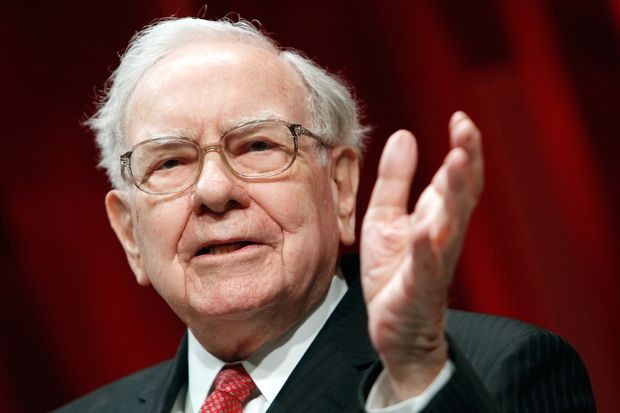

Warren Buffett Gives Away $4.1 billion and Resigns as Gates Foundation Trustee

90-year-old Warren Bates announced this week that he has resigned as the trustee at the Bill & Melinda Gates Foundation.

The Oracle of Omaha has also said he will donate $4.1 billion worth of Berkshire Hathaway shares to five foundations.

This year’s donation marked the halfway point for Buffett, who pledged in 2006 that he would give away all of his Berkshire shares through annual gifts to five foundations.

According to Buffett, his 16 annual contributions to the five foundations over the years were worth $41 billion when disbursed.

“Today is a milestone for me,” Buffett said. “In 2006, I pledged to distribute all of my Berkshire Hathaway shares — more than 99% of my net worth — to philanthropy. With today’s $4.1 billion distribution, I’m halfway there.”

“For years I have been a trustee — an inactive trustee at that — of only one recipient of my funds, the Bill and Melinda Gates Foundation (BMG). I am now resigning from that post, just as I have done at all corporate boards other than Berkshire’s,” Buffett said. “The CEO of BMG is Mark Suzman, an outstanding recent selection who has my full support. My goals are 100% in sync with those of the foundation, and my physical participation is in no way needed to achieve these goals.”

Buffett resigns as Bill and Melinda Gates, who founded the organization, go through a divorce.

The couple announced their divorce in May and along with Buffett were creators of the Giving Pledge.

“I’m optimistic. Though naysayers abound — as they have throughout my life — America’s best days most certainly lie ahead,” Buffett said. “Philanthropy will continue to pair human talent with financial resources. So, too, will business and government. Each force has its particular strengths and weaknesses. Combined, they will make the world a better place — a much better place — for future generations.”

Buffett is Berkshire’s largest shareholder, owning about 39% of the Class A shares, according to FactSet.

Disclaimer: We have no position in any of the companies mentioned and have not been compensated for this article.