Sponsored – Est. Read 7 Min

INVESTOR ALERT:

Highest Potential Upside in the Electric Vehicle Space?

Little-Known Xos, Inc. (Nasdaq: XOS) is on the cutting edge of the explosion in demand for fully electric commercial vehicles

This company’s shares – currently trading for less than a dollar – could offer investors windfall profit potential

Nearly 15 years after the first Tesla hit the road…the electric vehicle revolution is finally now in full swing.

In fact, the global EV market has been steadily growing – at a rate of more than 50% per year since 2015.[i]

According to the International Energy Association, there will be 145 million EVs on the road worldwide by the end of this decade…an astounding increase from the 16.5 million that were on the road as recently as 2021.

No question about it – this global transition to electric vehicles is one of the most important megatrends of our lifetime.

And it also presents a unique opportunity for investors to make money as this megatrend continues to develop.

But here’s something most investors don’t know:

The best way to play the electric vehicle boom – for maximum profit potential – is NOT by investing in Tesla shares.

In fact, it might not involve buying shares of companies that manufacture EV passenger vehicles at all.

Instead, the best way to play the EV megatrend just might come from the commercial EV market.

Right now one company – Xos, Inc. (Nasdaq: XOS) – is leading the commercial sector in a demonstrable way…and is very much worthy of investor attention.

7 Reasons Why You Should Have Xos, Inc. (Nasdaq: XOS) on Your Radar RIGHT NOW

1. The global transition to electric vehicles is the most important megatrend of our lifetime. Demand for electric vehicles was up 47% in the first half of 2023 from last year[v] – and experts are projecting that EV sales will make up more than two-thirds of global car sales by 2030.[vi] This worldwide shift away from traditional vehicles to electric vehicles presents investors with a potentially massive profit opportunity.

2. EVs are poised to become the dominant form of commercial vehicle. The global market for commercial electric vehicles is projected to grow at an annual rate of 41% through 2028 – taking the total market from just 129,000 vehicles in 2020 to more than 2 million by 2028.[vii]

4. Xos, Inc. (Nasdaq: XOS) has emerged as an early leader in this space. Xos, Inc. began delivering EV Stepvans in 2018 and is committed to making top-tier vehicles for leading fleets. Thanks to Xos’ proprietary technology, Xos Stepvans deliver total cost of ownership savings before incentives to fleet owners, saving their customers money and lowering payback periods.

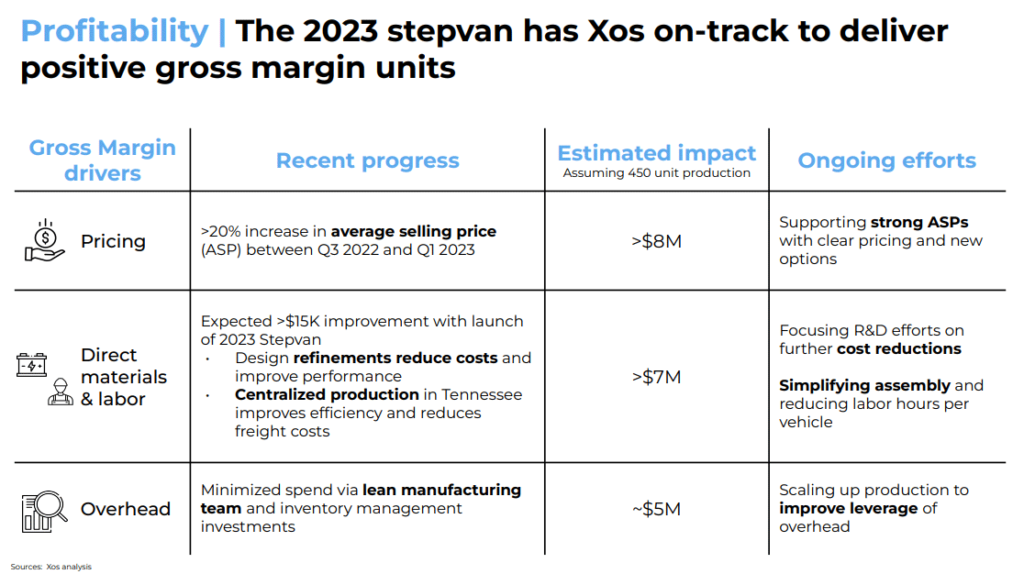

5. Xos, Inc. is on a market leading path to profitability. The company is uniquely positioned to be among the first publicly-traded EV manufacturers to deliver positive gross margin units. In fact, Xos has seen a greater than 20% increase in its average selling price between Q3 2022 and Q1 2023.

6. The company has strong, long-term relationships with many of its fleet customers. Xos, Inc. (Nasdaq: XOS) has outstanding relationships with many notable fleet customers including FedEx ISPs, Loomis, UniFirst, and Wiggins Lift Co. These relationships are now several years old, which is vitally important in a business defined by its relationships and repeat business.

7. Xos, Inc. also offers custom charging solutions to its fleet customers. Xos’ in-house team helps customers install fleet charging infrastructure to solve the critical issue regarding charge capability. In addition, the company also offers Xos Hub – a mobile charging solution that enables fleets to transition to EVs immediately.

Xos, Inc. (Nasdaq: XOS) Has Already Established a Leadership Position in the Commercial EV Market

What makes Xos, Inc. (Nasdaq: XOS) stand out from other investment opportunities in the EV space is that the company has already established a leadership position in the space – and more importantly…

Xos is already selling commercial EVs for a profit.

In an environment where many companies are mostly dependent on government incentives and regulatory assistance, Xos, Inc. has a massive head-start on the competition with its ability to deliver profitable commercial EVs today!

Xos, Inc. is leading the commercial EV sector at a critical juncture in the growth of EVs. And thanks to the company’s history and experience in manufacturing commercial EVs, Xos has figured out how to deliver profitable vehicles consistently while their competition is still unable to do so.

The company’s proprietary battery system, the X-Pack, and modular chassis, the X-Platform, are purpose-built for medium- and heavy-duty commercial vehicles in the last-mile sector.

And Xos’ fleet-as-a-service offering provides customers with a comprehensive suite of products and services, such as vehicle maintenance and purchase financing, to help fleets more easily make the transition from diesel to electric.

Xos, Inc. is a company with…

A long history of successful Stepvan production, with thousands of vehicles delivered since 2018…

-

The ability to deliver Stepvans that lower the cost of ownership – before incentives – for its customers when compared to diesel…

-

A number of strong customer relationships including fleet customers such as FedEx ISPs, Loomis, UniFirst, and Wiggins Lift Co..

-

Something no one else in the space has: The ability to deliver vehicles in a way that is profitable.

Xos, Inc. (Nasdaq: XOS) is Uniquely Positioned to Take Advantage of Strong Regulatory Tailwinds

in the EV Industry

There’s no question that the transition to EVs is happening. In fact, it’s essentially being mandated by federal, state and local governments.

Recent mandates require the purchase of thousands of new units…and government incentives are funding this transition to EVs in a powerful way.

In California, the Advance Clean Fleets (ACF) rules passed in 2023 by the California Air Resources Board (CARB) require medium-duty fleets, including stepvans, to transition to 100% zero-emission vehicles by 2035.

And 14 other states, California and the District of Columbia have signed a pledge for 30% zero-emission fleets by 2030 and 100% by 2050.

Xos, Inc. is uniquely positioned to take advantage of this mandated shift to EVs in the commercial sector thanks to its long history…its proprietary, cost-saving technology…and its ability to deliver positive gross margin units to its loyal fleet customers.

Xos Inc.’s mission is to decarbonize commercial transportation and facilitate a seamless transition for fleet owners from traditional internal combustion engines to fully-electric vehicles.

The company is enabling fleet owners throughout North America to begin successfully transitioning to EVs, including owners like…

Xos’ proprietary technology saves fleets money and helps enable companies’ transition to EVs.

Most fleets see payback times of less than five years – before incentives – a timeframe that is significantly shorter than that of Xos’ competitors.

Xos’ primary competitive advantage is not just its proprietary technology but also its knowledge that comes with long-standing customer relationships.

This gives the company a leg up in terms of profitability.

The simple fact that Xos, Inc. (Nasdaq: XOS) has been in the market, delivering commercial EVs much longer than many of its competitors – means that the company can take advantage of design efficiencies.

As a result, Xos Stepvans are now more efficient…more easily serviced…have a longer range…and produced more profitably than any others available on the market.

Breaking News:

On September 14, 2023 Xos, Inc. (Nasdaq: XOS) announced the delivery of 100% battery-electric stepvans to several parcel and delivery independent service providers in Tennessee and California.

7 Reasons Why You Should Have Xos, Inc. (Nasdaq: XOS) on Your Radar RIGHT NOW

1. The global transition to electric vehicles is the most important megatrend of our lifetime. Demand for electric vehicles was up 47% in the first half of 2023 from last year[v] – and experts are projecting that EV sales will make up more than two-thirds of global car sales by 2030.[vi] This worldwide shift away from traditional vehicles to electric vehicles presents investors with a potentially massive profit opportunity.

2. EVs are poised to become the dominant form of commercial vehicle. The global market for commercial electric vehicles is projected to grow at an annual rate of 41% through 2028 – taking the total market from just 129,000 vehicles in 2020 to more than 2 million by 2028.[vii]

4. Xos, Inc. (Nasdaq: XOS) has emerged as an early leader in this space. Xos, Inc. began delivering EV Stepvans in 2018 and is committed to making top-tier vehicles for leading fleets. Thanks to Xos’ proprietary technology, Xos Stepvans deliver total cost of ownership savings before incentives to fleet owners, saving their customers money and lowering payback periods.

5. Xos, Inc. is on a market leading path to profitability. The company is uniquely positioned to be among the first publicly-traded EV manufacturers to deliver positive gross margin units. In fact, Xos has seen a greater than 20% increase in its average selling price between Q3 2022 and Q1 2023.

6. The company has strong, long-term relationships with many of its fleet customers. Xos, Inc. (Nasdaq: XOS) has outstanding relationships with many notable fleet customers including FedEx ISPs, Loomis, UniFirst, and Wiggins Lift Co. These relationships are now several years old, which is vitally important in a business defined by its relationships and repeat business.

7. Xos, Inc. also offers custom charging solutions to its fleet customers. Xos’ in-house team helps customers install fleet charging infrastructure to solve the critical issue regarding charge capability. In addition, the company also offers Xos Hub – a mobile charging solution that enables fleets to transition to EVs immediately.

[i] https://www.wri.org/insights/what-projected-growth-electric-vehicles-adoption

[ii] https://www.weforum.org/agenda/2023/05/electric-vehicles-ev-sales-growth-2022/

[iii] https://www.weforum.org/agenda/2022/09/electric-vehicle-revolution-policy/

[iv] https://www.iea.org/news/demand-for-electric-cars-is-booming-with-sales-expected-to-

leap-35-this-year-after-a-record-breaking-2022

[v] https://insideclimatenews.org/news/27072023/inside-clean-energy-ev-supply-demand-lower-

[vi] https://rmi.org/press-release/evs-to-surpass-two-thirds-of-global-car-sales-by-2030-putting-at-

risk-nearly-half-of-oil-demand-new-research-finds/#:~:text=By%202030%2C%20falling%20costs%

20will,wheelers%20to%20heavy%20duty%20trucks.

[vii] https://www.statista.com/statistics/1249935/global-electric-commercial-vehicle-market-size/

[viii] https://environmentalenergybrief.sidley.com/2023/08/17/california-air-resources-board-revisits-

advanced-clean-fleets-rule-through-formation-of-truck-regulation-advisory-

committee/#:~:text=In%20April%202023%2C%20the%20California,

of%20their%20existing%20internal%20combustion

[ix] https://insideclimatenews.org/news/27072023/inside-clean-energy-ev-supply-demand-lower-

[x] https://rmi.org/press-release/evs-to-surpass-two-thirds-of-global-car-sales-by-2030-putting-at-

risk-nearly-half-of-oil-demand-new-research-finds/#:~:text=By%202030%2C%20falling%20costs%

20will,wheelers%20to%20heavy%20duty%20trucks.

[xi] https://www.statista.com/statistics/1249935/global-electric-commercial-vehicle-market-size/

[x11] https://environmentalenergybrief.sidley.com/2023/08/17/california-air-resources-board-revisits-

advanced-clean-fleets-rule-through-formation-of-truck-regulation-advisory-committee/

#:~:text=In%20April%202023%2C%20the%20California,of%20their

%20existing%20internal%20combustion

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer Xos, INC., Winning Media LLC has been hired for a period beginning on 10/XX/23 and ending on 12/XX/23 to conduct investor relations advertising and marketing and publicly disseminate information about (XOS) via Website, Email and SMS. Winning Media has been compensated the sum total of twenty five thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Xos, INC.

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (XOS). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.