Sponsored – Est. 9 Min Read

Explosive Upside Potential:

Undervalued Biotech Advancing Surprising Heart Health Breakthrough

Cardiol Therapeutics, Inc. (Nasdaq: CRDL); (TSX: CRDL) is the company behind a potentially game-changing new treatment for inflammatory heart disease.

Early investors could see the potential for extreme upside as this company’s “fast-tracked” treatments move closer to approval.

7 Reasons

Why Cardiol Therapeutics, Inc. (Nasdaq: CRDL); (TSX: CRDL) Could Become the Next Fast-Moving Biotech Stock Success

1. Massive Potential Market

Heart disease is the leading cause of death in the United States. One person in the United States dies every 33 seconds from cardiovascular disease[1]…and the estimated global annual economic cost of heart failure is $108 billion[2]. Improving heart health worldwide is a global challenge and Cardiol Therapeutics is focused on developing novel therapeutic approaches for patients with underserved heart diseases.

2. Impressive Drug Candidate Pipeline

Acute myocarditis and recurrent pericarditis are each debilitating forms of inflammatory heart disease that impact younger patients. And because there are no affordable and effective treatments, there is now an urgent need for alternative therapies. Cardiol’s impressive drug candidate pipeline is highlighted by its lead product, CardiolRx.™ CardiolRx™ is in a Phase II multi-national, randomized, double-blind, and placebo-controlled study to evaluate its efficacy and safety in acute myocarditis, as well as for the treatment of recurrent pericarditis.

- “Fast-Tracked” Approval Advantages

FDA Orphan Drug Designation (ODD) has been granted to CardiolRx™ for the treatment of pericarditis, including recurrent pericarditis. This designation provides a number of “fast-tracking” advantages including development incentives, cost savings and exclusivity benefits. CardiolRx™ is also eligible for FDA ODD in acute myocarditis and European Medicine Agency orphan medicine designations for recurrent pericarditis and acute myocarditis.

- Potential for Significant Increase in Valuation

Cardiol Therapeutics has very few competitors in the area of treatments for inflammatory heart disease. The only company that currently has an FDA-approved treatment for recurrent pericarditis is Kiniksa Pharmaceuticals (Nasdaq: KNSA), with a market capitalization of over $1.6 billion. Cardiol Therapeutics is moving closer to FDA approval, with therapies that target a broader range of potential patients and at much lower cost. Yet Cardiol Therapeutics’ current market cap is nearly 10 times lower than Kniksa’s at just under $160 million. This means the potential exists for a considerable “re-rate” of Cardiol Therapeutics as the company continues to advance its candidates.

- The Next Lucrative Buyout Candidate?

“Big Pharma” acquisitions can often mean huge paydays for shareholders of promising biotech companies that are bought out by larger firms. For example, in 2021 Jazz Pharmaceuticals’ buyout of GW Pharmaceuticals triggered a 2,371% gain for GW Pharmaceuticals’ early investors. And in 2020, Bristol-Myers Squibb’s acquisition of a little-known company, MyoKardia, helped early investors realize potential 2,150% gains.

6. Outstanding Research Partners

The company is working together with world-class researchers and clinicians at international centers of excellence to leverage their expertise in drug development, experimental execution, inflammation and fibrosis, and treatment of cardiovascular diseases. This impressive list of partners includes the Cleveland Clinic, Mayo Clinic, Houston Methodist Debakey Heart & Vascular Center, Massachusetts General Hospital, UVA Health, and more.

- Highly Experienced Leadership Team

Cardiol Therapeutics is led by a highly experienced management team, Board of Directors and Scientific Advisory Board. This group has extensive expertise in successfully developing therapeutics from pre-clinical through to commercialization and are committed to developing high impact and life changing therapies to heal the heart.

Cardiol Therapeutics’ Heart Health Breakthrough Could Help Early Investors See Significant Upside Potential

One of the most exciting – and potentially most lucrative – biotech investment stories of our lifetime may now be unfolding.

At a time when heart disease continues its devastating reign as the nation’s leading killer, patients are in dire need of new treatment options that could potentially help save countless lives.

Right now, one under-the-radar biotech company is developing innovative anti-inflammatory and anti-fibrotic therapies for the treatment of heart disease. And so far, the results are remarkably promising.

This company is Cardiol Therapeutics, Inc. (Nasdaq: CRDL); (TSX: CRDL).

What makes the company unique is that it is developing pharmaceutically manufactured cannabidiol (CBD) therapies for inflammatory heart diseases.

Cardiol’s lead oral drug candidate is CardiolRx™, which is being developed for two very important rare heart diseases that effect a younger patient population: acute myocarditis and recurrent pericarditis.

CardiolRx™ is a pharmaceutically manufactured, ultra-pure, high-concentration, THC-free, cannabidiol formulation. This development of a CBD-based treatment for heart diseases makes Cardiol Therapeutics an early leader in this space as it works to gain FDA certification.

18 Week Extension Shows Remarkable Durability in Recurrent Pericarditis

On November 18, at the American Heart Association Scientific Sessions, Cardiol Therapeutics provided detailed results for its Phase II MAvERIC study evaluating CardiolRX in recurrent pericarditis including new data on patients in the 18-week extension cohort, which showed remarkable durability of the 8-week results…

An Impressive Pipeline of Drug Candidates Targeting Underserved Heart Diseases

Cardiol Therapeutics is focused on understanding how inflammation and fibrosis contribute to diseases of the heart and the company is working to develop therapies, now in clinical trials for rare conditions to target these mechanisms and promote healing.

- FDA Orphan Drug Designation (ODD) granted to CardiolRx™ for the treatment of pericarditis, which includes recurrent pericarditis.

- CardiolRx™ eligible for FDA ODD in acute myocarditis and EMA orphan medicine designations for recurrent pericarditis and acute myocarditis.

The company’s lead drug candidate, CardiolRx™, uses cannabidiol (CBD) as a pharmaceutically manufactured oral solution.

Pre-clinical research has shown that cannabidiol may be able to help people who suffer from cardiovascular issues by potentially reducing heart inflammation and fibrosis.

More specifically, cannabidiol has been shown to attenuate multiple intracellular inflammatory signaling pathways, including inhibiting activation of the NLRP3 inflammasome, known to play an important role in the development and progression of inflammation and fibrosis associated with pericarditis, myocarditis and heart failure.

A Phase I safety and pharmacokinetic study of single and multiple ascending doses of CardiolRx™ was completed and demonstrated that CardiolRx™ was safe and generally well tolerated at all dose levels, with no serious adverse events reported.

CardiolRx™ is currently being evaluated in a MAvERIC-Pilot Study, a Phase II multi-center, open-label study assessing the tolerability, safety, and efficacy of CardiolRx™ on recurrent pericarditis.

Recurrent Pericarditis

Pericarditis refers to inflammation of the pericardium (the membrane, or sac, surrounding the heart) that leads to fluid accumulation (effusion) and pericardial thickening.

- Recurrent pericarditis is the reappearance of symptoms after a symptom-free period of at least 4–6 weeks following an index acute episode.

- Symptoms include debilitating chest pain, shortness of breath, and depression.

- Associated with an increase in C-reactive protein (CRP) – a commonly used clinical marker of inflammation.

- Quality of life and physical activity adversely affected, with severe cases requiring emergency department visits or hospitalizations.

- Current first- and second-line management consist of NSAIDs, colchicine, and corticosteroids.

- One FDA-approved therapy: $270,000/year LP (rilonacept) primarily used for ≥3 recurrences.

- 160,000 (based on 40/100,000(1) ) annual U.S. prevalence; includes 38,000 with a recurrence.

4.7 – 6.2 years

The average duration of recurrent pericarditis in patients who are difficult to treat.

18,000

Pericarditis hospitalizations per year in the Untied States (based on 5.4/100,000).

38,000

Number of recurrent pericarditis patients in the United States annually.

There is a significant clinical need in the area of recurrent pericarditis as patients suffering from this disease typically see a high recurrence burden and prolonged disease duration with symptoms persisting for several years, despite currently available off-label therapies and an approved biologic in the U.S.

The only FDA-approved therapy for recurrent pericarditis, launched in 2021, is costly and is primarily used as a third-line intervention. On an annual basis, the number of patients in the United States having experienced at least one recurrence is estimated at 38,000.

Approximately 60% of patients with multiple recurrences (>1) still suffer for longer than two years, and one third are still impacted at five years. Hospitalization due to recurrent pericarditis is often associated with a 6-8-day length of stay and cost per stay is estimated to range between $20,000 and $30,000 in the United States.

On June 13, Cardiol reported 8-week clinical data from the MAvERIC-Pilot study showing a substantial reduction in the primary efficacy endpoint of patient-reported pericarditis pain at the end of the 8-week treatment period (“TP”), as well as normalization of inflammation – as measured by C-reactive protein (“CRP”) – in 80% of patients with elevated CRP at baseline.

Upcoming on November 18, full clinical data will be reported in an oral presentation at the premier global event for advancements in cardiovascular science and medicine at the American Heart Association. Dr. S. Allen Luis, Co-Director, Pericardial Diseases Clinic and Associate Professor of Medicine, Department of Cardiovascular Medicine at the Mayo Clinic, will present on behalf of the MAvERIC-Pilot investigators.

Cardiol’s MAVERIC Program in recurrent pericarditis is comprised of the Phase II MAvERIC-Pilot study evaluating the tolerability, safety, and efficacy of CardiolRx™ in patients with recurrent pericarditis, the Phase II/III MAVERIC-2 trial evaluating the impact of CardiolRx™ in recurrent pericarditis patients following cessation of interleukin-1 blocker therapy, and the planned Phase III MAVERIC-3 trial designed to assess CardiolRx™ for the treatment of the broader population of pericarditis patients to prevent recurrence.

The MAVERIC-2 trial will be a double-blind, randomized, placebo-controlled trial and is expected to commence in Q4 2024 and enroll 110 patients at 20 clinical sites in the U.S. and Europe. The primary endpoint is the percent of patients free from new episodes of pericarditis at 24 weeks. The secondary endpoint is median time to a new episode of pericarditis. The trial provides the Company the opportunity to expand the market potential for CardiolRx™ through the execution of a cost-effective study and potentially provides a path for an accelerated regulatory approval timeline.

Acute Myocarditis Is a Leading Cause of Sudden Cardiac Death in People Under 35 Years of Age

Myocarditis is an inflammatory condition of the heart muscle (myocardium) characterized by chest pain, impaired cardiac function, atrial and ventricular arrhythmias, and conduction disturbances.

Although the symptoms are often mild, myocarditis remains an important cause of acute and fulminant heart failure and is a leading cause of sudden cardiac death in people under 35 years of age.

Although viral infection is the most common cause of myocarditis, the condition can also result from bacterial infection, commonly used drugs and mRNA vaccines, as well as therapies used to treat several common cancers, including chemo-therapeutic agents and immune checkpoint inhibitors.

Acute Myocarditis

Inflammatory condition of the heart muscle (myocardium) often resulting from viral infection, and characterized by chest pain, impaired heart function, arrythmias, and conduction disturbances.

- An important cause of acute and fulminant heart failure in young adults and a leading cause of sudden cardiac death in people <35 years of age.

- Complications include heart failure, cardiogenic shock, unstable heart rhythm, cardiac arrest, and/or organ failure; severe cases can lead to ventricular assist device, extracorporeal oxygenation, or heart transplant.

- 46,000 (based on 14.4/100,00)(1) ) annual U.S. prevalence, up to 30% develop a chronic inflammatory dilated cardiomyopathy(2)(3) .

- No FDA- or EMA-approved drug for treatment of acute myocarditis.

37 years

Average age of patient hospitalized with acute myocarditis in the United Kingdom.

4 – 6%

In-hospital mortality as a percentage of acute myocarditis admissions.

32,400

Number of deaths worldwide due to myocarditis in 2019.

- Patients hospitalized with the condition experience an average seven-day length of stay and a 4 – 6% risk of in-hospital mortality, with average hospital charge per stay estimated at $110,000 in the United States.

Cardiol Therapeutics is currently conducting a Phase II ARCHER Trial, a randomized, double-blind, placebo-controlled trial evaluating the impact of CardiolRx™ on myocardial recovery in patients with acute myocarditis.

Cardiol Therapeutics believes there is a significant opportunity to develop an important new therapy for acute myocarditis that would also be eligible for designation as an orphan drug in the United States and the European Union.

Heart Failure Affects More than 64 Million People Worldwide

The Company’s other drug candidate, CRD-38, is a novel subcutaneously administered drug formulation intended for use in heart failure.

Heart failure is a chronic, progressive syndrome in which the heart muscle is unable to pump enough blood to meet the body’s needs for blood and oxygen.

People with heart failure suffer from shortness of breath, rapid heart rate, edema, reduced exercise capacity, often struggle with simple daily activities, and are frequently hospitalized. For many, these symptoms significantly reduce their quality of life.

Cardiol Therapeutics is currently undertaking IND-enabling activities to support clinical evaluation of CRD-38 as a therapeutic strategy in heart failure care.

On the “Fast Track”:

Cardiol Therapeutics Granted FDA Orphan Drug Designation for CardiolRx™

The Company received Orphan Drug Designation (ODD) from the United States Food and Drug Administration for its lead drug, CardiolRx™.

FDA Orphan Drug Designation was granted to CardiolRx™ for the treatment of pericarditis, which includes recurrent pericarditis.

And CardiolRx™ is eligible for FDA Orphan Drug Designation in acute myocarditis and EMA orphan medicine designations for recurrent pericarditis and acute myocarditis.

Here’s why this designation is so critically important:

This designation qualifies CardiolRx™ for a number of development incentives, including tax credits for qualified clinical testing.

Orphan drugs can also qualify for fast-track regulatory development and approval…

And orphan drugs are often granted an exclusive monopoly for 7–10 years as a further incentive for drug companies to develop drugs for rare conditions.

According to Dr. Andrew Hamer, Cardiol Therapeutics’ Chief Medical Officer and Head of Research & Development, “This designation reinforces the potential of CardiolRx™ to improve the lives of patients suffering with recurrent pericarditis, a debilitating heart disease associated with symptoms that adversely affect quality of life and physical activity.”

Shares of Cardiol Therapeutics (Nasdaq: CRDL); (TSX: CRDL) Appear Significantly Undervalued

Based on the potential associated with Cardiol Therapeutics’ impressive product pipeline alone, the company’s shares would appear to be significantly undervalued.

From a financial perspective, the company is well-positioned, as the company is debt-free and well-capitalized to achieve its stated corporate milestones into 2026. And the company recently completed a new USD$15.5 million financing to fund a new trial and ongoing operations.

So, what type of re-rate potential might exist for shares of Cardiol Therapeutics, Inc. (Nasdaq: CRDL); (TSX: CRDL)?

At the moment, the only company with an FDA-approved treatment for recurrent pericarditis is Kiniksa Pharmaceuticals (Nasdaq: KNSA).

Over the past two-and-one-half years, shares of Kiniksa have soared by 198%[3] and the company’s market cap has grown to more than $1.6 billion.

Compare that to Cardiol Therapeutics’ current market cap of less than $160 million…and you can see there is potential for significant growth in valuation as the company moves closer to approval for its drug candidates.

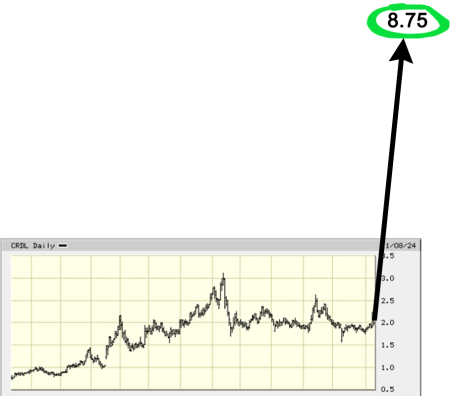

Analyst Consensus Price Target for Cardiol Therapeutics Represents a % Gain Over the Current Share Price

There are currently four stock analysts who have all issued a “buy” rating for the shares of Cardiol Therapeutics in the last 12 months.

The average twelve-month price target of the four analysts is $8.75.[4]

That average price target represents a forecasted upside of 339.70% from the $1.99 share price as of this writing.

Analyst Jason Wittes of Roth Capital Partners wrote on October 23, 2024 that, “Our 12-month price target is $10, based on a sum-of-the-parts valuation using 3x sales multiple on risk-adjusted peak sales and 9% WACC, consistent with industry norms.”

And on October 24, 2024, Vernon Bernardino of H.C. Wainright & Co. wrote, “We believe CardiolRx targets a nascent market opportunity that we look to be explored by MAVERIC-2. Importantly, with over 20 sites in the U.S. and Europe already identified, we think MAVERIC-2 could be conducted quickly, and think results could potentially be a positive catalyst in 2H25.”

Could Cardiol Therapeutics Be the Next Lucrative “Big Pharma Buyout” Candidate?

One of the most important considerations when it comes to biotech stocks is the potential for M&A activity.

These “Big Pharma Buyouts” can often translate into large paydays for early investors in those promising biotech companies that are bought out by larger firms.

For example, in 2021 GW Pharmaceuticals – the company behind the world’s first CBD-based drug – was acquired by Jazz Pharmaceuticals for $7.2 billion[5].

The very same shares of GW Pharmaceuticals that traded for $8.90 in May 2013 were purchased for a staggering $220 at the time of acquisition, triggering a 2,371% gain for early investors.

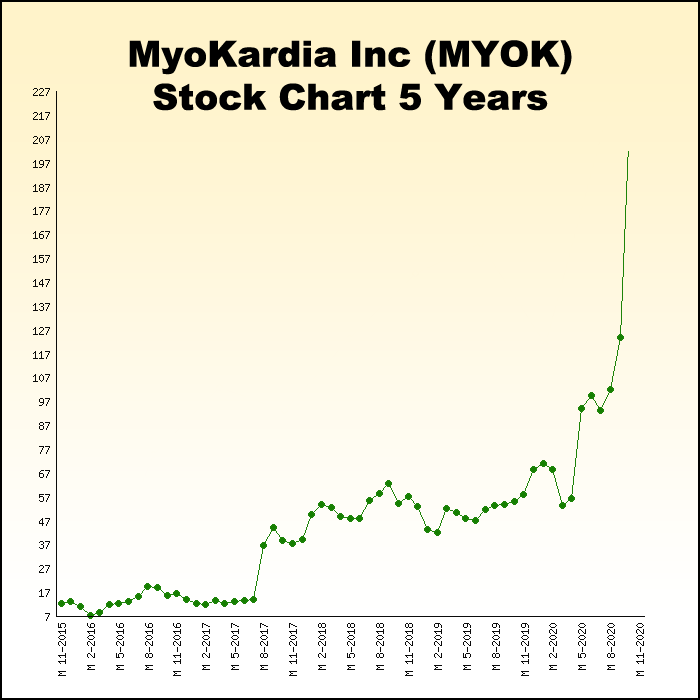

This also happened in 2020 when Bristol-Myers Squibb acquired MyoKardia, an up-and-coming biotech that had developed a new drug for irregular heart rhythms for $13.1 billion[6].

That buyout helped early investors realize potential 2,150% gains as Bristol-Myers paid $225 per share for MyoKardia, which IPO’d at $10 per share just five years earlier.

Those are just two recent examples of the upside potential for early investors in a buyout scenario.

With an impressive product pipeline, promising trial results and FDA Orphan Drug Designation, is it possible that Cardiol Therapeutics, Inc. (Nasdaq: CRDL); (TSX: CRDL) is now emerging as the next potential candidate for a lucrative buyout?

7 Reasons

Why Cardiol Therapeutics, Inc. (Nasdaq: CRDL); (TSX: CRDL) Could Become the Next Fast-Moving Biotech Stock Success

1. Massive Potential Market

Heart disease is the leading cause of death in the United States. One person in the United States dies every 33 seconds from cardiovascular disease[1]…and the estimated global annual economic cost of heart failure is $108 billion[2]. Improving heart health worldwide is a global challenge and Cardiol Therapeutics is focused on developing novel therapeutic approaches for patients with underserved heart diseases.

2. Impressive Drug Candidate Pipeline

Acute myocarditis and recurrent pericarditis are each debilitating forms of inflammatory heart disease that impact younger patients. And because there are no affordable and effective treatments, there is now an urgent need for alternative therapies. Cardiol’s impressive drug candidate pipeline is highlighted by its lead product, CardiolRx.™ CardiolRx™ is in a Phase II multi-national, randomized, double-blind, and placebo-controlled study to evaluate its efficacy and safety in acute myocarditis, as well as for the treatment of recurrent pericarditis.

- “Fast-Tracked” Approval Advantages

FDA Orphan Drug Designation (ODD) has been granted to CardiolRx™ for the treatment of pericarditis, including recurrent pericarditis. This designation provides a number of “fast-tracking” advantages including development incentives, cost savings and exclusivity benefits. CardiolRx™ is also eligible for FDA ODD in acute myocarditis and European Medicine Agency orphan medicine designations for recurrent pericarditis and acute myocarditis.

- Potential for Significant Increase in Valuation

Cardiol Therapeutics has very few competitors in the area of treatments for inflammatory heart disease. The only company that currently has an FDA-approved treatment for recurrent pericarditis is Kiniksa Pharmaceuticals (Nasdaq: KNSA), with a market capitalization of over $1.6 billion. Cardiol Therapeutics is moving closer to FDA approval, with therapies that target a broader range of potential patients and at much lower cost. Yet Cardiol Therapeutics’ current market cap is nearly 10 times lower than Kniksa’s at just under $160 million. This means the potential exists for a considerable “re-rate” of Cardiol Therapeutics as the company continues to advance its candidates.

- The Next Lucrative Buyout Candidate?

“Big Pharma” acquisitions can often mean huge paydays for shareholders of promising biotech companies that are bought out by larger firms. For example, in 2021 Jazz Pharmaceuticals’ buyout of GW Pharmaceuticals triggered a 2,371% gain for GW Pharmaceuticals’ early investors. And in 2020, Bristol-Myers Squibb’s acquisition of a little-known company, MyoKardia, helped early investors realize potential 2,150% gains.

6. Outstanding Research Partners

The company is working together with world-class researchers and clinicians at international centers of excellence to leverage their expertise in drug development, experimental execution, inflammation and fibrosis, and treatment of cardiovascular diseases. This impressive list of partners includes the Cleveland Clinic, Mayo Clinic, Houston Methodist Debakey Heart & Vascular Center, Massachusetts General Hospital, UVA Health, and more.

- Highly Experienced Leadership Team

Cardiol Therapeutics is led by a highly experienced management team, Board of Directors and Scientific Advisory Board. This group has extensive expertise in successfully developing therapeutics from pre-clinical through to commercialization and are committed to developing high impact and life changing therapies to heal the heart.

Sources

[1] https://www.cdc.gov/heart-disease/data-research/

facts-stats/index.html#:a

~:text=In%20the%20United%20States%3A,33%20seconds

%20from%20cardiovascular%20disease.

[2] https://pubmed.ncbi.nlm.nih.gov/24398230/#:~:text=

The%20overall%20economic%20cost%20of,

middle%20and%20low%2Dincome%20countries.

[3] Shares of KNSA traded at $7.66 on 5/1/22 and closed at $22.86 on 11/8/24

[4] https://www.marketbeat.com/stocks/NASDAQ/CRDL/forecast/

[5] https://www.reuters.com/article/business/jazz-pharma-to-buy-gw-pharma-for-

72-billion-adding-cannabis-based-drug-to-por-idUSKBN2A31RL/

[6] https://news.bms.com/news/details/2020/Bristol-Myers-Squibb-to-Acquire-MyoKardia-for-13.1-Billion-in-Cash/default.aspx

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer Cardiol Therapeutics Inc., Winning Media LLC has been hired for a period beginning on 11/12/24 and ending on 11/30/24 to conduct investor relations advertising and marketing and publicly disseminate information about Cardiol Therapeutics Inc. Website, Email and SMS. Winning Media has been compensated the sum total of fifty thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Cardiol Therapeutics Inc.

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (CRDL). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov