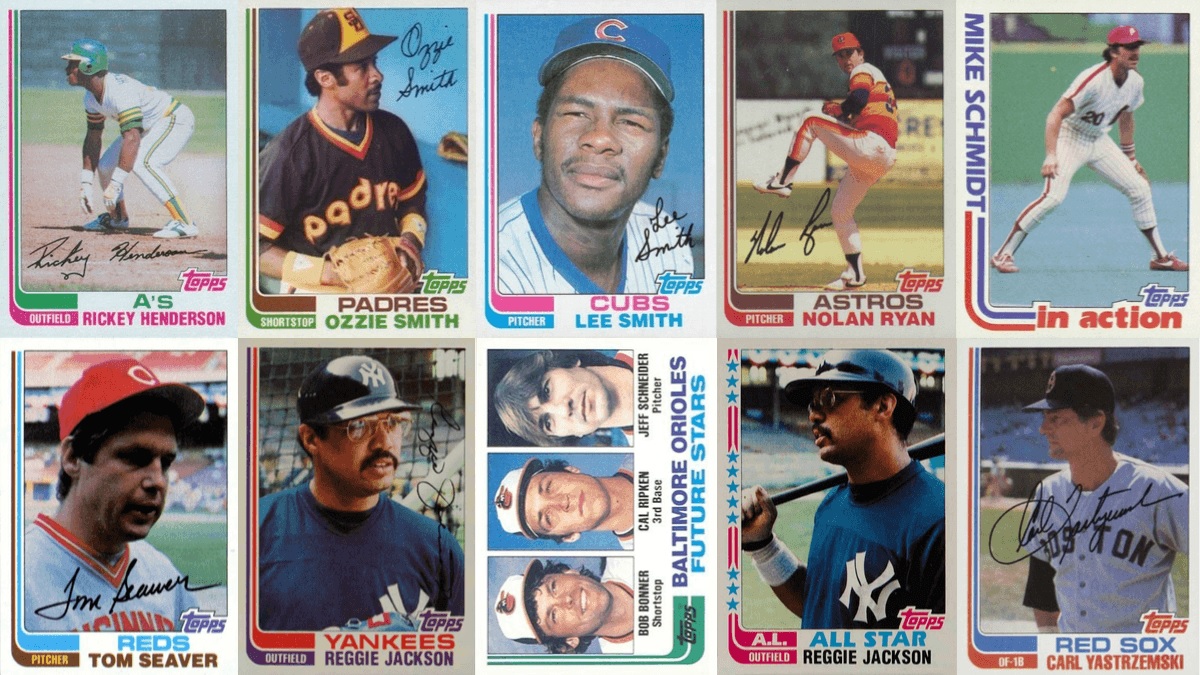

Sports Cards Firm Topps Backed by Former Disney Co Chief to Go Public Through $1.3B SPAC Deal

Topps Co Inc, a sports and entertainment collectible firm that is being backed by former Walt Disney Co Chief Michael Eisner, has announced this week its plans to go public.

The company will be going public through a merger with a blank-check firm in a deal valuing the combined company at $1.3 billion.

In a deal with Mudrick Capital Acquisition Corp II (MUDS), there will be gross proceeds of $571 million generated, including a $250 million private investment led by Mudrick Capital and institutional investors such as GAMCO Investors and Wells Capital Management, among others. MUDS is a special purpose acquisition company (SPAC).

Shares of MUDS were up more than 7% at $10.57 in pre-market trade.

Topps, which has been around for the last 80 years and is known for its specialty card trading, is looking to increase its presence in the e-commerce and digital apps industry through blockchain technology or non-fungible token (NFT)-based initiatives.

Michael Eisner had bought Topps through his firm The Tornante Company in 2007. He will remain Chairman of the combined company. Additionally, Tornante will roll its entire equity investment in Topps into the combined entity.

The company had generated record sales of $567 million in 2020, a 23% increase from a year earlier.

Topps is “well situated with a universally recognized brand to capitalize on the fast emerging market for collectible NFTs,” said Jason Mudrick, founder and chief investment officer of Mudrick Capital.

Eisner has said there is “a strong emotional connection between the Topps brand and consumers of all ages.”

Topps has a “growing portfolio of strategic licensing partnerships” that will help make it profitable, he said. The company owns the storied Bazooka gum brand as well as the Ring Pop, Baby Bottle Pop and Juicy Drop candy and sour gel brands.

The combined firm will be listed on the Nasdaq under the new ticker symbol “TOPP”.

Disclaimer: We have no position in any of the companies mentioned and have not been compensated for this article.