Sponsored – Est. 8 Min Read

LITTLE “AI” COMPANY CRACKS CODE TO TESLA’S BIG PROBLEM

See why insiders at Datametrex AI Limited (OTCQB: DTMXF) (TSXV: DM) are buying millions of shares.(3)

Datametrex AI Limited (OTCQB: DTMXF) (TSXV: DM)

BREAKING NEWS: Medi-Call Expands to Ontario and Alberta – Read More…

News Update: news content

5 Electrifying Reasons Datametrex AI Limited Could See Unstoppable Growth in 2022

Datametrex AI solves one of the biggest roadblocks of every EV manufacturer including; Tesla, Chevrolet, Toyota, BMW, Honda, Nissan, Ford, etc. (1)

Insiders are buying millions of shares in the open-market, and show no signs of slowing down as the company announces a share buyback program. (2)(3)

The company’s latest acquisition(1) furthers its place in the emerging $147.94 billion global EV charging market. (1)

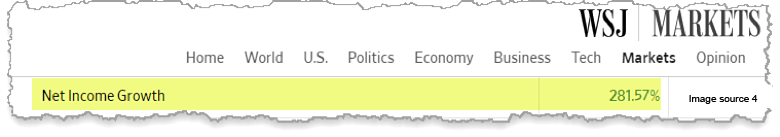

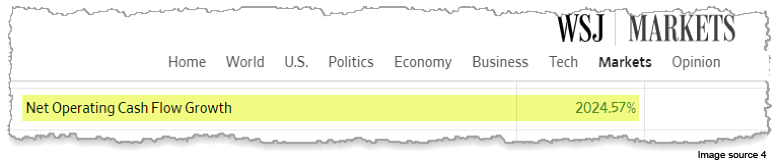

Shares could be severely undervalued as the Wall Street Journal is reporting that Datametrex had a net operating cash flow growth of 2,024% and a 281% gain in net income for 2021. (4)

The company is currently using its technology in 3 of the hottest sectors of 2022 including Cyber Security, Telehealth, and now Electric Vehicle Charging Solutions.

Datametrex AI Limited (OTCQB: DTMXF) (TSXV: DM)

The $1 Trillion Electric Vehicle Revolution Has a Big Problem

As you may know, the momentous shift in the auto industry away from fossil fuels and into electric, zero-emission vehicles is well underway. (5)

But what you may not know, there is a sizable portion of the global population that have yet to “buy in” to the EV revolution, and for good reason, as you will soon see.

Although ownership of Electric Vehicles is still small in the U.S., automakers are very busy trying to figure out how, exactly, to get more people to purchase an electric vehicle.

Coming in to assist with this mission are consumer surveys that try to understand people’s reasons for buying an EV, and their reasons for waiting to make the switch.

And believe it or not…

The biggest roadblock that stops many drivers from switching over to electric cars is “range anxiety.”

Even as some electric cars have EPA-rated range estimates of 200 or 300 miles, but much like mileage ratings for gas-powered cars, those numbers don’t always measure up in real life. (5) Which is why so many have “range anxiety” right now and are holding off on purchasing an electric vehicle…

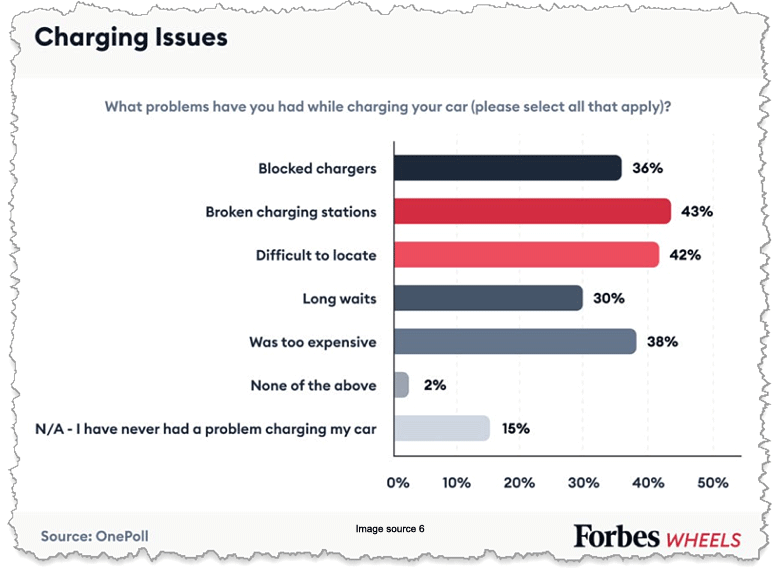

Forbes, the global media company that focuses on business, investing and technology, just shared the results of its 2022 Electric Vehicle survey and the numbers show something very alarming.(6) (But a company like “Datametrex AI” views it as an opportunity.)

After surveying Electric Vehicle owners across the US, in June 2022, Forbes found that range anxiety is still elevated across almost every demographic. Survey results from previous years showed overwhelming charging worries. (6) People are afraid that the EV they are riding in will run out of charge…(6)

That’s one of the main reasons people are hesitant to buy fully electric vehicles and why hybrids are still popular… But that could all change very soon?

Could you Imagine what Electric Vehicle automakers like Tesla, Chevrolet, Toyota, BMW, Honda, Nissan, and Ford would be willing to pay to solve their #1 problem? This could be a game changer for a company like Datametrex AI…

Keep reading to see how Datametrix AI helps drivers overcome “Range Anxiety.”

Datametrex AI Limited Enters the Potential $147 Billion Electric Vehicle Charging Infrastructure Market(1)

Datametrex AI Limited’s solutions address the “range anxiety” and “charge anxiety” concerns with 24/7 On-Demand Service and industry leading technologies that keeps EV’s charged and prepared for the road ahead. (7)

You see, on June 9, 2022, Datmetrex AI Datametrex announced the acquisition of EV Connect Solutions Inc. And with good reason… Because the Electric Vehicle Charging Infrastructure Market is estimated to reach $147.94 billion by 2030. (1)

With the acquisition of EV Connect Solutions Inc., Datmetrex AI also became the exclusive Canadian partner of EVAR, a company that was spun off from Samsung Electronics… (1)

Datametrex AI (OTCQB: DTMXF) (TSXV: DM) is entering the market with industry-leading technologies such as the roadside charging units, an evolving proprietary roadside assistance mobile application, and even the world’s first Autonomous EV Recharging Robot. (1)

The Datametrex AI application allows users to reserve ‘On Demand’ Service and the company’s drivers will come directly to the user.

The EVAR Mobile Charging Cart

Easy-to-move, mobile, fast-charging solution that can be installed where

EV charging is needed.

The World’s-first Autonomous EV Recharging Robot

The EV Recharging Robot is a fully automatic charging system with autonomous driving. The technology allows the EV Robot to locate and charge EVs independently

Smart EV Charger

Smart EV Charger is a fixed, standard level 2 charger with an intuitive design that anyone can use easily. The Smart EV Charger provides efficient charging through Bluetooth Mesh Technology and convenience with the NFC payment system

Rapid EV Charger

The Rapid EV Charger has a built-in load-balancing capability allowing up to 100kW charging speed allowing for a faster, more efficient charge.

Maybe That’s Why Insiders Are Buying Millions of Shares of Datametrex AI Limited (OTCQB: DTMXF) (TSXV: DM)(3)

Just days after the company announced the acquisition of EV Connect Solutions Inccompany insiders started buying millions of shares of Datametrex AI Limited. (3)

In fact, according to this press release, Datametrex announced that Senior Management, certain members of the Board of Directors, and company employees have collectively purchased approximately 4.3 million shares of the company. (3)

This has been verified through on of Wall Streets’ leading portals for financial research – SimplyWall.st (10)

Datametrex AI Limited even looks good to the Wall Street Journal(4)

And nobody in their right mind would blame these insiders for buying shares in Datametrex AI Limited (OTCQB: DTMXF) (TSXV: DM) …Afterall look what the Wall Street Journal is reporting the company’s Net Income Growth, Sales Growth, and Cash Flow Growth was in 2021.

Looks like Datametrex keeps getting better and better and 2022 looks like it could be another banner year for the company – Will Wall Street take notice before the retail investing crowd dives in?

The, Datametrex Applied for 3 EV Trademarks

Smart companies always protect their Intellectual Property, because of this, Datametrex has filed three trademark applications with the Canadian Intellectual Property Office and Registrar of Trademarks. (11)

The following applications were filed for registration of the trademark Datametrex Electric Vehicle Solutions (application No. 2192052), Datametrex (application No. 2192052) and Datametrex & Design (application No. 2192053) (11)

These trademark submissions could help Datametrex begin to make a name for themselves in the EV space and build its DM EV Solutions business with intellectual property that will lay the foundation for the company to integrate its existing AI technology and stand out in one of the fastest-growing markets. (11)

Datametrex AI Limited (OTCQB: DTMXF) (TSXV: DM) appears to be well managed as its positioning itself in EV Space and also has operations in the Cyber Security and Telehealth sectors.

Datametrex provides AI, ML, and BI technology operations and services through its wholly owned subsidiary, Nexalogy.

Nexalogy’s product offering, NexaSMART, is a media discovery engine that analyzes vast amounts of data with advanced clustering and filtering technology.

Nexalogy has been providing actionable social media and traditional media intelligence to governments and organizations for over a decade.

Nexalogy’s clients include, but are not limited to, the Canadian government, the US government, NATO, Samsung, Lotte Corporation, and more.

Medi-call is a subscription-based software as a service that connects patients with doctors. Its integrated grid system connects patients with providers in real time.

Medi-Call solves accessibility issues for patients living in rural or isolated communities and those also have limited mobility.

Medi-Call helps provide a solution to connect to healthcare professionals post pandemic and facilitates mobile health care services, including prescriptions and consultations and is passionate about building doctor-patient relationships.

Datametrex AI Limited is a technology-focused company with exposure to Artificial Intelligence (AI) and Machine Learning to create progressive solutions for the cyber security, telehealth and electric vehicle (EV) space.

Datametrex’ mission is to provide tools that support companies in fulfilling their operational goals with predictive and preventive technologies. By working with companies to set a new standard of protocols through Artificial Intelligence and health diagnostics, the Company provides progressive solutions to support the supply chain.

Datametrex AI Limited (OTCQB: DTMXF) (TSXV: DM) is Led by an Incredibly Strong Management Team

Marshall Gunter – CEO

Mr. Gunter’s engineering background is rooted in big data analysis and machine learning at scale. Working with Sequoia Capital and Lightspeed Venture Partners, Marshall brought Varagesale to the mass market. Marshall took Varagesale from a one-room shop to a powerhouse engineering department of 60 plus people and played a leading role in their $35-million-dollar raise. In addition, Marshall led the team that built iSentium’s sentiment engine. (8)

Don Shim, CAP, CA – CFO

Mr. Shim has led a successful accounting and finance career in both the US and Canada. He brings a wealth of knowledge to the team with his expertise in auditing publicly traded junior mining companies and high-tech industries. Member of the Chartered Professional Accountants of British Columbia and a Certified Public Accountant registered in Illinois, United States. Audit partner on numerous audit engagements for various publicly traded companies, primarily focusing on junior mining, oil and gas, pharmaceutical, and high-tech industries. (8)

Andrew Ryu – Chairman

Andrew Ryu is a seasoned and experienced entrepreneur and operator in public and private companies with over 20 years of experience. Graduate of McMaster University and the University of Toronto for Graduate Studies in Education. He is the founder and former CEO of Loyalist Group Limited, a company nominated as the top TSXV company in 2013, ranked fourth in 2014, and the top pick of the street in 2014. He was nominated for EY Entrepreneur of the Year in 2014. He is the founder of Graph Blockchain Inc. As a founder of Datametrex AI Limited (TSXV: DM), he has served as Chairman since 2016. (8)

Paul Haber, CPA, CA, C. Dir. – Director

Mr. Haber has been involved in corporate finance and capital markets for over 20 years. He has served as the CFO and Audit Committee Chair of many public and private companies. Some of the Boards Mr. Haber has sat on include, XTM Inc., South American Silver Corp., Migao Corporation, China Health and Diagnostics Inc., High Desert Gold Corp., and IND Dairytech Inc. Mr. Haber has also served as the CFO of various public companies including, Oremex Gold, SEL Exchange Inc., Leitch Technology Corp., and Migao Corporation. (8)

Benj Gallander – Director

Mr. Gallander brings over 40 years of experience in the markets, with ample skills in integrating business and strategic investors and his know-how bringing innovation to companies. Over time, he has refined his investment approach. As a result, he has achieved one of the best track records in the investment industry. Mr. Gallander is a co-editor of Contra the Heard investment letter. Over the past ten years, the portfolio he manages achieved an annualized return of approximately 18.4%. Benj co-writes “The Contra Guys” column for The Globe and Mail and is an author of three best-selling books, writes for several magazines, and has been a regular on BNN Bloomberg since virtually the beginning. (8)

Sources

Source 1: https://www.nasdaq.com/press-release/datametrex-announces-acquisition-of-ev-connect-solutions-inc.-2022-06-09

Source 2: https://finance.yahoo.com/news/datametrex-provides-normal-course-issuer-132700830.html

Source 3:https://finance.yahoo.com/news/datametrex-announces-insider-purchases-shares-120000897.html

Source 4: https://www.wsj.com/market-data/quotes/DTMXF/financials/annual/cash-flow

Source 5: https://getjerry.com/electric-vehicles/huge-problem-with-range-estimates-for-electric-vehicles

Source 6: https://www.forbes.com/wheels/features/ev-range-cost-confidence-survey/

Source 7: https://www.datametrex.com/ev-solutions

Source 8: https://www.datametrex.com/

Source 9: https://www.fox2detroit.com/news/electric-vehicles-what-is-range-anxiety-and-how-will-technology-solve-it

Source 10: https://simplywall.st/stocks/ca/software/tsxv-dm/datametrex-ai-shares

Source 11: https://finance.yahoo.com/news/datametrex-applies-3-ev-trademarks-162400573.html

Legal Disclaimer