“White Gold” Rush Triggers High Upside Investment Opportunity:

“White Gold” Rush Triggers High Upside Investment Opportunity:

Soaring Electric Vehicle Demand Means the Race is On to Boost North American Production of Lithium and Other Critical Energy Metals

With a diversified portfolio of potential high-upside projects, Infinity Stone Ventures (CSE: GEMS); (OTC: GEMSF) appears to offer investors the single best way to play the “White Gold” Rush for maximum profit potential

• CSE: GEMS | OTC: GEMSF • CSE: GEMS | OTC: GEMSF • CSE: GEMS | OTC: GEMSF • CSE: GEMS | OTC: GEMSF • CSE: GEMS | OTC: GEMSF • CSE: GEMS | OTC: GEMSF • CSE: GEMS | OTC: GEMSF

The “White Gold” Rush has arrived in North America…and in a big way.

A massive surge in demand for lithium has triggered a potentially explosive investment opportunity that transcends the current market landscape.

Automobile manufacturers have been blown away by the record-breaking levels of demand for new electric vehicles – and every one of those new EVs being produced will need lithium-ion batteries.

This fact, combined with the efforts by governments and the local and national level to lower carbon emissions has triggered The “White Gold” Rush has arrived in North America…and in a big way.

A massive surge in demand for lithium has triggered a potentially explosive investment opportunity that transcends the current market landscape.

Automobile manufacturers have been blown away by the record-breaking levels of demand for new electric vehicles – and every one of those new EVs being produced will need lithium-ion batteries.

This fact, combined with the efforts by governments and the local and national level to lower carbon emissions has triggered an intense race to “lock in” lithium supplies with producers throughout North America.

an intense race to “lock in” lithium supplies with producers throughout North America.

How quickly is this “White Gold” Rush moving in North America? Take a look at what has happened in the lithium space just recently:

- In October, the U.S. government announced an infusion of $2.8 billion to U.S.-based companies to “expand domestic manufacturing of batteries for electric vehicles and the electrical grid.”[i]

- Also in October, Tesla CEO Elon Musk confirmed his plans to build a $375 million lithium refinery on the Texas Gulf Coast in a bid to gain more control over the supply chain for EV batteries.[ii]

- BMW announced in October that it was investing $1 billion in its South Carolina factory to begin building electric vehicles…and “threw in” an additional $700 million to build an electric-battery plant nearby – for a total investment of $1.7 billion.[iii]

And that’s really just a fraction of what’s happening as auto manufacturers – and the U.S. government – move quickly to lessen dependence on Chinese manufacturing of EV batteries.

The “White Gold” Rush means that lithium exploration companies in North America are getting lots of attention…as any potential supply could prove to be exceptionally valuable.

One such company is Infinity Stone Ventures (CSE: GEMS); (OTC: GEMSF), an under-the-radar North American company that is right now working to supply critical energy metals to battery manufacturers.

With a diversified portfolio of potentially lucrative properties containing “battery metals” such as lithium, copper, graphite, manganese, cobalt and nickel, this company offers extraordinary upside potential for investors.

Infinity Stone Ventures is a company with a unique – and vitally important story to share with Wall Street.

But unlike some of the “fad” investments of the past two years that grabbed countless headlines, this is a company with a valuable portfolio of tangible assets…in a rapidly-growing space.

7 Key Reasons Why You Should Take a Close Look at

Infinity Stone Ventures (CSE: GEMS); (OTC: GEMSF) Right Now

Infinity Stone Ventures has a diversified portfolio of properties – with 100% interest in each – spanning lithium, copper, graphite, manganese, cobalt and nickel. An investment in Infinity Stone Ventures (CSE: GEMS); (OTC: GEMSF) is a diversified investment with multiple opportunities for efficient deployment of capital.

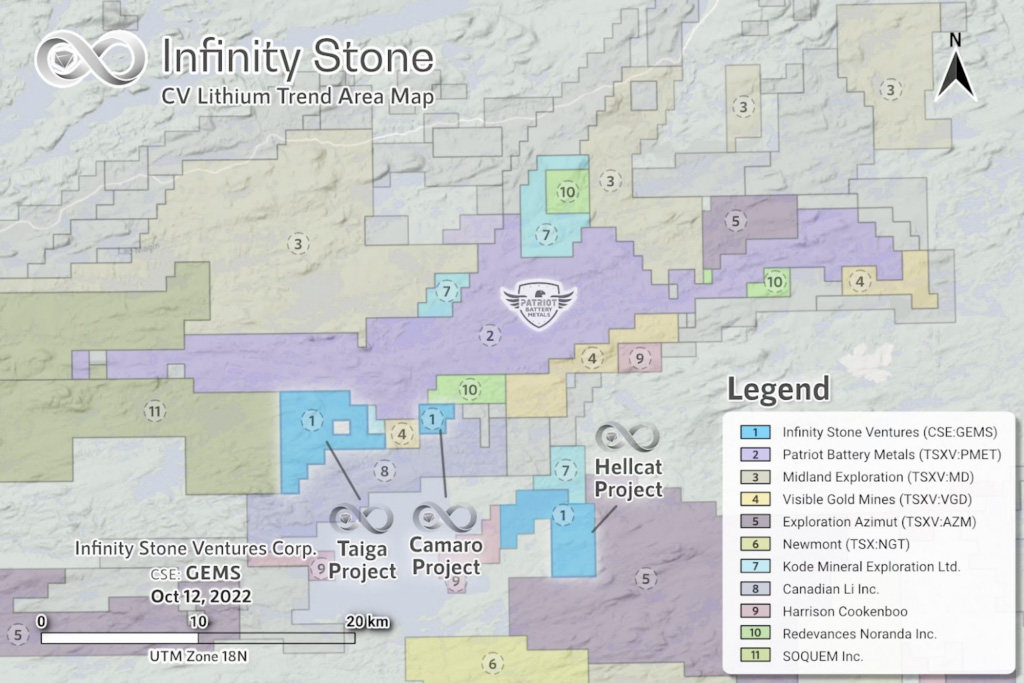

The company has, among others, a significant lithium project in Quebec – one of the most mining-friendly jurisdictions in the world – that is adjacent to the high-grade lithium deposit owned by Patriot Battery Metals. Plus the company has a potential high-upside graphite project in Thunder Bay, Ontario with eight historic drill holes all showing mineralization.

The race is on to ramp up the manufacturing of batteries for electric vehicles, with massive government incentives to help spur further growth. In the United States, the White House announced in October that it was deploying $3 billion to boost domestic output of EV batteries and the minerals used to make them. And Canada offers a lucrative 30% critical mineral flow-through tax credit to help incentive production. Companies who are able to move quickly in this growing space have an unprecedented opportunity to take advantage of these government incentives.

The Time is NOW: Electric Vehicle Manufacturers Are Scrambling for Batteries and Raw Materials to Meet Soaring Demand

There’s no question that the Electric Vehicle Revolution has arrived. In the first three months of 2022 alone, EV registrations shot up by 60% even as overall new car registrations dropped 18%.[i]

But that growth appears to be just the tip of the iceberg.

The world’s top automakers are planning to spend nearly $1.2 trillion through 2030 to develop and produce millions of electric vehicles, along with the batteries and raw materials needed for production.[i]

This includes significant investment in battery metals, with large new battery plants recently announced throughout North America, including…

- BMW Group investing $1.7 billion in South Carolina, including $700 million to build a massive battery assembly plant in Woodruff, SC…[ii]

- Panasonic, which supplies EV batteries to Tesla and others, announced plans for another $4 billion battery factory in Oklahoma. This factory is in addition to a large, $4 billion factory near Kansas City announced earlier in 2022…[iii]

- and Honda Motor Co. and LG Energy recently announced plans for a new $4.4 billion lithium-ion battery plant for electric vehicles in Ohio, near Honda’s main U.S. factory.[iv]

In the lithium space alone, Tesla founder Elon Musk has insisted that there needs to be more investment in global lithium refining to ease shortages in battery metals.

Significant capital is now being invested in EV battery production, which means even greater, more immediate demand for the critical energy metals needed for those batteries.

This means the timing for companies with high-upside critical energy properties – including Infinity Stone Ventures (CSE: GEMS); (OTC: GEMSF) – couldn’t be any better.

A True “One-Stop-Shop”: Infinity Stone Ventures Offers a Diversified Portfolio of Potentially Lucrative Critical Energy Metals Properties

Infinity Stone Ventures is meeting the demand from battery and wind turbine manufacturers, nuclear and hydrogen energy producers, and energy metals speculators by acquiring majority interest in critical mineral projects in stable mining-friendly jurisdictions, close to final use destinations in North American manufacturing hubs.

The company boasts a diversified portfolio of 100% interest in lithium, copper, manganese, graphite, cobalt, nickel properties in mining-friendly Ontario and Quebec.

Projects with existing exploration underway include:

Taiga, Camaro and Hellcat Projects – James Bay, Quebec

This project – recently expanded to cover 5,187 acres with 28 identified pegmatites – is in the James Bay Lithium District and is adjacent to Patriot Battery Metals’ (TSX.V: PMET) Corvette discovery.

A recently-completed mapping and sampling program from the property confirmed historically mapped pegmatites and identified new mineralized showings characterized by tourmaline, garnet, and muscovite, which are common LCT (Lithium-Cesium-Tantalum) pegmatite indicator minerals in the district.

A total of 87 samples were collected (across 3,850 hectares of claims) and have been shipped to SRC Labs in Saskatoon with initial assays anticipated in the coming weeks.

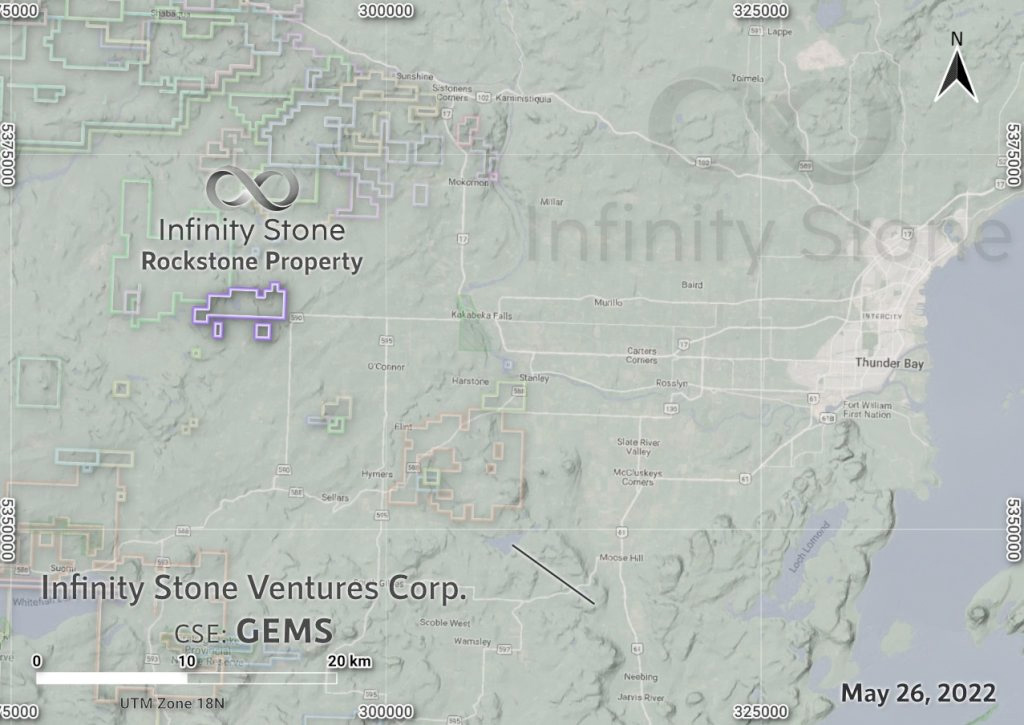

Rockstone Graphite Project – Thunder Bay, Ontario

Graphite is a key mineral in the production of EV battery cells. By weight, graphite is by far the largest component in lithium-ion batteries…and those batteries contain 10-15 times more graphite than lithium.

Approximately 1.2kg of graphite per kWh of energy capacity is required for modern EV battery cells. This means that a Tesla Model S 100D has approximately 120kg of graphite.

What this means is that – even though many people think EV batteries are all about lithium…it’s actually graphite that is far more essential.

Infinity Stone Ventures’ Rockstone Graphite Project is a 785 hectare project located 45 km west of the seaway port at the City of Thunder Bay, Ontario Canada. The Project has excellent access by logging haul roads that connect to paved/gravel roads with nearby railways and a shipping port.

The grade 23.1% C(g) from existing core samples places it amongst the top quartile in the world. The metallurgy and morphology appear to be consistent with what can be efficiently upgraded to battery-grade graphite.

Based upon the reprocessed Versatile Time Domain Electromagnetic (VTEM) survey completed by Sabina Silver Corporation in 2007, there are 18 drill-ready electromagnetic targets.

Zen-Whoberi Project – Windigo, Quebec

Infinity Stone’s Zen-Whoberi Project is a copper and cobalt project covering 680 hectares located 30 km north of Mont-Laurier, Quebec, Canada.

Previous drillings have discovered significant mineralization including:

- 0.57% Cu over 22.8 metres

- 1.27% Cu along a 200-metre strike length

- 1.1g/t Au over 1.2 metres

- 0.8 g/t Pt over 1.06 metres

- Several trench grab samples yielded 5.07% Cu, 0.59 g/t Au, 3.9 g/t Pt, and 0.2 g/t Pd

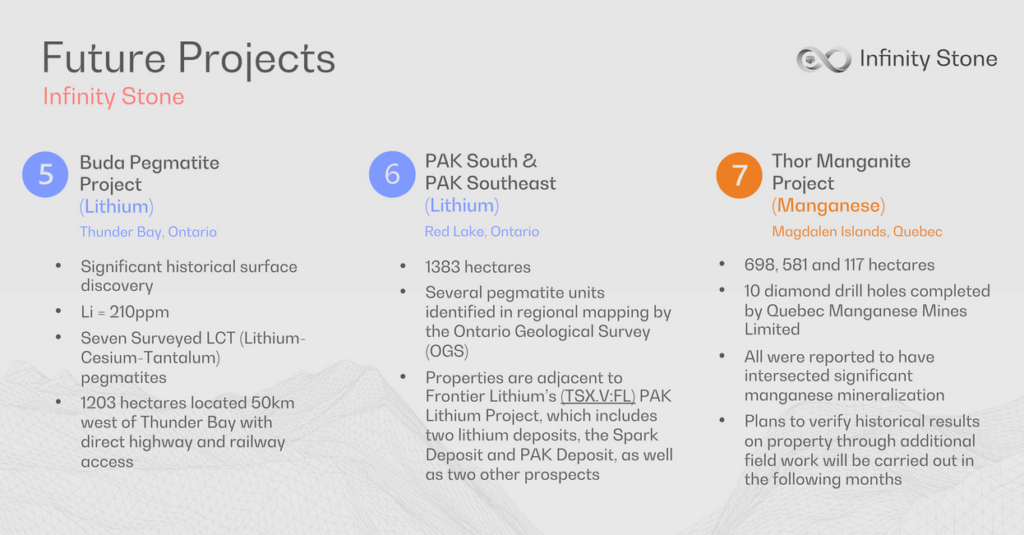

The company’s future projects – each of which a 100% interest is owned – include:

Breaking News:

Drilling to Commence on Rockstone Graphite Project

On October 18, Infinity Stone Ventures announced that its fall drill program on the Rockstone Graphite project located near Thunder Bay, Ontario was set to begin. Infinity Stone intends to commence diamond drilling of approximately 600 meters across 3 holes the first week of November 2022.

The aim of this drilling program is to expand on the historical drilling and confirm the potential for a significant graphite resource on the property.

For more information:

A Highly Successful, Experienced Management Team is Guiding Infinity Stone Ventures (CSE: GEMS); (OTC: GEMSF)

Zayn Kalyan – CEO, Director

Zayn Kalyan is an experienced investment banker and business development executive. Starting his career as a software engineer, his background in the “ground-up” development of startup technology companies serves as his foundation in finance. He has been the CEO of Infinity Stone since 2017 and has played a critical role in its evolution and focus on the battery metals space. As a partner at Altus Capital Partners, Zayn has played an instrumental role in the origination of over $50 million in financing.

Michael Townsend – Executive Chairman, Director

Mr. Townsend has extensive experience in corporate finance spanning over 25 years and 30 years in Capital Markets. Mr. Townsend is one of the founding partners of Altus Capital Partners, a boutique investment bank based in Vancouver, B.C. Altus has been involved in raising over $180-million in equity financings over the past five years. Mr. Townsend co-founded Hemptown, Patriot One Technologies Inc., and Body and Mind Inc., Raytec Metals Corp., and previously served as CEO of Lateegra Gold Corp. and CEO of West Hawk Development Corp.

Case Lewis, P. Geo. – Director

Mr. Lewis is a Professional Geologist and Qualified Person with over 13 years of diverse project and business experience, managing grassroots to advanced-stage exploration projects for precious metals and industrial minerals throughout Canada and internationally. He has served as director, QP, and technical advisor on numerous junior resource exploration companies and holds a degree in Geology from the University of Alberta.

Chris Cherry – Director

Mr. Cherry has over 20 years of corporate accounting and audit experience. Mr. Cherry has held senior level positions for various public companies including Director, Chief Financial Officer, and Secretary. Mr. Cherry has been a Chartered Accountant since February 2009 and a Certified General Accountant since 2004. In his former experience as an auditor, he held positions with KPMG LLP and Davidson and Co. LLP in Vancouver, where he gained experience as an auditor for junior public companies, and an IPO specialist.

Brandon Rook – Advisor

Mr. Rook has over 25 years of diversified business experience working as a geologist, advisor to numerous publicly listed companies as well as a CEO, President, and Director of several TSX-V listed companies. Currently, he is a director of four public companies. Mr. Rook has been responsible for raising over $100 million dollars to date. As a geologist and executive, he has worked with and led teams that have had significant discoveries in gold, copper, oil, natural gas, and diamonds.

7 Key Reasons Why You Should Take a Close Look at

Infinity Stone Ventures (CSE: GEMS); (OTC: GEMSF) Right Now

Resources

[i] https://www.wsj.com/articles/electric-car-demand-pushes-lithium-prices-to-records-11663749409

[ii] https://www.usfunds.com/resource/2-8-lithium-investment-expected-to-jumpstart-the-white-gold-rush/

[iii] https://www.bloomberg.com/news/articles/2022-10-19/tesla-confirms-plans-to-build-lithium-refinery-in-texas

[iv] https://fortune.com/2022/10/19/bmw-1-billion-electric-vehicle-plant-investment-spartanburg-south-carolina-batteries/

[v] https://www.nytimes.com/2022/07/14/business/electric-car-sales.html

[vi] https://www.caranddriver.com/news/a39998609/electric-car-sales-usa/

[vii] https://www.reuters.com/technology/exclusive-automakers-double-spending-evs-batteries-12-trillion-by-2030-2022-10-21/

[viii] https://www.reuters.com/technology/exclusive-automakers-double-spending-evs-batteries-12-trillion-by-2030-2022-10-21/

[ix] https://www.enr.com/articles/55107-us-electric-vehicle-battery-manufacturing-get-investment-jolt

[x] https://pv-magazine-usa.com/2022/08/29/panasonic-plans-second-4-billion-u-s-ev-battery-plant/

[xi] https://www.reuters.com/business/autos-transportation/honda-motor-lg-energy-build-ev-battery-plant-ohio-nikkei-2022-08-29/

[xii] https://www.bloomberg.com/news/articles/2022-07-21/lithium-refining-is-license-to-print-money-tesla-s-musk-says

Disclaimer: This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. Wallstreetnation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Please review all investment decisions with a licensed investment advisor.

This Advertorial was paid for in an effort to enhance public awareness of Infinity Stone Venture Corp. and its securities. Winning Media LLC was paid the sum total of $67,000 USD by Infinity Stone Venture Corp. to manage a digital media campaign.

Jade Cabbage Media, LLC d/b/a STOXmedia.com expects to be paid up to $20,000 USD dollars by Winning Media LLC as a total production budget for this advertising effort. Neither Wallstreetnation.com or STOXmedia currently hold the securities of Infinity Stone Venture Corp. and do not currently intend to purchase such securities. This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are a number of important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur. More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.