Sponsored – Est. Read 5 Min

Gold’s Unstoppable Surge: What Could Be Your Gateway to Generational Wealth in 2025

As Gold Shatters the $3,400 Barrier, Junior Mining Companies Might Be the Key Force Driving Unprecedented Profits for Investors

In an era of economic uncertainty and market volatility, one asset class is emerging as the undisputed champion of wealth creation: Gold.

As we witness the dawn of what some experts are calling “The Golden Age of Investing,” savvy investors are positioning themselves for gains that could redefine their financial futures.

With gold prices skyrocketing past the $3,400 per ounce mark, we’re not just seeing a rally – we’re experiencing a paradigm shift in the global financial landscape.

This isn’t merely a fleeting opportunity; it’s the beginning of a resource bull market that could span years, offering early investors the chance to build lasting, generational wealth from junior gold mining companies.

Why This Gold Rush is Different

- Record-Breaking Momentum: Gold has shattered all previous records, trading at an unprecedented $3,319 per ounce as of May 5th 2025.

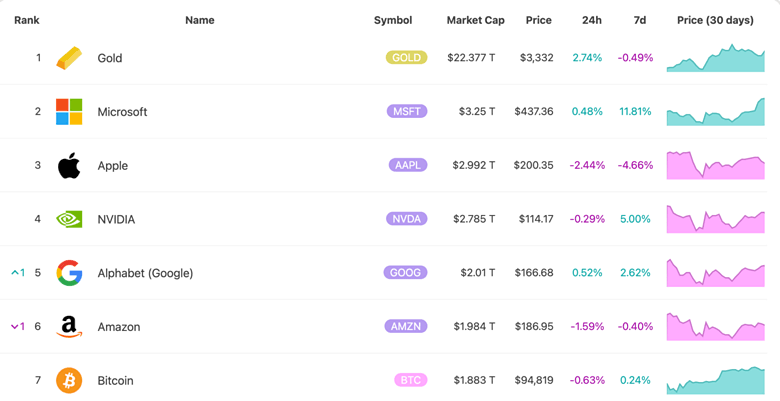

- Outpacing Tech Giants: Gold’s total market capitalization now eclipses tech behemoths like Nvidia, Microsoft, Apple, and Google combined.

- Global Economic Catalyst: As geopolitical tensions rise and traditional currencies falter, gold stands as a beacon of stability and growth.

- The Junior Mining Advantage: While established gold players soar, junior mining companies like Formation Metals Inc. . (OTC: FOMTF | CSE:FOMO) offer explosive growth potential in 2025.

Wealth Creation in the Commodity World

The gold rush of the 21st century is here, and it’s bigger than anything we’ve seen before. Imagine being at the forefront of a market transformation that could mint the next generation of millionaires.

What makes this rally especially compelling is that it’s not limited to institutional giants or the financial elite. Whether you’re a seasoned investor or just starting your journey, the opportunity to capitalize on this momentum is within reach.

From owning physical gold to exploring strategic positions in high-potential junior miners like Formation Metals Inc., there are multiple pathways to tap into this modern-day gold rush. Each ounce of bullion or share in a visionary mining company could be your ticket to riding this historic wave of wealth creation.

To put this opportunity into perspective, gold’s total market capitalization now dwarfs that of tech giants like Nvidia, Microsoft, Apple, and Tesla combined.

This isn’t just a fleeting moment of glory; it’s a fundamental shift in how the market values tangible assets versus speculative tech stocks.

Source: Infinite Market Cap

Unearthing Potential: The Junior Mining Sector’s Promise

While established gold miners are seeing their valuations soar, we see the real opportunity for exponential growth in junior mining companies. These agile operators, with their focus on exploration and development, offer investors a chance to get in on the ground floor of potentially massive gold discoveries.

One company that stands out in this exciting space is Formation Metals Inc. (OTC: FOMTF | CSE: FOMO). With their recent acquisition of the N2 property in Quebec’s prolific Casa Berardi gold trend, Formation Metals is positioning itself at the forefront of the gold rush.

Formation Metals: The Next Big Player in the Heart of Quebec’s Abitibi Gold Belt

Formation Metals’ N2 property is not just another gold exploration project in Quebec – it’s a strategic property with a rich history of gold mineralization and the potential to go from junior miner to major producer.

For reference, Quebec is one of the world’s leading gold mining regions, with high-grade deposits, low political risk, and world-class infrastructure. The province is dominated by the Abitibi greenstone belt, which has already produced over 200 million ounces of gold and continues to have significant untapped potential.

International mining companies such as Agnico Eagle (market capitalization: CAD 79.24 billion), Osisko Mining (CAD 6.07 billion) and Eldorado Gold (CAD 5.14 billion) are firmly established here.

Let’s dive into what makes this opportunity truly golden:

- Prime Location: The N2 property spans 87 claims covering approximately 4,400 hectares, strategically positioned just 25 km south of Matagami, Quebec. This isn’t just any patch of land – it’s situated along the prolific Casa Berardi mine trend, a geological wonderland for gold explorers with many past and present producing mines.

- Proximity to Proven Success: The property is a mere 1.5 km east of the former-producing Vezza gold mine and about 120 km east of the presently producing Casa Berardi gold mine, which boasts Proven & Probable reserves of 1.3 million ounces of gold. This neighborhood has a track record of producing winners.

- Substantial Historical Resource: The N2 property boasts an impressive historical global gold resource estimate of 877,000 ounces of contained gold consisting of 18.2 million tonnes grading 1.48 g/t gold and 243,000 tonnes grading 7.82 g/t gold. While this estimate isn’t compliant with current NI 43-101 standards, it provides an outstanding glimpse of the property’s potential.

- Geological Goldmine: The property is divided into two distinct domains separated by the Casa Berardi Deformation Zone, a major structural feature known for controlling gold mineralization. This geological setting is analogous to other major gold-bearing structures in the Abitibi greenstone belt, one of the world’s most prolific gold-producing regions, which has produced over 200 million ounces of gold from over 100 mines since the late 1800s.

- Multiple Zones of Gold Mineralization: The N2 property hosts six identified zones of gold mineralization, each with its own unique characteristics and exploration potential:

- RJ Zone: Boasts the second-highest probability (75.61%) of intercepting auriferous intervals, with high-grade “bonanza” style mineralization intercepts such as 48.44 g/t Au over 0.5 metres.

- A Zone: The crown jewel, with 522,900 historical ounces alone and the highest probability (83.64%) of intercepting auriferous intervals, has the potential for a larger, more continuous deposit. Only ~1.65 km of the ~5 km length has been drilled meaning 67% of the target remains to be tested.

- RJE Zone: Home to impressive high-grade intercepts, including 26 g/t Au over 0.8m.

- East Zone, Central Zone, and Kerr Zone: Each offering unique exploration opportunities and expansion potential.

- Proven Exploration Success: Historical drilling campaigns have yielded exciting results:

- 236 diamond drill holes totaling 55,517 meters

- 424 reverse circulation drill holes totaling 9,582 meters

- High-grade gold intercepts across multiple zones, including 44 g/t Au over 0.5m in the RJ Zone

- Bulk tonnage intercepts with over 56 metres of ~1.7 g/t Au across multiple intervals including over 1.8 g /t over 32 m

- Expansion Potential: All six zones remain open for expansion, either at depth or along strike, with over 10 km of strike to be drilled. The property’s location within the Abitibi sub province, coupled with its proximity to established mining infrastructure in Matagami, offers significant logistical benefits for future development.

The Bigger Picture: A Resource Bull Market in the Making

While the stock market has experienced periods of turbulence so far in 2025, gold mining investments have emerged as a beacon of steady growth. We’re witnessing the dawn of a new era in commodity investing, one that could reshape portfolios and create generational wealth.

The enthusiasm for gold has spilled over to gold miner stocks. The VanEck Gold Miners ETF (GDX) has jumped 37.95% year-to-date, significantly outperforming the broader market. This surge underscores the potential for outsized returns in the mining sector as gold prices continue to climb.

Formation Metals Inc., for instance, has seen its shares climb over 60% year-to-date, aligning with the trend set by industry leaders.

This upward momentum is expected to persist as gold maintains its position in the global financial spotlight. The current market dynamics, driven by geopolitical tensions, economic uncertainties, and evolving central bank policies, are creating an environment ripe for resource investors.

Source: Google Finance

The Road Ahead: Golden Horizons

As we navigate through 2025 and beyond, all signs point to a continued bull run in the gold market.

With prices already breaking records and showing no signs of slowing down, we could be on the cusp of a golden age for resource investors.

The opportunity is clear, the timing is right, and the potential rewards are substantial.

As smart money flows into gold and junior mining companies like Formation Metals, savvy investors have a chance to be part of what could be the biggest resource market of the 21st century.

The best time to act might very well be today. We stand on the threshold of a new era in wealth creation, and Formation Metals Inc. (OTC: FOMTF | CSE:FOMO) could become your portfolio’s standout investment in 2025 and beyond.

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer, Formation Metals Inc. (FOMO), Winning Media LLC has been hired for a period beginning on 5/1/25 and ending on 6/1/25 to conduct investor relations advertising and marketing and publicly disseminate information about Formation Metals Inc. via Website, Email and SMS. Winning Media has been compensated the sum total of sixty thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Formation Metals Inc.

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (FOMO). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.