announced its name change to TRUBAR Inc., marking its strategic shift to becoming a pure-play business focused entirely on the growth and expansion of its impressive TRUBAR™ for 2025 and beyond with a heavy emphasis on growth of both its retail and direct-to-consumer presence.

Key Reason #2:

Impressive Expansion of Retail Distribution Outlets and a Growing Online Presence

There’s no question that in the snack bar market, establishing a strong retail presence is critical to success.

Without distribution via major national and regional retailers, it is virtually impossible for any brand to build momentum.

When it comes to TRUBAR™, the company’s expansion of distribution outlets over the last twelve months has been nothing short of astounding.

Thanks to partnerships with major retailers like GNC, Whole Foods, CVS and Walmart, TRUBAR Inc. (TSXV: TRBR); (OTCQX: TRBRF) expanded the distribution of its TRUBAR™ six-fold in 2024, with over 15,000 distribution points today and a target of more than 25,000 stores by the end of 2025.

Within the past year alone, the retail distribution milestones have been happening with great frequency:

June 21, 2024

The company announces an expansion of its successful partnership with Costco as well as a new national rollout of TRUBAR™ at Costco locations

July 4, 2024

The company announces the launch of TRUBAR™ in more than 1,000 GNC retail locations across the U.S. and online at gnc.com

July 18, 2024

The company announces the launch of TRUBAR™ in select Whole Foods Market locations around the U.S.

September 9, 2024

The company announces a nationwide rollout of TRUBAR™ in 6,600 CVS store locations nationwide and online at cvs.com

September 16, 2024

The company announces a nationwide rollout of TRUBAR™ in more than 700 Walmart store locations across the U.S.

October 9, 2024

The company announces the rollout of TRUBAR™ in more than 300 Walmart stores across Canada

October 17, 2024

The company announces expansion of TRUBAR with GPM Investments, LLC, one of the largest convenience store chains in the U.S., providing access to more than 1,400 locations

October 24, 2024

The company announces the launch of TRUBAR™ in over 600 Love’s Travel Stops across 42 states, the largest network of travel stops and convenience stores across the U.S.

November 11, 2024

The company announces the launch of TRUBAR™ in more than 500 Albertsons Companies locations, the second-largest supermarket chain in North America.

January 15, 2024

The company announces the rollout of TRUBAR™ in select Sam’s Club warehouse stores across the U.S., a key strategic addition in expanding the brand’s North American distribution footprint with key retailer partners.

January 21, 2024

The company announces the launch of TRUBAR™ on Gopuff, the leading instant commerce platform with a presence in major U.S. markets.

January 21, 2025

The company announces the launch of TRUBAR™ in GoMart, a chain of regional convenience stores with a major presence in West Virginia along with locations in Ohio and Virginia.

February 24, 2025

The company announces the launch of TRUBAR™ in Costco Canada’s West Region. This milestone marks a major expansion of the TRUBAR™ footprint in Canada while deepening the company’s strategic partnership with Costco.

In addition to its rapidly expanding retail footprint, the company is continuing to expand its already impressive e-commerce sales efforts, which have grown from $10,000 per month in early 2024 to more than $1.1 million in March 2025.

April 14, 2025

The company announced the launch of TRUBAR™ in select Target locations, marking further progress in expanding the brand’s North American distribution footprint with key national retail partners.

Breakthrough Growth for TRUBAR Inc.’s Direct-to-Consumer Sales in 2024-2025

Direct-to-consumer sales for TRUBAR Inc. have continued to ramp up in recent months, increasing by 365% from Q1 to Q4 2024.

This direct-to-consumer presence is an important growth pillar for the company as online sales (through Amazon, Walmart and TRUBAR.com) typically carry higher gross margin than wholesale shipment to retailers.

In March 2025, TRUBAR™ reached an exciting milestone, exceeding $1 million in monthly DTC sales for the first time, driven by strong consumer demand and the successful launch of four new flavors: Strawberry Shorty Got Cake, Cocoa For Coconuts, Shake it Bake it Birthday Cake it, and Sweet & Dreamy Cookies and Creamy.

Two of the new flavors have already ranked among the Top 50 trending bars in Amazon’s Sports Nutrition Protein Bars category, demonstrating the brand’s growing popularity and continued commitment to product innovation and customer satisfaction.

Key Reason #3:

TRUBAR Inc. Is Thriving in a Rapidly Growing Segment of the $6 Billion Global Snack Bar Industry

The global snack bar market was estimated at just over $6 billion in 2023…and is projected to climb by 7.6% per year through 2030.

And as mentioned earlier, the global nutritional food and drink market generated $105.3 billion in 2022, and is anticipated to generate $320.7 billion by 2032, rising at a CAGR of 12.1% from 2023 to 2032.

For busy families, snacking has disrupted the normal conventions about how people eat, with 62% of “healthy snackers” in the U.S. reporting that they sometimes eat snacks in place of a meal.[2]

Of course, the rise in chronic health conditions worldwide has many consumers placing a greater emphasis on health and wellness even when it comes to snacking.

And plant-based bars provide a good source of protein, fiber, and healthy fats and often contain fewer calories and less sugar than traditional snack bars.

That’s why the plant-based segment of the global snack bar market is projected to grow at an exceptionally fast pace in the coming years.

Within the snack bar market, the global plant-based bars market size was valued at $2.73 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 14.0% through 2030.[4]

And the “Better-for-You” category of healthier products – is poised to grow at an even faster rate, with a projected CAGR of 15.9% over the next five years.

TRUBAR Inc. (TSXV: TRBR); (OTCQX: TRBRF) appears to be perfectly positioned to help investors take advantage of the massive global trend toward healthier snack options.

TRUBARs are gluten-free, dairy-free, soy-free and have no seed oils or sugar alcohols. They also do not use lab-produced, indigestible fiber or artificial sweeteners used by many of their competitors.

As TRUBAR Inc. continues its impressive growth – and its expansion of retail distribution outlets for TRUBAR™ – the company appears poised to ride the wave of industry growth for years to come.

Key Reason #4:

The Company Enjoys High Margins Thanks to Its Asset-Light Business Model

A critical aspect to the rapid success of TRUBAR Inc. is that the company operates an “asset light” business model.

This allows the company to build its sales momentum with minimal staff managing a few key vendors, allowing for fast growth and high margins without having to manage heavy asset costs.

The company uses co-manufacturers in key geographic regions to help with the production of TRUBAR™.

Currently the company is working with two co-manufacturers but has plans to onboard two more in 2025.

This impressive business model helps facilitate rapid growth and helps the company maintain its unusually high profit margins, all of which helps make for a more attractive investment and a more attractive potential takeover target.

Key Reason #5:

Recent M&A Transactions in the Snack Bar Market Highlight the High Upside Potential for TRUBAR Inc.

The snack bar market has seen a number of especially lucrative acquisitions over the past five years.

These acquisitions have ranged from the $280 million acquisition of Perfect Snacks, maker of Perfect Bar®, to the $5 billion acquisition of KIND North America by Mars, the world’s largest candy maker.

What’s important to consider as an investor is that a potential takeover could happen quickly…and it could deliver significant returns for shareholders.

In the case of companies in the snack bar space, the potential for acquisition has risen as those companies have approached $100 million in revenue – a figure that TRUBAR Inc. is now rapidly approaching.

Consider…the takeovers of ONE Brands, Perfect Snacks and KIND taking place at annual revenues of $84 million, $97 million and $120 million respectively.

With TRUBAR Inc. (TSXV: TRBR); (OTCQX: TRBRF) expected to hit $45 million in revenue in 2024 – and with the company on a clear path to $100 million – the time to act is now for those investors hoping to be on board should a potential takeover happen in the near future.

Additionally, TRUBAR Inc.’s highly experienced Board of Directors includes industry veterans with experience at many of the companies – including Kellogg’s, MARS and more – involved in some of the largest M&A activity in the space.

Key Reason #6:

TRUBAR Inc. (TSXV: TRBR); (OTCQX: TRBRF) Appears to Be Significantly Undervalued Compared to its Peers

When compared to other publicly traded companies in the snack bar space, TRUBAR Inc. (TSXV: TRBR); (OTCQX: TRBRF) appears to be wildly undervalued by the market.

Among the publicly traded companies that are comparable to TRUBAR Inc. are:

- BellRing Brands (NYSE: BRBR) with annual sales of $2.10 billion…an EV/Sales Ratio of 4.9x…and a market cap of $9.44 billion.

- The Hain Celestial Group, Inc. (Nasdaq: HAIN) with annual sales of $1.66 billion…an EV/Sales Ratio of 0.7x…and a market cap of $348 million.

- And The Simply Good Foods Company (Nasdaq: SMPL) with annual sales of $1.36 billion…an EV/Sales Ratio of 2.6x…and a market cap of $3.37 billion.

TRUBAR Inc. (TSXV: TRBR);(OTCQX: TRBRF) just reported annual sales of $45 million for 2024 – with a clear path to $100 million – so it is still in its early stages compared to many of these companies.

But with a current market capitalization of just under $100 million – in spite of high profit margins and rapidly-growing revenue – there is room for significant appreciation in market cap in the months ahead.

In fact, analyst Noel Atkinson of Clarus Securities, Inc. has established a price target of $1.75 per share for TRUBAR Inc. (TSXV: TRBR); (OTCQX: TRBRF).

That share price represents a potential upside of 94.44% from the current share price of $0.90.

On November 19 Atkinson wrote, “We increasingly view TRUBAR as having potential to ramp well beyond US$100MM/year of revenues, with drivers such as more bar flavors, full national deployments at one or more U.S. mass merchant retail chains (i.e., Walmart and/or Target), online sales growth, and/or adding SKUs (protein cookies, protein powders, etc.) We reiterate our Speculative Buy rating.”

Key Reason #7:

The VRG Capital Team Has a Proven History of Success in the Markets

The team leading the way for TRUBAR Inc. (TRBR: TRBR); (OTCQX: TRBRF) is VRG Capital.

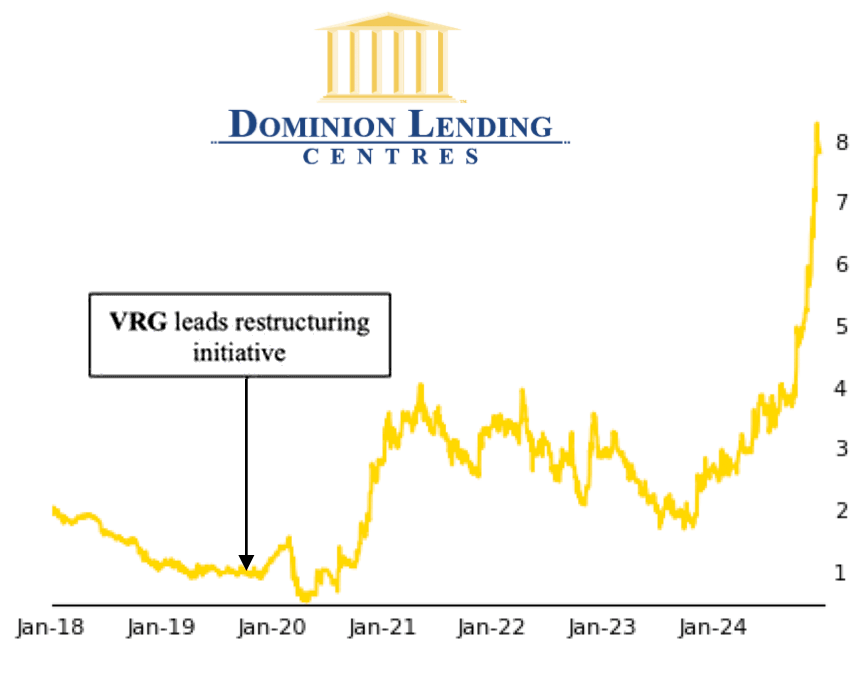

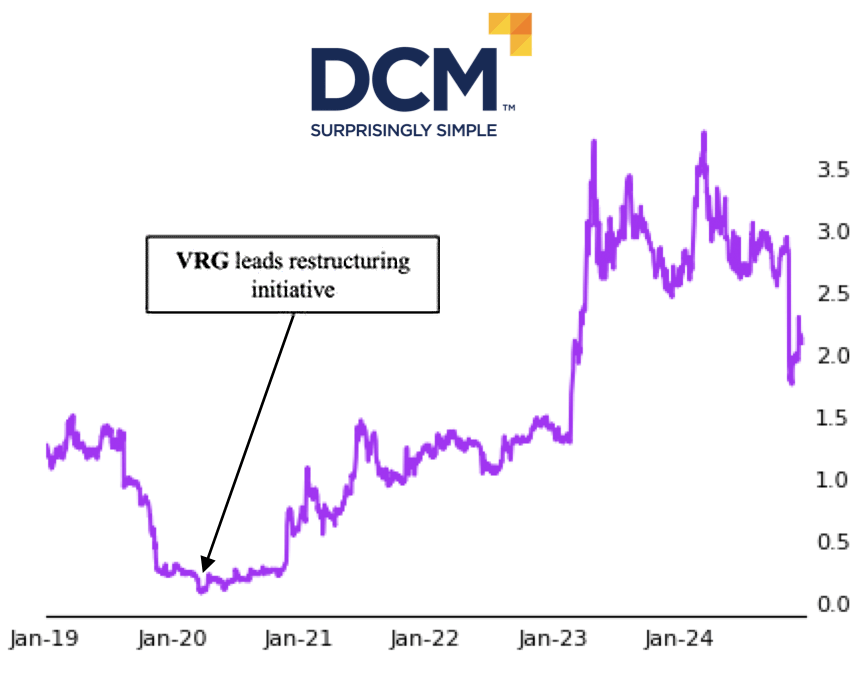

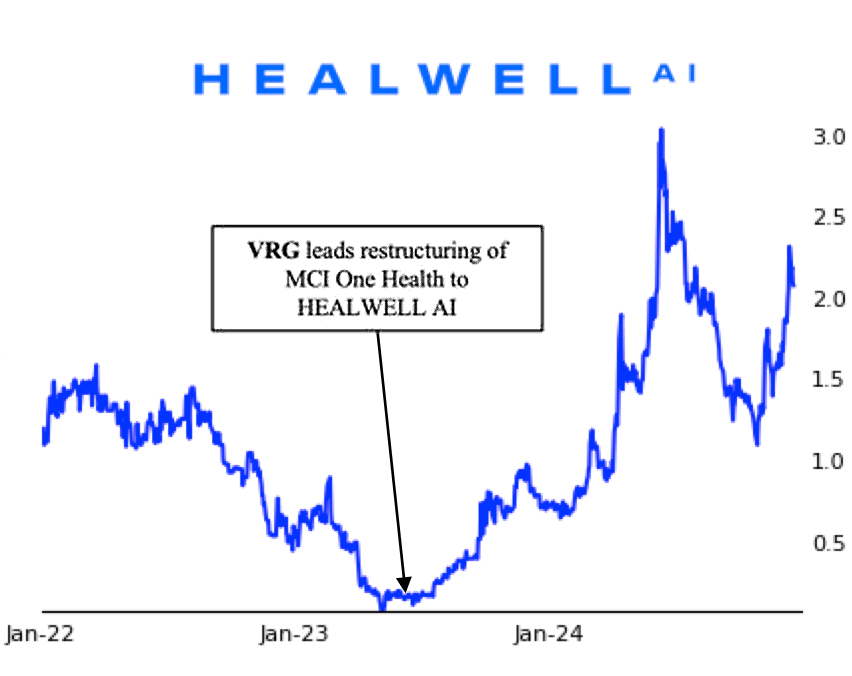

VRG Capital is a private investment company representing a select group of family offices in Canada. With decades of successful experience, VRG Capital specializes in identifying high-growth opportunities across diverse sectors.

In fact, VRG Capital has led over 70 investments with an average 15-year hold period, helping raise over half a billion of equity capital to support those businesses.

Among their more recent success stories are Dominion Lending Centers, DATA Communications Management Corp. and Healwell AI.

As you can see from those impressive charts, VRG Capital restructuring efforts have led to massive success in the markets time and time again.

And now this highly successful, experienced team – led by managing partner Kingsley Ward – is following the very same blueprint with TRUBAR Inc. (TSXV: TRBR); (OTCQX: TRBRF).

And the leadership team for TRUBAR Inc. also boasts a wealth of critical experience in the space.

This team includes:

Investor’s Summary

TRUBAR Inc. (TSXV: TRBR); (OTCQX: TRBRF) offers investors a unique, high-upside opportunity in the rapidly-growing healthy snack bar market.

With impressive growth – from $1 million in revenue as recently as 2021 to over $45 million in 2024 – the company appears to be on a “fast-track” to $100 million in annual sales for its TRUBAR™ brand.

TRUBAR™ is now available in an impressive 15,000 retail locations across North America thanks to an expanding base of critical partnerships with major national and regional retailers.

As the company approaches the $100 million annual revenue mark, it also becomes an attractive potential takeover candidate as recent M&A activity in the snack bar market would suggest.

All of this – plus the company’s impressive leadership – helps make TRUBAR Inc. (TSXV: TRBR); (OTCQX: TRBRF) an investment worthy of serious consideration for 2025 and beyond for individual investors.

[1] https://www.grandviewresearch.com/industry-analysis/energy-bar-market-report

[2] https://www.bakemag.com/articles/16140-the-growing-trend-of-plant-based-protein-bars

[3] https://www.cnbc.com/2022/06/15/these-could-be-the-next-hot-food-and-drink-trends.html

[4] https://www.statsandresearch.com/report/40275-global-plant-based-bars-market/

[5] https://www.forbes.com/sites/angelauyeung/2020/11/17/billionaires-united-candy-maker-mars-to-acquire-kind-bars-in-5-billion-deal/

[6] https://www.wsj.com/articles/mondelez-to-acquire-clif-bar-for-2-9-billion-11655760068

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer TRUBAR Inc. (TRBR), Winning Media LLC has been hired for a period beginning on 1/13/25 and ending on 2/14/25 to conduct investor relations advertising and marketing and publicly disseminate information about TRUBAR Inc. (TRBR) via Website, Email and SMS. Winning Media has been compensated the sum total of seventy five thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for TRUBAR Inc. (TRBR)

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (TRBR). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.