Sponsored – Est. 8 Min Read

“Double Play” Investment Potential from Gold Miner Working to Build Canada’s Largest Open-Pit Gold Mine

The Combination of Impressive Drill Results and Consistent Production History Means that Calibre Mining Corp. (OTCQX: CXBMF); (TSX: CXB) Offers Investors High Upside in Both the Near-Term…and the Long-Term

Investor Alert: Ten analysts now have a “Buy” rating on this company’s stock with an average target price representing 45% upside potentiala

News Update: news content

Breaking News

Fund Manager Names Calibre Mining Among ‘What to Buy Now’ Gold Stocks

For more information, click here.

8 Reasons Why You Should Strongly Consider Calibre Mining Corp. (OTCQX: CXBMF); (TSX: CXB) Right Now

1

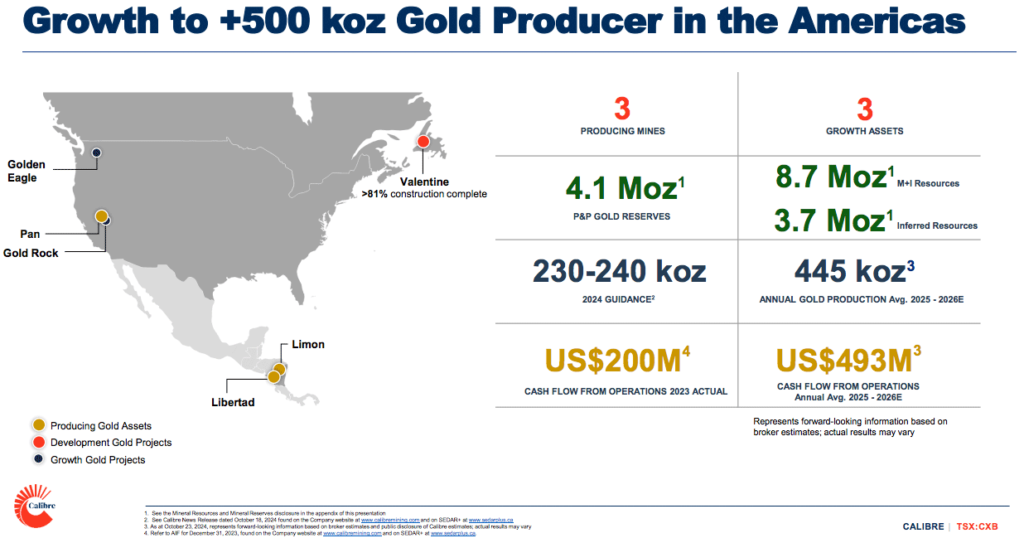

Calibre is Creating a High Growth, Cash Flow-Focused Mid-Tier Gold Producer with Significant Upside Potential: Calibre Mining Corp’s acquisition and advancement of the Valentine Gold Mine has the company on-track to build Atlantic Canada’s largest gold mine, which is projected to be in production in Q2 of 2025 and to produce almost 200,000 ounces of gold per year. Valentine Gold Mine’s construction is now more than 81% complete – with production scheduled to commence in Q2 of 2025 – and is fully funded. And given the geology at Valentine – and the fact that only a small percentage of the property has been explored – a new 100,000 metre, multi-rig drill program is well underway to expand the exploration potential. Initial drill results from this program suggest that the potential resource at Valentine could be much larger than first imagined. This potential expansion of the company’s resources could re-position Calibre as a global, growing mid-tier gold producer targeting 450,000 to 500,000 ounces of production per year when combined with existing operations.

2

Undervalued Opportunity: Calibre Mining Corp. (OTCQX: CXBMF); (TSX: CXB) is trading at a significant discount to its peers based on value of its gold production. While the peer average is roughly $6,669 EV/oz., Calibre Mining Corp.’s is nearly 50% less than that…at just $4,070 EV/oz. That makes the company an attractive undervalued play for those investors looking for smart exposure to the gold market.

3

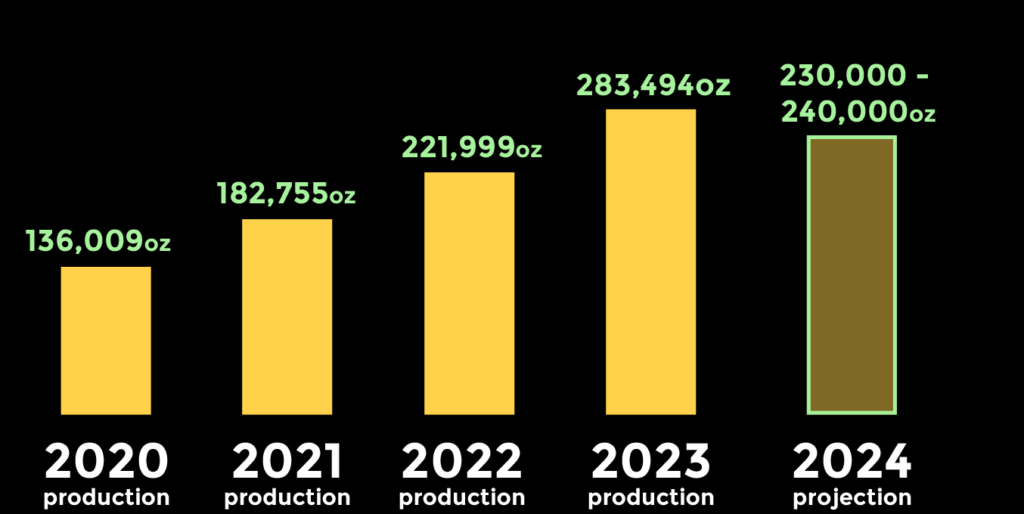

Calibre Mining Corp. Continues to Deliver Impressive Production: In 2023 the company produced a record 283,494 ounces of gold. This was the company’s fourth consecutive year of gold production…and Calibre Mining Corp. is now projecting consolidated gold production of 230,000 and 240,000 ounces for 2024. Since becoming a gold producer in 2019, Calibre has delivered 28% year-over-year production growth and has produced over 825,000 ounces of gold while increasing its reserves more than 10-fold to 4.1 million ounces.

4

Calibre Mining Corp. Offers Solid Value at Today’s Gold Prices Calibre’s consolidated total cash costs are between $1,300 and $1,350 per ounce of gold, while its consolidated all-in sustaining costs are between $1,550 and $1,600 per ounce. With gold prices today over $2,700 per ounce that leaves a profit margin of over $1,100 per ounce. And with up to 240,000 ounces of production in 2024, that could translate into millions in operating cash flow.

5

6

Calibre Was Recently Added to the Prestigious GDX Gold Miners ETF and the S&P/TSX Composite Index: In March 2024, it was announced that Calibre Mining Corp. was being added to the prestigious VanEck Gold Miners ETF (GDX). This is the nation’s oldest gold miners’ ETF and is designed to represent a portfolio of the largest global gold mining companies. Calibre’s addition to the GDX comes with a “block trade” purchase of 43.5 million shares and could generate added ongoing interest from institutional investors for Calibre in the months ahead. And in June the company announced that its shares had been added to the S&P/TSX Composite Index, marking another significant milestone for the company and reflecting the significant value it is creating for shareholders.

7

Calibre Mining Corp.’s Elite Management Team Has a History of Mining Success: The company is guided by a highly successful management team – led by President and CEO Darren Hall – with decades of experience in the exploration space. Collectively, the management team and board of directors has led the successful sale of seven mining companies exceeding US $5 billion in value, including two significant take-outs over the past five years. Mr. Hall previously worked for nearly 30 years at Newmont Mining Corporation…and was one of a handful of Calibre Mining Corp. executives who helped create Newmarket Gold, which ultimately created tremendous value for shareholders leading to a $2 billion transformational merger with Kirkland Lake Gold.

8

Calibre Mining Corp. is Working to Build Atlantic Canada’s Largest Open-Pit Gold Mine

Calibre Mining Corp. (OTCQX: CXBMF); (TSX: CXB) is an Americas-focused, growing mid-tier gold producer with a strong pipeline of development and exploration opportunities across Newfoundland & Labrador in Canada, Nevada and Washington in the USA, and Nicaragua.

The company now appears to offer investors not only smart exposure to precious metals…but also a unique “double play” profit opportunity.

First…Calibre Mining Corp. – at this moment – offers tremendous value in terms of its consistent gold production. The company has consistently increased its gold production each year – to the tune of 28% year-over-year production growth since 2019 – 2023 and it has done so while maintaining attractive margins.

Yet the company remains undervalued when compared to others in the space, trading at a significant discount to its peers in terms of estimated value per ounce.

That consistent production – at attractive margins – combined with its undervaluation makes the company an attractive value play right now.

But the second half of this company’s “double play” potential makes it even more attractive in the long-term.

The company’s recent acquisition and advancement of the Valentine Gold Mine – while offering the near-term benefit of production as soon as Q2 2025 – offers significant long-term expansion potential.

That’s because the location, geology and early drill results at the Valentine Gold Mine all point to the potential for significant resource expansion.

The company is working to build Atlantic Canada’s largest open pit gold mine…as the Valentine Gold Mine continues to evolve as a true game-changer for the company.

And, of course, all of this is happening for Calibre in the early stages of what appears to be a historic bull market for gold. So as the price of gold continues to climb higher – and experts are projecting higher gold prices in 2025 and beyond – Calibre’s potential value figures to climb as well.

This potential for a “double play” upside scenario – with both near- and long-term profit potential – makes Calibre Mining Corp. (OTCQX: CXBMF); (TSX: CXB) worthy of a closer look.

Calibre Mining Corp.’s Consistent Gold Production Year After Year

High Upside Alert: Why Calibre Mining Corp. (OTCQX: CXBMF); (TSX: CXB) Right Now Appears Significantly Undervalued Compared to its Peers

Investors looking for significant upside potential in the resource space should look no further than Calibre Mining Corp.

This is a company guided by an experienced team of experts with a proven history of successfully building mines…and delivering value for shareholders.

From growing gold production in Nicaragua…to expanding its gold mining footprint in Nevada…and now, acquiring and advancing construction of multi-million-ounce Valentine Gold Mine, Caliber Mining Corp. has consistently focused on growth.

The acquisition and advancement of the Valentine Gold Mine now has the company on-track to build Atlantic Canada’s largest gold mine, which is projected to be in production in Q2 of 2025 and to produce almost 200,000 ounces of gold per year.

Among its peer group, Calibre Mining Corp. has far-and-away the highest estimated production growth from 2024-2026. The company’s 90% projected growth is nearly five times the average of its peer group.

Yet the company’s market cap and its EV/oz. are both significantly lower than each of its peers.

This means investors have a unique opportunity – in the early stages of what appears to be a sustained bull market for gold – to invest in a growth-oriented gold mining company with significant upside potential.

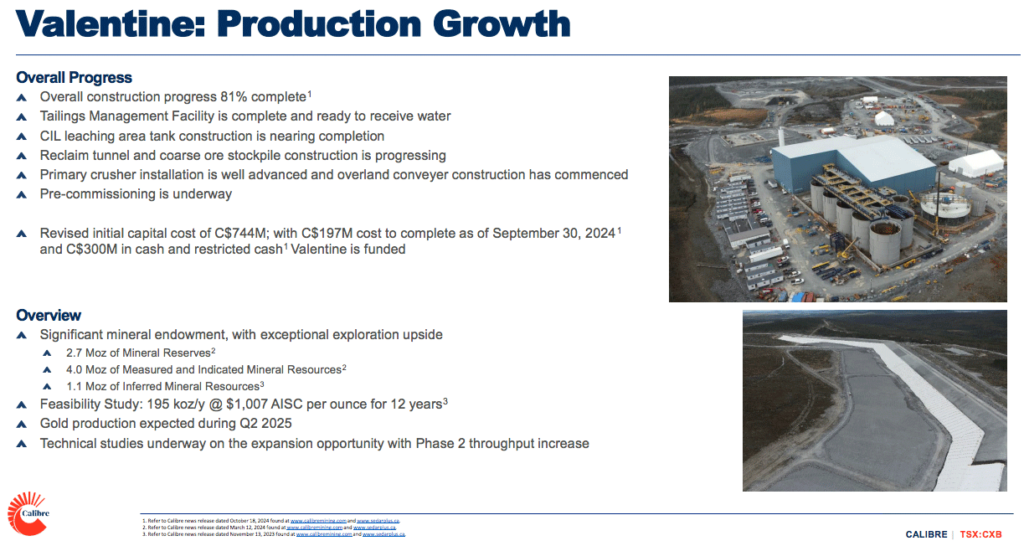

Progress at Calibre Mining Corp.’s Valentine Gold Mine Has the Company on a Path to Becoming a 500,000-ounce Gold Producer in the Americas

Within Canada, the province of Newfoundland and Labrador has emerged as an attractive destination for mining and exploration and has been ranked as one of the top mining jurisdictions in the world.

Earlier this year, Calibre Mining Corp. finalized its acquisition of the Valentine Gold Mine located in the Central Region of Newfoundland and Labrador.

And this mine has the potential to be a true game-changer for the company.

When completed, Valentine will be the largest gold mine in Atlantic Canada and a significant contributor to the economy of Newfoundland and Labrador.

Initial gold production from this mine is expected in Q2 of 2025. And upon full ramp-up, the mine is expected to contribute up to 195,000 ounces of gold per year.

A December 2022 feasibility study for Valentine outlined an open pit mining and conventional milling operation over a 14.3-year mine life with a 22% after-tax rate of return.

The company expects an average gold production of 195,000 ounces of gold per year for the first 12 years at a low projected All-in Sustaining Costs of $1,007 per ounce over that period. Production is scheduled to begin production in Q2 2025.

Valentine Project Highlights:

- Valentine Gold Mine in Central Newfoundland; World leading mining jurisdiction

- 100% ownership

- Largest Undeveloped Gold Resource in Atlantic Canada

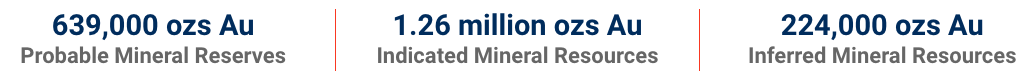

- M&I 3.96 Moz (64.62 Mt at 1.90 g/t Au)

- Inferred 1.10 Moz (20.75 Mt at 1.65 g/t Au)

- December 2022 Feasibility Study

- After-tax 22% IRR & C$634 NPV5% at US $1700 Gold, C$463M Cost to Complete

- 14.3 Year Mine Life; 2.7 Moz Mineral Reserve; 195k oz/a Years 1 to 12

- Ongoing Exploration on 20km Mineralized Trend

- Focus on Sprite, Victory

And the story for the Valentine Gold Project continues to get better.

On October 18, Calibre Mining Corp. announced that construction of the Valentine Gold Mine had surpassed 81% completion as of September 30.

According to President and CEO Darren Hall, “With approximately C$300 million in cash and C$197 million cost to complete, the Valentine build remains fully funded and on track for first gold during Q2, 2025, representing a significant milestone in Calibre’s strategy to diversify and grow its production in Canada.”

Alert: 47% Higher Gold Grades

Found at Valentine Gold Mine

And on September 3, the company announced partial ore control drill results from the Marathon Pit, one of three open pits comprising the Valentine Gold Mine.

At the Marathon pit, the company drilled 196 RC holes totaling 4,915 metres in three benches slated for mining in 2025. When comparing approximately the same tonnage to the 2022 Mineral Reserve model over three planned mining benches, the Ore Control Block model yields significantly more gold than the 2022 Mineral Reserve model due to 47% higher grades.

CEO Darren Hall said, “The results from the initial Marathon pit ore control drilling are very encouraging with 47% higher gold grades resulting in 44% additional ounces vs the 2022 Mineral Reserve in the same area. Given these results, our confidence continues to increase as we responsibly advance towards first gold at Valentine during Q2, 2025.”

Massive Upside: Why the Valentine Gold Mine Could Have Significant Expansion Potential

What’s important to keep in mind about Calibre’s Valentine Gold Mine is that it is a greenfield site that is embryonic in its development.

This is not a brownfield site with a re-awakened asset…but instead it’s the first significant development in Central Newfoundland.

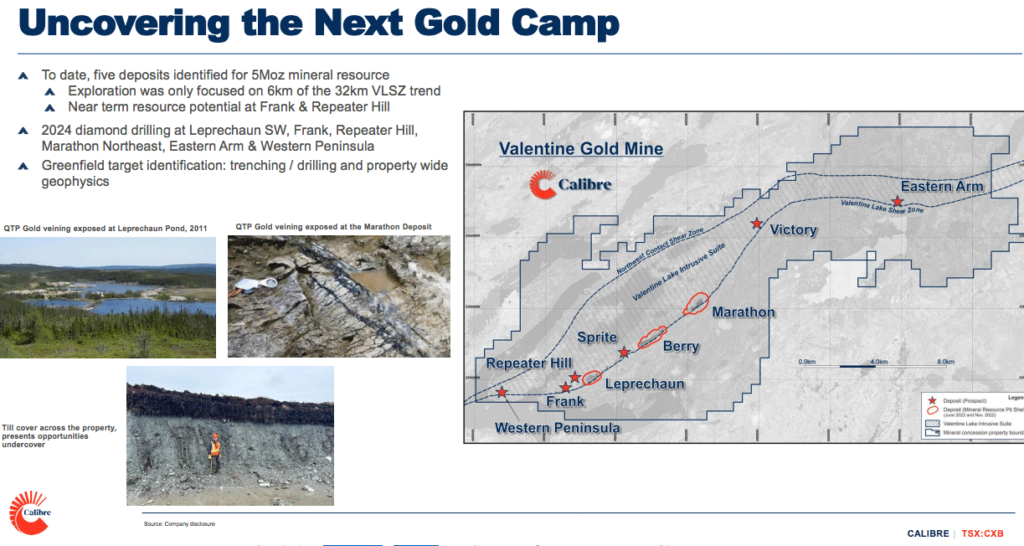

To date, five deposits have been identified as a potential 5-million-ounce mineral resource at Valentine.

But here’s where the potential upside comes in:

Exploration to date has been focused exclusively on just six kilometers of the 32-kilometer shear zone…which leaves another 26 kilometers to explore.

That 32-kilometer shear zone is what is known as an orogenic gold deposit.

Other orogenic gold deposits around the world are in the order of magnitude of between 30 and 50 million ounces in size.

One example is Canada’s Timmons Gold Camp, with deposits spread over 50 kilometers of strike length and numerous deposits. Another is the Cadillac-Larder Lake Fault Zone, a historically prolific gold fault with a total of 100 million ounces of gold produced.

In a span of roughly 15 years, 5 million ounces of resources has been discovered at Valentine.

But now geologists are beginning to realize that the potential of the Valentine Gold Mine could be much greater than first imagined, as just a small percentage of the shear zone has been explored to date.

Calibre Mining Corp. has decided to increase the size of its drilling program to help potentially uncover the next gold camp along this massive shear zone.

The company announced a 100,000-meter drilling program that will take place over the next 18 months. The goal of this program is to identify the next 5-million-ounce resource.

On June 5, the company announced drill results from its 2024 exploration program within the Valentine Gold Mine complex including at the Leprechaun Southwest region.

Highlights from the Leprechaun Southwest drill program include:

- 2.25 g/t Au over 15.30 meters Estimated True Width (“ETW”) including 24.68 g/t Au over 0.85 metres ETW in Hole LS-24-002;

- 1.87 g/t Au over 11.57 meters ETW including 9.26 g/t Au over 0.89 meters in Hole LS-14-007;

- 36.83 g/t Au over 0.91 meters ETW in Hole LS-24-010;

- 13.32 g/t Au over 0.85 meters ETW in Hole LS-24-011.

According to President and CEO Darren Hall, these drill results “reinforce the vast potential of the 32 km long Valentine Lake Shear Zone. Initial 2024 drilling intersected near surface gold mineralization outside of the current Mineral Reserve block model and in two holes outside of the Leprechaun Mineral Resource model. This new mineralization is located between 100 and 175 meters south of the recent high grade ore control drilling and both areas remain open for expansion. This, coupled with earlier positive results from the Frank Zone, located approximately one kilometer south of these Leprechaun results, indicates potential for further expansion at near mine targets.”

These results help support the idea that the potential resource at Valentine could be much larger than first imagined.

Calibre Mining Corp.’s Nicaraguran Gold Producing Assets

#1 Limon Mine & Mill – Western Nicaragua (100% owned)

Source 3

Mining operations use conventional open pit mining methods at the Limón Central open pit and a combination of top-down and bottom-up sequenced longitudinal open stoping (“LOS”) at the Santa Pancha underground mines. The El Limón processing plant consists of agitated cyanide leaching and carbon adsorption, followed by carbon elution, electrowinning, and doré production. The annual throughput is approximately 500,000 tonnes per annum (“tpa”) and the historical recovery is 94% to 95%.

Calibre’s asset base includes multiple ore sources, 2.7 million tpa of installed mill capacity from two processing facilities (El Limon and La Libertad), reliable in-country infrastructure, and favourable transportation costs. The Company will continue to optimize its consolidated mine and process plans as the Company progresses our “hub-and-spoke” approach to maximizing value from our integrated asset base.

#2 Libertad Mine & Mill – Central Nicaragua (100% owned)

Source 3

The La Libertad processing plant can treat approximately 2.25 million tonnes per annum (tpa), and current gold recoveries are approximately 94% to 95% for a blend of spent ore and run of mine (ROM) ore. Currently the mine is fed by ore trucked from Limon and Pavon as well ore mined near the mill at the Jabali underground mine.

The Libertad mill currently has surplus capacity and therefore benefits from satellites deposits.

Calibre’s asset base includes multiple ore sources, 2.7 million tpa of installed mill capacity from two processing facilities (El Limon and La Libertad), reliable in-country infrastructure, and favorable transportation costs.

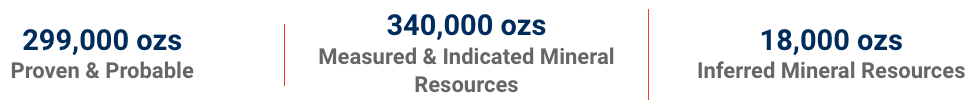

Calibre Mining Corp.’s Nevada-Based Gold Producing Assets

*Pan Gold Mine – Nevada (100% owned)

The Pan Mine is a Carlin-style, open-pit, heap-leach mine in east-central Nevada, approximately 28 km southeast of the town of Eureka, on the prolific Battle-Mountain – Eureka gold trend.

Pan ramped up smoothly after restarting operations in September 2017. Gold production has increased year over year since 2017 with 2021 gold production reaching 45, 397 ounces benefitting from the recent heap leach pad expansion and primary crushing circuit installed in 2020.

Previous operators spent approximately $1.5 million over the past four years on exploration, this presents a significant opportunity for Calibre to ramp up generative and regional exploration but also follow up on numerous targets surrounding the North and South pits that have limited drilling.

Source 3

8 Reasons Why You Should Strongly Consider Calibre Mining Corp. (OTCQX: CXBMF); (TSX: CXB) Right Now

1

Calibre is Creating a High Growth, Cash Flow-Focused Mid-Tier Gold Producer with Significant Upside Potential: Calibre Mining Corp’s acquisition and advancement of the Valentine Gold Mine has the company on-track to build Atlantic Canada’s largest gold mine, which is projected to be in production in Q2 of 2025 and to produce almost 200,000 ounces of gold per year. Valentine Gold Mine’s construction is now more than 81% complete – with production scheduled to commence in Q2 of 2025 – and is fully funded. And given the geology at Valentine – and the fact that only a small percentage of the property has been explored – a new 100,000 metre, multi-rig drill program is well underway to expand the exploration potential. Initial drill results from this program suggest that the potential resource at Valentine could be much larger than first imagined. This potential expansion of the company’s resources could re-position Calibre as a global, growing mid-tier gold producer targeting 450,000 to 500,000 ounces of production per year when combined with existing operations.

2

Undervalued Opportunity: Calibre Mining Corp. (OTCQX: CXBMF); (TSX: CXB) is trading at a significant discount to its peers based on value of its gold production. While the peer average is roughly $6,669 EV/oz., Calibre Mining Corp.’s is nearly 50% less than that…at just $4,070 EV/oz. That makes the company an attractive undervalued play for those investors looking for smart exposure to the gold market.

3

Calibre Mining Corp. Continues to Deliver Impressive Production: In 2023 the company produced a record 283,494 ounces of gold. This was the company’s fourth consecutive year of gold production…and Calibre Mining Corp. is now projecting consolidated gold production of 230,000 and 240,000 ounces for 2024. Since becoming a gold producer in 2019, Calibre has delivered 28% year-over-year production growth and has produced over 825,000 ounces of gold while increasing its reserves more than 10-fold to 4.1 million ounces.

4

Calibre Mining Corp. Offers Solid Value at Today’s Gold Prices Calibre’s consolidated total cash costs are between $1,300 and $1,350 per ounce of gold, while its consolidated all-in sustaining costs are between $1,550 and $1,600 per ounce. With gold prices today over $2,700 per ounce that leaves a profit margin of over $1,100 per ounce. And with up to 240,000 ounces of production in 2024, that could translate into millions in operating cash flow.

5

6

Calibre Was Recently Added to the Prestigious GDX Gold Miners ETF and the S&P/TSX Composite Index: In March 2024, it was announced that Calibre Mining Corp. was being added to the prestigious VanEck Gold Miners ETF (GDX). This is the nation’s oldest gold miners’ ETF and is designed to represent a portfolio of the largest global gold mining companies. Calibre’s addition to the GDX comes with a “block trade” purchase of 43.5 million shares and could generate added ongoing interest from institutional investors for Calibre in the months ahead. And in June the company announced that its shares had been added to the S&P/TSX Composite Index, marking another significant milestone for the company and reflecting the significant value it is creating for shareholders.

7

Calibre Mining Corp.’s Elite Management Team Has a History of Mining Success: The company is guided by a highly successful management team – led by President and CEO Darren Hall – with decades of experience in the exploration space. Collectively, the management team and board of directors has led the successful sale of seven mining companies exceeding US $5 billion in value, including two significant take-outs over the past five years. Mr. Hall previously worked for nearly 30 years at Newmont Mining Corporation…and was one of a handful of Calibre Mining Corp. executives who helped create Newmarket Gold, which ultimately created tremendous value for shareholders leading to a $2 billion transformational merger with Kirkland Lake Gold.

8

Sources

*Current share price as of 8/10/23 is C$1.55

and Haywood’s target price is C$3.00

[a] Average price target $3.805; CXB.TO shares closed at $2.62 on 10/29/24

[b] https://www.zerohedge.com/the-market-ear/ubs-says-gold-could-double-here

[i] https://www.cnbc.com/2022/12/22/gold-at-4000-analysts-share-their-

2023-outlook-for-prices.html

[ii] https://www.cnbc.com/2022/12/22/gold-at-4000-analysts-share-their-

2023-outlook-for-prices.html

[iii] https://www.calibremining.com/news/calibre-increases-nicaraguan-

mineral-reserve-grade-4957/ –

https://www.calibremining.com/site/assets/files/7183/cxb_

aif_december_31_2022.pdf

1 https://www.zerohedge.com/the-market-ear/ubs-says-gold-could-double-here

2 https://m.netdania.com/news/Calibre%20Mining%20Maintained%20at%20Outperform

%20at%20BMO%20Following%20Q2%20Production%20Results%3B%20Price%20Target

%20Kept%20at%20C%243.40/Buzz%20FX/%7Bhf%3A0%2Cna%3A[%7Bi%3A[%7Bi%3A

%22FXXAUUSD%22%7D%2C%7Bi%3A%22FXXAUUSDOZ

%22%7D%2C%7Bi%3A%22FXXAGUSD%22%7D%2C%7Bi%3A%22FXXAGUSDOZ%22

%7D%2C%7Bi%3A%22FXXPTUSD%22%7D%2C%7Bi%3A%22Copper%22%7D%2C

%7Bi%3A%22FXXPTUSDOZ%22%7D%2C%7Bi%3A%22FXXPDUSD%22%7D%2C%

7Bi%3A%22FXXPDUSDOZ%22%7D%2C%7Bi%3A%22FXBTCUSD%22%7D%2C%7Bi

%3A%22ICEEB0Y%22%7D%2C%7Bi%3A%22ICEET0Y%22%7D%2C%7Bi%3A%22

ICECE%22%7D]%7D]%7D/tcnews/A3175211%40%7B

%22Syms%22%3A[]%2C%22Inf%22%3A%7B%22PBL%22

%3A%22MT%20Newswires%22%7D%7D/1720627817

3 https://m.netdania.com/news/Calibre%20Mining%20

Maintained%20at%20Outperform%20at%20BMO%20Following%20

Q2%20Production%20Results%3B%20Price%20Target%20Kept%20at

%20C%243.40/Buzz%20FX/%7Bhf%3A0%2Cna%3A[%7Bi%3A[%7Bi%3A%22

FXXAUUSD%22%7D%2C%7Bi%3A%22FXXAUUSDOZ%22%7D%2C%7Bi%3A

%22FXXAGUSD%22%7D%2C%7Bi%3A%22FXXAGUSDOZ%22%7D%2C%7Bi%3A

%22FXXPTUSD%22%7D%2C%7Bi%3A%22Copper%22%7D

%2C%7Bi%3A%22FXXPTUSDOZ%22%7D

%2C%7Bi%3A%22FXXPDUSD%22%7D%2C%7Bi%3A

%22FXXPDUSDOZ%22%7D%2C%7Bi%3A%22

FXBTCUSD%22%7D%2C%7Bi%3A%22ICEEB0Y

%22%7D%2C%7Bi%3A%22ICEET0Y%22%7D%2C%7Bi%3A%

22ICECE%22%7D]%7D]%7D/tcnews/A3175211%40%

7B%22Syms%22%3A[]%2C%22Inf%22%3A%7B%22PBL

%22%3A%22MT%20Newswires%22%7D%7D/1720627817

4 https://www.zerohedge.com/the-market-ear/ubs-says-gold-could-double-here

5 https://m.netdania.com/news/Calibre%20Mining%20Maintained%20at%20Outperform

%20at%20BMO%20Following%20Q2%20Production%20Results%3B%20Price%20Target

%20Kept%20at%20C%243.40/Buzz%20FX/%7Bhf%3A0%2Cna%3A[%7Bi%3A[%7Bi%

3A%22FXXAUUSD%22%7D%2C%7Bi%3A%22FXXAUUSDOZ%22%7D%2C%7Bi%3A

%22FXXAGUSD%22%7D%2C%7Bi%3A%22FXXAGUSDOZ%22%7D%2C%7Bi%3A%

22FXXPTUSD%22%7D%2C%7Bi%3A%22Copper%22%7D%2C%7Bi%3A%22FXXPT

USDOZ%22%7D%2C%7Bi%3A%22FXXPDUSD%22%7D%2C%7Bi%3A%22FXXPD

USDOZ%22%7D%2C%7Bi%3A%22FXBTCUSD%22%7D%2C%7Bi%3A%22ICEEB0Y

%22%7D%2C%7Bi%3A%22ICEET0Y%22%7D%2C%7Bi%3A%22ICECE%22%7D]%7D]

%7D/tcnews/A3175211%40%7B%22Syms%22%3A[]%2C%22Inf%22%3A%7B%22

PBL%22%3A%22MT%20Newswires%22%7D%7D/1720627817

6 based on analyst consensus numbers 400,000 – 500,000 ounces

7 https://www.calibremining.com/news/calibre-delivers-fourth-consecutive-year-of-minera-8123/

Disclaimer:

This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. WallStreetNation.com, owned and operated by Jade Cabbage Media, LLC d/b/a STOXmedia.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold, or held by viewers that learn of the profiled companies through our website.

Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for in an effort to enhance public awareness of Calibre Mining. and its securities. Jade Cabbage Media, LLC d/b/a STOXmedia.com has received up to $20,000 USD dollars (1/04/23) by Winning Media LLC as a total production budget for this advertising effort. Neither WallStreetNation.com, Winning Media LLC or Jade Cabbage Media LLC currently hold the securities of Power Nickel Inc. and do not currently intend to purchase such securities.

The issuer, Calibre Mining Corp. has paid Winning Media LLC the sum total of one hundred fifty thousand dollars USD total production budget to manage a digital media campaign from January 1st, 2023 to December 31st, 2023.

This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are several important factors that could cause actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues, and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur.

More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEDAR and/or SEC’s EDGAR page. Jade Cabbage Media, LLC d/b/a STOXmedia.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.