Sponsored – Est. Read 8 Min

Disruptive Technology Alert:

Game-Changing Grid Modernization Technology Threatens to Turn the Energy Industry Upside-Down!

Little-known Nuvve Holding Corp.’s (Nasdaq: NVVE) Vehicle-to-Grid (V2G) tech solution helps enable grid load growth and reduces overall energy costs.

This disruptive technology can lower the cost of energy for consumers while making the energy grid more resilient…potentially delivering windfall profits for early investors.

Sponsored – Est. Read 8 Min

Disruptive Technology Alert:

Little-known Nuvve Holding Corp.’s (Nasdaq: NVVE) Vehicle-to-Grid (V2G) tech solution helps enable grid load growth and reduces overall energy costs.

This disruptive technology can lower the cost of energy for consumers while making the energy grid more resilient…potentially delivering windfall profits for early investors.

7 Critical Reasons

Why You Should Consider Nuvve Holding Corp. (Nasdaq: NVVE) Today

Reason #1:

Nuvve Could Bring Massive Disruption to the Energy Industry

Thanks to its game-changing vehicle-to-grid (V2G) technology, Nuvve Holding Corp. (Nasdaq: NVVE) has the potential disrupt the entire energy industry. By harnessing the latent energy stored in millions of EV batteries, Nuvve can help modernize the electric grid by utilizing that battery power while at the same time lowering energy costs for consumers. Nuvve has been successfully deploying this technology worldwide for more than eight years as it works to help make the grid more resilient.

Reason #2:

This Disruption is Coming at a Critical Time In Our Energy Evolution

As we are transitioning to a renewable generation, the load on our power grid is increasing for the first time in 25 years. This has resulted in electric bills essentially doubling over the past decade for many consumers…with no end in sight. Additionally, increasing demand from AI data centers is now placing extraordinary strain on the grid. In fact, the U.S. Department of Energy recently reported that data center load growth has tripled over the past decade and is projected to double or triple again by 2028.[i] Our energy load is not just increasing but it’s also becoming increasingly volatile, which leads to higher energy costs…and is precisely why Nuvve’s game-changing tech solution is so critically important.

Reason #3:

The Vehicle-to-Grid (V2G) Technology Market is Growing Rapidly

According to experts’ projections, the global vehicle-to-grid technology market size was estimated at $3.4 billion in 2023 and is projected to grow at an annual rate of 26.62% from 2024 to 2030. And as the U.S. and other global markets continue to electrify, V2G technology will play a vital role in transforming the energy landscape. The U.S. ancillary services market for power exceeded $8.0 billion in 2022 and is expected to reach $17 billion by 2031.[ii] Nuvve is on the leading edge of this market, as it has extensive experience developing V2G applications, including helping turn those EVs into storage systems that can facilitate more efficient energy deployment.

Reason #4:

Nuvve’s Impressive, Multi-Stream Recurring Revenue Model

The company generates revenue from multiple streams, including product sales, electric vehicle infrastructure solutions, grid optimization services, stationary storage solutions and energy-as-a-service programs. Nuvve expects to achieve consistent, high-margin recurring revenue as its megawatts under management scale up over the next five years. Companies like Apple (with its App Store model), Microsoft (with its subscription software), Netflix and Peloton have demonstrated the significant impact that a recurring revenue model can have on a company’s growth.

Reason #5:

Nuvve Enjoys Both a Critical First-Mover Advantage AND a Lucrative “Fast-Follower” Opportunity

Nuvve is a pioneer in V2G technology and has over 8 years of commercial V2G operations…more than 20 utility partners worldwide…and over 20 global patents with 7 pending. The company has successfully deployed V2G on five continents, offering turnkey electrification solutions for fleets of all types. This gives the company an extensive advantage over its competitors in the V2G space. Additionally, Nuvve’s Microgrid development work – in developing self-contained electrical networks that allow for generating electricity on-site for deployment as needed – establishes the company as a potential “fast follower” in that rapidly growing market. Companies like Schneider Electric (OTC: SBGSY), with a US $129.6 billion market cap, have demonstrated the significant potential upside within this market.

Reason #6:

Key Strategic Partnerships All Over the Globe

Nuvve has a number of strategic partnerships and customer relationships with large organizations worldwide. The company’s key customers and partners include Toyota Tsusho, Chubu Electric, Blue Bird School Buses, Nissan, BYD, Tai Power (Taiwan), San Diego Unified School District, the Fresno Economic Opportunities Commission and the State of New Mexico.

Reason #7:

Nuvve Appears to Offer Significant Re-rate Potential

With a potentially disruptive technology – and in a rapidly-growing industry sorely in need of solutions – Nuvve stands out for its potential to see significant increase in valuation. With a current market cap of just $3.1 million – and several partnership opportunities worth significantly more than that amount – this company has the potential to be a fast-mover.

Breaking News

On April 30, 2025 Nuvve Holding Corp. announced the appointment of James Altucher, a well-known cryptocurrency expert, venture capitalist, and best-selling author, to advist the company’s newly launched digital asset strategy and its wholly owned subsidiary, Nuvve-Digital Assets.

Nuvve’s anticipated crypto strategy will emphasize allocation to foundational assets such as Bitcoin and Ethereum while also diversifying across high-growth sectors, including Decentralized Finance (DeFi), Decentralized Physical Infrastructure (DePin), and the Tokenization of real-world assets. Targeted tokens in the portfolio include Aave, Chainlink, Render, Uniswap, and others that serve as the backbone of the evolving blockchain economy.

Why this Company Could Be a Fast Mover:

Nuvve Holding Corp. (Nasdaq: NVVE) Appears to Have the Perfect Energy Tech Solution…at Precisely the Right Time

There’s a massive story developing in the energy industry that could soon trigger one of the most impressive, high-upside investment opportunities to come along in years.

Here’s how the dominoes have already begun to fall in this fast-moving scenario:

The world of energy is changing rapidly.

With increasing energy demands from all over the globe as well as a worldwide transition to more renewable energy sources, the load on the electric grid is becoming increasingly volatile.

This increased volatility creates energy demand “peaks” that require greater infrastructure capacity from providers in order to prevent disruption.

And that means higher energy prices all around – in some cases more than a 7-fold increase in a short period of time!

It’s comparable to building a 15-lane highway that will only be used 1% of the time. Someone still has to pay for all of those additional lanes.

“Experts say the surging demand for energy in the U.S. is forecast to hit record highs both this year and next year, straining the country’s aging power grid and creating more planet-warming emissions. Part of the demand is from a growing number of data centers across the nation and the rise of artificial intelligence.”

Now – with unprecedented strain being placed on the power grid – along comes a company with what appears to be the right technology solution to help support the grid at precisely the perfect time.

That company is Nuvve Holding Corp. (Nasdaq: NVVE), a global leader in vehicle-to-grid (V2G) technology and commercial V2G deployments.

What Nuvve is doing is helping build and manage a smarter infrastructure to help make for more efficient usage…and bring costs down substantially.

Nuvve is Helping Modernize the Grid and Lower Energy Costs at a Critical Time in Our Energy Evolution

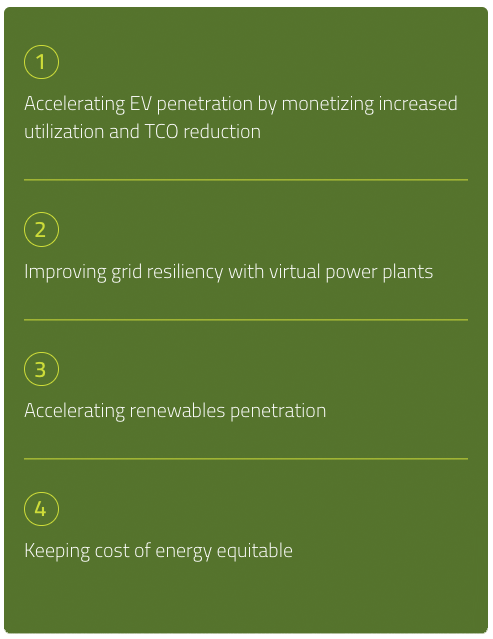

Nuvve’s AI-powered technology has the potential to disrupt the entire energy industry by harnessing the latent energy stored in millions of EV batteries and supporting the electric grid with that battery power.

Simply put, Nuvve’s proprietary V2G technology is helping modernize our grid so that we can more efficiently solve the issues our power grid is facing…

And it can help make energy affordable for consumers, corporation and municipalities.

For investors, the company’s unique, multi-stream, recurring-revenue model means significant potential upside as Nuvve continues its growth.

The company is now moving quickly to expand its base of energy partners and grow its megawatts under management, including the recent announcement of a contract potentially worth $400 million with the state of New Mexico.

And as that megawatts under management number climbs – and Nuvve’s partnerships expand – so too could the valuation for Nuvve’s seemingly undervalued shares.

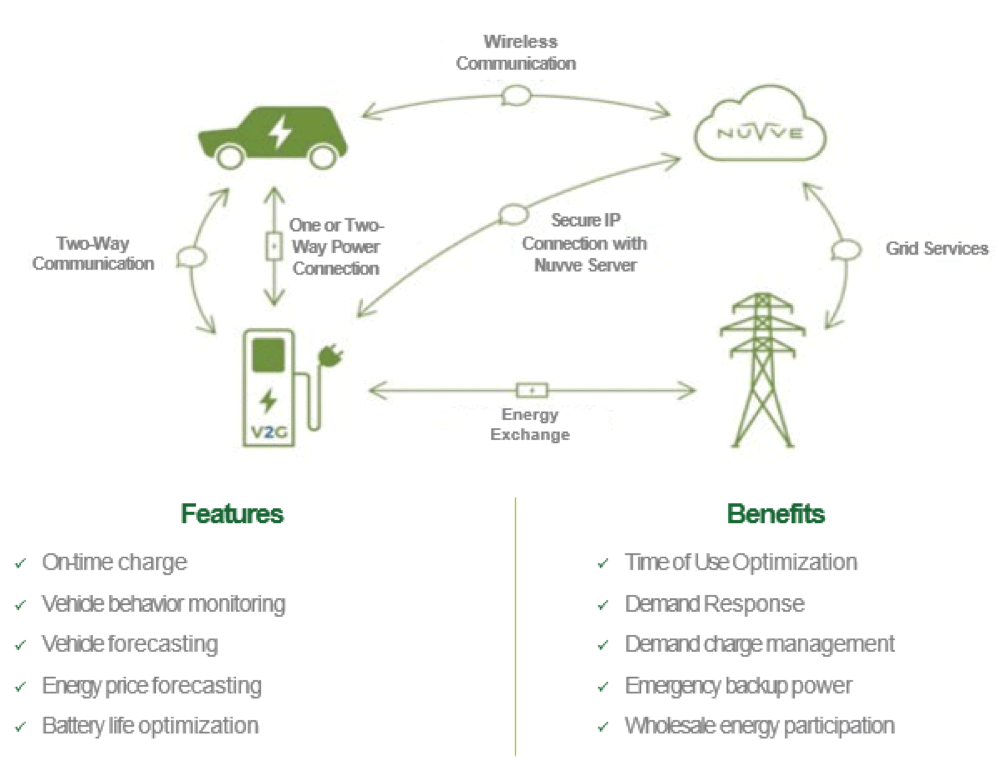

How it Works: Nuvve’s Disruptive V2G Solution

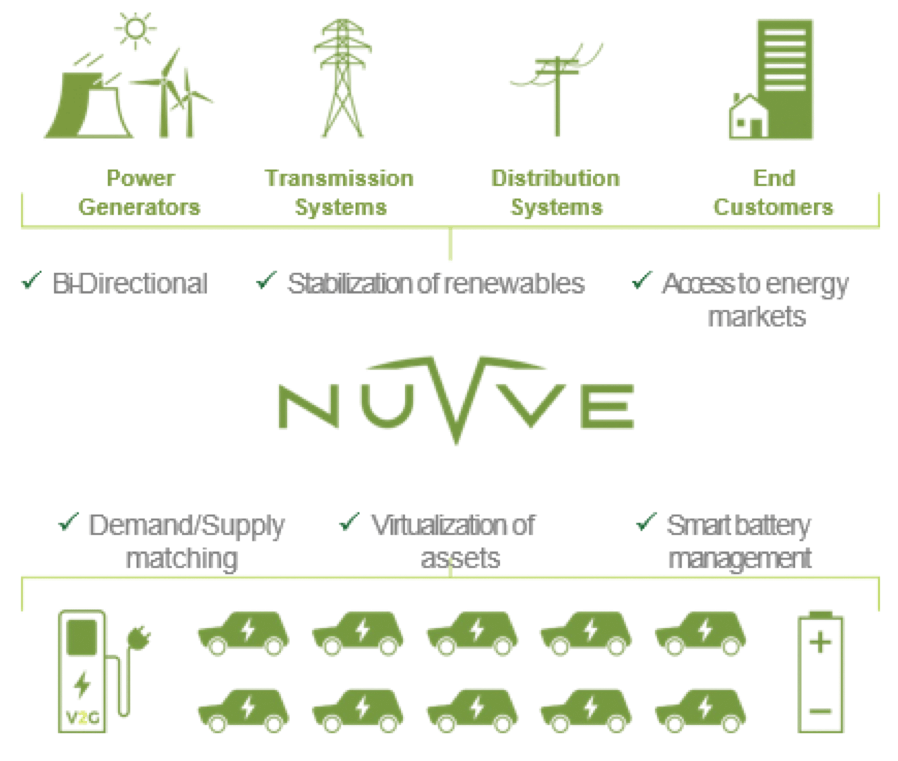

Nuvve’s intelligent energy platform combines the world’s most advanced V2G technology with an impressive, growing ecosystem of electrification partners.

Here’s how it works in a nutshell:

Nuvve’s AI-powered GIVe™ software platform provides the ability to manage and optimize site-level EV charging and behind-the meter solar and battery storage, and to aggregate energy across multiple sites to participate in ancillary/grid services markets.

This software platform works by allowing electric vehicles to store and return electricity to the grid, effectively turning EVs into energy assets.

In many cases, this can mean little or no costs for end-users to power their electric vehicles!

And, through Nuvve’s proprietary V2G technology, it allows for the energy harnessed from those EVs to be deployed in an efficient manner to help support and optimize the grid. This increases grid stability and helps lower overall energy costs at the same time!

Thanks to Nuvve’s disruptive solution, fleet operators save money, transition to EV fleets faster and optimize their capital asset life.

Nuvve believes it has the disruptive technology to integrate EVs into the electric system while leveraging the batteries inside the vehicles to solve the issues associated with energy intermittency and resiliency.

Here’s how Nuvve’s Vehicle to Grid (V2G) technology works for investors, consumers and the power grid:

- Nuvve’s V2G solution uses latent power storage in EV batteries and sells it to the power grid on behalf of its customers

- Nuvve’s solution helps dramatically reduce the cost of EV ownership for consumers

- Nuvve employs an AI-powered solution to make highly accurate forecasts of EV charging activity

- By working on behalf of its customers, Nuvve enjoys long-term relationships which help establish the company’s long-term recurring revenue stream

- This technology has the potential to disrupt the entire energy industry by linking latent energy stored in millions of EV batteries together to support the tremendous demands for power placed upon the grid.

Electric School Buses Could Help Power Illinois’ Grid

ComEd is preparing a vehicle-to-grid pilot program in which school districts will sell power to the grid by discharging parked electric school bus batteries.

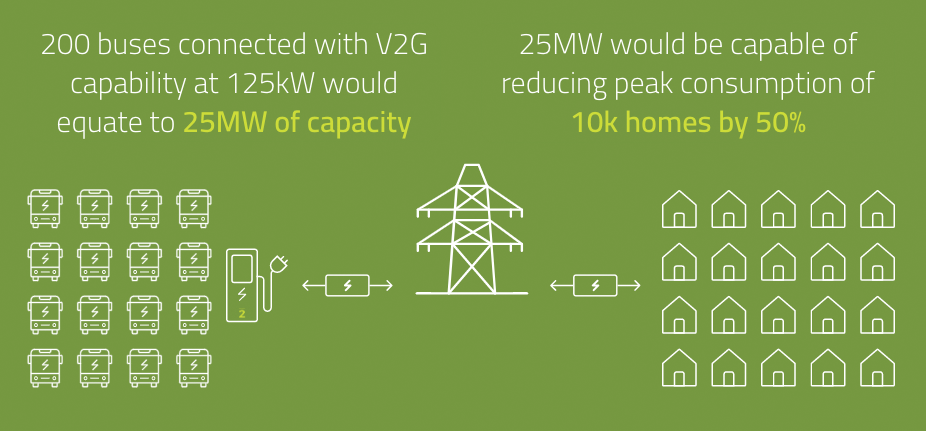

The Power of Nuvve’s V2G Hubs

Nuvve’s V2G Hubs feature leading V2G EV charging technology that precisely manages the charging and discharging of parked EV batteries while also prioritizing vehicle and driver considerations including battery health and charge needs for driving duties.

Nuvve’s system can combine the energy from multiple EV batteries to form virtual power plants to sell energy back to the grid, hedge against energy fluctuations and provide services that help with grid stability, predictability and resiliency.

These centers are capable of serving multi-modal electric vehicle fleets from ride-share services to delivery fleets and transit buses while supporting grid stakeholders from utilities to transmission system operators.

Nuvve Features an Impressive Revenue Model with Multiple Streams and Recurring Growth Potential

One of the most impressive aspects of the opportunity with Nuvve Holding Corp. (Nasdaq: NVVE) is the company’s strong revenue model.

Nuvve generates revenue from multiple streams, including:

- Product Sales – including the sales of hardware, stationary batteries, charging stations and more

- Grid Services – this includes revenue sharing from stored EV energy. For example, on individual EVs, Nuvve earns a commission on the revenue earned by the EV owner of approximately 30%

- V2G Hubs – Nuvve can deploy V2G hubs that can include local generation such as solar and storage and are often combined with other grid loads for full energy optimization combined with Grid Services.

- Stationary Storage – allowing for the deployment of storage solutions through the GIVe™ platform, helping local utilities modernize their grid and integrate power from EVs to offset grid load increase

- Subscription-Based Revenue – With large partnership agreements, the company locks in long-term, high-margin revenue for fleets of EVs.

Facilitating Grid Modernization: What Nuvve’s Growth Could Look Like in the Years Ahead

Nuvve’s recently announced four-year contract with the state of New Mexico provides a blueprint for the company’s growth strategy.

Via this partnership, the company will be working to enable grid load growth within the state through intelligent solutions that reduce energy costs, limit the need for grid upgrades and promote energy equity.

The contract will advance New Mexico’s “Vehicles as a Service” (VaaS) program, designed to facilitate fleet electrification through:

- Turnkey EV Charging Solutions – Deployment of advanced EV charging infrastructure, operations, and data management.

- Vehicle-to-Grid (V2G) and Microgrid Development – Scalable solutions integrating V2G-capable fleets, stationary battery storage, and solar energy to reduce costs and enhance grid resilience.

- Corridor Charging Stations – Establishing key EV charging sites along state highways for inter-city travel.

- EV Leasing and Infrastructure Financing – Providing innovative financial models to streamline fleet conversion.

- Asset Transition and Management – Purchasing and retiring internal combustion engine (ICE) vehicles, ensuring efficient fleet turnover.

The contract provides for multiple sources of revenue to Nuvve, as the leading contractor:

- Electric vehicle selection and qualification – Nuvve will manage EV transit solutions design, including selecting and qualifying electric vehicles procured by New Mexico governmental entities. Financing solutions will be provided by Nuvve’s partners to be announced next month.

- Electric vehicle infrastructure – Nuvve will procure and deploy a variety of electric vehicle infrastructure solutions, including bidirectional charging to provide V2G services to the local energy markets and utilities. Nuvve can recognize hardware revenues with gross margins generally ranging between 20% to 50%. Nuvve’s GIVe™ platform can also generate incremental revenues through the V2G infrastructure, which can earn gross margins of approximately 30%.

- V2G Hubs – Nuvve will deploy V2G hubs that can include local generation such as solar and storage and are often combined with other grid loads for full local energy optimization combined with Grid Services. Nuvve’s current estimates include 24 V2G hubs for the SONM. This infrastructure will be provided by Nuvve and procured from existing partners.

- Stationary Storage – Nuvve can deploy stationary storage solutions when combined with the GIVeTM platform, helping local utilities modernize their grid and integrate the EV on top of the grid load increase.

- EPC Services – New Mexico-based EPC partners will perform Engineering, procurement, and construction (EPC) services that will also be announced soon.

Projects by Nuuve and PG&E are just some of the efforts taking place right now to understand how EV batteries can help meet increasing global electricity demand.

Microgrid Development Could Trigger Even Faster Growth for Nuvve

Additionally, Nuvve’s Microgrid development work – in developing self-contained electrical networks that allow for generating electricity on-site for deployment as needed – establishes the company as a potential “fast follower” in that rapidly growing market.

Companies like Schneider Electric (OTC: SBGSY), with a US $129.6 billion market cap, have demonstrated the significant potential upside within this market.

Today, Nuvve is developing its own Microgrids, which feature scalable solutions that integrate V2G-capable fleets, stationary battery storage, and solar energy to reduce costs and enhance grid resilience.

As the company becomes a larger player in this space it could trigger rapid growth as the demand for Microgrid solutions continues to increase.

Additionally, investors in Nuvve are the beneficiaries of nearly $130 million of accumulated investment.

Nuvve’s patented V2G technology has been developed over decades, and is one of the most widely deployed platforms to date

Intelligent, cloud-based software has been proven to reliably monetize fleet investments while providing grid resilience

Reduces the cost of electrification for fleet owners and creates recurring revenue from V2G, charge management and grid services

Deep technical expertise and IP portfolio provide sustainable long-term competitive advantages

Nuvve’s Experienced Management Team Has the Company Well-Positioned for Success

Nuvve Holding Corp. (Nasdaq: NVVE) is led by an impressive team that has helped establish the company’s first-mover advantage and develop its potentially disruptive technology.

As the company moves ahead with a potentially more rapid growth phase in the months ahead, this experienced group has the track record to inspire confidence in the company’s near- and long-term future.

This impressive team includes:

Gregory Poilasne – Chief Executive Officer and Director

Mr. Poilasne is a co-founder of Nuvve and has served as Chief Executive Officer and a member of the Board since 2020. He previously served as Chairman of the Board. Mr. Poilasne has more than 20 years’ experience in the technology industry. He was the CEO of DockOn, a Radio-Frequency technology company from February 2011 to January 2016. He has served in management roles at other companies such as Rayspan, Kyocera Wireless and Ethertronics.

Ted Smith – President and COO, Director

Mr. Smith has served as President and Chief Operating Officer of Nuvve and a member of the Board since November 2020. Mr. Smith was a founding investor in Nuvve Corporation, a wholly owned subsidiary of Nuvve, and has served as a member of its board of directors since 2010 and as its Chief Operating Officer since April 2018. Mr. Smith has more than 20 years of experience in the finance industry and previously served in various roles at Wall Street Associates, a San Diego-based investment advisory firm, including Principal, Chief Operating Officer from 2007 to January 2017 and Chief Compliance Officer from 2003 to January 2017.

David Robson – Chief Financial Officer

Mr. Robson has served as Nuvve’s Chief Financial Officer since March 2021. Mr. Robson has over twenty-five years of finance, accounting and operational experience and has held senior positions with both public and private companies in a variety of industries. Mr. Robson has served on the board of directors of NuZee Coffee, a leading co-packing company for single-serve coffee formats. Mr. Robson was Chief Financial Officer and Chief Compliance Officer of Farmer Brothers Co., a national distributor of coffee, tea and culinary products from February 2017 to November 2019. Mr. Robson has served as Chief Financial Officer of other companies, both public and private, such as PIRCH, U.S. AutoParts, and Mervyn’s.

7 Critical Reasons

Why You Should Consider Nuvve Holding Corp. (Nasdaq: NVVE) Today

Reason #1:

Nuvve Could Bring Massive Disruption to the Energy Industry

Thanks to its game-changing vehicle-to-grid (V2G) technology, Nuvve Holding Corp. (Nasdaq: NVVE) has the potential disrupt the entire energy industry. By harnessing the latent energy stored in millions of EV batteries, Nuvve can help modernize the electric grid by utilizing that battery power while at the same time lowering energy costs for consumers. Nuvve has been successfully deploying this technology worldwide for more than eight years as it works to help make the grid more resilient.

Reason #2:

This Disruption is Coming at a Critical Time In Our Energy Evolution

As we are transitioning to a renewable generation, the load on our power grid is increasing for the first time in 25 years. This has resulted in electric bills essentially doubling over the past decade for many consumers…with no end in sight. Additionally, increasing demand from AI data centers is now placing extraordinary strain on the grid. In fact, the U.S. Department of Energy recently reported that data center load growth has tripled over the past decade and is projected to double or triple again by 2028.[i] Our energy load is not just increasing but it’s also becoming increasingly volatile, which leads to higher energy costs…and is precisely why Nuvve’s game-changing tech solution is so critically important.

Reason #3:

The Vehicle-to-Grid (V2G) Technology Market is Growing Rapidly

According to experts’ projections, the global vehicle-to-grid technology market size was estimated at $3.4 billion in 2023 and is projected to grow at an annual rate of 26.62% from 2024 to 2030. And as the U.S. and other global markets continue to electrify, V2G technology will play a vital role in transforming the energy landscape. The U.S. ancillary services market for power exceeded $8.0 billion in 2022 and is expected to reach $17 billion by 2031.[ii] Nuvve is on the leading edge of this market, as it has extensive experience developing V2G applications, including helping turn those EVs into storage systems that can facilitate more efficient energy deployment.

Reason #4:

Nuvve’s Impressive, Multi-Stream Recurring Revenue Model

The company generates revenue from multiple streams, including product sales, electric vehicle infrastructure solutions, grid optimization services, stationary storage solutions and energy-as-a-service programs. Nuvve expects to achieve consistent, high-margin recurring revenue as its megawatts under management scale up over the next five years. Companies like Apple (with its App Store model), Microsoft (with its subscription software), Netflix and Peloton have demonstrated the significant impact that a recurring revenue model can have on a company’s growth.

Reason #5:

Nuvve Enjoys Both a Critical First-Mover Advantage AND a Lucrative “Fast-Follower” Opportunity

Nuvve is a pioneer in V2G technology and has over 8 years of commercial V2G operations…more than 20 utility partners worldwide…and over 20 global patents with 7 pending. The company has successfully deployed V2G on five continents, offering turnkey electrification solutions for fleets of all types. This gives the company an extensive advantage over its competitors in the V2G space. Additionally, Nuvve’s Microgrid development work – in developing self-contained electrical networks that allow for generating electricity on-site for deployment as needed – establishes the company as a potential “fast follower” in that rapidly growing market. Companies like Schneider Electric (OTC: SBGSY), with a US $129.6 billion market cap, have demonstrated the significant potential upside within this market.

Reason #6:

Key Strategic Partnerships All Over the Globe

Nuvve has a number of strategic partnerships and customer relationships with large organizations worldwide. The company’s key customers and partners include Toyota Tsusho, Chubu Electric, Blue Bird School Buses, Nissan, BYD, Tai Power (Taiwan), San Diego Unified School District, the Fresno Economic Opportunities Commission and the State of New Mexico.

Reason #7:

Nuvve Appears to Offer Significant Re-rate Potential

With a potentially disruptive technology – and in a rapidly-growing industry sorely in need of solutions – Nuvve stands out for its potential to see significant increase in valuation. With a current market cap of just $3.1 million – and several partnership opportunities worth significantly more than that amount – this company has the potential to be a fast-mover.

[i] https://www.energy.gov/articles/doe-releases-new-report-evaluating-increase-electricity-demand-data-centers

[ii] https://www.transparencymarketresearch.com/ancillary-services-power-market.html

[iii] https://www.cbsnews.com/video/how-ai-and-data-centers-impact-climate-change/

[viii] https://www.energy.gov/articles/doe-releases-new-report-evaluating-increase-electricity-demand-data-centers

[ix] https://www.transparencymarketresearch.com/ancillary-services-power-market.html

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer Nuvve Holding Corp. (NVVE), Winning Media LLC has been hired for a period beginning on 3/12/25 and ending on 4/18/25 to conduct investor relations advertising and marketing and publicly disseminate information about Nuvve Holding Corp. (NVVE) via Website, Email and SMS. Winning Media has been compensated the sum total of one hundred thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Nuvve Holding Corp. (NVVE).

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (NVVE). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.