Discover this wildly undervalued NASDAQ company hiding in plain sight…

Discounted Share Price, High Growth Luxury Brand with Looming Big News… It’s a Beautiful Combo!

Shareholder equity of $24.31 million,(1) and a market cap as of May 9, 2022, $12.722 million.(2) It gets better…just wait until you hear the rest.

Gaucho Group Holdings, Inc.

5 Powerful Reasons You Can’t Ignore Gaucho Holdings (NASDAQ: VINO)

As is to be expected, companies rarely trade below liquidation value. But when they do, it can present a tremendous value – a real diamond in the rough.

In fact, the greatest value investors of all time made incredible fortunes recognizing value

We’re talking about legends like Warren Buffet, Peter Lynch, and Jim Rodgers to name a few.

Peter Lynch managed the Fidelity Magellan Fund from 1977 to 1990, beating the S&P 500 index 11 of those 13 years. Lynch consistently allocated funds to companies he saw as undervalued.(3)

From 1973 to 1980 — under Jim Rogers the Quantum Fund grew 4,200%. The S&P 500 grew just 47%. Rodgers focuses much of his investments on undervalued stocks and equities, that hold “real goods.”(3)

And of course there’s Warren Buffett, widely considered the greatest investor of all time.

What’s the lesson here? Not only is this strategy successful, but it also helped lead these great investors to generate insane profits.

Gaucho Holdings (NASDAQ: VINO) Boasts Some of the Most Desirable Holdings in a $349 Billion Luxury Market(5)

The company’s upscale asset base includes real estate that consists of a winery, wine production facilities & e-commerce, two boutique hotels, a golf course and tennis center, a 4,138-acre luxury residential vineyard development, as well as product inventory for fashion and home & living retail & e-commerce brands.(5)

They have six operational luxury brands across Fine Wines, Luxury Real Estate, Leather Accessories and Fashion, Home & Living, Hospitality and Olive Oil.

Low float. Rapid sales growth. Suppressed market cap.

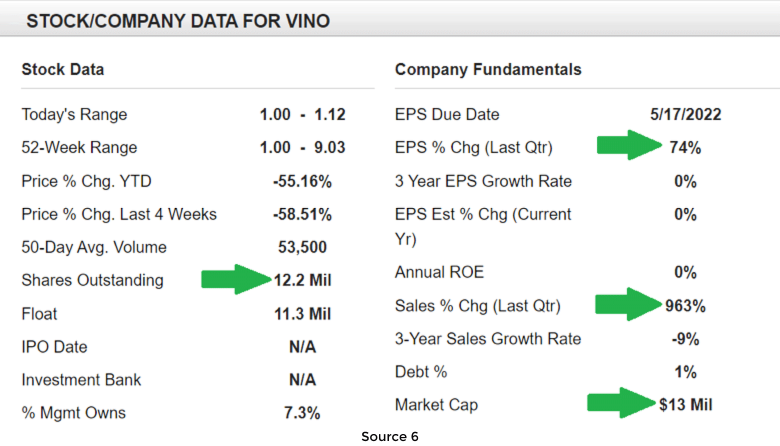

The one thing that should immediately grab your attention in the chart below from Investors Business Daily is the shares outstanding and low float of 11.3 million.(6)

Low float stocks do not have enormous supply. This denotes that any catalyst that triggers demand will have a larger impact on the available shares.

It is crucial to highlight that a news catalyst is what usually causes low float stocks to move so much. And later in the report, we will uncover potential big news rumbling at VINO.

Compare the market cap to the asset value – it looks to be screaming undervalued

In this chart from YCharts created on May 9, 2022, we can see VINO’s total assets at the end of 2021 is about double the market cap.(1)

Plus, the company has greatly increased sales and are looking to add more value to their holdings – which we will also cover.

So, do we remember our lesson from the greatest investors? The key to opportunity is value.

And Gaucho Group Holdings Inc.’s value has great potential upside while growing larger and larger everyday…

Value-added investor and advisor Bill Allen joins Gaucho Holdings Board of Directors(18)

Value-added investor and advisor Bill Allen joins Gaucho Holdings Board of Directors(18)

Bill was formerly the CEO of Bloomin’ Brands aka Outback Steakhouse, Flemings etc. (19)Bill took them private in a USD 3.9 BILLION transaction backed by L Catterton, the largest global consumer-focused private equity firm, and Bain Capital. Having Bill on our BOD and leading the LVH Las Vegas project says something positive for a 15-mil market cap company. Bill is thinking of next level opportunities for Gaucho, the potential milestones can be dramatic.

He is also the lead partner on Gaucho Holding’s Las Vegas LVH partnership.

Mr. Allen has also acted as an investor, advisor, and Board member to a wide portfolio of established and early-stage growth companies to include: Fleming’s Steakhouse, Mendocino Farms, Piada, Protein Bar, Dig Inn, Lemonade, TE2, Omnivore, Pepper Technology, Studio Movie Grill, Just Food for Dogs, Tender Greens, Relevant, Barcelona and Bar Taco, The Laser Spine Institute, PDQ, Cobalt, Matchbox Pizza, Punch Bowl Social, Proper Foods, and Boqueria. Mr. Allen attended Rider University in Lawrence Township, New Jersey for undergraduate studies.

Even more value! Gaucho Group Holdings, Inc. (NASDAQ: VINO) advised by this renown investor.

Gaucho Holdings is advised by one of those legendary value investors, the world-renown investor and author Doug Casey.(7)

Gaucho Holdings is advised by one of those legendary value investors, the world-renown investor and author Doug Casey.(7)

Casey’s written works – most notably, Crisis Investing – have sold hundreds of thousands of copies and have received universal acclaim from readers.

According to his site Casey Research his philosophy is simple. Get in early.

“Identifying a trend before the crowd lets you get in at the lowest price exposes you to the upside for the longest period of time.”(8)

Doug has traveled extensively, having lived in 10 countries. Currently, he spends much of his time at La Estancia de Cafayate near Salta, Argentina.

One cannot understate the strategic importance of having someone like Doug Casey on the Gaucho Holdings advisory board.

Heads up. Vanguard Group recently took a healthy position

When the big boys start to sniff around, things might be getting remarkably interesting. On February 14, 2022, the Vanguard Group snapped up 111,399 shares of VINO.(9)

One thing about VINO right now is lack of exposure. You certainly have not heard about them on CNBC or on Kudlow’s show or anything like that, have you?

But it appears there’s institution interest brewing. Perhaps, they are heeding Doug Casey’s mantra – get in early!

Besides, if behemoths like Vanguard start moving in, how soon before retail investors catch wind and follow suit?

The Quest to Become the LVMH (“Louis Vuitton Moet Hennessy”) of South America Gaucho Group Holdings, Inc. (NASDAQ: VINO)

Why LVMH? Why not? Their business model is extraordinarily successful. The company is invested in all luxury goods, particularly experiential luxury goods. As well they are also into wines and spirits. And of course, hotels and restaurants. They bought the Cipriani chain(10) and own the Orient Express and the train service as well.

As of May 9, 2022, LVMH market cap stands at an impressive $298 billion.(11)

Now let’s examine VINO’s ever-expanding luxury brands.(12)

Drawing on the cosmopolitan vibe of Buenos Aires and the spirit of traditional gaucho culture, Gaucho – Buenos Aires (www.gaucho.com) is a new destination for luxury ready-to-wear and leather accessories.

Weaving artisan techniques and materials into innovative contemporary designs, the brand is gaining traction as an emerging designer to watch.

The company also recently launched its home and living décor collection, Gaucho Casa, which challenges traditional lifestyle collections with its luxury textiles and home accessories rooted in the singular spirit of the gaucho aesthetic.

Gaucho – Buenos Aires and Gaucho Casa embody the spirit of Argentina – its grand history, and its revival as a global center of luxury. Inspired by the sophisticated elegance of the great European maisons, Gaucho – Buenos Aires is rooted in the traditions of Argentine culture. With its ambitious ready-to-wear collection, timeless leather goods, and luxury home items, this is the brand in which Argentine luxury finds its contemporary expression.

As the fifth-largest producer of wine on the planet, Argentina is so much more than a purveyor of Malbec.(13)

Argentinian wines are starting to fetch the attention they’ve sought for years, garnering strong scores, feature-length stories online, and growing tourist interest.(13)

And Algodon Wine Estates is a boutique Mendoza winery located in the beautiful foothills of the Sierra Pintadas, in the southernmost region of Argentina’s wine capital.

These premium wines are currently available throughout the U.S., and in distinguished wine bars, wine shops, restaurants and hotels in Buenos Aires and Mendoza.

Algodon Wine’s U.K. distributor currently has vendors in Germany, Switzerland, Guernsey, U.K., and the Netherlands.

In Buenos Aires, Algodon Mansion is the company’s luxury boutique hotel that caters to celebrities, sports stars, politicians, and other high-profile individuals, as well as consumers with high end tastes who want the very best. This 1912 landmark building’s architecture is fashioned in French Classical design and has been impeccably restored yet re-imagined with inspired contemporary elegance and sophistication.

It boasts luxury suites that offer the most exclusive comforts in design, technology, and amenities, located in the heart of the elegant Recoleta district.

Back in the wine capital of Mendoza, wine lovers can buy Argentina vineyard real estate at Algodon Wine Estates, nestled in scenic wine country and featuring championship golf, tennis, polo, and access to world-class skiing and more.

Algodon Wine Estates is a 4,138 acre (1,675 ha) real estate development, golf resort and wine hotel in San Rafael, Mendoza, Argentina. This is something you have to see to believe.

Watch this awe-inspiring video:

Located in San Rafael, Mendoza, Argentina, this 4,138-acre vineyard estate has an impressive lineage and features structures that date back to 1921. Situated on Argentina’s wine route, guests enjoy internationally award-winning lodging, vineyard and winery tours, and an award-winning restaurant, as well as championship tennis, 18 holes of golf that literally play through vineyards, 70-year-old olive groves, and fruit orchards.

Imagine, All This Value for Less Than $1.50 Per Share… And There May Be MORE Holdings On The Way! Gaucho Group Holdings, Inc. (NASDAQ: VINO)

In their most recent shareholder update, CEO Scott Mathis wrote, “Gross profit for the fourth quarter was $1.1 million. Interestingly, we believe our current stock value is below the liquidation value of the Company.(15)

In addition, our Argentine business operations are helped by producing in pesos and then selling in U.S. dollars. Argentina is also anticipating a record-breaking tourism boom due to the devalued peso, making it a desirable global destination, with increased tourism expected from neighboring Brazil as well as from the U.S. and the EU.”(15)

Now for that coming big news…

The first involves Las Vegas. There is an ongoing negotiation in regard to a property on the Las Vegas strip. Should everything go as planned, the partnership could be announced – but the property name will be delayed for a few weeks.

According to CEO Scott Mathis, “if the project comes to fruition, the value of the project could be worth anywhere from $80 to $120 million USD. We hope to announce something soon.” The company believes the Las Vegas project can expand the Gaucho brand in ways that may include lodging, hospitality, retail, and gaming.

While this is speculative at this point, it’s a wise idea to keep your eyes open in the next two to four weeks for a potential announcement.

The second involves Argentina. For the past eight to nine months Gaucho has been in discussions with a US-based five-star hotel chain. The concept in negotiation is to build an 80-room hotel with 40 to 60 branded residences. Mathis said, “At a 60% occupancy we believe that could bring in another $20 million in revenues.”

Anyone wishing to confirm these statements or perform their due diligence is urged to contact Gaucho Group Holdings, Inc. directly via the contact information on their website.

For all the current information on VINO, you will want to read Scott Mathis’ May 9, 2020, shareholder update HERE.

5 Powerful Reasons You Can’t Ignore Gaucho Holdings (NASDAQ: VINO)

Resources

Source 1: https://ycharts.com/companies/VINO/assets

Source 2: https://finance.yahoo.com/quote/VINO?p=VINO

Source 3: https://www.dividendinvestor.com/11-greatest-value-investors-of-all-time/

Source 4: http://www.berkshirehathaway.com/letters/2008ltr.pdf

Source 5: https://ir.gauchoholdings.com/presentations

Source 6: https://research.investors.com/stock-quotes/nasdaq-gaucho-group-holdings-vino.htm

Source 7: https://www.gauchoholdings.com/about/leadership

Source 8: https://www.caseyresearch.com/about/

Source 9: https://fintel.io/so/us/vino

Source 10: https://www.lvmh.com/

Source 11: https://finance.yahoo.com/quote/LVMUY?p=LVMUY&.tsrc=fin-srch

Source 12: https://www.gauchoholdings.com/brands

Source 13: https://www.themanual.com/food-and-drink/argentinian-wine-surge/

Source 14: https://vimeo.com/333158834

Source 15: https://marketing.gauchoholdings.com/template/0641e22b-a304-4a64-94f0-f3672410fd39

Source 16: https://www.xe.com/currencyconverter/convert/?Amount=1&From=USD&To=ARS

Source 17: https://cuex.com/en/usd-ars_pa

Source 18: https://www.bfly.com/team/bill-allen/

Disclaimer:

This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. Wallstreetnation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.