Sponsored – Est. Read 9 Min

This Undervalued U.S. Oil Stock

Could Emerge as 2025’s Top Breakout Energy Investment

With a large position in one of America’s most profitable oil basins, under-the-radar Prairie Operating Co. (Nasdaq: PROP) offers investors a chance at potential windfall profits

Thanks to a renewed urgency around American energy independence – including President Trump’s declaration of a National Energy Emergency on his first day back in office – stepping up domestic oil production has now become a critically important mission.

In the midst of this surge in demand for U.S.-based energy production, one little-known oil & gas company could offer investors the best way to play this scenario for maximum potential upside.

That company is Prairie Operating Co. (Nasdaq: PROP), a pure-play, Colorado oil & gas company that is focused on aggressive growth, both through the drill bit and through acquisition.

Here’s why this company could soon receive a great deal of attention from investors large and small:

Right now, Prairie Operating Co. is sitting on a massive position in one of the top oil-producing regions in the United States in terms of size and production.

I’m speaking of the DJ (Denver-Julesburg) Basin in Colorado…a region where superior economics, proven reserves and strategic location could help fuel years of growth for this potentially undervalued company.

Over the last two years, Prairie Operating Co. has quietly amassed nearly 65,000 gross acres of prime territory in an “oily” section of the DJ Basin…with more than 100 million barrels of oil equivalent already categorized as proven reserves.

In spite of this activity, the company’s shares have still been largely overlooked by Wall Street.

But that might not be the case for much longer.

With development-ready sites, an experienced team to guide the exploration and a solid balance sheet, Prairie Operating Co. appears to be smartly positioned for a surge in the months ahead.

To help you understand this opportunity as clearly as possible, here are…

7 Key Reasons

Why You Should Strongly Consider Prairie Operating Co. (Nasdaq: PROP) Right Now

1) A Large, Strategic Asset Base in One of America’s Most Profitable Oil Regions

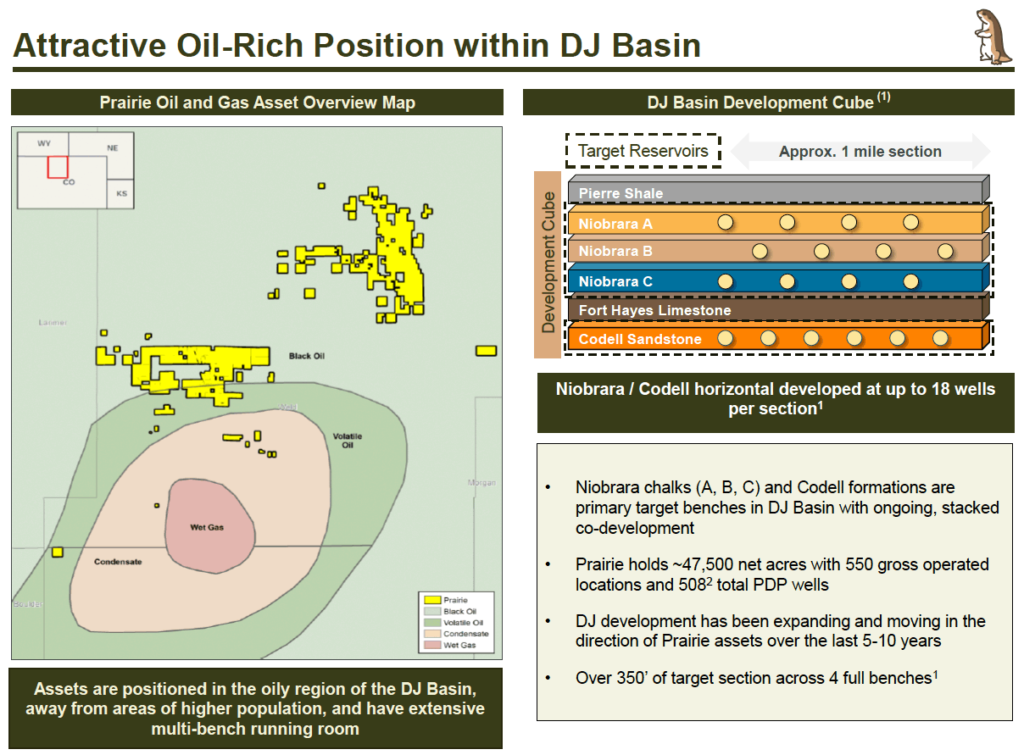

Prairie Operating Co. (Nasdaq: PROP) holds approximately 47,500 net acres (65,000 gross) in a liquids-rich part of the DJ Basin, a top-tier oil region in Colorado. This region boasts neighbors like Chevron, Civitas, EOG and Occidental…is strategically positioned away from population-dense areas…and has no potentially-conflicting federal leases.

2) Massive Runway: 10+ Years of Production Potential Already Identified

With more than 550 identified drilling locations – and 157 already permitted – Prairie has more than a decade of inventory lined up at a 60-well-per-year pace. Its acreage supports long laterals of 2-3 miles, helping boost the project’s economics and lont-term output.

3) 104 Million Barrels of Proven Reserves – and Room to Grow

Prairie Operating Co. holds proven reserves of approximately 104 million barrels of oil equivalent, which is a substantial foundation for a company of its size. 70% of these reserves are high-value liquids, which positions the company to benefit from favorable oil pricing dynamics. Additionally, as drilling expands across the company’s large footprint, future updates could reflect significant reserve growth.

4) Prairie’s DJ Basin Wells Can Deliver More Oil at Lower Cost

Colorado’s DJ Basin features industry-low costs and high full-cycle returns. Prairie’s wells compete favorably with others in the United States, including those in the Permian and Eagle Ford basins, offering the potential for standout returns with more efficient capital outlays.

5) Prairie is Pursuing Aggressive Growth Through Drilling and Smart Acquisitions

The company is pursuing a dual-pronged approach to growth that includes organic growth – through drilling and leasing – as well as inorganic growth through strategic M&A to position itself as the DJ Basin’s leading oil & gas operator.

With no long-term debt maturities, a 1.0x leverage target and a proactive hedging program, Prairie is effectively managing risk while maintaining capital flexibility to support ongoing growth and execute the company’s long-term strategic vision.

7) Management Team with Over 100 Years of Operational Experience

Prairie’s senior management team has a long record of commitment to responsible investment and safe operations, including over 100 years of experience around the world. Importantly from an investment perspective, this group has a proven successful track record of growing public companies from an early stage.

104 Million Barrels in Proven Reserves: Why Prairie Operating Co. (Nasdaq: PROP) is the Small Cap Energy Story Most Investors Are Missing

Prairie Operating Company (Nasdaq: PROP) is a U.S.-based small cap, high-growth oriented oil & gas company.

But Prairie Operating Co. is not just another small cap oil & gas exploration play.

It’s a focused and methodical player that is pursuing a strategy designed to help the company potentially dominate a high-upside niche within the DJ Basin – one of the most profitable onshore oil basins in North America.

The company is leveraging its strategic land position in northeastern Colorado, where it controls roughly 47,500 net acres. That 47,500 net acres is roughly the same size as the city of Miami.

And the company’s position is located in an oily, liquids-rich corridor that’s free of federal leases and away from population-heavy zones, giving Prairie two significant regulatory advantages.

Prairie’s highly contiguous land position also provides a unique operational edge: The ability to develop long lateral wells – of up to 3 miles – in a streamlined fashion, with 157 drilling locations already fully permitted and a broader inventory of more than 550 locations.

Additionally, the company has reported Proven Reserves of approximately 104 million barrels of oil equivalent, 70% of which are liquids.

But there’s even more good news to the Prairie Operating Co. story.

While many early stage companies in the oil & gas space can often run into significant cash issues, Prairie has taken a disciplined approach to growth, with an emphasis on financial flexibility and a conservative capital structure.

Prairie Operating Co. Completes Transformative Acquisition and Increases Average Daily Production by ~25,700 net Barrels of Oil Per Day

Just recently – in March 2025 – the company announced the successful closing of its acquisition of DJ Basin assets from Bayswater Exploration and Production. This acquisition significantly expanded the company’s operational footprint in the DJ basin, enhancing its production base and long-term growth potential.

Highlights of the transaction include:

- A transformational increase in oil-weighted production, adding ~25,700 net BOEPD.

- Expansion of footprint and inventory life with an additional 24,000 net acres, adding to approximately 600 highly economic drilling locations and roughly 10 years of drilling inventory.

- Significant increase in free cash flow, as the transaction is expected to be immediately accretive to per-share cash flow metrics.

- Provides meaningful infrastructure synergies by leveraging advantageous takeaway contracts and existing infrastructure to drive operational efficiencies and reduce development costs.

Additionally, in April 2025 the company announced the successful execution of a strategic hedging program which covers roughly 85% of its current daily production, implemented prior to the recent pullback in oil and gas prices.

This well-timed risk management initiative secures strong pricing for the company, enhances visibility and reinforces Prairie Operating Co.’s commitment to capital discipline and long-term value creation.

Key hedging terms:

- Remaining 2025 Production: $68.27/bbl WTI and $4.28/MMBtu Henry Hub

- 2026–1Q 2028 Production: $64.29/bbl WTI and $4.09/MMBtu Henry Hub

Colorado’s DJ Basin is a Top-Tier Energy Asset

Within the United States

While many of the energy sector’s mainstream press coverage is focused on the Permian or Eagle Ford, those within the industry understand that the DJ Basin has quietly emerged as one of the most economic oil plays in the U.S.

And Prairie Operating Co.’s location is right in the sweet spot of this incredible region.

Some of the many advantages of the DJ Basin for oil & gas exploration include:

- Lower full-cycle development costs than many peer basins

- Superior well performance from 2021+ results

- Lower Lease Operating Expenses (LOEs) and better per-well capital efficiency

This all translates into better margins, more cash flow and greater flexibility to reinvest for companies in the region.

Prairie Operating Co. is an Up-and-Coming Small Cap Surrounded by Some of the World’s Largest Energy Companies in the DJ Basin

It’s important to know that the DJ Basin features a number of prominent operators in the area including Chevron, Civitas, EOG and Occidental.

Those larger companies have consolidated most of the assets around Prairie Operating Co. as they recognize the value and the long-term exploration potential.

This means that Prairie can follow the template established by the “big boys” in the region for refining and perfecting drilling techniques and fracking techniques around the company.

Naturally, Prairie is very smartly hiring the same vendors and consultants those companies have used for their operations to drill great wells on their own property.

Prairie Operating Co. (Nasdaq: PROP) appears to be strategically positioned in its acreage as well as how efficiently it’s being developed.

The company boasts…

- Contiguous, oily acreage in one of the DJ Basin’s best regions

- No federal leases, which means a minimum of permitting hurdles

- 157 fully permitted well locations and up to 646 total sites

- High working interest, allowing Prairie to retain maximum upside

- And 2-3 mile laterals, potentially boosting per-well production and reducing unit costs.

These are rare competitive advantages for a small cap player…and Prairie Operating Co. has locked them in while still remaining virtually unknown to most of Wall Street.

Breaking News

Prairie Operating Co. Begins Completion of the Opal Coalbank Pad, Acquired from Bayswater

On April 28, 2025 Prairie Operating Co. (Nasdaq: PROP) announced that it is beginning completions of nine previously drilled but uncompleted wells acquired in the recent Bayswater transaction.

Prairie Operating Co.’s Focused Growth Strategy

Prairie’s growth strategy is both disciplined and aggressive, which is a rare combination in the small cap energy space.

The company is targeting organic growth through drilling and leasing. In this area, the company is targeting 10%+ production growth annually by:

- Drilling high-return wells in proven areas…

- Expanding DSUs (Drilling Spacing Units) via greenfield leasing…

- …and increasing working interest in existing DSUs to boost economics.

On the inorganic side, the company is…

- Evaluating a potentially robust pipeline of both large and small M&A opportunities within the DJ Basin…

- Leveraging its management’s extensive M&A track record (which includes successful deals at Rosehill, Southwestern and more)…

- …and consolidating assets to expand scale and operational efficiency.

Prairie Operating Co. (Nasdaq: PROP) is a company with a playbook built for smart, capital-efficient growth and a management team that has executed this plan before.

The company’s objective is clear: to ultimately position itself as the DJ Basin’s leading oil & gas operator.

Prairie Operating Co. is Guided by an Experienced Management Team With a Proven Record of Success

Prairie’s senior management team has more than 100 years of operational experience around the world.

These leaders have a long record of commitment to responsible investment and safe operations and apply best practices from the board room to field operations.

This experienced team includes:

Edward Kovalik – Chairman and Chief Executive Officer

Mr. Kovalik was the founder and managing member of KLR Group, a merchant bank focused on the Energy sector. KLR founded numerous Oil & Gas portfolio companies including River Bend, a JV in the Bakken with Blackstone/GSO. Additionally, KLR also founded KLR Energy, a SPAC that acquired and built Rosehill Resources into a $750M EV Permian company.

Gary Hanna – President

Mr. Hanna has over 40 years of public workout and start-up experience in E&P, having focused primarily in the Permian, Mid-Continent and the GOM. Gary served as the Chairman, President, and CEO of KLR Energy, having successfully acquired Tema to form Rosehill Resources, a pureplay Permian company that grew to 22,000 Boe/D of production. Before that, Gary was the Chairman, President and CEO of EPL Oil & Gas, which was sold to EXXI for $2.4B in an all-cash transaction. Prior to EPL, Gary served as the President of Maritech/SVP TTI whose market capitalization grew from $150M to $2.5B during his tenure.

Greg Patton – Executive Vice President and Chief Financial Officer

Mr. Patton has over 15 years of industry experience where he has served as Senior Vice President, Corporate Development and Finance for Great Western Petroleum. He has also served as CFO for Trigger Energy.

Bryan Freeman – Executive Vice President, Operations

Mr. Freeman was the SVP of Drilling and Completions at Rosehill Resources, where he managed the execution of the company’s $750M Capex program over three years. Prior to that, Bryan was the Production & Operation Engineering Manager for SM Energy for the Eagle Ford and Gulf Coast region where he led an 82 person team and three frac fleets. Before SM, Bryan served as a Senior Production Engineer at Hess, and Chevron before that. At Chevron, Bryan served as the team lead in Artificial Lift while overseeing a 300-well optimization project in the GOM.

Perhaps most importantly, insiders of Prairie Operating Co. (Nasdaq: PROP) own approximately 11% of the company’s shares, demonstrating a strong alignment with outside shareholders.

In an industry where management incentives can sometimes diverge from investor goals, Prairie stands out as a company where leadership is truly invested – both strategically and financially – in long-term shareholder success.

7 Key Reasons

Why You Should Strongly Consider Prairie Operating Co. (Nasdaq: PROP) Right Now

1) A Large, Strategic Asset Base in One of America’s Most Profitable Oil Regions

Prairie Operating Co. (Nasdaq: PROP) holds approximately 47,500 net acres (65,000 gross) in a liquids-rich part of the DJ Basin, a top-tier oil region in Colorado. This region boasts neighbors like Chevron, Civitas, EOG and Occidental…is strategically positioned away from population-dense areas…and has no potentially-conflicting federal leases.

2) Massive Runway: 10+ Years of Production Potential Already Identified

With more than 550 identified drilling locations – and 157 already permitted – Prairie has more than a decade of inventory lined up at a 60-well-per-year pace. Its acreage supports long laterals of 2-3 miles, helping boost the project’s economics and lont-term output.

3) 104 Million Barrels of Proven Reserves – and Room to Grow

Prairie Operating Co. holds proven reserves of approximately 104 million barrels of oil equivalent, which is a substantial foundation for a company of its size. 70% of these reserves are high-value liquids, which positions the company to benefit from favorable oil pricing dynamics. Additionally, as drilling expands across the company’s large footprint, future updates could reflect significant reserve growth.

4) Prairie’s DJ Basin Wells Can Deliver More Oil at Lower Cost

Colorado’s DJ Basin features industry-low costs and high full-cycle returns. Prairie’s wells compete favorably with others in the United States, including those in the Permian and Eagle Ford basins, offering the potential for standout returns with more efficient capital outlays.

5) Prairie is Pursuing Aggressive Growth Through Drilling and Smart Acquisitions

The company is pursuing a dual-pronged approach to growth that includes organic growth – through drilling and leasing – as well as inorganic growth through strategic M&A to position itself as the DJ Basin’s leading oil & gas operator.

With no long-term debt maturities, a 1.0x leverage target and a proactive hedging program, Prairie is effectively managing risk while maintaining capital flexibility to support ongoing growth and execute the company’s long-term strategic vision.

7) Management Team with Over 100 Years of Operational Experience

Prairie’s senior management team has a long record of commitment to responsible investment and safe operations, including over 100 years of experience around the world. Importantly from an investment perspective, this group has a proven successful track record of growing public companies from an early stage.

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer, Prairie Operating Co. (PROP), Winning Media LLC has been hired for a period beginning on 5/19/25 and ending on 7/31/25 to conduct investor relations advertising and marketing and publicly disseminate information about Prairie Operating Co. via Website, Email and SMS. Winning Media has been compensated the sum total of up to one hundred fifty thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifty thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Prairie Operating Co.

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (PROP). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.