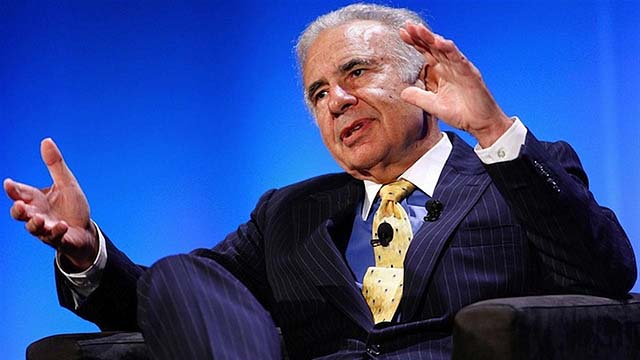

Billionaire Activist Carl Icahn Would Love to See These Two Companies Merge

Carl Icahn, the famed activist investor, recently told the Wall Street Journal that he would like to see Xerox successfully acquire HP Inc.

According to Icahn, the printing company and the printer maker combining would be a “no-brainer.”

It was recently reported that Xerox had offered $33 billion, or $22 a share for HP, which has a market capitalization of $29 billion, more than three times the market cap of Xerox.

According to the WSJ, Icahn currently has a 10.6 percent stake in Xerox and now has a 4.2 percent stake in HP, valued at about $1.2 billion.

Icahn said, “I think a combination is a no-brainer. I believe very strongly in the synergies, there will probably be a choice between cash and stock and I would much rather have the stock, assuming there’s a good management team.”

It was in 2018 that Icahn took control of Xerox’s board and got rid of the company’s CEO after Xerox made an ill-fated bid to buy Fujifilm Holdings Corp. Icahn at the time had said the Xerox board was “delusional” in its bid for Fujifilm.

Disclaimer: We have no position in any of the companies mentioned and have not been compensated for this article.