Sponsored – Est. Read 5 Min

Formation Metals Rides Gold’s Surge with Drill Permitting Now Underway

WSR Gold Outlook: As gold continues to break all-time highs, mining companies like Formation Metals are positioning themselves to ride the wave. With permitting underway for a fully funded 5,000-metre drill program, the company is targeting big upside in one of Canada’s most proven gold belts.

Gold just did what few assets ever manage—it quietly broke out to all-time highs AGAIN. While retail investors are still chasing tech stocks, the smart money is already rotating into gold and gold equities, betting that this cycle is far from over.

In the middle of this momentum shift sits a little-known junior that’s been making strategic moves of its own: Formation Metals Inc. (CSE: FOMO).

This week, the company announced it has officially begun permitting for a fully funded, 5,000-metre diamond drill program at its flagship N2 Gold Property in Quebec. And while many early-stage companies are still scrambling for capital, Formation is already financed and ready to execute.

A Historic Gold Resource—Now It’s Time to Expand

The N2 Property isn’t just prospective—it already hosts a historical resource of 877,000 ounces of gold. That alone gives Formation a head start in today’s market, where investors are increasingly focusing on companies with ounces in the ground.

But the real opportunity lies ahead.

Formation’s upcoming drill program aims to target extensions of known zones and new high-priority geophysical targets, the kind that—if hit—could dramatically reshape the project’s scale and market perception. With gold prices now trading near $2,400/oz, even marginal discoveries have become much more valuable.

The Gold Market Has Changed—And the Numbers Prove It

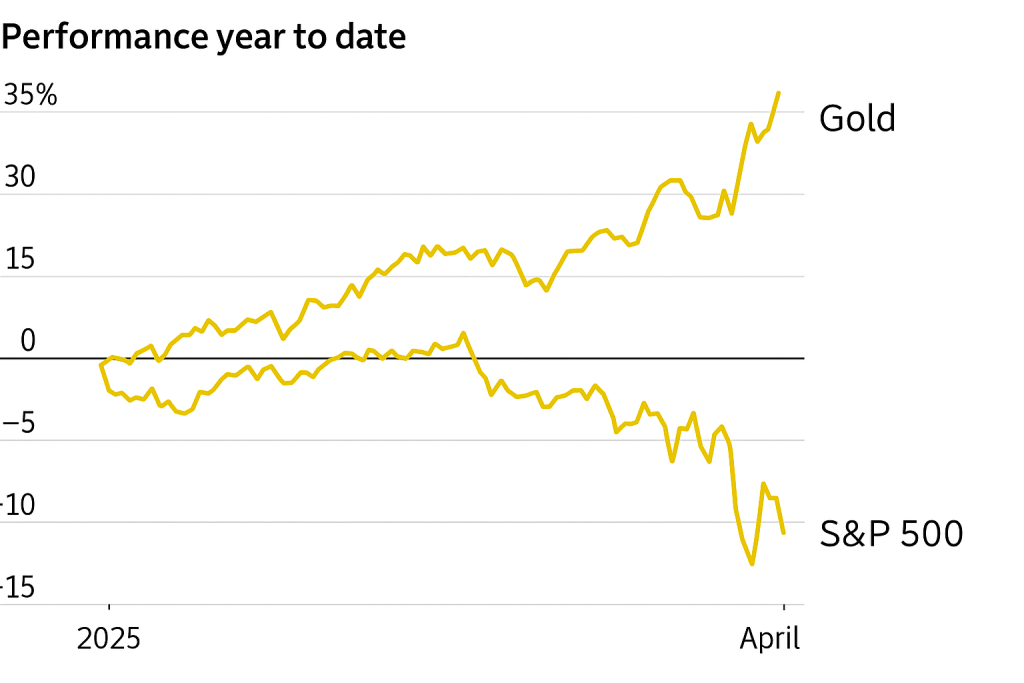

While many investors are still focused on rate cuts and tech earnings, gold has quietly crushed everything else in 2025.

In just over three months, gold has surged over 30% year-to-date, while the S&P 500 has dropped nearly 10%. That’s a +40% performance gap—and it’s not going unnoticed by institutions or retail capital.

Central banks are still buying. Real yields remain under pressure. And geopolitical instability—from Eastern Europe to the South China Sea—is keeping gold firmly in the spotlight.

In this kind of macro environment, well-structured juniors like Formation Metals aren’t just “speculative plays”—they’re potentially leveraged exposure to one of the few trends showing real strength.

Watch the CEO Break It Down

In a recent Radius Research interview, Formation CEO Deepak Varshney walks through the company’s vision for the N2 project, why the upcoming drill program could unlock significant value, and how Formation plans to differentiate itself in a rising gold market.

Location, Timing, and Capital: The Trifecta

Formation’s N2 Property is located in the heart of the Abitibi Greenstone Belt, home to over 200 million ounces of historical production. The region is not only geologically prolific—it’s also infrastructure-rich, politically stable, and home to multiple majors.

Combine that with the company’s fully funded status and a clear exploration roadmap, and you’ve got one of the rare juniors ready to act—while others are still pitching their story.

WSN Take

The gold bull market is no longer theoretical—it’s here.

And while big-cap producers may move first, it’s the juniors that often deliver that 10x upside when the market is in full swing.

Formation Metals is still flying under the radar, but it checks a lot of boxes investors should care about right now:

- Historical ounces already in the ground

- Fully funded drill campaign with permitting now underway

- Located in one of the most proven gold belts in the world

- Led by a team moving with urgency, not just intention

If the upcoming 5,000-metre program delivers, Formation could rapidly move from a quiet explorer to a front-runner in Canada’s next gold wave.

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer, Formation Metals Inc. (FOMO), Winning Media LLC has been hired for a period beginning on 5/1/25 and ending on 6/1/25 to conduct investor relations advertising and marketing and publicly disseminate information about Formation Metals Inc. via Website, Email and SMS. Winning Media has been compensated the sum total of sixty thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Formation Metals Inc.

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (FOMO). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.