Is the smart money looking at this one stock?

(OTC QX: IEGH)

IEGH – A GLOBAL LEADER IN CONSUMER FINANCE

IEG Holdings Corp provides $5,000 and $10,000 personal loans in the United States – Online! No longer do you need to enter a bank and beg for an answer. IEGH Founder/CEO Paul Mathieson established this business model in Australia, and lent ~$48 Million Dollars to over 11,500 customers. After moving the company to the US, the prosperous business model is being successfully replicated. The offspring of this idea is the “Mr. Amazing Loans” platform, which is currently offering online loans to residents of 17 states – with 25 states planned for mid-2017!

IEG Holdings Inc. has a major advantage as they are one of the very few online lenders with licenses to operate in multiple states in the U.S – covering more than half the U.S. population. IEGH offers loans through its website www.mramazingloans.com. After 8 years of securing state by state licensing and perfecting an underwriting algorithm, the company went live. Hardwork “paid off” and the company loaned $410,000 in 2013, $4.96 million in 2014, $5.44 million in 2015, and already $2.33 million in just the first six months of 2016. The growth is amazing – and should only get better from here.

Investment Evolution Personal Loans can be used for:

- financial emergencies

- debt consolidation

- buy a car

- pay medical or unexpected bills

- take that dream vacation

- extra cash for the holidays

Investment Evolution Offers Loans when your bank says NO:

- Personal loans are a better alternative to payday loans

- $5,000 -$10,000 loans are considered Consumer Finance Loans

- Personal Loan rates range between 19.9% – 29.9%

- Pay back over 5 years

- Don’t max out your credit card – there are better alternatives

Where can I apply?

IEGH online application, Mr. Amazing Loans, is a leading state-licensed online personal loan company. They are recognized as a personal loan provider with all personal loans offered at competitive rates. Currently, this is available to residents of Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Missouri, Nevada, New Jersey, New Mexico, Oregon, Pennsylvania, Texas, Utah and Virginia.

Investment Evolution plans to increase, US population coverage to 25 US states encompassing ~75% of US market (240 million people) by obtaining 8 additional state licenses including New York and Ohio.

Investment Evolution plans to increase, US population coverage to 25 US states encompassing ~75% of US market (240 million people) by obtaining 8 additional state licenses including New York and Ohio.

Forget the slow banks and expensive payday loans!

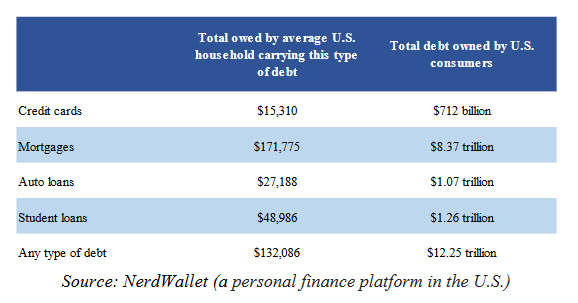

If your credit score is sub-par – you are still eligible for a loan. Is your credit card maxed? As of Q1-2016, the average household in the U.S. has debt of $132,086, of which, $15,310 is on credit cards

How IEGH Sets Itself Apart from Competitors

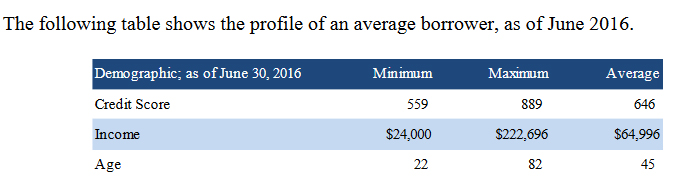

The interest rate charged on a consumer loan is based on the borrower’s credit worthiness and the ability to pay back the debt.

Private lenders do not conform within the strict lending guidelines of banks and other traditional lenders. They can therefore offer individually structured loans to meet the specific requirements of a borrower. These reasons, and the inherent risk of consumer loans, allow private lenders to charge significantly higher interest rates on their loans. The key for private lenders is to keep loan losses at reasonable levels.

Although unsecured loans have had higher delinquency rates than secured mortgages prior to the recession, they are currently much lower as the U.S. has yet to completely recover from the housing market collapse. The current delinquency rate on consumer loans is approximately 2.04%, and on credit cards is approximately 2.20%, lower than the 4.55% on single family residential mortgages.

One of the key differences of IEGH compared to traditional consumer lenders is the longer term of 5 years versus the typical term of 2 to 5 years on consumer loans. Management’s rationale to choose a longer term is that the required weekly / monthly prepayment amounts will be lower, making it easier for consumers to pay out their loans with less burden.

For example, a $5,000 loan has an estimated weekly payment of just $38 for a period of 5 years. Although the probability of default is higher for loans with longer terms, IEGH loans are fully amortized. Therefore, the capital at risk reduces with each repayment.

Another prime advantage of IEGH is that unlike a lot of lenders, they do not charge any lender fee or prepayment fees.

The entire process, from submitting an application to receipt of funds, typically takes a day and can be done in as little as one hour!

Putting yourself into debt might be beneficial to your portfolio

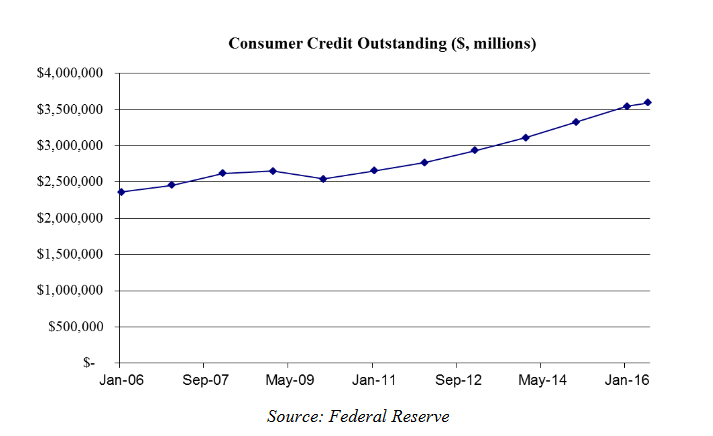

Life is Expensive. As personal spending increases, the need for loans through Mr. Amazing Loans surges exponentially.

IEGH originally offered loans to consumers via an office network, which comprised of one office in each state as required by state licensing regulations. With the emergence of e-businesses and using the cloud instead of physical office locations, Investment Evolution was able to create a full online loan distribution market.

Being cloud-based, Investment Evolution’s model has two key advantages over the Banks:

- Decreased costs attached to office space and staffing; IEGH can leverage the low cost of internet and mobile distribution channels, eliminating the need to pay rent, facility costs and other expenses associated with traditional brick-and-mortar facilities.

- Increases convenience for consumers, as they can obtain loans without having to visit an office location. Online and mobile banking are now mainstream. Nowadays, more sophisticated forms of transactions, including loans, mortgage management and more, are all being handled in virtual space.

Expansion: The Key to Financing the Future

- Management’s current focus is to expand within the U.S.

- This opens the doors to replicate the business in Canada and parts of Europe.

- IEGH is now a public company which allows proper fundraising, visibility, and expansion

- Management plans to uplist the shares to the NYSE MKT Exchange.

Could IEGH be a takeover target? See how undervalued as compared to their peers!

Lending Club (NYSE: LC) trades at $2.38 Billion Market Cap

OneMain Holdings (NYSE: OMF) trades at $4.1 Billion Market Cap

CashAmerica (NYSE: CSH) trades at $1.01 Billion Market Cap

FirstCash, Inc. (NYSE: FCFS) trades at $2.24 Billion Market Cap

IEGH trades at a miniscule $52 Million Market Cap, is experiencing tremendous growth, and is one of the few online lenders with licenses to operate in multiple states in the U.S. covering more than half the population! As a result of this growth and future potential, they have been given a Buy recommendation with a Fair Value of $2.40

IEGH is a highly scalable business model with low customer acquisition costs and 29.9% gross revenue margins and 20%+ unlevered net equity returns compared to ~2% revenue margins for peer to peer lenders

IEGH presents an opportunity to invest in a direct online consumer financing company in a large, niche market for high credit quality clients. With Strong barriers to entry – 16 state licenses have taken nearly 8 years to obtain – Investment Evolution is years ahead of any new players. As a successful standalone startup, they might make a perfect acquisition candidate, especially with the strong revenue growth (see below).

IEGH looks to be in a great position right now and numerous recent developments could lead to strong upside once again. At current levels IEGH represents a ground floor opportunity for investors to capitalize on this compelling company. Get started on your research now.